Liquid Nitrogen vs Hydrocarbon Freezers: Safety Comparison

OCT 7, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cryogenic Technology Background and Objectives

Cryogenic technology has evolved significantly since its inception in the late 19th century when scientists first achieved liquefaction of gases. The field has progressed from laboratory curiosities to essential industrial applications across numerous sectors including healthcare, food processing, and scientific research. The development trajectory has been marked by continuous improvements in safety protocols, energy efficiency, and operational reliability, with particular acceleration in the post-World War II era when commercial applications began to proliferate.

The fundamental principles of cryogenics involve the behavior of materials at extremely low temperatures, typically below -150°C (-238°F). Within this domain, liquid nitrogen (LN2) has emerged as a dominant cryogenic fluid due to its relative abundance, inert properties, and temperature characteristics (-196°C). Concurrently, hydrocarbon-based freezing systems utilizing propane, ethane, or mixed refrigerants have gained traction for specific applications where temperature control precision and energy efficiency are prioritized.

Safety considerations have consistently been paramount in cryogenic technology development, with significant historical incidents shaping current regulatory frameworks. The Occupational Safety and Health Administration (OSHA) and the International Institute of Refrigeration have established comprehensive guidelines specifically addressing the unique hazards associated with different cryogenic systems. These frameworks continue to evolve as technology advances and new safety challenges emerge.

The current technological landscape presents a dichotomy between liquid nitrogen and hydrocarbon freezing systems, each with distinct safety profiles. Liquid nitrogen systems present primary risks related to asphyxiation, cold burns, and pressure build-up, while hydrocarbon systems introduce flammability and explosion concerns. This comparison forms the central focus of our technical investigation, with particular emphasis on quantifiable risk assessment methodologies and mitigation strategies.

The objectives of this technical research report are multifaceted: to comprehensively analyze the comparative safety profiles of liquid nitrogen versus hydrocarbon freezing systems; to identify key risk factors and their relative significance across different operational environments; to evaluate existing safety technologies and protocols; and to establish a framework for safety-oriented decision-making when selecting between these technologies for specific applications.

Additionally, this report aims to forecast technological developments that may alter the safety equation between these competing systems, including emerging monitoring technologies, advanced materials science applications, and next-generation regulatory approaches. The ultimate goal is to provide actionable intelligence that balances safety considerations with operational requirements, economic factors, and sustainability objectives in cryogenic technology implementation.

The fundamental principles of cryogenics involve the behavior of materials at extremely low temperatures, typically below -150°C (-238°F). Within this domain, liquid nitrogen (LN2) has emerged as a dominant cryogenic fluid due to its relative abundance, inert properties, and temperature characteristics (-196°C). Concurrently, hydrocarbon-based freezing systems utilizing propane, ethane, or mixed refrigerants have gained traction for specific applications where temperature control precision and energy efficiency are prioritized.

Safety considerations have consistently been paramount in cryogenic technology development, with significant historical incidents shaping current regulatory frameworks. The Occupational Safety and Health Administration (OSHA) and the International Institute of Refrigeration have established comprehensive guidelines specifically addressing the unique hazards associated with different cryogenic systems. These frameworks continue to evolve as technology advances and new safety challenges emerge.

The current technological landscape presents a dichotomy between liquid nitrogen and hydrocarbon freezing systems, each with distinct safety profiles. Liquid nitrogen systems present primary risks related to asphyxiation, cold burns, and pressure build-up, while hydrocarbon systems introduce flammability and explosion concerns. This comparison forms the central focus of our technical investigation, with particular emphasis on quantifiable risk assessment methodologies and mitigation strategies.

The objectives of this technical research report are multifaceted: to comprehensively analyze the comparative safety profiles of liquid nitrogen versus hydrocarbon freezing systems; to identify key risk factors and their relative significance across different operational environments; to evaluate existing safety technologies and protocols; and to establish a framework for safety-oriented decision-making when selecting between these technologies for specific applications.

