Diesel Particulate Filter Efficiency vs Fuelling Techniques

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Technology Evolution and Objectives

Diesel Particulate Filter (DPF) technology has evolved significantly since its introduction in the early 1980s as a response to increasingly stringent emission regulations worldwide. Initially developed for heavy-duty diesel applications, DPF systems have progressively been refined to address the fundamental challenge of capturing and eliminating particulate matter (PM) from diesel exhaust without compromising engine performance or fuel efficiency.

The evolution of DPF technology can be traced through several distinct phases. First-generation DPFs focused primarily on filtration efficiency, utilizing ceramic wall-flow monoliths with limited regeneration capabilities. Second-generation systems introduced active regeneration strategies to address filter clogging issues, while third-generation DPFs incorporated advanced sensing technologies and more sophisticated control algorithms to optimize regeneration timing and efficiency.

Current DPF systems represent the fourth generation of this technology, featuring multi-functional catalytic coatings, enhanced thermal management, and integration with other emission control systems such as Selective Catalytic Reduction (SCR) and Diesel Oxidation Catalysts (DOC). These advancements have enabled DPF systems to achieve PM capture efficiencies exceeding 95% while minimizing the fuel economy penalty associated with regeneration events.

The relationship between DPF efficiency and fueling techniques has become increasingly important as manufacturers seek to optimize the balance between emissions control and operational costs. Traditional regeneration approaches relied heavily on post-injection fueling strategies, which often resulted in fuel dilution of engine oil and increased fuel consumption. Modern systems employ more sophisticated fueling techniques, including multiple injection events, variable injection timing, and precise control of injection pressure to optimize the regeneration process.

The primary objectives of current DPF technology development focus on several key areas: enhancing filtration efficiency across the entire particle size spectrum, reducing regeneration frequency while maintaining effective soot oxidation, minimizing the fuel consumption penalty associated with active regeneration, extending filter service life, and improving system robustness under varying operating conditions.

Future development goals include the integration of advanced materials such as silicon carbide and aluminum titanate to improve thermal durability, implementation of predictive regeneration strategies based on machine learning algorithms, and development of passive regeneration techniques that minimize or eliminate the need for active regeneration events. Additionally, there is significant interest in developing DPF systems optimized for alternative fuels and hybrid powertrains, as these technologies gain market share in the transportation sector.

The evolution of DPF technology can be traced through several distinct phases. First-generation DPFs focused primarily on filtration efficiency, utilizing ceramic wall-flow monoliths with limited regeneration capabilities. Second-generation systems introduced active regeneration strategies to address filter clogging issues, while third-generation DPFs incorporated advanced sensing technologies and more sophisticated control algorithms to optimize regeneration timing and efficiency.

Current DPF systems represent the fourth generation of this technology, featuring multi-functional catalytic coatings, enhanced thermal management, and integration with other emission control systems such as Selective Catalytic Reduction (SCR) and Diesel Oxidation Catalysts (DOC). These advancements have enabled DPF systems to achieve PM capture efficiencies exceeding 95% while minimizing the fuel economy penalty associated with regeneration events.

The relationship between DPF efficiency and fueling techniques has become increasingly important as manufacturers seek to optimize the balance between emissions control and operational costs. Traditional regeneration approaches relied heavily on post-injection fueling strategies, which often resulted in fuel dilution of engine oil and increased fuel consumption. Modern systems employ more sophisticated fueling techniques, including multiple injection events, variable injection timing, and precise control of injection pressure to optimize the regeneration process.

The primary objectives of current DPF technology development focus on several key areas: enhancing filtration efficiency across the entire particle size spectrum, reducing regeneration frequency while maintaining effective soot oxidation, minimizing the fuel consumption penalty associated with active regeneration, extending filter service life, and improving system robustness under varying operating conditions.

Future development goals include the integration of advanced materials such as silicon carbide and aluminum titanate to improve thermal durability, implementation of predictive regeneration strategies based on machine learning algorithms, and development of passive regeneration techniques that minimize or eliminate the need for active regeneration events. Additionally, there is significant interest in developing DPF systems optimized for alternative fuels and hybrid powertrains, as these technologies gain market share in the transportation sector.

