Explore GDI Engine Potential for Alternative Fuels

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

GDI Technology Evolution and Adaptation Goals

Gasoline Direct Injection (GDI) technology has undergone significant evolution since its commercial introduction in the late 1990s. Initially developed to improve fuel efficiency and reduce emissions in conventional gasoline engines, GDI systems have progressively advanced through multiple generations. The first-generation systems focused primarily on stratified charge combustion, while second-generation developments enhanced injection pressure capabilities from 50-100 bar to 150-200 bar, enabling more precise fuel atomization and combustion control.

The third generation of GDI technology, emerging around 2010, introduced multi-pulse injection strategies and pressures exceeding 300 bar, substantially improving particulate matter reduction while maintaining performance benefits. Current state-of-the-art systems operate at pressures up to 350-400 bar with sophisticated electronic control units capable of multiple injection events per combustion cycle, optimizing for various driving conditions.

Looking forward, GDI technology stands at a critical juncture as the automotive industry faces increasing pressure to reduce carbon emissions while maintaining performance standards. The adaptation of GDI systems for alternative fuels represents a promising pathway to address these challenges. Ethanol, methanol, and other biofuels offer reduced carbon footprints compared to conventional gasoline, but require specific modifications to injection systems to accommodate their different physical and chemical properties.

The primary technical goal for GDI evolution is developing injection systems capable of handling multiple fuel types without compromising performance or durability. This includes addressing challenges such as different viscosities, lubricity characteristics, and corrosion potentials of alternative fuels. Advanced materials for injector components and modified sealing technologies will be essential to ensure system longevity.

Another critical adaptation goal involves optimizing combustion strategies for alternative fuels through enhanced engine control algorithms. These must account for variations in stoichiometric ratios, flame propagation speeds, and knock resistance characteristics across different fuel compositions. The development of real-time fuel composition sensing and adaptive control strategies represents a significant technical hurdle but offers substantial benefits for multi-fuel flexibility.

Ultimately, the evolution of GDI technology aims to create a flexible platform capable of efficiently utilizing both conventional and alternative fuels, potentially serving as a bridge technology during the broader transition to low-carbon transportation. Success in this domain would provide manufacturers with a versatile powertrain solution adaptable to regional fuel availability and evolving regulatory requirements while maintaining consumer expectations for performance and reliability.

The third generation of GDI technology, emerging around 2010, introduced multi-pulse injection strategies and pressures exceeding 300 bar, substantially improving particulate matter reduction while maintaining performance benefits. Current state-of-the-art systems operate at pressures up to 350-400 bar with sophisticated electronic control units capable of multiple injection events per combustion cycle, optimizing for various driving conditions.

Looking forward, GDI technology stands at a critical juncture as the automotive industry faces increasing pressure to reduce carbon emissions while maintaining performance standards. The adaptation of GDI systems for alternative fuels represents a promising pathway to address these challenges. Ethanol, methanol, and other biofuels offer reduced carbon footprints compared to conventional gasoline, but require specific modifications to injection systems to accommodate their different physical and chemical properties.

The primary technical goal for GDI evolution is developing injection systems capable of handling multiple fuel types without compromising performance or durability. This includes addressing challenges such as different viscosities, lubricity characteristics, and corrosion potentials of alternative fuels. Advanced materials for injector components and modified sealing technologies will be essential to ensure system longevity.

Another critical adaptation goal involves optimizing combustion strategies for alternative fuels through enhanced engine control algorithms. These must account for variations in stoichiometric ratios, flame propagation speeds, and knock resistance characteristics across different fuel compositions. The development of real-time fuel composition sensing and adaptive control strategies represents a significant technical hurdle but offers substantial benefits for multi-fuel flexibility.

Ultimately, the evolution of GDI technology aims to create a flexible platform capable of efficiently utilizing both conventional and alternative fuels, potentially serving as a bridge technology during the broader transition to low-carbon transportation. Success in this domain would provide manufacturers with a versatile powertrain solution adaptable to regional fuel availability and evolving regulatory requirements while maintaining consumer expectations for performance and reliability.

Market Analysis for Alternative Fuel GDI Systems

The global market for alternative fuel GDI (Gasoline Direct Injection) systems is experiencing significant growth, driven by stringent emission regulations and increasing consumer demand for fuel-efficient vehicles. Current market valuations place the alternative fuel GDI systems sector at approximately $5.2 billion, with projections indicating a compound annual growth rate of 8.7% through 2030. This growth trajectory is substantially higher than the conventional fuel injection systems market, which is growing at roughly 4.3% annually.

