Supply Chain And Scale Strategy For Room-Temperature Sodium-Sulfur Batteries

AUG 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

RT Na-S Battery Development Background and Objectives

Room-temperature sodium-sulfur (RT Na-S) batteries have emerged as a promising alternative to lithium-ion batteries due to their potential for high energy density, low cost, and environmental sustainability. The development of these batteries traces back to the 1960s when high-temperature Na-S batteries were first introduced, operating at temperatures above 300°C. However, the safety concerns and complex thermal management requirements associated with high-temperature operation have driven research toward room-temperature alternatives over the past two decades.

The evolution of RT Na-S battery technology has been marked by significant breakthroughs in electrode materials, electrolyte formulations, and cell design. Early iterations faced challenges with poor cycle life, low Coulombic efficiency, and the shuttle effect of polysulfides. Recent advancements in carbon-sulfur composite cathodes, solid-state electrolytes, and sodium anode protection strategies have substantially improved performance metrics, bringing this technology closer to commercial viability.

The primary technical objective for RT Na-S battery development is to achieve energy densities exceeding 400 Wh/kg at the cell level while maintaining stable cycling performance over 1000+ cycles. This represents a significant improvement over current lithium-ion technologies while utilizing more abundant and less geopolitically constrained raw materials. Additional objectives include reducing production costs to below $100/kWh, ensuring operational safety across a wide temperature range (-20°C to 60°C), and establishing scalable manufacturing processes compatible with existing battery production infrastructure.

Global interest in RT Na-S technology has intensified due to increasing concerns about lithium supply chain vulnerabilities and price volatility. The European Union's Critical Raw Materials Act and similar initiatives worldwide have prioritized technologies that reduce dependence on critical minerals, positioning sodium-based batteries as strategically important for energy security. Research funding has correspondingly increased, with major programs established in China, the EU, Japan, and the United States.

The technology roadmap for RT Na-S batteries envisions progressive improvements in energy density, cycle life, and manufacturing readiness levels over the next decade. Near-term goals focus on optimizing electrode-electrolyte interfaces and mitigating the shuttle effect, while medium-term objectives target the development of high-loading electrodes and fast-charging capabilities. Long-term aspirations include the integration of RT Na-S cells into commercial energy storage systems and eventually electric vehicles, potentially revolutionizing the energy storage landscape with a more sustainable and economically viable solution.

The evolution of RT Na-S battery technology has been marked by significant breakthroughs in electrode materials, electrolyte formulations, and cell design. Early iterations faced challenges with poor cycle life, low Coulombic efficiency, and the shuttle effect of polysulfides. Recent advancements in carbon-sulfur composite cathodes, solid-state electrolytes, and sodium anode protection strategies have substantially improved performance metrics, bringing this technology closer to commercial viability.

The primary technical objective for RT Na-S battery development is to achieve energy densities exceeding 400 Wh/kg at the cell level while maintaining stable cycling performance over 1000+ cycles. This represents a significant improvement over current lithium-ion technologies while utilizing more abundant and less geopolitically constrained raw materials. Additional objectives include reducing production costs to below $100/kWh, ensuring operational safety across a wide temperature range (-20°C to 60°C), and establishing scalable manufacturing processes compatible with existing battery production infrastructure.

Global interest in RT Na-S technology has intensified due to increasing concerns about lithium supply chain vulnerabilities and price volatility. The European Union's Critical Raw Materials Act and similar initiatives worldwide have prioritized technologies that reduce dependence on critical minerals, positioning sodium-based batteries as strategically important for energy security. Research funding has correspondingly increased, with major programs established in China, the EU, Japan, and the United States.

The technology roadmap for RT Na-S batteries envisions progressive improvements in energy density, cycle life, and manufacturing readiness levels over the next decade. Near-term goals focus on optimizing electrode-electrolyte interfaces and mitigating the shuttle effect, while medium-term objectives target the development of high-loading electrodes and fast-charging capabilities. Long-term aspirations include the integration of RT Na-S cells into commercial energy storage systems and eventually electric vehicles, potentially revolutionizing the energy storage landscape with a more sustainable and economically viable solution.