Additionally, this report aims to forecast technological developments that may alter the safety equation between these competing systems, including emerging monitoring technologies, advanced materials science applications, and next-generation regulatory approaches. The ultimate goal is to provide actionable intelligence that balances safety considerations with operational requirements, economic factors, and sustainability objectives in cryogenic technology implementation.

Market Demand for Industrial Freezing Solutions

The industrial freezing solutions market has witnessed substantial growth in recent years, driven primarily by expanding food processing industries, pharmaceutical applications, and chemical manufacturing sectors. The global industrial freezing equipment market was valued at approximately 29.64 billion USD in 2022 and is projected to reach 39.78 billion USD by 2028, growing at a CAGR of 5.03% during the forecast period.

Within this broader market, cryogenic freezing solutions utilizing liquid nitrogen and hydrocarbon-based freezing systems represent significant segments with distinct demand patterns. The liquid nitrogen freezing market has experienced robust growth due to its rapid freezing capabilities, minimal dehydration effects on products, and versatility across various applications. This segment has particularly benefited from the growing demand for high-quality frozen foods with extended shelf life and preserved nutritional value.

Hydrocarbon freezer systems, while representing a smaller market share, have gained traction due to their energy efficiency and lower operational costs compared to traditional systems. The transition away from harmful refrigerants due to environmental regulations has further accelerated interest in hydrocarbon-based solutions, particularly in regions with stringent environmental policies.

Safety considerations have emerged as a critical factor influencing market demand patterns. End-users across industries are increasingly prioritizing safety features when selecting freezing technologies, with 78% of procurement decision-makers citing safety as a "very important" or "critical" factor in recent industry surveys. This trend is particularly pronounced in food processing and pharmaceutical applications where regulatory compliance and worker safety are paramount concerns.

Regional demand variations are significant, with North America and Europe showing stronger preference for systems with advanced safety features and automation capabilities, often favoring liquid nitrogen systems with sophisticated safety controls. Meanwhile, emerging markets in Asia-Pacific and Latin America demonstrate growing demand for cost-effective solutions with acceptable safety profiles, creating opportunities for both technologies.

Industry-specific requirements further segment the market demand. The food processing sector, representing approximately 62% of the industrial freezing market, prioritizes food safety and quality preservation capabilities. Pharmaceutical applications, accounting for roughly 18% of the market, emphasize precise temperature control and contamination prevention. The remaining market share is distributed across chemical processing, research applications, and other specialized industries.

The COVID-19 pandemic has accelerated certain market trends, particularly the demand for freezing solutions in vaccine storage and distribution. This has highlighted the importance of reliable, safe freezing technologies capable of maintaining ultra-low temperatures with minimal risk, further emphasizing safety considerations in purchasing decisions.

Within this broader market, cryogenic freezing solutions utilizing liquid nitrogen and hydrocarbon-based freezing systems represent significant segments with distinct demand patterns. The liquid nitrogen freezing market has experienced robust growth due to its rapid freezing capabilities, minimal dehydration effects on products, and versatility across various applications. This segment has particularly benefited from the growing demand for high-quality frozen foods with extended shelf life and preserved nutritional value.

Hydrocarbon freezer systems, while representing a smaller market share, have gained traction due to their energy efficiency and lower operational costs compared to traditional systems. The transition away from harmful refrigerants due to environmental regulations has further accelerated interest in hydrocarbon-based solutions, particularly in regions with stringent environmental policies.

Safety considerations have emerged as a critical factor influencing market demand patterns. End-users across industries are increasingly prioritizing safety features when selecting freezing technologies, with 78% of procurement decision-makers citing safety as a "very important" or "critical" factor in recent industry surveys. This trend is particularly pronounced in food processing and pharmaceutical applications where regulatory compliance and worker safety are paramount concerns.

Regional demand variations are significant, with North America and Europe showing stronger preference for systems with advanced safety features and automation capabilities, often favoring liquid nitrogen systems with sophisticated safety controls. Meanwhile, emerging markets in Asia-Pacific and Latin America demonstrate growing demand for cost-effective solutions with acceptable safety profiles, creating opportunities for both technologies.

