Conductive Adhesives vs Electrically Conductive Tapes: A Review

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Bonding Evolution and Objectives

Conductive bonding technologies have evolved significantly over the past several decades, transitioning from traditional soldering methods to advanced electrically conductive adhesives and tapes. This evolution has been driven by the increasing miniaturization of electronic components, the need for more flexible and reliable connections, and growing environmental concerns regarding lead-based soldering materials.

The earliest forms of conductive bonding relied heavily on tin-lead solders, which dominated the electronics industry throughout the 20th century. However, the implementation of RoHS (Restriction of Hazardous Substances) directives in the early 2000s accelerated the development of lead-free alternatives, creating an opportunity for conductive adhesives and tapes to gain market share.

Electrically conductive adhesives (ECAs) emerged as a promising alternative, initially in the form of isotropic conductive adhesives (ICAs) containing metal fillers such as silver, gold, or nickel dispersed in polymer matrices. These were followed by anisotropic conductive adhesives (ACAs), which conduct electricity in a single direction, making them ideal for high-density interconnections. The development trajectory has focused on improving conductivity while maintaining mechanical strength and processing compatibility.

Electrically conductive tapes represent a parallel technological development, offering advantages in terms of ease of application and reworkability. These tapes typically consist of pressure-sensitive adhesives (PSAs) embedded with conductive particles or constructed with conductive layers. Their evolution has been marked by improvements in adhesion strength, conductivity stability over time, and resistance to environmental factors.

The current technological landscape shows a convergence of these technologies, with hybrid solutions emerging that combine the benefits of both adhesives and tapes. Recent innovations include stretchable conductive adhesives for wearable electronics, ultra-thin conductive tapes for transparent applications, and self-healing conductive materials that can restore electrical pathways after mechanical damage.

The primary objectives in this field now center around several key areas: enhancing electrical conductivity while reducing material costs; improving thermal management capabilities to handle increasing power densities; developing environmentally sustainable formulations with reduced or eliminated toxic components; and creating solutions that maintain reliable performance under extreme conditions such as high temperatures, humidity, and mechanical stress.

Additionally, there is growing interest in developing conductive bonding solutions specifically tailored for emerging technologies such as flexible electronics, Internet of Things (IoT) devices, and advanced automotive applications. These applications demand bonding technologies that can accommodate substrate movement, withstand harsh environments, and maintain stable electrical connections throughout product lifecycles.

The earliest forms of conductive bonding relied heavily on tin-lead solders, which dominated the electronics industry throughout the 20th century. However, the implementation of RoHS (Restriction of Hazardous Substances) directives in the early 2000s accelerated the development of lead-free alternatives, creating an opportunity for conductive adhesives and tapes to gain market share.

Electrically conductive adhesives (ECAs) emerged as a promising alternative, initially in the form of isotropic conductive adhesives (ICAs) containing metal fillers such as silver, gold, or nickel dispersed in polymer matrices. These were followed by anisotropic conductive adhesives (ACAs), which conduct electricity in a single direction, making them ideal for high-density interconnections. The development trajectory has focused on improving conductivity while maintaining mechanical strength and processing compatibility.

Electrically conductive tapes represent a parallel technological development, offering advantages in terms of ease of application and reworkability. These tapes typically consist of pressure-sensitive adhesives (PSAs) embedded with conductive particles or constructed with conductive layers. Their evolution has been marked by improvements in adhesion strength, conductivity stability over time, and resistance to environmental factors.

The current technological landscape shows a convergence of these technologies, with hybrid solutions emerging that combine the benefits of both adhesives and tapes. Recent innovations include stretchable conductive adhesives for wearable electronics, ultra-thin conductive tapes for transparent applications, and self-healing conductive materials that can restore electrical pathways after mechanical damage.