Market Analysis for Room-Temperature Sodium-Sulfur Batteries

The global market for room-temperature sodium-sulfur (RT-Na-S) batteries is experiencing significant growth driven by increasing demand for sustainable energy storage solutions. This emerging technology addresses critical limitations of traditional lithium-ion batteries, particularly in terms of resource availability and cost. The market potential for RT-Na-S batteries spans multiple sectors including grid-scale energy storage, electric vehicles, and consumer electronics.

Current market assessments indicate that the energy storage market, where RT-Na-S batteries could play a significant role, is projected to grow substantially over the next decade. The grid-scale energy storage segment presents the most immediate opportunity for RT-Na-S battery deployment, especially in regions investing heavily in renewable energy infrastructure that requires efficient storage solutions.

The electric vehicle sector represents another substantial market opportunity. As automotive manufacturers seek alternatives to lithium-ion batteries due to supply chain vulnerabilities and cost concerns, RT-Na-S technology offers a promising pathway. The abundance of sodium resources globally provides a strategic advantage for scaling production without the geopolitical constraints associated with lithium and cobalt.

Consumer electronics constitutes a tertiary market segment with potential for RT-Na-S battery adoption, particularly as the technology matures and energy density improves. This segment may become more significant as miniaturization challenges are overcome.

Regional market analysis reveals varying levels of interest and investment. Asia-Pacific, particularly China, Japan, and South Korea, leads in research and development investments for sodium-based battery technologies. Europe follows closely with strong policy support for sustainable energy solutions, while North America shows growing interest driven by energy security concerns and sustainability goals.

Market barriers for RT-Na-S batteries include competition from established lithium-ion technology, which benefits from decades of optimization and manufacturing scale. Additionally, technical challenges related to cycle life, energy density, and safety must be addressed to achieve widespread commercial adoption.

The economic value proposition of RT-Na-S batteries centers on material cost advantages. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, and sulfur is an industrial byproduct available at low cost. This translates to potential raw material cost savings of 30-40% compared to lithium-ion batteries, though these advantages must be balanced against current performance limitations.

Market forecasts suggest that RT-Na-S batteries could capture a meaningful share of the stationary storage market within 5-7 years, contingent upon successful demonstration of commercial-scale production and performance improvements. The total addressable market could expand significantly as technology advances enable penetration into more demanding applications like transportation.

Current market assessments indicate that the energy storage market, where RT-Na-S batteries could play a significant role, is projected to grow substantially over the next decade. The grid-scale energy storage segment presents the most immediate opportunity for RT-Na-S battery deployment, especially in regions investing heavily in renewable energy infrastructure that requires efficient storage solutions.

The electric vehicle sector represents another substantial market opportunity. As automotive manufacturers seek alternatives to lithium-ion batteries due to supply chain vulnerabilities and cost concerns, RT-Na-S technology offers a promising pathway. The abundance of sodium resources globally provides a strategic advantage for scaling production without the geopolitical constraints associated with lithium and cobalt.

Consumer electronics constitutes a tertiary market segment with potential for RT-Na-S battery adoption, particularly as the technology matures and energy density improves. This segment may become more significant as miniaturization challenges are overcome.

Regional market analysis reveals varying levels of interest and investment. Asia-Pacific, particularly China, Japan, and South Korea, leads in research and development investments for sodium-based battery technologies. Europe follows closely with strong policy support for sustainable energy solutions, while North America shows growing interest driven by energy security concerns and sustainability goals.

Market barriers for RT-Na-S batteries include competition from established lithium-ion technology, which benefits from decades of optimization and manufacturing scale. Additionally, technical challenges related to cycle life, energy density, and safety must be addressed to achieve widespread commercial adoption.

The economic value proposition of RT-Na-S batteries centers on material cost advantages. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, and sulfur is an industrial byproduct available at low cost. This translates to potential raw material cost savings of 30-40% compared to lithium-ion batteries, though these advantages must be balanced against current performance limitations.

Market forecasts suggest that RT-Na-S batteries could capture a meaningful share of the stationary storage market within 5-7 years, contingent upon successful demonstration of commercial-scale production and performance improvements. The total addressable market could expand significantly as technology advances enable penetration into more demanding applications like transportation.

