Energy market integration strategies for green hydrogen producers

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Hydrogen Technology Background and Objectives

Green hydrogen has emerged as a pivotal element in the global transition toward sustainable energy systems. The concept of producing hydrogen through electrolysis powered by renewable energy sources dates back to the early 2000s, but significant technological advancements and cost reductions have only materialized in the past decade. This evolution has been driven by the urgent need to decarbonize sectors where direct electrification remains challenging, such as heavy industry, long-distance transport, and chemical manufacturing.

The technological trajectory of green hydrogen production has seen remarkable improvements in electrolyzer efficiency, durability, and scalability. Early systems operated at efficiency levels below 60%, whereas modern designs can achieve over 80% efficiency. This progress has been complemented by the dramatic cost reduction in renewable energy generation, particularly solar photovoltaics and wind power, which has enhanced the economic viability of green hydrogen production.

Current market integration of green hydrogen faces several technical and economic barriers. The intermittent nature of renewable energy sources creates challenges for continuous hydrogen production, while the lack of standardized infrastructure for hydrogen storage, transport, and distribution limits market accessibility. Additionally, the cost disparity between green hydrogen and its fossil fuel-derived counterparts remains a significant obstacle to widespread adoption.

The primary objective of green hydrogen technology development is to achieve cost parity with conventional hydrogen production methods by 2030. This entails reducing the levelized cost of green hydrogen from the current range of $3-6/kg to below $2/kg. Secondary objectives include enhancing system flexibility to accommodate variable renewable energy inputs, developing more efficient and durable electrolysis technologies, and establishing comprehensive standards for hydrogen quality and safety.

Looking forward, the integration of green hydrogen into existing energy markets requires innovative strategies that address both technical and market challenges. These include the development of hybrid energy systems that optimize the interplay between electricity and hydrogen markets, implementation of dynamic production models that respond to grid conditions and market signals, and creation of hydrogen hubs that concentrate production, storage, and end-use applications to achieve economies of scale.

The ultimate goal extends beyond technological advancement to encompass the creation of a robust hydrogen economy where green hydrogen serves as a versatile energy carrier, enabling sector coupling and facilitating deeper penetration of renewable energy across all economic sectors.

The technological trajectory of green hydrogen production has seen remarkable improvements in electrolyzer efficiency, durability, and scalability. Early systems operated at efficiency levels below 60%, whereas modern designs can achieve over 80% efficiency. This progress has been complemented by the dramatic cost reduction in renewable energy generation, particularly solar photovoltaics and wind power, which has enhanced the economic viability of green hydrogen production.

Current market integration of green hydrogen faces several technical and economic barriers. The intermittent nature of renewable energy sources creates challenges for continuous hydrogen production, while the lack of standardized infrastructure for hydrogen storage, transport, and distribution limits market accessibility. Additionally, the cost disparity between green hydrogen and its fossil fuel-derived counterparts remains a significant obstacle to widespread adoption.

The primary objective of green hydrogen technology development is to achieve cost parity with conventional hydrogen production methods by 2030. This entails reducing the levelized cost of green hydrogen from the current range of $3-6/kg to below $2/kg. Secondary objectives include enhancing system flexibility to accommodate variable renewable energy inputs, developing more efficient and durable electrolysis technologies, and establishing comprehensive standards for hydrogen quality and safety.

Looking forward, the integration of green hydrogen into existing energy markets requires innovative strategies that address both technical and market challenges. These include the development of hybrid energy systems that optimize the interplay between electricity and hydrogen markets, implementation of dynamic production models that respond to grid conditions and market signals, and creation of hydrogen hubs that concentrate production, storage, and end-use applications to achieve economies of scale.

The ultimate goal extends beyond technological advancement to encompass the creation of a robust hydrogen economy where green hydrogen serves as a versatile energy carrier, enabling sector coupling and facilitating deeper penetration of renewable energy across all economic sectors.