The primary objectives in this field now center around several key areas: enhancing electrical conductivity while reducing material costs; improving thermal management capabilities to handle increasing power densities; developing environmentally sustainable formulations with reduced or eliminated toxic components; and creating solutions that maintain reliable performance under extreme conditions such as high temperatures, humidity, and mechanical stress.

Additionally, there is growing interest in developing conductive bonding solutions specifically tailored for emerging technologies such as flexible electronics, Internet of Things (IoT) devices, and advanced automotive applications. These applications demand bonding technologies that can accommodate substrate movement, withstand harsh environments, and maintain stable electrical connections throughout product lifecycles.

Market Applications and Demand Analysis

The market for conductive bonding solutions has witnessed significant growth in recent years, driven primarily by the expanding electronics industry and the increasing demand for miniaturized devices. The global market for conductive adhesives and tapes collectively reached approximately $3.5 billion in 2022 and is projected to grow at a CAGR of 6.8% through 2028, reflecting the robust demand across various application sectors.

Electronics manufacturing represents the largest application segment, accounting for over 40% of the total market share. Within this segment, smartphone assembly dominates the consumption of both conductive adhesives and tapes, with manufacturers increasingly adopting these solutions to replace traditional soldering methods. The trend toward thinner, lighter, and more flexible electronic devices has particularly accelerated the adoption of electrically conductive tapes, which offer superior flexibility compared to rigid solder joints.

Automotive electronics emerges as the fastest-growing application segment, with a projected growth rate exceeding 8% annually. The increasing integration of electronic components in vehicles, coupled with the rapid expansion of electric vehicle production, has created substantial demand for reliable conductive bonding solutions that can withstand harsh operating conditions. Conductive adhesives are particularly valued in this sector for their ability to join dissimilar materials while maintaining electrical conductivity.

Medical device manufacturing represents another significant market, valued at approximately $580 million in 2022. The demand in this sector is driven by the need for biocompatible conductive bonding solutions for implantable devices, wearable health monitors, and diagnostic equipment. Silicone-based conductive adhesives have gained particular traction in this segment due to their biocompatibility and flexibility.

Regionally, Asia Pacific dominates the market, accounting for over 60% of global consumption, primarily due to the concentration of electronics manufacturing in countries like China, Taiwan, South Korea, and Japan. North America and Europe follow, with significant demand coming from high-tech industries, automotive manufacturing, and medical device production.

Consumer preferences are increasingly shifting toward environmentally friendly solutions, creating growing demand for lead-free conductive adhesives and recyclable conductive tapes. This trend is particularly pronounced in Europe, where stringent environmental regulations have accelerated the transition away from traditional soldering methods containing lead and other hazardous materials.

The market is also witnessing increased demand for specialized products, including thermally conductive adhesives that can simultaneously provide electrical conductivity and heat dissipation capabilities, addressing the thermal management challenges in high-performance electronic devices.

Electronics manufacturing represents the largest application segment, accounting for over 40% of the total market share. Within this segment, smartphone assembly dominates the consumption of both conductive adhesives and tapes, with manufacturers increasingly adopting these solutions to replace traditional soldering methods. The trend toward thinner, lighter, and more flexible electronic devices has particularly accelerated the adoption of electrically conductive tapes, which offer superior flexibility compared to rigid solder joints.

Automotive electronics emerges as the fastest-growing application segment, with a projected growth rate exceeding 8% annually. The increasing integration of electronic components in vehicles, coupled with the rapid expansion of electric vehicle production, has created substantial demand for reliable conductive bonding solutions that can withstand harsh operating conditions. Conductive adhesives are particularly valued in this sector for their ability to join dissimilar materials while maintaining electrical conductivity.

Medical device manufacturing represents another significant market, valued at approximately $580 million in 2022. The demand in this sector is driven by the need for biocompatible conductive bonding solutions for implantable devices, wearable health monitors, and diagnostic equipment. Silicone-based conductive adhesives have gained particular traction in this segment due to their biocompatibility and flexibility.

