Quantifying GDI Engine's Lubricant Usage Over Cycles

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

GDI Engine Lubrication Technology Background and Objectives

Gasoline Direct Injection (GDI) engine technology has evolved significantly since its commercial introduction in the late 1990s. This advanced fuel delivery system has become increasingly prevalent in modern automotive designs due to its superior fuel efficiency and reduced emissions compared to traditional port fuel injection systems. The evolution of GDI technology represents a critical advancement in internal combustion engine development, particularly as global automotive regulations continue to demand higher efficiency and lower environmental impact.

The lubricant system in GDI engines faces unique challenges compared to conventional engines. The higher operating temperatures, increased cylinder pressures, and direct fuel impingement create more severe conditions for engine oils. These conditions accelerate oil degradation processes including oxidation, thermal breakdown, and contamination with fuel and combustion byproducts. Understanding these degradation mechanisms is essential for optimizing lubricant formulations and maintenance intervals.

Historical development of engine lubrication technology has progressed from simple mineral oils to highly engineered synthetic formulations with complex additive packages. This evolution has been driven by increasingly stringent requirements for engine protection, longevity, and performance under extreme conditions. The interaction between modern lubricants and GDI technology represents a critical area of ongoing research and development in the automotive industry.

The primary objective of quantifying GDI engine lubricant usage over cycles is to establish precise models that predict oil degradation rates under various operating conditions. This knowledge is fundamental to optimizing oil change intervals, reducing unnecessary maintenance, minimizing environmental impact from premature oil disposal, and extending engine lifespan. Additionally, accurate quantification enables the development of more resilient lubricant formulations specifically engineered for GDI applications.

Current technological trends indicate a growing focus on real-time oil condition monitoring systems, predictive maintenance algorithms, and lubricant formulations specifically designed for GDI engines. These innovations aim to address the unique challenges posed by direct injection technology, including fuel dilution of oil, increased soot formation, and accelerated oxidation processes.

The convergence of GDI technology with electrification in hybrid vehicles presents additional complexities for lubricant performance, as these systems often feature intermittent engine operation and unique thermal cycles. Understanding lubricant behavior in these next-generation powertrains represents an emerging frontier in automotive engineering research and development.

The lubricant system in GDI engines faces unique challenges compared to conventional engines. The higher operating temperatures, increased cylinder pressures, and direct fuel impingement create more severe conditions for engine oils. These conditions accelerate oil degradation processes including oxidation, thermal breakdown, and contamination with fuel and combustion byproducts. Understanding these degradation mechanisms is essential for optimizing lubricant formulations and maintenance intervals.

Historical development of engine lubrication technology has progressed from simple mineral oils to highly engineered synthetic formulations with complex additive packages. This evolution has been driven by increasingly stringent requirements for engine protection, longevity, and performance under extreme conditions. The interaction between modern lubricants and GDI technology represents a critical area of ongoing research and development in the automotive industry.

The primary objective of quantifying GDI engine lubricant usage over cycles is to establish precise models that predict oil degradation rates under various operating conditions. This knowledge is fundamental to optimizing oil change intervals, reducing unnecessary maintenance, minimizing environmental impact from premature oil disposal, and extending engine lifespan. Additionally, accurate quantification enables the development of more resilient lubricant formulations specifically engineered for GDI applications.

Current technological trends indicate a growing focus on real-time oil condition monitoring systems, predictive maintenance algorithms, and lubricant formulations specifically designed for GDI engines. These innovations aim to address the unique challenges posed by direct injection technology, including fuel dilution of oil, increased soot formation, and accelerated oxidation processes.

The convergence of GDI technology with electrification in hybrid vehicles presents additional complexities for lubricant performance, as these systems often feature intermittent engine operation and unique thermal cycles. Understanding lubricant behavior in these next-generation powertrains represents an emerging frontier in automotive engineering research and development.

