Overview of Patents in Microinjection Molding Methodologies

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microinjection Molding Technology Evolution and Objectives

Microinjection molding technology emerged in the late 1980s as a specialized adaptation of conventional injection molding, designed to produce miniaturized components with high precision. The evolution of this technology has been driven by increasing demands from industries such as medical devices, electronics, and microfluidics, where components with microscale features and tight tolerances are essential.

The initial development phase (1985-1995) focused primarily on adapting existing injection molding equipment for smaller shot sizes and higher precision. During this period, the fundamental challenges of material flow behavior at the microscale were identified, leading to the first specialized microinjection molding machines introduced by companies like Battenfeld and Arburg.

The second evolutionary phase (1995-2005) witnessed significant advancements in machine design, with the introduction of dedicated microinjection molding systems featuring improved control over injection parameters, enhanced precision, and specialized screw designs. This period also saw the development of specialized mold technologies, including micro-EDM (Electrical Discharge Machining) and LIGA (Lithography, Electroplating, and Molding) processes for creating high-aspect-ratio microstructures.

From 2005 to 2015, the technology matured with integration of advanced process monitoring and control systems. Patent activity during this period reveals a strong focus on overcoming challenges related to material flow, demolding of microfeatures, and achieving consistent part quality. Innovations in variothermal processing, where mold temperature is dynamically controlled during the injection cycle, represented a significant breakthrough for replicating high-aspect-ratio microstructures.

The most recent evolutionary phase (2015-present) has been characterized by the integration of Industry 4.0 concepts, with smart manufacturing approaches incorporating real-time process monitoring, machine learning algorithms for process optimization, and automated quality control systems. Patent trends indicate growing interest in multi-material microinjection molding and the processing of novel materials including biocompatible and biodegradable polymers.

The primary technical objectives driving innovation in microinjection molding include: achieving sub-micron feature replication with high fidelity; reducing cycle times while maintaining quality; developing specialized materials optimized for microscale flow behavior; improving energy efficiency; and enhancing process reliability through advanced monitoring and control systems. These objectives align with broader industry trends toward miniaturization, functional integration, and sustainable manufacturing practices.

Looking forward, the technology roadmap suggests continued evolution toward fully automated micro-manufacturing cells, with microinjection molding as a central component in integrated production systems for complex microscale devices.

The initial development phase (1985-1995) focused primarily on adapting existing injection molding equipment for smaller shot sizes and higher precision. During this period, the fundamental challenges of material flow behavior at the microscale were identified, leading to the first specialized microinjection molding machines introduced by companies like Battenfeld and Arburg.

The second evolutionary phase (1995-2005) witnessed significant advancements in machine design, with the introduction of dedicated microinjection molding systems featuring improved control over injection parameters, enhanced precision, and specialized screw designs. This period also saw the development of specialized mold technologies, including micro-EDM (Electrical Discharge Machining) and LIGA (Lithography, Electroplating, and Molding) processes for creating high-aspect-ratio microstructures.

From 2005 to 2015, the technology matured with integration of advanced process monitoring and control systems. Patent activity during this period reveals a strong focus on overcoming challenges related to material flow, demolding of microfeatures, and achieving consistent part quality. Innovations in variothermal processing, where mold temperature is dynamically controlled during the injection cycle, represented a significant breakthrough for replicating high-aspect-ratio microstructures.

The most recent evolutionary phase (2015-present) has been characterized by the integration of Industry 4.0 concepts, with smart manufacturing approaches incorporating real-time process monitoring, machine learning algorithms for process optimization, and automated quality control systems. Patent trends indicate growing interest in multi-material microinjection molding and the processing of novel materials including biocompatible and biodegradable polymers.

The primary technical objectives driving innovation in microinjection molding include: achieving sub-micron feature replication with high fidelity; reducing cycle times while maintaining quality; developing specialized materials optimized for microscale flow behavior; improving energy efficiency; and enhancing process reliability through advanced monitoring and control systems. These objectives align with broader industry trends toward miniaturization, functional integration, and sustainable manufacturing practices.

