How to Compare Liquid Nitrogen Storage Tanks for Industrial Use

OCT 7, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cryogenic Storage Technology Background and Objectives

Cryogenic storage technology has evolved significantly over the past century, with liquid nitrogen storage becoming a cornerstone of industrial applications requiring ultra-low temperatures. The development of this technology began in the early 20th century with the liquefaction of atmospheric gases, but saw substantial advancement during the space race era when cryogenic propellants became essential. Today's liquid nitrogen storage solutions represent the culmination of decades of engineering improvements in thermal insulation, materials science, and pressure management systems.

The industrial application landscape for cryogenic storage has expanded dramatically, encompassing sectors such as healthcare (biological sample preservation), food processing (flash freezing), manufacturing (metal treatment), electronics (superconductivity research), and energy (LNG storage). This diversification has driven the evolution of storage tank designs to meet varying requirements across industries, with specialized features emerging to address specific operational needs.

Current technological trends in cryogenic storage focus on improving energy efficiency, extending holding times, enhancing safety features, and reducing operational costs. The push toward sustainability has accelerated innovation in vacuum insulation technologies, with multi-layer insulation (MLI) systems and advanced vacuum maintenance techniques representing significant breakthroughs in minimizing heat transfer and nitrogen loss.

The primary objective of modern liquid nitrogen storage tank development centers on optimizing the balance between thermal performance, durability, capacity, and cost-effectiveness. Engineers strive to minimize evaporation rates (typically targeting below 1-2% daily) while maintaining structural integrity under extreme temperature differentials and providing reliable pressure relief mechanisms to prevent catastrophic failures.

Emerging challenges in the field include the development of smart monitoring systems for remote tank management, integration with IoT platforms for predictive maintenance, and the creation of more environmentally friendly manufacturing processes. Additionally, there is growing interest in portable and modular cryogenic storage solutions that can be deployed in various industrial settings with minimal infrastructure requirements.

The global market for industrial cryogenic storage equipment continues to expand, with projections indicating compound annual growth rates between 6-8% through 2028. This growth is driven by increasing demand in emerging economies, expansion of biobanking facilities worldwide, and the rising adoption of cryogenic technologies in new industrial applications such as quantum computing and advanced materials research.

The industrial application landscape for cryogenic storage has expanded dramatically, encompassing sectors such as healthcare (biological sample preservation), food processing (flash freezing), manufacturing (metal treatment), electronics (superconductivity research), and energy (LNG storage). This diversification has driven the evolution of storage tank designs to meet varying requirements across industries, with specialized features emerging to address specific operational needs.

Current technological trends in cryogenic storage focus on improving energy efficiency, extending holding times, enhancing safety features, and reducing operational costs. The push toward sustainability has accelerated innovation in vacuum insulation technologies, with multi-layer insulation (MLI) systems and advanced vacuum maintenance techniques representing significant breakthroughs in minimizing heat transfer and nitrogen loss.

The primary objective of modern liquid nitrogen storage tank development centers on optimizing the balance between thermal performance, durability, capacity, and cost-effectiveness. Engineers strive to minimize evaporation rates (typically targeting below 1-2% daily) while maintaining structural integrity under extreme temperature differentials and providing reliable pressure relief mechanisms to prevent catastrophic failures.

Emerging challenges in the field include the development of smart monitoring systems for remote tank management, integration with IoT platforms for predictive maintenance, and the creation of more environmentally friendly manufacturing processes. Additionally, there is growing interest in portable and modular cryogenic storage solutions that can be deployed in various industrial settings with minimal infrastructure requirements.

The global market for industrial cryogenic storage equipment continues to expand, with projections indicating compound annual growth rates between 6-8% through 2028. This growth is driven by increasing demand in emerging economies, expansion of biobanking facilities worldwide, and the rising adoption of cryogenic technologies in new industrial applications such as quantum computing and advanced materials research.

Industrial Market Demand for Liquid Nitrogen Storage

The global liquid nitrogen storage market has witnessed substantial growth in recent years, driven primarily by expanding applications across various industrial sectors. The market value reached approximately $5.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% through 2030, indicating robust demand for liquid nitrogen storage solutions.

Healthcare and pharmaceutical industries represent the largest market segment, accounting for nearly 38% of the total demand. This is primarily due to the critical role liquid nitrogen plays in preserving biological samples, vaccines, and other temperature-sensitive medical materials. The COVID-19 pandemic significantly accelerated this demand, as vaccine storage requirements created unprecedented needs for reliable cryogenic storage systems.