Market Analysis of GDI Engine Lubricant Consumption

The global market for GDI (Gasoline Direct Injection) engine lubricants has experienced significant growth over the past decade, driven primarily by the widespread adoption of GDI technology in modern vehicles. Current market valuations place the GDI engine lubricant sector at approximately 3.2 billion USD in 2023, with projections indicating a compound annual growth rate of 5.7% through 2030.

The demand for specialized lubricants for GDI engines stems from their unique operational characteristics. GDI engines operate at higher temperatures and pressures than traditional port fuel injection systems, creating more severe conditions for lubricants. This has opened a premium segment within the automotive lubricant market, with GDI-specific formulations commanding price premiums of 15-20% over conventional engine oils.

Regional analysis reveals varying adoption rates and market maturity. North America and Europe currently dominate the market share at 32% and 29% respectively, driven by stringent emission regulations and higher rates of GDI engine adoption. The Asia-Pacific region, particularly China and India, represents the fastest-growing market segment with annual growth rates exceeding 8%, attributed to rapid automotive industry expansion and increasing consumer preference for fuel-efficient vehicles.

Consumer behavior studies indicate a growing awareness among vehicle owners regarding the specialized lubricant requirements of GDI engines. This awareness has translated to increased willingness to pay premium prices for lubricants that promise extended engine life and maintained fuel efficiency benefits. Approximately 62% of GDI engine owners follow manufacturer-recommended lubricant specifications, a significantly higher percentage compared to conventional engine owners.

The competitive landscape features both established lubricant manufacturers and new entrants specializing in high-performance formulations. Major oil companies have expanded their product portfolios to include GDI-specific lubricants, while specialty chemical companies have developed additives designed to address GDI-specific challenges such as intake valve deposits and fuel dilution.

Market forecasts suggest that as GDI technology continues to evolve, lubricant consumption patterns will shift toward longer drain intervals but higher-quality formulations. This trend is expected to maintain value growth even as volume growth potentially slows. The aftermarket segment for GDI engine lubricants is projected to grow at 6.3% annually, outpacing OEM supply channels.

Environmental regulations and sustainability concerns are emerging as significant market drivers, with low-SAPS (Sulfated Ash, Phosphorus, and Sulfur) formulations gaining market share. These environmentally friendly options currently represent 27% of the GDI lubricant market and are expected to reach 40% by 2028.

The demand for specialized lubricants for GDI engines stems from their unique operational characteristics. GDI engines operate at higher temperatures and pressures than traditional port fuel injection systems, creating more severe conditions for lubricants. This has opened a premium segment within the automotive lubricant market, with GDI-specific formulations commanding price premiums of 15-20% over conventional engine oils.

Regional analysis reveals varying adoption rates and market maturity. North America and Europe currently dominate the market share at 32% and 29% respectively, driven by stringent emission regulations and higher rates of GDI engine adoption. The Asia-Pacific region, particularly China and India, represents the fastest-growing market segment with annual growth rates exceeding 8%, attributed to rapid automotive industry expansion and increasing consumer preference for fuel-efficient vehicles.

Consumer behavior studies indicate a growing awareness among vehicle owners regarding the specialized lubricant requirements of GDI engines. This awareness has translated to increased willingness to pay premium prices for lubricants that promise extended engine life and maintained fuel efficiency benefits. Approximately 62% of GDI engine owners follow manufacturer-recommended lubricant specifications, a significantly higher percentage compared to conventional engine owners.

The competitive landscape features both established lubricant manufacturers and new entrants specializing in high-performance formulations. Major oil companies have expanded their product portfolios to include GDI-specific lubricants, while specialty chemical companies have developed additives designed to address GDI-specific challenges such as intake valve deposits and fuel dilution.

Market forecasts suggest that as GDI technology continues to evolve, lubricant consumption patterns will shift toward longer drain intervals but higher-quality formulations. This trend is expected to maintain value growth even as volume growth potentially slows. The aftermarket segment for GDI engine lubricants is projected to grow at 6.3% annually, outpacing OEM supply channels.

Environmental regulations and sustainability concerns are emerging as significant market drivers, with low-SAPS (Sulfated Ash, Phosphorus, and Sulfur) formulations gaining market share. These environmentally friendly options currently represent 27% of the GDI lubricant market and are expected to reach 40% by 2028.

