How to Maximize Thermopile Sensor Life Using Protective Layers

SEP 10, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermopile Sensor Protection Background and Objectives

Thermopile sensors have emerged as critical components in various industrial, medical, and consumer applications due to their ability to detect infrared radiation without physical contact. The evolution of these sensors dates back to the early 20th century with the discovery of the thermoelectric effect, but significant commercial applications only materialized in the 1980s and 1990s with advancements in microfabrication techniques. Today's thermopile sensors represent the culmination of decades of refinement in materials science, semiconductor processing, and packaging technologies.

The technological trajectory of thermopile sensors has been characterized by continuous improvements in sensitivity, response time, and miniaturization. However, a persistent challenge has been ensuring longevity under harsh operating conditions. Exposure to environmental factors such as moisture, corrosive gases, particulate matter, and temperature fluctuations can significantly degrade sensor performance and reduce operational lifespan. This vulnerability has historically limited the deployment of thermopile sensors in certain high-value applications where reliability is paramount.

Recent technological trends indicate a growing emphasis on protective strategies for extending sensor life. The industry has witnessed a shift from basic encapsulation methods to sophisticated multi-layer protection systems incorporating advanced materials. This evolution aligns with broader trends in the sensor market, where longevity and reliability have become key differentiators in an increasingly competitive landscape.

The primary objective of this technical research is to comprehensively evaluate existing and emerging protective layer technologies for thermopile sensors. We aim to identify optimal material compositions, deposition techniques, and structural designs that maximize sensor lifespan without compromising measurement accuracy or response characteristics. Additionally, we seek to establish quantifiable metrics for evaluating protection effectiveness across diverse operating environments.

Secondary objectives include mapping the correlation between specific environmental stressors and sensor degradation mechanisms, developing accelerated aging test protocols that reliably predict real-world performance, and identifying cost-effective implementation strategies suitable for volume manufacturing. The research also aims to anticipate future developments in protective technologies by analyzing emerging materials and deposition methods that show promise for next-generation thermopile sensors.

This investigation is particularly timely given the expanding application scope of thermopile sensors in critical systems such as medical diagnostics, industrial process control, and automotive safety features, where sensor failure can have significant consequences. By establishing a robust framework for maximizing thermopile sensor life through protective layers, this research seeks to enable new applications and improve the reliability of existing implementations.

The technological trajectory of thermopile sensors has been characterized by continuous improvements in sensitivity, response time, and miniaturization. However, a persistent challenge has been ensuring longevity under harsh operating conditions. Exposure to environmental factors such as moisture, corrosive gases, particulate matter, and temperature fluctuations can significantly degrade sensor performance and reduce operational lifespan. This vulnerability has historically limited the deployment of thermopile sensors in certain high-value applications where reliability is paramount.

Recent technological trends indicate a growing emphasis on protective strategies for extending sensor life. The industry has witnessed a shift from basic encapsulation methods to sophisticated multi-layer protection systems incorporating advanced materials. This evolution aligns with broader trends in the sensor market, where longevity and reliability have become key differentiators in an increasingly competitive landscape.

The primary objective of this technical research is to comprehensively evaluate existing and emerging protective layer technologies for thermopile sensors. We aim to identify optimal material compositions, deposition techniques, and structural designs that maximize sensor lifespan without compromising measurement accuracy or response characteristics. Additionally, we seek to establish quantifiable metrics for evaluating protection effectiveness across diverse operating environments.

Secondary objectives include mapping the correlation between specific environmental stressors and sensor degradation mechanisms, developing accelerated aging test protocols that reliably predict real-world performance, and identifying cost-effective implementation strategies suitable for volume manufacturing. The research also aims to anticipate future developments in protective technologies by analyzing emerging materials and deposition methods that show promise for next-generation thermopile sensors.

This investigation is particularly timely given the expanding application scope of thermopile sensors in critical systems such as medical diagnostics, industrial process control, and automotive safety features, where sensor failure can have significant consequences. By establishing a robust framework for maximizing thermopile sensor life through protective layers, this research seeks to enable new applications and improve the reliability of existing implementations.