Technical Barriers and Global Research Status

Room-temperature sodium-sulfur (RT-Na/S) batteries face significant technical barriers despite their promising theoretical energy density and cost advantages. The primary challenge remains the insulating nature of sulfur, leading to poor electronic conductivity and slow reaction kinetics. This results in low sulfur utilization and rapid capacity decay during cycling. Additionally, the polysulfide shuttle effect—where sodium polysulfides dissolve in the electrolyte and migrate between electrodes—causes active material loss and electrode degradation.

Material compatibility issues present another major obstacle. The highly reactive nature of sodium metal anodes leads to safety concerns and unstable solid-electrolyte interphase (SEI) formation. Current electrolyte systems struggle to simultaneously address polysulfide dissolution, sodium dendrite growth, and wide electrochemical stability windows required for practical operation.

Manufacturing scalability remains problematic due to the air and moisture sensitivity of sodium metal and certain electrolyte components. This necessitates specialized dry-room or inert atmosphere production facilities, significantly increasing manufacturing costs and complexity compared to lithium-ion battery production lines.

Globally, research efforts are concentrated in China, South Korea, Japan, the United States, and several European countries. Chinese institutions lead in publication volume, with significant contributions from research groups at the Chinese Academy of Sciences, Tsinghua University, and industrial players like CATL. The United States shows strong fundamental research through national laboratories (Argonne, PNNL) and universities (Stanford, MIT), while European efforts are coordinated through initiatives like Horizon Europe and the Battery 2030+ program.

Recent research breakthroughs include carbon-sulfur composite cathodes with tailored pore structures to physically confine polysulfides, functional polymer electrolytes that chemically bind polysulfides, and protective coatings for sodium metal anodes. Advanced characterization techniques, including in-situ X-ray diffraction and cryo-electron microscopy, have enhanced understanding of reaction mechanisms and failure modes.

Despite progress, the technology readiness level (TRL) of RT-Na/S batteries remains at 3-4 (laboratory validation), significantly behind commercial lithium-ion technologies (TRL 9). The performance gap is substantial—current RT-Na/S prototypes demonstrate energy densities of 200-300 Wh/kg with cycle lives rarely exceeding 500 cycles, compared to commercial lithium-ion batteries achieving 250-300 Wh/kg with 1,000+ cycles. This performance deficit, combined with manufacturing challenges, indicates that significant research investment and technological breakthroughs are still required before commercial viability can be achieved.

Material compatibility issues present another major obstacle. The highly reactive nature of sodium metal anodes leads to safety concerns and unstable solid-electrolyte interphase (SEI) formation. Current electrolyte systems struggle to simultaneously address polysulfide dissolution, sodium dendrite growth, and wide electrochemical stability windows required for practical operation.

Manufacturing scalability remains problematic due to the air and moisture sensitivity of sodium metal and certain electrolyte components. This necessitates specialized dry-room or inert atmosphere production facilities, significantly increasing manufacturing costs and complexity compared to lithium-ion battery production lines.

Globally, research efforts are concentrated in China, South Korea, Japan, the United States, and several European countries. Chinese institutions lead in publication volume, with significant contributions from research groups at the Chinese Academy of Sciences, Tsinghua University, and industrial players like CATL. The United States shows strong fundamental research through national laboratories (Argonne, PNNL) and universities (Stanford, MIT), while European efforts are coordinated through initiatives like Horizon Europe and the Battery 2030+ program.

Recent research breakthroughs include carbon-sulfur composite cathodes with tailored pore structures to physically confine polysulfides, functional polymer electrolytes that chemically bind polysulfides, and protective coatings for sodium metal anodes. Advanced characterization techniques, including in-situ X-ray diffraction and cryo-electron microscopy, have enhanced understanding of reaction mechanisms and failure modes.