Regionally, Asia Pacific dominates the market, accounting for over 60% of global consumption, primarily due to the concentration of electronics manufacturing in countries like China, Taiwan, South Korea, and Japan. North America and Europe follow, with significant demand coming from high-tech industries, automotive manufacturing, and medical device production.

Consumer preferences are increasingly shifting toward environmentally friendly solutions, creating growing demand for lead-free conductive adhesives and recyclable conductive tapes. This trend is particularly pronounced in Europe, where stringent environmental regulations have accelerated the transition away from traditional soldering methods containing lead and other hazardous materials.

The market is also witnessing increased demand for specialized products, including thermally conductive adhesives that can simultaneously provide electrical conductivity and heat dissipation capabilities, addressing the thermal management challenges in high-performance electronic devices.

Technical Limitations and Development Challenges

Despite the advantages of both conductive adhesives and electrically conductive tapes, these materials face significant technical limitations that hinder their widespread adoption in high-performance electronic applications. Conductive adhesives, particularly those based on epoxy resins, suffer from relatively high electrical resistivity compared to traditional soldering methods. This limitation becomes particularly problematic in high-frequency applications where signal integrity is paramount.

Thermal stability presents another major challenge for both technologies. Conductive adhesives tend to experience performance degradation at elevated temperatures, with some formulations showing significant increases in resistance after thermal cycling. Similarly, conductive tapes can lose adhesion strength and electrical conductivity when subjected to thermal stress, limiting their application in environments with wide temperature fluctuations.

Moisture sensitivity remains a persistent issue, especially for conductive adhesives. Water absorption can lead to swelling, increased resistivity, and eventual failure of the conductive pathways. This necessitates careful packaging and handling protocols that increase manufacturing complexity and cost.

The mechanical reliability of these interconnection technologies also presents ongoing challenges. Conductive adhesives typically exhibit lower shear strength compared to solder joints, making them susceptible to failure under mechanical stress. Conductive tapes, while flexible, may experience creep under sustained loading, potentially compromising electrical connections over time.

Processing challenges further complicate implementation. Conductive adhesives require precise dispensing equipment and carefully controlled curing conditions to achieve consistent performance. Conductive tapes demand specialized application techniques to ensure uniform pressure distribution and avoid trapped air bubbles that could compromise conductivity.

Long-term stability and aging effects represent perhaps the most significant barrier to wider adoption. Both technologies can experience performance degradation over time due to oxidation of conductive particles, polymer matrix degradation, and interfacial changes. This uncertainty about long-term reliability makes many manufacturers hesitant to adopt these technologies for mission-critical applications.

Current development efforts focus on addressing these limitations through novel material formulations. Research into nanoparticle-enhanced conductive adhesives shows promise for improving conductivity while maintaining processing advantages. Similarly, advanced conductive tape designs incorporating novel conductive elements and adhesive systems aim to enhance thermal stability and long-term reliability.

Thermal stability presents another major challenge for both technologies. Conductive adhesives tend to experience performance degradation at elevated temperatures, with some formulations showing significant increases in resistance after thermal cycling. Similarly, conductive tapes can lose adhesion strength and electrical conductivity when subjected to thermal stress, limiting their application in environments with wide temperature fluctuations.

Moisture sensitivity remains a persistent issue, especially for conductive adhesives. Water absorption can lead to swelling, increased resistivity, and eventual failure of the conductive pathways. This necessitates careful packaging and handling protocols that increase manufacturing complexity and cost.

The mechanical reliability of these interconnection technologies also presents ongoing challenges. Conductive adhesives typically exhibit lower shear strength compared to solder joints, making them susceptible to failure under mechanical stress. Conductive tapes, while flexible, may experience creep under sustained loading, potentially compromising electrical connections over time.

Processing challenges further complicate implementation. Conductive adhesives require precise dispensing equipment and carefully controlled curing conditions to achieve consistent performance. Conductive tapes demand specialized application techniques to ensure uniform pressure distribution and avoid trapped air bubbles that could compromise conductivity.