Market Demand Analysis for Efficient DPF Systems

The global market for Diesel Particulate Filter (DPF) systems is experiencing significant growth driven by increasingly stringent emission regulations worldwide. The automotive industry faces mounting pressure to reduce particulate matter emissions, with Euro 7 standards, China 6b, and US EPA Tier 3 regulations creating substantial demand for more efficient DPF technologies. Current market projections indicate the global DPF market will reach approximately $24.8 billion by 2027, growing at a CAGR of 8.3% from 2022.

Commercial vehicle fleets represent the largest market segment, with fleet operators actively seeking DPF solutions that minimize regeneration frequency and fuel penalties. This demand is particularly acute in long-haul transportation, where even marginal fuel efficiency improvements translate to substantial operational cost savings. Market research indicates that fleet operators are willing to pay premium prices for DPF systems that demonstrate superior efficiency and reduced maintenance requirements.

Consumer preferences are increasingly influencing OEM decisions, with vehicle buyers showing greater awareness of environmental impact and fuel economy. This trend is especially pronounced in European and North American markets, where consumers often consider total cost of ownership, including maintenance expenses related to DPF systems. The aftermarket segment for replacement DPF systems is also expanding rapidly, projected to grow at 9.1% annually through 2026.

Regional analysis reveals varying market dynamics. Europe leads in DPF adoption due to its pioneering emission regulations, while North America shows accelerating growth as regulations tighten. The Asia-Pacific region, particularly China and India, represents the fastest-growing market as these countries implement more stringent emission standards to combat urban air pollution.

Industry surveys indicate that manufacturers are prioritizing R&D investments in advanced fueling techniques that optimize DPF performance. The market increasingly demands integrated systems that balance NOx reduction with particulate filtration efficiency. Technologies enabling passive regeneration through fuel management are gaining significant market traction, with 76% of fleet managers expressing preference for systems requiring minimal active regeneration.

Emerging market opportunities exist in retrofitting older diesel vehicles with advanced DPF systems, particularly in developing economies where complete fleet replacement is economically unfeasible. Additionally, the off-highway vehicle segment (construction, agriculture, mining) shows growing demand for specialized DPF solutions that can withstand harsh operating conditions while maintaining efficiency.

Commercial vehicle fleets represent the largest market segment, with fleet operators actively seeking DPF solutions that minimize regeneration frequency and fuel penalties. This demand is particularly acute in long-haul transportation, where even marginal fuel efficiency improvements translate to substantial operational cost savings. Market research indicates that fleet operators are willing to pay premium prices for DPF systems that demonstrate superior efficiency and reduced maintenance requirements.

Consumer preferences are increasingly influencing OEM decisions, with vehicle buyers showing greater awareness of environmental impact and fuel economy. This trend is especially pronounced in European and North American markets, where consumers often consider total cost of ownership, including maintenance expenses related to DPF systems. The aftermarket segment for replacement DPF systems is also expanding rapidly, projected to grow at 9.1% annually through 2026.

Regional analysis reveals varying market dynamics. Europe leads in DPF adoption due to its pioneering emission regulations, while North America shows accelerating growth as regulations tighten. The Asia-Pacific region, particularly China and India, represents the fastest-growing market as these countries implement more stringent emission standards to combat urban air pollution.

Industry surveys indicate that manufacturers are prioritizing R&D investments in advanced fueling techniques that optimize DPF performance. The market increasingly demands integrated systems that balance NOx reduction with particulate filtration efficiency. Technologies enabling passive regeneration through fuel management are gaining significant market traction, with 76% of fleet managers expressing preference for systems requiring minimal active regeneration.

Emerging market opportunities exist in retrofitting older diesel vehicles with advanced DPF systems, particularly in developing economies where complete fleet replacement is economically unfeasible. Additionally, the off-highway vehicle segment (construction, agriculture, mining) shows growing demand for specialized DPF solutions that can withstand harsh operating conditions while maintaining efficiency.

