Diesel Particulate Filter vs SCR Systems: Pros and Cons

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Emission Control Technology Background and Objectives

Emission control technologies have evolved significantly over the past several decades in response to increasingly stringent environmental regulations worldwide. The journey began in the 1970s with the introduction of basic catalytic converters, progressing through various technological iterations to address the complex challenge of reducing harmful emissions from internal combustion engines, particularly diesel engines which present unique pollution control challenges.

The diesel engine, while valued for its efficiency and durability, produces significant amounts of particulate matter (PM) and nitrogen oxides (NOx), both of which pose serious environmental and health concerns. These emissions contribute to air pollution, respiratory diseases, and climate change, driving the development of specialized control technologies.

Two primary technologies have emerged as leading solutions for diesel emission control: Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR) systems. DPF technology, introduced commercially in the early 2000s, physically captures particulate matter from exhaust gases, while SCR systems, which gained widespread adoption in the late 2000s, use chemical reactions to convert NOx emissions into harmless nitrogen and water.

The evolution of these technologies has been largely driven by regulatory frameworks such as the European emission standards (Euro I-VI), the US EPA's Tier standards, and similar regulations in other major markets. Each regulatory update has pushed manufacturers to develop more efficient and effective emission control solutions, resulting in significant technological advancements.

The primary objective of modern emission control technology research is to balance multiple competing factors: emission reduction efficiency, fuel economy impact, system durability, maintenance requirements, and cost-effectiveness. This balance is particularly challenging as regulations continue to tighten while consumers and fleet operators remain sensitive to operational costs.

Current technological goals include developing systems that maintain high efficiency across diverse operating conditions, reduce the frequency of regeneration cycles for DPFs, minimize the consumption of diesel exhaust fluid (DEF) in SCR systems, and integrate these technologies with other emission control components to create comprehensive solutions.

Looking forward, the industry aims to further refine these technologies to meet upcoming regulatory standards such as Euro VII and US EPA Tier 4 Final, while also preparing for the transition to alternative powertrains. This includes developing systems that can function effectively with renewable diesel fuels and hybrid powertrains, extending the viability of internal combustion engines in an increasingly carbon-conscious world.

The diesel engine, while valued for its efficiency and durability, produces significant amounts of particulate matter (PM) and nitrogen oxides (NOx), both of which pose serious environmental and health concerns. These emissions contribute to air pollution, respiratory diseases, and climate change, driving the development of specialized control technologies.

Two primary technologies have emerged as leading solutions for diesel emission control: Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR) systems. DPF technology, introduced commercially in the early 2000s, physically captures particulate matter from exhaust gases, while SCR systems, which gained widespread adoption in the late 2000s, use chemical reactions to convert NOx emissions into harmless nitrogen and water.

The evolution of these technologies has been largely driven by regulatory frameworks such as the European emission standards (Euro I-VI), the US EPA's Tier standards, and similar regulations in other major markets. Each regulatory update has pushed manufacturers to develop more efficient and effective emission control solutions, resulting in significant technological advancements.

The primary objective of modern emission control technology research is to balance multiple competing factors: emission reduction efficiency, fuel economy impact, system durability, maintenance requirements, and cost-effectiveness. This balance is particularly challenging as regulations continue to tighten while consumers and fleet operators remain sensitive to operational costs.

Current technological goals include developing systems that maintain high efficiency across diverse operating conditions, reduce the frequency of regeneration cycles for DPFs, minimize the consumption of diesel exhaust fluid (DEF) in SCR systems, and integrate these technologies with other emission control components to create comprehensive solutions.

Looking forward, the industry aims to further refine these technologies to meet upcoming regulatory standards such as Euro VII and US EPA Tier 4 Final, while also preparing for the transition to alternative powertrains. This includes developing systems that can function effectively with renewable diesel fuels and hybrid powertrains, extending the viability of internal combustion engines in an increasingly carbon-conscious world.

Market Demand Analysis for Diesel Aftertreatment Systems

The global diesel aftertreatment systems market has experienced significant growth driven by increasingly stringent emission regulations across major economies. The market value reached approximately $12.3 billion in 2022 and is projected to grow at a CAGR of 7.2% through 2030, potentially reaching $21.5 billion. This growth trajectory is primarily fueled by the implementation of Euro 6/VI, China VI, and US EPA Tier 4 emission standards, which mandate substantial reductions in particulate matter (PM) and nitrogen oxides (NOx) emissions.

