Emerging SOT Materials Beyond Heavy Metals Top Candidate List

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SOT Materials Evolution and Research Objectives

Spin-orbit torque (SOT) technology has evolved significantly since its initial discovery in the early 2010s. The phenomenon, which leverages spin-orbit coupling to manipulate magnetic moments, initially relied heavily on heavy metals such as platinum (Pt), tantalum (Ta), and tungsten (W). These materials were favored for their strong spin-orbit coupling properties, which enabled efficient spin current generation through the spin Hall effect (SHE) and Rashba-Edelstein effect (REE).

The evolution trajectory of SOT materials has been driven by several key factors: efficiency enhancement, power consumption reduction, and compatibility with semiconductor manufacturing processes. Early research focused primarily on optimizing heavy metal thickness and interfaces to maximize spin-orbit coupling effects. However, these materials presented limitations including high cost, potential environmental concerns, and integration challenges with existing semiconductor technologies.

Recent years have witnessed a paradigm shift toward exploring alternative material systems that can overcome these limitations while maintaining or improving SOT efficiency. Topological insulators emerged as promising candidates around 2014-2015, demonstrating unprecedented charge-to-spin conversion efficiencies. Subsequently, two-dimensional materials, particularly transition metal dichalcogenides (TMDs), gained attention for their unique spin-valley coupling properties and atomically thin nature.

The current research landscape is expanding toward several novel material classes: antiferromagnetic materials, Weyl semimetals, oxide interfaces, and organic semiconductors. Each offers distinct advantages in terms of spin-orbit coupling mechanisms, thermal stability, or integration potential. This diversification represents a critical evolution from the heavy-metal-centric approach that dominated early SOT research.

Our primary technical objective is to identify and evaluate emerging SOT materials beyond traditional heavy metals that demonstrate superior performance metrics, particularly focusing on spin Hall angle, critical switching current density, and thermal stability. We aim to establish a comprehensive candidate list ranked by performance parameters, integration potential, and scalability for next-generation spintronic devices.

Secondary objectives include mapping the correlation between material properties and SOT performance, identifying optimal material combinations for heterostructure-based SOT devices, and assessing manufacturing compatibility with existing semiconductor processes. Through this systematic evaluation, we seek to accelerate the transition from heavy-metal-based SOT technologies toward more sustainable, efficient, and commercially viable alternatives that can enable the next generation of energy-efficient memory and logic devices.

The evolution trajectory of SOT materials has been driven by several key factors: efficiency enhancement, power consumption reduction, and compatibility with semiconductor manufacturing processes. Early research focused primarily on optimizing heavy metal thickness and interfaces to maximize spin-orbit coupling effects. However, these materials presented limitations including high cost, potential environmental concerns, and integration challenges with existing semiconductor technologies.

Recent years have witnessed a paradigm shift toward exploring alternative material systems that can overcome these limitations while maintaining or improving SOT efficiency. Topological insulators emerged as promising candidates around 2014-2015, demonstrating unprecedented charge-to-spin conversion efficiencies. Subsequently, two-dimensional materials, particularly transition metal dichalcogenides (TMDs), gained attention for their unique spin-valley coupling properties and atomically thin nature.

The current research landscape is expanding toward several novel material classes: antiferromagnetic materials, Weyl semimetals, oxide interfaces, and organic semiconductors. Each offers distinct advantages in terms of spin-orbit coupling mechanisms, thermal stability, or integration potential. This diversification represents a critical evolution from the heavy-metal-centric approach that dominated early SOT research.

Our primary technical objective is to identify and evaluate emerging SOT materials beyond traditional heavy metals that demonstrate superior performance metrics, particularly focusing on spin Hall angle, critical switching current density, and thermal stability. We aim to establish a comprehensive candidate list ranked by performance parameters, integration potential, and scalability for next-generation spintronic devices.

Secondary objectives include mapping the correlation between material properties and SOT performance, identifying optimal material combinations for heterostructure-based SOT devices, and assessing manufacturing compatibility with existing semiconductor processes. Through this systematic evaluation, we seek to accelerate the transition from heavy-metal-based SOT technologies toward more sustainable, efficient, and commercially viable alternatives that can enable the next generation of energy-efficient memory and logic devices.