Market Demand Analysis for Green Hydrogen

The global green hydrogen market is experiencing unprecedented growth, driven by the urgent need for decarbonization across multiple sectors. Current market assessments indicate that green hydrogen demand could reach 530 million tons by 2050, representing a substantial increase from today's minimal production levels. This growth trajectory is supported by declining renewable energy costs, with solar PV and wind power prices having fallen by approximately 85% and 55% respectively over the past decade, making electrolysis increasingly economically viable.

Industrial applications currently dominate the hydrogen demand landscape, with refineries and ammonia production accounting for over 60% of total hydrogen consumption. However, emerging sectors show significant growth potential. The transportation sector, particularly heavy-duty vehicles, shipping, and aviation, is projected to become a major demand driver as these hard-to-electrify segments seek low-carbon alternatives. Several major automotive manufacturers have already launched hydrogen fuel cell vehicles, while shipping companies are developing hydrogen-powered vessels.

Energy storage represents another crucial market segment, with green hydrogen offering a solution to the intermittency challenges of renewable energy. Countries with high renewable penetration are increasingly exploring hydrogen as a seasonal storage medium, potentially creating substantial demand in regions with ambitious renewable targets.

Geographic demand patterns reveal significant regional variations. The European Union has positioned itself as a leader through its Hydrogen Strategy, targeting 40 GW of electrolyzer capacity by 2030. Japan and South Korea have established clear hydrogen roadmaps focused on energy security and industrial applications. China's emerging interest in hydrogen, particularly for transportation, signals potential massive demand growth in Asia.

Market barriers remain significant despite positive trends. The cost gap between green hydrogen ($3-6/kg) and conventional gray hydrogen ($1-2/kg) continues to be the primary obstacle to widespread adoption. Infrastructure limitations, including transportation and storage facilities, further constrain market growth. Regulatory frameworks across different jurisdictions remain inconsistent, creating uncertainty for investors and producers.

Consumer willingness to pay premiums for green products varies significantly across sectors. While industrial users typically prioritize cost competitiveness, certain consumer-facing industries demonstrate greater willingness to absorb green premiums. This segmentation suggests that initial market penetration may be most successful in sectors with strong sustainability commitments or direct consumer visibility.

Industrial applications currently dominate the hydrogen demand landscape, with refineries and ammonia production accounting for over 60% of total hydrogen consumption. However, emerging sectors show significant growth potential. The transportation sector, particularly heavy-duty vehicles, shipping, and aviation, is projected to become a major demand driver as these hard-to-electrify segments seek low-carbon alternatives. Several major automotive manufacturers have already launched hydrogen fuel cell vehicles, while shipping companies are developing hydrogen-powered vessels.

Energy storage represents another crucial market segment, with green hydrogen offering a solution to the intermittency challenges of renewable energy. Countries with high renewable penetration are increasingly exploring hydrogen as a seasonal storage medium, potentially creating substantial demand in regions with ambitious renewable targets.

Geographic demand patterns reveal significant regional variations. The European Union has positioned itself as a leader through its Hydrogen Strategy, targeting 40 GW of electrolyzer capacity by 2030. Japan and South Korea have established clear hydrogen roadmaps focused on energy security and industrial applications. China's emerging interest in hydrogen, particularly for transportation, signals potential massive demand growth in Asia.

Market barriers remain significant despite positive trends. The cost gap between green hydrogen ($3-6/kg) and conventional gray hydrogen ($1-2/kg) continues to be the primary obstacle to widespread adoption. Infrastructure limitations, including transportation and storage facilities, further constrain market growth. Regulatory frameworks across different jurisdictions remain inconsistent, creating uncertainty for investors and producers.

Consumer willingness to pay premiums for green products varies significantly across sectors. While industrial users typically prioritize cost competitiveness, certain consumer-facing industries demonstrate greater willingness to absorb green premiums. This segmentation suggests that initial market penetration may be most successful in sectors with strong sustainability commitments or direct consumer visibility.