Commercial vehicles represent the largest market segment, accounting for over 60% of the total demand for diesel aftertreatment systems. This dominance stems from the widespread use of diesel engines in heavy-duty trucks, buses, and off-road equipment, where alternatives like full electrification face significant technical and economic barriers. The construction and agricultural sectors are emerging as particularly strong growth areas, with increasing regulatory focus on non-road mobile machinery emissions.

Regional analysis reveals that Asia-Pacific currently leads the market with approximately 40% share, driven by China's aggressive emission standards implementation and India's transition to Bharat Stage VI norms. Europe follows closely at 35%, with North America representing about 20% of the global market. Developing regions are showing accelerated adoption rates as they implement more stringent emission regulations, creating new market opportunities.

The aftertreatment systems market is experiencing a shift in demand patterns between DPF and SCR technologies. While DPFs have historically dominated due to their effectiveness in reducing particulate matter, SCR systems are gaining market share rapidly due to their superior NOx reduction capabilities. The combined DPF-SCR system segment is growing at the fastest rate, reflecting the industry trend toward integrated solutions that address multiple pollutants simultaneously.

Fleet operators' purchasing decisions are increasingly influenced by total cost of ownership considerations rather than initial acquisition costs alone. This shift benefits more advanced systems that offer improved fuel efficiency and reduced maintenance requirements despite higher upfront costs. Market research indicates that systems demonstrating fuel economy improvements of 2-5% can achieve payback periods of less than three years, making them attractive investments for commercial fleet operators.

The aftermarket segment for replacement parts and service is expanding at a CAGR of 8.5%, outpacing the overall market growth. This trend reflects the aging vehicle fleet in developed markets and the increasing complexity of aftertreatment systems, which require more frequent maintenance and component replacement to maintain optimal performance and compliance with emission standards.

Commercial vehicles represent the largest market segment, accounting for over 60% of the total demand for diesel aftertreatment systems. This dominance stems from the widespread use of diesel engines in heavy-duty trucks, buses, and off-road equipment, where alternatives like full electrification face significant technical and economic barriers. The construction and agricultural sectors are emerging as particularly strong growth areas, with increasing regulatory focus on non-road mobile machinery emissions.

Regional analysis reveals that Asia-Pacific currently leads the market with approximately 40% share, driven by China's aggressive emission standards implementation and India's transition to Bharat Stage VI norms. Europe follows closely at 35%, with North America representing about 20% of the global market. Developing regions are showing accelerated adoption rates as they implement more stringent emission regulations, creating new market opportunities.

The aftertreatment systems market is experiencing a shift in demand patterns between DPF and SCR technologies. While DPFs have historically dominated due to their effectiveness in reducing particulate matter, SCR systems are gaining market share rapidly due to their superior NOx reduction capabilities. The combined DPF-SCR system segment is growing at the fastest rate, reflecting the industry trend toward integrated solutions that address multiple pollutants simultaneously.

Fleet operators' purchasing decisions are increasingly influenced by total cost of ownership considerations rather than initial acquisition costs alone. This shift benefits more advanced systems that offer improved fuel efficiency and reduced maintenance requirements despite higher upfront costs. Market research indicates that systems demonstrating fuel economy improvements of 2-5% can achieve payback periods of less than three years, making them attractive investments for commercial fleet operators.

The aftermarket segment for replacement parts and service is expanding at a CAGR of 8.5%, outpacing the overall market growth. This trend reflects the aging vehicle fleet in developed markets and the increasing complexity of aftertreatment systems, which require more frequent maintenance and component replacement to maintain optimal performance and compliance with emission standards.

DPF and SCR Current Status and Technical Challenges

Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR) systems represent two critical technologies in modern diesel emission control strategies. Currently, DPF technology has reached maturity with widespread implementation across light and heavy-duty diesel vehicles globally. These filters typically achieve particulate matter (PM) reduction efficiencies of 85-95%, significantly contributing to meeting stringent emission standards like Euro 6 and EPA Tier 4. However, DPF systems face ongoing challenges with regeneration management, as incomplete regeneration cycles can lead to filter clogging and subsequent vehicle performance issues.

