How to Strengthen Ethyl Acetate’s Market Position?

JUN 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Market Overview and Objectives

Ethyl acetate, a versatile organic compound, has been a staple in various industries for decades. Its market has seen steady growth, driven by its wide-ranging applications in coatings, adhesives, pharmaceuticals, and food processing. The global ethyl acetate market is projected to expand further, with a compound annual growth rate (CAGR) of 5.2% from 2021 to 2028, reaching a value of $5.7 billion by the end of the forecast period.

The primary objective in strengthening ethyl acetate's market position is to capitalize on emerging opportunities while addressing existing challenges. One key focus is the increasing demand for eco-friendly and sustainable products. As environmental regulations tighten globally, there is a growing need for bio-based ethyl acetate, derived from renewable resources. This shift presents both a challenge and an opportunity for market players to innovate and adapt their production processes.

Another crucial aspect is the optimization of production efficiency and cost-effectiveness. With fluctuating raw material prices, particularly ethanol and acetic acid, manufacturers must explore advanced technologies and processes to maintain competitive pricing. This includes investigating catalytic processes that improve yield and reduce energy consumption, as well as exploring alternative feedstocks to diversify supply chains.

The Asia-Pacific region, particularly China and India, continues to be a major growth driver for the ethyl acetate market. Rapid industrialization, increasing disposable incomes, and growing demand from end-use industries in these countries present significant opportunities for market expansion. However, to capitalize on this potential, companies must navigate complex regulatory landscapes and adapt to local market dynamics.

In the pharmaceutical sector, ethyl acetate's role as a solvent in drug formulation and as an intermediate in the synthesis of various active pharmaceutical ingredients (APIs) is becoming increasingly important. With the global pharmaceutical industry experiencing robust growth, especially in the wake of the COVID-19 pandemic, there is a heightened focus on securing high-purity ethyl acetate supplies for critical medical applications.

To strengthen ethyl acetate's market position, industry players must also address the challenge of substitutes. While ethyl acetate offers unique properties, alternative solvents and technologies are continually emerging. Developing new applications and enhancing the performance characteristics of ethyl acetate-based products will be crucial in maintaining and expanding market share across various industries.

The primary objective in strengthening ethyl acetate's market position is to capitalize on emerging opportunities while addressing existing challenges. One key focus is the increasing demand for eco-friendly and sustainable products. As environmental regulations tighten globally, there is a growing need for bio-based ethyl acetate, derived from renewable resources. This shift presents both a challenge and an opportunity for market players to innovate and adapt their production processes.

Another crucial aspect is the optimization of production efficiency and cost-effectiveness. With fluctuating raw material prices, particularly ethanol and acetic acid, manufacturers must explore advanced technologies and processes to maintain competitive pricing. This includes investigating catalytic processes that improve yield and reduce energy consumption, as well as exploring alternative feedstocks to diversify supply chains.

The Asia-Pacific region, particularly China and India, continues to be a major growth driver for the ethyl acetate market. Rapid industrialization, increasing disposable incomes, and growing demand from end-use industries in these countries present significant opportunities for market expansion. However, to capitalize on this potential, companies must navigate complex regulatory landscapes and adapt to local market dynamics.

In the pharmaceutical sector, ethyl acetate's role as a solvent in drug formulation and as an intermediate in the synthesis of various active pharmaceutical ingredients (APIs) is becoming increasingly important. With the global pharmaceutical industry experiencing robust growth, especially in the wake of the COVID-19 pandemic, there is a heightened focus on securing high-purity ethyl acetate supplies for critical medical applications.

To strengthen ethyl acetate's market position, industry players must also address the challenge of substitutes. While ethyl acetate offers unique properties, alternative solvents and technologies are continually emerging. Developing new applications and enhancing the performance characteristics of ethyl acetate-based products will be crucial in maintaining and expanding market share across various industries.

Demand Analysis for Ethyl Acetate

The global demand for ethyl acetate has been steadily increasing, driven by its versatile applications across various industries. The market for ethyl acetate is primarily fueled by its extensive use as a solvent in paints, coatings, and adhesives. The construction and automotive sectors, in particular, contribute significantly to the growing demand for ethyl acetate-based products.

In the paints and coatings industry, ethyl acetate is highly valued for its fast-evaporating properties and ability to dissolve a wide range of resins. This makes it an essential component in the production of high-quality finishes for both industrial and consumer applications. The ongoing expansion of the construction industry, especially in developing economies, is expected to further boost the demand for ethyl acetate in this sector.