Long-term stability and aging effects represent perhaps the most significant barrier to wider adoption. Both technologies can experience performance degradation over time due to oxidation of conductive particles, polymer matrix degradation, and interfacial changes. This uncertainty about long-term reliability makes many manufacturers hesitant to adopt these technologies for mission-critical applications.

Current development efforts focus on addressing these limitations through novel material formulations. Research into nanoparticle-enhanced conductive adhesives shows promise for improving conductivity while maintaining processing advantages. Similarly, advanced conductive tape designs incorporating novel conductive elements and adhesive systems aim to enhance thermal stability and long-term reliability.

Current Conductive Adhesive and Tape Technologies

01 Conductive adhesive compositions with metal fillers

Conductive adhesives can be formulated using various metal fillers to achieve electrical conductivity. These compositions typically include metal particles such as silver, copper, nickel, or gold dispersed in an adhesive matrix. The metal particles create conductive pathways through the adhesive, allowing for electrical current to flow. The concentration and type of metal filler can be adjusted to achieve different levels of conductivity, while maintaining the adhesive properties required for bonding applications.- Conductive adhesives with metal fillers: Conductive adhesives incorporating metal fillers such as silver, copper, or nickel particles provide electrical conductivity while maintaining adhesive properties. These formulations typically contain a polymer matrix with dispersed metal particles that create conductive pathways. The concentration and distribution of metal fillers are critical for achieving optimal conductivity while preserving mechanical strength and adhesion properties. These adhesives are widely used in electronics assembly, particularly for applications requiring both electrical connections and structural bonding.

- Carbon-based conductive adhesive formulations: Carbon-based materials such as carbon black, graphite, and carbon nanotubes are incorporated into adhesive formulations to create electrically conductive tapes and adhesives. These carbon-filled systems offer advantages including lower cost compared to metal-filled alternatives, reduced weight, and corrosion resistance. The carbon particles form conductive networks within the polymer matrix, with conductivity dependent on particle concentration, dispersion quality, and the type of carbon material used. These formulations are particularly useful in EMI/RFI shielding applications and static dissipation.

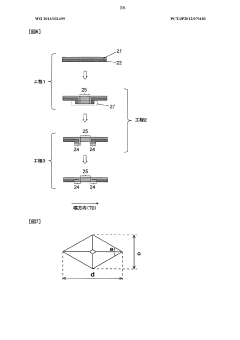

- Manufacturing methods for conductive tapes: Various manufacturing techniques are employed to produce electrically conductive tapes, including coating, lamination, and extrusion processes. Key manufacturing considerations include achieving uniform dispersion of conductive fillers, controlling adhesive thickness, and ensuring consistent electrical properties across the tape. Some methods involve applying conductive coatings to carrier films, while others incorporate conductive elements directly into the adhesive matrix. Post-processing techniques such as curing under specific temperature and pressure conditions can enhance both electrical and mechanical properties of the finished tapes.

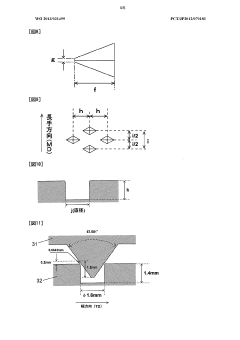

- Anisotropic conductive adhesives: Anisotropic conductive adhesives (ACAs) provide electrical conductivity in specific directions while maintaining insulation in others. These specialized formulations typically contain conductive particles arranged to create directional conductivity paths when compressed. The particles can be metal-coated polymer spheres, solid metal particles, or other conductive elements that establish electrical connections between components when pressure is applied. ACAs are particularly valuable in fine-pitch electronics assembly, display technologies, and flexible circuit connections where traditional soldering methods may be impractical.