Looking forward, the technology roadmap suggests continued evolution toward fully automated micro-manufacturing cells, with microinjection molding as a central component in integrated production systems for complex microscale devices.

Market Applications and Demand Analysis for Microinjection Molding

The microinjection molding market has experienced significant growth over the past decade, driven primarily by increasing demand for miniaturized components across multiple industries. The global market value for microinjection molding was estimated at $1.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 7.2% through 2030. This growth trajectory reflects the expanding applications of this technology in various high-value sectors.

Medical device manufacturing represents the largest application segment, accounting for approximately 38% of the total market share. The demand for minimally invasive surgical tools, drug delivery systems, microfluidic devices, and implantable components has created substantial opportunities for microinjection molding technologies. The increasing prevalence of chronic diseases and the aging global population further amplify this demand, as healthcare providers seek smaller, more precise medical instruments and devices.

The electronics industry constitutes the second-largest application segment at 27% market share. The continuous miniaturization trend in consumer electronics, coupled with the growing complexity of electronic components, has intensified the need for high-precision microinjection molding capabilities. Microconnectors, switches, sensors, and other miniaturized electronic parts require the dimensional accuracy and material versatility that advanced microinjection molding processes can provide.

Automotive applications represent a rapidly growing segment (18% market share), particularly with the transition toward electric vehicles and advanced driver assistance systems. These technologies require numerous small, high-precision components that can be efficiently produced through microinjection molding. Weight reduction initiatives in the automotive industry further drive demand for micro-molded parts that can replace heavier traditional components.

Emerging applications in aerospace, telecommunications, and biotechnology collectively account for the remaining 17% of market demand. These sectors are increasingly adopting microinjection molding for specialized applications such as micro-optical components, microfluidic chips for genetic analysis, and miniaturized communication devices.

Regional analysis reveals that North America and Europe currently dominate the market with combined market share of 58%, primarily due to their established medical device and automotive industries. However, the Asia-Pacific region is experiencing the fastest growth rate at 9.8% annually, driven by rapid industrialization, increasing healthcare expenditure, and the expanding electronics manufacturing base in countries like China, Japan, and South Korea.

Customer requirements are evolving toward higher precision (tolerances below ±5 μm), enhanced surface finishes, and the ability to process advanced materials including high-performance polymers, bioresorbable materials, and polymer-metal composites. These market demands are directly influencing patent activities in microinjection molding methodologies, with particular emphasis on process optimization, tooling innovations, and material development.

Medical device manufacturing represents the largest application segment, accounting for approximately 38% of the total market share. The demand for minimally invasive surgical tools, drug delivery systems, microfluidic devices, and implantable components has created substantial opportunities for microinjection molding technologies. The increasing prevalence of chronic diseases and the aging global population further amplify this demand, as healthcare providers seek smaller, more precise medical instruments and devices.

The electronics industry constitutes the second-largest application segment at 27% market share. The continuous miniaturization trend in consumer electronics, coupled with the growing complexity of electronic components, has intensified the need for high-precision microinjection molding capabilities. Microconnectors, switches, sensors, and other miniaturized electronic parts require the dimensional accuracy and material versatility that advanced microinjection molding processes can provide.

Automotive applications represent a rapidly growing segment (18% market share), particularly with the transition toward electric vehicles and advanced driver assistance systems. These technologies require numerous small, high-precision components that can be efficiently produced through microinjection molding. Weight reduction initiatives in the automotive industry further drive demand for micro-molded parts that can replace heavier traditional components.

Emerging applications in aerospace, telecommunications, and biotechnology collectively account for the remaining 17% of market demand. These sectors are increasingly adopting microinjection molding for specialized applications such as micro-optical components, microfluidic chips for genetic analysis, and miniaturized communication devices.

Regional analysis reveals that North America and Europe currently dominate the market with combined market share of 58%, primarily due to their established medical device and automotive industries. However, the Asia-Pacific region is experiencing the fastest growth rate at 9.8% annually, driven by rapid industrialization, increasing healthcare expenditure, and the expanding electronics manufacturing base in countries like China, Japan, and South Korea.