Regional analysis reveals distinct market characteristics across different geographies. North America and Europe currently dominate the market share, collectively accounting for 68% of global demand. This dominance stems from their advanced regulatory frameworks promoting cleaner vehicle technologies and substantial investments in alternative fuel infrastructure. However, the Asia-Pacific region, particularly China and India, is emerging as the fastest-growing market with annual growth rates exceeding 12%, primarily due to rapid urbanization, increasing vehicle ownership, and government initiatives to combat air pollution.

Consumer demand patterns indicate a growing preference for vehicles with alternative fuel capabilities. Market surveys show that 47% of new vehicle buyers now consider fuel efficiency and environmental impact as primary purchase factors, up from 29% five years ago. This shift in consumer behavior is creating substantial market pull for GDI systems compatible with ethanol blends, compressed natural gas, and other alternative fuels.

The competitive landscape is characterized by both established automotive component manufacturers and emerging technology companies. Traditional tier-one suppliers hold approximately 73% market share, leveraging their established relationships with OEMs. However, specialized alternative fuel technology startups have captured 18% of the market in recent years, primarily through innovative solutions offering superior performance with non-conventional fuels.

Market segmentation analysis reveals that passenger vehicles represent the largest application segment (62%), followed by light commercial vehicles (24%) and heavy-duty applications (14%). Within the passenger vehicle segment, mid-range vehicles show the highest adoption rate of alternative fuel GDI systems, indicating a broadening market beyond premium vehicle categories.

Key market drivers include regulatory pressures such as Euro 7 standards in Europe and CAFE regulations in the United States, which are pushing manufacturers toward more efficient and cleaner engine technologies. Additionally, the volatility in conventional fuel prices has accelerated interest in multi-fuel capable engines, creating a strategic hedge for both manufacturers and consumers against future energy market uncertainties.

Regional analysis reveals distinct market characteristics across different geographies. North America and Europe currently dominate the market share, collectively accounting for 68% of global demand. This dominance stems from their advanced regulatory frameworks promoting cleaner vehicle technologies and substantial investments in alternative fuel infrastructure. However, the Asia-Pacific region, particularly China and India, is emerging as the fastest-growing market with annual growth rates exceeding 12%, primarily due to rapid urbanization, increasing vehicle ownership, and government initiatives to combat air pollution.

Consumer demand patterns indicate a growing preference for vehicles with alternative fuel capabilities. Market surveys show that 47% of new vehicle buyers now consider fuel efficiency and environmental impact as primary purchase factors, up from 29% five years ago. This shift in consumer behavior is creating substantial market pull for GDI systems compatible with ethanol blends, compressed natural gas, and other alternative fuels.

The competitive landscape is characterized by both established automotive component manufacturers and emerging technology companies. Traditional tier-one suppliers hold approximately 73% market share, leveraging their established relationships with OEMs. However, specialized alternative fuel technology startups have captured 18% of the market in recent years, primarily through innovative solutions offering superior performance with non-conventional fuels.

Market segmentation analysis reveals that passenger vehicles represent the largest application segment (62%), followed by light commercial vehicles (24%) and heavy-duty applications (14%). Within the passenger vehicle segment, mid-range vehicles show the highest adoption rate of alternative fuel GDI systems, indicating a broadening market beyond premium vehicle categories.

Key market drivers include regulatory pressures such as Euro 7 standards in Europe and CAFE regulations in the United States, which are pushing manufacturers toward more efficient and cleaner engine technologies. Additionally, the volatility in conventional fuel prices has accelerated interest in multi-fuel capable engines, creating a strategic hedge for both manufacturers and consumers against future energy market uncertainties.

Technical Barriers and Regional Development Status

Despite significant advancements in GDI (Gasoline Direct Injection) technology, several technical barriers persist when adapting these engines for alternative fuels. The primary challenge lies in the fuel property differences between conventional gasoline and alternatives such as ethanol, methanol, natural gas, and hydrogen. These differences affect atomization characteristics, combustion stability, and emission profiles, requiring substantial modifications to injection systems, combustion chamber designs, and engine control strategies.

