Emission Monitoring Strategies for Turbine Engine Regulatory Compliance

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Turbine Engine Emission Regulations Background and Objectives

The evolution of turbine engine technology has been marked by significant advancements in performance and efficiency over the past century. However, these improvements have been accompanied by growing concerns regarding environmental impact, particularly in terms of emissions. Since the 1970s, regulatory frameworks have progressively emerged to address these concerns, with the International Civil Aviation Organization (ICAO) establishing the first international standards for aircraft engine emissions in 1981 through Annex 16 to the Convention on International Civil Aviation.

The regulatory landscape has become increasingly stringent, with major aviation authorities including the FAA, EASA, and CAAC implementing comprehensive emissions standards for nitrogen oxides (NOx), carbon monoxide (CO), unburned hydrocarbons (UHC), smoke, and more recently, particulate matter (PM). The introduction of ICAO's Committee on Aviation Environmental Protection (CAEP) has further standardized these regulations globally, with successive iterations (CAEP/1 through CAEP/11) progressively tightening emission limits.

Current regulatory frameworks focus on landing and take-off (LTO) cycle emissions, which impact local air quality around airports, as well as cruise emissions that contribute to global climate change. The technical parameters governed by these regulations include emission indices (EI), which measure grams of pollutant per kilogram of fuel burned, and regulatory parameters such as Dp/Foo (mass of pollutant divided by rated output) for various engine operating modes.

The primary objective of emission monitoring strategies is to ensure compliance with these increasingly stringent regulations while maintaining or improving engine performance. This involves developing accurate, reliable, and cost-effective monitoring systems that can provide real-time data on engine emissions across various operating conditions. Such systems must be capable of detecting and quantifying regulated pollutants at the parts-per-million level, often in challenging environments characterized by high temperatures, pressures, and vibrations.

Beyond mere compliance, emission monitoring strategies aim to support the aviation industry's broader sustainability goals, including the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and various net-zero carbon emission initiatives. These strategies must balance regulatory requirements with practical considerations such as weight, cost, reliability, and integration with existing engine control systems.

Looking forward, emission monitoring technologies must anticipate future regulatory developments, including potential limits on non-volatile particulate matter (nvPM), expanded cruise emission regulations, and possible carbon dioxide (CO2) standards. The ultimate goal is to enable a transition toward environmentally sustainable aviation while maintaining the economic viability and operational efficiency of turbine engine technology.

The regulatory landscape has become increasingly stringent, with major aviation authorities including the FAA, EASA, and CAAC implementing comprehensive emissions standards for nitrogen oxides (NOx), carbon monoxide (CO), unburned hydrocarbons (UHC), smoke, and more recently, particulate matter (PM). The introduction of ICAO's Committee on Aviation Environmental Protection (CAEP) has further standardized these regulations globally, with successive iterations (CAEP/1 through CAEP/11) progressively tightening emission limits.

Current regulatory frameworks focus on landing and take-off (LTO) cycle emissions, which impact local air quality around airports, as well as cruise emissions that contribute to global climate change. The technical parameters governed by these regulations include emission indices (EI), which measure grams of pollutant per kilogram of fuel burned, and regulatory parameters such as Dp/Foo (mass of pollutant divided by rated output) for various engine operating modes.

The primary objective of emission monitoring strategies is to ensure compliance with these increasingly stringent regulations while maintaining or improving engine performance. This involves developing accurate, reliable, and cost-effective monitoring systems that can provide real-time data on engine emissions across various operating conditions. Such systems must be capable of detecting and quantifying regulated pollutants at the parts-per-million level, often in challenging environments characterized by high temperatures, pressures, and vibrations.

Beyond mere compliance, emission monitoring strategies aim to support the aviation industry's broader sustainability goals, including the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and various net-zero carbon emission initiatives. These strategies must balance regulatory requirements with practical considerations such as weight, cost, reliability, and integration with existing engine control systems.

Looking forward, emission monitoring technologies must anticipate future regulatory developments, including potential limits on non-volatile particulate matter (nvPM), expanded cruise emission regulations, and possible carbon dioxide (CO2) standards. The ultimate goal is to enable a transition toward environmentally sustainable aviation while maintaining the economic viability and operational efficiency of turbine engine technology.