The current generation of DPF systems utilizes various substrate materials including cordierite, silicon carbide, and aluminum titanate, each offering different thermal durability and filtration efficiency profiles. A significant technical challenge remains in optimizing the balance between back-pressure minimization and filtration efficiency, as increased back-pressure negatively impacts fuel economy by 2-5% depending on driving conditions and regeneration frequency.

SCR systems have similarly evolved substantially, with current technologies achieving NOx reduction rates of 75-95% under optimal conditions. Modern SCR systems employ advanced catalyst formulations, typically vanadium-based or zeolite-based, with the latter showing superior performance at higher temperatures. The urea injection strategy has become increasingly sophisticated, utilizing predictive algorithms and closed-loop control systems to optimize dosing rates based on real-time engine parameters.

A primary technical challenge for SCR systems remains their temperature dependency, as catalytic efficiency drops significantly below 200°C, creating a "cold-start emissions gap" that accounts for a disproportionate percentage of total NOx emissions in urban driving cycles. Additionally, ammonia slip (excess NH3 emissions) continues to present challenges, requiring precise control strategies and potentially secondary catalysts.

Integration challenges between DPF and SCR systems represent another significant hurdle. When implemented together, thermal management becomes complex as DPF regeneration requires high temperatures that can affect SCR catalyst performance and longevity. The positioning of components in the exhaust stream creates competing requirements, with some manufacturers adopting a DPF-first approach while others place the SCR upstream to prioritize NOx reduction.

Durability and aging characteristics present ongoing challenges for both systems. DPF ash accumulation from non-combustible materials in fuel and lubricants necessitates periodic maintenance, while SCR catalysts face potential poisoning from sulfur compounds and thermal degradation. Current research focuses on developing more robust catalyst formulations and improved system diagnostics to predict maintenance requirements more accurately.

The current generation of DPF systems utilizes various substrate materials including cordierite, silicon carbide, and aluminum titanate, each offering different thermal durability and filtration efficiency profiles. A significant technical challenge remains in optimizing the balance between back-pressure minimization and filtration efficiency, as increased back-pressure negatively impacts fuel economy by 2-5% depending on driving conditions and regeneration frequency.

SCR systems have similarly evolved substantially, with current technologies achieving NOx reduction rates of 75-95% under optimal conditions. Modern SCR systems employ advanced catalyst formulations, typically vanadium-based or zeolite-based, with the latter showing superior performance at higher temperatures. The urea injection strategy has become increasingly sophisticated, utilizing predictive algorithms and closed-loop control systems to optimize dosing rates based on real-time engine parameters.

A primary technical challenge for SCR systems remains their temperature dependency, as catalytic efficiency drops significantly below 200°C, creating a "cold-start emissions gap" that accounts for a disproportionate percentage of total NOx emissions in urban driving cycles. Additionally, ammonia slip (excess NH3 emissions) continues to present challenges, requiring precise control strategies and potentially secondary catalysts.

Integration challenges between DPF and SCR systems represent another significant hurdle. When implemented together, thermal management becomes complex as DPF regeneration requires high temperatures that can affect SCR catalyst performance and longevity. The positioning of components in the exhaust stream creates competing requirements, with some manufacturers adopting a DPF-first approach while others place the SCR upstream to prioritize NOx reduction.

Durability and aging characteristics present ongoing challenges for both systems. DPF ash accumulation from non-combustible materials in fuel and lubricants necessitates periodic maintenance, while SCR catalysts face potential poisoning from sulfur compounds and thermal degradation. Current research focuses on developing more robust catalyst formulations and improved system diagnostics to predict maintenance requirements more accurately.

Current DPF and SCR Implementation Solutions

01 DPF and SCR system integration for emission reduction

Integration of Diesel Particulate Filter (DPF) and Selective Catalytic Reduction (SCR) systems in a single exhaust aftertreatment system to effectively reduce both particulate matter and NOx emissions from diesel engines. This combined approach optimizes the space requirements and improves overall emission reduction efficiency by allowing the systems to work synergistically.- DPF and SCR system integration for emission reduction: Integration of Diesel Particulate Filter (DPF) and Selective Catalytic Reduction (SCR) systems in a single exhaust aftertreatment system to effectively reduce both particulate matter and NOx emissions from diesel engines. This combined approach optimizes the space requirements and improves overall emission reduction efficiency by allowing the systems to work synergistically.