Market Demand Analysis for Long-lasting Thermopile Sensors

The global market for thermopile sensors has been experiencing steady growth, driven primarily by increasing applications in various industries including automotive, consumer electronics, healthcare, and industrial automation. The demand for long-lasting thermopile sensors is particularly pronounced as these devices are increasingly deployed in critical systems where maintenance and replacement are costly and disruptive.

Current market analysis indicates that the thermopile sensor market is expected to grow at a compound annual growth rate of approximately 8% through 2028. This growth is largely attributed to the expanding use of non-contact temperature measurement technologies across multiple sectors. The automotive industry represents one of the largest market segments, where thermopile sensors are utilized in climate control systems, engine monitoring, and advanced driver-assistance systems.

Consumer electronics constitutes another significant market segment, with thermopile sensors being integrated into smartphones, tablets, and wearable devices for temperature monitoring and energy management. The miniaturization trend in electronics has created demand for smaller yet more durable thermopile sensors that can withstand the rigors of daily use while maintaining accuracy.

In the healthcare sector, the need for reliable temperature measurement devices has surged, especially following global health crises. Medical equipment manufacturers are seeking thermopile sensors with extended operational lifespans to ensure consistent performance in critical diagnostic and monitoring equipment. The ability to function accurately over extended periods without degradation is a key purchasing criterion in this segment.

Industrial applications represent a growing market for thermopile sensors, particularly in process control, predictive maintenance, and energy management systems. In these environments, sensors are often exposed to harsh conditions including extreme temperatures, chemicals, and mechanical stress, making durability and longevity paramount considerations for buyers.

Market research reveals that end-users are increasingly willing to pay premium prices for thermopile sensors with demonstrated longevity. The total cost of ownership, rather than initial acquisition cost, has become a decisive factor in purchasing decisions. This shift has created a market opportunity for sensors with advanced protective layers that can extend operational life by preventing contamination, oxidation, and physical damage.

Regional analysis shows that North America and Europe currently lead in the adoption of high-durability thermopile sensors, primarily due to stringent regulatory requirements and higher investment capabilities. However, the Asia-Pacific region is expected to witness the fastest growth rate as manufacturing capabilities improve and applications expand across emerging economies.

The market demand for protective layer technologies is particularly strong, with customers seeking solutions that can shield sensors from moisture, dust, chemicals, and mechanical abrasion without compromising measurement accuracy or response time. This has spurred research into advanced materials including specialized polymers, ceramic coatings, and composite structures designed specifically for thermopile protection.

Current market analysis indicates that the thermopile sensor market is expected to grow at a compound annual growth rate of approximately 8% through 2028. This growth is largely attributed to the expanding use of non-contact temperature measurement technologies across multiple sectors. The automotive industry represents one of the largest market segments, where thermopile sensors are utilized in climate control systems, engine monitoring, and advanced driver-assistance systems.

Consumer electronics constitutes another significant market segment, with thermopile sensors being integrated into smartphones, tablets, and wearable devices for temperature monitoring and energy management. The miniaturization trend in electronics has created demand for smaller yet more durable thermopile sensors that can withstand the rigors of daily use while maintaining accuracy.

In the healthcare sector, the need for reliable temperature measurement devices has surged, especially following global health crises. Medical equipment manufacturers are seeking thermopile sensors with extended operational lifespans to ensure consistent performance in critical diagnostic and monitoring equipment. The ability to function accurately over extended periods without degradation is a key purchasing criterion in this segment.

Industrial applications represent a growing market for thermopile sensors, particularly in process control, predictive maintenance, and energy management systems. In these environments, sensors are often exposed to harsh conditions including extreme temperatures, chemicals, and mechanical stress, making durability and longevity paramount considerations for buyers.

Market research reveals that end-users are increasingly willing to pay premium prices for thermopile sensors with demonstrated longevity. The total cost of ownership, rather than initial acquisition cost, has become a decisive factor in purchasing decisions. This shift has created a market opportunity for sensors with advanced protective layers that can extend operational life by preventing contamination, oxidation, and physical damage.

Regional analysis shows that North America and Europe currently lead in the adoption of high-durability thermopile sensors, primarily due to stringent regulatory requirements and higher investment capabilities. However, the Asia-Pacific region is expected to witness the fastest growth rate as manufacturing capabilities improve and applications expand across emerging economies.

