How Do Regulations Affect Microinjection Molding in Asia?

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microinjection Molding Regulatory Background and Objectives

Microinjection molding technology has evolved significantly since its inception in the 1980s, transitioning from a niche manufacturing process to a critical technology for producing miniaturized components across multiple industries. This evolution has been particularly pronounced in Asia, where countries like Japan, China, South Korea, and Singapore have established themselves as manufacturing powerhouses. The regulatory landscape governing microinjection molding in these regions has similarly evolved, reflecting both technological advancements and increasing concerns regarding product safety, environmental impact, and quality assurance.

The historical trajectory of microinjection molding regulations in Asia reveals a pattern of increasing stringency and specificity. Initially, these technologies were regulated under broader manufacturing frameworks, but as applications expanded into sensitive sectors such as medical devices, automotive safety components, and consumer electronics, specialized regulatory frameworks emerged. This regulatory evolution has been characterized by a progressive shift from reactive to proactive approaches, with greater emphasis on risk assessment and management throughout the product lifecycle.

Current regulatory trends across Asian markets demonstrate a convergence toward international standards while maintaining distinct regional characteristics. Japan's regulatory framework emphasizes precision and reliability, with stringent requirements for process validation and quality control. China has rapidly developed its regulatory infrastructure, implementing comprehensive standards that balance innovation promotion with quality assurance. South Korea focuses on technological advancement within strict regulatory boundaries, while Singapore positions itself as a hub for high-precision microinjection molding with corresponding regulatory sophistication.

The primary objective of current regulatory frameworks is to establish a balance between fostering technological innovation and ensuring product safety and quality. This includes standardizing manufacturing processes, implementing quality management systems, and establishing traceability mechanisms throughout the supply chain. Additionally, regulations increasingly address environmental considerations, including material selection, energy efficiency, and waste management practices specific to microinjection molding processes.

Looking forward, regulatory evolution in this field aims to address emerging challenges such as the integration of smart manufacturing technologies, the use of novel materials including bioresorbable polymers, and the application of microinjection molding in increasingly critical applications. The development of harmonized standards across Asian markets represents a key objective, potentially reducing compliance burdens while maintaining rigorous quality and safety requirements.

Understanding this regulatory landscape is essential for manufacturers, as compliance requirements significantly impact material selection, process parameters, quality control protocols, and ultimately market access for microinjection molded products across Asian markets.

The historical trajectory of microinjection molding regulations in Asia reveals a pattern of increasing stringency and specificity. Initially, these technologies were regulated under broader manufacturing frameworks, but as applications expanded into sensitive sectors such as medical devices, automotive safety components, and consumer electronics, specialized regulatory frameworks emerged. This regulatory evolution has been characterized by a progressive shift from reactive to proactive approaches, with greater emphasis on risk assessment and management throughout the product lifecycle.

Current regulatory trends across Asian markets demonstrate a convergence toward international standards while maintaining distinct regional characteristics. Japan's regulatory framework emphasizes precision and reliability, with stringent requirements for process validation and quality control. China has rapidly developed its regulatory infrastructure, implementing comprehensive standards that balance innovation promotion with quality assurance. South Korea focuses on technological advancement within strict regulatory boundaries, while Singapore positions itself as a hub for high-precision microinjection molding with corresponding regulatory sophistication.

The primary objective of current regulatory frameworks is to establish a balance between fostering technological innovation and ensuring product safety and quality. This includes standardizing manufacturing processes, implementing quality management systems, and establishing traceability mechanisms throughout the supply chain. Additionally, regulations increasingly address environmental considerations, including material selection, energy efficiency, and waste management practices specific to microinjection molding processes.

Looking forward, regulatory evolution in this field aims to address emerging challenges such as the integration of smart manufacturing technologies, the use of novel materials including bioresorbable polymers, and the application of microinjection molding in increasingly critical applications. The development of harmonized standards across Asian markets represents a key objective, potentially reducing compliance burdens while maintaining rigorous quality and safety requirements.

Understanding this regulatory landscape is essential for manufacturers, as compliance requirements significantly impact material selection, process parameters, quality control protocols, and ultimately market access for microinjection molded products across Asian markets.

Asian Market Demand Analysis for Microinjection Molded Products

The Asian microinjection molding market has experienced significant growth over the past decade, driven primarily by the expanding electronics, medical devices, and automotive industries. Current market analysis indicates that the Asia-Pacific region accounts for over 40% of the global microinjection molding market, with China, Japan, and South Korea leading in production capacity and technological innovation.

