EV Auxiliary Power Potential Of Room-Temperature Sodium-Sulfur Batteries

AUG 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Na-S Battery Technology Background and Objectives

Sodium-sulfur (Na-S) battery technology has evolved significantly since its inception in the 1960s by Ford Motor Company. Initially developed as high-temperature systems operating at 300-350°C, these batteries demonstrated impressive energy density but faced substantial challenges in safety and practical application. The evolution towards room-temperature sodium-sulfur batteries represents a critical advancement in energy storage technology, particularly for electric vehicle (EV) applications where auxiliary power systems demand both efficiency and safety.

The fundamental chemistry of Na-S batteries leverages the abundant and cost-effective nature of both sodium and sulfur, positioning this technology as a promising alternative to lithium-ion batteries. Sodium, being the sixth most abundant element in the Earth's crust, offers significant advantages in terms of resource availability and cost reduction potential. This abundance addresses growing concerns about lithium supply chain vulnerabilities and price volatility in the EV market.

Recent technological breakthroughs have focused on overcoming the historical limitations of Na-S batteries, particularly the dendrite formation issues and the shuttle effect of polysulfides. These advancements have enabled the development of room-temperature variants that maintain high energy density while eliminating the safety risks associated with high-temperature operation. The theoretical energy density of Na-S batteries reaches up to 760 Wh/kg, significantly exceeding current lithium-ion technologies.

The primary objective of room-temperature Na-S battery research for EV auxiliary power applications is to develop systems that can deliver stable performance across varying operational conditions while maintaining long cycle life. Current targets include achieving energy densities above 300 Wh/kg at room temperature, cycle life exceeding 1,000 cycles, and improved safety profiles compared to conventional lithium-ion batteries.

Another critical goal is cost reduction, with projections suggesting that mature Na-S technology could reduce battery costs by 30-40% compared to current lithium-ion solutions. This cost advantage stems from both material abundance and potentially simplified manufacturing processes. The development trajectory aims to reach commercial viability for EV auxiliary power applications by 2025-2027.

Environmental sustainability represents another key objective in Na-S battery development. The technology offers reduced environmental impact through the use of more abundant materials and potentially simpler recycling processes compared to lithium-ion batteries. This aligns with the automotive industry's increasing focus on full lifecycle sustainability of vehicle components.

Technical objectives also include addressing specific challenges related to EV auxiliary power applications, such as rapid response capabilities for regenerative braking systems, tolerance to frequent partial charge-discharge cycles, and resilience to temperature fluctuations encountered in automotive environments.

The fundamental chemistry of Na-S batteries leverages the abundant and cost-effective nature of both sodium and sulfur, positioning this technology as a promising alternative to lithium-ion batteries. Sodium, being the sixth most abundant element in the Earth's crust, offers significant advantages in terms of resource availability and cost reduction potential. This abundance addresses growing concerns about lithium supply chain vulnerabilities and price volatility in the EV market.

Recent technological breakthroughs have focused on overcoming the historical limitations of Na-S batteries, particularly the dendrite formation issues and the shuttle effect of polysulfides. These advancements have enabled the development of room-temperature variants that maintain high energy density while eliminating the safety risks associated with high-temperature operation. The theoretical energy density of Na-S batteries reaches up to 760 Wh/kg, significantly exceeding current lithium-ion technologies.

The primary objective of room-temperature Na-S battery research for EV auxiliary power applications is to develop systems that can deliver stable performance across varying operational conditions while maintaining long cycle life. Current targets include achieving energy densities above 300 Wh/kg at room temperature, cycle life exceeding 1,000 cycles, and improved safety profiles compared to conventional lithium-ion batteries.

Another critical goal is cost reduction, with projections suggesting that mature Na-S technology could reduce battery costs by 30-40% compared to current lithium-ion solutions. This cost advantage stems from both material abundance and potentially simplified manufacturing processes. The development trajectory aims to reach commercial viability for EV auxiliary power applications by 2025-2027.

Environmental sustainability represents another key objective in Na-S battery development. The technology offers reduced environmental impact through the use of more abundant materials and potentially simpler recycling processes compared to lithium-ion batteries. This aligns with the automotive industry's increasing focus on full lifecycle sustainability of vehicle components.

Technical objectives also include addressing specific challenges related to EV auxiliary power applications, such as rapid response capabilities for regenerative braking systems, tolerance to frequent partial charge-discharge cycles, and resilience to temperature fluctuations encountered in automotive environments.

EV Auxiliary Power Market Analysis

The electric vehicle (EV) auxiliary power market is experiencing significant growth as the global automotive industry shifts toward electrification. Auxiliary power systems in EVs are critical components that support various vehicle functions beyond propulsion, including climate control, lighting, infotainment systems, and safety features. The current market size for EV auxiliary power systems is estimated at $5.2 billion globally, with projections indicating growth to reach $12.7 billion by 2030, representing a compound annual growth rate of 11.8%.

This growth is primarily driven by the rapid expansion of the EV market itself, which saw global sales increase by 40% in 2022 alone. As EV adoption accelerates, the demand for more efficient, reliable, and cost-effective auxiliary power solutions continues to rise. Traditional lithium-ion batteries currently dominate this market segment, accounting for approximately 78% of auxiliary power solutions in modern EVs.