The market demand for protective layer technologies is particularly strong, with customers seeking solutions that can shield sensors from moisture, dust, chemicals, and mechanical abrasion without compromising measurement accuracy or response time. This has spurred research into advanced materials including specialized polymers, ceramic coatings, and composite structures designed specifically for thermopile protection.

Current Challenges in Thermopile Sensor Protection

Thermopile sensors face significant protection challenges in various industrial and consumer applications. The primary issue stems from their exposure to harsh environmental conditions, including extreme temperatures, corrosive chemicals, and mechanical stresses. These factors can severely compromise sensor performance and reduce operational lifespan. Traditional protective measures often fail to provide adequate long-term protection while maintaining optimal sensor sensitivity.

Moisture ingress represents one of the most persistent challenges for thermopile sensor protection. When water molecules penetrate the sensor housing or protective layers, they can cause electrical shorts, corrosion of metal components, and degradation of the sensing elements. This is particularly problematic in applications with temperature cycling, where condensation can repeatedly form and evaporate, accelerating deterioration processes.

Chemical compatibility issues present another significant hurdle. Many protective materials that offer excellent mechanical or thermal protection may react unfavorably with the sensor materials or with substances present in the operating environment. These chemical interactions can lead to gradual degradation of the protective layer itself, ultimately exposing the sensitive thermopile elements to damage.

Thermal management challenges also complicate protection strategies. Protective layers must balance two competing requirements: they must shield the sensor from environmental factors while allowing efficient heat transfer to maintain measurement accuracy. Excessively thick or thermally insulating protective materials can distort temperature readings and reduce sensor response time, effectively trading longevity for performance.

Manufacturing consistency poses additional difficulties. The application of protective layers must be precisely controlled to ensure uniform coverage without introducing defects that could become failure points. Variations in coating thickness, adhesion quality, or material composition can lead to inconsistent sensor performance and unpredictable lifespans across production batches.

Cost considerations further constrain protection solutions. While advanced materials like specialized ceramics or composite polymers might offer superior protection characteristics, their implementation must remain economically viable for mass production. This economic pressure often forces compromises in protection strategy that may limit maximum achievable sensor lifespan.

Emerging applications in extreme environments are pushing the boundaries of current protection technologies. For instance, thermopile sensors deployed in aerospace, automotive, or industrial process monitoring face combinations of stressors that conventional protective approaches cannot adequately address. These applications demand innovative multi-layer protection systems that can withstand simultaneous thermal, chemical, and mechanical challenges without compromising measurement accuracy.

Moisture ingress represents one of the most persistent challenges for thermopile sensor protection. When water molecules penetrate the sensor housing or protective layers, they can cause electrical shorts, corrosion of metal components, and degradation of the sensing elements. This is particularly problematic in applications with temperature cycling, where condensation can repeatedly form and evaporate, accelerating deterioration processes.

Chemical compatibility issues present another significant hurdle. Many protective materials that offer excellent mechanical or thermal protection may react unfavorably with the sensor materials or with substances present in the operating environment. These chemical interactions can lead to gradual degradation of the protective layer itself, ultimately exposing the sensitive thermopile elements to damage.

Thermal management challenges also complicate protection strategies. Protective layers must balance two competing requirements: they must shield the sensor from environmental factors while allowing efficient heat transfer to maintain measurement accuracy. Excessively thick or thermally insulating protective materials can distort temperature readings and reduce sensor response time, effectively trading longevity for performance.

Manufacturing consistency poses additional difficulties. The application of protective layers must be precisely controlled to ensure uniform coverage without introducing defects that could become failure points. Variations in coating thickness, adhesion quality, or material composition can lead to inconsistent sensor performance and unpredictable lifespans across production batches.

Cost considerations further constrain protection solutions. While advanced materials like specialized ceramics or composite polymers might offer superior protection characteristics, their implementation must remain economically viable for mass production. This economic pressure often forces compromises in protection strategy that may limit maximum achievable sensor lifespan.

