How to Explore New Markets for Ethyl Acetate Products?

JUN 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Market Overview and Objectives

Ethyl acetate, a versatile organic compound, has been a staple in various industries for decades. Its market has shown steady growth, driven by its wide-ranging applications in coatings, adhesives, pharmaceuticals, and food industries. The global ethyl acetate market size was valued at approximately $3.3 billion in 2020 and is projected to reach $4.9 billion by 2028, growing at a CAGR of around 5.1% during the forecast period.

The primary objective of exploring new markets for ethyl acetate products is to capitalize on emerging opportunities and diversify the product portfolio. This strategy aims to mitigate risks associated with market saturation in traditional sectors and to tap into high-growth potential areas. By identifying and penetrating new markets, companies can achieve sustainable growth and maintain a competitive edge in the evolving chemical industry landscape.

One of the key drivers for market expansion is the increasing demand for eco-friendly and low-VOC (Volatile Organic Compound) products. As environmental regulations become more stringent globally, there is a growing need for greener alternatives in various applications. Ethyl acetate, being biodegradable and less toxic compared to other solvents, presents an opportunity to meet this demand, particularly in sectors like packaging, cosmetics, and household products.

The Asia-Pacific region has emerged as a lucrative market for ethyl acetate, driven by rapid industrialization, urbanization, and the growth of end-use industries. Countries like China, India, and Southeast Asian nations offer significant potential for market expansion due to their burgeoning manufacturing sectors and increasing consumer demand for products that utilize ethyl acetate.

Another promising avenue for market growth lies in the pharmaceutical industry. With the rising focus on healthcare and the continuous development of new drugs, the demand for high-purity ethyl acetate in pharmaceutical applications is expected to increase. This presents an opportunity to develop specialized grades of ethyl acetate tailored for pharmaceutical use, potentially commanding higher margins.

The food and beverage industry also offers untapped potential for ethyl acetate products. As a food additive and flavoring agent, ethyl acetate can be marketed more aggressively in this sector, particularly in developing economies where the processed food industry is rapidly expanding. Additionally, the growing trend of natural and organic products opens up possibilities for ethyl acetate derived from renewable sources, catering to the environmentally conscious consumer base.

To successfully explore these new markets, a comprehensive approach involving market research, product development, and strategic partnerships will be crucial. Understanding regional regulations, consumer preferences, and industry-specific requirements will be key to tailoring ethyl acetate products and marketing strategies for different market segments.

The primary objective of exploring new markets for ethyl acetate products is to capitalize on emerging opportunities and diversify the product portfolio. This strategy aims to mitigate risks associated with market saturation in traditional sectors and to tap into high-growth potential areas. By identifying and penetrating new markets, companies can achieve sustainable growth and maintain a competitive edge in the evolving chemical industry landscape.

One of the key drivers for market expansion is the increasing demand for eco-friendly and low-VOC (Volatile Organic Compound) products. As environmental regulations become more stringent globally, there is a growing need for greener alternatives in various applications. Ethyl acetate, being biodegradable and less toxic compared to other solvents, presents an opportunity to meet this demand, particularly in sectors like packaging, cosmetics, and household products.

The Asia-Pacific region has emerged as a lucrative market for ethyl acetate, driven by rapid industrialization, urbanization, and the growth of end-use industries. Countries like China, India, and Southeast Asian nations offer significant potential for market expansion due to their burgeoning manufacturing sectors and increasing consumer demand for products that utilize ethyl acetate.

Another promising avenue for market growth lies in the pharmaceutical industry. With the rising focus on healthcare and the continuous development of new drugs, the demand for high-purity ethyl acetate in pharmaceutical applications is expected to increase. This presents an opportunity to develop specialized grades of ethyl acetate tailored for pharmaceutical use, potentially commanding higher margins.