Current Status and Challenges in Energy Market Integration

The integration of green hydrogen producers into existing energy markets presents a complex landscape with significant regional variations. Currently, most energy markets lack dedicated frameworks for hydrogen integration, forcing producers to navigate regulatory structures designed primarily for conventional energy sources. In Europe, the EU Hydrogen Strategy provides initial guidance, but implementation remains fragmented across member states, creating market uncertainty for producers seeking cross-border operations.

Market access represents a critical challenge, as green hydrogen producers face substantial barriers to entry. Grid connection protocols, designed for traditional energy sources, often fail to accommodate hydrogen's unique production and storage characteristics. Additionally, the absence of standardized certification systems for "green" hydrogen complicates market participation and value recognition, particularly in premium markets willing to pay for environmental attributes.

Price competitiveness remains the most significant hurdle. Production costs for green hydrogen currently range from $3-8/kg, substantially higher than grey hydrogen's $1-2/kg. This gap creates a challenging economic environment where market integration depends heavily on subsidies, carbon pricing mechanisms, or premium market segments willing to absorb higher costs for sustainability benefits.

Regulatory frameworks exhibit considerable inconsistency globally. While countries like Germany, Japan, and Australia have developed hydrogen-specific roadmaps, many regions operate with regulatory gaps that create investment uncertainty. The classification of hydrogen as an energy carrier versus a chemical feedstock further complicates regulatory treatment across different market segments.

Infrastructure limitations present physical barriers to market integration. The nascent state of hydrogen transport infrastructure restricts market access to localized applications, often requiring co-location of production and consumption. Existing natural gas pipelines offer potential for blending, but technical limitations typically restrict hydrogen content to 5-20% by volume, limiting market penetration.

Market liquidity and trading mechanisms remain underdeveloped. Unlike established energy commodities, hydrogen lacks transparent price discovery mechanisms and standardized contracts. This absence of market depth increases transaction costs and risk premiums for market participants, further challenging economic viability.

Cross-sectoral integration presents both opportunities and challenges. While hydrogen can potentially link previously separate energy markets (electricity, gas, transport, industry), the regulatory frameworks governing these sectors often operate in isolation, creating coordination failures that impede efficient market integration.

Market access represents a critical challenge, as green hydrogen producers face substantial barriers to entry. Grid connection protocols, designed for traditional energy sources, often fail to accommodate hydrogen's unique production and storage characteristics. Additionally, the absence of standardized certification systems for "green" hydrogen complicates market participation and value recognition, particularly in premium markets willing to pay for environmental attributes.

Price competitiveness remains the most significant hurdle. Production costs for green hydrogen currently range from $3-8/kg, substantially higher than grey hydrogen's $1-2/kg. This gap creates a challenging economic environment where market integration depends heavily on subsidies, carbon pricing mechanisms, or premium market segments willing to absorb higher costs for sustainability benefits.

Regulatory frameworks exhibit considerable inconsistency globally. While countries like Germany, Japan, and Australia have developed hydrogen-specific roadmaps, many regions operate with regulatory gaps that create investment uncertainty. The classification of hydrogen as an energy carrier versus a chemical feedstock further complicates regulatory treatment across different market segments.

Infrastructure limitations present physical barriers to market integration. The nascent state of hydrogen transport infrastructure restricts market access to localized applications, often requiring co-location of production and consumption. Existing natural gas pipelines offer potential for blending, but technical limitations typically restrict hydrogen content to 5-20% by volume, limiting market penetration.

Market liquidity and trading mechanisms remain underdeveloped. Unlike established energy commodities, hydrogen lacks transparent price discovery mechanisms and standardized contracts. This absence of market depth increases transaction costs and risk premiums for market participants, further challenging economic viability.