Emerging applications in extreme environments are pushing the boundaries of current protection technologies. For instance, thermopile sensors deployed in aerospace, automotive, or industrial process monitoring face combinations of stressors that conventional protective approaches cannot adequately address. These applications demand innovative multi-layer protection systems that can withstand simultaneous thermal, chemical, and mechanical challenges without compromising measurement accuracy.

Current Protective Layer Solutions and Materials

01 Protective coatings for thermopile sensors

Various protective coatings can be applied to thermopile sensors to extend their operational life and protect against environmental factors. These coatings include silicon nitride, silicon dioxide, and polymer-based materials that shield the sensitive elements from moisture, chemicals, and mechanical damage. The protective layers are typically deposited using techniques such as chemical vapor deposition or sputtering to ensure uniform coverage and strong adhesion to the sensor surface.- Protective coatings for thermopile sensors: Various protective coatings can be applied to thermopile sensors to extend their lifespan and protect against environmental factors. These coatings include polymer films, ceramic layers, and specialized materials that shield the sensitive elements from moisture, corrosion, and mechanical damage. The protective layers are designed to maintain sensor accuracy while providing a barrier against contaminants that could degrade performance over time.

- Encapsulation techniques for sensor longevity: Encapsulation methods are employed to seal thermopile sensors from harsh environments, significantly extending their operational life. These techniques include hermetic sealing, vacuum packaging, and specialized encapsulants that prevent ingress of harmful substances while allowing thermal radiation to reach the sensing elements. Proper encapsulation maintains calibration stability and prevents drift in sensor readings over extended periods of use.

- Materials selection for thermopile protection: The selection of appropriate materials for protective layers is critical for thermopile sensor longevity. Materials such as silicon nitride, silicon dioxide, specialized polymers, and metal oxides offer different advantages in terms of thermal conductivity, transparency to infrared radiation, and resistance to environmental stressors. The material composition directly impacts the sensor's ability to maintain accuracy and stability throughout its operational life.

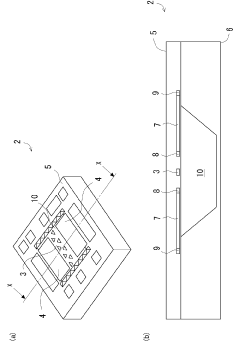

- Structural design for enhanced durability: Innovative structural designs can significantly improve thermopile sensor durability and lifespan. These include suspended membrane structures, reinforced sensing elements, and specialized housing configurations that minimize mechanical stress and thermal cycling effects. The physical arrangement of sensor components and protective elements plays a crucial role in preventing degradation and ensuring consistent performance over extended periods.

- Environmental resistance technologies: Advanced technologies have been developed to enhance thermopile sensors' resistance to specific environmental challenges. These include anti-corrosion treatments, moisture-repellent coatings, and specialized barriers against chemical contaminants. Some solutions incorporate self-healing materials or sacrificial protection layers that gradually degrade while preserving the integrity of the sensing elements, thereby extending the overall sensor life in harsh operating conditions.

02 Encapsulation techniques for enhanced durability

Encapsulation methods provide comprehensive protection for thermopile sensors, significantly extending their service life. These techniques involve hermetically sealing the sensor elements within specialized housings or applying conformal coatings that conform to the sensor's geometry. Advanced encapsulation materials include glass frit seals, ceramic packages, and specialized polymers that offer resistance to thermal cycling, vibration, and corrosive environments while maintaining the sensor's thermal response characteristics.Expand Specific Solutions03 Passivation layers for environmental resistance

Passivation layers are specifically designed to protect thermopile sensors from oxidation, corrosion, and other degradation mechanisms. These thin films, often composed of materials like aluminum oxide, tantalum oxide, or specialized passivation compounds, create a barrier against reactive species while allowing efficient thermal transfer. The passivation process can be tailored to specific operating environments, with multi-layer approaches providing enhanced protection against particular chemical exposures or extreme temperature conditions.Expand Specific Solutions04 Membrane structures for thermal isolation and protection