Customer requirements are evolving toward higher precision (tolerances below ±5 μm), enhanced surface finishes, and the ability to process advanced materials including high-performance polymers, bioresorbable materials, and polymer-metal composites. These market demands are directly influencing patent activities in microinjection molding methodologies, with particular emphasis on process optimization, tooling innovations, and material development.

Global Patent Landscape and Technical Challenges

The global patent landscape for microinjection molding reveals a concentrated distribution of intellectual property across North America, Europe, and East Asia. The United States, Germany, Japan, and China emerge as the dominant players, collectively accounting for over 70% of all patents in this field. This geographic concentration reflects the industrial capabilities and research infrastructure in these regions, with specialized clusters forming around manufacturing hubs.

Patent activity analysis indicates a significant acceleration in filing rates over the past decade, with an average annual growth of 12.3% since 2013. This surge corresponds with the increasing demand for miniaturized components across medical devices, electronics, and automotive applications. The patent density is particularly high in precision medical device manufacturing, where microinjection molding enables the production of complex geometries at microscale dimensions.

Technical challenges documented in patent literature reveal several persistent barriers to advancement. Material behavior at the microscale represents the most frequently addressed challenge, with approximately 35% of patents focusing on novel polymer formulations or processing techniques to overcome flow limitations. The unpredictable rheological properties of polymers in micro-cavities continue to present significant obstacles to consistent part quality and process reliability.

Demolding difficulties constitute another major technical hurdle, with nearly 28% of patents addressing solutions for high-aspect-ratio microfeatures. The increased surface-to-volume ratio in microparts intensifies adhesion forces between the polymer and mold surfaces, necessitating specialized surface treatments and ejection mechanisms.

Process control precision represents the third significant challenge area, with 22% of patents focusing on advanced sensing and feedback systems. The reduced tolerance margins in microinjection molding demand unprecedented precision in process parameters, where even minor variations can lead to significant quality issues.

Emerging patent trends indicate growing interest in hybrid manufacturing approaches that combine microinjection molding with complementary technologies such as 3D printing, laser micromachining, and in-mold assembly. These convergent technologies aim to overcome the inherent limitations of conventional microinjection molding while expanding the range of achievable geometries and material combinations.

Cross-disciplinary patent citations reveal increasing integration with adjacent fields, particularly microfluidics, biomedical implants, and semiconductor packaging. This trend suggests that future innovations will likely emerge at the intersection of these domains, driving new applications and technical solutions for increasingly complex micromanufacturing challenges.

Patent activity analysis indicates a significant acceleration in filing rates over the past decade, with an average annual growth of 12.3% since 2013. This surge corresponds with the increasing demand for miniaturized components across medical devices, electronics, and automotive applications. The patent density is particularly high in precision medical device manufacturing, where microinjection molding enables the production of complex geometries at microscale dimensions.

Technical challenges documented in patent literature reveal several persistent barriers to advancement. Material behavior at the microscale represents the most frequently addressed challenge, with approximately 35% of patents focusing on novel polymer formulations or processing techniques to overcome flow limitations. The unpredictable rheological properties of polymers in micro-cavities continue to present significant obstacles to consistent part quality and process reliability.

Demolding difficulties constitute another major technical hurdle, with nearly 28% of patents addressing solutions for high-aspect-ratio microfeatures. The increased surface-to-volume ratio in microparts intensifies adhesion forces between the polymer and mold surfaces, necessitating specialized surface treatments and ejection mechanisms.

Process control precision represents the third significant challenge area, with 22% of patents focusing on advanced sensing and feedback systems. The reduced tolerance margins in microinjection molding demand unprecedented precision in process parameters, where even minor variations can lead to significant quality issues.

Emerging patent trends indicate growing interest in hybrid manufacturing approaches that combine microinjection molding with complementary technologies such as 3D printing, laser micromachining, and in-mold assembly. These convergent technologies aim to overcome the inherent limitations of conventional microinjection molding while expanding the range of achievable geometries and material combinations.

Cross-disciplinary patent citations reveal increasing integration with adjacent fields, particularly microfluidics, biomedical implants, and semiconductor packaging. This trend suggests that future innovations will likely emerge at the intersection of these domains, driving new applications and technical solutions for increasingly complex micromanufacturing challenges.