Cross-sectoral integration presents both opportunities and challenges. While hydrogen can potentially link previously separate energy markets (electricity, gas, transport, industry), the regulatory frameworks governing these sectors often operate in isolation, creating coordination failures that impede efficient market integration.

Current Energy Market Integration Strategies

01 Grid integration of green hydrogen systems

Integration of green hydrogen production systems with existing power grids enables efficient energy storage and distribution. These systems can utilize excess renewable energy during off-peak hours to produce hydrogen, which can then be used during peak demand periods. This approach helps balance grid loads, improve energy security, and maximize the utilization of renewable energy sources while reducing curtailment issues.- Grid integration of green hydrogen systems: Integration of green hydrogen production systems with existing power grids enables efficient energy storage and distribution. These systems can utilize excess renewable energy during off-peak hours to produce hydrogen, which can then be used during peak demand periods. This approach helps balance grid loads, improve energy security, and maximize the utilization of renewable energy sources while reducing curtailment issues.

- Market mechanisms for green hydrogen trading: Development of market mechanisms and trading platforms specifically designed for green hydrogen facilitates its integration into existing energy markets. These mechanisms include pricing models, certification systems, and trading protocols that enable transparent and efficient hydrogen commerce. Such market structures help establish hydrogen as a tradable commodity and support the growth of a hydrogen-based economy.

- Infrastructure development for hydrogen distribution: Creating and expanding infrastructure for hydrogen storage, transportation, and distribution is essential for market integration. This includes pipelines, storage facilities, refueling stations, and conversion of existing natural gas infrastructure to accommodate hydrogen. Developing this infrastructure network enables efficient movement of hydrogen from production sites to end-users across various sectors.

- Cross-sector integration of green hydrogen: Integration of green hydrogen across multiple sectors including transportation, industry, power generation, and residential applications creates synergies and economies of scale. This cross-sector approach enables hydrogen to serve as a versatile energy carrier that connects previously separate energy systems. By addressing multiple markets simultaneously, the overall demand for green hydrogen increases, improving economic viability.

- Policy frameworks and incentives for market adoption: Development of supportive policy frameworks, regulations, and financial incentives accelerates the integration of green hydrogen into energy markets. These include carbon pricing mechanisms, subsidies for green hydrogen production, mandates for hydrogen use in specific sectors, and standardization of hydrogen quality and safety requirements. Such policies help overcome initial cost barriers and create a level playing field with conventional energy sources.

02 Market mechanisms for green hydrogen trading

Development of market mechanisms and trading platforms specifically designed for green hydrogen facilitates its integration into existing energy markets. These mechanisms include pricing structures, certification systems, and trading protocols that enable transparent and efficient hydrogen commerce. Such systems help establish green hydrogen as a tradable commodity and support its adoption across various sectors.Expand Specific Solutions03 Infrastructure development for hydrogen distribution

Creating and expanding infrastructure for hydrogen storage, transportation, and distribution is essential for market integration. This includes pipelines, storage facilities, refueling stations, and conversion technologies that enable hydrogen to be moved efficiently from production sites to end users. Strategic infrastructure development reduces costs and improves accessibility of green hydrogen across different geographical regions.Expand Specific Solutions04 Cross-sector integration of green hydrogen

Integration of green hydrogen across multiple sectors such as transportation, industry, and power generation maximizes its market potential. By developing applications that span different industries, green hydrogen can serve as a versatile energy carrier that connects previously separate energy systems. This cross-sector approach creates synergies and economies of scale that improve the overall economics of hydrogen adoption.Expand Specific Solutions05 Policy frameworks and incentives for market development

Implementation of supportive policy frameworks and financial incentives accelerates the integration of green hydrogen into energy markets. These include carbon pricing, subsidies, tax benefits, and regulatory standards that improve the competitiveness of green hydrogen against conventional alternatives. Effective policies create market certainty and attract investments needed for scaling up hydrogen production and utilization technologies.Expand Specific Solutions