Material compatibility presents another significant hurdle, as alternative fuels often exhibit different chemical properties that can accelerate component degradation. Ethanol, for instance, is more corrosive than gasoline, necessitating specialized materials for fuel lines, injectors, and seals to ensure durability and reliability over the engine's lifetime.

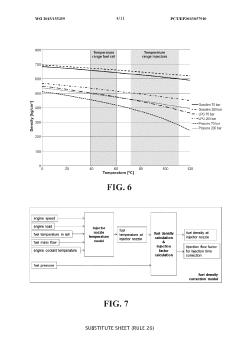

Cold-start performance remains problematic for many alternative fuels, particularly those with high latent heat of vaporization like ethanol and methanol. These fuels require more energy for vaporization, leading to difficult cold starts in low-temperature environments without sophisticated heating systems or dual-fuel strategies.

Calibration complexity increases exponentially with alternative fuels, as engine management systems must accommodate wider variations in fuel properties, including different stoichiometric air-fuel ratios, heating values, and octane ratings. This necessitates more sophisticated sensors and adaptive control algorithms capable of real-time fuel quality detection and adjustment.

Regional development status of GDI technology for alternative fuels varies significantly worldwide. North America leads in ethanol-compatible GDI systems, driven by the widespread availability of E85 fuel and supportive regulatory frameworks. Brazil has developed specialized expertise in ethanol-optimized GDI engines due to its long-standing ethanol fuel program.

European development focuses primarily on advanced biofuels and synthetic fuels that maintain compatibility with existing infrastructure while reducing carbon footprint. Their approach emphasizes drop-in fuels that require minimal engine modifications while meeting stringent emission standards.

Asian markets, particularly China and Japan, are advancing rapidly in methanol and natural gas adaptations for GDI technology. China has invested heavily in methanol fuel infrastructure and compatible engine technology, while Japan leads in hydrogen-related GDI research, exploring hybrid solutions that combine hydrogen with conventional fuels.

Emerging economies face unique challenges in adopting alternative fuel GDI systems, including limited infrastructure, inconsistent fuel quality, and cost constraints. These regions often prioritize robust, flexible-fuel solutions that can operate reliably across varying fuel qualities and environmental conditions.

Material compatibility presents another significant hurdle, as alternative fuels often exhibit different chemical properties that can accelerate component degradation. Ethanol, for instance, is more corrosive than gasoline, necessitating specialized materials for fuel lines, injectors, and seals to ensure durability and reliability over the engine's lifetime.

Cold-start performance remains problematic for many alternative fuels, particularly those with high latent heat of vaporization like ethanol and methanol. These fuels require more energy for vaporization, leading to difficult cold starts in low-temperature environments without sophisticated heating systems or dual-fuel strategies.

Calibration complexity increases exponentially with alternative fuels, as engine management systems must accommodate wider variations in fuel properties, including different stoichiometric air-fuel ratios, heating values, and octane ratings. This necessitates more sophisticated sensors and adaptive control algorithms capable of real-time fuel quality detection and adjustment.

Regional development status of GDI technology for alternative fuels varies significantly worldwide. North America leads in ethanol-compatible GDI systems, driven by the widespread availability of E85 fuel and supportive regulatory frameworks. Brazil has developed specialized expertise in ethanol-optimized GDI engines due to its long-standing ethanol fuel program.

European development focuses primarily on advanced biofuels and synthetic fuels that maintain compatibility with existing infrastructure while reducing carbon footprint. Their approach emphasizes drop-in fuels that require minimal engine modifications while meeting stringent emission standards.

Asian markets, particularly China and Japan, are advancing rapidly in methanol and natural gas adaptations for GDI technology. China has invested heavily in methanol fuel infrastructure and compatible engine technology, while Japan leads in hydrogen-related GDI research, exploring hybrid solutions that combine hydrogen with conventional fuels.

Emerging economies face unique challenges in adopting alternative fuel GDI systems, including limited infrastructure, inconsistent fuel quality, and cost constraints. These regions often prioritize robust, flexible-fuel solutions that can operate reliably across varying fuel qualities and environmental conditions.