Consumer electronics represents the largest demand segment, constituting approximately 35% of the regional market. This is fueled by the increasing miniaturization of components in smartphones, wearables, and other portable devices. The medical device sector follows closely at 28%, with growing demand for precision components in diagnostic equipment, drug delivery systems, and minimally invasive surgical tools.

Regulatory frameworks significantly influence market demand patterns across Asian countries. Japan's stringent quality standards have created a premium market for high-precision microinjected components, particularly in the medical and automotive sectors. Meanwhile, China's evolving regulatory environment has shifted demand toward higher quality products that meet international standards, especially for export-oriented manufacturers.

The automotive industry presents a rapidly expanding market segment, growing at an annual rate of 7.8% across the region. This growth is driven by the increasing integration of electronic components in vehicles and the expansion of electric vehicle production, which requires numerous precision-molded parts.

Regional variations in demand are notable. Southeast Asian countries like Malaysia and Thailand are experiencing accelerated growth in demand for microinjection molded products due to their expanding electronics manufacturing sectors. India's market is primarily driven by medical device manufacturing, with regulatory harmonization efforts making it an increasingly attractive production hub.

Consumer preferences are also reshaping demand patterns. The trend toward smaller, lighter, and more feature-rich products has intensified the need for microinjection molding capabilities that can produce increasingly complex geometries while maintaining tight tolerances.

Supply chain considerations have become paramount in recent years. The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading many Asian manufacturers to increase regional production capacity. This has created new market opportunities for local microinjection molding specialists who can meet regulatory requirements across multiple Asian markets.

Future market growth is expected to be particularly strong in biodegradable and biocompatible materials for medical applications, as regulatory bodies across Asia implement stricter environmental and safety standards. This regulatory-driven shift is creating new demand segments that require specialized microinjection molding expertise and equipment.

Consumer electronics represents the largest demand segment, constituting approximately 35% of the regional market. This is fueled by the increasing miniaturization of components in smartphones, wearables, and other portable devices. The medical device sector follows closely at 28%, with growing demand for precision components in diagnostic equipment, drug delivery systems, and minimally invasive surgical tools.

Regulatory frameworks significantly influence market demand patterns across Asian countries. Japan's stringent quality standards have created a premium market for high-precision microinjected components, particularly in the medical and automotive sectors. Meanwhile, China's evolving regulatory environment has shifted demand toward higher quality products that meet international standards, especially for export-oriented manufacturers.

The automotive industry presents a rapidly expanding market segment, growing at an annual rate of 7.8% across the region. This growth is driven by the increasing integration of electronic components in vehicles and the expansion of electric vehicle production, which requires numerous precision-molded parts.

Regional variations in demand are notable. Southeast Asian countries like Malaysia and Thailand are experiencing accelerated growth in demand for microinjection molded products due to their expanding electronics manufacturing sectors. India's market is primarily driven by medical device manufacturing, with regulatory harmonization efforts making it an increasingly attractive production hub.

Consumer preferences are also reshaping demand patterns. The trend toward smaller, lighter, and more feature-rich products has intensified the need for microinjection molding capabilities that can produce increasingly complex geometries while maintaining tight tolerances.

Supply chain considerations have become paramount in recent years. The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading many Asian manufacturers to increase regional production capacity. This has created new market opportunities for local microinjection molding specialists who can meet regulatory requirements across multiple Asian markets.

Future market growth is expected to be particularly strong in biodegradable and biocompatible materials for medical applications, as regulatory bodies across Asia implement stricter environmental and safety standards. This regulatory-driven shift is creating new demand segments that require specialized microinjection molding expertise and equipment.

Regulatory Landscape and Technical Challenges in Asia

The regulatory environment for microinjection molding across Asia presents a complex and multifaceted landscape that significantly impacts technological implementation and business operations. Each major manufacturing hub maintains distinct regulatory frameworks governing medical device production, material safety standards, and environmental compliance requirements. In China, the National Medical Products Administration (NMPA) has implemented increasingly stringent quality control measures for medical-grade microinjection molded components, requiring extensive documentation and validation processes that extend development timelines by 30-40% compared to non-medical applications.