The food and beverage industry constitutes the second-largest market segment at 24%, where liquid nitrogen is extensively used for flash freezing, packaging, and transportation of perishable goods. The growing consumer preference for frozen ready-to-eat meals and the expansion of cold chain logistics have further stimulated demand in this sector.

Manufacturing and electronics industries collectively account for approximately 18% of market demand, utilizing liquid nitrogen for various processes including metal treatment, circuit board manufacturing, and superconductivity applications. The semiconductor industry, in particular, has shown increased demand due to the expansion of manufacturing facilities globally.

Research institutions and laboratories represent about 12% of the market, requiring liquid nitrogen storage for scientific experiments, sample preservation, and various research applications. The remaining 8% is distributed across other industries including aerospace, energy, and automotive sectors.

Geographically, North America leads the market with a 35% share, followed by Europe (28%), Asia-Pacific (25%), and the rest of the world (12%). However, the Asia-Pacific region is experiencing the fastest growth rate at 8.2% annually, driven by rapid industrialization in countries like China and India.

Key customer requirements across these industries include longer holding times, improved energy efficiency, enhanced safety features, and digital monitoring capabilities. The demand for portable and smaller-capacity tanks has increased by 22% in the last three years, reflecting the need for flexibility in various industrial applications.

Cost considerations remain paramount, with customers increasingly focusing on total cost of ownership rather than initial purchase price. This has led to growing interest in tanks with superior insulation properties that minimize liquid nitrogen loss through evaporation, despite their higher upfront costs.

Healthcare and pharmaceutical industries represent the largest market segment, accounting for nearly 38% of the total demand. This is primarily due to the critical role liquid nitrogen plays in preserving biological samples, vaccines, and other temperature-sensitive medical materials. The COVID-19 pandemic significantly accelerated this demand, as vaccine storage requirements created unprecedented needs for reliable cryogenic storage systems.

The food and beverage industry constitutes the second-largest market segment at 24%, where liquid nitrogen is extensively used for flash freezing, packaging, and transportation of perishable goods. The growing consumer preference for frozen ready-to-eat meals and the expansion of cold chain logistics have further stimulated demand in this sector.

Manufacturing and electronics industries collectively account for approximately 18% of market demand, utilizing liquid nitrogen for various processes including metal treatment, circuit board manufacturing, and superconductivity applications. The semiconductor industry, in particular, has shown increased demand due to the expansion of manufacturing facilities globally.

Research institutions and laboratories represent about 12% of the market, requiring liquid nitrogen storage for scientific experiments, sample preservation, and various research applications. The remaining 8% is distributed across other industries including aerospace, energy, and automotive sectors.

Geographically, North America leads the market with a 35% share, followed by Europe (28%), Asia-Pacific (25%), and the rest of the world (12%). However, the Asia-Pacific region is experiencing the fastest growth rate at 8.2% annually, driven by rapid industrialization in countries like China and India.

Key customer requirements across these industries include longer holding times, improved energy efficiency, enhanced safety features, and digital monitoring capabilities. The demand for portable and smaller-capacity tanks has increased by 22% in the last three years, reflecting the need for flexibility in various industrial applications.

Cost considerations remain paramount, with customers increasingly focusing on total cost of ownership rather than initial purchase price. This has led to growing interest in tanks with superior insulation properties that minimize liquid nitrogen loss through evaporation, despite their higher upfront costs.

Current Challenges in LN2 Storage Tank Technology

Despite significant advancements in liquid nitrogen (LN2) storage technology, several critical challenges persist in the industrial sector. The primary concern remains thermal efficiency, as even state-of-the-art vacuum insulation systems experience heat leakage over time. This gradual degradation of vacuum integrity leads to increased boil-off rates, resulting in product loss and higher operational costs. Industry data indicates that even well-maintained tanks typically experience a 0.5-1.5% daily evaporation rate, which accumulates to substantial losses for large-scale operations.

Material limitations present another significant challenge. The extreme temperature differential between LN2 (-196°C) and ambient conditions creates severe thermal stress on tank components. Current materials struggle to maintain structural integrity over extended periods, leading to microscopic cracks and potential safety hazards. While advanced composites and specialized alloys have improved durability, they significantly increase manufacturing costs, creating a difficult trade-off between longevity and affordability.