Current GDI Solutions for Alternative Fuel Compatibility

01 GDI Engine Fuel Injection Systems

Gasoline Direct Injection (GDI) engines utilize advanced fuel injection systems that spray fuel directly into the combustion chamber rather than the intake port. These systems typically include high-pressure fuel pumps, precision injectors, and electronic control units that optimize fuel delivery timing and quantity. This direct injection approach allows for better fuel atomization, improved combustion efficiency, and reduced emissions while enabling higher compression ratios.- GDI Engine Fuel Injection Systems: Gasoline Direct Injection (GDI) engines utilize advanced fuel injection systems that directly spray fuel into the combustion chamber rather than the intake port. These systems improve fuel atomization, combustion efficiency, and allow for precise control of the air-fuel mixture. The technology includes high-pressure injectors, fuel rails, and electronic control units that optimize fuel delivery timing and quantity based on engine operating conditions.

- GDI Engine Combustion Control and Optimization: This category focuses on methods and systems for optimizing the combustion process in GDI engines. Innovations include stratified charge combustion strategies, multiple injection events per cycle, and advanced ignition timing control. These technologies help reduce emissions, improve thermal efficiency, and enhance power output while maintaining fuel economy benefits. Combustion chamber designs are specifically engineered to promote efficient air-fuel mixing and complete combustion.

- GDI Engine Emission Reduction Technologies: This area covers technologies specifically designed to reduce harmful emissions from GDI engines. Solutions include particulate filters to capture soot particles, advanced catalytic converters, exhaust gas recirculation systems, and combustion optimization strategies. These technologies address challenges unique to GDI engines such as particulate matter formation due to fuel wall wetting and higher NOx emissions compared to port fuel injection engines.

- GDI Engine Component Design and Manufacturing: This category encompasses innovations in the design and manufacturing of critical GDI engine components. This includes high-pressure fuel pumps capable of delivering fuel at pressures exceeding 200 bar, specialized injector designs with multiple orifices for optimal spray patterns, pistons with unique crown geometries to enhance air-fuel mixing, and cylinder head designs that accommodate direct injectors. Manufacturing processes for these precision components are also covered.

- GDI Engine Control Systems and Diagnostics: This category focuses on electronic control systems and diagnostic methods specific to GDI engines. Innovations include engine control units with specialized algorithms for GDI operation, sensors for monitoring fuel pressure and injection timing, on-board diagnostic systems for detecting injector malfunctions, and adaptive control strategies that compensate for component aging and variations. These systems ensure optimal engine performance across various operating conditions while maintaining compliance with emissions regulations.

02 GDI Engine Combustion Control Technologies

Advanced combustion control technologies in GDI engines focus on optimizing the air-fuel mixture and ignition timing to enhance performance and efficiency. These technologies include stratified charge combustion, multiple injection strategies, and variable valve timing systems. By precisely controlling the combustion process, these technologies help reduce fuel consumption, lower emissions, and improve power output across different operating conditions.Expand Specific Solutions03 GDI Engine Emission Reduction Systems

Emission reduction systems for GDI engines address challenges such as particulate matter and NOx emissions. These systems incorporate technologies like exhaust gas recirculation (EGR), particulate filters, catalytic converters specifically designed for direct injection engines, and advanced after-treatment solutions. The integration of these systems helps GDI engines meet increasingly stringent emission regulations while maintaining performance advantages.Expand Specific Solutions04 GDI Engine Thermal Management

Thermal management systems in GDI engines control operating temperatures to optimize efficiency and prevent issues like carbon buildup. These systems include advanced cooling circuits, heat exchangers, thermal barrier coatings, and electronic temperature control modules. Effective thermal management helps maintain ideal combustion temperatures, reduces thermal stress on components, and contributes to extended engine life and consistent performance.Expand Specific Solutions05 GDI Engine Component Design and Materials

Specialized component designs and materials are essential for GDI engines to withstand higher pressures and temperatures. These include reinforced pistons with specific crown designs, hardened valve seats, high-strength cylinder heads, and specialized coatings to reduce friction and wear. Advanced materials such as aluminum alloys with silicon carbide reinforcement and heat-resistant steels are employed to enhance durability while reducing weight and improving thermal efficiency.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The GDI (Gasoline Direct Injection) engine market for alternative fuels is currently in a growth phase, with increasing adoption across automotive sectors. Major players like Hyundai Motor Co. and Kia Corp. are leading innovation in this space, while established manufacturers such as Ford Global Technologies and Renault SA are investing heavily in GDI technology adaptation for biofuels and synthetic fuels. Research institutions including Southwest Research Institute and Indian Institute of Technology Madras are advancing technical solutions for efficiency improvements. Companies like Tula Technology and Delphi Technologies are developing specialized control systems to optimize GDI performance with alternative fuels. The market is expected to expand significantly as automotive manufacturers respond to emissions regulations, with technical challenges around fuel compatibility and combustion optimization being addressed through collaborative research efforts between industry and academic institutions.