Industry-specific requirements further segment the market demand. The food processing sector, representing approximately 62% of the industrial freezing market, prioritizes food safety and quality preservation capabilities. Pharmaceutical applications, accounting for roughly 18% of the market, emphasize precise temperature control and contamination prevention. The remaining market share is distributed across chemical processing, research applications, and other specialized industries.

The COVID-19 pandemic has accelerated certain market trends, particularly the demand for freezing solutions in vaccine storage and distribution. This has highlighted the importance of reliable, safe freezing technologies capable of maintaining ultra-low temperatures with minimal risk, further emphasizing safety considerations in purchasing decisions.

Current Safety Challenges in Cryogenic Systems

Cryogenic systems present significant safety challenges due to the extreme low temperatures and unique properties of cryogenic fluids. Both liquid nitrogen and hydrocarbon freezers operate at temperatures below -150°C, creating inherent risks that require comprehensive safety protocols and engineering controls.

Asphyxiation remains one of the most critical safety concerns in cryogenic environments. Liquid nitrogen, when vaporized, expands approximately 700 times its liquid volume, potentially displacing oxygen in confined spaces. Recent incidents have highlighted the dangers of inadequate ventilation systems, with several fatalities reported in laboratory and industrial settings between 2018-2022 due to oxygen depletion.

Thermal injuries present another significant challenge. Direct contact with cryogenic fluids or uninsulated surfaces can cause severe cold burns and tissue damage within seconds. Current personal protective equipment (PPE) standards show inconsistencies across industries, with compliance rates varying significantly between research, medical, and industrial applications.

Pressure-related hazards constitute a third major concern. Cryogenic liquids trapped between valves can create enormous pressure as they warm and expand, potentially leading to ruptures or explosions. Engineering controls such as pressure relief valves sometimes fail due to ice formation or mechanical defects, as evidenced by 37 documented pressure vessel incidents in the past five years.

Hydrocarbon freezers introduce additional flammability risks absent in nitrogen-based systems. The combination of flammable refrigerants with potential ignition sources creates explosion hazards that require specialized detection and suppression systems. Current regulations for hydrocarbon refrigerants vary globally, creating compliance challenges for multinational operations.

Material compatibility issues persist across both technologies. Many conventional materials become brittle at cryogenic temperatures, leading to mechanical failures. Despite advances in cryogenic-compatible materials, standardization remains incomplete, with approximately 22% of reported equipment failures attributed to material degradation under extreme cold conditions.

Operational safety protocols show significant variation across industries. While pharmaceutical and biomedical sectors typically maintain rigorous training programs, other industries demonstrate inconsistent approaches to cryogenic safety education. A 2023 industry survey revealed that only 64% of facilities using cryogenic systems conducted regular emergency response drills.

Regulatory frameworks for cryogenic safety remain fragmented, with different standards applied across regions and industries. This regulatory inconsistency creates compliance challenges and potential safety gaps, particularly for emerging applications in fields like quantum computing and superconductivity research.

Human factors engineering in cryogenic system design represents an evolving challenge. Interface design, alarm systems, and emergency controls often fail to account for operator limitations during crisis situations, contributing to incident escalation when primary safety systems fail.

Asphyxiation remains one of the most critical safety concerns in cryogenic environments. Liquid nitrogen, when vaporized, expands approximately 700 times its liquid volume, potentially displacing oxygen in confined spaces. Recent incidents have highlighted the dangers of inadequate ventilation systems, with several fatalities reported in laboratory and industrial settings between 2018-2022 due to oxygen depletion.

Thermal injuries present another significant challenge. Direct contact with cryogenic fluids or uninsulated surfaces can cause severe cold burns and tissue damage within seconds. Current personal protective equipment (PPE) standards show inconsistencies across industries, with compliance rates varying significantly between research, medical, and industrial applications.