Market Analysis for Emission Monitoring Solutions

The global market for emission monitoring solutions in the turbine engine sector is experiencing robust growth, driven primarily by increasingly stringent regulatory frameworks across major economies. The market value reached approximately $4.2 billion in 2022 and is projected to grow at a compound annual growth rate of 7.8% through 2028, potentially reaching $6.6 billion by the end of the forecast period. This growth trajectory is particularly pronounced in regions with mature environmental regulations such as North America and Europe.

Demand segmentation reveals that continuous emission monitoring systems (CEMS) currently dominate the market with a 65% share, while predictive emission monitoring systems (PEMS) are gaining traction due to their cost-effectiveness and reduced maintenance requirements. The aviation sector represents the largest end-user segment at 38%, followed by power generation at 31% and marine applications at 17%.

Key market drivers include the implementation of more stringent emission standards globally, with the International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and the European Union's Emissions Trading System (EU ETS) being particularly influential. Additionally, corporate sustainability initiatives and ESG reporting requirements are creating substantial private sector demand beyond regulatory compliance.

Regional analysis indicates that North America currently leads the market with a 36% share, followed by Europe at 32% and Asia-Pacific at 22%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate at 9.3% annually, primarily due to rapid industrialization in China and India coupled with evolving environmental regulations in these economies.

Customer pain points identified through market research include high initial implementation costs, integration challenges with legacy systems, and concerns about measurement accuracy under variable operating conditions. The total cost of ownership, including calibration and maintenance expenses, remains a significant consideration for potential adopters.

Emerging market opportunities include the integration of artificial intelligence and machine learning capabilities for predictive maintenance and emissions forecasting, cloud-based monitoring solutions that enable remote compliance management, and miniaturized sensor technologies that reduce installation complexity and costs. The retrofit market segment is particularly promising, with an estimated 65% of existing turbine engines requiring upgrades to meet forthcoming regulatory standards.

Demand segmentation reveals that continuous emission monitoring systems (CEMS) currently dominate the market with a 65% share, while predictive emission monitoring systems (PEMS) are gaining traction due to their cost-effectiveness and reduced maintenance requirements. The aviation sector represents the largest end-user segment at 38%, followed by power generation at 31% and marine applications at 17%.

Key market drivers include the implementation of more stringent emission standards globally, with the International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and the European Union's Emissions Trading System (EU ETS) being particularly influential. Additionally, corporate sustainability initiatives and ESG reporting requirements are creating substantial private sector demand beyond regulatory compliance.

Regional analysis indicates that North America currently leads the market with a 36% share, followed by Europe at 32% and Asia-Pacific at 22%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate at 9.3% annually, primarily due to rapid industrialization in China and India coupled with evolving environmental regulations in these economies.

Customer pain points identified through market research include high initial implementation costs, integration challenges with legacy systems, and concerns about measurement accuracy under variable operating conditions. The total cost of ownership, including calibration and maintenance expenses, remains a significant consideration for potential adopters.

Emerging market opportunities include the integration of artificial intelligence and machine learning capabilities for predictive maintenance and emissions forecasting, cloud-based monitoring solutions that enable remote compliance management, and miniaturized sensor technologies that reduce installation complexity and costs. The retrofit market segment is particularly promising, with an estimated 65% of existing turbine engines requiring upgrades to meet forthcoming regulatory standards.

Current Emission Monitoring Technologies and Barriers

The current landscape of emission monitoring technologies for turbine engines is characterized by a blend of established methods and emerging innovations. Traditional Continuous Emission Monitoring Systems (CEMS) remain the regulatory standard, utilizing extractive sampling techniques where exhaust gases are collected and analyzed for pollutants including NOx, CO, CO2, and unburned hydrocarbons. These systems typically employ chemiluminescence detectors for NOx, non-dispersive infrared analyzers for CO and CO2, and flame ionization detectors for hydrocarbon measurements.

Predictive Emission Monitoring Systems (PEMS) have gained traction as a cost-effective alternative, using mathematical algorithms and operational parameters to estimate emissions without direct measurement. While PEMS offer reduced maintenance requirements and lower operational costs, their accuracy depends heavily on the quality of initial correlation data and may require periodic recalibration against direct measurements.

Remote sensing technologies represent a significant advancement, employing optical methods such as Differential Optical Absorption Spectroscopy (DOAS) and Fourier Transform Infrared (FTIR) spectroscopy to measure emissions without physical sampling. These non-intrusive approaches enable real-time monitoring without disrupting engine operation, though they face challenges in calibration and data interpretation under varying atmospheric conditions.