Despite progress, the technology readiness level (TRL) of RT-Na/S batteries remains at 3-4 (laboratory validation), significantly behind commercial lithium-ion technologies (TRL 9). The performance gap is substantial—current RT-Na/S prototypes demonstrate energy densities of 200-300 Wh/kg with cycle lives rarely exceeding 500 cycles, compared to commercial lithium-ion batteries achieving 250-300 Wh/kg with 1,000+ cycles. This performance deficit, combined with manufacturing challenges, indicates that significant research investment and technological breakthroughs are still required before commercial viability can be achieved.

Current Manufacturing Solutions for RT Na-S Batteries

01 Materials and Electrode Design for Room-Temperature Sodium-Sulfur Batteries

Advanced materials and electrode designs are crucial for room-temperature sodium-sulfur batteries. These include novel sulfur cathodes, sodium anodes, and composite materials that enhance electrochemical performance at ambient temperatures. Specialized electrode structures help contain the polysulfide shuttle effect while maintaining high energy density and cycle life, which are essential for commercial viability.- Materials and Electrode Design for Room-Temperature Sodium-Sulfur Batteries: Advanced materials and electrode designs are crucial for room-temperature sodium-sulfur batteries. These include novel sulfur-based cathodes, sodium anodes, and composite materials that enhance electrochemical performance at ambient temperatures. Specialized electrode structures help contain polysulfide dissolution and improve cycling stability, which are key challenges in commercializing these batteries.

- Electrolyte Solutions and Ionic Conductivity Enhancement: Electrolyte formulations play a critical role in room-temperature sodium-sulfur batteries. Research focuses on developing non-aqueous electrolytes with additives that improve ionic conductivity and stability at ambient temperatures. These formulations help mitigate the shuttle effect of polysulfides and enhance the overall battery performance, addressing one of the main barriers to commercial scaling.

- Manufacturing Processes and Scale-Up Technologies: Specialized manufacturing processes are being developed to enable mass production of room-temperature sodium-sulfur batteries. These include automated assembly lines, quality control systems, and scalable production methods that maintain performance while reducing costs. Innovations in cell design and assembly techniques address challenges in transitioning from laboratory to industrial scale production.

- Supply Chain Management and Raw Material Sourcing: Effective supply chain strategies for room-temperature sodium-sulfur batteries focus on securing sustainable sources of sodium, sulfur, and other critical materials. This includes developing alternative material sources, recycling processes, and vertical integration approaches to reduce dependency on volatile supply markets. Strategic partnerships with material suppliers help ensure consistent quality and availability for large-scale production.

- Commercialization Strategies and Market Integration: Commercialization of room-temperature sodium-sulfur batteries requires comprehensive market integration strategies. These include cost optimization approaches, product standardization, and targeted application development for sectors where these batteries offer competitive advantages. Business models that address initial capital requirements and demonstrate clear value propositions to potential customers are essential for successful market entry and scaling.

02 Electrolyte Solutions and Ionic Conductivity Enhancement

Innovative electrolyte formulations are key to enabling room-temperature operation of sodium-sulfur batteries. These include solid-state electrolytes, polymer electrolytes, and liquid electrolytes with additives that improve ionic conductivity and interface stability. Enhanced electrolyte systems address challenges related to sodium dendrite formation and sulfur dissolution, contributing to better battery performance and safety.Expand Specific Solutions03 Manufacturing Processes and Scale-Up Technologies

Efficient manufacturing processes and scale-up technologies are essential for commercial production of room-temperature sodium-sulfur batteries. These include automated assembly lines, quality control systems, and cost-effective production methods that maintain performance while reducing manufacturing expenses. Innovations in cell assembly, sealing techniques, and thermal management systems enable mass production capabilities.Expand Specific Solutions04 Supply Chain Management and Raw Material Sourcing

Strategic supply chain management and raw material sourcing are critical for sustainable production of room-temperature sodium-sulfur batteries. This includes securing stable supplies of sodium, sulfur, and other key components while developing recycling processes to recover valuable materials. Geographic diversification of suppliers and vertical integration strategies help mitigate supply chain risks and price volatility.Expand Specific Solutions05 Battery Management Systems and Integration Solutions