Consumer expectations are evolving rapidly in this space, with increasing demands for extended range, faster charging capabilities, and enhanced reliability. Market research indicates that 67% of potential EV buyers consider auxiliary power performance—particularly the ability to maintain climate control and other functions without significantly impacting driving range—as an important factor in their purchasing decisions.

Regional analysis reveals varying market dynamics. Asia-Pacific leads the market with 42% share, driven primarily by China's aggressive EV adoption policies and manufacturing capabilities. Europe follows at 31%, with stringent emissions regulations accelerating the transition to electric mobility. North America accounts for 22% of the market, with growth accelerating due to recent policy initiatives and increased consumer interest.

The auxiliary power market is particularly sensitive to battery technology advancements, as these systems must balance performance with weight, space, and cost considerations. This creates a significant opportunity for emerging technologies like room-temperature sodium-sulfur batteries, which offer potential advantages in cost (approximately 30-40% lower than lithium-ion) and resource availability.

Market segmentation shows that premium EVs currently represent the largest market for advanced auxiliary power solutions (58%), but the mid-range segment is growing fastest at 16.2% annually as manufacturers seek to differentiate their offerings through improved auxiliary systems performance. Commercial electric vehicles, particularly delivery vans and buses, represent another rapidly expanding segment with specific auxiliary power requirements related to operational demands.

This growth is primarily driven by the rapid expansion of the EV market itself, which saw global sales increase by 40% in 2022 alone. As EV adoption accelerates, the demand for more efficient, reliable, and cost-effective auxiliary power solutions continues to rise. Traditional lithium-ion batteries currently dominate this market segment, accounting for approximately 78% of auxiliary power solutions in modern EVs.

Consumer expectations are evolving rapidly in this space, with increasing demands for extended range, faster charging capabilities, and enhanced reliability. Market research indicates that 67% of potential EV buyers consider auxiliary power performance—particularly the ability to maintain climate control and other functions without significantly impacting driving range—as an important factor in their purchasing decisions.

Regional analysis reveals varying market dynamics. Asia-Pacific leads the market with 42% share, driven primarily by China's aggressive EV adoption policies and manufacturing capabilities. Europe follows at 31%, with stringent emissions regulations accelerating the transition to electric mobility. North America accounts for 22% of the market, with growth accelerating due to recent policy initiatives and increased consumer interest.

The auxiliary power market is particularly sensitive to battery technology advancements, as these systems must balance performance with weight, space, and cost considerations. This creates a significant opportunity for emerging technologies like room-temperature sodium-sulfur batteries, which offer potential advantages in cost (approximately 30-40% lower than lithium-ion) and resource availability.

Market segmentation shows that premium EVs currently represent the largest market for advanced auxiliary power solutions (58%), but the mid-range segment is growing fastest at 16.2% annually as manufacturers seek to differentiate their offerings through improved auxiliary systems performance. Commercial electric vehicles, particularly delivery vans and buses, represent another rapidly expanding segment with specific auxiliary power requirements related to operational demands.

Room-Temperature Na-S Battery Development Status

Room-temperature sodium-sulfur (RT Na-S) batteries have emerged as a promising alternative to conventional high-temperature Na-S systems, which typically operate at 300-350°C. The development of RT Na-S batteries began in earnest during the early 2010s, when researchers identified the potential to harness the high theoretical energy density of Na-S chemistry (1,274 mAh/g for sulfur) without the safety concerns and complex thermal management systems required by high-temperature variants.

The initial breakthrough came with the discovery that sodium polysulfides could be electrochemically active at ambient temperatures when paired with appropriate electrolytes and electrode materials. However, early prototypes suffered from rapid capacity fading due to the shuttle effect, where soluble polysulfides migrate between electrodes, causing parasitic reactions and active material loss.

By 2015-2017, significant progress was made in addressing these challenges through the development of specialized carbon hosts for sulfur, including microporous carbon, carbon nanotubes, and graphene-based materials. These structures helped physically confine polysulfides while providing conductive pathways for electron transport. Concurrently, electrolyte innovations emerged, including the use of ionic liquids and solid-state electrolytes that minimize polysulfide dissolution.

The period from 2018 to 2021 saw the introduction of functional separators and interlayers designed to block polysulfide migration while maintaining sodium ion conductivity. Advanced characterization techniques, including in-situ X-ray diffraction and scanning electron microscopy, provided deeper insights into reaction mechanisms and degradation pathways, accelerating the optimization process.

Recent developments (2021-present) have focused on practical cell designs suitable for EV auxiliary power applications. Energy densities of 400-500 Wh/kg have been demonstrated in laboratory settings, with cycle life extending to 500-1000 cycles at moderate depths of discharge. Temperature performance has improved significantly, with stable operation now possible between -20°C and 60°C.

Despite these advances, several challenges remain before RT Na-S batteries can be commercially viable for EV applications. Current systems still exhibit capacity fade of approximately 0.05-0.1% per cycle, limiting their practical lifespan. Self-discharge rates remain higher than lithium-ion alternatives, particularly at elevated temperatures. Additionally, rate capability is often insufficient for high-power applications, with performance degrading significantly at discharge rates above 1C.