- Pressure-sensitive conductive adhesive systems: Pressure-sensitive conductive adhesives combine the convenience of pressure-sensitive application with electrical conductivity. These systems adhere upon application of light pressure without requiring heat, solvents, or curing agents. The formulations typically include elastomeric components that provide tackiness and conformability along with conductive fillers that establish electrical pathways. These adhesives offer advantages in rapid assembly processes, reworkable connections, and applications requiring conformability to irregular surfaces. They are commonly used in temporary bonding, EMI shielding, and grounding applications where both electrical connectivity and removability are desired.

02 Electrically conductive tapes with anisotropic properties

Anisotropic conductive tapes provide electrical conductivity in specific directions while maintaining insulation in others. These tapes typically contain conductive particles aligned in a particular orientation or distributed in a way that creates directional conductivity. This property is particularly useful in electronics assembly where connections need to be made in one direction while preventing short circuits in other directions. The tapes often incorporate pressure-sensitive adhesives that allow for easy application and reliable bonding.Expand Specific Solutions03 Thermal management in conductive adhesive systems

Conductive adhesives and tapes designed for thermal management applications combine electrical conductivity with heat dissipation properties. These materials often incorporate thermally conductive fillers such as ceramic particles, carbon materials, or metal oxides alongside electrically conductive components. The dual functionality allows these adhesives to both create electrical connections and help manage heat in electronic assemblies, which is critical for the reliability and performance of high-power electronic devices.Expand Specific Solutions04 Manufacturing methods for conductive adhesive products

Various manufacturing techniques are employed to produce conductive adhesives and tapes with consistent electrical properties. These methods include specialized mixing processes to ensure uniform dispersion of conductive particles, coating techniques for applying adhesive to backing materials, and curing processes that optimize both adhesive strength and electrical conductivity. Some manufacturing approaches involve the alignment of conductive particles using electromagnetic fields during curing to enhance directional conductivity or overall performance.Expand Specific Solutions05 Flexible and stretchable conductive adhesives

Flexible and stretchable conductive adhesives address the need for electrical connections that can withstand mechanical deformation. These materials combine elastomeric adhesive matrices with conductive fillers that maintain electrical pathways even when stretched or bent. Applications include wearable electronics, flexible displays, and other devices that require electrical connections across moving or flexible joints. The formulations often incorporate specialized conductive materials such as carbon nanotubes, silver nanowires, or specially treated metal particles that can maintain conductivity under strain.Expand Specific Solutions

Leading Manufacturers and Industry Landscape

The conductive adhesives and electrically conductive tapes market is currently in a growth phase, driven by increasing demand for flexible electronics and miniaturization trends. The global market size is estimated to reach $4-5 billion by 2025, with a CAGR of 8-10%. Technologically, conductive adhesives are more mature for high-precision applications, while conductive tapes are gaining traction in consumer electronics. Leading players include 3M Innovative Properties, which dominates with comprehensive product portfolios, followed by Henkel AG and Nitto Denko focusing on specialized solutions. Other significant competitors include tesa SE and Scapa Group in industrial applications, while companies like Laird Technologies and Joinset are advancing niche innovations in thermal management and flexible electronics. Academic institutions like Tsinghua University and Xiamen University are contributing to technological advancements through collaborative research with industry partners.

3M Innovative Properties Co.

Technical Solution: 3M has developed a comprehensive portfolio of both conductive adhesives and tapes with distinctive technological approaches. Their conductive adhesives utilize anisotropic conductive film (ACF) technology that contains conductive particles precisely dispersed in an adhesive matrix, allowing electrical conductivity only in the z-direction while maintaining insulation in the x-y plane[1]. This technology enables high-density interconnections with fine pitch capabilities down to 40μm. For electrically conductive tapes, 3M employs metal foil-based solutions with conductive adhesive layers that provide EMI shielding while maintaining consistent electrical performance across varying environmental conditions. Their XYZ-Axis Electrically Conductive Tapes feature unique three-dimensional conductivity through specialized particle arrangement techniques[2]. 3M has also pioneered hybrid solutions that combine the flexibility of tapes with the connection reliability of adhesives through their Electrically Conductive Adhesive Transfer Tapes (ECATT) technology.