Advanced battery management systems and integration solutions optimize the performance and safety of room-temperature sodium-sulfur batteries in various applications. These include thermal management technologies, state-of-charge monitoring, and safety mechanisms that prevent thermal runaway. Specialized control algorithms and integration frameworks enable these batteries to be effectively deployed in grid storage, electric vehicles, and other energy storage applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The room-temperature sodium-sulfur battery market is in an early growth phase, characterized by increasing research activity but limited commercial deployment. The global market size remains relatively small compared to lithium-ion technologies, though projections indicate significant expansion potential due to cost advantages and abundant raw materials. Technologically, the field shows varying maturity levels across players. NGK Insulators leads with established high-temperature sodium-sulfur technology but faces challenges in room-temperature adaptations. Research institutions like Shanghai Institute of Ceramics and universities (Cornell, Kyoto, Beihang) are advancing fundamental solutions to electrolyte stability and dendrite formation issues. Commercial entities including CATL, Samsung SDI, and POSCO Holdings are strategically positioning themselves through materials research and prototype development, leveraging their battery manufacturing expertise to accelerate commercialization pathways.

NGK Insulators, Ltd.

Technical Solution: NGK Insulators has pioneered commercial sodium-sulfur (NaS) battery technology, developing a comprehensive supply chain strategy for room-temperature operation. Their approach involves replacing traditional ceramic beta-alumina electrolytes with polymer-based solid electrolytes that function at ambient temperatures. NGK has established vertical integration by controlling critical raw material sourcing, particularly high-purity sulfur processing and specialized sodium handling facilities. Their manufacturing scale strategy includes modular production lines that can be rapidly expanded to meet market demand, with current facilities capable of producing up to 200 MWh of storage capacity annually. NGK has implemented a three-phase commercialization roadmap: initial deployment in stationary grid storage applications, followed by industrial power management systems, and eventually targeting electric mobility solutions as the technology matures.

Strengths: Extensive experience with sodium-sulfur battery systems; established supply chain infrastructure; proven track record in grid-scale energy storage deployment. Weaknesses: Traditional focus on high-temperature NaS batteries requires significant adaptation for room-temperature variants; higher production costs compared to lithium-ion alternatives; safety concerns related to sodium reactivity still need addressing.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed an innovative approach to room-temperature sodium-sulfur batteries focusing on scalable manufacturing processes. Their technology utilizes a proprietary carbon-sulfur composite cathode structure that enhances sulfur utilization and prevents polysulfide shuttling, a common failure mechanism in Na-S systems. Samsung's supply chain strategy leverages their existing battery production infrastructure, with specialized adaptations for sodium handling. They've established strategic partnerships with sodium suppliers and developed proprietary electrolyte formulations containing flame-retardant additives to enhance safety profiles. Their scale-up strategy involves a phased approach, beginning with pilot production lines capable of 50 MWh annual capacity, with plans to expand to gigawatt-hour scale production by 2025. Samsung is positioning these batteries primarily for stationary storage applications, particularly in regions with limited lithium resources.

Strengths: Extensive battery manufacturing expertise; established global supply chain network; strong R&D capabilities for electrolyte and electrode development. Weaknesses: Less experience with sodium chemistry compared to lithium systems; requires significant capital investment to scale production; market acceptance challenges compared to more established battery technologies.

Critical Patents and Technical Innovations

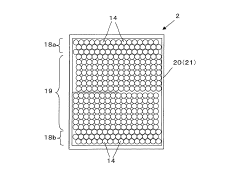

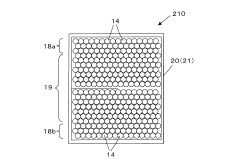

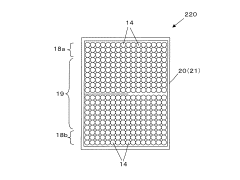

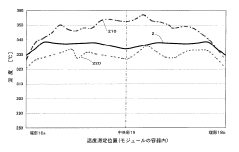

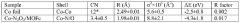

Sodium-sulfur battery

PatentInactiveJP2007273297A

Innovation

- The battery design incorporates a heat medium with varying heat capacity between the outer peripheral and central portions of the container, along with specific cell arrangements such as close-packed and square arrays, to maintain uniform temperature distribution.