Advanced membrane structures serve dual purposes in thermopile sensors by providing both thermal isolation and physical protection. These thin, suspended structures support the thermopile junctions while minimizing thermal mass and conduction paths. Protective membranes are typically fabricated from materials like silicon nitride, polyimide, or silicon carbide that offer excellent mechanical strength despite their minimal thickness. The membrane design must balance robustness against environmental factors with optimal thermal performance characteristics.Expand Specific Solutions05 Self-healing and regenerative protective systems

Innovative self-healing and regenerative protective systems represent the cutting edge in thermopile sensor life extension. These approaches incorporate materials that can repair minor damage automatically or through controlled activation processes. Examples include self-healing polymers that flow to fill microcracks, sacrificial layers that corrode preferentially to protect critical components, and regenerative coatings that can be refreshed in-situ. These technologies are particularly valuable in applications where sensor replacement is difficult or impossible.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The thermopile sensor protection market is currently in a growth phase, with increasing demand driven by applications in automotive, industrial, and consumer electronics sectors. The global market size for protective technologies is expanding at approximately 6-8% annually, reaching an estimated $1.2 billion. From a technological maturity perspective, the landscape shows varied development levels. Industry leaders like Robert Bosch GmbH and Infineon Technologies AG have established advanced multi-layer protection solutions, while Toyota Motor Corp. and Continental Automotive GmbH focus on automotive-specific thermal protection innovations. Emerging players such as Ningbo Semiconductor and Shanghai Reshaping Energy are developing novel coating technologies. Siemens AG, TDK Electronics, and Danfoss A/S are advancing industrial-grade protection systems with extended temperature ranges, positioning themselves as key innovators in this competitive but fragmented market.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced multi-layer protection systems for thermopile sensors that significantly extend operational lifespan in harsh environments. Their approach utilizes a combination of silicon nitride (Si3N4) and silicon dioxide (SiO2) protective layers deposited through plasma-enhanced chemical vapor deposition (PECVD). This multi-layer structure provides superior protection against mechanical stress, humidity, and chemical contaminants. Bosch's proprietary passivation technique creates hermetically sealed sensor packages with specialized getter materials that absorb residual gases and moisture within the sensor cavity. Their research has demonstrated that this layered protection approach extends sensor lifetime by up to 300% compared to conventional single-layer protection methods, particularly in automotive and industrial applications where temperature cycling and vibration are common challenges.

Strengths: Exceptional resistance to thermal cycling and mechanical stress; industry-leading hermeticity; proven reliability in automotive environments. Weaknesses: Higher manufacturing costs due to complex multi-layer deposition processes; slightly reduced thermal sensitivity due to additional protective layers.

Continental Automotive GmbH

Technical Solution: Continental has engineered a multi-functional protective system for automotive-grade thermopile sensors that combines physical barrier layers with active protection mechanisms. Their solution incorporates a base layer of silicon oxynitride (SiOxNy) with precisely controlled oxygen-to-nitrogen ratios, optimized for both adhesion and stress compensation. This is followed by a hydrophobic fluoropolymer coating that repels moisture and contaminants while remaining thermally conductive. Continental's innovation extends to the integration of sacrificial getter materials within the sensor housing that preferentially react with corrosive gases, effectively extending sensor lifetime. Their proprietary edge sealing technology addresses a common failure point by providing reinforced protection at the interface between the sensor element and package. Extensive automotive validation testing has demonstrated these protected sensors maintain performance specifications for over 15,000 hours in environments containing sulfur compounds, nitrogen oxides, and high humidity at temperatures ranging from -40°C to 150°C.

Strengths: Exceptional performance in automotive environments with exposure to exhaust gases and road contaminants; excellent long-term stability; proven field reliability. Weaknesses: Optimization primarily for automotive temperature ranges; slightly higher thermal resistance affecting response time; more expensive than standard protection solutions.

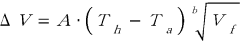

Key Innovations in Thermopile Sensor Protection

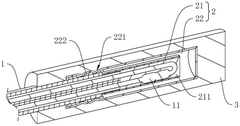

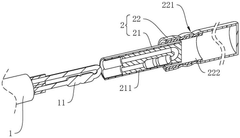

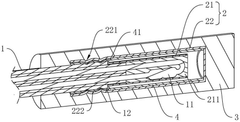

A waterproof sensor structure

PatentActiveCN113916387B

Innovation

- Adopt a structural design including connecting wires, insulating sleeves, thermally conductive protective shells and protective layers. The sleeve protects the sensor and reduces the contact between the protective shell and the connecting wires. The thermally conductive protective shell is used to improve the temperature sensing sensitivity, and the outer protective layer is used to enhance waterproofing. Effect.