- Regeneration strategies for DPF systems: Various regeneration strategies for Diesel Particulate Filters to maintain their efficiency in trapping particulate matter. These strategies include active regeneration through temperature control, passive regeneration using catalytic coatings, and controlled injection of fuel or additives to initiate the combustion of trapped soot, thereby preventing filter clogging and maintaining optimal emission reduction performance.

- Advanced SCR catalyst formulations: Development of advanced catalyst formulations for Selective Catalytic Reduction systems to enhance NOx conversion efficiency. These formulations include zeolite-based catalysts, metal-oxide catalysts, and hybrid catalyst systems that operate effectively across a wider temperature range, improving the overall performance of emission reduction systems in various operating conditions.

- Control systems and sensors for emission management: Sophisticated control systems and sensor technologies for real-time monitoring and management of exhaust aftertreatment systems. These include NOx sensors, temperature sensors, pressure differential sensors, and integrated control algorithms that optimize the operation of DPF and SCR systems based on engine load, exhaust temperature, and other parameters to maximize emission reduction efficiency.

- Urea dosing and injection systems for SCR: Advanced urea dosing and injection systems for SCR technology that ensure precise delivery of the reducing agent. These systems include improved injector designs, mixing elements, and control strategies that optimize the distribution and hydrolysis of urea to ammonia, enhancing the NOx reduction efficiency while minimizing ammonia slip and deposit formation in the exhaust system.

02 Regeneration strategies for DPF systems

Various regeneration strategies for Diesel Particulate Filters to maintain their efficiency in trapping particulate matter. These strategies include active regeneration through temperature control, passive regeneration using catalytic coatings, and combined approaches that optimize fuel economy while ensuring effective soot oxidation. Advanced control algorithms monitor filter loading and trigger regeneration at optimal times.Expand Specific Solutions03 Urea-based SCR systems for NOx reduction

Selective Catalytic Reduction systems using urea-based solutions (commonly known as DEF or AdBlue) to convert nitrogen oxides into nitrogen and water. These systems include precise injection control, mixing elements for uniform distribution, and specialized catalysts that optimize the conversion efficiency across various operating conditions and temperatures.Expand Specific Solutions04 Sensor and control systems for emission management

Advanced sensor technologies and control systems that monitor and manage the performance of DPF and SCR systems. These include NOx sensors, particulate matter sensors, temperature sensors, and pressure differential sensors that provide real-time data to the engine control unit. Sophisticated algorithms use this data to optimize dosing rates, regeneration timing, and overall system performance.Expand Specific Solutions05 Novel catalyst formulations for improved emission control

Innovative catalyst formulations that enhance the performance of both DPF and SCR systems. These include zeolite-based catalysts, precious metal catalysts, and multi-functional catalytic coatings that can simultaneously address multiple pollutants. Advanced materials science approaches have led to catalysts with improved thermal stability, poison resistance, and conversion efficiency across broader temperature ranges.Expand Specific Solutions

Major Manufacturers and Competitive Landscape

The diesel particulate filter (DPF) and selective catalytic reduction (SCR) systems market is in a mature growth phase, with an estimated global value exceeding $15 billion. Major players like BASF, Bosch, Johnson Matthey, and Umicore dominate the emission control technology landscape, with increasing competition from Weichai Power and Zhejiang Yinlun in Asia. Technology maturity varies between the two systems: DPF technology is well-established with incremental improvements focusing on durability and regeneration efficiency, while SCR systems continue to evolve with advancements in catalyst formulations and urea injection systems. OEMs including Volvo, Caterpillar, Cummins, and PACCAR are increasingly integrating these technologies to meet stringent Euro VI and EPA emissions standards.

BASF SE

Technical Solution: BASF has developed comprehensive emission control solutions addressing both particulate matter and NOx reduction challenges. Their DPF technology utilizes advanced ceramic substrates with optimized porosity and channel designs that achieve >99% particulate matter capture efficiency while maintaining acceptable backpressure levels. BASF's proprietary catalyst formulations incorporate carefully balanced platinum and palladium loadings that promote soot oxidation at temperatures as low as 250°C, significantly enhancing passive regeneration capabilities. For SCR systems, BASF offers their EMPRO™ technology featuring copper zeolite catalysts with exceptional thermal durability (up to 900°C) and industry-leading low-temperature activity (180°C onset). Their catalyst formulations demonstrate NOx conversion efficiencies exceeding 95% across broad operating conditions. BASF has pioneered multi-functional coating technologies that combine SCR functionality with ammonia slip catalysts and hydrocarbon traps in single components, reducing system complexity and packaging requirements. Their latest innovation includes SCR on filter (SCRoF) technology that integrates particulate filtration and NOx reduction into a single substrate, offering up to 30% volume reduction compared to conventional separate systems.