Current Challenges in GDI Engine Lubrication Quantification

The quantification of lubricant usage in Gasoline Direct Injection (GDI) engines presents significant technical challenges that have yet to be fully resolved. Current measurement methodologies often lack precision when tracking oil consumption across multiple engine cycles, particularly under varying operational conditions. Traditional methods such as drain-and-weigh techniques provide only aggregate consumption data without cycle-specific insights, limiting their utility for advanced engine development.

Real-time monitoring systems face substantial obstacles in GDI environments due to the complex interaction between high-pressure fuel injection systems and lubricant behavior. The direct injection process creates unique thermal gradients and pressure fluctuations that affect oil film thickness and distribution in ways that differ significantly from port fuel injection engines. These dynamics make consistent measurement particularly challenging during transient operations.

Sensor technology represents another critical limitation. Current oil level sensors typically offer insufficient resolution to detect the minute changes in lubricant volume that occur over individual cycles. More advanced sensors capable of such precision often cannot withstand the harsh operating environment of a GDI engine, including high temperatures and exposure to combustion byproducts, leading to rapid degradation and unreliable readings.

The contamination of lubricant with fuel dilution—a particular concern in GDI engines due to wall wetting phenomena—further complicates quantification efforts. This contamination alters the physical properties of the lubricant, affecting both its performance and the accuracy of measurement systems that rely on consistent fluid characteristics. Current analytical methods struggle to differentiate between actual consumption and property changes due to contamination.

Computational fluid dynamics (CFD) models offer potential solutions but currently face validation challenges. While these models can simulate oil transport mechanisms, they require extensive calibration against experimental data to achieve reliable predictive capability. The multi-phase, multi-scale nature of oil-fuel-air interactions in GDI engines exceeds the capabilities of many existing simulation frameworks.

Laboratory testing protocols also present limitations. Accelerated aging tests often fail to accurately replicate the complex wear patterns and lubricant degradation mechanisms observed in real-world GDI operation. This disconnect between laboratory and field performance creates significant uncertainty when projecting lubricant consumption over the full lifecycle of an engine.

Standardization remains another significant hurdle. The industry lacks universally accepted methodologies for quantifying and reporting lubricant usage in GDI engines, making cross-platform comparisons difficult and hindering collaborative research efforts. This fragmentation of approaches slows the overall pace of innovation in lubricant technology specifically optimized for GDI applications.

Real-time monitoring systems face substantial obstacles in GDI environments due to the complex interaction between high-pressure fuel injection systems and lubricant behavior. The direct injection process creates unique thermal gradients and pressure fluctuations that affect oil film thickness and distribution in ways that differ significantly from port fuel injection engines. These dynamics make consistent measurement particularly challenging during transient operations.

Sensor technology represents another critical limitation. Current oil level sensors typically offer insufficient resolution to detect the minute changes in lubricant volume that occur over individual cycles. More advanced sensors capable of such precision often cannot withstand the harsh operating environment of a GDI engine, including high temperatures and exposure to combustion byproducts, leading to rapid degradation and unreliable readings.

The contamination of lubricant with fuel dilution—a particular concern in GDI engines due to wall wetting phenomena—further complicates quantification efforts. This contamination alters the physical properties of the lubricant, affecting both its performance and the accuracy of measurement systems that rely on consistent fluid characteristics. Current analytical methods struggle to differentiate between actual consumption and property changes due to contamination.

Computational fluid dynamics (CFD) models offer potential solutions but currently face validation challenges. While these models can simulate oil transport mechanisms, they require extensive calibration against experimental data to achieve reliable predictive capability. The multi-phase, multi-scale nature of oil-fuel-air interactions in GDI engines exceeds the capabilities of many existing simulation frameworks.

Laboratory testing protocols also present limitations. Accelerated aging tests often fail to accurately replicate the complex wear patterns and lubricant degradation mechanisms observed in real-world GDI operation. This disconnect between laboratory and field performance creates significant uncertainty when projecting lubricant consumption over the full lifecycle of an engine.

