How Ethyl Acetate Affects Global Trade Dynamics?

JUN 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Overview

Ethyl acetate, a versatile organic compound with the chemical formula CH3COOC2H5, plays a significant role in global trade dynamics. This colorless liquid, known for its characteristic sweet smell, is widely used across various industries due to its unique properties and applications. As a solvent, it finds extensive use in the production of paints, coatings, adhesives, and inks, making it a crucial component in manufacturing processes worldwide.

The global ethyl acetate market has experienced steady growth over the past decade, driven by increasing demand from end-use industries such as packaging, automotive, and electronics. Its low toxicity and high solvency power have made it a preferred choice over other solvents, contributing to its rising popularity in both developed and emerging economies. The Asia-Pacific region, particularly China and India, has emerged as a major producer and consumer of ethyl acetate, influencing global trade patterns and supply chains.

In the pharmaceutical industry, ethyl acetate serves as an important intermediate in the synthesis of various drugs and active pharmaceutical ingredients. Its use in the extraction of caffeine from coffee and tea has also contributed to its significance in the food and beverage sector. The cosmetics industry relies on ethyl acetate for nail polish removers and other personal care products, further diversifying its market presence.

The production of ethyl acetate involves the esterification of ethanol and acetic acid, a process that has seen technological advancements to improve efficiency and reduce environmental impact. These innovations have led to the development of bio-based ethyl acetate, aligning with the growing trend towards sustainable and eco-friendly products. This shift has created new opportunities for trade and investment in green technologies, potentially reshaping the global ethyl acetate market landscape.

Trade dynamics surrounding ethyl acetate are influenced by factors such as raw material availability, production costs, and regulatory environments across different regions. Fluctuations in oil prices, being a key raw material source, can significantly impact the production costs and, consequently, the global trade flows of ethyl acetate. Additionally, environmental regulations and safety standards vary among countries, affecting the production, transportation, and use of ethyl acetate in different markets.

The COVID-19 pandemic has highlighted the importance of ethyl acetate in the production of hand sanitizers and disinfectants, leading to sudden spikes in demand and trade volumes. This unexpected shift has underscored the compound's versatility and its critical role in global supply chains, particularly during times of crisis. As economies recover and adapt to new realities, the trade patterns of ethyl acetate are likely to evolve, reflecting changing industrial needs and consumer preferences.

The global ethyl acetate market has experienced steady growth over the past decade, driven by increasing demand from end-use industries such as packaging, automotive, and electronics. Its low toxicity and high solvency power have made it a preferred choice over other solvents, contributing to its rising popularity in both developed and emerging economies. The Asia-Pacific region, particularly China and India, has emerged as a major producer and consumer of ethyl acetate, influencing global trade patterns and supply chains.

In the pharmaceutical industry, ethyl acetate serves as an important intermediate in the synthesis of various drugs and active pharmaceutical ingredients. Its use in the extraction of caffeine from coffee and tea has also contributed to its significance in the food and beverage sector. The cosmetics industry relies on ethyl acetate for nail polish removers and other personal care products, further diversifying its market presence.

The production of ethyl acetate involves the esterification of ethanol and acetic acid, a process that has seen technological advancements to improve efficiency and reduce environmental impact. These innovations have led to the development of bio-based ethyl acetate, aligning with the growing trend towards sustainable and eco-friendly products. This shift has created new opportunities for trade and investment in green technologies, potentially reshaping the global ethyl acetate market landscape.

Trade dynamics surrounding ethyl acetate are influenced by factors such as raw material availability, production costs, and regulatory environments across different regions. Fluctuations in oil prices, being a key raw material source, can significantly impact the production costs and, consequently, the global trade flows of ethyl acetate. Additionally, environmental regulations and safety standards vary among countries, affecting the production, transportation, and use of ethyl acetate in different markets.

The COVID-19 pandemic has highlighted the importance of ethyl acetate in the production of hand sanitizers and disinfectants, leading to sudden spikes in demand and trade volumes. This unexpected shift has underscored the compound's versatility and its critical role in global supply chains, particularly during times of crisis. As economies recover and adapt to new realities, the trade patterns of ethyl acetate are likely to evolve, reflecting changing industrial needs and consumer preferences.