Current Patented Methodologies and Technical Solutions

01 Equipment and apparatus for microinjection molding

Specialized equipment and apparatus are essential for microinjection molding processes. These include micro-molds with precise cavity designs, advanced injection units capable of delivering small material volumes with high accuracy, and specialized clamping systems. The equipment often features enhanced control systems for temperature, pressure, and injection speed to ensure the production of high-quality micro components with tight tolerances.- Equipment and apparatus for microinjection molding: Specialized equipment and apparatus are essential for microinjection molding processes. These include micro-molds with precise cavity designs, advanced injection units capable of delivering small material volumes with high accuracy, and specialized clamping systems. The equipment often features enhanced temperature control systems, high-precision positioning mechanisms, and integrated monitoring tools to ensure consistent quality in the production of micro-scale components.

- Material selection and preparation for microinjection molding: The selection and preparation of materials play a crucial role in microinjection molding. Materials must possess specific rheological properties suitable for micro-scale flow, including low viscosity and high melt flow index. Polymer blends, thermoplastic elastomers, and specialized compounds with additives are commonly used. Proper drying, conditioning, and contamination control of materials are essential to prevent defects in the final micro-molded products.

- Process parameters and optimization techniques: Optimizing process parameters is critical for successful microinjection molding. Key parameters include injection speed, pressure profiles, holding time, cooling rate, and mold temperature. Advanced techniques such as vacuum-assisted molding, variotherm processes, and precise gate control are employed to enhance filling of micro-features. Simulation software and design of experiments methodologies help in determining optimal processing windows for specific micro-components.

- Biomedical applications of microinjection molding: Microinjection molding has significant applications in the biomedical field. It enables the production of micro-needles, microfluidic devices, implantable medical components, and lab-on-a-chip systems. The process allows for the creation of complex geometries with biocompatible materials while maintaining sterility requirements. These micro-molded components are used in drug delivery systems, diagnostic devices, and tissue engineering applications.

- Quality control and metrology for micro-molded parts: Quality control and metrology are essential aspects of microinjection molding. Advanced inspection techniques include optical and laser scanning, micro-CT imaging, and atomic force microscopy to verify dimensional accuracy and surface quality. In-line monitoring systems detect variations in process parameters that might affect part quality. Statistical process control methods are implemented to maintain consistency in high-volume production of micro-components with tight tolerances.

02 Material selection and preparation for microinjection molding

The selection and preparation of materials play a crucial role in microinjection molding. Materials must possess specific rheological properties to fill micro-cavities effectively. Polymer blends, thermoplastic elastomers, and engineered resins are commonly used. Material preparation involves precise drying, conditioning, and sometimes modification with additives to enhance flow properties and prevent degradation during the high-shear conditions of the microinjection process.Expand Specific Solutions03 Process parameters and optimization techniques

Optimizing process parameters is critical for successful microinjection molding. Key parameters include melt temperature, injection speed, holding pressure, cooling time, and mold temperature. Advanced techniques such as Design of Experiments (DOE) and simulation software are used to determine optimal processing windows. Real-time monitoring and adaptive control systems help maintain consistency and quality in the production of micro components with complex geometries.Expand Specific Solutions04 Biological and medical applications of microinjection molding

Microinjection molding has significant applications in biological and medical fields. It enables the production of microfluidic devices, lab-on-a-chip systems, drug delivery components, and medical diagnostic tools. The technology allows for the creation of complex microstructures with biocompatible materials, facilitating advancements in point-of-care diagnostics, tissue engineering, and personalized medicine. Special considerations include material biocompatibility and sterile manufacturing environments.Expand Specific Solutions05 Advanced microinjection molding techniques and innovations

Innovative techniques are continuously being developed to enhance microinjection molding capabilities. These include multi-material microinjection molding, micro-assembly injection molding, and in-mold decoration for micro components. Other advancements include vacuum-assisted microinjection molding, ultrasonic-assisted processes, and integration with additive manufacturing technologies. These innovations enable the production of increasingly complex micro parts with enhanced functionality and improved surface quality.Expand Specific Solutions