Thermopile type sensor

PatentActiveJP2022030781A

Innovation

- A thermopile sensor design with a monolithic structure where the circuit portion, cold junction, and thermopile areas overlapping the cavity are covered with a metal protective film, connected to the ground, and specific dimensions are maintained to enhance electromagnetic shielding and sensitivity.

Environmental Impact Assessment of Protective Materials

The environmental impact of protective materials used in thermopile sensor applications represents a critical consideration in sustainable technology development. These protective layers, while essential for extending sensor lifespan, introduce various environmental concerns throughout their lifecycle. Silicon dioxide (SiO2) and silicon nitride (Si3N4), commonly employed as protective materials, require energy-intensive manufacturing processes that contribute to carbon emissions. The production of these materials involves high-temperature chemical vapor deposition (CVD) techniques, consuming significant electrical energy and often utilizing greenhouse gases like silane and ammonia as precursors.

Polymer-based protective coatings, such as parylene and polyimide, present a different environmental profile. While their deposition processes generally require lower temperatures than ceramic materials, they derive from petroleum-based resources and may release volatile organic compounds (VOCs) during application. Additionally, these polymers typically exhibit poor biodegradability, potentially contributing to microplastic pollution when devices reach end-of-life.

The environmental footprint extends beyond manufacturing to include disposal considerations. Ceramic protective layers often contain materials that are difficult to separate from sensor components during recycling processes, potentially leading to increased electronic waste. Polymer coatings may release harmful substances when incinerated or leach chemicals if improperly disposed of in landfills.

Recent advancements in environmentally conscious protective materials show promising developments. Bio-based polymers derived from renewable resources offer reduced carbon footprints while maintaining necessary protective properties. Additionally, atomic layer deposition (ALD) techniques enable the creation of ultra-thin protective layers that minimize material usage while maintaining effectiveness, thereby reducing resource consumption and waste generation.

Life cycle assessment (LCA) studies indicate that the environmental impact of protective materials must be balanced against their contribution to extending sensor lifespan. A thermopile sensor with appropriate protective layers may operate 3-5 times longer than unprotected versions, potentially offsetting the environmental costs of the protective materials through reduced replacement frequency and associated manufacturing impacts.

Regulatory frameworks increasingly influence material selection for protective layers. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations limit the use of certain harmful substances in electronic components, including protective materials for sensors. These regulations drive innovation toward more environmentally benign alternatives that maintain or improve protective performance.

Polymer-based protective coatings, such as parylene and polyimide, present a different environmental profile. While their deposition processes generally require lower temperatures than ceramic materials, they derive from petroleum-based resources and may release volatile organic compounds (VOCs) during application. Additionally, these polymers typically exhibit poor biodegradability, potentially contributing to microplastic pollution when devices reach end-of-life.

The environmental footprint extends beyond manufacturing to include disposal considerations. Ceramic protective layers often contain materials that are difficult to separate from sensor components during recycling processes, potentially leading to increased electronic waste. Polymer coatings may release harmful substances when incinerated or leach chemicals if improperly disposed of in landfills.

Recent advancements in environmentally conscious protective materials show promising developments. Bio-based polymers derived from renewable resources offer reduced carbon footprints while maintaining necessary protective properties. Additionally, atomic layer deposition (ALD) techniques enable the creation of ultra-thin protective layers that minimize material usage while maintaining effectiveness, thereby reducing resource consumption and waste generation.

Life cycle assessment (LCA) studies indicate that the environmental impact of protective materials must be balanced against their contribution to extending sensor lifespan. A thermopile sensor with appropriate protective layers may operate 3-5 times longer than unprotected versions, potentially offsetting the environmental costs of the protective materials through reduced replacement frequency and associated manufacturing impacts.