Despite technological progress, substantial barriers impede comprehensive emission monitoring implementation. Cost remains a primary obstacle, with high-precision CEMS installations potentially exceeding $500,000 per unit, plus significant ongoing maintenance expenses. This financial burden particularly affects smaller operators and developing markets where regulatory enforcement may be less stringent.

Technical limitations present additional challenges. Current technologies struggle with accurate measurement of ultrafine particulate matter and volatile organic compounds at the low concentrations typical in modern high-efficiency turbines. Measurement accuracy is further compromised by the harsh operating environments of turbine engines, where high temperatures, pressures, and vibration levels can degrade sensor performance and reliability.

Regulatory fragmentation across different jurisdictions creates compliance complexity, with varying standards for measurement frequency, accuracy requirements, and reportable pollutants. This inconsistency complicates the development of universally applicable monitoring solutions and increases compliance costs for operators with international operations.

Data management presents another significant barrier, as continuous monitoring generates enormous volumes of information requiring sophisticated processing systems. The integration of emission data with operational parameters for meaningful analysis demands advanced computational capabilities that many operators lack, limiting the potential for emissions optimization based on monitoring results.

Predictive Emission Monitoring Systems (PEMS) have gained traction as a cost-effective alternative, using mathematical algorithms and operational parameters to estimate emissions without direct measurement. While PEMS offer reduced maintenance requirements and lower operational costs, their accuracy depends heavily on the quality of initial correlation data and may require periodic recalibration against direct measurements.

Remote sensing technologies represent a significant advancement, employing optical methods such as Differential Optical Absorption Spectroscopy (DOAS) and Fourier Transform Infrared (FTIR) spectroscopy to measure emissions without physical sampling. These non-intrusive approaches enable real-time monitoring without disrupting engine operation, though they face challenges in calibration and data interpretation under varying atmospheric conditions.

Despite technological progress, substantial barriers impede comprehensive emission monitoring implementation. Cost remains a primary obstacle, with high-precision CEMS installations potentially exceeding $500,000 per unit, plus significant ongoing maintenance expenses. This financial burden particularly affects smaller operators and developing markets where regulatory enforcement may be less stringent.

Technical limitations present additional challenges. Current technologies struggle with accurate measurement of ultrafine particulate matter and volatile organic compounds at the low concentrations typical in modern high-efficiency turbines. Measurement accuracy is further compromised by the harsh operating environments of turbine engines, where high temperatures, pressures, and vibration levels can degrade sensor performance and reliability.

Regulatory fragmentation across different jurisdictions creates compliance complexity, with varying standards for measurement frequency, accuracy requirements, and reportable pollutants. This inconsistency complicates the development of universally applicable monitoring solutions and increases compliance costs for operators with international operations.

Data management presents another significant barrier, as continuous monitoring generates enormous volumes of information requiring sophisticated processing systems. The integration of emission data with operational parameters for meaningful analysis demands advanced computational capabilities that many operators lack, limiting the potential for emissions optimization based on monitoring results.

Existing Emission Compliance Strategies

01 Continuous Emission Monitoring Systems (CEMS)

Continuous Emission Monitoring Systems provide real-time data collection and analysis of emissions from industrial sources. These systems help facilities maintain compliance with regulatory standards by constantly measuring pollutant concentrations. Advanced CEMS incorporate automated alerts when emissions approach threshold limits, enabling proactive management of potential compliance issues. The technology includes sensors, data acquisition systems, and reporting tools that work together to ensure accurate monitoring and documentation for regulatory submissions.- Continuous Emission Monitoring Systems (CEMS): Continuous Emission Monitoring Systems are used to track and report emissions data in real-time, helping facilities maintain regulatory compliance. These systems include sensors, data acquisition systems, and reporting tools that monitor pollutants such as greenhouse gases, particulate matter, and other regulated substances. CEMS provide accurate, timely data that can be used for compliance reporting, identifying emission trends, and implementing corrective actions when necessary.

- Emission Data Management and Reporting Platforms: Software platforms designed specifically for managing and reporting emissions data help organizations streamline compliance processes. These platforms collect, analyze, and format emissions data according to regulatory requirements, automating the reporting process and reducing the risk of errors. They often include features such as data validation, audit trails, and customizable reporting templates to meet various regulatory frameworks across different jurisdictions.