Leading Patent Holders and Industry Competitors

Microinjection molding technology is currently in a growth phase, with the market expected to reach significant expansion due to increasing demand for miniaturized components across medical, automotive, and electronics sectors. The competitive landscape features established players like Husky Injection Molding Systems leading in equipment manufacturing, while technology giants such as IBM and GlobalFoundries contribute advanced process innovations. Asian manufacturers including Huawei and Shenzhen Futaihong are rapidly gaining market share, particularly in consumer electronics applications. Academic institutions like Jiangsu University and University of Melbourne are driving fundamental research advancements. The technology is approaching maturity in traditional applications but remains in development for emerging fields such as microfluidics and biomedical devices, with companies like 3M and SABIC advancing material science aspects of the technology.

Husky Injection Molding Systems Ltd.

Technical Solution: Husky has developed advanced microinjection molding systems featuring their Ultra SideGate™ technology specifically designed for micro-parts with weights as low as 0.05g. Their patented technology incorporates precise thermal control systems that maintain melt temperature within ±0.2°C throughout the injection process, critical for micro-feature replication. Husky's systems employ specialized screw designs with compression ratios optimized for microinjection applications (typically 2.5:1 to 3:1) and utilize advanced servo-electric drives that achieve positioning accuracy of ±0.001mm. Their patented valve gate technology enables gate opening/closing cycles under 100ms, allowing for high-precision dosing in micro-applications. Husky has also pioneered multi-layer microinjection technology that can create micro-components with distinct material layers as thin as 25μm, particularly valuable for medical device applications requiring biocompatible surfaces with different mechanical properties in the core.

Strengths: Industry-leading precision in thermal control and positioning accuracy; specialized expertise in medical and electronics micro-components; comprehensive patent portfolio covering both hardware and process methodologies. Weaknesses: Systems typically require higher capital investment than competitors; specialized tooling requirements may increase overall implementation costs; systems optimized primarily for higher production volumes.

SABIC Global Technologies BV

Technical Solution: SABIC has developed an extensive patent portfolio focused on specialized materials and processing techniques for microinjection molding. Their LNP™ Thermocomp compound series features patented nano-fillers that enable flow through micro-channels as small as 50μm while maintaining structural integrity and dimensional stability. SABIC's patents cover specialized nucleating agents that accelerate crystallization in semi-crystalline polymers, reducing cycle times in microinjection applications by up to 30% while improving feature replication. Their "Microprecision" technology incorporates patented processing additives that significantly reduce mold surface friction, enabling filling of high-aspect-ratio microfeatures (up to 20:1) without excessive injection pressures. SABIC has also patented specialized polymer blends with precisely controlled melt elasticity properties that prevent defects common in microinjection molding such as jetting and hesitation marks. Recent patents focus on sustainable materials specifically formulated for medical microinjection applications, including compounds that maintain dimensional stability within ±3μm while incorporating up to 40% recycled content, addressing growing regulatory requirements in medical device manufacturing.

Strengths: Comprehensive material science expertise specifically applied to microinjection challenges; ability to customize formulations for specific application requirements; strong integration between material development and processing parameters. Weaknesses: Material solutions often require specific processing conditions that may not be achievable on all equipment; higher material costs compared to standard resins; some specialized formulations have limited shelf life or special handling requirements.

Key Patent Analysis and Technical Innovations

Method of injection molding with constant-velocity flow front control

PatentInactiveEP3317075A1

Innovation

- A method using mold modeling software to determine a set of operating conditions for the injection molding system that maintains a constant flow front velocity throughout the filling process by adjusting the force profile based on the cross-sectional area of the mold cavity, ensuring uniform flow front velocity despite changes in thickness.