Hyundai Motor Co., Ltd.

Technical Solution: Hyundai has developed a flexible-fuel GDI system specifically designed to optimize performance with various alternative fuels. Their technology features specialized injector nozzle designs with enhanced durability against the corrosive properties of ethanol and other biofuels. Hyundai's system incorporates dual-path fuel delivery that can adjust pressure and flow rates based on the detected fuel composition, ensuring optimal atomization regardless of fuel type. Their combustion control strategy includes advanced cylinder pressure sensing that enables real-time combustion feedback and adjustment of injection parameters to maintain efficiency across different fuel blends. Hyundai has implemented specialized piston and combustion chamber designs that enhance mixture formation with alternative fuels, particularly addressing the different vaporization characteristics of ethanol blends. Their system also features adaptive cold-start strategies that compensate for the different volatility profiles of alternative fuels, ensuring reliable starting in all conditions.

Strengths: Comprehensive system approach that addresses both hardware durability and control software adaptation; extensive validation in markets with varying fuel quality standards. Weaknesses: Higher component costs compared to conventional single-fuel systems; requires more sophisticated onboard diagnostics to maintain optimal performance.

Ford Global Technologies LLC

Technical Solution: Ford has developed advanced GDI engine systems specifically optimized for alternative fuels, particularly ethanol and methanol blends. Their Ecoboost technology incorporates specialized fuel injectors with increased flow capacity and corrosion resistance to handle the chemical properties of biofuels. Ford's system features adaptive injection timing and pressure control algorithms that automatically adjust based on fuel composition detection, enabling seamless switching between conventional gasoline and alternative fuels without performance degradation. Their dual-fuel calibration strategy optimizes combustion parameters including injection timing, duration, and pressure based on real-time fuel property sensing, maintaining optimal performance across varying fuel compositions. Ford has also implemented specialized piston crown designs that enhance mixture formation with alternative fuels, improving combustion stability and reducing emissions.

Strengths: Robust adaptive control systems that can handle varying fuel compositions without manual recalibration; extensive real-world validation across global markets with different fuel standards. Weaknesses: Higher system complexity increases manufacturing costs; requires more sophisticated onboard diagnostics to maintain optimal performance over vehicle lifetime.

Key Patents and Innovations in Fuel Injection Systems

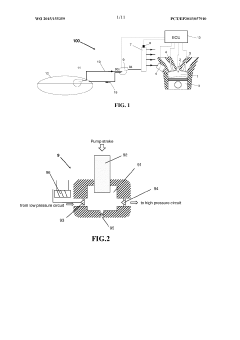

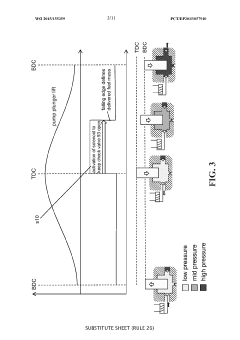

LPG direct injection engine

PatentWO2015155359A1

Innovation

- An LPG direct injection engine with a high-pressure pump and electronic control unit for precise liquefied petroleum gas injection between 360° and 60° BTDC, optimized valve overlap, and cylinder deactivation system to reduce emissions and improve efficiency.

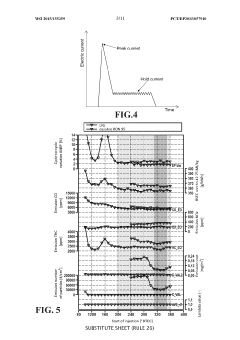

Method for maximizing the formation of deposits in injector nozzles of GDI engines

PatentWO2018002610A1

Innovation

- A method to maximize deposit formation in GDI engine injector nozzles by simulating severe conditions through controlled engine speed and load variations, high nozzle temperatures, and moderate fuel flow rates, allowing for automated and unsupervised testing to quickly assess fuel's deposit-forming tendencies.