Global Market Analysis

Ethyl acetate, a versatile organic compound, plays a significant role in shaping global trade dynamics. The global market for ethyl acetate has experienced substantial growth in recent years, driven by its widespread applications across various industries. The compound's unique properties make it an essential ingredient in the production of paints, coatings, adhesives, and pharmaceuticals, among other products.

The demand for ethyl acetate has been steadily increasing, particularly in emerging economies where rapid industrialization and urbanization are fueling the growth of end-use industries. Asia-Pacific region, led by China and India, has emerged as the largest consumer and producer of ethyl acetate, accounting for a substantial share of the global market. This shift in production and consumption patterns has significantly impacted global trade flows, with Asian countries becoming major exporters of ethyl acetate to other regions.

The automotive and construction industries are key drivers of ethyl acetate demand, as the compound is extensively used in automotive paints and coatings, as well as in construction adhesives. The growing automotive sector in developing countries and the global trend towards sustainable and energy-efficient buildings have further boosted the demand for ethyl acetate-based products.

In recent years, the pharmaceutical industry has also emerged as a significant consumer of ethyl acetate, using it as a solvent in drug manufacturing processes. The increasing focus on healthcare and the expansion of pharmaceutical production in emerging markets have contributed to the compound's growing importance in global trade.

The fluctuations in crude oil prices have a direct impact on ethyl acetate production costs and, consequently, on its global trade dynamics. As ethyl acetate is primarily derived from petroleum-based feedstocks, changes in oil prices can lead to significant variations in production costs and market prices, affecting trade patterns and competitiveness among different regions.

Environmental regulations and sustainability concerns have also influenced the ethyl acetate market. There is a growing trend towards the development of bio-based ethyl acetate, derived from renewable resources such as sugarcane or corn. This shift has the potential to alter global trade dynamics by reducing dependence on petroleum-based sources and creating new opportunities for countries with abundant biomass resources.

The COVID-19 pandemic has had a notable impact on the global ethyl acetate market, causing temporary disruptions in supply chains and altering demand patterns. However, the increased focus on hygiene and sanitation has led to a surge in demand for ethyl acetate in the production of disinfectants and sanitizers, partially offsetting the decline in other end-use sectors.

The demand for ethyl acetate has been steadily increasing, particularly in emerging economies where rapid industrialization and urbanization are fueling the growth of end-use industries. Asia-Pacific region, led by China and India, has emerged as the largest consumer and producer of ethyl acetate, accounting for a substantial share of the global market. This shift in production and consumption patterns has significantly impacted global trade flows, with Asian countries becoming major exporters of ethyl acetate to other regions.

The automotive and construction industries are key drivers of ethyl acetate demand, as the compound is extensively used in automotive paints and coatings, as well as in construction adhesives. The growing automotive sector in developing countries and the global trend towards sustainable and energy-efficient buildings have further boosted the demand for ethyl acetate-based products.

In recent years, the pharmaceutical industry has also emerged as a significant consumer of ethyl acetate, using it as a solvent in drug manufacturing processes. The increasing focus on healthcare and the expansion of pharmaceutical production in emerging markets have contributed to the compound's growing importance in global trade.

The fluctuations in crude oil prices have a direct impact on ethyl acetate production costs and, consequently, on its global trade dynamics. As ethyl acetate is primarily derived from petroleum-based feedstocks, changes in oil prices can lead to significant variations in production costs and market prices, affecting trade patterns and competitiveness among different regions.

Environmental regulations and sustainability concerns have also influenced the ethyl acetate market. There is a growing trend towards the development of bio-based ethyl acetate, derived from renewable resources such as sugarcane or corn. This shift has the potential to alter global trade dynamics by reducing dependence on petroleum-based sources and creating new opportunities for countries with abundant biomass resources.

The COVID-19 pandemic has had a notable impact on the global ethyl acetate market, causing temporary disruptions in supply chains and altering demand patterns. However, the increased focus on hygiene and sanitation has led to a surge in demand for ethyl acetate in the production of disinfectants and sanitizers, partially offsetting the decline in other end-use sectors.

Production Challenges

The production of ethyl acetate faces several challenges that significantly impact global trade dynamics. One of the primary issues is the volatility of raw material prices, particularly ethanol and acetic acid. These fluctuations can lead to unpredictable production costs, affecting the competitiveness of manufacturers in different regions and potentially disrupting established trade patterns.