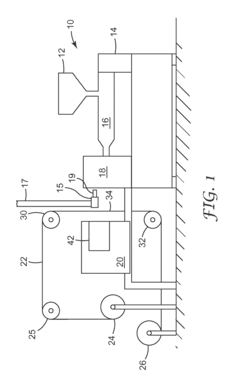

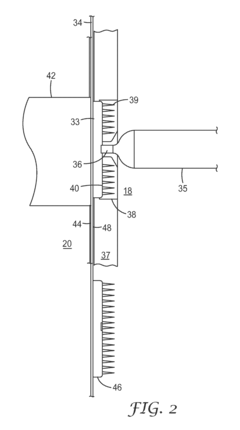

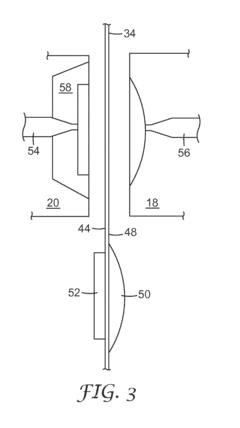

Articles injection molded on a web

PatentActiveUS20120263919A1

Innovation

- The method involves using an injection molding apparatus with ultrasonic vibrations, electromagnetic induction heating, and dynamic mold temperature cycling to mold microstructured parts on a carrier web, allowing for rapid and precise filling of microcavities with polymer melt, and enabling shorter mold cycle times.

Patent Licensing and Commercialization Strategies

The commercialization of microinjection molding patents requires strategic approaches to maximize return on investment while fostering innovation. Effective patent licensing strategies begin with comprehensive portfolio assessment, identifying which patents hold the greatest commercial potential based on market demand, technological uniqueness, and application versatility. Companies typically employ tiered licensing models, offering different terms for core versus peripheral technologies.

Exclusive licensing arrangements provide licensees with market exclusivity, commanding premium fees but limiting the licensor's revenue streams to fewer partners. Conversely, non-exclusive licensing enables broader market penetration through multiple licensees, potentially generating greater cumulative revenue while accelerating industry adoption of the technology. Cross-licensing agreements have emerged as particularly valuable in the microinjection molding sector, allowing companies to access complementary technologies without monetary exchanges.

Geographic licensing strategies play a crucial role, especially given the global manufacturing distribution of microinjection molding applications. Companies often segment their licensing approaches by region, applying different terms based on market maturity, competitive landscape, and intellectual property enforcement reliability. This territorial approach optimizes revenue while managing risk exposure in emerging markets.

Revenue models for patent licensing have evolved beyond traditional royalty structures. Performance-based licensing ties compensation to production volumes or sales figures, aligning incentives between licensors and licensees. Hybrid models incorporating upfront payments with reduced royalty rates have gained popularity, providing immediate capital for further R&D while maintaining long-term revenue streams.

Patent pooling represents an increasingly important commercialization strategy, particularly for microinjection molding technologies requiring multiple complementary patents. These collaborative arrangements simplify licensing processes for potential implementers while reducing transaction costs and litigation risks for patent holders. Notable examples include consortia formed around medical device manufacturing standards and automotive microcomponent production.

Direct commercialization through spin-off ventures offers an alternative to licensing for organizations with sufficient resources. This approach retains greater control over technology implementation and potentially captures more value across the supply chain. Universities and research institutions increasingly utilize this strategy, establishing start-ups to bridge the gap between academic innovation and commercial application in specialized microinjection molding markets.

Exclusive licensing arrangements provide licensees with market exclusivity, commanding premium fees but limiting the licensor's revenue streams to fewer partners. Conversely, non-exclusive licensing enables broader market penetration through multiple licensees, potentially generating greater cumulative revenue while accelerating industry adoption of the technology. Cross-licensing agreements have emerged as particularly valuable in the microinjection molding sector, allowing companies to access complementary technologies without monetary exchanges.

Geographic licensing strategies play a crucial role, especially given the global manufacturing distribution of microinjection molding applications. Companies often segment their licensing approaches by region, applying different terms based on market maturity, competitive landscape, and intellectual property enforcement reliability. This territorial approach optimizes revenue while managing risk exposure in emerging markets.

Revenue models for patent licensing have evolved beyond traditional royalty structures. Performance-based licensing ties compensation to production volumes or sales figures, aligning incentives between licensors and licensees. Hybrid models incorporating upfront payments with reduced royalty rates have gained popularity, providing immediate capital for further R&D while maintaining long-term revenue streams.