The food and beverage industry also offers untapped potential for ethyl acetate products. As a food additive and flavoring agent, ethyl acetate can be marketed more aggressively in this sector, particularly in developing economies where the processed food industry is rapidly expanding. Additionally, the growing trend of natural and organic products opens up possibilities for ethyl acetate derived from renewable sources, catering to the environmentally conscious consumer base.

To successfully explore these new markets, a comprehensive approach involving market research, product development, and strategic partnerships will be crucial. Understanding regional regulations, consumer preferences, and industry-specific requirements will be key to tailoring ethyl acetate products and marketing strategies for different market segments.

Demand Analysis for Ethyl Acetate Products

The global demand for ethyl acetate products has been steadily increasing, driven by its versatile applications across various industries. The market for ethyl acetate is primarily segmented into paints and coatings, adhesives and sealants, pharmaceuticals, food and beverages, and others. In the paints and coatings industry, ethyl acetate is widely used as a solvent due to its excellent solvency and fast evaporation rate, contributing significantly to market growth.

The adhesives and sealants sector represents another major consumer of ethyl acetate, particularly in packaging applications. The growing e-commerce industry and increasing demand for packaged goods have fueled the need for high-performance adhesives, thereby boosting ethyl acetate consumption. In the pharmaceutical industry, ethyl acetate finds applications in the production of various drugs and as an extraction solvent, with the sector's growth directly impacting ethyl acetate demand.

The food and beverage industry utilizes ethyl acetate as a flavoring agent and in the decaffeination of coffee and tea. As consumer preferences shift towards healthier and more diverse food options, the demand for ethyl acetate in this sector is expected to rise. Additionally, the cosmetics and personal care industry is emerging as a promising market for ethyl acetate, particularly in nail polish removers and other beauty products.

Geographically, Asia-Pacific dominates the ethyl acetate market, with China and India being the major consumers. The rapid industrialization, growing population, and increasing disposable income in these countries are driving the demand for ethyl acetate-based products. North America and Europe follow, with mature markets showing steady growth in specialized applications.

The automotive industry presents a significant opportunity for ethyl acetate products, especially in automotive coatings and adhesives. As the automotive sector shifts towards electric vehicles and lightweight materials, the demand for high-performance coatings and adhesives is expected to increase, potentially opening new avenues for ethyl acetate applications.

Environmental regulations and sustainability concerns are influencing market dynamics, with a growing emphasis on bio-based ethyl acetate. This trend is creating opportunities for manufacturers to develop eco-friendly alternatives, potentially expanding the market into new, environmentally conscious segments.

In conclusion, the demand analysis for ethyl acetate products reveals a robust and diverse market with growth potential across multiple industries. To explore new markets, companies should focus on emerging applications in pharmaceuticals, cosmetics, and sustainable products while also strengthening their presence in established sectors like paints and adhesives.

The adhesives and sealants sector represents another major consumer of ethyl acetate, particularly in packaging applications. The growing e-commerce industry and increasing demand for packaged goods have fueled the need for high-performance adhesives, thereby boosting ethyl acetate consumption. In the pharmaceutical industry, ethyl acetate finds applications in the production of various drugs and as an extraction solvent, with the sector's growth directly impacting ethyl acetate demand.

The food and beverage industry utilizes ethyl acetate as a flavoring agent and in the decaffeination of coffee and tea. As consumer preferences shift towards healthier and more diverse food options, the demand for ethyl acetate in this sector is expected to rise. Additionally, the cosmetics and personal care industry is emerging as a promising market for ethyl acetate, particularly in nail polish removers and other beauty products.

Geographically, Asia-Pacific dominates the ethyl acetate market, with China and India being the major consumers. The rapid industrialization, growing population, and increasing disposable income in these countries are driving the demand for ethyl acetate-based products. North America and Europe follow, with mature markets showing steady growth in specialized applications.

The automotive industry presents a significant opportunity for ethyl acetate products, especially in automotive coatings and adhesives. As the automotive sector shifts towards electric vehicles and lightweight materials, the demand for high-performance coatings and adhesives is expected to increase, potentially opening new avenues for ethyl acetate applications.