Environmental regulations pose another significant challenge to ethyl acetate production. As governments worldwide implement stricter emission controls and sustainability requirements, manufacturers must invest in cleaner production technologies and waste management systems. This can lead to increased production costs and potentially create disparities in competitiveness between countries with varying environmental standards.

The energy-intensive nature of ethyl acetate production also presents challenges, especially in regions with high energy costs. The distillation process required for purification consumes substantial amounts of energy, making production efficiency a critical factor in maintaining competitiveness. Manufacturers in countries with access to cheaper energy sources may gain a significant advantage in the global market, potentially altering trade flows.

Quality control is another crucial aspect of ethyl acetate production that can impact trade dynamics. Ensuring consistent product quality across different batches and production facilities is essential for maintaining customer trust and meeting industry standards. Variations in quality can lead to shifts in supplier preferences and affect established trade relationships.

The scale of production facilities also plays a role in shaping global trade patterns. Large-scale producers can often achieve economies of scale, allowing them to offer more competitive prices. This can lead to consolidation in the industry and potentially create regional production hubs that dominate global trade in ethyl acetate.

Transportation and storage challenges are also significant factors affecting the global trade of ethyl acetate. As a flammable liquid, it requires specialized handling and storage facilities, which can increase logistics costs and complexity. Countries with well-developed infrastructure for handling hazardous materials may have an advantage in the ethyl acetate trade, potentially influencing global supply chains.

Lastly, the development of alternative production methods, such as bio-based ethyl acetate, presents both challenges and opportunities. While these methods may offer more sustainable production options, they also require significant investment in research and development. The adoption of these new technologies could reshape the competitive landscape of ethyl acetate production and alter existing trade relationships.

Environmental regulations pose another significant challenge to ethyl acetate production. As governments worldwide implement stricter emission controls and sustainability requirements, manufacturers must invest in cleaner production technologies and waste management systems. This can lead to increased production costs and potentially create disparities in competitiveness between countries with varying environmental standards.

The energy-intensive nature of ethyl acetate production also presents challenges, especially in regions with high energy costs. The distillation process required for purification consumes substantial amounts of energy, making production efficiency a critical factor in maintaining competitiveness. Manufacturers in countries with access to cheaper energy sources may gain a significant advantage in the global market, potentially altering trade flows.

Quality control is another crucial aspect of ethyl acetate production that can impact trade dynamics. Ensuring consistent product quality across different batches and production facilities is essential for maintaining customer trust and meeting industry standards. Variations in quality can lead to shifts in supplier preferences and affect established trade relationships.

The scale of production facilities also plays a role in shaping global trade patterns. Large-scale producers can often achieve economies of scale, allowing them to offer more competitive prices. This can lead to consolidation in the industry and potentially create regional production hubs that dominate global trade in ethyl acetate.

Transportation and storage challenges are also significant factors affecting the global trade of ethyl acetate. As a flammable liquid, it requires specialized handling and storage facilities, which can increase logistics costs and complexity. Countries with well-developed infrastructure for handling hazardous materials may have an advantage in the ethyl acetate trade, potentially influencing global supply chains.

Lastly, the development of alternative production methods, such as bio-based ethyl acetate, presents both challenges and opportunities. While these methods may offer more sustainable production options, they also require significant investment in research and development. The adoption of these new technologies could reshape the competitive landscape of ethyl acetate production and alter existing trade relationships.

Current Trade Patterns

01 Production and purification of ethyl acetate

Various methods for producing and purifying ethyl acetate are described. These include esterification processes, distillation techniques, and the use of specific catalysts to improve yield and purity. The production methods aim to optimize the reaction conditions and separation processes to obtain high-quality ethyl acetate efficiently.- Production and purification of ethyl acetate: Various methods for producing and purifying ethyl acetate are described, including esterification processes, distillation techniques, and separation methods. These processes aim to improve the yield and purity of ethyl acetate for industrial applications.

- Applications of ethyl acetate in chemical processes: Ethyl acetate is utilized in various chemical processes as a solvent, reactant, or intermediate. It finds applications in the production of pharmaceuticals, polymers, and other organic compounds. The versatility of ethyl acetate in different chemical reactions is highlighted.