Strengths: Superior particle dispersion technology ensuring consistent electrical performance; extensive product range addressing multiple application scenarios; strong R&D capabilities enabling customized solutions for specific industries. Weaknesses: Premium pricing compared to competitors; some conductive adhesive solutions require specialized application equipment; longer curing times for certain adhesive formulations compared to tape-based solutions.

Nitto Denko Corp.

Technical Solution: Nitto Denko has developed proprietary RESIN SEAL technology for their conductive adhesives, which features a unique polymer matrix with embedded conductive particles that maintain stable electrical pathways even under thermal stress and mechanical deformation[3]. Their conductive adhesives employ silver, copper, and carbon-based fillers with proprietary surface treatments to prevent oxidation and maintain long-term conductivity. For electrically conductive tapes, Nitto offers their ELECRYSTA series, which utilizes a patented multi-layer structure with alternating conductive and adhesive layers to achieve both strong bonding and reliable electrical connectivity. Their tapes incorporate nano-scale metal particles that create multiple conduction paths, ensuring performance even if some paths are compromised[4]. Nitto has also developed specialized double-sided conductive tapes with differential adhesion strengths on each side, allowing for secure bonding to different substrate materials while maintaining uniform electrical conductivity.

Strengths: Superior thermal stability with operating temperature ranges from -40°C to 150°C; excellent resistance to environmental factors including humidity and chemical exposure; innovative particle technology enabling higher conductivity at lower filler loadings. Weaknesses: Limited product availability in some global regions; higher costs for specialized formulations; some adhesive solutions require longer processing times compared to competitive offerings.

Key Patents and Technical Innovations

Conductive adhesive tape

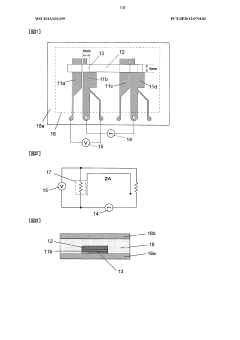

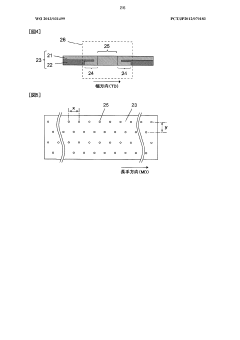

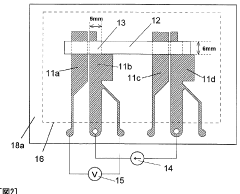

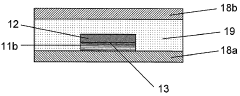

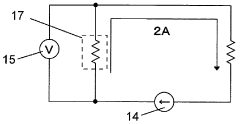

PatentWO2013031499A1

Innovation

- A conductive adhesive tape with an initial resistance value of 1 Ω or less, featuring a terminal portion with a specific area configuration and a silver-plated conductor pattern, is designed to maintain a resistance value multiplier of 5 times or less after 1500 hours in a constant temperature and humidity test, ensuring stable electrical conductivity.

Electrically conductive adhesive tape

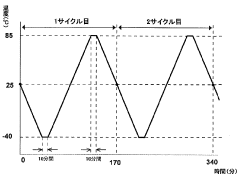

PatentWO2011108490A1

Innovation

- A conductive adhesive tape with a specific configuration, including a metal foil with a pressure-sensitive adhesive layer, where the maximum resistance value in the first cycle is 1Ω or less and the maximum resistance value at the 200th cycle is five times or less than the initial value, ensuring stable electrical conductivity through controlled terminal area and structure optimization.