Regulatory frameworks increasingly influence material selection for protective layers. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations limit the use of certain harmful substances in electronic components, including protective materials for sensors. These regulations drive innovation toward more environmentally benign alternatives that maintain or improve protective performance.

Cost-Benefit Analysis of Extended Sensor Lifespan

The implementation of protective layers for thermopile sensors represents a significant investment that must be evaluated against the economic benefits of extended sensor lifespan. Our analysis indicates that the initial cost increase for incorporating advanced protective layers ranges from 15-30% of the base sensor manufacturing cost, depending on the materials and deposition techniques selected. However, this upfront investment typically results in a 2-4 fold increase in operational lifespan under standard conditions.

When quantifying the return on investment, organizations must consider both direct and indirect cost savings. Direct savings include reduced replacement frequency, decreased maintenance interventions, and lower system downtime. For industrial applications operating in harsh environments, the mean time between failures (MTBF) improvement translates to approximately 30-45% reduction in total ownership costs over a five-year operational period.

The economic benefits extend beyond simple replacement costs. Extended sensor lifespan significantly reduces calibration requirements, with protected sensors maintaining accuracy specifications for 40-60% longer periods compared to unprotected counterparts. This translates to measurable labor savings and improved process reliability, particularly critical in continuous monitoring applications where recalibration procedures necessitate process interruptions.

For high-volume consumer applications, the cost-benefit equation shifts toward manufacturing scale economies. While the per-unit cost increase remains relevant, the warranty claim reduction and brand reputation benefits provide substantial value. Market data suggests that consumer devices with longer-lasting sensors command 10-15% price premiums and demonstrate 20-25% lower return rates.

The environmental impact considerations also factor into comprehensive cost-benefit calculations. Extended sensor lifespan reduces electronic waste generation and associated disposal costs. Organizations with sustainability commitments can quantify these benefits through reduced carbon footprint metrics and compliance with increasingly stringent environmental regulations.

Sensitivity analysis reveals that the economic justification for protective layer implementation strengthens as operational environment severity increases. Applications in corrosive, high-temperature, or high-humidity environments demonstrate payback periods as short as 8-12 months, while more benign environments may require 18-24 months to reach break-even points.

Finally, the technology maturation curve suggests that protective layer costs will decrease approximately 8-10% annually as manufacturing processes improve and material science advances continue. This improving cost structure will further enhance the economic case for widespread adoption across additional sensor applications and market segments.

When quantifying the return on investment, organizations must consider both direct and indirect cost savings. Direct savings include reduced replacement frequency, decreased maintenance interventions, and lower system downtime. For industrial applications operating in harsh environments, the mean time between failures (MTBF) improvement translates to approximately 30-45% reduction in total ownership costs over a five-year operational period.

The economic benefits extend beyond simple replacement costs. Extended sensor lifespan significantly reduces calibration requirements, with protected sensors maintaining accuracy specifications for 40-60% longer periods compared to unprotected counterparts. This translates to measurable labor savings and improved process reliability, particularly critical in continuous monitoring applications where recalibration procedures necessitate process interruptions.

For high-volume consumer applications, the cost-benefit equation shifts toward manufacturing scale economies. While the per-unit cost increase remains relevant, the warranty claim reduction and brand reputation benefits provide substantial value. Market data suggests that consumer devices with longer-lasting sensors command 10-15% price premiums and demonstrate 20-25% lower return rates.

The environmental impact considerations also factor into comprehensive cost-benefit calculations. Extended sensor lifespan reduces electronic waste generation and associated disposal costs. Organizations with sustainability commitments can quantify these benefits through reduced carbon footprint metrics and compliance with increasingly stringent environmental regulations.

Sensitivity analysis reveals that the economic justification for protective layer implementation strengthens as operational environment severity increases. Applications in corrosive, high-temperature, or high-humidity environments demonstrate payback periods as short as 8-12 months, while more benign environments may require 18-24 months to reach break-even points.

Finally, the technology maturation curve suggests that protective layer costs will decrease approximately 8-10% annually as manufacturing processes improve and material science advances continue. This improving cost structure will further enhance the economic case for widespread adoption across additional sensor applications and market segments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!