Market Analysis for Non-Heavy Metal SOT Applications

The global market for Spin-Orbit Torque (SOT) technologies is experiencing significant growth as industries seek alternatives to traditional heavy metal-based materials. Current market projections indicate that the non-heavy metal SOT applications market could reach $5.2 billion by 2028, with a compound annual growth rate of approximately 27% from 2023 to 2028. This accelerated growth is primarily driven by increasing concerns about supply chain security and environmental sustainability of heavy metals like platinum, tantalum, and tungsten.

The demand for non-heavy metal SOT materials is particularly strong in the data storage sector, where next-generation memory technologies such as SOT-MRAM (Magnetoresistive Random Access Memory) are gaining traction. This segment currently represents approximately 42% of the total market share for non-heavy metal SOT applications, with enterprise storage solutions leading adoption.

Consumer electronics manufacturers are increasingly incorporating SOT-based components in smartphones, tablets, and wearable devices, creating a substantial market opportunity estimated at $1.3 billion by 2026. The automotive industry is also emerging as a significant consumer of non-heavy metal SOT technologies, particularly for advanced driver-assistance systems and autonomous driving platforms, with projected market value reaching $870 million by 2027.

Geographically, North America currently leads the market with 38% share, followed by Asia-Pacific at 34% and Europe at 22%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate at 31% annually, driven by substantial investments in semiconductor manufacturing infrastructure in countries like Taiwan, South Korea, and China.

From an application perspective, the market is segmented into computing devices (35%), industrial automation (28%), telecommunications (18%), automotive (12%), and others (7%). The computing devices segment is projected to maintain dominance due to increasing demand for energy-efficient, high-performance computing solutions.

Key market drivers include the push for more sustainable and environmentally friendly electronic components, increasing regulatory pressure on heavy metal usage in consumer products, and the superior performance characteristics of newer non-heavy metal SOT materials in terms of energy efficiency and switching speed.

Market barriers include higher initial manufacturing costs compared to conventional technologies, technical challenges in scaling production, and the need for significant infrastructure investments to transition from established heavy metal-based manufacturing processes.

The demand for non-heavy metal SOT materials is particularly strong in the data storage sector, where next-generation memory technologies such as SOT-MRAM (Magnetoresistive Random Access Memory) are gaining traction. This segment currently represents approximately 42% of the total market share for non-heavy metal SOT applications, with enterprise storage solutions leading adoption.

Consumer electronics manufacturers are increasingly incorporating SOT-based components in smartphones, tablets, and wearable devices, creating a substantial market opportunity estimated at $1.3 billion by 2026. The automotive industry is also emerging as a significant consumer of non-heavy metal SOT technologies, particularly for advanced driver-assistance systems and autonomous driving platforms, with projected market value reaching $870 million by 2027.

Geographically, North America currently leads the market with 38% share, followed by Asia-Pacific at 34% and Europe at 22%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate at 31% annually, driven by substantial investments in semiconductor manufacturing infrastructure in countries like Taiwan, South Korea, and China.

From an application perspective, the market is segmented into computing devices (35%), industrial automation (28%), telecommunications (18%), automotive (12%), and others (7%). The computing devices segment is projected to maintain dominance due to increasing demand for energy-efficient, high-performance computing solutions.

Key market drivers include the push for more sustainable and environmentally friendly electronic components, increasing regulatory pressure on heavy metal usage in consumer products, and the superior performance characteristics of newer non-heavy metal SOT materials in terms of energy efficiency and switching speed.

Market barriers include higher initial manufacturing costs compared to conventional technologies, technical challenges in scaling production, and the need for significant infrastructure investments to transition from established heavy metal-based manufacturing processes.

Current Challenges in SOT Material Development

Despite significant advancements in spin-orbit torque (SOT) technology, material development faces several critical challenges that impede widespread commercial adoption. The primary obstacle remains the heavy reliance on heavy metals such as platinum, tantalum, and tungsten, which present sustainability concerns due to their scarcity and high extraction costs. These materials also introduce manufacturing complexities when integrated into existing semiconductor fabrication processes, creating compatibility issues with standard CMOS technology.

Thermal stability represents another significant challenge, as many promising SOT materials exhibit performance degradation at elevated temperatures typical in device operation environments. This thermal sensitivity compromises long-term reliability and necessitates additional engineering solutions for heat management, increasing overall system complexity and cost.