Environmental regulations and sustainability concerns are influencing market dynamics, with a growing emphasis on bio-based ethyl acetate. This trend is creating opportunities for manufacturers to develop eco-friendly alternatives, potentially expanding the market into new, environmentally conscious segments.

In conclusion, the demand analysis for ethyl acetate products reveals a robust and diverse market with growth potential across multiple industries. To explore new markets, companies should focus on emerging applications in pharmaceuticals, cosmetics, and sustainable products while also strengthening their presence in established sectors like paints and adhesives.

Current Challenges in Ethyl Acetate Market Expansion

The ethyl acetate market is currently facing several significant challenges in its expansion efforts. One of the primary obstacles is the intense competition from alternative solvents and substitutes. As environmental regulations become more stringent, industries are increasingly seeking eco-friendly alternatives, which puts pressure on traditional ethyl acetate products.

Market saturation in established regions is another hurdle for ethyl acetate producers. Mature markets like North America and Europe are experiencing slower growth rates, necessitating the exploration of new geographical areas for expansion. However, penetrating emerging markets comes with its own set of challenges, including regulatory hurdles, cultural differences, and the need for localized marketing strategies.

The volatility of raw material prices, particularly ethanol and acetic acid, poses a significant challenge to market expansion. Fluctuations in these key ingredients directly impact production costs and, consequently, the competitiveness of ethyl acetate products in the global market. This price instability makes it difficult for manufacturers to maintain consistent profit margins and plan long-term growth strategies.

Transportation and logistics present another set of challenges for ethyl acetate market expansion. As a flammable liquid, ethyl acetate requires specialized handling and storage, which can increase distribution costs and limit market reach. This is particularly problematic when exploring new markets in remote or underdeveloped regions with limited infrastructure.

The ongoing global economic uncertainties, exacerbated by factors such as trade tensions and the aftermath of the COVID-19 pandemic, have created a challenging environment for market expansion. These uncertainties have led to cautious spending behaviors among potential customers and delayed investment decisions in new applications or markets for ethyl acetate products.

Technological advancements in competing industries also pose a challenge to ethyl acetate market growth. As industries develop new materials and processes that reduce or eliminate the need for solvents like ethyl acetate, manufacturers must continuously innovate to maintain their market position and find new applications for their products.

Lastly, the increasing focus on sustainability and circular economy principles challenges ethyl acetate producers to develop more environmentally friendly production methods and end-of-life solutions for their products. This shift requires significant investment in research and development, as well as potential changes to existing manufacturing processes, which can be both costly and time-consuming.

Market saturation in established regions is another hurdle for ethyl acetate producers. Mature markets like North America and Europe are experiencing slower growth rates, necessitating the exploration of new geographical areas for expansion. However, penetrating emerging markets comes with its own set of challenges, including regulatory hurdles, cultural differences, and the need for localized marketing strategies.

The volatility of raw material prices, particularly ethanol and acetic acid, poses a significant challenge to market expansion. Fluctuations in these key ingredients directly impact production costs and, consequently, the competitiveness of ethyl acetate products in the global market. This price instability makes it difficult for manufacturers to maintain consistent profit margins and plan long-term growth strategies.

Transportation and logistics present another set of challenges for ethyl acetate market expansion. As a flammable liquid, ethyl acetate requires specialized handling and storage, which can increase distribution costs and limit market reach. This is particularly problematic when exploring new markets in remote or underdeveloped regions with limited infrastructure.

The ongoing global economic uncertainties, exacerbated by factors such as trade tensions and the aftermath of the COVID-19 pandemic, have created a challenging environment for market expansion. These uncertainties have led to cautious spending behaviors among potential customers and delayed investment decisions in new applications or markets for ethyl acetate products.

Technological advancements in competing industries also pose a challenge to ethyl acetate market growth. As industries develop new materials and processes that reduce or eliminate the need for solvents like ethyl acetate, manufacturers must continuously innovate to maintain their market position and find new applications for their products.