Emissions Standards and Regulatory Framework

The global regulatory landscape for vehicle emissions has evolved significantly over the past decades, creating a complex framework that directly impacts the development of GDI (Gasoline Direct Injection) engines for alternative fuels. The European Union's Euro standards represent one of the most influential regulatory frameworks, with Euro 7 implementation scheduled for 2025, imposing stricter limits on nitrogen oxides (NOx), particulate matter (PM), and carbon dioxide (CO2) emissions.

In the United States, the Corporate Average Fuel Economy (CAFE) standards and EPA Tier 3 regulations continue to drive automotive innovation toward cleaner technologies. These regulations specifically target greenhouse gas emissions and fuel economy improvements, with increasingly stringent requirements through 2026 that mandate fleet-wide average improvements of approximately 5% annually.

China's implementation of the China 6 standards, comparable to Euro 6 but with some unique testing requirements, has created another significant regulatory force in the global automotive market. These standards are particularly relevant for GDI technology adaptation as they include specific limits on particulate number (PN) emissions, a challenge for traditional GDI systems.

The regulatory frameworks increasingly incorporate real-world driving emissions (RDE) testing protocols, moving beyond laboratory conditions to ensure emissions compliance across actual driving scenarios. This shift presents both challenges and opportunities for GDI engines utilizing alternative fuels, as real-world performance becomes a critical metric for compliance.

Carbon neutrality targets established by major economies further shape the regulatory landscape. The EU's commitment to carbon neutrality by 2050, Japan's 2050 target, and China's 2060 goal all create long-term pressure for fundamental changes in propulsion technologies. These targets are driving the transition toward zero-emission vehicles while creating interim opportunities for low-carbon alternative fuel solutions in GDI engines.

Low Emission Zones (LEZs) and Zero Emission Zones (ZEZs) in urban centers worldwide represent another regulatory trend affecting GDI technology development. These zones restrict vehicle access based on emissions performance, creating immediate market incentives for cleaner technologies that can meet increasingly stringent local requirements while maintaining performance characteristics.

The regulatory framework also includes incentive structures for alternative fuels, with varying approaches across regions. The EU's Renewable Energy Directive II promotes advanced biofuels, while the US Renewable Fuel Standard creates market mechanisms for renewable fuel adoption. These incentives directly influence the commercial viability of alternative fuel applications in GDI engines.

In the United States, the Corporate Average Fuel Economy (CAFE) standards and EPA Tier 3 regulations continue to drive automotive innovation toward cleaner technologies. These regulations specifically target greenhouse gas emissions and fuel economy improvements, with increasingly stringent requirements through 2026 that mandate fleet-wide average improvements of approximately 5% annually.

China's implementation of the China 6 standards, comparable to Euro 6 but with some unique testing requirements, has created another significant regulatory force in the global automotive market. These standards are particularly relevant for GDI technology adaptation as they include specific limits on particulate number (PN) emissions, a challenge for traditional GDI systems.

The regulatory frameworks increasingly incorporate real-world driving emissions (RDE) testing protocols, moving beyond laboratory conditions to ensure emissions compliance across actual driving scenarios. This shift presents both challenges and opportunities for GDI engines utilizing alternative fuels, as real-world performance becomes a critical metric for compliance.

Carbon neutrality targets established by major economies further shape the regulatory landscape. The EU's commitment to carbon neutrality by 2050, Japan's 2050 target, and China's 2060 goal all create long-term pressure for fundamental changes in propulsion technologies. These targets are driving the transition toward zero-emission vehicles while creating interim opportunities for low-carbon alternative fuel solutions in GDI engines.

Low Emission Zones (LEZs) and Zero Emission Zones (ZEZs) in urban centers worldwide represent another regulatory trend affecting GDI technology development. These zones restrict vehicle access based on emissions performance, creating immediate market incentives for cleaner technologies that can meet increasingly stringent local requirements while maintaining performance characteristics.

The regulatory framework also includes incentive structures for alternative fuels, with varying approaches across regions. The EU's Renewable Energy Directive II promotes advanced biofuels, while the US Renewable Fuel Standard creates market mechanisms for renewable fuel adoption. These incentives directly influence the commercial viability of alternative fuel applications in GDI engines.