Patent pooling represents an increasingly important commercialization strategy, particularly for microinjection molding technologies requiring multiple complementary patents. These collaborative arrangements simplify licensing processes for potential implementers while reducing transaction costs and litigation risks for patent holders. Notable examples include consortia formed around medical device manufacturing standards and automotive microcomponent production.

Direct commercialization through spin-off ventures offers an alternative to licensing for organizations with sufficient resources. This approach retains greater control over technology implementation and potentially captures more value across the supply chain. Universities and research institutions increasingly utilize this strategy, establishing start-ups to bridge the gap between academic innovation and commercial application in specialized microinjection molding markets.

Intellectual Property Protection and Legal Considerations

Intellectual property protection in microinjection molding represents a critical consideration for manufacturers and innovators in this specialized field. Patent landscapes reveal that major industrial players have established robust IP portfolios covering various aspects of microinjection molding methodologies. These patents typically encompass specialized equipment designs, novel process parameters, material formulations, and unique tooling configurations that enable the production of microscale components with high precision.

The legal framework governing microinjection molding patents varies significantly across global markets. In established manufacturing regions such as Europe, North America, and East Asia, patent protection systems are well-developed but exhibit important jurisdictional differences. Companies must navigate these variations when developing global IP strategies, particularly regarding patent term lengths, enforcement mechanisms, and disclosure requirements.

Trade secret protection offers an alternative approach for certain aspects of microinjection molding technology. Process know-how, proprietary material formulations, and specialized parameter settings that are difficult to reverse-engineer may be better protected through confidentiality measures rather than patents. This strategy requires robust internal security protocols and carefully structured non-disclosure agreements with partners and suppliers.

Patent infringement risks are particularly pronounced in microinjection molding due to the technical complexity and specialized nature of the field. The highly technical nature of claims often necessitates expert analysis to determine potential infringement. Companies operating in this space should implement systematic freedom-to-operate analyses before commercializing new methodologies or entering new markets.

Licensing arrangements have become increasingly common in the microinjection molding ecosystem. Cross-licensing agreements between technology developers and manufacturing specialists allow for more efficient technology utilization while reducing litigation risks. These arrangements typically include field-of-use restrictions, royalty structures, and technology transfer provisions tailored to the specific application domains.

Recent legal trends indicate increased scrutiny of overly broad microinjection molding patents, with courts in multiple jurisdictions invalidating claims that lack sufficient specificity or enablement. This trend underscores the importance of drafting precise, technically detailed patent applications that clearly delineate the innovative aspects of new methodologies while providing adequate disclosure for skilled practitioners to implement the invention.

The legal framework governing microinjection molding patents varies significantly across global markets. In established manufacturing regions such as Europe, North America, and East Asia, patent protection systems are well-developed but exhibit important jurisdictional differences. Companies must navigate these variations when developing global IP strategies, particularly regarding patent term lengths, enforcement mechanisms, and disclosure requirements.

Trade secret protection offers an alternative approach for certain aspects of microinjection molding technology. Process know-how, proprietary material formulations, and specialized parameter settings that are difficult to reverse-engineer may be better protected through confidentiality measures rather than patents. This strategy requires robust internal security protocols and carefully structured non-disclosure agreements with partners and suppliers.

Patent infringement risks are particularly pronounced in microinjection molding due to the technical complexity and specialized nature of the field. The highly technical nature of claims often necessitates expert analysis to determine potential infringement. Companies operating in this space should implement systematic freedom-to-operate analyses before commercializing new methodologies or entering new markets.

Licensing arrangements have become increasingly common in the microinjection molding ecosystem. Cross-licensing agreements between technology developers and manufacturing specialists allow for more efficient technology utilization while reducing litigation risks. These arrangements typically include field-of-use restrictions, royalty structures, and technology transfer provisions tailored to the specific application domains.

Recent legal trends indicate increased scrutiny of overly broad microinjection molding patents, with courts in multiple jurisdictions invalidating claims that lack sufficient specificity or enablement. This trend underscores the importance of drafting precise, technically detailed patent applications that clearly delineate the innovative aspects of new methodologies while providing adequate disclosure for skilled practitioners to implement the invention.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!