Lastly, the increasing focus on sustainability and circular economy principles challenges ethyl acetate producers to develop more environmentally friendly production methods and end-of-life solutions for their products. This shift requires significant investment in research and development, as well as potential changes to existing manufacturing processes, which can be both costly and time-consuming.

Existing Strategies for Ethyl Acetate Market Penetration

01 Production and purification of ethyl acetate

Various methods for producing and purifying ethyl acetate are described. These include esterification processes, distillation techniques, and the use of catalysts to improve yield and purity. The production methods aim to optimize the synthesis of ethyl acetate from ethanol and acetic acid or other precursors.- Production and purification of ethyl acetate: Various methods for producing and purifying ethyl acetate are described, including esterification processes, distillation techniques, and separation methods. These processes aim to improve the yield and purity of ethyl acetate for industrial applications.

- Applications of ethyl acetate in chemical processes: Ethyl acetate is utilized in diverse chemical processes, such as solvent extraction, organic synthesis, and as a reaction medium. Its properties make it suitable for various industrial applications, including the production of pharmaceuticals, polymers, and other chemical compounds.

- Ethyl acetate in coating and adhesive formulations: Ethyl acetate is employed in the formulation of coatings, adhesives, and related products. Its solvent properties and compatibility with various resins make it valuable in these applications, contributing to improved product performance and characteristics.

- Environmental and safety considerations for ethyl acetate: Research and development efforts focus on improving the environmental impact and safety aspects of ethyl acetate production and use. This includes developing greener production methods, enhancing recycling processes, and implementing safety measures for handling and storage.

- Novel applications and derivatives of ethyl acetate: Ongoing research explores new applications and derivatives of ethyl acetate, including its use in advanced materials, energy storage systems, and biotechnology. These innovations aim to expand the utility of ethyl acetate and its related compounds in various industries.

02 Applications of ethyl acetate in industrial processes

Ethyl acetate finds diverse applications in industrial processes. It is used as a solvent in various industries, including pharmaceuticals, coatings, and adhesives. The compound is also utilized in extraction processes, as a reaction medium, and in the production of other chemicals.Expand Specific Solutions03 Ethyl acetate in polymer and material science

Ethyl acetate plays a role in polymer and material science applications. It is used in the preparation of various polymers, as a solvent for resins, and in the development of coatings and films. The compound's properties make it suitable for use in material processing and modification.Expand Specific Solutions04 Environmental and safety considerations for ethyl acetate

Research and development efforts focus on addressing environmental and safety concerns related to ethyl acetate. This includes developing eco-friendly production methods, improving handling and storage practices, and exploring alternatives to reduce environmental impact and enhance worker safety.Expand Specific Solutions05 Novel synthesis routes and catalysts for ethyl acetate production

Innovative approaches to ethyl acetate synthesis are being explored, including the development of new catalysts and reaction pathways. These methods aim to improve efficiency, reduce energy consumption, and enhance selectivity in the production of ethyl acetate from various starting materials.Expand Specific Solutions

Key Players in Ethyl Acetate Production and Distribution

The ethyl acetate market is in a mature growth stage, with a global market size estimated to reach $4.3 billion by 2026. The industry is characterized by established players like Celanese, SABIC, and Eastman Chemical, alongside emerging companies such as Nantong Baichuan and Jiangsu Baichuan. Technological maturity is high, with most innovations focusing on process optimization and sustainability. Key players are investing in bio-based ethyl acetate production, as exemplified by Viridis Chemical's 100% biobased offering. The competitive landscape is intensifying as companies explore new applications and markets, particularly in emerging economies, to drive growth in this mature industry.

Celanese International Corp.