Strengths: Exceptional catalyst formulation expertise with optimized precious metal utilization; comprehensive substrate portfolio allowing customized solutions for different applications; advanced manufacturing capabilities ensuring consistent quality at scale. Weaknesses: Premium pricing reflecting advanced technology content; requires sophisticated system integration to maximize performance benefits; optimal performance dependent on precise urea dosing systems.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced Diesel Particulate Filter (DPF) systems that utilize cordierite or silicon carbide substrates with carefully engineered wall porosity (10-15 μm) to capture particulate matter with over 95% efficiency. Their DPF technology incorporates active regeneration through precise fuel injection timing and post-injection strategies, maintaining optimal backpressure levels. For SCR systems, Bosch employs a modular BlueHDI technology with AdBlue injection and specialized catalysts that can achieve NOx reduction rates of 90-95% across various operating temperatures (200-450°C). Their integrated systems combine both technologies with sophisticated sensors and control algorithms that continuously monitor exhaust composition, temperature, and pressure to optimize the balance between particulate filtration and NOx reduction based on real-time driving conditions.

Strengths: Industry-leading control systems integration allowing for precise dosing and regeneration timing; comprehensive sensor networks enabling adaptive operation across diverse conditions; modular design approach permitting customization for different vehicle platforms. Weaknesses: Higher system complexity requiring sophisticated maintenance; premium pricing compared to basic compliance solutions; regeneration strategies can impact fuel economy during certain driving cycles.

Key Patents and Technical Innovations in Emission Control

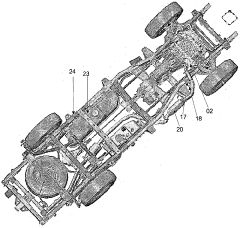

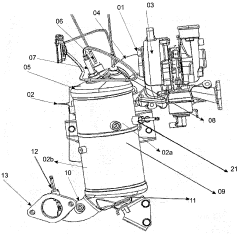

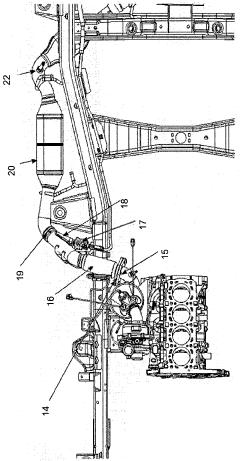

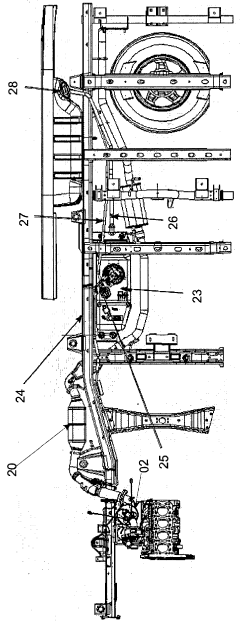

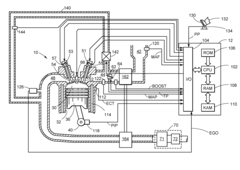

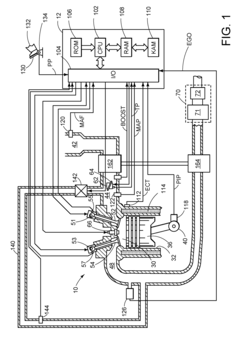

Integrated exhaust gas after-treatment system for diesel fuel engines

PatentWO2012085931A1

Innovation

- An integrated exhaust gas after-treatment system combining a Diesel Oxidation Catalyst (DOC) - Diesel Particulate Filter (DPF) assembly, a Selective Catalytic Reduction (SCR) system, and a reducing agent supply system, with strategically placed sensors and a dosing module for simultaneous reduction of pollutants, including automatic particulate filter regeneration.