Standardization remains another significant hurdle. The industry lacks universally accepted methodologies for quantifying and reporting lubricant usage in GDI engines, making cross-platform comparisons difficult and hindering collaborative research efforts. This fragmentation of approaches slows the overall pace of innovation in lubricant technology specifically optimized for GDI applications.

Existing Methodologies for Quantifying Lubricant Usage

01 Lubricant formulations for GDI engines

Specialized lubricant formulations designed specifically for Gasoline Direct Injection (GDI) engines that address unique challenges such as fuel dilution, deposit formation, and higher operating temperatures. These formulations typically include advanced additive packages to maintain engine cleanliness, reduce friction, and extend oil change intervals while protecting critical engine components from wear.- Lubricant formulations for GDI engines: Specialized lubricant formulations designed specifically for Gasoline Direct Injection (GDI) engines that address unique challenges such as increased operating temperatures and fuel dilution. These formulations typically include additives that provide enhanced thermal stability, deposit control, and protection against wear in high-pressure fuel injection systems.

- Fuel efficiency improvement through lubricant technology: Advanced lubricants that reduce friction in GDI engines, resulting in improved fuel economy. These lubricants contain friction modifiers and viscosity improvers that maintain optimal performance while reducing energy losses in the engine, particularly at high temperatures and under variable load conditions typical of GDI operation.

- Deposit control and engine cleanliness: Lubricant technologies specifically designed to prevent carbon deposits on GDI injectors and intake valves. These formulations contain detergents and dispersants that keep engine components clean, preventing performance degradation and maintaining optimal fuel atomization in direct injection systems.

- Wear protection for high-pressure components: Specialized lubricants that provide enhanced protection for high-pressure components in GDI engines, including camshafts, fuel pumps, and injectors. These formulations contain anti-wear additives and extreme pressure agents that form protective films on metal surfaces, reducing wear under the high mechanical and thermal stresses present in GDI systems.

- Oil consumption and volatility control: Lubricant formulations designed to minimize oil consumption in GDI engines by controlling oil volatility. These lubricants maintain their viscosity and performance characteristics even under the high temperatures experienced in direct injection engines, reducing the need for frequent top-ups and helping to prevent oil-related deposits on combustion chamber components.

02 Deposit control in GDI engines

Lubricant technologies focused on preventing and managing carbon deposits that commonly form in GDI engines, particularly on injectors and intake valves. These solutions incorporate detergents, dispersants, and cleaning agents that help maintain fuel spray patterns, optimize combustion efficiency, and prevent power loss associated with deposit buildup in direct injection systems.Expand Specific Solutions03 Fuel economy improvement through lubricant technology

Low-viscosity lubricant formulations designed to reduce internal friction in GDI engines, thereby improving fuel economy while maintaining adequate engine protection. These lubricants often incorporate friction modifiers and synthetic base oils that can withstand the high-stress conditions of direct injection systems while minimizing energy losses through reduced pumping and friction losses.Expand Specific Solutions04 Wear protection systems for GDI engines

Advanced anti-wear additives and technologies specifically designed to protect GDI engine components that experience increased stress due to higher pressures and temperatures. These lubricant systems provide enhanced protection for critical components such as high-pressure fuel pumps, camshafts, and piston rings, which are particularly vulnerable in direct injection environments.Expand Specific Solutions05 Lubricant monitoring and maintenance systems

Diagnostic and monitoring technologies designed to track lubricant condition in GDI engines, allowing for optimized oil change intervals and early detection of potential issues. These systems may include sensors, sampling methods, or analytical techniques that evaluate oil degradation, contamination levels, and remaining useful life to ensure proper engine protection and performance.Expand Specific Solutions

Key Industry Players in GDI Engine Lubrication Technology

The GDI engine lubricant usage quantification market is in a growth phase, with increasing demand driven by automotive efficiency requirements and environmental regulations. The market is estimated to reach significant value as GDI technology adoption expands globally. Technologically, the field shows varying maturity levels across players. Lubrizol, Infineum, and Afton Chemical lead in specialized lubricant formulations, while automotive manufacturers like Hyundai, Kia, Toyota, and Ford focus on integration with engine design. Research institutions such as Southwest Research Institute and AVL List contribute advanced testing methodologies. Oil majors including ExxonMobil and BP leverage their extensive R&D capabilities to develop GDI-specific solutions, creating a competitive landscape balanced between specialized additive companies and integrated automotive/petroleum players.