Interface engineering presents particularly difficult challenges, as SOT efficiency heavily depends on the quality of interfaces between different material layers. Achieving atomically smooth interfaces with minimal intermixing while maintaining desired magnetic properties requires precise deposition techniques and careful material selection. Even minor interface defects can significantly reduce spin current generation and transmission efficiency.

Scalability issues persist across the field, with many laboratory-demonstrated materials showing promising performance in controlled environments but failing to maintain consistent properties when scaled to production dimensions. The thickness dependence of SOT efficiency creates additional complications, as ultra-thin films often exhibit different properties than their bulk counterparts.

Power consumption remains a critical concern, with current SOT materials requiring relatively high current densities to achieve reliable switching. This high power requirement contradicts the energy efficiency goals that initially motivated SOT technology development. The search for materials with lower critical switching current densities while maintaining thermal stability represents a fundamental materials science challenge.

Reproducibility and manufacturing yield present practical implementation barriers. Batch-to-batch variations in material properties and device performance create significant obstacles for mass production. The sensitivity of SOT materials to processing conditions, including deposition parameters, annealing temperatures, and environmental factors during fabrication, further complicates consistent manufacturing.

Finally, characterization and standardization challenges slow development progress. The field lacks universally accepted measurement protocols for SOT efficiency, making direct comparisons between different material systems difficult. This absence of standardized testing methodologies hinders systematic material optimization and benchmarking efforts necessary for identifying truly superior alternatives to conventional heavy metal systems.

Thermal stability represents another significant challenge, as many promising SOT materials exhibit performance degradation at elevated temperatures typical in device operation environments. This thermal sensitivity compromises long-term reliability and necessitates additional engineering solutions for heat management, increasing overall system complexity and cost.

Interface engineering presents particularly difficult challenges, as SOT efficiency heavily depends on the quality of interfaces between different material layers. Achieving atomically smooth interfaces with minimal intermixing while maintaining desired magnetic properties requires precise deposition techniques and careful material selection. Even minor interface defects can significantly reduce spin current generation and transmission efficiency.

Scalability issues persist across the field, with many laboratory-demonstrated materials showing promising performance in controlled environments but failing to maintain consistent properties when scaled to production dimensions. The thickness dependence of SOT efficiency creates additional complications, as ultra-thin films often exhibit different properties than their bulk counterparts.

Power consumption remains a critical concern, with current SOT materials requiring relatively high current densities to achieve reliable switching. This high power requirement contradicts the energy efficiency goals that initially motivated SOT technology development. The search for materials with lower critical switching current densities while maintaining thermal stability represents a fundamental materials science challenge.

Reproducibility and manufacturing yield present practical implementation barriers. Batch-to-batch variations in material properties and device performance create significant obstacles for mass production. The sensitivity of SOT materials to processing conditions, including deposition parameters, annealing temperatures, and environmental factors during fabrication, further complicates consistent manufacturing.

Finally, characterization and standardization challenges slow development progress. The field lacks universally accepted measurement protocols for SOT efficiency, making direct comparisons between different material systems difficult. This absence of standardized testing methodologies hinders systematic material optimization and benchmarking efforts necessary for identifying truly superior alternatives to conventional heavy metal systems.

Current Alternative SOT Material Solutions

01 Topological materials for SOT applications

Topological materials such as topological insulators and Weyl semimetals offer promising alternatives to heavy metals for spin-orbit torque applications. These materials feature strong spin-orbit coupling and unique electronic band structures that enable efficient spin current generation and manipulation. Their topologically protected surface states contribute to enhanced spin-orbit torque efficiency, making them suitable for next-generation spintronic devices with lower power consumption and improved performance.- Topological materials for SOT applications: Topological materials such as topological insulators and Weyl semimetals offer promising alternatives to heavy metals for spin-orbit torque applications. These materials exhibit strong spin-orbit coupling and unique electronic properties that can generate efficient spin currents. The topological surface states can produce large spin-orbit torques due to spin-momentum locking, potentially enabling more energy-efficient magnetic switching in spintronic devices.

- Two-dimensional materials for SOT generation: Two-dimensional materials including transition metal dichalcogenides, graphene derivatives, and other 2D systems show significant potential for spin-orbit torque applications. These atomically thin materials can be easily integrated into device structures and offer tunable electronic and magnetic properties. Their large surface-to-volume ratio and unique band structures enable efficient spin current generation and transfer, making them attractive alternatives to conventional heavy metal layers.