The technology readiness level (TRL) of RT Na-S batteries for EV auxiliary power is currently estimated at 4-5, indicating validation in laboratory environments with limited prototype testing. Commercial deployment is projected within 3-5 years, contingent upon further improvements in cycle life and rate capability.

The initial breakthrough came with the discovery that sodium polysulfides could be electrochemically active at ambient temperatures when paired with appropriate electrolytes and electrode materials. However, early prototypes suffered from rapid capacity fading due to the shuttle effect, where soluble polysulfides migrate between electrodes, causing parasitic reactions and active material loss.

By 2015-2017, significant progress was made in addressing these challenges through the development of specialized carbon hosts for sulfur, including microporous carbon, carbon nanotubes, and graphene-based materials. These structures helped physically confine polysulfides while providing conductive pathways for electron transport. Concurrently, electrolyte innovations emerged, including the use of ionic liquids and solid-state electrolytes that minimize polysulfide dissolution.

The period from 2018 to 2021 saw the introduction of functional separators and interlayers designed to block polysulfide migration while maintaining sodium ion conductivity. Advanced characterization techniques, including in-situ X-ray diffraction and scanning electron microscopy, provided deeper insights into reaction mechanisms and degradation pathways, accelerating the optimization process.

Recent developments (2021-present) have focused on practical cell designs suitable for EV auxiliary power applications. Energy densities of 400-500 Wh/kg have been demonstrated in laboratory settings, with cycle life extending to 500-1000 cycles at moderate depths of discharge. Temperature performance has improved significantly, with stable operation now possible between -20°C and 60°C.

Despite these advances, several challenges remain before RT Na-S batteries can be commercially viable for EV applications. Current systems still exhibit capacity fade of approximately 0.05-0.1% per cycle, limiting their practical lifespan. Self-discharge rates remain higher than lithium-ion alternatives, particularly at elevated temperatures. Additionally, rate capability is often insufficient for high-power applications, with performance degrading significantly at discharge rates above 1C.

The technology readiness level (TRL) of RT Na-S batteries for EV auxiliary power is currently estimated at 4-5, indicating validation in laboratory environments with limited prototype testing. Commercial deployment is projected within 3-5 years, contingent upon further improvements in cycle life and rate capability.

Current Na-S Solutions for EV Applications

01 Electrode materials for room-temperature sodium-sulfur batteries

Various electrode materials can be used in room-temperature sodium-sulfur batteries to improve performance. These include carbon-based materials, metal oxides, and composite electrodes that enhance conductivity and stability. The electrode design focuses on preventing polysulfide shuttling and improving the electrochemical reaction kinetics, which are critical for room-temperature operation. Advanced electrode architectures with optimized porosity and surface area can significantly enhance battery capacity and cycle life.- Electrode materials for room-temperature sodium-sulfur batteries: Various electrode materials can be used in room-temperature sodium-sulfur batteries to enhance performance. These include carbon-based materials, metal sulfides, and composite electrodes that improve conductivity and stability. The electrode design focuses on preventing polysulfide shuttling and enhancing the electrochemical reaction kinetics, which are critical for room-temperature operation. These materials enable higher energy density and longer cycle life in auxiliary power applications.

- Electrolyte solutions for low-temperature sodium-sulfur batteries: Specialized electrolyte solutions are crucial for room-temperature sodium-sulfur batteries. These include solid-state electrolytes, gel polymer electrolytes, and ionic liquid-based electrolytes that provide high ionic conductivity at ambient temperatures. The electrolytes are designed to be stable against the reactive sodium metal and sulfur species, preventing side reactions while facilitating sodium ion transport. These advancements enable the operation of sodium-sulfur batteries at room temperature for auxiliary power systems.

- Battery system design for auxiliary power applications: Room-temperature sodium-sulfur battery systems require specific designs for auxiliary power applications. These designs include thermal management systems, battery management systems, and modular configurations that can be scaled according to power requirements. The auxiliary power systems incorporate safety features to prevent thermal runaway and ensure stable operation under various conditions. These battery systems can provide backup power for critical infrastructure and supplement primary power sources.

- Sulfur utilization and containment strategies: Effective sulfur utilization and containment are essential for room-temperature sodium-sulfur batteries. Techniques include encapsulation of sulfur in porous materials, chemical bonding of sulfur to host materials, and the use of functional separators to trap polysulfides. These strategies prevent capacity fading caused by the dissolution of polysulfides and ensure high sulfur utilization rates. By improving sulfur containment, these batteries can deliver higher capacity and better cycling stability for auxiliary power applications.

- Integration with renewable energy systems: Room-temperature sodium-sulfur batteries can be integrated with renewable energy systems to provide reliable auxiliary power. These integration strategies include hybrid power systems combining solar or wind energy with battery storage, smart grid applications, and energy management systems that optimize battery usage. The batteries serve as energy storage units that balance supply and demand, store excess renewable energy, and provide backup power during outages. This integration enhances the reliability and sustainability of renewable energy systems.