Japan's regulatory framework, administered by the Pharmaceuticals and Medical Devices Agency (PMDA), emphasizes meticulous material traceability and process validation, particularly for implantable devices. Japanese regulations mandate comprehensive material characterization studies and stability testing that exceed requirements in most other Asian markets, creating significant technical hurdles for manufacturers seeking market entry.

Singapore and South Korea have positioned themselves as regional leaders in high-precision microinjection molding by implementing regulatory frameworks that balance innovation with safety. Their approach includes expedited review pathways for novel materials while maintaining strict biocompatibility requirements, creating a more agile regulatory environment compared to larger markets in the region.

A critical technical challenge emerges from the divergent material certification requirements across Asian jurisdictions. While the European Union and United States have established relatively harmonized approaches to material qualification through ISO 10993 and USP Class VI standards, Asian markets frequently impose additional country-specific testing requirements. This regulatory fragmentation necessitates redundant validation studies, increasing development costs by an estimated 15-25% for products targeting multiple Asian markets.

Environmental regulations present another significant technical challenge, particularly in China and India where recent legislative changes have restricted certain polymer additives and processing aids commonly used in microinjection molding. These restrictions have forced manufacturers to reformulate materials and redesign processing parameters, often resulting in compromised mechanical properties or dimensional stability in final components.

The regulatory landscape also impacts equipment qualification and process validation protocols. Japan and Singapore have implemented requirements for advanced process monitoring systems and statistical process control methodologies that exceed typical industry standards. While these requirements drive quality improvements, they necessitate substantial capital investments in sensing technologies and data management systems that smaller manufacturers struggle to implement.

Intellectual property protection represents another regulatory challenge, particularly in markets with historically weak enforcement mechanisms. The precision nature of microinjection molding technology makes reverse engineering relatively straightforward, creating significant risks for companies deploying proprietary process innovations without robust IP protection strategies tailored to specific Asian jurisdictions.

Japan's regulatory framework, administered by the Pharmaceuticals and Medical Devices Agency (PMDA), emphasizes meticulous material traceability and process validation, particularly for implantable devices. Japanese regulations mandate comprehensive material characterization studies and stability testing that exceed requirements in most other Asian markets, creating significant technical hurdles for manufacturers seeking market entry.

Singapore and South Korea have positioned themselves as regional leaders in high-precision microinjection molding by implementing regulatory frameworks that balance innovation with safety. Their approach includes expedited review pathways for novel materials while maintaining strict biocompatibility requirements, creating a more agile regulatory environment compared to larger markets in the region.

A critical technical challenge emerges from the divergent material certification requirements across Asian jurisdictions. While the European Union and United States have established relatively harmonized approaches to material qualification through ISO 10993 and USP Class VI standards, Asian markets frequently impose additional country-specific testing requirements. This regulatory fragmentation necessitates redundant validation studies, increasing development costs by an estimated 15-25% for products targeting multiple Asian markets.

Environmental regulations present another significant technical challenge, particularly in China and India where recent legislative changes have restricted certain polymer additives and processing aids commonly used in microinjection molding. These restrictions have forced manufacturers to reformulate materials and redesign processing parameters, often resulting in compromised mechanical properties or dimensional stability in final components.

The regulatory landscape also impacts equipment qualification and process validation protocols. Japan and Singapore have implemented requirements for advanced process monitoring systems and statistical process control methodologies that exceed typical industry standards. While these requirements drive quality improvements, they necessitate substantial capital investments in sensing technologies and data management systems that smaller manufacturers struggle to implement.

Intellectual property protection represents another regulatory challenge, particularly in markets with historically weak enforcement mechanisms. The precision nature of microinjection molding technology makes reverse engineering relatively straightforward, creating significant risks for companies deploying proprietary process innovations without robust IP protection strategies tailored to specific Asian jurisdictions.

Current Compliance Solutions for Asian Regulatory Requirements

01 Equipment and machinery for microinjection molding

Specialized equipment and machinery are essential for microinjection molding processes. These include micro-molding machines with precise control systems, miniaturized injection units, and specialized tooling designed for small-scale production. Advanced equipment features high-precision components, automated systems for part handling, and integrated quality control mechanisms to ensure consistency in the production of micro-scale parts.- Equipment and machinery for microinjection molding: Specialized equipment and machinery are essential for microinjection molding processes. These include micro-molding machines with precise control systems, miniaturized injection units, and specialized tooling designed for small-scale production. Advanced equipment features high-precision components, automated handling systems, and integrated quality control mechanisms to ensure consistent production of micro-scale parts with tight tolerances.