Infineum International Ltd.

Technical Solution: Infineum has developed advanced analytical methodologies for quantifying lubricant degradation in GDI (Gasoline Direct Injection) engines through their proprietary PARC (Predictive Analytics for Real-time Condition) system. This technology utilizes real-time sensors embedded within engine components to continuously monitor oil condition parameters including viscosity changes, oxidation levels, and particulate contamination specifically related to GDI operation. Their approach incorporates machine learning algorithms that analyze data across thousands of engine cycles to establish predictive models for lubricant depletion rates under varying operating conditions. Infineum's system can detect the accelerated lubricant degradation unique to GDI engines caused by increased fuel dilution and higher operating temperatures, allowing for precise quantification of remaining useful lubricant life based on actual engine usage patterns rather than traditional time or mileage intervals.

Strengths: Industry-leading sensor integration technology provides real-time monitoring capabilities; proprietary algorithms offer predictive maintenance opportunities beyond simple measurement. Weaknesses: System requires significant initial investment for implementation; accuracy depends on comprehensive calibration specific to each engine design.

The Lubrizol Corp.

Technical Solution: Lubrizol has pioneered the Lubricant Consumption Tracking System (LCTS) specifically designed for GDI engines, which combines physical oil level sensors with advanced chemical markers to differentiate between consumption and degradation. Their technology employs proprietary tracer compounds added to lubricant formulations that can be detected in exhaust emissions at parts-per-billion levels, enabling precise measurement of oil consumed through combustion versus oil degraded through oxidation or contamination. The system incorporates cycle-specific analysis that accounts for the unique challenges of GDI engines, including fuel dilution effects and carbon deposit formation that accelerate lubricant degradation. Lubrizol's approach includes specialized algorithms that normalize consumption data across different operating conditions, providing standardized metrics for comparing lubricant performance across various GDI engine designs and driving cycles.

Strengths: Differentiation between consumption and degradation provides more accurate usage metrics; chemical tracer technology offers precision beyond traditional measurement methods. Weaknesses: Requires specialized lubricant formulations containing proprietary markers; additional exhaust analysis equipment needed for complete implementation.

Critical Patents in GDI Engine Lubrication Monitoring

Method for maximizing the formation of deposits in injector nozzles of GDI engines

PatentWO2018002610A1

Innovation

- A method to maximize deposit formation in GDI engine injector nozzles by simulating severe conditions through controlled engine speed and load variations, high nozzle temperatures, and moderate fuel flow rates, allowing for automated and unsupervised testing to quickly assess fuel's deposit-forming tendencies.

Lubricant compositions for direct injection engines

PatentWO2015042340A1

Innovation

- A lubricant composition containing a metal overbased detergent, such as sulfonate, phenate, or salicylate detergents, is supplied to the engine, which includes additives like ashless dispersants and anti-wear agents, to reduce LSPI events by modifying engine operating conditions and fuel composition.

Environmental Impact of GDI Engine Lubricant Consumption

The environmental implications of lubricant consumption in Gasoline Direct Injection (GDI) engines represent a significant concern in automotive sustainability. As GDI technology continues to dominate the market due to its improved fuel efficiency and reduced CO2 emissions, the environmental footprint of its lubricant usage demands thorough examination. Studies indicate that GDI engines typically consume between 0.05-0.15 liters of oil per 1,000 kilometers, which translates to substantial volumes when considering global vehicle populations.

The production phase of engine lubricants carries considerable environmental burden. Conventional mineral-based oils require extensive petroleum refining processes that generate greenhouse gas emissions, contribute to air pollution, and consume significant water resources. Synthetic lubricants, while offering extended service intervals, often involve energy-intensive manufacturing processes with their own environmental consequences.