Environmental Impact and Sustainability Considerations

The environmental impact of electronic interconnection technologies has become increasingly important as industries strive toward sustainable manufacturing practices. When comparing conductive adhesives and electrically conductive tapes, several environmental factors must be considered throughout their lifecycle, from production to disposal.

Conductive adhesives, particularly those based on epoxy resins, often contain volatile organic compounds (VOCs) that can be released during application and curing processes. These emissions contribute to air pollution and may pose health risks to workers in manufacturing environments. However, recent advancements have led to the development of water-based conductive adhesives with significantly reduced VOC content, offering more environmentally friendly alternatives.

Electrically conductive tapes, on the other hand, typically utilize acrylic or silicone-based adhesives with conductive fillers. While these generally emit fewer VOCs during application, their production process may involve energy-intensive manufacturing steps. The backing materials used in these tapes, often polyimide or PET films, present additional environmental considerations regarding resource consumption and biodegradability.

End-of-life management represents a critical sustainability challenge for both technologies. Conductive adhesives, once cured and integrated into electronic assemblies, are difficult to separate during recycling processes. This complicates the recovery of valuable metals and can lead to increased electronic waste. Conductive tapes face similar challenges, with the additional concern of mixed material composition that further hinders recycling efforts.

Carbon footprint assessments reveal notable differences between these technologies. The production of silver-filled conductive adhesives typically generates higher greenhouse gas emissions due to silver mining and processing. Conversely, conductive tapes using carbon-based fillers generally have lower embedded carbon, though their manufacturing energy requirements may offset some of these benefits.

Recent sustainability innovations include bio-based conductive adhesives derived from renewable resources such as lignin and cellulose. These formulations reduce dependence on petroleum-based raw materials while maintaining acceptable electrical performance. Similarly, research into recyclable conductive tapes with designed-for-disassembly features shows promise for improving end-of-life recovery rates.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of these materials. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have driven manufacturers toward developing formulations with reduced environmental impact, influencing global supply chains and product designs across the electronics industry.

Conductive adhesives, particularly those based on epoxy resins, often contain volatile organic compounds (VOCs) that can be released during application and curing processes. These emissions contribute to air pollution and may pose health risks to workers in manufacturing environments. However, recent advancements have led to the development of water-based conductive adhesives with significantly reduced VOC content, offering more environmentally friendly alternatives.

Electrically conductive tapes, on the other hand, typically utilize acrylic or silicone-based adhesives with conductive fillers. While these generally emit fewer VOCs during application, their production process may involve energy-intensive manufacturing steps. The backing materials used in these tapes, often polyimide or PET films, present additional environmental considerations regarding resource consumption and biodegradability.

End-of-life management represents a critical sustainability challenge for both technologies. Conductive adhesives, once cured and integrated into electronic assemblies, are difficult to separate during recycling processes. This complicates the recovery of valuable metals and can lead to increased electronic waste. Conductive tapes face similar challenges, with the additional concern of mixed material composition that further hinders recycling efforts.

Carbon footprint assessments reveal notable differences between these technologies. The production of silver-filled conductive adhesives typically generates higher greenhouse gas emissions due to silver mining and processing. Conversely, conductive tapes using carbon-based fillers generally have lower embedded carbon, though their manufacturing energy requirements may offset some of these benefits.

Recent sustainability innovations include bio-based conductive adhesives derived from renewable resources such as lignin and cellulose. These formulations reduce dependence on petroleum-based raw materials while maintaining acceptable electrical performance. Similarly, research into recyclable conductive tapes with designed-for-disassembly features shows promise for improving end-of-life recovery rates.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of these materials. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have driven manufacturers toward developing formulations with reduced environmental impact, influencing global supply chains and product designs across the electronics industry.

Reliability Testing and Performance Standards

Reliability testing and performance standards are critical aspects when evaluating conductive adhesives and electrically conductive tapes for industrial applications. These materials must maintain their electrical and mechanical properties under various environmental conditions and over extended periods to ensure product reliability.