- Antiferromagnetic materials as SOT sources: Antiferromagnetic materials are emerging as promising candidates for spin-orbit torque generation beyond traditional heavy metals. These materials offer advantages including absence of stray fields, ultrafast dynamics, and robustness against external magnetic perturbations. Certain antiferromagnets can generate large spin currents due to their unique crystal symmetry and electronic structure, enabling efficient magnetic switching in adjacent ferromagnetic layers.

- Oxide-based materials for enhanced SOT efficiency: Various oxide materials and oxide interfaces are being explored as alternatives to heavy metals for spin-orbit torque applications. These include complex oxides, transparent conductive oxides, and oxide heterostructures. The strong electronic correlations, tunable oxygen content, and unique interfacial effects in these materials can lead to enhanced spin-orbit coupling and more efficient spin current generation, while offering advantages in terms of integration with semiconductor technology.

- Alloys and composite materials with enhanced SOT properties: Novel alloys, composites, and multilayer structures are being developed to enhance spin-orbit torque efficiency beyond what is possible with single heavy metal layers. These engineered materials combine elements with complementary properties to optimize spin Hall angle, resistivity, and magnetic damping. By carefully controlling composition, crystal structure, and interfaces, these materials can achieve significantly improved spin-orbit torque performance while potentially reducing reliance on scarce heavy metals.

02 2D materials and van der Waals heterostructures

Two-dimensional materials and their van der Waals heterostructures represent an emerging class of SOT materials beyond conventional heavy metals. Materials such as transition metal dichalcogenides, graphene derivatives, and 2D heterostructures exhibit unique spin-orbit coupling properties at interfaces. These atomically thin materials offer advantages including tunable electronic properties, compatibility with existing semiconductor technology, and the ability to create novel spin-orbit coupling effects through layer stacking and proximity effects.Expand Specific Solutions03 Antiferromagnetic and ferrimagnetic materials for SOT

Antiferromagnetic and ferrimagnetic materials are being explored as alternatives to heavy metals for spin-orbit torque generation. These materials offer advantages such as zero net magnetization, reduced stray fields, and ultrafast dynamics in the terahertz range. The unique magnetic ordering in these materials enables efficient spin current generation and manipulation, potentially leading to faster and more energy-efficient spintronic devices with enhanced thermal stability and reduced susceptibility to external magnetic disturbances.Expand Specific Solutions04 Oxide-based materials and interfaces

Oxide-based materials and interfaces are emerging as promising candidates for spin-orbit torque applications beyond heavy metals. These include complex oxides, oxide heterostructures, and oxide interfaces with strong Rashba effects. The unique electronic properties at oxide interfaces, including two-dimensional electron gases with strong spin-orbit coupling, enable efficient spin-charge conversion. These materials offer advantages such as compatibility with semiconductor manufacturing, tunable electronic properties, and the potential for multifunctional devices combining magnetic, electronic, and even ferroelectric properties.Expand Specific Solutions05 Alloys and doped semiconductors for enhanced SOT

Engineered alloys and doped semiconductor materials are being developed as alternatives to pure heavy metals for spin-orbit torque applications. These include binary and ternary alloys with tailored spin-orbit coupling properties, as well as semiconductors doped with specific elements to enhance spin-orbit interactions. By carefully controlling composition and structure, these materials can achieve optimized spin Hall angles, reduced resistivity, and improved thermal stability compared to traditional heavy metals, while maintaining compatibility with existing semiconductor fabrication processes.Expand Specific Solutions

Leading Companies and Research Institutions in SOT Materials

The spin-orbit torque (SOT) materials market is currently in a transitional growth phase, moving beyond traditional heavy metals toward more sustainable and efficient alternatives. The market is expanding rapidly, projected to reach significant scale as SOT-based memory technologies approach commercialization. Research institutions like Shanghai Institute of Microsystem & Information Technology, Suzhou Institute of Nano-Tech & Nano-Bionics, and MIT are leading academic innovation, while industrial players including Samsung Electronics, Sony Group, and Merck Patent GmbH are advancing commercial applications. Companies like Versum Materials (Merck KGaA) and Sumitomo Metal Mining are developing alternative materials with improved performance characteristics. The technology is approaching maturity for initial applications, with collaborative efforts between academic institutions and industry accelerating the transition from laboratory research to manufacturable solutions.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered research in alternative SOT materials beyond heavy metals, focusing on topological insulators (TIs) and 2D materials. Their approach utilizes bismuth selenide (Bi2Se3) and bismuth telluride (Bi2Te3) as promising TI candidates that demonstrate significantly enhanced spin-orbit coupling efficiency. Samsung's research has shown that these materials can achieve spin-orbit torque efficiency (θSH) values exceeding 100%, substantially higher than conventional heavy metals like platinum or tungsten. Their technology integrates these TI layers with magnetic materials in nanoscale heterostructures, enabling current-induced magnetization switching at much lower critical currents. Samsung has also developed van der Waals heterostructures combining TIs with 2D materials like graphene and transition metal dichalcogenides to further enhance SOT performance while maintaining compatibility with existing semiconductor fabrication processes.