- Ethyl acetate in extraction and separation processes: The use of ethyl acetate as an extraction solvent or in separation processes is described. Its properties make it suitable for extracting various compounds from mixtures or for use in liquid-liquid extraction techniques. Applications in the food, pharmaceutical, and chemical industries are mentioned.

- Environmental and safety considerations for ethyl acetate: Methods for handling, storing, and disposing of ethyl acetate are discussed, considering its flammability and potential environmental impact. Techniques for reducing emissions, recovering ethyl acetate from waste streams, and ensuring safe handling in industrial settings are described.

- Novel applications and formulations of ethyl acetate: Innovative uses of ethyl acetate in various industries are presented, including its application in coatings, adhesives, and specialty chemicals. New formulations incorporating ethyl acetate for specific purposes, such as in cleaning products or as a component in composite materials, are described.

02 Applications of ethyl acetate in industrial processes

Ethyl acetate finds diverse applications in industrial processes. It is used as a solvent in various industries, including pharmaceuticals, coatings, and electronics. The compound is also employed in extraction processes, as a reaction medium, and in the production of other chemicals. Its versatility makes it a valuable component in many manufacturing processes.Expand Specific Solutions03 Ethyl acetate in green chemistry and sustainable processes

Research focuses on developing environmentally friendly methods for ethyl acetate production and utilization. This includes the use of renewable resources, bio-based feedstocks, and sustainable catalysts. Efforts are made to reduce energy consumption and waste generation in ethyl acetate-related processes, aligning with green chemistry principles.Expand Specific Solutions04 Recovery and recycling of ethyl acetate

Methods for recovering and recycling ethyl acetate from industrial processes are developed to improve efficiency and reduce environmental impact. These include adsorption techniques, membrane separation, and advanced distillation processes. The aim is to minimize waste and maximize the reuse of ethyl acetate in various applications.Expand Specific Solutions05 Ethyl acetate as a component in formulations and mixtures

Ethyl acetate is used as a key component in various formulations and mixtures. It serves as a solvent in paints, adhesives, and cleaning solutions. The compound is also utilized in the preparation of pharmaceutical formulations and as a flavoring agent in food products. Its properties make it suitable for a wide range of applications in different industries.Expand Specific Solutions

Key Industry Players

The global ethyl acetate market is in a mature growth stage, with a steady increase in demand driven by its versatile applications across industries. The market size is projected to reach several billion dollars by 2025, reflecting a compound annual growth rate of around 5-6%. Technologically, the production process is well-established, with major players like Celanese International Corp., Eastman Chemical Co., and China Petroleum & Chemical Corp. continuously improving efficiency and sustainability. Emerging companies such as LanzaTech NZ Ltd. are exploring innovative bio-based production methods, indicating potential for technological disruption in this mature market. The competitive landscape is characterized by a mix of established chemical giants and specialized manufacturers, with increasing focus on eco-friendly production processes and product diversification.

Celanese International Corp.

Technical Solution: Celanese has developed an innovative process for ethyl acetate production using ethylene and acetic acid as raw materials. This method, known as the Celanese VA-Ethyl Acetate Process, offers significant advantages over traditional esterification routes. The process utilizes a proprietary catalyst system that enables high selectivity and yield, resulting in a more efficient and cost-effective production method[1]. Celanese's technology allows for the integration of ethyl acetate production with existing acetic acid facilities, creating synergies in raw material and energy utilization. The company has also implemented advanced process control systems to optimize production parameters, ensuring consistent product quality and minimizing waste[2].

Strengths: High efficiency, cost-effectiveness, and integration capabilities with existing facilities. Weaknesses: Dependence on ethylene and acetic acid availability, potential vulnerability to raw material price fluctuations.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a novel approach to ethyl acetate production using a bio-based feedstock. The company utilizes a fermentation process to convert biomass into acetic acid, which is then esterified with ethanol to produce ethyl acetate. This bio-based route aligns with global sustainability trends and reduces dependence on fossil fuel-derived raw materials. Sinopec has invested in large-scale fermentation facilities and optimized the downstream esterification process to ensure high product purity[3]. The company has also implemented advanced separation technologies to efficiently recover and purify the ethyl acetate, minimizing energy consumption and environmental impact[4].

Strengths: Sustainable production method, reduced carbon footprint, and alignment with green chemistry principles. Weaknesses: Potentially higher production costs compared to traditional petrochemical routes, and dependence on biomass availability.