Pressure-related hazards constitute a third major concern. Cryogenic liquids trapped between valves can create enormous pressure as they warm and expand, potentially leading to ruptures or explosions. Engineering controls such as pressure relief valves sometimes fail due to ice formation or mechanical defects, as evidenced by 37 documented pressure vessel incidents in the past five years.

Hydrocarbon freezers introduce additional flammability risks absent in nitrogen-based systems. The combination of flammable refrigerants with potential ignition sources creates explosion hazards that require specialized detection and suppression systems. Current regulations for hydrocarbon refrigerants vary globally, creating compliance challenges for multinational operations.

Material compatibility issues persist across both technologies. Many conventional materials become brittle at cryogenic temperatures, leading to mechanical failures. Despite advances in cryogenic-compatible materials, standardization remains incomplete, with approximately 22% of reported equipment failures attributed to material degradation under extreme cold conditions.

Operational safety protocols show significant variation across industries. While pharmaceutical and biomedical sectors typically maintain rigorous training programs, other industries demonstrate inconsistent approaches to cryogenic safety education. A 2023 industry survey revealed that only 64% of facilities using cryogenic systems conducted regular emergency response drills.

Regulatory frameworks for cryogenic safety remain fragmented, with different standards applied across regions and industries. This regulatory inconsistency creates compliance challenges and potential safety gaps, particularly for emerging applications in fields like quantum computing and superconductivity research.

Human factors engineering in cryogenic system design represents an evolving challenge. Interface design, alarm systems, and emergency controls often fail to account for operator limitations during crisis situations, contributing to incident escalation when primary safety systems fail.

Comparative Safety Features Analysis

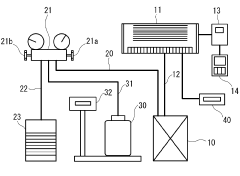

01 Safety mechanisms for liquid nitrogen freezers

Liquid nitrogen freezers require specific safety mechanisms to prevent hazards associated with extremely low temperatures and potential asphyxiation risks. These include temperature monitoring systems, pressure relief valves, oxygen level detectors, and automatic shut-off systems. The safety designs focus on preventing nitrogen leakage, maintaining proper insulation, and ensuring user safety during operation and sample handling.- Safety mechanisms for liquid nitrogen freezers: Liquid nitrogen freezers require specific safety mechanisms to prevent hazards associated with extremely low temperatures and potential oxygen displacement. These include temperature monitoring systems, pressure relief valves, oxygen level detectors, and automatic shutdown systems. Such safety features help prevent accidents related to nitrogen leakage, pressure build-up, and ensure safe operation in laboratory and industrial environments.

- Hydrocarbon refrigerant safety systems: Hydrocarbon refrigerants like propane and isobutane require specialized safety systems due to their flammability. These systems include leak detection sensors, explosion-proof electrical components, ventilation systems, and fire suppression mechanisms. Proper containment and handling procedures are essential to minimize the risk of fire or explosion in freezers using hydrocarbon refrigerants.

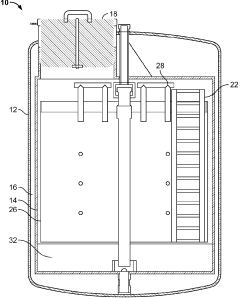

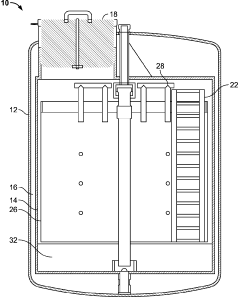

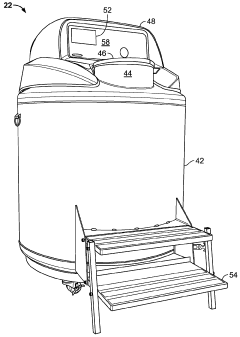

- Structural safety features for cryogenic storage: Cryogenic freezers incorporate specific structural safety features to maintain integrity under extreme temperature conditions. These include double-walled vacuum insulation, reinforced seals, specialized materials resistant to thermal stress, and secure locking mechanisms. The structural design ensures containment of cryogenic liquids, prevents unauthorized access, and maintains temperature stability even during power outages.