The packaging industry represents another major consumer of ethyl acetate, particularly in the production of flexible packaging materials. As consumer preferences shift towards convenient and sustainable packaging solutions, the demand for ethyl acetate in this sector is projected to grow. The food and beverage industry, in particular, relies heavily on ethyl acetate-based adhesives for packaging applications, driving market growth.

The pharmaceutical industry also contributes to the increasing demand for ethyl acetate. Its use as a solvent in the production of various drugs and as an extraction medium in the manufacturing of antibiotics underscores its importance in this sector. As global healthcare needs continue to expand, the pharmaceutical industry's demand for ethyl acetate is expected to rise accordingly.

In the electronics industry, ethyl acetate finds applications in the production of printed circuit boards and as a cleaning agent for electronic components. With the rapid advancement of technology and the growing demand for electronic devices, this sector is likely to become an increasingly important consumer of ethyl acetate in the coming years.

The Asia-Pacific region, led by China and India, is expected to be the fastest-growing market for ethyl acetate. Rapid industrialization, urbanization, and increasing disposable incomes in these countries are driving the demand across various end-use industries. North America and Europe, while mature markets, continue to show steady demand, particularly in high-value applications such as pharmaceuticals and specialty coatings.

Environmental regulations and sustainability concerns are influencing market dynamics, with a growing emphasis on bio-based ethyl acetate production. This trend is likely to shape future demand patterns, potentially opening new market opportunities for environmentally friendly ethyl acetate products.

In the paints and coatings industry, ethyl acetate is highly valued for its fast-evaporating properties and ability to dissolve a wide range of resins. This makes it an essential component in the production of high-quality finishes for both industrial and consumer applications. The ongoing expansion of the construction industry, especially in developing economies, is expected to further boost the demand for ethyl acetate in this sector.

The packaging industry represents another major consumer of ethyl acetate, particularly in the production of flexible packaging materials. As consumer preferences shift towards convenient and sustainable packaging solutions, the demand for ethyl acetate in this sector is projected to grow. The food and beverage industry, in particular, relies heavily on ethyl acetate-based adhesives for packaging applications, driving market growth.

The pharmaceutical industry also contributes to the increasing demand for ethyl acetate. Its use as a solvent in the production of various drugs and as an extraction medium in the manufacturing of antibiotics underscores its importance in this sector. As global healthcare needs continue to expand, the pharmaceutical industry's demand for ethyl acetate is expected to rise accordingly.

In the electronics industry, ethyl acetate finds applications in the production of printed circuit boards and as a cleaning agent for electronic components. With the rapid advancement of technology and the growing demand for electronic devices, this sector is likely to become an increasingly important consumer of ethyl acetate in the coming years.

The Asia-Pacific region, led by China and India, is expected to be the fastest-growing market for ethyl acetate. Rapid industrialization, urbanization, and increasing disposable incomes in these countries are driving the demand across various end-use industries. North America and Europe, while mature markets, continue to show steady demand, particularly in high-value applications such as pharmaceuticals and specialty coatings.

Environmental regulations and sustainability concerns are influencing market dynamics, with a growing emphasis on bio-based ethyl acetate production. This trend is likely to shape future demand patterns, potentially opening new market opportunities for environmentally friendly ethyl acetate products.

Technical Challenges in Ethyl Acetate Production

The production of ethyl acetate faces several technical challenges that impact its market position. One of the primary issues is the optimization of the esterification process, which is crucial for efficient and cost-effective production. The traditional batch process suffers from low productivity and high energy consumption, leading to increased production costs and reduced competitiveness in the market.

Another significant challenge is the purification of ethyl acetate. The azeotropic mixture formed with water during the production process necessitates complex separation techniques. Conventional distillation methods are energy-intensive and often result in product loss, affecting both yield and quality. This challenge is particularly acute when aiming for high-purity ethyl acetate required in certain applications.

Raw material sourcing and price volatility also present technical hurdles. The primary feedstocks, ethanol and acetic acid, are subject to market fluctuations, which can significantly impact production costs. Developing flexible production processes that can accommodate varying feedstock qualities and sources without compromising product quality is a persistent challenge for manufacturers.

Environmental concerns and regulatory pressures add another layer of complexity to ethyl acetate production. The need to reduce volatile organic compound (VOC) emissions and improve overall process sustainability requires innovative approaches to reactor design and process integration. This includes the development of more efficient catalysts and the implementation of advanced process control systems to minimize waste and energy consumption.