Key Players in Green Hydrogen Production and Energy Markets

The green hydrogen market is currently in an early growth phase, characterized by rapid technological advancements and increasing strategic investments. The global market size is projected to expand significantly, with estimates suggesting a compound annual growth rate of 50-60% through 2030. From a technological maturity perspective, the landscape shows varying degrees of development. State Grid Corporation of China and Saudi Aramco are leveraging their extensive energy infrastructure to scale hydrogen integration, while specialized innovators like Iogen Corp. and BluWave-AI are developing cutting-edge AI-driven optimization solutions. Research institutions including Huaneng Clean Energy Research Institute and North China Electric Power University are advancing fundamental technologies, while Hitachi and X Development are focusing on system integration innovations that could potentially disrupt traditional energy market structures.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed a comprehensive green hydrogen market integration strategy centered on its carbon-neutral hydrogen production facilities. The company is investing $5 billion in green hydrogen production by 2025, focusing on utilizing its existing infrastructure for hydrogen transport and storage. Their approach includes developing dedicated hydrogen pipelines connecting production sites to industrial clusters and export terminals. Aramco's strategy involves vertical integration across the hydrogen value chain, from renewable power generation to end-use applications, particularly targeting European and Asian export markets. The company has established partnerships with major energy consumers to secure long-term offtake agreements, creating market stability. Additionally, Aramco is developing hydrogen hubs that co-locate production with industrial users to minimize transportation costs and maximize efficiency.

Strengths: Extensive existing energy infrastructure that can be repurposed for hydrogen; Strong financial position enabling large-scale investments; Established global trading relationships. Weaknesses: Heavy reliance on fossil fuel revenue creates potential conflicts in transition strategy; Limited experience in renewable energy operations compared to traditional oil and gas.

Hitachi Ltd.

Technical Solution: Hitachi has pioneered an integrated energy systems approach for green hydrogen market integration, focusing on digital solutions and grid optimization. Their technology platform combines AI-driven energy management systems with hydrogen production facilities to enable dynamic response to electricity price fluctuations and grid conditions. Hitachi's solution includes advanced electrolyzers that can ramp production up or down based on renewable energy availability, optimizing hydrogen production costs. The company has developed specialized software that provides real-time analytics on hydrogen production economics, storage levels, and market demand signals. Their system incorporates predictive maintenance capabilities for electrolyzer fleets, maximizing operational uptime and efficiency. Hitachi has also created digital twins of hydrogen production and distribution networks to simulate different market scenarios and optimize investment decisions.

Strengths: Strong digital technology capabilities that enable sophisticated energy management; Extensive experience in grid infrastructure and industrial systems integration; Global presence across multiple markets. Weaknesses: Less direct experience in hydrogen production compared to pure-play hydrogen companies; Requires partnerships with other companies for complete end-to-end hydrogen solutions.

Key Technical Innovations for Market Integration

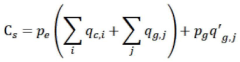

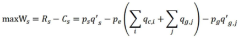

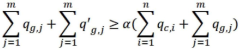

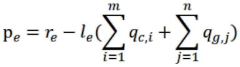

Market subject transaction strategy system under collaborative linkage of green certificate market and carbon market

PatentPendingCN117541308A

Innovation

- A trading strategy system for market entities under the coordinated linkage of the green certificate market and the carbon market is constructed. By calculating the first-order derivative module of the objective function, the optimal purchase and sale of electricity, carbon price, and green certificate price of each trading entity are solved, and renewable energy is analyzed. The impact of changes in energy quota ratio and carbon quota coefficient on power development, establishing cost-benefit calculation modules and decision-making modules for power generators and electricity sellers, and optimizing the trading strategies of market entities.