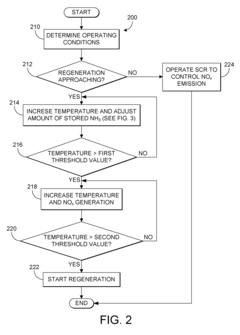

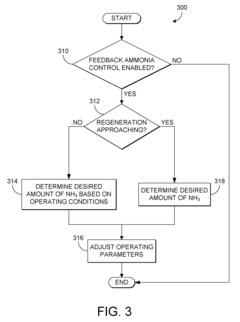

SCR catalyst heating control

PatentActiveUS8240136B2

Innovation

- A method is implemented to adjust the operating parameters before regeneration, reducing the amount of ammonia stored in the SCR catalyst based on operating conditions, and initiating regeneration when a desired ammonia level is reached, thereby controlling the heating process to minimize ammonia slip and NOx emissions.

Environmental Impact and Sustainability Assessment

The environmental impact of diesel emission control technologies represents a critical consideration in their evaluation and implementation. Diesel Particulate Filters (DPFs) demonstrate significant environmental benefits by capturing over 95% of particulate matter emissions, including harmful black carbon particles that contribute to both air pollution and climate change. This reduction directly improves air quality in urban environments and helps mitigate respiratory health issues among populations exposed to diesel exhaust.

Selective Catalytic Reduction (SCR) systems, meanwhile, excel at reducing nitrogen oxide (NOx) emissions by 80-95%, addressing a primary contributor to smog formation and acid rain. This technology's environmental advantage lies in its ability to target these harmful compounds without significantly impacting fuel efficiency, unlike some alternative NOx reduction methods.

From a sustainability perspective, DPF systems present certain challenges related to their regeneration processes. The periodic high-temperature regeneration cycles necessary to burn off collected particulates can increase fuel consumption by 2-5%, resulting in higher CO2 emissions that partially offset their particulate matter reduction benefits. Additionally, the production and disposal of DPFs involve rare earth metals and ceramic materials that raise resource extraction and end-of-life management concerns.

SCR systems demonstrate better fuel efficiency characteristics but require the continuous consumption of diesel exhaust fluid (DEF), typically a urea solution. The production, transportation, and storage of DEF create an additional environmental footprint that must be factored into sustainability assessments. The ammonia slip phenomenon—where excess ammonia escapes into the atmosphere—also presents a potential environmental concern with improperly calibrated SCR systems.

Life cycle assessment studies indicate that both technologies offer net environmental benefits despite their drawbacks. The combined implementation of DPF and SCR systems provides complementary environmental protection by addressing both particulate matter and NOx emissions simultaneously. This integrated approach has become increasingly common in modern diesel applications, particularly in regions with stringent emission standards.

Future sustainability improvements for both technologies focus on reducing their secondary environmental impacts through advanced materials, improved control algorithms, and more efficient regeneration strategies. Research into catalyst materials that operate effectively at lower temperatures could significantly reduce the energy penalties associated with these emission control systems.

Selective Catalytic Reduction (SCR) systems, meanwhile, excel at reducing nitrogen oxide (NOx) emissions by 80-95%, addressing a primary contributor to smog formation and acid rain. This technology's environmental advantage lies in its ability to target these harmful compounds without significantly impacting fuel efficiency, unlike some alternative NOx reduction methods.

From a sustainability perspective, DPF systems present certain challenges related to their regeneration processes. The periodic high-temperature regeneration cycles necessary to burn off collected particulates can increase fuel consumption by 2-5%, resulting in higher CO2 emissions that partially offset their particulate matter reduction benefits. Additionally, the production and disposal of DPFs involve rare earth metals and ceramic materials that raise resource extraction and end-of-life management concerns.

SCR systems demonstrate better fuel efficiency characteristics but require the continuous consumption of diesel exhaust fluid (DEF), typically a urea solution. The production, transportation, and storage of DEF create an additional environmental footprint that must be factored into sustainability assessments. The ammonia slip phenomenon—where excess ammonia escapes into the atmosphere—also presents a potential environmental concern with improperly calibrated SCR systems.

Life cycle assessment studies indicate that both technologies offer net environmental benefits despite their drawbacks. The combined implementation of DPF and SCR systems provides complementary environmental protection by addressing both particulate matter and NOx emissions simultaneously. This integrated approach has become increasingly common in modern diesel applications, particularly in regions with stringent emission standards.