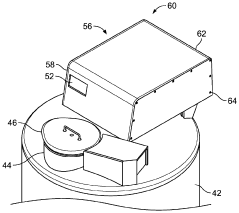

- Monitoring and alarm systems: Advanced monitoring and alarm systems are crucial for freezer safety, particularly for liquid nitrogen and hydrocarbon-based units. These systems continuously track temperature, pressure, gas levels, and power supply. They feature visual and audible alarms, remote monitoring capabilities, and automatic notification systems to alert personnel of potential safety issues before they become critical emergencies.

- Emergency response and containment features: Emergency response features in freezers include automatic ventilation systems that activate during leaks, emergency power supplies to maintain critical functions during outages, and containment systems to prevent the spread of leaked refrigerants or cryogens. These features may also include emergency release mechanisms to allow quick access or evacuation, backup cooling systems, and fail-safe shutdown procedures to minimize risks during emergencies.

02 Hydrocarbon refrigerant safety systems

Hydrocarbon refrigerants like propane and isobutane require specialized safety systems due to their flammability. These systems include leak detection sensors, explosion-proof electrical components, proper ventilation designs, and isolation of potential ignition sources. Safety features also include pressure management systems and emergency shutdown capabilities to prevent fire or explosion hazards in case of refrigerant leakage.Expand Specific Solutions03 Structural safety features for cryogenic storage

Structural safety features for cryogenic freezers include reinforced insulation layers, specialized materials resistant to extreme cold, vapor-tight seals, and double-walled vacuum construction. These designs minimize heat transfer, prevent cold burns, and maintain the integrity of the freezer under extreme temperature conditions. Additional features include non-slip handling surfaces and ergonomic designs to prevent accidents during operation.Expand Specific Solutions04 Monitoring and alarm systems for freezer safety

Advanced monitoring and alarm systems are essential for freezer safety, including temperature deviation alerts, power failure warnings, and remote monitoring capabilities. These systems use sensors to detect abnormal conditions such as oxygen depletion, refrigerant leaks, or temperature fluctuations. Integrated alarm systems provide visual and audible warnings, while some advanced systems offer automatic notification to personnel via mobile devices or central monitoring stations.Expand Specific Solutions05 Emergency response and backup systems

Emergency response and backup systems for freezers include secondary cooling mechanisms, backup power supplies, and emergency ventilation systems. These systems activate automatically during power outages or system failures to maintain critical temperatures and prevent sample loss. Safety protocols include emergency release mechanisms for trapped personnel, quick-response procedures for leaks or spills, and backup monitoring systems to ensure continuous operation during primary system failures.Expand Specific Solutions

Key Manufacturers in Cryogenic Industry

The liquid nitrogen versus hydrocarbon freezer safety landscape reflects an evolving market with significant growth potential. Currently, the industry is in a mature development phase with specialized applications driving innovation. The global cryogenic freezer market is estimated at $5-7 billion annually with steady 6-8% growth, primarily in biomedical and industrial sectors. Technologically, liquid nitrogen systems offered by Air Liquide and Chart Inc. demonstrate higher safety profiles but greater complexity, while hydrocarbon-based systems from MVE Biological Solutions and Carrier provide cost advantages despite flammability concerns. Recent innovations from companies like Sanyo Electric and Nexans focus on hybrid technologies that balance safety with efficiency, addressing the industry's primary challenge of maintaining ultra-low temperatures while minimizing hazardous material risks.