Current DPF Technology Challenges

Diesel Particulate Filters (DPFs) face significant technical challenges that impact their efficiency and operational performance. The primary challenge lies in the balance between particulate matter capture efficiency and backpressure management. As DPFs accumulate soot, the increasing backpressure can negatively affect engine performance, fuel economy, and emissions control. This fundamental trade-off remains a persistent engineering challenge despite decades of development.

Material durability presents another critical challenge. Current DPF substrates, typically made from cordierite or silicon carbide, must withstand extreme thermal conditions during regeneration cycles that can exceed 600°C. Thermal stress during these cycles can lead to cracking, melting, or structural degradation, particularly when uncontrolled regeneration occurs. This vulnerability significantly impacts filter longevity and maintenance requirements.

The regeneration process itself poses complex challenges that directly relate to fueling techniques. Passive regeneration relies on normal exhaust temperatures and NO2 as an oxidizing agent, but often proves insufficient in low-temperature driving conditions. Active regeneration, which involves injecting additional fuel to increase exhaust temperatures, creates its own set of problems including increased fuel consumption, potential oil dilution from post-injection strategies, and thermal management complexities.

Ash accumulation represents a long-term challenge that fueling techniques cannot address. Non-combustible materials from engine oil additives and fuel impurities gradually build up within the filter, creating irreversible clogging that eventually necessitates replacement or specialized cleaning. This ash accumulation accelerates in engines using biofuels or lower-quality fuels with higher impurity levels.

Sensor technology and control system limitations further complicate DPF management. Current pressure differential sensors lack precision in determining the actual soot load distribution within the filter. This imprecision leads to suboptimal regeneration timing and potentially unnecessary fuel consumption during active regeneration events.

Cold-start emissions control remains particularly challenging for DPF systems. During cold operation, particulate matter emissions increase significantly while the DPF operates below optimal temperature ranges. Advanced fueling techniques attempting to address this issue often result in increased hydrocarbon emissions or fuel dilution of engine oil.

The integration of DPF systems with other emissions control technologies, particularly Selective Catalytic Reduction (SCR) systems, creates additional challenges. The temperature requirements for optimal DPF regeneration may conflict with those needed for efficient NOx reduction in SCR systems, requiring complex thermal management strategies that impact overall system efficiency and fuel consumption.

Material durability presents another critical challenge. Current DPF substrates, typically made from cordierite or silicon carbide, must withstand extreme thermal conditions during regeneration cycles that can exceed 600°C. Thermal stress during these cycles can lead to cracking, melting, or structural degradation, particularly when uncontrolled regeneration occurs. This vulnerability significantly impacts filter longevity and maintenance requirements.

The regeneration process itself poses complex challenges that directly relate to fueling techniques. Passive regeneration relies on normal exhaust temperatures and NO2 as an oxidizing agent, but often proves insufficient in low-temperature driving conditions. Active regeneration, which involves injecting additional fuel to increase exhaust temperatures, creates its own set of problems including increased fuel consumption, potential oil dilution from post-injection strategies, and thermal management complexities.

Ash accumulation represents a long-term challenge that fueling techniques cannot address. Non-combustible materials from engine oil additives and fuel impurities gradually build up within the filter, creating irreversible clogging that eventually necessitates replacement or specialized cleaning. This ash accumulation accelerates in engines using biofuels or lower-quality fuels with higher impurity levels.

Sensor technology and control system limitations further complicate DPF management. Current pressure differential sensors lack precision in determining the actual soot load distribution within the filter. This imprecision leads to suboptimal regeneration timing and potentially unnecessary fuel consumption during active regeneration events.

Cold-start emissions control remains particularly challenging for DPF systems. During cold operation, particulate matter emissions increase significantly while the DPF operates below optimal temperature ranges. Advanced fueling techniques attempting to address this issue often result in increased hydrocarbon emissions or fuel dilution of engine oil.