- Blockchain-Based Emission Tracking Systems: Blockchain technology is being applied to emission monitoring to create transparent, tamper-proof records of emissions data. These systems provide an immutable ledger of emissions information that can be shared with regulators and stakeholders while maintaining data integrity. Blockchain-based solutions enhance trust in emissions reporting by creating verifiable records and can facilitate carbon credit trading and other market-based compliance mechanisms.

- AI and Machine Learning for Predictive Emission Analysis: Artificial intelligence and machine learning algorithms are being employed to analyze emissions data, predict potential compliance issues, and optimize emission control systems. These technologies can identify patterns in emissions data that might indicate equipment malfunctions or process inefficiencies before they lead to compliance violations. Predictive analytics help facilities take proactive measures to maintain compliance and reduce emissions through operational adjustments.

- Integrated Environmental Compliance Management Systems: Comprehensive systems that integrate emission monitoring with broader environmental compliance management help organizations address multiple regulatory requirements simultaneously. These systems combine emissions data with other environmental metrics such as water quality, waste management, and permit tracking to provide a holistic view of environmental compliance. By centralizing environmental data management, these systems improve coordination between different departments and streamline interactions with regulatory agencies.

02 Digital Compliance Management Platforms

Digital platforms designed specifically for environmental compliance management integrate emission monitoring data with regulatory requirements. These systems provide centralized dashboards for tracking compliance status across multiple facilities and emission sources. Features include automated report generation, document management, and regulatory updates to ensure organizations stay current with changing requirements. The platforms often incorporate workflow management tools to streamline compliance processes and assign responsibilities to appropriate personnel.Expand Specific Solutions03 Blockchain-Based Emission Tracking

Blockchain technology is being applied to emission monitoring to create immutable records of emissions data. This approach enhances data integrity and transparency in regulatory reporting by preventing unauthorized alterations to historical emissions data. The distributed ledger system allows for secure sharing of verified emissions information between organizations, regulators, and other stakeholders. Smart contracts can be implemented to automate compliance verification and trigger actions when certain emission thresholds are reached.Expand Specific Solutions04 AI and Predictive Analytics for Compliance

Artificial intelligence and machine learning algorithms are being utilized to analyze emission patterns and predict potential compliance issues before they occur. These systems can identify anomalies in emission data that might indicate equipment malfunctions or process inefficiencies leading to increased emissions. Predictive models help organizations optimize their operations to maintain regulatory compliance while maximizing operational efficiency. The technology can also suggest corrective actions based on historical data and successful interventions.Expand Specific Solutions05 Integrated Environmental Management Systems

Comprehensive environmental management systems integrate emission monitoring with broader sustainability initiatives and compliance requirements. These systems connect emission data with energy consumption, waste management, and other environmental metrics to provide a holistic view of environmental performance. The integrated approach allows organizations to identify synergies between different environmental programs and optimize resource allocation for compliance activities. Reporting capabilities typically include both regulatory compliance documentation and sustainability reporting for stakeholders.Expand Specific Solutions

Leading Manufacturers and Regulatory Bodies

The emission monitoring landscape for turbine engine regulatory compliance is in a growth phase, with increasing market size driven by stricter environmental regulations globally. The market is characterized by a mix of established players and emerging technologies. Major companies like General Electric, Siemens Energy, and Rolls-Royce lead with mature monitoring solutions, while specialized firms such as AVL List and Solar Turbines offer complementary technologies. The technical maturity varies across solutions, with GE, Safran, and Pratt & Whitney demonstrating advanced capabilities in integrated emission monitoring systems. Automotive players including BMW and Ford are transferring relevant technologies from vehicle emissions to turbine applications. The competitive landscape is evolving as companies like Honeywell and Bosch introduce digital monitoring innovations to meet increasingly stringent compliance requirements.

General Electric Company

Technical Solution: General Electric has developed comprehensive emission monitoring systems for turbine engines that integrate advanced sensor technologies with real-time analytics platforms. Their Digital Twin technology creates virtual models of physical turbine assets to predict emissions performance and identify potential compliance issues before they occur. GE's continuous emissions monitoring systems (CEMS) utilize infrared spectroscopy and electrochemical sensors to measure NOx, CO, CO2, and other regulated pollutants with high precision. Their Smart Combustion technology dynamically adjusts fuel-air ratios based on real-time emissions data, maintaining optimal performance while staying within regulatory limits. GE has also pioneered the use of additive manufacturing to create advanced combustor designs that inherently produce fewer emissions through improved mixing and combustion efficiency.