The scale-up of new production technologies from laboratory to industrial scale presents its own set of challenges. Maintaining reaction efficiency, product quality, and process safety at larger scales often requires significant engineering efforts and capital investment. This can be a barrier to the adoption of novel production methods that could potentially improve market position.

Lastly, the integration of continuous flow chemistry in ethyl acetate production, while promising, faces implementation challenges. These include ensuring consistent product quality, managing heat transfer in larger reactors, and developing robust online monitoring and control systems. Overcoming these technical hurdles is crucial for realizing the benefits of continuous production, such as improved efficiency and reduced environmental impact.

Addressing these technical challenges is essential for strengthening ethyl acetate's market position. Innovations in process technology, catalysis, and separation techniques hold the key to enhancing production efficiency, reducing costs, and improving product quality. As the industry evolves, overcoming these hurdles will be critical in maintaining competitiveness and meeting the growing demand for ethyl acetate across various sectors.

Another significant challenge is the purification of ethyl acetate. The azeotropic mixture formed with water during the production process necessitates complex separation techniques. Conventional distillation methods are energy-intensive and often result in product loss, affecting both yield and quality. This challenge is particularly acute when aiming for high-purity ethyl acetate required in certain applications.

Raw material sourcing and price volatility also present technical hurdles. The primary feedstocks, ethanol and acetic acid, are subject to market fluctuations, which can significantly impact production costs. Developing flexible production processes that can accommodate varying feedstock qualities and sources without compromising product quality is a persistent challenge for manufacturers.

Environmental concerns and regulatory pressures add another layer of complexity to ethyl acetate production. The need to reduce volatile organic compound (VOC) emissions and improve overall process sustainability requires innovative approaches to reactor design and process integration. This includes the development of more efficient catalysts and the implementation of advanced process control systems to minimize waste and energy consumption.

The scale-up of new production technologies from laboratory to industrial scale presents its own set of challenges. Maintaining reaction efficiency, product quality, and process safety at larger scales often requires significant engineering efforts and capital investment. This can be a barrier to the adoption of novel production methods that could potentially improve market position.

Lastly, the integration of continuous flow chemistry in ethyl acetate production, while promising, faces implementation challenges. These include ensuring consistent product quality, managing heat transfer in larger reactors, and developing robust online monitoring and control systems. Overcoming these technical hurdles is crucial for realizing the benefits of continuous production, such as improved efficiency and reduced environmental impact.

Addressing these technical challenges is essential for strengthening ethyl acetate's market position. Innovations in process technology, catalysis, and separation techniques hold the key to enhancing production efficiency, reducing costs, and improving product quality. As the industry evolves, overcoming these hurdles will be critical in maintaining competitiveness and meeting the growing demand for ethyl acetate across various sectors.

Current Ethyl Acetate Production Methods

01 Market analysis and forecasting

Utilizing data analytics and forecasting techniques to analyze the ethyl acetate market position, including demand trends, supply chain dynamics, and future market projections. This approach helps businesses make informed decisions about production, pricing, and investment strategies in the ethyl acetate industry.- Market analysis and forecasting: Utilizing data analytics and forecasting techniques to analyze the ethyl acetate market position, including demand trends, supply chain dynamics, and future market projections. This approach helps businesses make informed decisions about production, pricing, and investment strategies in the ethyl acetate industry.

- Competitive positioning strategies: Developing and implementing strategies to improve a company's competitive position in the ethyl acetate market. This may include product differentiation, cost leadership, or niche market targeting to gain a competitive advantage and increase market share.

- Supply chain optimization: Enhancing the efficiency of the ethyl acetate supply chain through improved logistics, inventory management, and distribution strategies. This optimization can lead to cost reductions, improved product availability, and better market positioning.

- Market segmentation and targeting: Identifying and targeting specific market segments within the ethyl acetate industry to maximize sales and profitability. This approach involves analyzing customer needs, preferences, and behaviors to tailor products and marketing strategies accordingly.

- Pricing strategies and market dynamics: Developing pricing strategies that reflect market dynamics and competitive positioning in the ethyl acetate industry. This includes analyzing factors such as production costs, demand elasticity, and competitor pricing to optimize revenue and market share.