The integration of DPF systems with other emissions control technologies, particularly Selective Catalytic Reduction (SCR) systems, creates additional challenges. The temperature requirements for optimal DPF regeneration may conflict with those needed for efficient NOx reduction in SCR systems, requiring complex thermal management strategies that impact overall system efficiency and fuel consumption.

Current Fuelling Techniques for DPF Optimization

01 Filter material composition and structure

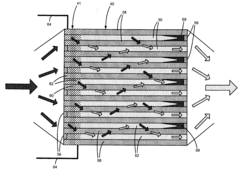

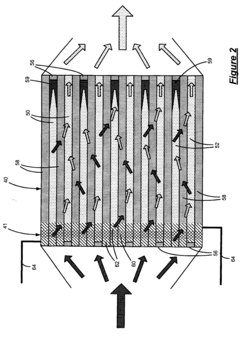

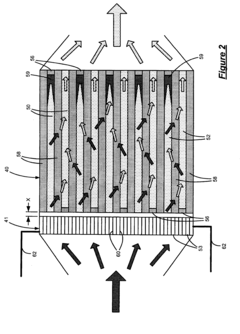

The efficiency of diesel particulate filters is significantly influenced by the materials used and their structural design. Advanced ceramic materials, such as cordierite and silicon carbide, offer improved filtration capabilities while maintaining durability under high temperatures. The pore size distribution, wall thickness, and channel geometry are critical factors that affect the filter's ability to capture particulate matter while minimizing backpressure on the engine. Innovations in filter substrate design include asymmetric cell structures and variable porosity that optimize the balance between filtration efficiency and pressure drop.- Filter material composition and structure: The efficiency of diesel particulate filters is significantly influenced by the materials used and their structural design. Advanced ceramic materials, such as cordierite and silicon carbide, offer high filtration efficiency while maintaining thermal stability under extreme exhaust conditions. The pore size distribution, wall thickness, and channel geometry of the filter substrate are critical factors that determine particulate capture efficiency. Innovations in filter substrate design include asymmetric cell structures and gradient porosity that optimize the balance between filtration efficiency and pressure drop.

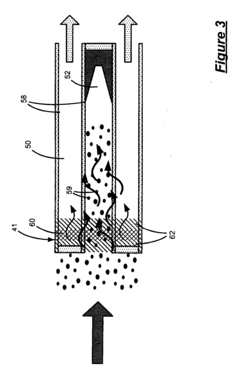

- Regeneration systems and strategies: Regeneration systems are essential for maintaining diesel particulate filter efficiency by periodically removing accumulated soot. Active regeneration methods involve raising exhaust temperatures to burn off particulate matter, while passive systems utilize catalytic materials to lower the soot combustion temperature. Advanced regeneration strategies include controlled injection timing, post-injection events, and intelligent thermal management to optimize the regeneration process. These systems help prevent filter clogging and maintain consistent filtration performance over the operational lifetime of the filter.

- Catalytic coatings and additives: Catalytic coatings and fuel additives play a crucial role in enhancing diesel particulate filter efficiency. Precious metal catalysts such as platinum, palladium, and rhodium, when applied to filter surfaces, facilitate soot oxidation at lower temperatures. Cerium-based additives in fuel can act as oxygen storage components that promote continuous regeneration. The distribution and loading of catalytic materials on the filter substrate significantly impact both filtration efficiency and regeneration performance. Novel catalyst formulations aim to improve low-temperature activity while maintaining thermal durability.

- Monitoring and diagnostic systems: Advanced monitoring and diagnostic systems are critical for maintaining optimal diesel particulate filter efficiency. Pressure differential sensors measure the pressure drop across the filter to determine soot loading levels. Temperature sensors monitor exhaust conditions to control regeneration processes. Sophisticated algorithms analyze sensor data to predict filter condition and optimize regeneration timing. On-board diagnostic systems can detect filter malfunctions, including cracks or melting, which would compromise filtration efficiency. These monitoring systems ensure the filter operates at peak efficiency throughout its service life.