During engine operation, lubricant degradation leads to particulate matter formation that may escape through the exhaust system or crankcase ventilation. These emissions contain volatile organic compounds (VOCs) and polycyclic aromatic hydrocarbons (PAHs) that contribute to ground-level ozone formation and pose potential health risks. GDI engines, with their higher operating temperatures and pressures, accelerate lubricant degradation compared to conventional port fuel injection systems.

Improper disposal of used engine oil represents one of the most severe environmental threats. A single liter of improperly discarded oil can contaminate up to one million liters of groundwater. Despite recycling programs, the Environmental Protection Agency estimates that approximately 40% of used motor oil in the United States is not properly collected or recycled, leading to soil and water contamination.

The environmental impact extends to biodiversity effects, as oil contamination in aquatic ecosystems disrupts food chains and damages habitats. Bioaccumulation of lubricant-derived compounds in organisms presents long-term ecological concerns that are difficult to quantify but potentially significant.

Recent lifecycle assessment studies comparing conventional and GDI engines suggest that while GDI technology reduces carbon emissions through improved fuel efficiency, these gains may be partially offset by increased lubricant consumption rates and the associated environmental impacts throughout the lubricant lifecycle.

Emerging technologies such as bio-based lubricants and nanomaterial additives offer promising pathways to reduce environmental impact. Bio-lubricants derived from renewable resources demonstrate improved biodegradability and reduced toxicity, while advanced nanomaterial additives can extend oil change intervals by enhancing lubricant stability under the extreme conditions characteristic of GDI engines.

The production phase of engine lubricants carries considerable environmental burden. Conventional mineral-based oils require extensive petroleum refining processes that generate greenhouse gas emissions, contribute to air pollution, and consume significant water resources. Synthetic lubricants, while offering extended service intervals, often involve energy-intensive manufacturing processes with their own environmental consequences.

During engine operation, lubricant degradation leads to particulate matter formation that may escape through the exhaust system or crankcase ventilation. These emissions contain volatile organic compounds (VOCs) and polycyclic aromatic hydrocarbons (PAHs) that contribute to ground-level ozone formation and pose potential health risks. GDI engines, with their higher operating temperatures and pressures, accelerate lubricant degradation compared to conventional port fuel injection systems.

Improper disposal of used engine oil represents one of the most severe environmental threats. A single liter of improperly discarded oil can contaminate up to one million liters of groundwater. Despite recycling programs, the Environmental Protection Agency estimates that approximately 40% of used motor oil in the United States is not properly collected or recycled, leading to soil and water contamination.

The environmental impact extends to biodiversity effects, as oil contamination in aquatic ecosystems disrupts food chains and damages habitats. Bioaccumulation of lubricant-derived compounds in organisms presents long-term ecological concerns that are difficult to quantify but potentially significant.

Recent lifecycle assessment studies comparing conventional and GDI engines suggest that while GDI technology reduces carbon emissions through improved fuel efficiency, these gains may be partially offset by increased lubricant consumption rates and the associated environmental impacts throughout the lubricant lifecycle.

Emerging technologies such as bio-based lubricants and nanomaterial additives offer promising pathways to reduce environmental impact. Bio-lubricants derived from renewable resources demonstrate improved biodegradability and reduced toxicity, while advanced nanomaterial additives can extend oil change intervals by enhancing lubricant stability under the extreme conditions characteristic of GDI engines.

Durability Testing Standards for GDI Engine Lubrication

Durability testing standards for GDI (Gasoline Direct Injection) engine lubrication have evolved significantly to address the unique challenges posed by this advanced fuel delivery system. These standards establish comprehensive protocols for evaluating lubricant performance under various operating conditions, ensuring reliable engine protection throughout its service life.

The Society of Automotive Engineers (SAE) and the American Petroleum Institute (API) have developed specific test sequences that focus on GDI-specific lubrication requirements. These include the Sequence VH test for valve train wear, Sequence IIIH for high-temperature oxidation stability, and Sequence IVB for cam wear protection—all critical aspects for GDI engines that operate at higher temperatures and pressures than traditional port fuel injection systems.