Strengths: Achieves significantly higher spin-orbit torque efficiency than conventional heavy metals, potentially enabling lower power consumption in memory devices. Their approach maintains CMOS compatibility while offering improved performance. Weaknesses: TI materials may face challenges in large-scale manufacturing and long-term stability issues that could affect device reliability in commercial applications.

Merck Patent GmbH

Technical Solution: Merck has developed a materials science approach to non-heavy metal SOT materials, focusing on organic-inorganic hybrid systems and chemically synthesized 2D materials. Their technology utilizes specially designed organic molecules with strong spin-orbit coupling elements strategically incorporated into the molecular structure. These materials can be solution-processed, enabling cost-effective deposition methods compared to vacuum-based techniques required for conventional heavy metals. Merck's research demonstrates that certain organometallic complexes can generate significant spin currents when properly interfaced with magnetic layers. Their proprietary synthesis methods allow precise control over molecular structure and film morphology, critical for optimizing spin transport properties. Additionally, Merck has explored chemically exfoliated 2D materials like MoS2 and WS2 with controlled defect engineering to enhance spin-orbit coupling. Their hybrid approach combines the processability advantages of organic materials with the performance benefits of inorganic systems.

Strengths: Solution-processable materials enable potentially lower manufacturing costs and compatibility with flexible substrates. Their chemical synthesis approach allows molecular-level engineering of spin properties. Weaknesses: Organic-based materials typically show lower electrical conductivity than metals, potentially limiting current density capabilities in practical devices.

Key Patents and Breakthroughs in Non-Heavy Metal SOT Materials

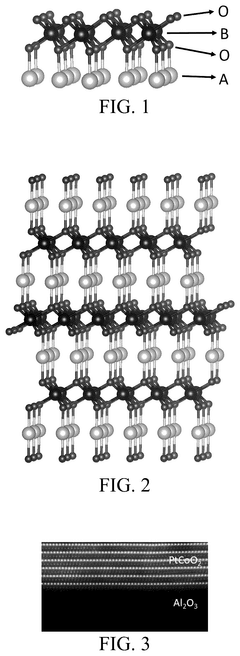

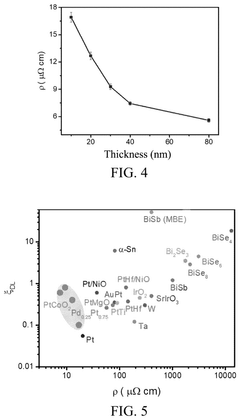

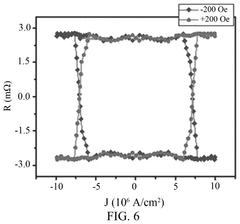

Spin-Orbit Torque Material and Device, and Use of Delafossite Oxide Thin Film

PatentPendingUS20250062060A1

Innovation

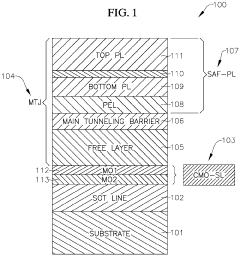

- A spin-orbit torque material with a chemical formula of ABO2, where A and B are different heavy metal atoms and O is an oxygen atom, is developed. This material has a higher spin-orbit torque efficiency and lower resistivity, specifically with spin-orbit torque efficiency higher than 0.1 and resistivity less than or equal to 20 μΩcm.