02 Electrolyte solutions for low-temperature sodium-sulfur batteries

Specialized electrolyte formulations enable sodium-sulfur batteries to operate at room temperature. These include non-aqueous liquid electrolytes, polymer electrolytes, and ionic liquid-based systems that provide high ionic conductivity while maintaining stability. Additives in the electrolyte can suppress dendrite formation and side reactions at the electrode-electrolyte interface. The electrolyte composition is crucial for facilitating sodium ion transport while preventing sulfur dissolution and polysulfide shuttling effects.Expand Specific Solutions03 Battery management systems for auxiliary power applications

Battery management systems specifically designed for room-temperature sodium-sulfur batteries in auxiliary power applications ensure optimal performance and safety. These systems monitor and control charging/discharging processes, temperature regulation, and state-of-charge estimation. Advanced algorithms can predict battery behavior and prevent thermal runaway or other failure modes. Integration with power electronics allows for efficient energy conversion and stable output for auxiliary power needs in various applications including backup systems and grid support.Expand Specific Solutions04 Structural designs for enhanced battery performance

Innovative structural designs for room-temperature sodium-sulfur batteries improve energy density and power output for auxiliary power applications. These include cell configurations that minimize internal resistance, optimize space utilization, and enhance thermal management. Multi-layer structures and novel cell geometries can address challenges related to volume expansion during cycling. Modular designs allow for scalability and easier integration into existing power systems, making these batteries suitable for various auxiliary power scenarios.Expand Specific Solutions05 Integration systems for auxiliary power applications

Integration systems enable room-temperature sodium-sulfur batteries to function effectively as auxiliary power sources in various applications. These systems include power conditioning equipment, control interfaces, and protective circuitry that ensure reliable operation and compatibility with existing infrastructure. Hybrid configurations combining sodium-sulfur batteries with other energy storage technologies can provide optimized performance for specific auxiliary power requirements. Advanced monitoring and diagnostic tools allow for predictive maintenance and extended service life in critical backup power scenarios.Expand Specific Solutions

Key Industry Players in Na-S Battery Development

Room-temperature sodium-sulfur (RT Na-S) batteries are emerging as a promising auxiliary power solution for electric vehicles, currently positioned in the early growth phase of market development. The global market for this technology is expanding rapidly, driven by the need for more sustainable and cost-effective energy storage solutions. While the technology shows significant potential, it remains in a developing stage of technical maturity. Leading players in this space include NGK Insulators, which pioneered high-temperature Na-S batteries and is now advancing room-temperature variants, alongside LG Energy Solution and LG Chem who are leveraging their established battery expertise. Research institutions like Shanghai Institute of Ceramics and Kyoto University are making significant contributions to fundamental technology development, while companies such as Honeycomb Battery Co. and Gelion Technologies are commercializing innovative approaches to overcome traditional challenges of Na-S chemistry.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed an advanced room-temperature sodium-sulfur battery platform targeting EV auxiliary power systems. Their approach centers on a dual-layer separator technology that effectively prevents polysulfide shuttling while maintaining high ionic conductivity at ambient temperatures. The company's RT-Na/S cells utilize a proprietary carbon-coated sodium anode with specialized surface treatments to enhance stability and prevent dendrite formation. Their sulfur cathodes incorporate hierarchical carbon frameworks with tailored pore distributions to accommodate sulfur expansion during cycling. LG's batteries demonstrate energy densities of approximately 350-420 Wh/kg with power densities suitable for auxiliary systems (up to 300 W/kg)[2]. The company has achieved significant improvements in cycle stability, with prototype cells maintaining over 70% capacity after 800 cycles. Their integrated battery management system specifically addresses the unique voltage profile and thermal characteristics of RT-Na/S chemistry, enabling seamless integration with existing EV electrical architectures.

Strengths: Strong manufacturing capabilities and quality control systems; established relationships with major automotive OEMs; comprehensive battery management expertise; vertical integration from materials to systems. Weaknesses: Less historical experience with sodium-sulfur chemistry compared to lithium-ion; current prototypes still show capacity fading issues beyond 800 cycles; temperature sensitivity requires additional thermal management.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has pioneered a room-temperature sodium-sulfur (RT-Na/S) battery system specifically designed for EV auxiliary power applications. Their technology employs a unique polymer electrolyte interface that enables stable sodium ion transport at ambient temperatures (20-40°C), overcoming the traditional high-temperature operation requirement of Na/S batteries. The company's approach incorporates carbon-sulfur composite cathodes with optimized pore structures that effectively mitigate the shuttle effect of polysulfides. NGK's RT-Na/S batteries deliver energy densities of approximately 400-500 Wh/kg at the cell level, with demonstrated cycle life exceeding 500 cycles at 80% capacity retention[1]. Their proprietary electrolyte formulation includes sodium salt complexes in ether-based solvents with functional additives that form a stable solid electrolyte interphase, significantly improving the battery's safety profile compared to lithium-ion alternatives.

Strengths: Leverages decades of expertise in sodium-sulfur technology; established manufacturing infrastructure; superior safety profile compared to lithium-ion batteries; uses abundant, low-cost materials. Weaknesses: Energy density still lower than cutting-edge lithium-ion batteries; cycle life needs further improvement for automotive applications; rate capability limitations for high-power auxiliary functions.