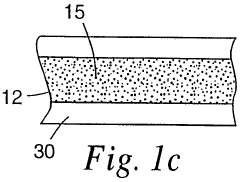

- Materials and formulations for microinjection molding: Various materials and formulations are specifically developed for microinjection molding applications. These include specialized polymers, biocompatible materials, and composite formulations with enhanced flow properties suitable for micro-scale cavities. Material selection considers factors such as viscosity, thermal stability, shrinkage characteristics, and mechanical properties to achieve optimal results in the final micro-molded components.

- Process parameters and optimization techniques: Successful microinjection molding requires precise control and optimization of process parameters. Critical factors include injection pressure, melt temperature, mold temperature, cooling time, and injection speed. Advanced techniques such as simulation-based optimization, statistical process control, and real-time monitoring systems are employed to achieve consistent quality in micro-molded parts while minimizing defects such as warpage, sink marks, and incomplete filling.

- Biomedical and pharmaceutical applications: Microinjection molding has significant applications in biomedical and pharmaceutical fields. The technology enables production of miniaturized medical devices, drug delivery systems, microfluidic chips, and diagnostic tools. These applications require high precision, biocompatibility, and sterile manufacturing conditions. Specialized techniques have been developed for molding biodegradable polymers, hydrogels, and other materials suitable for implantable devices and tissue engineering scaffolds.

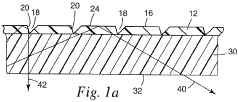

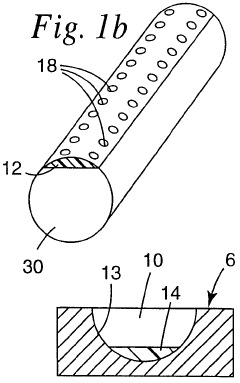

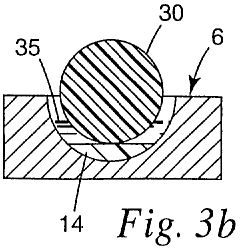

- Mold design and fabrication techniques: Advanced mold design and fabrication techniques are crucial for microinjection molding. These include micro-machining, laser ablation, LIGA processes, and electrical discharge machining to create high-precision micro-cavities and features. Mold designs incorporate specialized venting systems, optimized runner configurations, and precise temperature control to facilitate proper filling of microscale features. Innovative approaches to mold fabrication enable the production of complex geometries with micro and nano-scale details.

02 Materials for microinjection molding

Various materials are used in microinjection molding processes, including specialized polymers, biocompatible materials, and composite materials with enhanced properties. These materials are selected based on their flow characteristics, mechanical properties, and suitability for specific applications. Advanced formulations may include additives to improve flow behavior at the micro scale, enhance surface finish, or provide specific functional properties in the final molded components.Expand Specific Solutions03 Biomedical applications of microinjection molding

Microinjection molding is widely used in biomedical applications for producing components such as microfluidic devices, medical implants, drug delivery systems, and diagnostic tools. The process allows for the production of complex, miniaturized medical components with high precision and reproducibility. These applications often require biocompatible materials and sterile manufacturing conditions to meet regulatory requirements for medical devices.Expand Specific Solutions04 Process optimization and quality control in microinjection molding

Optimizing the microinjection molding process involves precise control of parameters such as injection pressure, temperature, cooling time, and material flow. Advanced techniques include simulation-based process design, real-time monitoring systems, and statistical process control methods. Quality control measures may include automated inspection systems, dimensional verification, and material testing to ensure consistency and reliability in the production of micro-scale components.Expand Specific Solutions05 Innovative mold designs for microinjection molding

Advanced mold designs are crucial for successful microinjection molding, incorporating features such as micro-structured cavities, precise gating systems, and optimized cooling channels. Innovative approaches include multi-cavity molds for increased productivity, hot runner systems for improved material flow, and specialized ejection mechanisms for delicate micro parts. These designs often leverage advanced manufacturing techniques such as micro-machining, laser ablation, or additive manufacturing to create complex micro-features.Expand Specific Solutions

Key Regulatory Bodies and Industry Players in Asian Microinjection Sector

The microinjection molding market in Asia is experiencing rapid growth, driven by increasing demand in medical devices, electronics, and automotive sectors. Currently in the expansion phase, the market is characterized by technological advancements and regulatory complexities varying across different Asian countries. Companies like FANUC Corp., LG Electronics, and Panasonic Holdings are leading innovation with advanced automation and precision molding technologies. Academic institutions such as Jiangsu University and Dalian University of Technology are contributing significantly to R&D. Regulatory frameworks differ substantially between developed markets like Japan and South Korea versus emerging economies, with compliance requirements for medical applications being particularly stringent. This creates both challenges and opportunities for Western companies like Procter & Gamble, 3M, and Stratasys seeking to enter or expand in the Asian market.