Pressure management systems remain problematic, particularly in fluctuating industrial environments. Conventional pressure relief valves and venting mechanisms often lack the precision required for optimal performance across varying usage patterns. This results in either excessive venting (wasting nitrogen) or insufficient pressure release (creating safety risks). The industry lacks standardized solutions that can adapt to both steady-state and variable-demand industrial applications.

Monitoring and control systems represent another technological gap. Many current LN2 tanks rely on basic analog gauges or rudimentary digital systems that provide limited real-time data. This hampers efficient inventory management and prevents predictive maintenance. The integration of IoT and advanced sensors is still in early adoption phases, with compatibility and reliability issues in harsh industrial environments.

Scale-up challenges persist for industries requiring large volumes of LN2. As tank size increases, the engineering complexities grow disproportionately. Maintaining uniform cooling, preventing stratification, and ensuring structural integrity become exponentially more difficult. This has created a technological plateau where efficiency gains diminish beyond certain capacity thresholds.

Regulatory compliance adds another layer of complexity, with fragmented international standards creating inconsistencies in safety requirements and performance metrics. This complicates global manufacturing and deployment, forcing manufacturers to create market-specific variations rather than standardized solutions, ultimately increasing costs and limiting technological convergence.

Material limitations present another significant challenge. The extreme temperature differential between LN2 (-196°C) and ambient conditions creates severe thermal stress on tank components. Current materials struggle to maintain structural integrity over extended periods, leading to microscopic cracks and potential safety hazards. While advanced composites and specialized alloys have improved durability, they significantly increase manufacturing costs, creating a difficult trade-off between longevity and affordability.

Pressure management systems remain problematic, particularly in fluctuating industrial environments. Conventional pressure relief valves and venting mechanisms often lack the precision required for optimal performance across varying usage patterns. This results in either excessive venting (wasting nitrogen) or insufficient pressure release (creating safety risks). The industry lacks standardized solutions that can adapt to both steady-state and variable-demand industrial applications.

Monitoring and control systems represent another technological gap. Many current LN2 tanks rely on basic analog gauges or rudimentary digital systems that provide limited real-time data. This hampers efficient inventory management and prevents predictive maintenance. The integration of IoT and advanced sensors is still in early adoption phases, with compatibility and reliability issues in harsh industrial environments.

Scale-up challenges persist for industries requiring large volumes of LN2. As tank size increases, the engineering complexities grow disproportionately. Maintaining uniform cooling, preventing stratification, and ensuring structural integrity become exponentially more difficult. This has created a technological plateau where efficiency gains diminish beyond certain capacity thresholds.

Regulatory compliance adds another layer of complexity, with fragmented international standards creating inconsistencies in safety requirements and performance metrics. This complicates global manufacturing and deployment, forcing manufacturers to create market-specific variations rather than standardized solutions, ultimately increasing costs and limiting technological convergence.

Technical Comparison Framework for LN2 Tanks

01 Structural design of liquid nitrogen storage tanks

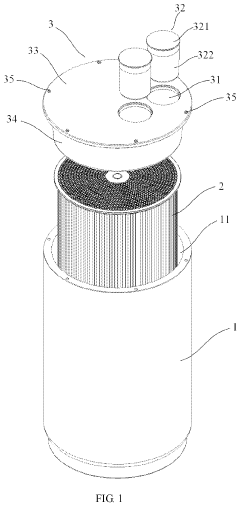

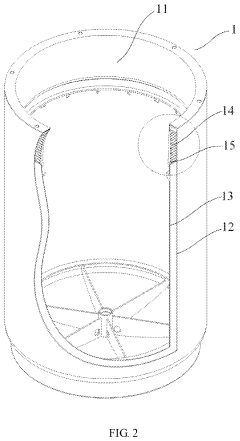

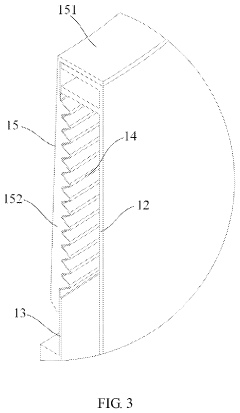

Liquid nitrogen storage tanks feature specialized structural designs to maintain cryogenic temperatures and ensure safety. These designs include double-walled vacuum insulation, pressure relief systems, and reinforced outer shells. The structural elements are engineered to minimize heat transfer, prevent leakage, and withstand the extreme temperature differentials between the stored liquid nitrogen and ambient conditions.- Structural design of liquid nitrogen storage tanks: Liquid nitrogen storage tanks are designed with specific structural features to ensure efficient storage and safety. These designs include double-walled vacuum insulation structures, reinforced outer shells, and specialized support systems that minimize heat transfer. The structural elements are engineered to withstand extreme temperature differentials while maintaining the integrity of the tank. Advanced materials and construction techniques are employed to enhance durability and prevent nitrogen leakage.