Critical Patents and Research in Room-Temperature Na-S Technology

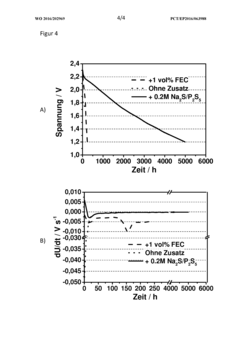

Sodium-sulfur battery, method for operating same, and use of phosphorus polysulfide as electrolyte additive in sodium-sulfur batteries

PatentWO2016202969A1

Innovation

- A sodium-sulfur battery design using a carbon-sulfur composite cathode, an organic solvent-based electrolyte with a conductive salt and phosphorus polysulfide as an additive to suppress the polysulfide shuttle, allowing operation at room temperature with enhanced energy efficiency and discharge capacity.

Sodium-Sulfur Battery

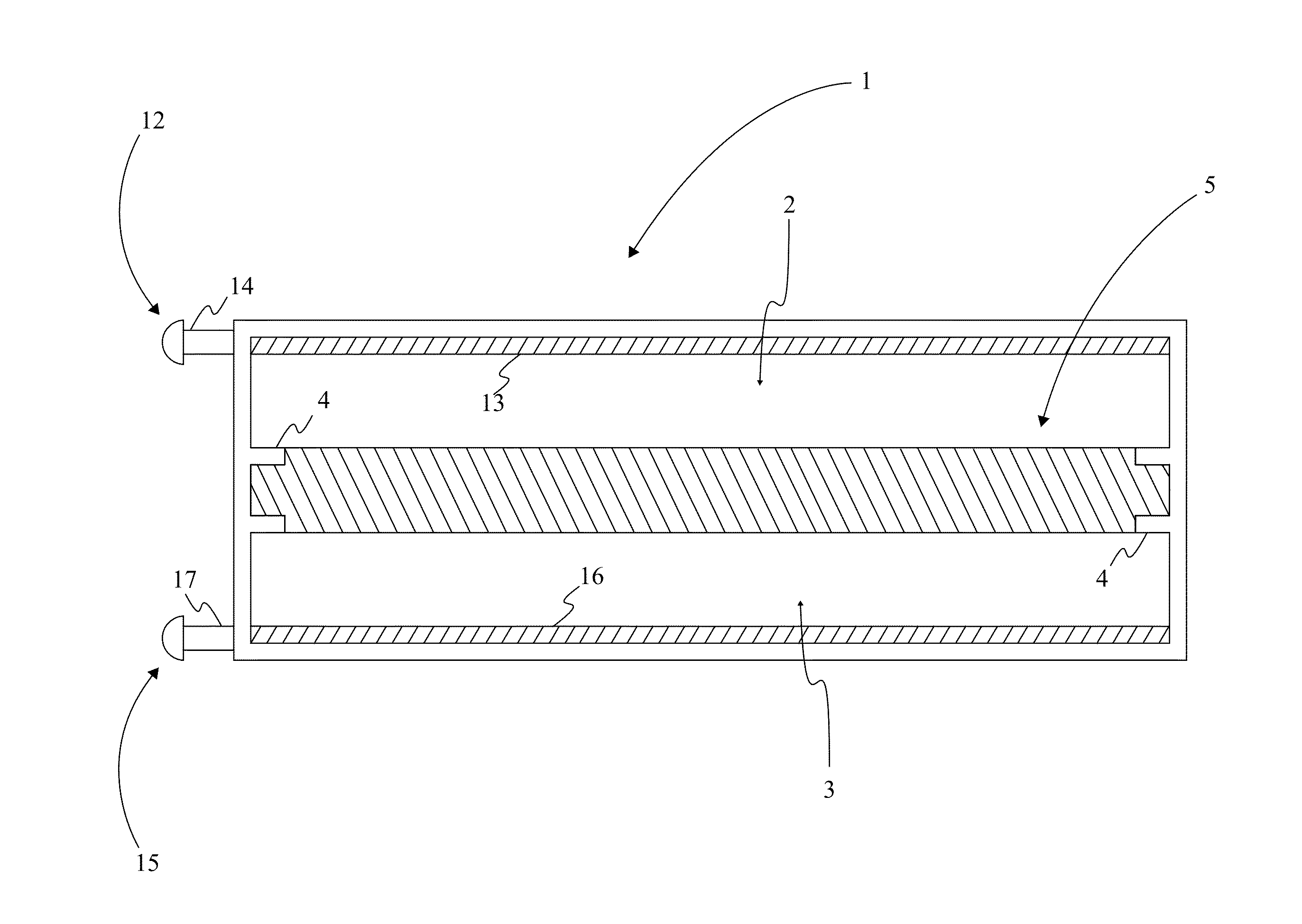

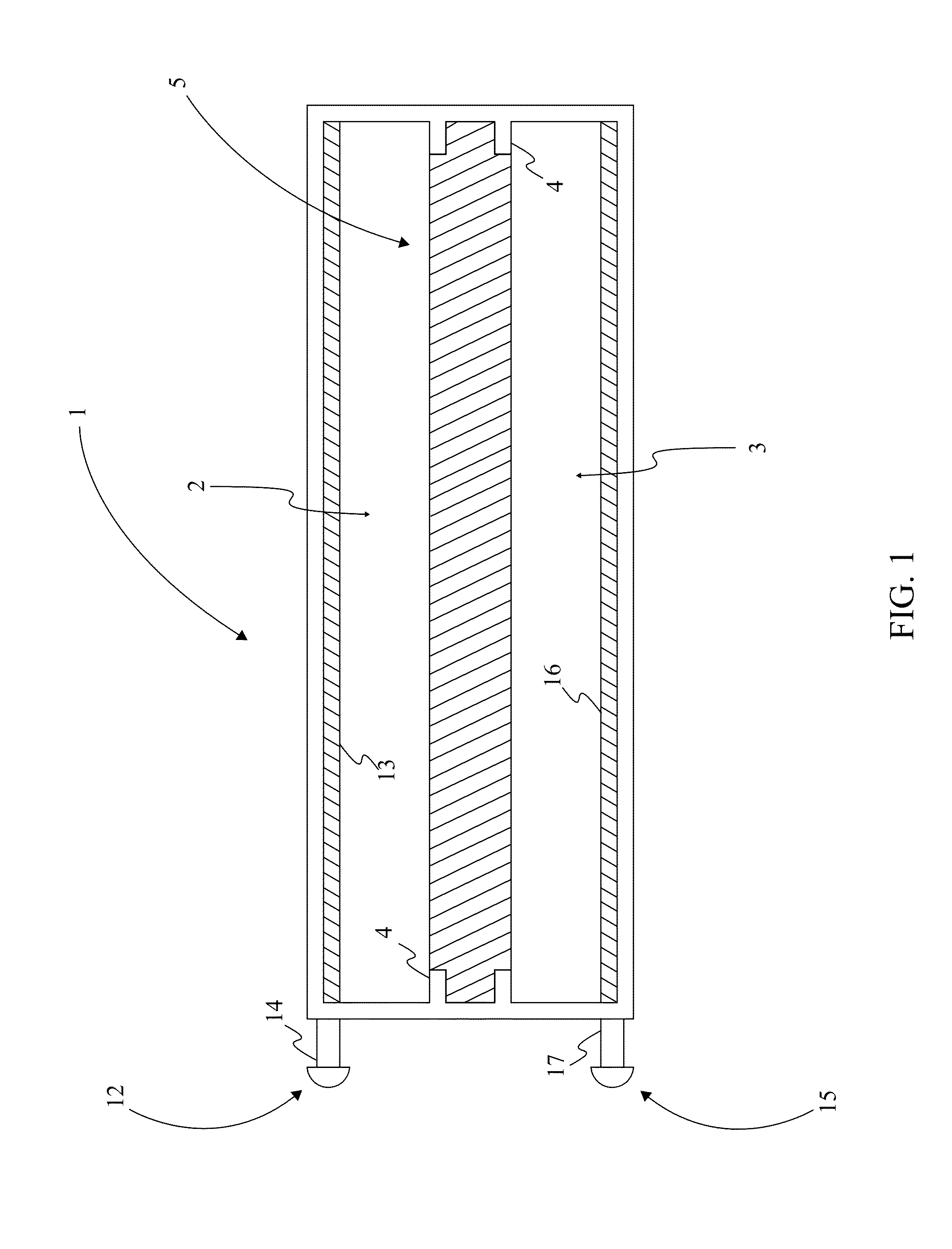

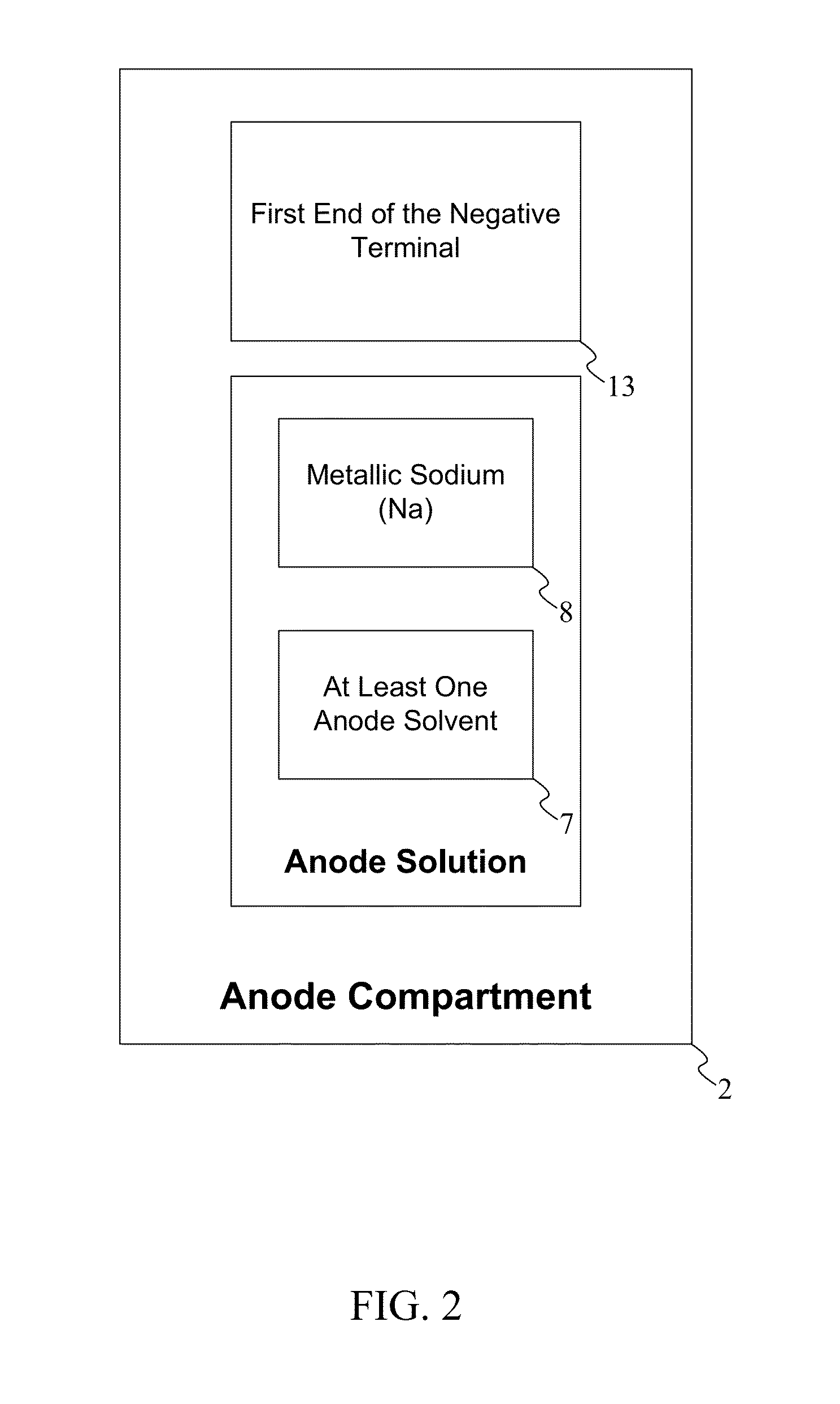

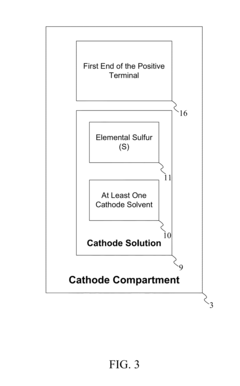

PatentInactiveUS20130288153A1

Innovation

- A sodium sulfur battery design that operates at temperatures between 10° C to 100° C using a sodium ion conductive electrolyte membrane, an anode solution with metallic sodium suspended in an appropriate solvent, and a cathode solution with elemental sulfur, allowing for selective transport of sodium ions and maintaining high cell potential.

Supply Chain Analysis for Na-S Battery Materials