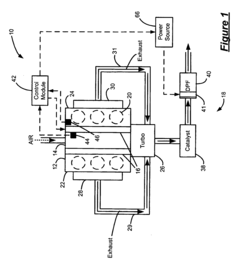

- Integration with exhaust aftertreatment systems: The integration of diesel particulate filters with other exhaust aftertreatment components significantly impacts overall system efficiency. Combined systems such as SCR-on-filter (SCRoF) or DOC-DPF configurations optimize space utilization while enhancing pollutant reduction. The positioning of the DPF relative to other components affects thermal management and regeneration efficiency. Advanced system architectures consider the interactions between NOx reduction, particulate filtration, and hydrocarbon oxidation to achieve optimal emissions control. Integrated control strategies coordinate the operation of multiple aftertreatment devices to maximize overall efficiency.

02 Regeneration methods and control strategies

Effective regeneration processes are essential for maintaining diesel particulate filter efficiency over time. Various approaches include active regeneration using fuel injection or electric heating elements to raise temperatures and burn off accumulated soot, passive regeneration utilizing catalytic coatings that lower soot combustion temperatures, and combined systems that integrate both methods. Advanced control strategies monitor filter loading conditions and engine parameters to optimize regeneration timing and duration, preventing excessive thermal stress while ensuring complete soot removal. These systems often incorporate predictive algorithms to balance regeneration frequency with fuel economy and filter longevity.Expand Specific Solutions03 Catalytic coatings and additives

The application of catalytic coatings and fuel additives significantly enhances diesel particulate filter efficiency. Noble metals like platinum and palladium, as well as base metal oxides, can be applied to filter surfaces to lower the combustion temperature of trapped particulates, facilitating more frequent passive regeneration. Fuel-borne catalysts containing cerium or iron compounds promote soot oxidation at lower temperatures. Advanced coating technologies ensure uniform catalyst distribution throughout the filter substrate, optimizing contact between catalytic materials and particulate matter while maintaining thermal stability during high-temperature regeneration events.Expand Specific Solutions04 Monitoring and diagnostic systems

Sophisticated monitoring and diagnostic systems are crucial for maintaining optimal diesel particulate filter efficiency. These systems employ pressure differential sensors to measure filter loading, temperature sensors to monitor regeneration conditions, and particulate matter sensors to evaluate filtration performance. Advanced diagnostic algorithms can detect filter cracks, ash accumulation, and incomplete regeneration events. Real-time monitoring enables adaptive control strategies that optimize filter performance across varying operating conditions, while predictive diagnostics can anticipate maintenance needs before efficiency degradation occurs, reducing downtime and preventing filter damage.Expand Specific Solutions05 Integration with other emission control systems

The integration of diesel particulate filters with other emission control technologies significantly enhances overall system efficiency. Combining DPFs with selective catalytic reduction (SCR) systems allows for simultaneous reduction of particulate matter and nitrogen oxides. Exhaust gas recirculation (EGR) systems can be optimized to reduce soot formation before it reaches the filter. Advanced system architectures position components to maximize thermal efficiency, with some designs incorporating diesel oxidation catalysts upstream of the particulate filter to increase exhaust temperatures and promote passive regeneration. These integrated approaches enable compliance with stringent emission standards while minimizing the performance impact on the engine.Expand Specific Solutions

Key Industry Players in DPF Technology

The diesel particulate filter (DPF) efficiency versus fueling techniques market is in a mature growth phase, with increasing regulatory pressure driving innovation. The global market size for DPF technologies exceeds $12 billion annually, growing at 5-7% CAGR due to stringent emission standards worldwide. Leading automotive manufacturers like GM, Volvo Lastvagnar, and Renault are advancing integration technologies, while specialized companies such as MANN+HUMMEL, Faurecia, and MAHLE have developed proprietary filter materials and regeneration systems. Component suppliers including Corning, Umicore, and The Lubrizol Corporation are focusing on catalyst formulations that optimize filter performance across various fueling conditions. Chinese players like Kailong High Technology and SINOTECH are rapidly gaining market share with cost-effective solutions for emerging markets.