02 Competitive positioning strategies

Developing and implementing strategies to improve a company's competitive position in the ethyl acetate market. This may involve product differentiation, cost leadership, or niche market targeting to gain a competitive advantage and increase market share.Expand Specific Solutions03 Supply chain optimization

Optimizing the ethyl acetate supply chain through improved logistics, inventory management, and distribution networks. This approach aims to reduce costs, increase efficiency, and enhance overall market competitiveness for ethyl acetate producers and distributors.Expand Specific Solutions04 Market segmentation and targeting

Identifying and targeting specific market segments within the ethyl acetate industry to maximize growth opportunities. This involves analyzing customer needs, preferences, and usage patterns to develop tailored marketing and sales strategies for different segments of the ethyl acetate market.Expand Specific Solutions05 Technological innovation and product development

Investing in research and development to create innovative ethyl acetate products or production processes. This approach aims to improve product quality, reduce production costs, or develop new applications for ethyl acetate, thereby enhancing market position and competitiveness.Expand Specific Solutions

Key Players in Ethyl Acetate Industry

The ethyl acetate market is in a mature stage, characterized by steady growth and established applications across various industries. The global market size is estimated to be around $3-4 billion, with a compound annual growth rate of 4-5%. Key players like Celanese, Eastman Chemical, and SABIC dominate the market, leveraging their extensive production capacities and technological expertise. The technology for ethyl acetate production is well-established, with ongoing research focused on improving efficiency and sustainability. Companies such as Resonac Corp. and LanzaTech are exploring innovative bio-based production methods to strengthen their market position and address growing environmental concerns.

Celanese International Corp.

Technical Solution: Celanese International Corp. has implemented a multi-faceted approach to strengthen ethyl acetate's market position. The company has developed a VAntage® ethyl acetate production technology that utilizes a highly selective precious metal catalyst, achieving ethanol conversion rates of up to 99% with selectivity to ethyl acetate exceeding 97%[1]. This process operates at lower temperatures compared to traditional methods, resulting in reduced energy consumption and operational costs[2]. Celanese has also introduced a patented reactive distillation process that combines reaction and separation steps, significantly improving process efficiency and product purity[3]. Furthermore, the company has invested in backward integration, securing ethanol supply through strategic partnerships with bio-ethanol producers, ensuring a stable and potentially cost-effective feedstock source[4]. Celanese has also focused on developing high-purity grades of ethyl acetate for specialized applications in electronics and pharmaceuticals, commanding premium prices in these niche markets[5].

Strengths: High conversion and selectivity rates, energy-efficient processes, and strategic feedstock integration. Weaknesses: Potential vulnerability to ethanol price fluctuations and competition in specialty markets.

Eastman Chemical Co.

Technical Solution: Eastman Chemical Co. has developed a proprietary technology called "Eastman Gasification Technology" to strengthen ethyl acetate's market position. This process involves the gasification of coal or petroleum coke to produce syngas, which is then converted to acetic acid and subsequently to ethyl acetate[1]. The company has also implemented advanced distillation techniques, including dividing wall column technology, which allows for more efficient separation of ethyl acetate from reaction mixtures, reducing energy consumption by up to 30%[2]. Eastman has further enhanced its market position by developing specialty grades of ethyl acetate tailored for high-performance applications in electronics and pharmaceuticals, featuring ultra-low impurity levels[3]. Additionally, the company has invested in circular economy initiatives, developing a carbon renewal technology that can process mixed plastic waste into molecular components for ethyl acetate production, addressing sustainability concerns[4].

Strengths: Versatile feedstock options, energy-efficient separation processes, and specialty product offerings. Weaknesses: Potential environmental concerns with coal gasification and the need for significant capital investment in new technologies.

Innovations in Ethyl Acetate Synthesis

Process of low energy consumption for preparing a carboxylic acid ester

PatentWO2012123279A1

Innovation

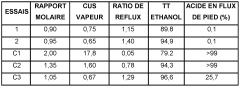

- A process involving the reaction of ethyl alcohol with acetic acid in the presence of a solid acid catalyst, using a reactive distillation system with a centrally placed reaction zone between upper and lower separation zones, optimizing the molar ratio of acetic acid to ethyl alcohol between 0.85 and 0.97, and controlling the reflux ratio between 1.0 and 1.5, significantly reduces energy costs and minimizes acetic acid at the column bottom.