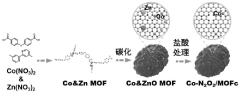

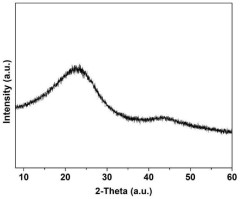

Room-temperature sodium-sulfur battery and preparation method thereof

PatentPendingCN118099560A

Innovation

- Metal-organic framework materials (MOF) are used as precursors to synthesize single-atom catalyst Co-N2O2/MOFc composites as sulfur storage materials, which can be used as cathodes of room-temperature sodium-sulfur batteries to improve polysulfide conversion efficiency and prevent shuttle and loss.

Raw Material Supply Chain Analysis

The sodium-sulfur battery supply chain presents unique opportunities and challenges compared to traditional lithium-ion battery systems. Sodium resources are abundantly available worldwide, with estimated reserves exceeding 23 billion tons primarily in the form of sodium chloride in seawater and salt deposits. This widespread distribution creates a geopolitically stable supply situation, unlike lithium which is concentrated in the "Lithium Triangle" of South America and a few other regions.

Sulfur, the cathode material, represents an industrial byproduct from petroleum refining and natural gas processing, with global production exceeding 70 million tons annually. This creates a circular economy opportunity where waste material becomes a valuable battery component. Current sulfur prices remain relatively low at approximately $150-200 per ton, significantly undercutting lithium-based cathode materials which can cost $15,000-20,000 per ton.

The supply chain for room-temperature sodium-sulfur batteries benefits from established industrial infrastructure for both primary materials. Sodium carbonate and sodium hydroxide production facilities exist globally, with China, the United States, and India being major producers. The industrial ecosystem for sulfur processing is similarly mature, with well-established purification and handling protocols.

Critical supply chain bottlenecks exist primarily in specialized components rather than raw materials. The solid electrolyte interface (SEI) formation additives, sodium-ion conducting separators, and advanced carbon matrices for sulfur containment represent emerging material needs with less developed supply chains. These specialized materials currently command premium prices and face limited production capacity.

Manufacturing scale-up considerations must address the highly reactive nature of sodium metal and the potential for polysulfide shuttle effects. This necessitates specialized handling equipment and controlled atmosphere production environments, adding complexity to manufacturing facility design and operation. Current production facilities remain primarily at pilot scale, with total global capacity under 100 MWh annually.

Regional supply chain development shows interesting differentiation, with East Asian manufacturers focusing on integrated production models while European and North American entities pursue more specialized component strategies. China has established early leadership in sodium precursor processing, leveraging its existing battery manufacturing infrastructure, while South Korea and Japan lead in electrolyte technology development.

Sulfur, the cathode material, represents an industrial byproduct from petroleum refining and natural gas processing, with global production exceeding 70 million tons annually. This creates a circular economy opportunity where waste material becomes a valuable battery component. Current sulfur prices remain relatively low at approximately $150-200 per ton, significantly undercutting lithium-based cathode materials which can cost $15,000-20,000 per ton.

The supply chain for room-temperature sodium-sulfur batteries benefits from established industrial infrastructure for both primary materials. Sodium carbonate and sodium hydroxide production facilities exist globally, with China, the United States, and India being major producers. The industrial ecosystem for sulfur processing is similarly mature, with well-established purification and handling protocols.

Critical supply chain bottlenecks exist primarily in specialized components rather than raw materials. The solid electrolyte interface (SEI) formation additives, sodium-ion conducting separators, and advanced carbon matrices for sulfur containment represent emerging material needs with less developed supply chains. These specialized materials currently command premium prices and face limited production capacity.

Manufacturing scale-up considerations must address the highly reactive nature of sodium metal and the potential for polysulfide shuttle effects. This necessitates specialized handling equipment and controlled atmosphere production environments, adding complexity to manufacturing facility design and operation. Current production facilities remain primarily at pilot scale, with total global capacity under 100 MWh annually.

Regional supply chain development shows interesting differentiation, with East Asian manufacturers focusing on integrated production models while European and North American entities pursue more specialized component strategies. China has established early leadership in sodium precursor processing, leveraging its existing battery manufacturing infrastructure, while South Korea and Japan lead in electrolyte technology development.