Technical Solution: Celanese has developed a multi-pronged approach to explore new markets for ethyl acetate products. They have implemented a market segmentation strategy, focusing on high-growth industries such as pharmaceuticals, electronics, and sustainable packaging. The company has invested in R&D to develop specialized grades of ethyl acetate tailored for these sectors, such as high-purity grades for electronics and bio-based ethyl acetate for eco-conscious consumers[1]. Celanese has also expanded its global distribution network, establishing strategic partnerships in emerging markets like Southeast Asia and Latin America to capture new growth opportunities[2]. Additionally, they have implemented a digital marketing strategy, leveraging data analytics to identify potential customers and tailor their offerings accordingly[3].

Strengths: Strong R&D capabilities, global presence, and diversified product portfolio. Weaknesses: Potential vulnerability to raw material price fluctuations and competition from local producers in emerging markets.

Eastman Chemical Co.

Technical Solution: Eastman Chemical Co. has adopted an innovation-driven approach to explore new markets for ethyl acetate products. They have focused on developing sustainable solutions, including a proprietary process for producing bio-based ethyl acetate from renewable resources[4]. This aligns with the growing demand for eco-friendly chemicals in various industries. Eastman has also invested in application development centers globally, working closely with customers to create tailored ethyl acetate formulations for specific end-use applications, such as advanced coatings and adhesives[5]. The company has implemented a "market-back" innovation strategy, identifying unmet needs in potential markets and developing products to address these gaps[6]. Furthermore, Eastman has leveraged its strong brand reputation to enter premium segments in established markets, offering high-performance ethyl acetate products for specialized applications.

Strengths: Strong focus on sustainability, customer-centric innovation, and established brand reputation. Weaknesses: Potentially higher production costs for bio-based products and dependence on patent protection for proprietary technologies.

Innovative Applications of Ethyl Acetate

Process for production of ethyl acetate

PatentWO2025072073A1

Innovation

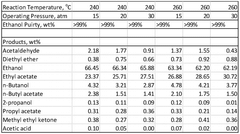

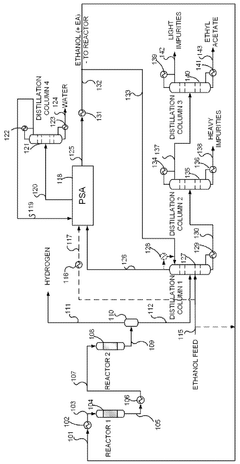

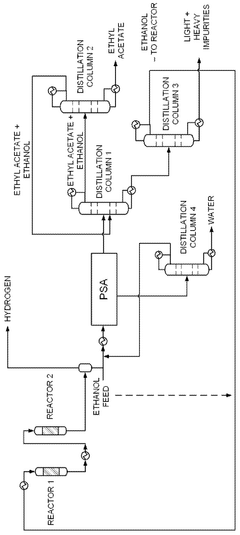

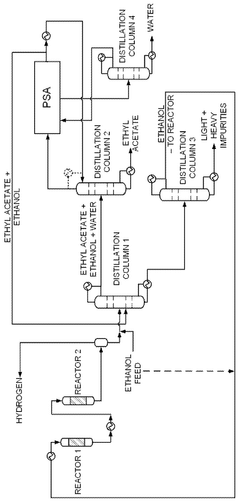

- A novel process that converts ethanol to ethyl acetate through dehydrogenation, followed by selective hydrogenation of byproducts to facilitate easier separation, and utilizes pressure swing adsorption to minimize water content and protect the catalyst.

Ethyl Acetate Production

PatentActiveUS20120178962A1

Innovation

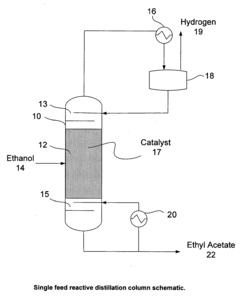

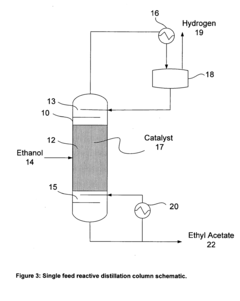

- A reactive distillation process using a single reactive distillation column where ethanol is dehydrogenated over a catalyst to produce ethyl acetate and hydrogen, with optional hydrogenation of byproducts to simplify separation and achieve high purity ethyl acetate, utilizing catalysts like copper, ruthenium, and platinum supported on materials like carbon or alumina.