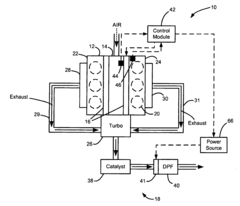

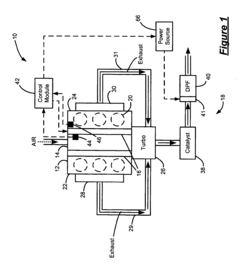

GM Global Technology Operations LLC

Technical Solution: GM has developed a comprehensive DPF management system that focuses on optimizing the relationship between fueling strategies and filter efficiency. Their approach incorporates advanced fuel injection mapping that precisely controls injection timing, pressure, and multiple injection events to minimize soot production while maintaining performance. GM's technology includes predictive DPF loading models that anticipate regeneration needs based on driving patterns and environmental conditions, allowing for more efficient timing of active regeneration events. Their system employs variable swirl intake ports and optimized combustion chamber designs that work in concert with the fueling strategy to reduce particulate formation at the source. GM has also implemented sophisticated thermal management systems that utilize precise exhaust gas temperature control through fuel post-injection to ensure efficient DPF regeneration while minimizing fuel consumption penalties.

Strengths: Holistic approach integrating engine design, fueling strategies, and aftertreatment; predictive algorithms reduce unnecessary regeneration events; system adaptability across various vehicle platforms and duty cycles. Weaknesses: Complex control systems require extensive calibration; potential for increased maintenance costs in certain applications; regeneration strategies can still impact fuel economy during urban driving conditions.

MANN+HUMMEL GmbH

Technical Solution: MANN+HUMMEL has developed specialized DPF technologies that focus on filter substrate design and its interaction with various fueling techniques. Their advanced ceramic filter materials feature optimized porosity and channel structures that enhance filtration efficiency while minimizing back pressure penalties. The company's DPF systems incorporate innovative catalyst coatings that work synergistically with modern diesel fueling strategies, lowering the temperature threshold required for passive regeneration. MANN+HUMMEL has engineered filter substrates with asymmetric cell structures that provide increased ash storage capacity, extending filter service life even with varying fuel quality. Their technology includes integrated pressure and temperature sensors that provide real-time data to engine management systems, enabling adaptive fueling strategies that optimize filter performance across diverse operating conditions. The company has also developed specialized filter designs for different applications, recognizing that optimal DPF efficiency requires tailored solutions based on specific engine characteristics and fueling patterns.

Strengths: Specialized expertise in filtration technology; filter designs optimized for different engine types and duty cycles; robust performance even with varying fuel quality. Weaknesses: Reliance on engine manufacturers' fueling strategies for optimal performance; limited control over the complete system integration; potential for higher initial costs compared to standard DPF solutions.

Critical Patents in DPF-Fuel Interaction

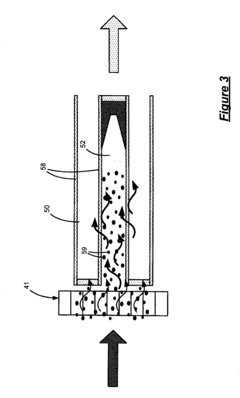

Diesel particulate filter (DPF) regeneration by electrical heating of resistive coatings

PatentInactiveUS20070062181A1

Innovation

- An exhaust system with a resistive electrical heater integrally formed within the DPF, selectively heating the exhaust to initiate particulate combustion, and a control module that determines the need for regeneration based on particulate matter thresholds, using the heater only during the initial phase to minimize temperature excursions and maximize efficiency.

Electrical diesel particulate filter (DPF) regeneration

PatentInactiveUS20070044460A1

Innovation

- An exhaust system with a diesel particulate filter (DPF) and an electrical heater upstream, which selectively heats the exhaust to initiate combustion of particulates, using a resistive heater offset from the DPF, controlled by a module that determines the need for regeneration based on particulate matter thresholds, initiating a controlled heating process.