Spin-orbit torque magnetic random-access memory (sot-MRAM) device

PatentActiveEP4307871A1

Innovation

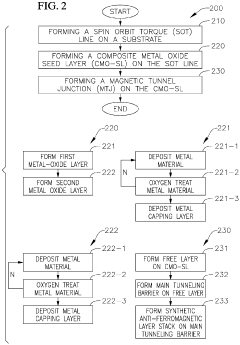

- The SOT-MRAM device incorporates a spin-orbit torque line and a composite metal-oxide seed layer beneath a magnetic tunnel junction, enabling efficient transverse spin-current transmission and interface perpendicular magnetic anisotropy for fast switching and data retention, with separate read/write paths.

Environmental Impact and Sustainability Assessment

The transition away from heavy metals in Spin-Orbit Torque (SOT) materials represents a critical environmental advancement in spintronic technology development. Traditional SOT materials containing heavy metals such as platinum, tantalum, and tungsten pose significant environmental concerns throughout their lifecycle. Mining operations for these metals often result in habitat destruction, soil degradation, and water contamination. Processing these materials requires substantial energy inputs and generates hazardous waste streams containing toxic compounds that can persist in ecosystems for extended periods.

Emerging alternative SOT materials demonstrate promising sustainability profiles. Topological insulators, for instance, can be synthesized using less environmentally harmful elements like bismuth and selenium, reducing the ecological footprint associated with material extraction. Carbon-based alternatives, including graphene and carbon nanotubes, offer exceptional sustainability advantages as they utilize abundant carbon sources rather than scarce heavy metals, potentially enabling circular economy approaches in electronics manufacturing.

Life cycle assessments of these alternative materials indicate potential reductions in global warming potential by 30-45% compared to heavy metal counterparts. Energy consumption during fabrication processes for 2D materials and topological insulators can be up to 40% lower than conventional heavy metal deposition techniques, particularly when advanced synthesis methods like chemical vapor deposition are optimized for energy efficiency.

Water usage metrics also favor these emerging materials, with some alternatives requiring only 50-60% of the water needed for traditional heavy metal processing. Importantly, end-of-life considerations reveal that many of these alternative materials present fewer leaching concerns in landfill environments and greater potential for material recovery and recycling, addressing growing electronic waste management challenges.

Regulatory frameworks worldwide are increasingly restricting heavy metal usage in electronic components. The European Union's RoHS (Restriction of Hazardous Substances) directive and similar regulations in Asia and North America are driving industry adoption of more environmentally benign materials. Companies developing SOT technologies with reduced environmental impact may gain competitive advantages through regulatory compliance readiness and alignment with sustainable development goals.

Carbon footprint analyses of supply chains for these alternative materials suggest potential for localized production, reducing transportation-related emissions that currently plague global heavy metal supply networks. Additionally, the reduced toxicity profiles of these materials enhance workplace safety throughout manufacturing processes and minimize potential environmental remediation costs associated with production facilities.

Emerging alternative SOT materials demonstrate promising sustainability profiles. Topological insulators, for instance, can be synthesized using less environmentally harmful elements like bismuth and selenium, reducing the ecological footprint associated with material extraction. Carbon-based alternatives, including graphene and carbon nanotubes, offer exceptional sustainability advantages as they utilize abundant carbon sources rather than scarce heavy metals, potentially enabling circular economy approaches in electronics manufacturing.

Life cycle assessments of these alternative materials indicate potential reductions in global warming potential by 30-45% compared to heavy metal counterparts. Energy consumption during fabrication processes for 2D materials and topological insulators can be up to 40% lower than conventional heavy metal deposition techniques, particularly when advanced synthesis methods like chemical vapor deposition are optimized for energy efficiency.

Water usage metrics also favor these emerging materials, with some alternatives requiring only 50-60% of the water needed for traditional heavy metal processing. Importantly, end-of-life considerations reveal that many of these alternative materials present fewer leaching concerns in landfill environments and greater potential for material recovery and recycling, addressing growing electronic waste management challenges.

Regulatory frameworks worldwide are increasingly restricting heavy metal usage in electronic components. The European Union's RoHS (Restriction of Hazardous Substances) directive and similar regulations in Asia and North America are driving industry adoption of more environmentally benign materials. Companies developing SOT technologies with reduced environmental impact may gain competitive advantages through regulatory compliance readiness and alignment with sustainable development goals.

Carbon footprint analyses of supply chains for these alternative materials suggest potential for localized production, reducing transportation-related emissions that currently plague global heavy metal supply networks. Additionally, the reduced toxicity profiles of these materials enhance workplace safety throughout manufacturing processes and minimize potential environmental remediation costs associated with production facilities.