Regulatory Framework for Ethyl Acetate Usage

The regulatory framework for ethyl acetate usage plays a crucial role in shaping market opportunities and constraints for this versatile chemical compound. As manufacturers and distributors seek to explore new markets for ethyl acetate products, understanding and navigating the complex web of regulations is essential for successful market entry and expansion.

At the international level, the United Nations' Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provides a standardized approach to hazard communication. Ethyl acetate is classified under GHS as a flammable liquid and vapor, with potential health hazards including eye and respiratory irritation. Compliance with GHS labeling and safety data sheet requirements is mandatory for global trade.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). While ethyl acetate is not considered a hazardous air pollutant, its use in certain applications may be subject to volatile organic compound (VOC) emission limits set by state and local authorities. The Food and Drug Administration (FDA) also oversees the use of ethyl acetate in food packaging and pharmaceutical applications.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation governs the production, import, and use of ethyl acetate within the EU market. Manufacturers and importers must register ethyl acetate with the European Chemicals Agency (ECHA) and provide safety information. Additionally, the EU's Classification, Labelling and Packaging (CLP) Regulation aligns with GHS standards for hazard communication.

In Asia, countries like China and Japan have their own chemical management systems. China's Order No. 7 and Measures on Environmental Management of New Chemical Substances regulate the import and manufacture of ethyl acetate. Japan's Chemical Substances Control Law (CSCL) requires notification and assessment of new chemical substances, including ethyl acetate derivatives.

Emerging markets often present a complex regulatory landscape, with varying degrees of alignment with international standards. Countries may have specific import restrictions, local registration requirements, or industry-specific regulations that impact the use of ethyl acetate in different applications.

As companies explore new markets for ethyl acetate products, conducting thorough regulatory assessments for each target market is essential. This includes understanding product registration requirements, import/export regulations, labeling and packaging standards, and any sector-specific regulations that may apply to intended applications.

At the international level, the United Nations' Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provides a standardized approach to hazard communication. Ethyl acetate is classified under GHS as a flammable liquid and vapor, with potential health hazards including eye and respiratory irritation. Compliance with GHS labeling and safety data sheet requirements is mandatory for global trade.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA). While ethyl acetate is not considered a hazardous air pollutant, its use in certain applications may be subject to volatile organic compound (VOC) emission limits set by state and local authorities. The Food and Drug Administration (FDA) also oversees the use of ethyl acetate in food packaging and pharmaceutical applications.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation governs the production, import, and use of ethyl acetate within the EU market. Manufacturers and importers must register ethyl acetate with the European Chemicals Agency (ECHA) and provide safety information. Additionally, the EU's Classification, Labelling and Packaging (CLP) Regulation aligns with GHS standards for hazard communication.

In Asia, countries like China and Japan have their own chemical management systems. China's Order No. 7 and Measures on Environmental Management of New Chemical Substances regulate the import and manufacture of ethyl acetate. Japan's Chemical Substances Control Law (CSCL) requires notification and assessment of new chemical substances, including ethyl acetate derivatives.

Emerging markets often present a complex regulatory landscape, with varying degrees of alignment with international standards. Countries may have specific import restrictions, local registration requirements, or industry-specific regulations that impact the use of ethyl acetate in different applications.

As companies explore new markets for ethyl acetate products, conducting thorough regulatory assessments for each target market is essential. This includes understanding product registration requirements, import/export regulations, labeling and packaging standards, and any sector-specific regulations that may apply to intended applications.

Environmental Impact of Ethyl Acetate Production

The environmental impact of ethyl acetate production is a critical consideration in the exploration of new markets for ethyl acetate products. The manufacturing process of ethyl acetate involves several chemical reactions and industrial processes that can have significant environmental implications if not properly managed.