Technological Innovations

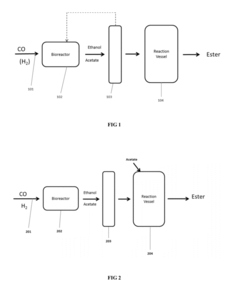

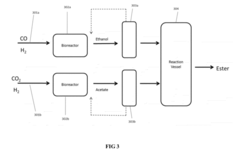

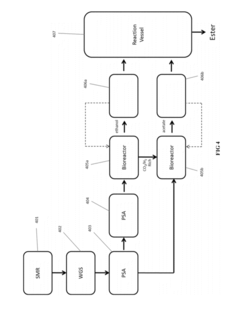

Process for the production of esters

PatentWO2012162321A2

Innovation

- A process involving anaerobic microbial fermentation of CO to produce ethanol and acetic acid, followed by an esterification reaction to form ethyl acetate, which can be optimized through continuous removal of water and use of reactive distillation to enhance conversion rates.

Process for the Production of Esters

PatentActiveUS20120301934A1

Innovation

- Anaerobic microbial fermentation of CO to produce ethanol and acetic acid, followed by an esterification reaction to form ethyl acetate, utilizing a continuous process that includes bioreactors and reactive distillation to optimize product yield.

Regulatory Framework

The regulatory framework surrounding ethyl acetate plays a crucial role in shaping its impact on global trade dynamics. As a widely used solvent and chemical intermediate, ethyl acetate is subject to various regulations across different countries and regions, which significantly influence its production, distribution, and international trade.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). The substance is listed on the TSCA Inventory, which means manufacturers and importers must comply with reporting requirements and potential restrictions. Additionally, the Occupational Safety and Health Administration (OSHA) sets permissible exposure limits for workers handling ethyl acetate in industrial settings.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which applies to ethyl acetate. Under REACH, manufacturers and importers must register the substance with the European Chemicals Agency (ECHA) and provide safety data. This regulation ensures a high level of protection for human health and the environment while promoting the free circulation of chemicals within the EU market.

In China, the Ministry of Ecology and Environment oversees the regulation of ethyl acetate through the Measures for Environmental Management of New Chemical Substances. Manufacturers and importers must obtain approval before producing or importing the substance, which can impact the global supply chain and trade flows.

International agreements also play a role in shaping the regulatory landscape for ethyl acetate. The Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provides a standardized approach to hazard communication, facilitating international trade while ensuring safety standards are met across borders.

The varying regulatory requirements across different regions can create trade barriers and affect the competitiveness of ethyl acetate producers. Compliance costs associated with meeting diverse regulatory standards may influence pricing strategies and market access. Companies operating in multiple jurisdictions must navigate a complex web of regulations, which can impact their global supply chain management and distribution networks.

Furthermore, regulatory changes can have ripple effects on global trade patterns. For instance, stricter environmental regulations in one region may lead to increased production and exports from countries with more lenient standards, potentially shifting the balance of trade and altering global market dynamics.

As sustainability concerns grow, regulations surrounding the production and use of ethyl acetate are likely to evolve. This could include increased focus on renewable sourcing, emissions control, and lifecycle assessments, which may further influence global trade flows and market competitiveness in the coming years.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). The substance is listed on the TSCA Inventory, which means manufacturers and importers must comply with reporting requirements and potential restrictions. Additionally, the Occupational Safety and Health Administration (OSHA) sets permissible exposure limits for workers handling ethyl acetate in industrial settings.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which applies to ethyl acetate. Under REACH, manufacturers and importers must register the substance with the European Chemicals Agency (ECHA) and provide safety data. This regulation ensures a high level of protection for human health and the environment while promoting the free circulation of chemicals within the EU market.

In China, the Ministry of Ecology and Environment oversees the regulation of ethyl acetate through the Measures for Environmental Management of New Chemical Substances. Manufacturers and importers must obtain approval before producing or importing the substance, which can impact the global supply chain and trade flows.

International agreements also play a role in shaping the regulatory landscape for ethyl acetate. The Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provides a standardized approach to hazard communication, facilitating international trade while ensuring safety standards are met across borders.

The varying regulatory requirements across different regions can create trade barriers and affect the competitiveness of ethyl acetate producers. Compliance costs associated with meeting diverse regulatory standards may influence pricing strategies and market access. Companies operating in multiple jurisdictions must navigate a complex web of regulations, which can impact their global supply chain management and distribution networks.