Future sustainability improvements for both technologies focus on reducing their secondary environmental impacts through advanced materials, improved control algorithms, and more efficient regeneration strategies. Research into catalyst materials that operate effectively at lower temperatures could significantly reduce the energy penalties associated with these emission control systems.

Regulatory Compliance and Global Emission Standards

The global regulatory landscape for diesel emissions has evolved significantly over the past decades, with increasingly stringent standards driving technological innovation in emission control systems. The European Union's Euro standards have progressed from Euro 1 in 1992 to the current Euro 6d, with each iteration substantially reducing allowable particulate matter (PM) and nitrogen oxide (NOx) emissions. Similarly, the United States EPA has implemented Tier 1 through Tier 4 Final standards, with California's CARB often setting even more rigorous requirements.

These regulations have directly influenced the development and adoption of both Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR) systems. DPF technology became virtually mandatory with the introduction of Euro 5 standards in 2009, which reduced particulate matter limits by 80% compared to Euro 4. Meanwhile, SCR systems gained prominence with Euro 6 implementation in 2014, which cut NOx emission limits by more than 50%.

Compliance requirements vary significantly across global markets, creating challenges for manufacturers operating internationally. While the EU and North America maintain the most stringent standards, emerging economies have adopted phased approaches. China has implemented China VI standards (comparable to Euro 6), while India is transitioning to Bharat Stage VI. Brazil, Russia, and other developing markets typically follow European standards with several years' delay.

The regulatory timeline creates distinct market dynamics for DPF and SCR technologies. In regions with less stringent PM regulations but tightening NOx limits, SCR systems may be prioritized. Conversely, markets with strict PM controls but more lenient NOx standards might favor DPF-only solutions. Most advanced markets now effectively require both technologies to meet comprehensive emission standards.

Future regulatory trends point toward even lower emission limits, with Euro 7 standards (expected around 2025) potentially reducing NOx limits by an additional 35% and introducing stricter real-world driving emissions (RDE) testing protocols. The EPA's Cleaner Trucks Initiative similarly aims to further reduce heavy-duty vehicle emissions. These upcoming regulations will likely necessitate more sophisticated integration of DPF and SCR systems, potentially with additional technologies like passive NOx adsorbers.

Non-compliance penalties have also intensified, as evidenced by the "Dieselgate" scandal, which resulted in billions in fines and settlements. This regulatory enforcement environment has accelerated investment in emission control technologies, with manufacturers increasingly viewing advanced DPF and SCR systems as essential risk management tools rather than optional features.

These regulations have directly influenced the development and adoption of both Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR) systems. DPF technology became virtually mandatory with the introduction of Euro 5 standards in 2009, which reduced particulate matter limits by 80% compared to Euro 4. Meanwhile, SCR systems gained prominence with Euro 6 implementation in 2014, which cut NOx emission limits by more than 50%.

Compliance requirements vary significantly across global markets, creating challenges for manufacturers operating internationally. While the EU and North America maintain the most stringent standards, emerging economies have adopted phased approaches. China has implemented China VI standards (comparable to Euro 6), while India is transitioning to Bharat Stage VI. Brazil, Russia, and other developing markets typically follow European standards with several years' delay.

The regulatory timeline creates distinct market dynamics for DPF and SCR technologies. In regions with less stringent PM regulations but tightening NOx limits, SCR systems may be prioritized. Conversely, markets with strict PM controls but more lenient NOx standards might favor DPF-only solutions. Most advanced markets now effectively require both technologies to meet comprehensive emission standards.

Future regulatory trends point toward even lower emission limits, with Euro 7 standards (expected around 2025) potentially reducing NOx limits by an additional 35% and introducing stricter real-world driving emissions (RDE) testing protocols. The EPA's Cleaner Trucks Initiative similarly aims to further reduce heavy-duty vehicle emissions. These upcoming regulations will likely necessitate more sophisticated integration of DPF and SCR systems, potentially with additional technologies like passive NOx adsorbers.

Non-compliance penalties have also intensified, as evidenced by the "Dieselgate" scandal, which resulted in billions in fines and settlements. This regulatory enforcement environment has accelerated investment in emission control technologies, with manufacturers increasingly viewing advanced DPF and SCR systems as essential risk management tools rather than optional features.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!