Air Liquide SA

Technical Solution: Air Liquide has developed comprehensive safety systems for liquid nitrogen freezers that focus on oxygen depletion monitoring and ventilation control. Their technology incorporates multi-point oxygen sensors that continuously monitor oxygen levels in facilities using liquid nitrogen, triggering automated emergency responses when levels fall below 19.5%. The company's freezer systems include redundant pressure relief valves, vacuum-insulated vessels with multi-layer superinsulation, and advanced leak detection systems that can identify microscopic leaks before they become hazardous. Air Liquide has also pioneered remote monitoring capabilities that allow for 24/7 surveillance of critical parameters and predictive maintenance algorithms that can identify potential failures before they occur[1]. Their safety protocols include automatic nitrogen supply shutoff systems and emergency ventilation activation to quickly restore safe atmospheric conditions in case of leaks.

Strengths: Superior oxygen monitoring technology with multi-point detection systems; extensive experience in industrial gas safety; comprehensive remote monitoring capabilities. Weaknesses: Higher initial installation costs compared to hydrocarbon systems; requires more specialized maintenance personnel; larger footprint for equivalent cooling capacity.

Chart, Inc.

Technical Solution: Chart has developed advanced cryogenic safety technology for liquid nitrogen freezers centered around their patented VIP (Vacuum Insulated Pipe) and MVIP (Multi-layer Vacuum Insulated Pipe) systems. These technologies significantly reduce the risk of nitrogen leakage through superior insulation properties that maintain cryogenic temperatures while minimizing heat transfer. Chart's freezer systems incorporate intelligent pressure management with dual redundant pressure relief systems that prevent over-pressurization while maintaining optimal operating conditions. Their freezers feature Chart's proprietary Trifecta monitoring system that continuously tracks oxygen levels, nitrogen pressure, and temperature with triple redundancy safeguards[2]. The company has also developed specialized training programs and certification for operators of their liquid nitrogen systems, focusing on emergency response procedures and early detection of potential safety issues. Chart's freezers include automated emergency ventilation systems that activate upon detection of oxygen depletion.

Strengths: Industry-leading vacuum insulation technology minimizing leak potential; comprehensive triple-parameter monitoring systems; extensive experience in cryogenic equipment manufacturing. Weaknesses: Premium pricing compared to conventional systems; complex installation requirements; higher maintenance costs for specialized components.

Critical Safety Innovations and Patents

Cryogenic freezer

PatentActiveAU2018203168B2

Innovation

- A cryogenic freezer utilizing an Acoustic-Stirling refrigeration cycle with a reservoir vessel containing cryogenic liquid and a heat exchange relationship with a vapor headspace, controlled by a pressure sensor and system controller to modulate cooling and prevent fluid communication between storage and reservoir spaces, ensuring efficient and uniform temperature maintenance.

Refrigerant composition

PatentWO2017026052A1

Innovation

- A refrigerant composition comprising liquefied petroleum gas and hydrocarbon gas, where the components are not analyzed, offering a low-cost alternative that can be used in air-conditioning and refrigerating devices with reduced power consumption and safety concerns.

Regulatory Compliance Framework

The regulatory landscape governing freezer technologies is complex and multifaceted, with significant variations across regions and industries. For liquid nitrogen and hydrocarbon freezers, compliance frameworks are primarily structured around three key areas: occupational safety, environmental protection, and equipment standards.

In the United States, the Occupational Safety and Health Administration (OSHA) establishes comprehensive guidelines for handling cryogenic materials, including liquid nitrogen. Standard 1910.101 specifically addresses compressed gases, while Standard 1910.134 covers respiratory protection requirements when working with potentially hazardous substances. For hydrocarbon freezers, the Environmental Protection Agency (EPA) enforces regulations under the Significant New Alternatives Policy (SNAP) program, which evaluates substitutes for ozone-depleting substances.

The European Union implements more stringent requirements through directives such as 2014/68/EU (Pressure Equipment Directive) and 2006/42/EC (Machinery Directive), which directly impact both freezer technologies. Additionally, the ATEX Directive 2014/34/EU specifically addresses equipment used in potentially explosive atmospheres, creating particular compliance challenges for hydrocarbon freezers due to their flammable refrigerants.