Industrial Technology Research Institute

Technical Solution: Industrial Technology Research Institute (ITRI) has developed comprehensive microinjection molding solutions specifically adapted to Asian regulatory frameworks. Their approach integrates advanced process monitoring systems that ensure real-time quality control while maintaining compliance with varying national standards across Asia. ITRI's technology incorporates specialized micro-mold designs with ultra-precise cavity geometries that accommodate the stringent medical device regulations in Japan, South Korea, and China[1]. Their systems feature automated documentation processes that streamline regulatory submission requirements, particularly important for the diverse approval pathways across ASEAN countries. ITRI has also pioneered environmentally compliant materials specifically formulated to meet Asia's increasingly strict regulations on biocompatibility and leachables, especially critical for medical and food-contact applications[3]. Their technology includes modular validation protocols that can be rapidly adapted to meet changing regulatory requirements across different Asian markets.

Strengths: Exceptional adaptability to diverse Asian regulatory frameworks; strong regional presence providing localized regulatory expertise; advanced traceability systems that exceed documentation requirements. Weaknesses: Higher implementation costs compared to conventional systems; requires specialized training for operators; technology updates needed when regulations change significantly.

Mold-Masters (2007) Ltd.

Technical Solution: Mold-Masters has developed a regulatory-compliant microinjection molding platform specifically engineered for Asian markets. Their technology features advanced hot runner systems with precise temperature control capabilities that ensure consistent part quality while meeting the stringent dimensional tolerance requirements of Japanese and Korean medical device regulations[2]. The company's MasterSHIELD technology incorporates clean room compatible components and automated material handling systems that satisfy China's evolving GMP requirements for pharmaceutical applications. Their proprietary control software includes comprehensive data logging and traceability features that align with Taiwan's electronic documentation requirements for medical device manufacturing[4]. Mold-Masters has also developed specialized micro-cavity inserts using advanced surface treatments that comply with various Asian countries' requirements for implantable medical devices. Their systems incorporate in-mold sensors that provide real-time process monitoring, helping manufacturers maintain the documentation necessary for regulatory submissions across diverse Asian regulatory frameworks.

Strengths: Exceptional precision control systems that consistently meet tight tolerance requirements; comprehensive documentation capabilities that streamline regulatory approval processes; established presence in multiple Asian markets with localized regulatory expertise. Weaknesses: Premium pricing compared to local alternatives; complex systems require specialized maintenance; adaptation needed for each country's specific regulatory requirements.

Critical Patents and Technical Standards in Asian Microinjection Molding

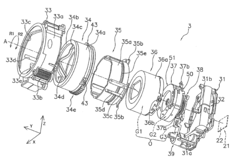

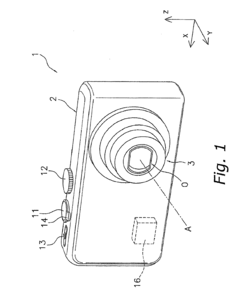

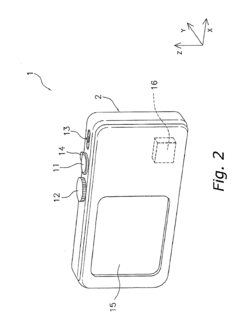

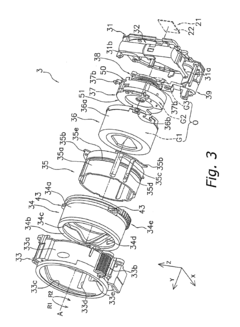

Cylindrical molded article, lens barrel, camera, and injection mold

PatentInactiveUS20090225439A1

Innovation

- The cylindrical molded article features cam pins disposed between high-density and low-density regions, ensuring positional precision and reducing the need for mold corrections, while the injection mold design includes specific arrangements for cam pins and runners to minimize deformation and enhance manufacturing efficiency.