Strengths: Comprehensive integration of hardware and software solutions; extensive fleet data for predictive analytics; global service network for implementation and maintenance. Weaknesses: Higher initial implementation costs; proprietary systems may limit integration with third-party equipment; complex systems require specialized training for operation and maintenance.

Rolls-Royce Plc

Technical Solution: Rolls-Royce has developed an integrated emissions monitoring strategy centered around their "IntelligentEngine" vision. Their system combines physical sensors with digital analytics to create a comprehensive emissions profile across all operating conditions. The company's CEMS (Continuous Emissions Monitoring System) utilizes advanced laser-based gas analyzers that provide real-time measurements of NOx, CO, unburned hydrocarbons, and particulate matter. Rolls-Royce's proprietary EEMS (Engine Emissions Management System) software processes this data through machine learning algorithms to identify trends and predict potential compliance issues before they occur. Their strategy also incorporates remote monitoring capabilities, allowing for centralized oversight of distributed turbine assets and enabling fleet-wide emissions optimization. The company has invested significantly in developing low-emission combustor technologies that work in tandem with their monitoring systems to ensure regulatory compliance.

Strengths: Highly accurate real-time monitoring capabilities; sophisticated predictive analytics for proactive compliance management; seamless integration with their turbine control systems. Weaknesses: Solutions primarily optimized for their own turbine models; relatively high implementation costs; requires specialized expertise for system maintenance and calibration.

Key Monitoring Technologies and Patents

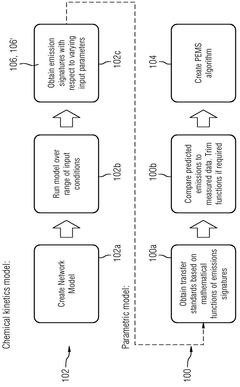

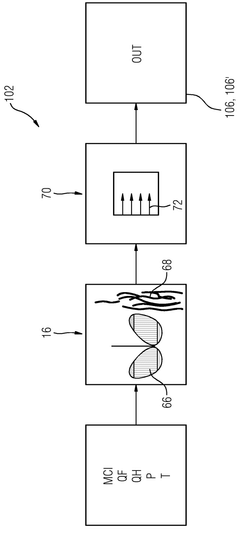

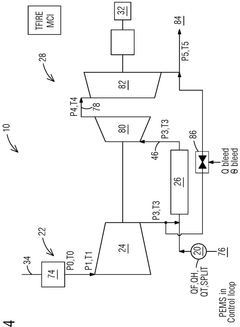

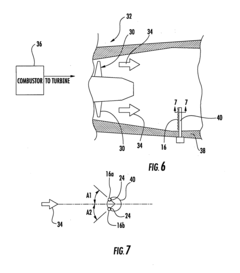

Predictive emission control for turbine engines

PatentWO2025042449A2

Innovation

- The implementation of a Predictive Emission Monitoring System (PEMS) model that predicts the behavior of emissions in a turbine engine, allowing for concurrent adjustments of the fuel supply arrangement and either the bleed valve arrangement or the inlet guide vane arrangement to meet a desired emission-abatement strategy.

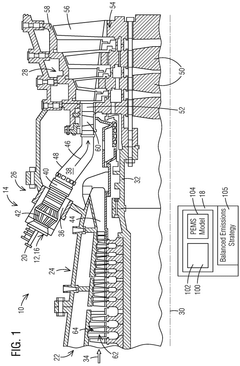

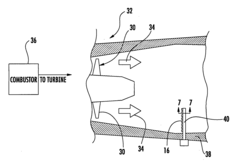

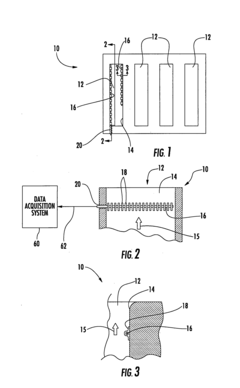

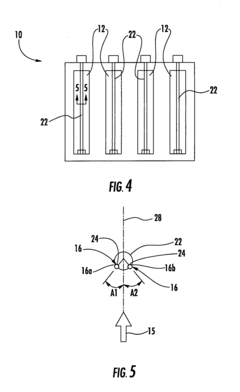

MEMS emissions sensor system for a turbine engine

PatentInactiveUS20080282770A1

Innovation

- The implementation of Microelectromechanical Systems (MEMS) emissions sensors positioned within the turbine engine, capable of measuring carbon monoxide and temperature, which are adapted to withstand high temperatures and connected to a data acquisition system for statistical analysis and filtering of emissions values.