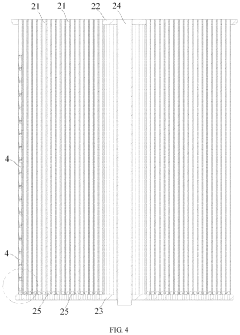

- Insulation technologies for cryogenic storage: Effective insulation is critical for liquid nitrogen storage tanks to maintain cryogenic temperatures and minimize evaporation. Various insulation technologies are employed, including multi-layer vacuum insulation, specialized foam materials, and radiation shields. These insulation systems create thermal barriers that significantly reduce heat transfer from the environment to the stored liquid nitrogen. Advanced vacuum techniques and composite insulation materials help extend holding times and improve energy efficiency of the storage systems.

- Monitoring and safety systems for liquid nitrogen tanks: Liquid nitrogen storage tanks incorporate sophisticated monitoring and safety systems to ensure proper operation and prevent hazards. These include temperature sensors, pressure relief valves, liquid level indicators, and automated alarm systems. Safety features are designed to prevent overpressure situations, detect leaks, and alert operators to abnormal conditions. Some advanced systems include remote monitoring capabilities and automated emergency response mechanisms to mitigate risks associated with cryogenic storage.

- Transportation and handling mechanisms: Specialized transportation and handling mechanisms are integrated into liquid nitrogen storage tank designs to facilitate safe movement and operation. These include reinforced wheels, stabilizing structures, lifting points, and ergonomic handling features. Some designs incorporate shock absorption systems to protect the tank during transport and prevent nitrogen spillage. Advanced models feature automated dispensing systems and secure locking mechanisms to ensure safe access and controlled distribution of the liquid nitrogen.

- Capacity optimization and storage efficiency: Innovations in liquid nitrogen storage tanks focus on optimizing storage capacity while maintaining efficiency. These include compartmentalized designs, space-efficient configurations, and modular systems that can be scaled according to requirements. Advanced internal structures maximize the volume available for liquid nitrogen while minimizing the overall footprint of the tank. Some designs incorporate specialized filling systems and evaporation recovery mechanisms to reduce nitrogen loss and improve operational efficiency.

02 Insulation technologies for cryogenic storage

Advanced insulation technologies are critical for maintaining the ultra-low temperatures required for liquid nitrogen storage. These include multi-layer vacuum insulation, specialized foam materials, and thermal barriers that minimize heat transfer. Effective insulation systems significantly reduce evaporation rates, extend holding times, and improve the overall efficiency of liquid nitrogen storage tanks.Expand Specific Solutions03 Monitoring and safety systems

Modern liquid nitrogen storage tanks incorporate sophisticated monitoring and safety systems to ensure proper operation and prevent accidents. These include temperature sensors, liquid level indicators, pressure monitoring devices, and automated alarm systems. Safety features such as pressure relief valves, emergency venting mechanisms, and oxygen level monitors in storage areas protect against potential hazards associated with cryogenic storage.Expand Specific Solutions04 Portable and specialized liquid nitrogen containers

Specialized portable containers and transport vessels are designed for the safe movement and temporary storage of liquid nitrogen. These containers feature reinforced construction, enhanced insulation, secure locking mechanisms, and ergonomic handling features. Designs vary based on capacity requirements, from small laboratory dewars to larger transport vessels, each optimized for specific applications while maintaining safety and efficiency.Expand Specific Solutions05 Innovations in liquid nitrogen dispensing systems

Advanced dispensing systems for liquid nitrogen storage tanks enable precise and safe transfer of the cryogenic liquid. These innovations include automated dispensing mechanisms, controlled flow valves, anti-splash features, and quick-connect couplings. Modern dispensing systems minimize nitrogen loss during transfers, reduce operator exposure risks, and provide accurate measurement of dispensed volumes for various scientific, medical, and industrial applications.Expand Specific Solutions