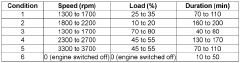

ASTM International provides complementary standards such as D7320 for measuring deposit formation in GDI injectors and D6594 for evaluating lubricant effects on fuel economy. These standards incorporate cycle-based testing methodologies that simulate real-world driving conditions, including cold starts, high-load operation, and extended idling periods that are particularly challenging for GDI systems.

The International Organization for Standardization (ISO) contributes global perspectives through standards like ISO 23581, which addresses lubricant performance in high-efficiency internal combustion engines. This standard specifically accounts for GDI engines' tendency toward increased oil dilution due to wall wetting phenomena and subsequent fuel contamination of the lubricant.

Manufacturer-specific durability standards often exceed these industry benchmarks, with companies like Toyota, Volkswagen, and Ford implementing proprietary test cycles that may extend to 100,000+ miles equivalent testing. These tests frequently incorporate accelerated aging protocols that compress years of service into weeks of laboratory evaluation.

Modern durability standards increasingly incorporate oil consumption measurements as a key performance indicator. The correlation between oil consumption rates and engine design factors such as piston ring configuration, cylinder liner surface finish, and PCV system design is carefully monitored throughout standardized test cycles.

Emerging standards are beginning to address GDI-specific concerns such as low-speed pre-ignition (LSPI) resistance and compatibility with stop-start systems. The ILSAC GF-6 specification, for instance, includes the Sequence IX test specifically designed to evaluate a lubricant's ability to mitigate LSPI events that can cause catastrophic engine damage in GDI applications.

As GDI technology continues to evolve toward higher injection pressures (now exceeding 350 bar in some applications), durability standards are adapting to ensure lubricants can maintain their protective properties under increasingly demanding conditions throughout the engine's operational lifetime.

The Society of Automotive Engineers (SAE) and the American Petroleum Institute (API) have developed specific test sequences that focus on GDI-specific lubrication requirements. These include the Sequence VH test for valve train wear, Sequence IIIH for high-temperature oxidation stability, and Sequence IVB for cam wear protection—all critical aspects for GDI engines that operate at higher temperatures and pressures than traditional port fuel injection systems.

ASTM International provides complementary standards such as D7320 for measuring deposit formation in GDI injectors and D6594 for evaluating lubricant effects on fuel economy. These standards incorporate cycle-based testing methodologies that simulate real-world driving conditions, including cold starts, high-load operation, and extended idling periods that are particularly challenging for GDI systems.

The International Organization for Standardization (ISO) contributes global perspectives through standards like ISO 23581, which addresses lubricant performance in high-efficiency internal combustion engines. This standard specifically accounts for GDI engines' tendency toward increased oil dilution due to wall wetting phenomena and subsequent fuel contamination of the lubricant.

Manufacturer-specific durability standards often exceed these industry benchmarks, with companies like Toyota, Volkswagen, and Ford implementing proprietary test cycles that may extend to 100,000+ miles equivalent testing. These tests frequently incorporate accelerated aging protocols that compress years of service into weeks of laboratory evaluation.

Modern durability standards increasingly incorporate oil consumption measurements as a key performance indicator. The correlation between oil consumption rates and engine design factors such as piston ring configuration, cylinder liner surface finish, and PCV system design is carefully monitored throughout standardized test cycles.

Emerging standards are beginning to address GDI-specific concerns such as low-speed pre-ignition (LSPI) resistance and compatibility with stop-start systems. The ILSAC GF-6 specification, for instance, includes the Sequence IX test specifically designed to evaluate a lubricant's ability to mitigate LSPI events that can cause catastrophic engine damage in GDI applications.

As GDI technology continues to evolve toward higher injection pressures (now exceeding 350 bar in some applications), durability standards are adapting to ensure lubricants can maintain their protective properties under increasingly demanding conditions throughout the engine's operational lifetime.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!