Method for producing ethyl acetate production catalyst

PatentPendingUS20230330636A1

Innovation

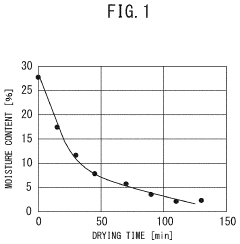

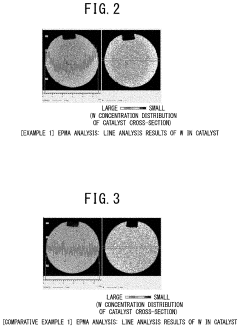

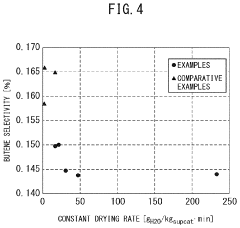

- A method involving impregnating a silica carrier with an aqueous solution of heteropolyacid or its salt at a volume close to 100% of the carrier's water absorption capacity, followed by drying at a controlled rate of 5 to 300 gH2O/kgsupcat·min, ensures a high amount of active ingredient is supported on the carrier surface, enhancing catalyst activity and selectivity.

Environmental Impact of Ethyl Acetate Production

The environmental impact of ethyl acetate production is a critical consideration in strengthening its market position. The manufacturing process of ethyl acetate primarily involves the esterification of ethanol and acetic acid, which can have several environmental implications.

One of the main environmental concerns is the emission of volatile organic compounds (VOCs) during production. Ethyl acetate itself is a VOC, and its release into the atmosphere can contribute to air pollution and the formation of ground-level ozone. To mitigate this impact, modern production facilities employ advanced emission control technologies, such as thermal oxidizers and scrubbers, to capture and treat VOC emissions effectively.

Water pollution is another potential environmental issue associated with ethyl acetate production. The process generates wastewater containing organic compounds and acids, which, if not properly treated, can harm aquatic ecosystems. Implementing robust wastewater treatment systems and adopting closed-loop water recycling processes can significantly reduce the water footprint of ethyl acetate production.

Energy consumption is a substantial factor in the environmental impact of ethyl acetate manufacturing. The esterification reaction and subsequent purification steps require considerable energy input, often derived from fossil fuels. To improve sustainability, many producers are transitioning to renewable energy sources and implementing energy-efficient technologies, such as heat integration systems and advanced distillation techniques.

The sourcing of raw materials also plays a crucial role in the environmental profile of ethyl acetate. Traditionally, ethanol and acetic acid are derived from petrochemical sources, contributing to the depletion of non-renewable resources. However, there is a growing trend towards using bio-based feedstocks, such as bioethanol from agricultural waste, which can significantly reduce the carbon footprint of ethyl acetate production.

Waste generation and disposal are additional environmental concerns. The production process may generate by-products and spent catalysts that require proper handling and disposal. Implementing waste minimization strategies, such as catalyst regeneration and by-product valorization, can help reduce the environmental burden of ethyl acetate production.

To strengthen ethyl acetate's market position from an environmental perspective, producers are increasingly focusing on developing greener production methods. This includes exploring catalytic processes that operate at lower temperatures and pressures, reducing energy requirements and minimizing waste generation. Additionally, the adoption of continuous flow chemistry techniques can lead to more efficient and environmentally friendly production processes.

As environmental regulations become more stringent globally, ethyl acetate manufacturers are also investing in life cycle assessment (LCA) studies to comprehensively evaluate the environmental impact of their products from cradle to grave. These assessments help identify hotspots in the production chain and guide targeted improvements to enhance the overall sustainability of ethyl acetate production.

One of the main environmental concerns is the emission of volatile organic compounds (VOCs) during production. Ethyl acetate itself is a VOC, and its release into the atmosphere can contribute to air pollution and the formation of ground-level ozone. To mitigate this impact, modern production facilities employ advanced emission control technologies, such as thermal oxidizers and scrubbers, to capture and treat VOC emissions effectively.

Water pollution is another potential environmental issue associated with ethyl acetate production. The process generates wastewater containing organic compounds and acids, which, if not properly treated, can harm aquatic ecosystems. Implementing robust wastewater treatment systems and adopting closed-loop water recycling processes can significantly reduce the water footprint of ethyl acetate production.

Energy consumption is a substantial factor in the environmental impact of ethyl acetate manufacturing. The esterification reaction and subsequent purification steps require considerable energy input, often derived from fossil fuels. To improve sustainability, many producers are transitioning to renewable energy sources and implementing energy-efficient technologies, such as heat integration systems and advanced distillation techniques.