Major Manufacturers and Market Competition

The liquid nitrogen storage tank market is in a growth phase, driven by increasing industrial applications across pharmaceuticals, healthcare, and manufacturing sectors. The market size is expanding steadily, with projections indicating significant growth due to rising demand for cryogenic storage solutions. Technologically, the industry shows varying maturity levels, with established players like Air Liquide SA and Air Liquide Deutschland GmbH offering advanced solutions based on decades of experience. Emerging companies such as NITROcrete LLC, Boreas Cryo Safety, and Zero Cryogenic Technology are introducing innovations in monitoring systems and specialized applications. Traditional industrial gas companies (Korea Gas Corp., Exxonmobil) compete alongside specialized cryogenic equipment manufacturers (Shanghai Origincell, Preload Cryogenics), creating a diverse competitive landscape with opportunities for both technological differentiation and market specialization.

Shanghai Origincell Biological Cryo Equipment Co. Ltd.

Technical Solution: Shanghai Origincell specializes in biological cryogenic storage solutions with their BioCryo™ series of liquid nitrogen tanks specifically designed for industrial applications. Their tanks utilize a proprietary multi-layer vacuum insulation technology with up to 30 radiation barriers, achieving static evaporation rates as low as 0.18% per day. The company's tanks feature an integrated intelligent monitoring platform that tracks temperature variations within ±0.5°C accuracy and provides real-time alerts via mobile applications. Their patented neck tube design reduces evaporation loss by approximately 25% compared to conventional designs. Origincell's tanks incorporate a dual-phase liquid nitrogen management system that optimizes both liquid and vapor phase storage within the same unit, maximizing storage efficiency while maintaining temperature uniformity across the storage space.

Strengths: Specialized expertise in biological material preservation requirements; superior temperature uniformity across storage space; advanced monitoring systems with cloud integration capabilities. Weaknesses: More focused on biological applications than general industrial use; limited global service network compared to larger competitors; higher cost for specialized biological features that may not be necessary for all industrial applications.

Air Liquide SA

Technical Solution: Air Liquide's industrial liquid nitrogen storage solution centers on their proprietary Vacuum Insulated Pipe (VIP) technology and multi-layer insulation systems. Their tanks feature advanced vacuum insulation with multiple radiation barriers that reduce heat transfer by up to 80% compared to conventional systems. The company's Telemonitoring System provides real-time monitoring of tank pressure, temperature, and liquid level with predictive maintenance capabilities. Air Liquide's tanks incorporate patented pressure management systems that maintain optimal pressure conditions while minimizing product loss through automatic venting and pressure building circuits. Their modular design allows for capacity expansion without complete system replacement, and tanks are available in capacities ranging from 3,000 to over 100,000 liters with customizable configurations for different industrial applications.

Strengths: Industry-leading thermal efficiency with heat leak rates as low as 0.08% per day; global service network with 24/7 technical support; comprehensive digital monitoring solutions. Weaknesses: Higher initial investment cost compared to standard solutions; proprietary components may limit third-party maintenance options; larger footprint requirements for some advanced features.

Key Performance Metrics and Testing Standards

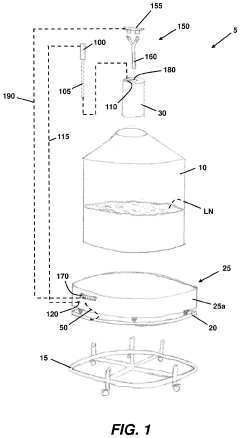

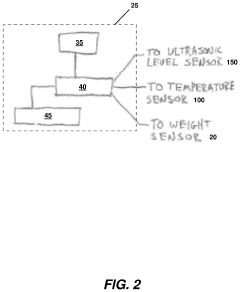

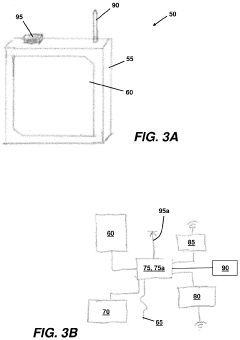

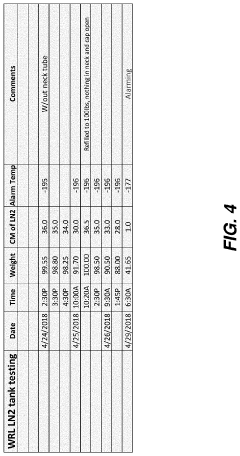

System and method for monitoring and reporting liquid nitrogen container level

PatentActiveUS20200072698A1

Innovation

- Implementing a weight-based monitoring system using a sensitive load cell or scale to detect subtle changes in container weight, combined with optional temperature and ultrasonic level sensors, to provide real-time data analysis and alert systems for leak detection and prediction.