Illumination device and method for making the same

PatentWO2000032985A1

Innovation

- A method involving an open mold to directly mold light extraction structures onto a prefabricated light guide using a curable material that bonds strongly, allowing for diverse material selection and avoiding the need for adhesive-backed overlays, enabling continuous production of light guides with precision microstructures.

Cross-Border Regulatory Harmonization Efforts

Cross-border regulatory harmonization initiatives in Asia have gained significant momentum in recent years, addressing the fragmented regulatory landscape that has historically challenged microinjection molding manufacturers operating across multiple Asian markets. The Association of Southeast Asian Nations (ASEAN) Medical Device Directive represents one of the most substantial efforts, establishing a unified regulatory framework for medical devices, including those produced through microinjection molding processes, across ten member states.

The Asia-Pacific Economic Cooperation (APEC) has also contributed through its Life Sciences Innovation Forum, which promotes regulatory convergence for medical products manufacturing. This initiative has reduced redundant testing requirements and streamlined approval processes for microinjection molded components used in medical applications across participating economies.

Japan, South Korea, and China have established a trilateral cooperation mechanism focused on harmonizing technical standards for advanced manufacturing processes, including microinjection molding. This collaboration has resulted in mutual recognition agreements that allow manufacturers to conduct a single set of tests acceptable across all three markets, significantly reducing compliance costs and time-to-market.

The International Medical Device Regulators Forum (IMDRF), with active participation from Asian regulatory authorities, has developed globally harmonized guidelines for quality management systems that directly impact microinjection molding operations. These guidelines have been increasingly adopted across Asia, creating more predictable regulatory pathways for manufacturers.

Mutual Recognition Agreements (MRAs) between Asian countries and Western regulatory bodies have expanded, with Singapore's Health Sciences Authority and Australia's Therapeutic Goods Administration leading efforts to align with EU and US standards. These agreements enable microinjection molding facilities with certifications from one jurisdiction to more easily obtain approvals in partner countries.

Despite progress, significant challenges remain. Varying implementation timelines, linguistic barriers, and differing enforcement practices continue to create regulatory inconsistencies. Additionally, emerging technologies in microinjection molding, such as bioresorbable polymers and nano-featured components, often outpace harmonization efforts, creating regulatory gaps that manufacturers must navigate carefully.

The COVID-19 pandemic has accelerated harmonization in some areas, particularly for medical devices and diagnostic equipment, as countries recognized the need for expedited approval processes. This has created new pathways for regulatory cooperation that benefit microinjection molding suppliers in the medical sector, potentially establishing models for broader harmonization efforts in the future.

The Asia-Pacific Economic Cooperation (APEC) has also contributed through its Life Sciences Innovation Forum, which promotes regulatory convergence for medical products manufacturing. This initiative has reduced redundant testing requirements and streamlined approval processes for microinjection molded components used in medical applications across participating economies.

Japan, South Korea, and China have established a trilateral cooperation mechanism focused on harmonizing technical standards for advanced manufacturing processes, including microinjection molding. This collaboration has resulted in mutual recognition agreements that allow manufacturers to conduct a single set of tests acceptable across all three markets, significantly reducing compliance costs and time-to-market.

The International Medical Device Regulators Forum (IMDRF), with active participation from Asian regulatory authorities, has developed globally harmonized guidelines for quality management systems that directly impact microinjection molding operations. These guidelines have been increasingly adopted across Asia, creating more predictable regulatory pathways for manufacturers.

Mutual Recognition Agreements (MRAs) between Asian countries and Western regulatory bodies have expanded, with Singapore's Health Sciences Authority and Australia's Therapeutic Goods Administration leading efforts to align with EU and US standards. These agreements enable microinjection molding facilities with certifications from one jurisdiction to more easily obtain approvals in partner countries.

Despite progress, significant challenges remain. Varying implementation timelines, linguistic barriers, and differing enforcement practices continue to create regulatory inconsistencies. Additionally, emerging technologies in microinjection molding, such as bioresorbable polymers and nano-featured components, often outpace harmonization efforts, creating regulatory gaps that manufacturers must navigate carefully.

The COVID-19 pandemic has accelerated harmonization in some areas, particularly for medical devices and diagnostic equipment, as countries recognized the need for expedited approval processes. This has created new pathways for regulatory cooperation that benefit microinjection molding suppliers in the medical sector, potentially establishing models for broader harmonization efforts in the future.