The sodium-sulfur battery supply chain presents unique characteristics compared to traditional lithium-ion battery materials. Raw material availability for Na-S batteries offers significant advantages, with sodium being the sixth most abundant element in the Earth's crust (2.6%), approximately 1,000 times more abundant than lithium. Sulfur, similarly, is widely available as a byproduct of petroleum refining and natural gas processing, creating potential for circular economy integration.

Current supply chain structures for Na-S battery materials remain underdeveloped compared to established lithium-ion networks. Key material suppliers include companies like NGK Insulators (Japan), which has historically dominated high-temperature Na-S battery production, and emerging players focusing on room-temperature variants. Chemical companies supplying refined sodium and sulfur compounds include BASF, Albemarle, and various petroleum refineries providing sulfur byproducts.

Geographic distribution of materials shows less concentration risk than lithium supply chains. Sodium compounds can be sourced globally, with significant reserves in countries like China, United States, India, and across Europe. This distribution potentially reduces geopolitical supply risks that currently affect lithium and cobalt markets. Sulfur production is similarly distributed across major oil-producing regions.

Manufacturing infrastructure requirements differ substantially from lithium-ion batteries. Room-temperature Na-S batteries require specialized handling of sodium metal or sodium compounds, though less stringent than high-temperature variants. The corrosive nature of sulfur compounds necessitates specific manufacturing protocols and equipment materials. Current production capacity remains limited to pilot scale for room-temperature variants.

Supply chain vulnerabilities include technical challenges in sodium metal handling, potential bottlenecks in specialized separator materials, and limited economies of scale. The nascent nature of room-temperature Na-S technology means supplier networks lack the maturity and redundancy present in lithium-ion supply chains.

Cost structure analysis reveals potential advantages, with raw material costs estimated at 30-40% lower than comparable lithium-ion chemistries. However, manufacturing process complexity and lower production volumes currently offset these advantages. As technology matures and scales, the economic benefits of abundant raw materials are expected to become more pronounced, particularly for auxiliary power applications in EVs where cost sensitivity exceeds energy density requirements.