Tube array type nitrogen canister

PatentActiveUS20210199246A1

Innovation

- A tube-array-type liquid nitrogen container design featuring a rotatable top cap and external robotic arm, utilizing a double-layer vacuum structure with a corrugated pipe and sleeve for thermal insulation, and a tube-array component with holding tubes and positioning plates for precise alignment and automatic access of freezing tubes.

Safety Compliance and Risk Management

Safety compliance and risk management represent critical considerations when comparing liquid nitrogen storage tanks for industrial applications. Regulatory frameworks such as OSHA standards, ASME Pressure Vessel Code, and ISO standards establish minimum safety requirements that all storage systems must meet. These regulations cover aspects including pressure relief mechanisms, material specifications, and inspection protocols that manufacturers must adhere to during design and production.

Risk assessment methodologies should be systematically applied when evaluating different storage solutions. This includes analyzing potential failure modes, oxygen depletion hazards in confined spaces, and pressure build-up scenarios. Advanced tanks incorporate multiple redundant safety systems including primary pressure relief valves, secondary rupture discs, and vacuum loss protection mechanisms that significantly reduce operational risks.

Personnel safety considerations extend beyond the equipment itself to operational protocols. Modern storage tanks feature enhanced safety elements such as improved insulation to prevent cold burns, ergonomic filling connections to minimize exposure risks, and integrated oxygen monitoring systems. These features should be carefully evaluated during the comparison process as they directly impact workplace safety compliance.

Maintenance requirements constitute another crucial safety dimension. Different tank designs present varying inspection schedules and maintenance complexities that affect long-term safety performance. Tanks with accessible components and self-diagnostic capabilities generally offer superior safety profiles through early detection of potential issues. Documentation of maintenance procedures and compliance with periodic inspection requirements should be thoroughly examined.

Emergency response capabilities differ significantly between tank models and manufacturers. Advanced systems incorporate features like remote monitoring, automated shutdown procedures, and integration with facility-wide safety systems. The availability of manufacturer support for emergency situations, including response time guarantees and spare parts availability, represents an often overlooked aspect of safety management that deserves careful consideration.

Insurance and liability implications should factor into the comparison process. Tanks with superior safety records and certifications beyond minimum requirements often qualify for reduced insurance premiums. Additionally, manufacturers' willingness to provide extended warranties and assume certain liability responsibilities indicates confidence in their safety engineering and should be weighted accordingly in the evaluation process.

Risk assessment methodologies should be systematically applied when evaluating different storage solutions. This includes analyzing potential failure modes, oxygen depletion hazards in confined spaces, and pressure build-up scenarios. Advanced tanks incorporate multiple redundant safety systems including primary pressure relief valves, secondary rupture discs, and vacuum loss protection mechanisms that significantly reduce operational risks.

Personnel safety considerations extend beyond the equipment itself to operational protocols. Modern storage tanks feature enhanced safety elements such as improved insulation to prevent cold burns, ergonomic filling connections to minimize exposure risks, and integrated oxygen monitoring systems. These features should be carefully evaluated during the comparison process as they directly impact workplace safety compliance.

Maintenance requirements constitute another crucial safety dimension. Different tank designs present varying inspection schedules and maintenance complexities that affect long-term safety performance. Tanks with accessible components and self-diagnostic capabilities generally offer superior safety profiles through early detection of potential issues. Documentation of maintenance procedures and compliance with periodic inspection requirements should be thoroughly examined.

Emergency response capabilities differ significantly between tank models and manufacturers. Advanced systems incorporate features like remote monitoring, automated shutdown procedures, and integration with facility-wide safety systems. The availability of manufacturer support for emergency situations, including response time guarantees and spare parts availability, represents an often overlooked aspect of safety management that deserves careful consideration.

Insurance and liability implications should factor into the comparison process. Tanks with superior safety records and certifications beyond minimum requirements often qualify for reduced insurance premiums. Additionally, manufacturers' willingness to provide extended warranties and assume certain liability responsibilities indicates confidence in their safety engineering and should be weighted accordingly in the evaluation process.