Environmental Impact Assessment

Turbine engine emissions have significant environmental implications that extend beyond mere regulatory compliance. The combustion processes in these engines release various pollutants including nitrogen oxides (NOx), carbon monoxide (CO), unburned hydrocarbons (UHC), sulfur oxides (SOx), and particulate matter (PM). These emissions contribute substantially to air quality degradation, especially in areas surrounding airports and power generation facilities.

The environmental footprint of turbine engine emissions manifests through multiple pathways. NOx emissions participate in photochemical reactions that form ground-level ozone, a major component of smog that causes respiratory issues and damages vegetation. At higher altitudes, aviation NOx contributes to climate forcing effects that may exceed those of carbon dioxide in certain scenarios. Particulate matter emissions pose direct health risks through inhalation and can reduce visibility in affected areas.

Climate change implications are particularly concerning, as turbine engines produce greenhouse gases that contribute to global warming. Beyond CO2, the water vapor emissions from aircraft at high altitudes can form contrails and cirrus clouds that trap heat in the atmosphere, potentially amplifying warming effects. Recent studies suggest these non-CO2 effects may account for approximately two-thirds of aviation's total climate impact.

Ecosystem impacts occur when engine emissions deposit nitrogen and sulfur compounds into sensitive environments, leading to acidification of soils and water bodies. This process can disrupt nutrient cycles, damage forests, and reduce biodiversity in affected ecosystems. Coastal and alpine environments are particularly vulnerable to these effects due to their limited buffering capacity.

Public health consequences of turbine engine emissions include increased incidence of respiratory diseases, cardiovascular problems, and premature mortality in populations exposed to elevated levels of air pollutants. The World Health Organization has identified air pollution as a leading environmental risk factor for disease and mortality worldwide, with engine emissions being significant contributors in many urban areas.

Economic valuation of these environmental impacts reveals substantial external costs not captured in traditional market transactions. Studies estimate the health and environmental damages from aviation emissions alone at billions of dollars annually. These externalities provide strong economic justification for stringent emission regulations and monitoring strategies beyond simple compliance objectives.

Effective emission monitoring strategies must therefore consider not only regulatory thresholds but also the broader environmental context in which turbine engines operate. This holistic approach enables more accurate assessment of true environmental costs and benefits of different operational and technological choices in turbine engine management.

The environmental footprint of turbine engine emissions manifests through multiple pathways. NOx emissions participate in photochemical reactions that form ground-level ozone, a major component of smog that causes respiratory issues and damages vegetation. At higher altitudes, aviation NOx contributes to climate forcing effects that may exceed those of carbon dioxide in certain scenarios. Particulate matter emissions pose direct health risks through inhalation and can reduce visibility in affected areas.

Climate change implications are particularly concerning, as turbine engines produce greenhouse gases that contribute to global warming. Beyond CO2, the water vapor emissions from aircraft at high altitudes can form contrails and cirrus clouds that trap heat in the atmosphere, potentially amplifying warming effects. Recent studies suggest these non-CO2 effects may account for approximately two-thirds of aviation's total climate impact.

Ecosystem impacts occur when engine emissions deposit nitrogen and sulfur compounds into sensitive environments, leading to acidification of soils and water bodies. This process can disrupt nutrient cycles, damage forests, and reduce biodiversity in affected ecosystems. Coastal and alpine environments are particularly vulnerable to these effects due to their limited buffering capacity.

Public health consequences of turbine engine emissions include increased incidence of respiratory diseases, cardiovascular problems, and premature mortality in populations exposed to elevated levels of air pollutants. The World Health Organization has identified air pollution as a leading environmental risk factor for disease and mortality worldwide, with engine emissions being significant contributors in many urban areas.

Economic valuation of these environmental impacts reveals substantial external costs not captured in traditional market transactions. Studies estimate the health and environmental damages from aviation emissions alone at billions of dollars annually. These externalities provide strong economic justification for stringent emission regulations and monitoring strategies beyond simple compliance objectives.