One of the primary environmental concerns is the emission of volatile organic compounds (VOCs) during production. Ethyl acetate itself is a VOC, and its release into the atmosphere can contribute to air pollution and the formation of ground-level ozone. To mitigate this impact, modern production facilities employ advanced emission control technologies, such as thermal oxidizers or carbon adsorption systems, to capture and treat VOC emissions.

Water pollution is another potential environmental issue associated with ethyl acetate production. The process generates wastewater that may contain organic compounds and other contaminants. Proper treatment of this wastewater is essential to prevent the release of harmful substances into local water bodies. Many facilities implement on-site wastewater treatment systems or partner with specialized treatment facilities to ensure compliance with environmental regulations.

Energy consumption is a significant factor in the environmental footprint of ethyl acetate production. The process requires substantial energy inputs for heating, cooling, and distillation. To address this, manufacturers are increasingly adopting energy-efficient technologies and exploring renewable energy sources to reduce their carbon footprint and overall environmental impact.

The sourcing of raw materials for ethyl acetate production also has environmental implications. Traditional production methods rely on petroleum-based feedstocks, which are non-renewable resources. However, there is a growing trend towards using bio-based feedstocks, such as ethanol derived from agricultural sources, to create more sustainable production processes. This shift not only reduces dependence on fossil fuels but also potentially lowers the overall carbon footprint of ethyl acetate production.

Waste management is another crucial aspect of the environmental impact assessment. The production process generates various waste streams, including spent catalysts, byproducts, and packaging materials. Implementing effective waste reduction, recycling, and disposal strategies is essential for minimizing the environmental burden of these waste products.

As companies explore new markets for ethyl acetate products, they must consider the environmental regulations and standards in target regions. Different countries and regions may have varying requirements for emissions control, waste management, and overall environmental performance. Compliance with these regulations is not only a legal necessity but also a key factor in gaining market acceptance and maintaining a positive corporate image.

One of the primary environmental concerns is the emission of volatile organic compounds (VOCs) during production. Ethyl acetate itself is a VOC, and its release into the atmosphere can contribute to air pollution and the formation of ground-level ozone. To mitigate this impact, modern production facilities employ advanced emission control technologies, such as thermal oxidizers or carbon adsorption systems, to capture and treat VOC emissions.

Water pollution is another potential environmental issue associated with ethyl acetate production. The process generates wastewater that may contain organic compounds and other contaminants. Proper treatment of this wastewater is essential to prevent the release of harmful substances into local water bodies. Many facilities implement on-site wastewater treatment systems or partner with specialized treatment facilities to ensure compliance with environmental regulations.

Energy consumption is a significant factor in the environmental footprint of ethyl acetate production. The process requires substantial energy inputs for heating, cooling, and distillation. To address this, manufacturers are increasingly adopting energy-efficient technologies and exploring renewable energy sources to reduce their carbon footprint and overall environmental impact.

The sourcing of raw materials for ethyl acetate production also has environmental implications. Traditional production methods rely on petroleum-based feedstocks, which are non-renewable resources. However, there is a growing trend towards using bio-based feedstocks, such as ethanol derived from agricultural sources, to create more sustainable production processes. This shift not only reduces dependence on fossil fuels but also potentially lowers the overall carbon footprint of ethyl acetate production.

Waste management is another crucial aspect of the environmental impact assessment. The production process generates various waste streams, including spent catalysts, byproducts, and packaging materials. Implementing effective waste reduction, recycling, and disposal strategies is essential for minimizing the environmental burden of these waste products.

As companies explore new markets for ethyl acetate products, they must consider the environmental regulations and standards in target regions. Different countries and regions may have varying requirements for emissions control, waste management, and overall environmental performance. Compliance with these regulations is not only a legal necessity but also a key factor in gaining market acceptance and maintaining a positive corporate image.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!