Scale-up Strategies and Production Economics

The scale-up of room-temperature sodium-sulfur (RT-Na-S) batteries from laboratory to commercial production requires strategic planning and economic considerations. Current manufacturing processes for RT-Na-S batteries remain predominantly at pilot scale, with production volumes typically below 10 MWh annually. The transition to gigawatt-hour scale production necessitates significant infrastructure development and process optimization.

Material supply chains represent a critical factor in scaling RT-Na-S battery production. Unlike lithium-ion batteries, sodium resources are abundant and geographically distributed, with global reserves exceeding 300 billion tons. This abundance translates to potentially lower raw material costs and reduced supply chain vulnerabilities. Sulfur, as a byproduct of petroleum refining, is also widely available at approximately $150-200 per ton, further enhancing the economic viability of RT-Na-S technology.

Production economics analysis indicates that RT-Na-S batteries could achieve manufacturing costs of $70-90 per kWh at scale, compared to current lithium-ion costs of $100-135 per kWh. This cost advantage stems primarily from less expensive cathode materials and simplified electrolyte formulations. However, realizing these economics requires overcoming several manufacturing challenges, particularly related to sulfur handling and sodium metal processing.

Vertical integration strategies appear most promising for initial commercialization efforts. Companies controlling the entire value chain from raw materials to finished cells can better manage quality control and intellectual property protection during early scaling phases. As the technology matures, specialized suppliers for components like sodium anodes and sulfur cathodes will likely emerge, creating a more diversified supply ecosystem.

Equipment requirements for RT-Na-S battery production differ significantly from lithium-ion manufacturing lines. While some processes can utilize modified lithium-ion equipment, specialized machinery for sodium metal handling under inert conditions represents a substantial capital investment. Initial analysis suggests capital expenditure requirements of $50-70 million for a 100 MWh annual production facility, with economies of scale reducing per-kWh capital costs at gigafactory scale.

Yield optimization presents another critical economic factor. Current laboratory processes achieve 85-90% yields, but industrial scale production will require exceeding 95% to maintain economic viability. Process automation and advanced quality control systems, particularly for electrolyte filling and cell sealing operations, will be essential to achieving these targets while maintaining consistent performance across production batches.

Material supply chains represent a critical factor in scaling RT-Na-S battery production. Unlike lithium-ion batteries, sodium resources are abundant and geographically distributed, with global reserves exceeding 300 billion tons. This abundance translates to potentially lower raw material costs and reduced supply chain vulnerabilities. Sulfur, as a byproduct of petroleum refining, is also widely available at approximately $150-200 per ton, further enhancing the economic viability of RT-Na-S technology.

Production economics analysis indicates that RT-Na-S batteries could achieve manufacturing costs of $70-90 per kWh at scale, compared to current lithium-ion costs of $100-135 per kWh. This cost advantage stems primarily from less expensive cathode materials and simplified electrolyte formulations. However, realizing these economics requires overcoming several manufacturing challenges, particularly related to sulfur handling and sodium metal processing.

Vertical integration strategies appear most promising for initial commercialization efforts. Companies controlling the entire value chain from raw materials to finished cells can better manage quality control and intellectual property protection during early scaling phases. As the technology matures, specialized suppliers for components like sodium anodes and sulfur cathodes will likely emerge, creating a more diversified supply ecosystem.

Equipment requirements for RT-Na-S battery production differ significantly from lithium-ion manufacturing lines. While some processes can utilize modified lithium-ion equipment, specialized machinery for sodium metal handling under inert conditions represents a substantial capital investment. Initial analysis suggests capital expenditure requirements of $50-70 million for a 100 MWh annual production facility, with economies of scale reducing per-kWh capital costs at gigafactory scale.

Yield optimization presents another critical economic factor. Current laboratory processes achieve 85-90% yields, but industrial scale production will require exceeding 95% to maintain economic viability. Process automation and advanced quality control systems, particularly for electrolyte filling and cell sealing operations, will be essential to achieving these targets while maintaining consistent performance across production batches.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!