Furthermore, regulatory changes can have ripple effects on global trade patterns. For instance, stricter environmental regulations in one region may lead to increased production and exports from countries with more lenient standards, potentially shifting the balance of trade and altering global market dynamics.

As sustainability concerns grow, regulations surrounding the production and use of ethyl acetate are likely to evolve. This could include increased focus on renewable sourcing, emissions control, and lifecycle assessments, which may further influence global trade flows and market competitiveness in the coming years.

Environmental Impact

The environmental impact of ethyl acetate production and usage is a critical consideration in global trade dynamics. As a widely used solvent in various industries, ethyl acetate's lifecycle has significant implications for environmental sustainability and regulatory compliance across international markets.

Production of ethyl acetate primarily involves the esterification of ethanol and acetic acid, a process that requires energy input and generates waste products. The environmental footprint of this production process varies depending on the source of raw materials and the efficiency of manufacturing facilities. Petrochemical-derived ethanol and acetic acid contribute to fossil fuel depletion and greenhouse gas emissions, while bio-based alternatives may offer reduced carbon footprints but raise concerns about land use and food security.

During its use phase, ethyl acetate's volatile organic compound (VOC) status presents challenges for air quality management. Emissions from industrial applications and consumer products contribute to smog formation and can have adverse effects on human health and ecosystems. This has led to stringent regulations in many countries, particularly in urban areas with high population densities and existing air quality issues.

The disposal and potential environmental release of ethyl acetate also merit attention. While it is biodegradable and does not persist in the environment for extended periods, improper handling or accidental spills can lead to short-term contamination of soil and water resources. This risk necessitates proper waste management practices and influences the logistics of global trade in ethyl acetate and products containing it.

International variations in environmental regulations regarding VOC emissions, waste management, and product safety create a complex landscape for global trade in ethyl acetate. Countries with stricter environmental policies may impose import restrictions or require additional documentation, potentially altering trade flows and market access. Conversely, regions with less stringent regulations may become hubs for production or consumption, raising concerns about environmental justice and the potential for "pollution havens."

The push for greener alternatives and sustainable chemistry has spurred innovation in bio-based ethyl acetate production and the development of substitute solvents with lower environmental impacts. These trends are reshaping the competitive landscape and influencing investment decisions in the chemical industry. As consumers and businesses increasingly prioritize environmental sustainability, the demand for eco-friendly products may shift trade patterns and create new opportunities for environmentally responsible supply chains.

Production of ethyl acetate primarily involves the esterification of ethanol and acetic acid, a process that requires energy input and generates waste products. The environmental footprint of this production process varies depending on the source of raw materials and the efficiency of manufacturing facilities. Petrochemical-derived ethanol and acetic acid contribute to fossil fuel depletion and greenhouse gas emissions, while bio-based alternatives may offer reduced carbon footprints but raise concerns about land use and food security.

During its use phase, ethyl acetate's volatile organic compound (VOC) status presents challenges for air quality management. Emissions from industrial applications and consumer products contribute to smog formation and can have adverse effects on human health and ecosystems. This has led to stringent regulations in many countries, particularly in urban areas with high population densities and existing air quality issues.

The disposal and potential environmental release of ethyl acetate also merit attention. While it is biodegradable and does not persist in the environment for extended periods, improper handling or accidental spills can lead to short-term contamination of soil and water resources. This risk necessitates proper waste management practices and influences the logistics of global trade in ethyl acetate and products containing it.

International variations in environmental regulations regarding VOC emissions, waste management, and product safety create a complex landscape for global trade in ethyl acetate. Countries with stricter environmental policies may impose import restrictions or require additional documentation, potentially altering trade flows and market access. Conversely, regions with less stringent regulations may become hubs for production or consumption, raising concerns about environmental justice and the potential for "pollution havens."

The push for greener alternatives and sustainable chemistry has spurred innovation in bio-based ethyl acetate production and the development of substitute solvents with lower environmental impacts. These trends are reshaping the competitive landscape and influencing investment decisions in the chemical industry. As consumers and businesses increasingly prioritize environmental sustainability, the demand for eco-friendly products may shift trade patterns and create new opportunities for environmentally responsible supply chains.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!