Total Cost of Ownership Analysis

When evaluating liquid nitrogen storage tanks for industrial applications, a comprehensive Total Cost of Ownership (TCO) analysis is essential for making informed procurement decisions that extend beyond the initial purchase price. This analysis encompasses various cost components throughout the tank's lifecycle, providing a holistic financial perspective.

Initial acquisition costs represent only the starting point of the TCO calculation. These include the base price of the tank, additional features or customizations, shipping expenses, and installation costs. While lower-priced tanks may seem attractive initially, they often entail higher operational expenses over time, diminishing their apparent cost advantage.

Operational expenses constitute a significant portion of the TCO. Energy consumption varies considerably between tank models, with vacuum-insulated tanks generally offering superior energy efficiency despite higher upfront costs. Liquid nitrogen loss through evaporation (boil-off rate) directly impacts operational costs, with high-quality tanks featuring advanced insulation systems demonstrating lower evaporation rates, typically between 0.5% and 1.5% daily.

Maintenance requirements represent another crucial cost factor. Regular maintenance activities include vacuum integrity checks, pressure relief valve testing, and insulation performance verification. Premium tanks often feature more durable components and advanced monitoring systems, reducing maintenance frequency and associated costs over time.

The expected service life of storage tanks significantly influences TCO calculations. Industrial-grade tanks typically last 10-20 years, with premium models often positioned at the upper end of this range. This longevity effectively distributes the initial investment over a longer period, reducing the annualized cost of ownership.

Insurance costs vary based on tank specifications and safety features. Tanks with enhanced safety systems and compliance with international standards generally command lower insurance premiums, offsetting their higher purchase prices through reduced ongoing expenses.

Decommissioning and disposal costs must also be factored into comprehensive TCO analyses. These include professional decontamination, dismantling, transportation, and environmentally responsible disposal expenses, which can vary significantly based on tank materials and construction.

Productivity impacts represent an often-overlooked aspect of TCO. Tanks with superior reliability and performance minimize operational disruptions, reducing costly downtime and maintaining production continuity. Advanced monitoring systems that provide real-time data on nitrogen levels and system performance further enhance operational efficiency.

By conducting thorough TCO analyses that incorporate these diverse cost factors, industrial users can make procurement decisions that optimize long-term financial performance rather than focusing exclusively on minimizing initial expenditure.

Initial acquisition costs represent only the starting point of the TCO calculation. These include the base price of the tank, additional features or customizations, shipping expenses, and installation costs. While lower-priced tanks may seem attractive initially, they often entail higher operational expenses over time, diminishing their apparent cost advantage.

Operational expenses constitute a significant portion of the TCO. Energy consumption varies considerably between tank models, with vacuum-insulated tanks generally offering superior energy efficiency despite higher upfront costs. Liquid nitrogen loss through evaporation (boil-off rate) directly impacts operational costs, with high-quality tanks featuring advanced insulation systems demonstrating lower evaporation rates, typically between 0.5% and 1.5% daily.

Maintenance requirements represent another crucial cost factor. Regular maintenance activities include vacuum integrity checks, pressure relief valve testing, and insulation performance verification. Premium tanks often feature more durable components and advanced monitoring systems, reducing maintenance frequency and associated costs over time.

The expected service life of storage tanks significantly influences TCO calculations. Industrial-grade tanks typically last 10-20 years, with premium models often positioned at the upper end of this range. This longevity effectively distributes the initial investment over a longer period, reducing the annualized cost of ownership.

Insurance costs vary based on tank specifications and safety features. Tanks with enhanced safety systems and compliance with international standards generally command lower insurance premiums, offsetting their higher purchase prices through reduced ongoing expenses.

Decommissioning and disposal costs must also be factored into comprehensive TCO analyses. These include professional decontamination, dismantling, transportation, and environmentally responsible disposal expenses, which can vary significantly based on tank materials and construction.

Productivity impacts represent an often-overlooked aspect of TCO. Tanks with superior reliability and performance minimize operational disruptions, reducing costly downtime and maintaining production continuity. Advanced monitoring systems that provide real-time data on nitrogen levels and system performance further enhance operational efficiency.

By conducting thorough TCO analyses that incorporate these diverse cost factors, industrial users can make procurement decisions that optimize long-term financial performance rather than focusing exclusively on minimizing initial expenditure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!