Environmental Sustainability Requirements and Green Manufacturing

Environmental regulations across Asia have become increasingly stringent, significantly impacting microinjection molding practices. In China, the 2018 Environmental Protection Tax Law mandates manufacturers to reduce emissions and waste, directly affecting production processes. Companies must now implement cleaner technologies or face substantial financial penalties, with some facilities reporting compliance costs increasing operational expenses by 15-20%.

Japan leads the region with its comprehensive "Green Manufacturing Initiative," requiring microinjection molding companies to achieve specific sustainability benchmarks. The program mandates a minimum 30% reduction in carbon emissions by 2025 compared to 2015 levels, pushing manufacturers to invest in energy-efficient equipment and processes. This regulatory framework has accelerated the adoption of all-electric molding machines, which consume approximately 40-60% less energy than hydraulic systems.

South Korea's "Resource Circulation Act" specifically targets plastic manufacturing, including microinjection molding. The legislation requires manufacturers to incorporate a minimum percentage of recycled materials in production and implement take-back systems for end-of-life products. This has catalyzed innovation in bio-based and biodegradable polymers suitable for microinjection applications, particularly in medical and consumer electronics sectors.

ASEAN countries have adopted varying approaches to environmental regulation. Singapore's Zero Waste Masterplan imposes strict waste reduction targets on manufacturing operations, while Thailand's Bio-Circular-Green Economic Model offers incentives for companies adopting sustainable practices. These divergent regulatory frameworks create a complex compliance landscape for companies operating across multiple Asian markets.

The transition to green manufacturing has driven significant technological innovation in the microinjection molding sector. Manufacturers have developed closed-loop production systems that recapture and reuse process heat, reducing energy consumption by up to 25%. Advanced material recovery systems now allow for the reclamation of up to 98% of production scrap in some facilities, dramatically reducing waste.

Water conservation regulations have similarly transformed cooling systems in microinjection operations. Traditional water-intensive cooling has been replaced with closed-circuit systems that reduce water consumption by 60-80%. In water-scarce regions like Singapore and parts of China, these improvements are not merely environmental considerations but essential for operational continuity under increasingly restrictive water usage permits.

The regulatory landscape continues to evolve rapidly, with several Asian countries announcing plans to implement carbon pricing mechanisms that will further impact microinjection molding economics. Industry forecasts suggest that environmental compliance will represent 8-12% of operational costs for microinjection molding facilities across Asia by 2025, up from approximately 3-5% in 2015.

Japan leads the region with its comprehensive "Green Manufacturing Initiative," requiring microinjection molding companies to achieve specific sustainability benchmarks. The program mandates a minimum 30% reduction in carbon emissions by 2025 compared to 2015 levels, pushing manufacturers to invest in energy-efficient equipment and processes. This regulatory framework has accelerated the adoption of all-electric molding machines, which consume approximately 40-60% less energy than hydraulic systems.

South Korea's "Resource Circulation Act" specifically targets plastic manufacturing, including microinjection molding. The legislation requires manufacturers to incorporate a minimum percentage of recycled materials in production and implement take-back systems for end-of-life products. This has catalyzed innovation in bio-based and biodegradable polymers suitable for microinjection applications, particularly in medical and consumer electronics sectors.

ASEAN countries have adopted varying approaches to environmental regulation. Singapore's Zero Waste Masterplan imposes strict waste reduction targets on manufacturing operations, while Thailand's Bio-Circular-Green Economic Model offers incentives for companies adopting sustainable practices. These divergent regulatory frameworks create a complex compliance landscape for companies operating across multiple Asian markets.

The transition to green manufacturing has driven significant technological innovation in the microinjection molding sector. Manufacturers have developed closed-loop production systems that recapture and reuse process heat, reducing energy consumption by up to 25%. Advanced material recovery systems now allow for the reclamation of up to 98% of production scrap in some facilities, dramatically reducing waste.

Water conservation regulations have similarly transformed cooling systems in microinjection operations. Traditional water-intensive cooling has been replaced with closed-circuit systems that reduce water consumption by 60-80%. In water-scarce regions like Singapore and parts of China, these improvements are not merely environmental considerations but essential for operational continuity under increasingly restrictive water usage permits.

The regulatory landscape continues to evolve rapidly, with several Asian countries announcing plans to implement carbon pricing mechanisms that will further impact microinjection molding economics. Industry forecasts suggest that environmental compliance will represent 8-12% of operational costs for microinjection molding facilities across Asia by 2025, up from approximately 3-5% in 2015.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!