Emissions Regulations Impact on DPF Development

The evolution of emissions regulations has been a primary driver for Diesel Particulate Filter (DPF) development over the past two decades. Beginning with Euro 3 standards in 2000, which first introduced particulate matter (PM) limits for diesel vehicles, regulatory frameworks have progressively tightened emission constraints, necessitating increasingly sophisticated DPF technologies.

The implementation of Euro 5 standards in 2009 marked a significant milestone, as it effectively mandated DPF installation in all new diesel vehicles by reducing PM limits by 80% compared to Euro 4. This regulatory pressure accelerated research into filter materials, regeneration strategies, and system integration approaches that could maintain efficiency while minimizing fuel economy penalties.

In North America, the EPA's Tier 2 and Tier 3 standards, along with California's LEV III regulations, have similarly driven DPF innovation by establishing stringent PM mass limits and introducing particle number (PN) restrictions. These regulations have forced manufacturers to develop DPF systems that not only capture larger particulates but also efficiently filter ultrafine particles that pose significant health risks.

The introduction of Real Driving Emissions (RDE) testing in Europe under Euro 6d has further challenged DPF technology by requiring systems to perform effectively across diverse driving conditions, not just in laboratory settings. This has led to advanced fueling techniques specifically designed to maintain DPF efficiency during various operational modes, including low-temperature urban driving where traditional passive regeneration is difficult to achieve.

China's rapid adoption of stringent emissions standards (China 6) has expanded the global market for advanced DPF technologies, creating economies of scale that have accelerated innovation. These standards have particularly emphasized NOx reduction alongside particulate control, driving the development of integrated emission control systems where fueling strategies must simultaneously support DPF regeneration and SCR (Selective Catalytic Reduction) efficiency.

Looking forward, upcoming Euro 7 and EPA regulations are expected to further reduce allowable emission limits while expanding the conditions under which vehicles must comply. This regulatory trajectory is pushing research toward predictive regeneration strategies that optimize fuel consumption during DPF cleaning cycles, advanced sensor technologies for real-time monitoring, and novel catalyst formulations that lower regeneration temperature requirements.

The regulatory focus has also shifted toward lifecycle emissions performance, requiring DPF systems to maintain high efficiency throughout the vehicle's operational life. This has prompted development of more durable filter materials and adaptive fueling strategies that can compensate for DPF aging effects while minimizing the fuel consumption penalty associated with regeneration events.

The implementation of Euro 5 standards in 2009 marked a significant milestone, as it effectively mandated DPF installation in all new diesel vehicles by reducing PM limits by 80% compared to Euro 4. This regulatory pressure accelerated research into filter materials, regeneration strategies, and system integration approaches that could maintain efficiency while minimizing fuel economy penalties.

In North America, the EPA's Tier 2 and Tier 3 standards, along with California's LEV III regulations, have similarly driven DPF innovation by establishing stringent PM mass limits and introducing particle number (PN) restrictions. These regulations have forced manufacturers to develop DPF systems that not only capture larger particulates but also efficiently filter ultrafine particles that pose significant health risks.

The introduction of Real Driving Emissions (RDE) testing in Europe under Euro 6d has further challenged DPF technology by requiring systems to perform effectively across diverse driving conditions, not just in laboratory settings. This has led to advanced fueling techniques specifically designed to maintain DPF efficiency during various operational modes, including low-temperature urban driving where traditional passive regeneration is difficult to achieve.

China's rapid adoption of stringent emissions standards (China 6) has expanded the global market for advanced DPF technologies, creating economies of scale that have accelerated innovation. These standards have particularly emphasized NOx reduction alongside particulate control, driving the development of integrated emission control systems where fueling strategies must simultaneously support DPF regeneration and SCR (Selective Catalytic Reduction) efficiency.

Looking forward, upcoming Euro 7 and EPA regulations are expected to further reduce allowable emission limits while expanding the conditions under which vehicles must comply. This regulatory trajectory is pushing research toward predictive regeneration strategies that optimize fuel consumption during DPF cleaning cycles, advanced sensor technologies for real-time monitoring, and novel catalyst formulations that lower regeneration temperature requirements.