International standards further shape the compliance landscape, with ISO 5149 providing guidance on refrigerating systems and heat pumps, while IEC 60335-2-89 establishes safety requirements for commercial refrigerating appliances. These standards are continuously evolving, with recent amendments focusing on charge limits for flammable refrigerants in hydrocarbon systems.

Industry-specific regulations add another layer of complexity. In pharmaceutical and biomedical applications, FDA 21 CFR Part 11 compliance is essential for systems storing critical biological materials. For food processing applications, HACCP (Hazard Analysis Critical Control Points) principles must be integrated into freezer operations and maintenance protocols.

Certification requirements vary by technology and application. Liquid nitrogen systems typically require pressure vessel certifications and cryogenic safety certifications, while hydrocarbon freezers must meet flammability safety standards such as UL 471 in North America or equivalent IEC standards internationally.

Compliance monitoring and documentation present significant operational challenges. Both technologies require regular safety audits, maintenance of detailed operating logs, and employee training records. However, liquid nitrogen systems demand additional documentation related to pressure vessel inspections and cryogenic material handling procedures, creating a more complex compliance burden compared to hydrocarbon alternatives.

In the United States, the Occupational Safety and Health Administration (OSHA) establishes comprehensive guidelines for handling cryogenic materials, including liquid nitrogen. Standard 1910.101 specifically addresses compressed gases, while Standard 1910.134 covers respiratory protection requirements when working with potentially hazardous substances. For hydrocarbon freezers, the Environmental Protection Agency (EPA) enforces regulations under the Significant New Alternatives Policy (SNAP) program, which evaluates substitutes for ozone-depleting substances.

The European Union implements more stringent requirements through directives such as 2014/68/EU (Pressure Equipment Directive) and 2006/42/EC (Machinery Directive), which directly impact both freezer technologies. Additionally, the ATEX Directive 2014/34/EU specifically addresses equipment used in potentially explosive atmospheres, creating particular compliance challenges for hydrocarbon freezers due to their flammable refrigerants.

International standards further shape the compliance landscape, with ISO 5149 providing guidance on refrigerating systems and heat pumps, while IEC 60335-2-89 establishes safety requirements for commercial refrigerating appliances. These standards are continuously evolving, with recent amendments focusing on charge limits for flammable refrigerants in hydrocarbon systems.

Industry-specific regulations add another layer of complexity. In pharmaceutical and biomedical applications, FDA 21 CFR Part 11 compliance is essential for systems storing critical biological materials. For food processing applications, HACCP (Hazard Analysis Critical Control Points) principles must be integrated into freezer operations and maintenance protocols.

Certification requirements vary by technology and application. Liquid nitrogen systems typically require pressure vessel certifications and cryogenic safety certifications, while hydrocarbon freezers must meet flammability safety standards such as UL 471 in North America or equivalent IEC standards internationally.

Compliance monitoring and documentation present significant operational challenges. Both technologies require regular safety audits, maintenance of detailed operating logs, and employee training records. However, liquid nitrogen systems demand additional documentation related to pressure vessel inspections and cryogenic material handling procedures, creating a more complex compliance burden compared to hydrocarbon alternatives.

Environmental Impact Assessment

The environmental impact of freezer systems extends far beyond their immediate operational safety concerns. When comparing liquid nitrogen and hydrocarbon freezers, several critical environmental factors must be considered for comprehensive assessment.

Liquid nitrogen systems present a mixed environmental profile. While liquid nitrogen itself is not a greenhouse gas and has zero global warming potential (GWP), its production process is highly energy-intensive. The cryogenic distillation of air requires substantial electricity consumption, resulting in significant indirect carbon emissions when powered by non-renewable energy sources. Studies indicate that producing one kilogram of liquid nitrogen can generate between 0.5-1.0 kg of CO2 equivalent emissions, depending on the energy mix used in production.