Regulatory Framework and Policy Incentives

The regulatory landscape for green hydrogen production is evolving rapidly across global markets, creating both opportunities and challenges for producers seeking integration strategies. At the international level, frameworks such as the European Union's Hydrogen Strategy and the U.S. Hydrogen Earthshot initiative are establishing foundational guidelines for market development. These frameworks typically address production standards, safety protocols, and cross-border trading mechanisms essential for market integration.

National policies increasingly incorporate specific incentives designed to accelerate green hydrogen adoption. Feed-in tariffs, similar to those that catalyzed solar industry growth, are emerging in countries like Germany and Japan, providing guaranteed revenue streams for producers. Tax credits, particularly production tax credits modeled after the U.S. Section 45V hydrogen incentives, offer significant financial benefits that improve project economics and attract investment capital.

Carbon pricing mechanisms represent another critical policy tool influencing market integration. Regions with established carbon markets or carbon taxes create indirect incentives for green hydrogen by increasing the cost of carbon-intensive alternatives. The EU Emissions Trading System exemplifies how carbon pricing can shift market dynamics in favor of low-carbon hydrogen production pathways.

Renewable energy certificate systems are being adapted to accommodate hydrogen production, with guarantees of origin and hydrogen certification schemes developing in multiple jurisdictions. These certification frameworks enable premium pricing for green hydrogen and facilitate integration into existing energy markets through recognized standards and trading platforms.

Infrastructure development receives substantial policy support through dedicated funding programs and regulatory accommodations. Hydrogen pipeline regulations, storage facility permitting, and grid connection protocols are being streamlined in progressive markets to reduce barriers to entry. Public-private partnerships for infrastructure development, backed by government loan guarantees and grants, are accelerating the creation of hydrogen hubs that enable market integration.

Regulatory sandboxes and innovation zones provide controlled environments for testing novel market integration approaches with temporary regulatory exemptions. These experimental frameworks allow producers to demonstrate new business models and integration strategies before wider regulatory reforms are implemented. Such flexibility is particularly valuable for developing hydrogen trading platforms, virtual power plant participation, and grid balancing service provision.

National policies increasingly incorporate specific incentives designed to accelerate green hydrogen adoption. Feed-in tariffs, similar to those that catalyzed solar industry growth, are emerging in countries like Germany and Japan, providing guaranteed revenue streams for producers. Tax credits, particularly production tax credits modeled after the U.S. Section 45V hydrogen incentives, offer significant financial benefits that improve project economics and attract investment capital.

Carbon pricing mechanisms represent another critical policy tool influencing market integration. Regions with established carbon markets or carbon taxes create indirect incentives for green hydrogen by increasing the cost of carbon-intensive alternatives. The EU Emissions Trading System exemplifies how carbon pricing can shift market dynamics in favor of low-carbon hydrogen production pathways.

Renewable energy certificate systems are being adapted to accommodate hydrogen production, with guarantees of origin and hydrogen certification schemes developing in multiple jurisdictions. These certification frameworks enable premium pricing for green hydrogen and facilitate integration into existing energy markets through recognized standards and trading platforms.

Infrastructure development receives substantial policy support through dedicated funding programs and regulatory accommodations. Hydrogen pipeline regulations, storage facility permitting, and grid connection protocols are being streamlined in progressive markets to reduce barriers to entry. Public-private partnerships for infrastructure development, backed by government loan guarantees and grants, are accelerating the creation of hydrogen hubs that enable market integration.

Regulatory sandboxes and innovation zones provide controlled environments for testing novel market integration approaches with temporary regulatory exemptions. These experimental frameworks allow producers to demonstrate new business models and integration strategies before wider regulatory reforms are implemented. Such flexibility is particularly valuable for developing hydrogen trading platforms, virtual power plant participation, and grid balancing service provision.

Economic Viability and Cost Reduction Pathways

The economic viability of green hydrogen production remains a significant challenge in current market conditions. Production costs typically range from $3-8 per kilogram, substantially higher than conventional hydrogen derived from fossil fuels at $1-2 per kilogram. This cost differential creates a fundamental barrier to widespread adoption despite growing environmental imperatives.