Effective emission monitoring strategies must therefore consider not only regulatory thresholds but also the broader environmental context in which turbine engines operate. This holistic approach enables more accurate assessment of true environmental costs and benefits of different operational and technological choices in turbine engine management.

Cost-Benefit Analysis of Compliance Solutions

The implementation of emission monitoring systems for turbine engines represents a significant investment for operators, necessitating thorough cost-benefit analysis to determine optimal compliance strategies. Initial capital expenditures for continuous emission monitoring systems (CEMS) typically range from $100,000 to $500,000 per installation, depending on the complexity of the turbine system and regulatory requirements. These systems also incur ongoing operational costs of approximately $25,000-$75,000 annually for maintenance, calibration, and data management.

When evaluating predictive emission monitoring systems (PEMS) as an alternative, the initial investment is generally 30-40% lower than CEMS, with implementation costs between $70,000 and $300,000. However, PEMS require more sophisticated data analytics capabilities and periodic validation against direct measurement methods, adding complexity to the compliance process.

The financial benefits of proper emission monitoring extend beyond mere regulatory compliance. Operators implementing advanced monitoring solutions report fuel efficiency improvements of 2-5%, translating to substantial operational savings for large turbine installations. Additionally, enhanced monitoring capabilities enable more precise engine tuning, potentially extending maintenance intervals by 10-15% and reducing lifetime maintenance costs.

Non-compliance penalties must be factored into this analysis, as regulatory fines can exceed $10,000 per day of violation in many jurisdictions. More significantly, operations may face shutdown orders during non-compliance periods, resulting in revenue losses that can reach millions of dollars for critical power generation or industrial applications.

Return on investment (ROI) calculations indicate that most comprehensive emission monitoring solutions achieve payback within 2-4 years when accounting for efficiency gains, maintenance optimization, and avoided compliance penalties. Cloud-based monitoring solutions are emerging as particularly cost-effective options, reducing on-site infrastructure requirements while providing enhanced data analytics capabilities.

For multinational operators, standardizing monitoring approaches across different regulatory environments can yield economies of scale, reducing per-unit compliance costs by approximately 15-20% compared to jurisdiction-specific solutions. This standardization also simplifies staff training and system maintenance procedures.

The long-term financial analysis must consider evolving regulatory landscapes, as emission standards typically become more stringent over time. Systems designed with scalability and upgradeability features demonstrate superior lifetime value, despite potentially higher initial costs, by reducing the need for complete system replacements as regulations evolve.

When evaluating predictive emission monitoring systems (PEMS) as an alternative, the initial investment is generally 30-40% lower than CEMS, with implementation costs between $70,000 and $300,000. However, PEMS require more sophisticated data analytics capabilities and periodic validation against direct measurement methods, adding complexity to the compliance process.

The financial benefits of proper emission monitoring extend beyond mere regulatory compliance. Operators implementing advanced monitoring solutions report fuel efficiency improvements of 2-5%, translating to substantial operational savings for large turbine installations. Additionally, enhanced monitoring capabilities enable more precise engine tuning, potentially extending maintenance intervals by 10-15% and reducing lifetime maintenance costs.

Non-compliance penalties must be factored into this analysis, as regulatory fines can exceed $10,000 per day of violation in many jurisdictions. More significantly, operations may face shutdown orders during non-compliance periods, resulting in revenue losses that can reach millions of dollars for critical power generation or industrial applications.

Return on investment (ROI) calculations indicate that most comprehensive emission monitoring solutions achieve payback within 2-4 years when accounting for efficiency gains, maintenance optimization, and avoided compliance penalties. Cloud-based monitoring solutions are emerging as particularly cost-effective options, reducing on-site infrastructure requirements while providing enhanced data analytics capabilities.

For multinational operators, standardizing monitoring approaches across different regulatory environments can yield economies of scale, reducing per-unit compliance costs by approximately 15-20% compared to jurisdiction-specific solutions. This standardization also simplifies staff training and system maintenance procedures.

The long-term financial analysis must consider evolving regulatory landscapes, as emission standards typically become more stringent over time. Systems designed with scalability and upgradeability features demonstrate superior lifetime value, despite potentially higher initial costs, by reducing the need for complete system replacements as regulations evolve.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!