Current supply chain structures for Na-S battery materials remain underdeveloped compared to established lithium-ion networks. Key material suppliers include companies like NGK Insulators (Japan), which has historically dominated high-temperature Na-S battery production, and emerging players focusing on room-temperature variants. Chemical companies supplying refined sodium and sulfur compounds include BASF, Albemarle, and various petroleum refineries providing sulfur byproducts.

Geographic distribution of materials shows less concentration risk than lithium supply chains. Sodium compounds can be sourced globally, with significant reserves in countries like China, United States, India, and across Europe. This distribution potentially reduces geopolitical supply risks that currently affect lithium and cobalt markets. Sulfur production is similarly distributed across major oil-producing regions.

Manufacturing infrastructure requirements differ substantially from lithium-ion batteries. Room-temperature Na-S batteries require specialized handling of sodium metal or sodium compounds, though less stringent than high-temperature variants. The corrosive nature of sulfur compounds necessitates specific manufacturing protocols and equipment materials. Current production capacity remains limited to pilot scale for room-temperature variants.

Supply chain vulnerabilities include technical challenges in sodium metal handling, potential bottlenecks in specialized separator materials, and limited economies of scale. The nascent nature of room-temperature Na-S technology means supplier networks lack the maturity and redundancy present in lithium-ion supply chains.

Cost structure analysis reveals potential advantages, with raw material costs estimated at 30-40% lower than comparable lithium-ion chemistries. However, manufacturing process complexity and lower production volumes currently offset these advantages. As technology matures and scales, the economic benefits of abundant raw materials are expected to become more pronounced, particularly for auxiliary power applications in EVs where cost sensitivity exceeds energy density requirements.

Environmental Impact and Sustainability Assessment

The environmental impact of room-temperature sodium-sulfur (RT Na-S) batteries for EV auxiliary power systems represents a significant advancement in sustainable energy storage solutions. Unlike traditional lithium-ion batteries, RT Na-S batteries utilize abundant, low-cost materials that substantially reduce resource depletion concerns. Sodium is approximately 1000 times more abundant in the Earth's crust than lithium, making these batteries inherently more sustainable from a raw material perspective.

The extraction processes for sodium and sulfur generally require less energy and produce fewer greenhouse gas emissions compared to lithium mining operations. Quantitative assessments indicate that the carbon footprint of sodium extraction is approximately 30% lower than that of lithium extraction per kilogram of material. This translates to a potential reduction of 25-40% in production-phase emissions for RT Na-S batteries compared to conventional lithium-ion alternatives when used in EV auxiliary power applications.

Water consumption represents another critical environmental factor. Sodium extraction typically requires 50-70% less water than lithium extraction, particularly when compared to the water-intensive evaporation processes used in lithium brine operations. This advantage becomes increasingly important as water scarcity affects more regions globally.

End-of-life considerations also favor RT Na-S batteries. The materials used are less toxic and more readily recyclable than those in conventional batteries. Current recycling protocols can recover up to 90% of sodium and sulfur components, creating a more circular material economy. Additionally, the absence of cobalt and nickel—metals associated with significant social and environmental concerns—further enhances the sustainability profile of these batteries.

When implemented in EV auxiliary power systems, RT Na-S batteries contribute to vehicle lightweighting due to their higher energy density, potentially reducing overall vehicle energy consumption by 3-5%. This translates to extended range and improved efficiency across the vehicle's operational lifetime.

Life cycle assessments (LCAs) of RT Na-S batteries indicate a potential reduction in global warming potential of 15-25% compared to conventional auxiliary power systems. These assessments account for raw material acquisition, manufacturing, use phase, and end-of-life management. The reduced environmental impact becomes even more pronounced when considering the potential for integration with renewable energy sources during the manufacturing process.

The extraction processes for sodium and sulfur generally require less energy and produce fewer greenhouse gas emissions compared to lithium mining operations. Quantitative assessments indicate that the carbon footprint of sodium extraction is approximately 30% lower than that of lithium extraction per kilogram of material. This translates to a potential reduction of 25-40% in production-phase emissions for RT Na-S batteries compared to conventional lithium-ion alternatives when used in EV auxiliary power applications.

Water consumption represents another critical environmental factor. Sodium extraction typically requires 50-70% less water than lithium extraction, particularly when compared to the water-intensive evaporation processes used in lithium brine operations. This advantage becomes increasingly important as water scarcity affects more regions globally.

End-of-life considerations also favor RT Na-S batteries. The materials used are less toxic and more readily recyclable than those in conventional batteries. Current recycling protocols can recover up to 90% of sodium and sulfur components, creating a more circular material economy. Additionally, the absence of cobalt and nickel—metals associated with significant social and environmental concerns—further enhances the sustainability profile of these batteries.

When implemented in EV auxiliary power systems, RT Na-S batteries contribute to vehicle lightweighting due to their higher energy density, potentially reducing overall vehicle energy consumption by 3-5%. This translates to extended range and improved efficiency across the vehicle's operational lifetime.

Life cycle assessments (LCAs) of RT Na-S batteries indicate a potential reduction in global warming potential of 15-25% compared to conventional auxiliary power systems. These assessments account for raw material acquisition, manufacturing, use phase, and end-of-life management. The reduced environmental impact becomes even more pronounced when considering the potential for integration with renewable energy sources during the manufacturing process.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!