The sourcing of raw materials also plays a crucial role in the environmental profile of ethyl acetate. Traditionally, ethanol and acetic acid are derived from petrochemical sources, contributing to the depletion of non-renewable resources. However, there is a growing trend towards using bio-based feedstocks, such as bioethanol from agricultural waste, which can significantly reduce the carbon footprint of ethyl acetate production.

Waste generation and disposal are additional environmental concerns. The production process may generate by-products and spent catalysts that require proper handling and disposal. Implementing waste minimization strategies, such as catalyst regeneration and by-product valorization, can help reduce the environmental burden of ethyl acetate production.

To strengthen ethyl acetate's market position from an environmental perspective, producers are increasingly focusing on developing greener production methods. This includes exploring catalytic processes that operate at lower temperatures and pressures, reducing energy requirements and minimizing waste generation. Additionally, the adoption of continuous flow chemistry techniques can lead to more efficient and environmentally friendly production processes.

As environmental regulations become more stringent globally, ethyl acetate manufacturers are also investing in life cycle assessment (LCA) studies to comprehensively evaluate the environmental impact of their products from cradle to grave. These assessments help identify hotspots in the production chain and guide targeted improvements to enhance the overall sustainability of ethyl acetate production.

Regulatory Framework for Ethyl Acetate Industry

The regulatory framework for the ethyl acetate industry plays a crucial role in shaping market dynamics and ensuring product safety. Globally, regulations vary, but generally focus on environmental protection, workplace safety, and product quality standards. In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA), while the Occupational Safety and Health Administration (OSHA) sets workplace exposure limits.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation governs the production, import, and use of ethyl acetate within its member states. This comprehensive framework requires manufacturers and importers to register substances and provide safety data, ensuring a high level of protection for human health and the environment.

In Asia, countries like China and India have implemented their own chemical regulatory systems. China's Measures for Environmental Management of New Chemical Substances (MEP Order 7) requires notification and registration of new chemical substances, including ethyl acetate. India's Chemical Management and Safety Rules under the Environment Protection Act impose similar requirements for chemical manufacturers and importers.

Regulatory compliance often necessitates significant investments in safety equipment, emission control technologies, and quality management systems. These requirements can act as barriers to entry for new market players, potentially strengthening the position of established ethyl acetate producers who have already made such investments.

However, regulatory frameworks also present opportunities for market differentiation. Companies that exceed regulatory requirements in areas such as environmental performance or product purity may gain a competitive edge, particularly in markets where customers prioritize sustainability or high-quality standards.

The global nature of the ethyl acetate market means that producers must navigate a complex web of international regulations. This complexity can be challenging but also offers opportunities for companies with strong regulatory expertise to gain advantages in market access and compliance efficiency.

As regulations evolve, particularly in response to growing environmental concerns, ethyl acetate producers must stay agile. Anticipating and adapting to regulatory changes can be a key factor in maintaining and strengthening market position. This may involve investing in research and development to improve production processes, reduce emissions, or develop more environmentally friendly alternatives.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation governs the production, import, and use of ethyl acetate within its member states. This comprehensive framework requires manufacturers and importers to register substances and provide safety data, ensuring a high level of protection for human health and the environment.

In Asia, countries like China and India have implemented their own chemical regulatory systems. China's Measures for Environmental Management of New Chemical Substances (MEP Order 7) requires notification and registration of new chemical substances, including ethyl acetate. India's Chemical Management and Safety Rules under the Environment Protection Act impose similar requirements for chemical manufacturers and importers.

Regulatory compliance often necessitates significant investments in safety equipment, emission control technologies, and quality management systems. These requirements can act as barriers to entry for new market players, potentially strengthening the position of established ethyl acetate producers who have already made such investments.

However, regulatory frameworks also present opportunities for market differentiation. Companies that exceed regulatory requirements in areas such as environmental performance or product purity may gain a competitive edge, particularly in markets where customers prioritize sustainability or high-quality standards.

The global nature of the ethyl acetate market means that producers must navigate a complex web of international regulations. This complexity can be challenging but also offers opportunities for companies with strong regulatory expertise to gain advantages in market access and compliance efficiency.

As regulations evolve, particularly in response to growing environmental concerns, ethyl acetate producers must stay agile. Anticipating and adapting to regulatory changes can be a key factor in maintaining and strengthening market position. This may involve investing in research and development to improve production processes, reduce emissions, or develop more environmentally friendly alternatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!