Hydrocarbon freezers, utilizing propane (R-290) or isobutane (R-600a), offer substantially lower direct environmental impact compared to traditional HFC refrigerants. These natural refrigerants have negligible GWP values (typically <10) and zero ozone depletion potential. However, their flammability necessitates smaller charge sizes, potentially affecting system efficiency in larger applications.

Leakage considerations present another important dimension in this comparison. Liquid nitrogen systems operate as open-loop configurations where the nitrogen is eventually released to atmosphere. While nitrogen constitutes 78% of atmospheric air and is inert, large-scale releases in confined areas can temporarily alter local atmospheric composition. Hydrocarbon systems, being closed-loop, retain refrigerants during normal operation, but accidental leakage presents both safety and environmental concerns.

Energy efficiency metrics favor different systems depending on application scale. For ultra-low temperature requirements, liquid nitrogen systems demonstrate superior efficiency in batch processing scenarios. Conversely, hydrocarbon systems typically achieve better energy performance in continuous cooling applications and moderate temperature ranges, particularly in smaller-scale operations where charge limitations are less restrictive.

End-of-life considerations reveal additional environmental implications. Hydrocarbon refrigerants require careful recovery and disposal to prevent atmospheric release, though their natural origin makes them less problematic than synthetic alternatives. Liquid nitrogen delivery systems involve minimal disposal concerns for the refrigerant itself, but the specialized tanks and delivery infrastructure represent significant embedded carbon and material footprints.

Regulatory frameworks increasingly favor natural refrigerants like hydrocarbons over synthetic alternatives, though safety requirements may limit their application in certain settings. Liquid nitrogen, while exempt from most refrigerant regulations, faces increasing scrutiny regarding energy efficiency standards and carbon footprint considerations in jurisdictions with strict carbon reduction targets.

Liquid nitrogen systems present a mixed environmental profile. While liquid nitrogen itself is not a greenhouse gas and has zero global warming potential (GWP), its production process is highly energy-intensive. The cryogenic distillation of air requires substantial electricity consumption, resulting in significant indirect carbon emissions when powered by non-renewable energy sources. Studies indicate that producing one kilogram of liquid nitrogen can generate between 0.5-1.0 kg of CO2 equivalent emissions, depending on the energy mix used in production.

Hydrocarbon freezers, utilizing propane (R-290) or isobutane (R-600a), offer substantially lower direct environmental impact compared to traditional HFC refrigerants. These natural refrigerants have negligible GWP values (typically <10) and zero ozone depletion potential. However, their flammability necessitates smaller charge sizes, potentially affecting system efficiency in larger applications.

Leakage considerations present another important dimension in this comparison. Liquid nitrogen systems operate as open-loop configurations where the nitrogen is eventually released to atmosphere. While nitrogen constitutes 78% of atmospheric air and is inert, large-scale releases in confined areas can temporarily alter local atmospheric composition. Hydrocarbon systems, being closed-loop, retain refrigerants during normal operation, but accidental leakage presents both safety and environmental concerns.

Energy efficiency metrics favor different systems depending on application scale. For ultra-low temperature requirements, liquid nitrogen systems demonstrate superior efficiency in batch processing scenarios. Conversely, hydrocarbon systems typically achieve better energy performance in continuous cooling applications and moderate temperature ranges, particularly in smaller-scale operations where charge limitations are less restrictive.

End-of-life considerations reveal additional environmental implications. Hydrocarbon refrigerants require careful recovery and disposal to prevent atmospheric release, though their natural origin makes them less problematic than synthetic alternatives. Liquid nitrogen delivery systems involve minimal disposal concerns for the refrigerant itself, but the specialized tanks and delivery infrastructure represent significant embedded carbon and material footprints.

Regulatory frameworks increasingly favor natural refrigerants like hydrocarbons over synthetic alternatives, though safety requirements may limit their application in certain settings. Liquid nitrogen, while exempt from most refrigerant regulations, faces increasing scrutiny regarding energy efficiency standards and carbon footprint considerations in jurisdictions with strict carbon reduction targets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!