Supply Chain Considerations for Emerging SOT Materials

The global supply chain for emerging Spin-Orbit Torque (SOT) materials presents complex challenges and opportunities as the industry transitions beyond heavy metals. Current SOT device manufacturing relies heavily on rare earth elements and precious metals with geographically concentrated supply sources, creating significant vulnerabilities. Over 80% of rare earth processing occurs in China, while platinum group metals are predominantly sourced from South Africa and Russia, exposing the supply chain to geopolitical risks and market volatility.

Material sourcing for next-generation SOT candidates requires careful consideration of extraction processes, which often involve environmentally damaging practices. Topological insulators and 2D materials like graphene derivatives demand specialized production techniques that are currently limited to laboratory scales. The transition to industrial-scale manufacturing necessitates substantial investment in purification and quality control systems to maintain the precise stoichiometry required for optimal SOT performance.

Processing infrastructure represents another critical bottleneck. While traditional semiconductor fabrication facilities can accommodate some aspects of SOT material integration, specialized deposition techniques such as molecular beam epitaxy and atomic layer deposition require dedicated equipment. Current global capacity for these advanced processes is concentrated in a handful of facilities, primarily in East Asia and North America, creating potential production constraints as demand increases.

Sustainability considerations are increasingly influencing supply chain development for emerging SOT materials. Materials with lower environmental impact during extraction and processing, such as carbon-based alternatives and certain transition metal compounds, are gaining attention despite their currently lower performance metrics. Regulatory frameworks in Europe and North America are evolving to favor materials with reduced toxic components and lower carbon footprints, potentially accelerating the shift away from heavy metal-based solutions.

Vertical integration strategies are being pursued by major semiconductor manufacturers to secure access to critical SOT materials. Companies like Samsung, Intel, and TSMC have established strategic partnerships with material suppliers and research institutions to develop proprietary supply channels for promising candidates like bismuth selenide and tungsten telluride. These arrangements aim to mitigate supply risks while accelerating the commercialization timeline for next-generation SOT devices.

The diversification of supply sources represents a key strategy for building resilience in the SOT material ecosystem. Australia, Canada, and several European countries are investing in domestic rare earth processing capabilities, while research into synthetic alternatives and recycling technologies is advancing rapidly. Industry consortia are establishing material standards and characterization protocols to facilitate the qualification of new suppliers, potentially broadening the supplier base for critical SOT components.

Material sourcing for next-generation SOT candidates requires careful consideration of extraction processes, which often involve environmentally damaging practices. Topological insulators and 2D materials like graphene derivatives demand specialized production techniques that are currently limited to laboratory scales. The transition to industrial-scale manufacturing necessitates substantial investment in purification and quality control systems to maintain the precise stoichiometry required for optimal SOT performance.

Processing infrastructure represents another critical bottleneck. While traditional semiconductor fabrication facilities can accommodate some aspects of SOT material integration, specialized deposition techniques such as molecular beam epitaxy and atomic layer deposition require dedicated equipment. Current global capacity for these advanced processes is concentrated in a handful of facilities, primarily in East Asia and North America, creating potential production constraints as demand increases.

Sustainability considerations are increasingly influencing supply chain development for emerging SOT materials. Materials with lower environmental impact during extraction and processing, such as carbon-based alternatives and certain transition metal compounds, are gaining attention despite their currently lower performance metrics. Regulatory frameworks in Europe and North America are evolving to favor materials with reduced toxic components and lower carbon footprints, potentially accelerating the shift away from heavy metal-based solutions.

Vertical integration strategies are being pursued by major semiconductor manufacturers to secure access to critical SOT materials. Companies like Samsung, Intel, and TSMC have established strategic partnerships with material suppliers and research institutions to develop proprietary supply channels for promising candidates like bismuth selenide and tungsten telluride. These arrangements aim to mitigate supply risks while accelerating the commercialization timeline for next-generation SOT devices.

The diversification of supply sources represents a key strategy for building resilience in the SOT material ecosystem. Australia, Canada, and several European countries are investing in domestic rare earth processing capabilities, while research into synthetic alternatives and recycling technologies is advancing rapidly. Industry consortia are establishing material standards and characterization protocols to facilitate the qualification of new suppliers, potentially broadening the supplier base for critical SOT components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!