The regulatory focus has also shifted toward lifecycle emissions performance, requiring DPF systems to maintain high efficiency throughout the vehicle's operational life. This has prompted development of more durable filter materials and adaptive fueling strategies that can compensate for DPF aging effects while minimizing the fuel consumption penalty associated with regeneration events.

Cost-Benefit Analysis of Advanced Fuelling Strategies

The implementation of advanced fuelling strategies for diesel engines presents a complex economic equation that must be carefully evaluated against the performance improvements in Diesel Particulate Filter (DPF) efficiency. Initial investment costs for upgrading to sophisticated fuel injection systems range from $2,000 to $8,000 per vehicle, depending on the technology level and integration complexity. These systems include high-pressure common rail injection, multiple injection events capability, and advanced electronic control units.

Operational cost analysis reveals that advanced fuelling techniques can reduce fuel consumption by 3-7% through more precise combustion control, translating to annual savings of approximately $1,200-$2,800 for heavy-duty vehicles with typical annual mileage. Additionally, these systems extend DPF service intervals by 15-30% by reducing particulate matter formation at the source, decreasing maintenance costs by an estimated $600-$1,500 annually.

The environmental benefits, while difficult to monetize directly, include reduced carbon emissions valued at $80-$150 per ton in carbon markets, and decreased particulate emissions that contribute to improved public health outcomes. Studies suggest these health benefits could represent $3,000-$5,000 in societal value per vehicle annually, though these figures rarely appear on corporate balance sheets.

Return on investment calculations indicate that fleet operators can expect to recover their investment in advanced fuelling systems within 1.5-3 years, depending on vehicle usage patterns and fuel prices. The payback period shortens considerably when regulatory compliance costs are factored in, particularly in regions with stringent emissions standards where non-compliance penalties can exceed $10,000 per violation.

Long-term economic analysis demonstrates that vehicles equipped with advanced fuelling systems maintain higher resale values, typically commanding a 5-10% premium in secondary markets. Furthermore, these technologies provide a hedge against increasingly strict emissions regulations, potentially avoiding costly retrofits or premature fleet replacement.

Sensitivity analysis shows that the cost-benefit ratio is most heavily influenced by fuel prices, with each $0.10 increase in diesel prices improving the ROI of advanced fuelling systems by approximately 4%. Vehicle utilization rates also significantly impact the equation, with high-mileage applications seeing substantially better returns than low-usage scenarios.

Operational cost analysis reveals that advanced fuelling techniques can reduce fuel consumption by 3-7% through more precise combustion control, translating to annual savings of approximately $1,200-$2,800 for heavy-duty vehicles with typical annual mileage. Additionally, these systems extend DPF service intervals by 15-30% by reducing particulate matter formation at the source, decreasing maintenance costs by an estimated $600-$1,500 annually.

The environmental benefits, while difficult to monetize directly, include reduced carbon emissions valued at $80-$150 per ton in carbon markets, and decreased particulate emissions that contribute to improved public health outcomes. Studies suggest these health benefits could represent $3,000-$5,000 in societal value per vehicle annually, though these figures rarely appear on corporate balance sheets.

Return on investment calculations indicate that fleet operators can expect to recover their investment in advanced fuelling systems within 1.5-3 years, depending on vehicle usage patterns and fuel prices. The payback period shortens considerably when regulatory compliance costs are factored in, particularly in regions with stringent emissions standards where non-compliance penalties can exceed $10,000 per violation.

Long-term economic analysis demonstrates that vehicles equipped with advanced fuelling systems maintain higher resale values, typically commanding a 5-10% premium in secondary markets. Furthermore, these technologies provide a hedge against increasingly strict emissions regulations, potentially avoiding costly retrofits or premature fleet replacement.

Sensitivity analysis shows that the cost-benefit ratio is most heavily influenced by fuel prices, with each $0.10 increase in diesel prices improving the ROI of advanced fuelling systems by approximately 4%. Vehicle utilization rates also significantly impact the equation, with high-mileage applications seeing substantially better returns than low-usage scenarios.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!