Standard reliability tests for both conductive adhesives and tapes include thermal cycling (-40°C to +125°C), high temperature storage (typically 85°C/85% RH for 1000 hours), and thermal shock testing. These tests evaluate how these materials respond to extreme temperature fluctuations and prolonged exposure to heat and humidity, which can significantly impact their conductive properties and adhesion strength.

Mechanical reliability testing involves shear strength assessment, peel strength measurement, and vibration resistance evaluation. Conductive adhesives typically undergo additional creep resistance testing, while tapes are specifically tested for their repositionability characteristics and residue-free removal capabilities. These mechanical tests are crucial as they simulate real-world stresses that these materials will encounter during product lifecycles.

Electrical performance standards focus on volume resistivity stability, which should remain below 10^-4 Ω·cm for most applications. Contact resistance testing is particularly important for conductive tapes, as their performance can degrade significantly at connection points. Both materials must also pass current carrying capacity tests to ensure they can handle the required electrical loads without degradation.

Industry-specific standards vary significantly. Automotive applications follow AEC-Q100 standards, requiring functionality at temperatures from -40°C to +125°C and resistance to humidity, salt spray, and vibration. Medical device applications must meet biocompatibility standards (ISO 10993) and maintain performance after sterilization processes. Consumer electronics typically follow JEDEC standards, with emphasis on drop testing and thermal cycling resilience.

Environmental testing has become increasingly important, with RoHS and REACH compliance mandatory in many markets. Accelerated aging tests simulate years of environmental exposure in compressed timeframes, providing critical data on long-term reliability. These tests typically involve exposure to UV radiation, temperature cycling, and humidity fluctuations simultaneously.

Comparative analysis shows that conductive adhesives generally offer superior long-term reliability in high-stress environments, while conductive tapes excel in applications requiring frequent disassembly or where processing temperatures must remain low. The selection between these materials should be guided by application-specific reliability requirements and the relevant industry standards.

Standard reliability tests for both conductive adhesives and tapes include thermal cycling (-40°C to +125°C), high temperature storage (typically 85°C/85% RH for 1000 hours), and thermal shock testing. These tests evaluate how these materials respond to extreme temperature fluctuations and prolonged exposure to heat and humidity, which can significantly impact their conductive properties and adhesion strength.

Mechanical reliability testing involves shear strength assessment, peel strength measurement, and vibration resistance evaluation. Conductive adhesives typically undergo additional creep resistance testing, while tapes are specifically tested for their repositionability characteristics and residue-free removal capabilities. These mechanical tests are crucial as they simulate real-world stresses that these materials will encounter during product lifecycles.

Electrical performance standards focus on volume resistivity stability, which should remain below 10^-4 Ω·cm for most applications. Contact resistance testing is particularly important for conductive tapes, as their performance can degrade significantly at connection points. Both materials must also pass current carrying capacity tests to ensure they can handle the required electrical loads without degradation.

Industry-specific standards vary significantly. Automotive applications follow AEC-Q100 standards, requiring functionality at temperatures from -40°C to +125°C and resistance to humidity, salt spray, and vibration. Medical device applications must meet biocompatibility standards (ISO 10993) and maintain performance after sterilization processes. Consumer electronics typically follow JEDEC standards, with emphasis on drop testing and thermal cycling resilience.

Environmental testing has become increasingly important, with RoHS and REACH compliance mandatory in many markets. Accelerated aging tests simulate years of environmental exposure in compressed timeframes, providing critical data on long-term reliability. These tests typically involve exposure to UV radiation, temperature cycling, and humidity fluctuations simultaneously.

Comparative analysis shows that conductive adhesives generally offer superior long-term reliability in high-stress environments, while conductive tapes excel in applications requiring frequent disassembly or where processing temperatures must remain low. The selection between these materials should be guided by application-specific reliability requirements and the relevant industry standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!