Capital expenditure represents approximately 30-40% of green hydrogen production costs, with electrolyzer technology being the primary investment. Current electrolyzer costs range from $500-1,000 per kW of capacity, though economies of scale are gradually reducing this figure. Industry projections suggest potential cost reductions of 60-70% by 2030 through manufacturing scale-up and technological improvements.

Operational expenditure is dominated by electricity costs, accounting for 50-70% of total production expenses. Access to low-cost renewable electricity is therefore critical to economic viability. Regions with abundant solar and wind resources that can achieve electricity costs below $30/MWh represent optimal production locations. Strategic co-location with renewable generation assets can further reduce costs through minimized transmission fees and grid charges.

Several pathways exist for improving economic viability. Technological advancement in electrolyzer efficiency could increase conversion rates from the current 65-75% to over 80%, significantly reducing electricity requirements per unit of hydrogen produced. Material innovations, particularly replacing precious metal catalysts with abundant alternatives, offer substantial cost reduction potential.

Policy support mechanisms remain essential for bridging the cost gap in the near term. Carbon pricing, production subsidies, and regulatory frameworks like the EU's Carbon Border Adjustment Mechanism can effectively improve competitiveness against carbon-intensive alternatives. The implementation of Contracts for Difference (CfDs) has proven particularly effective in providing investment certainty while gradually exposing producers to market signals.

Integration with existing industrial clusters offers immediate economic benefits through shared infrastructure and reduced transportation costs. The development of hydrogen hubs around industrial centers enables producers to access established demand while minimizing distribution expenses, which can otherwise add $1-3 per kilogram to delivered costs.

Long-term economic viability will ultimately depend on achieving system-wide scale. Industry forecasts suggest that with sufficient deployment, green hydrogen could reach cost parity with conventional hydrogen by 2030-2035 in optimal regions, creating a self-sustaining market that no longer requires policy intervention.

Capital expenditure represents approximately 30-40% of green hydrogen production costs, with electrolyzer technology being the primary investment. Current electrolyzer costs range from $500-1,000 per kW of capacity, though economies of scale are gradually reducing this figure. Industry projections suggest potential cost reductions of 60-70% by 2030 through manufacturing scale-up and technological improvements.

Operational expenditure is dominated by electricity costs, accounting for 50-70% of total production expenses. Access to low-cost renewable electricity is therefore critical to economic viability. Regions with abundant solar and wind resources that can achieve electricity costs below $30/MWh represent optimal production locations. Strategic co-location with renewable generation assets can further reduce costs through minimized transmission fees and grid charges.

Several pathways exist for improving economic viability. Technological advancement in electrolyzer efficiency could increase conversion rates from the current 65-75% to over 80%, significantly reducing electricity requirements per unit of hydrogen produced. Material innovations, particularly replacing precious metal catalysts with abundant alternatives, offer substantial cost reduction potential.

Policy support mechanisms remain essential for bridging the cost gap in the near term. Carbon pricing, production subsidies, and regulatory frameworks like the EU's Carbon Border Adjustment Mechanism can effectively improve competitiveness against carbon-intensive alternatives. The implementation of Contracts for Difference (CfDs) has proven particularly effective in providing investment certainty while gradually exposing producers to market signals.

Integration with existing industrial clusters offers immediate economic benefits through shared infrastructure and reduced transportation costs. The development of hydrogen hubs around industrial centers enables producers to access established demand while minimizing distribution expenses, which can otherwise add $1-3 per kilogram to delivered costs.

Long-term economic viability will ultimately depend on achieving system-wide scale. Industry forecasts suggest that with sufficient deployment, green hydrogen could reach cost parity with conventional hydrogen by 2030-2035 in optimal regions, creating a self-sustaining market that no longer requires policy intervention.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!