Lifecycle Assessment and Sustainability Metrics

Lifecycle assessment (LCA) of Gasoline Direct Injection (GDI) engines with alternative fuels reveals significant environmental impact variations across the entire value chain. When comparing traditional fossil fuels with alternatives like ethanol, methanol, and hydrogen in GDI applications, comprehensive cradle-to-grave analyses demonstrate distinct sustainability profiles for each fuel pathway.

Carbon intensity metrics show that ethanol from agricultural sources can reduce lifecycle GHG emissions by 20-40% compared to conventional gasoline in GDI engines, though these benefits depend heavily on feedstock source and production methods. Second-generation biofuels derived from agricultural waste demonstrate even greater potential, with up to 60% emissions reduction when used in optimized GDI systems.

Water consumption represents another critical sustainability metric, with hydrogen production for GDI applications currently requiring 9-12 gallons of water per kilogram produced via electrolysis. This water footprint must be factored against the zero-emission operation benefits at the vehicle level. Synthetic fuels compatible with GDI technology show promising lifecycle assessments when produced using renewable electricity, though energy conversion efficiency losses remain a challenge.

Land use change impacts vary dramatically among alternative fuels. First-generation biofuels raise concerns about indirect land use change that can negate climate benefits, while advanced biofuels and electrofuels compatible with GDI systems offer pathways that minimize land disturbance. Quantitative sustainability metrics indicate that GDI engines running on renewable methanol can achieve carbon payback periods of 3-5 years compared to conventional systems.

Air quality impacts throughout the lifecycle present complex tradeoffs. While GDI engines running on alternative fuels generally reduce tailpipe emissions of certain pollutants, upstream production emissions must be carefully assessed. Particulate matter emissions from GDI engines remain a concern regardless of fuel type, though advanced filtration systems are showing promise in mitigating these effects.

Economic sustainability metrics reveal that the total cost of ownership for GDI vehicles using alternative fuels is approaching parity with conventional systems in certain markets, particularly where carbon pricing mechanisms exist. Sensitivity analysis indicates that production scale and feedstock costs remain the primary determinants of economic viability for most alternative fuel pathways in GDI applications.

Standardized sustainability certification frameworks are emerging to validate environmental claims for alternative fuels in advanced combustion systems like GDI. These frameworks incorporate metrics spanning carbon intensity, water usage, land impact, and social factors to provide holistic sustainability assessments that support informed decision-making across the transportation sector.

Carbon intensity metrics show that ethanol from agricultural sources can reduce lifecycle GHG emissions by 20-40% compared to conventional gasoline in GDI engines, though these benefits depend heavily on feedstock source and production methods. Second-generation biofuels derived from agricultural waste demonstrate even greater potential, with up to 60% emissions reduction when used in optimized GDI systems.

Water consumption represents another critical sustainability metric, with hydrogen production for GDI applications currently requiring 9-12 gallons of water per kilogram produced via electrolysis. This water footprint must be factored against the zero-emission operation benefits at the vehicle level. Synthetic fuels compatible with GDI technology show promising lifecycle assessments when produced using renewable electricity, though energy conversion efficiency losses remain a challenge.

Land use change impacts vary dramatically among alternative fuels. First-generation biofuels raise concerns about indirect land use change that can negate climate benefits, while advanced biofuels and electrofuels compatible with GDI systems offer pathways that minimize land disturbance. Quantitative sustainability metrics indicate that GDI engines running on renewable methanol can achieve carbon payback periods of 3-5 years compared to conventional systems.

Air quality impacts throughout the lifecycle present complex tradeoffs. While GDI engines running on alternative fuels generally reduce tailpipe emissions of certain pollutants, upstream production emissions must be carefully assessed. Particulate matter emissions from GDI engines remain a concern regardless of fuel type, though advanced filtration systems are showing promise in mitigating these effects.

Economic sustainability metrics reveal that the total cost of ownership for GDI vehicles using alternative fuels is approaching parity with conventional systems in certain markets, particularly where carbon pricing mechanisms exist. Sensitivity analysis indicates that production scale and feedstock costs remain the primary determinants of economic viability for most alternative fuel pathways in GDI applications.

Standardized sustainability certification frameworks are emerging to validate environmental claims for alternative fuels in advanced combustion systems like GDI. These frameworks incorporate metrics spanning carbon intensity, water usage, land impact, and social factors to provide holistic sustainability assessments that support informed decision-making across the transportation sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!