Lithium Phosphate Vs Solid-State: Safety Assessment Comparison

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Safety Evolution and Objectives

Battery safety has evolved significantly since the commercialization of lithium-ion batteries in the early 1990s. Initially, safety concerns were secondary to performance metrics such as energy density and cycle life. However, several high-profile incidents, including the 2006 Sony laptop battery recalls and the 2013 Boeing 787 Dreamliner battery fires, dramatically shifted industry focus toward safety as a primary consideration in battery development.

The evolution of battery safety has been characterized by incremental improvements in electrolyte formulations, separator designs, and battery management systems. Traditional lithium-ion batteries with liquid electrolytes have inherent safety vulnerabilities due to their flammable organic components. This led to the development of lithium phosphate (LiFePO4 or LFP) chemistry in the late 1990s, which offered improved thermal stability compared to earlier lithium cobalt oxide (LiCoO2) cathodes.

Despite these improvements, the fundamental architecture of lithium-ion batteries continued to present safety challenges. The presence of liquid electrolytes remained a persistent risk factor, prompting research into solid-state alternatives beginning in the early 2000s. Solid-state battery technology represents a paradigm shift in battery safety design, eliminating flammable components entirely rather than merely mitigating their risks.

Current safety objectives in battery technology development focus on several key parameters: thermal runaway prevention, resistance to mechanical damage, stability under extreme environmental conditions, and fail-safe mechanisms that prevent cascading failures. These objectives are increasingly important as batteries scale up for electric vehicle and grid storage applications, where the consequences of failure are more severe.

For lithium phosphate batteries, safety objectives center on maintaining their inherent thermal stability advantages while improving energy density. The primary goal is to develop systems that physically cannot enter thermal runaway conditions regardless of abuse conditions. This includes innovations in cell design, advanced battery management systems, and improved manufacturing quality control.

Solid-state battery safety objectives are more ambitious, aiming to create fundamentally intrinsically safe energy storage systems. The elimination of liquid electrolytes addresses the root cause of many safety incidents, potentially enabling batteries that remain stable even when physically damaged. Research objectives include developing solid electrolytes with high ionic conductivity at room temperature, stable interfaces between electrodes and electrolytes, and manufacturing processes suitable for mass production.

Regulatory frameworks have evolved alongside these technological developments, with standards bodies such as UL, IEC, and UN establishing increasingly stringent safety requirements. These standards now encompass abuse testing protocols that simulate real-world failure scenarios, from nail penetration tests to thermal shock evaluations.

The evolution of battery safety has been characterized by incremental improvements in electrolyte formulations, separator designs, and battery management systems. Traditional lithium-ion batteries with liquid electrolytes have inherent safety vulnerabilities due to their flammable organic components. This led to the development of lithium phosphate (LiFePO4 or LFP) chemistry in the late 1990s, which offered improved thermal stability compared to earlier lithium cobalt oxide (LiCoO2) cathodes.

Despite these improvements, the fundamental architecture of lithium-ion batteries continued to present safety challenges. The presence of liquid electrolytes remained a persistent risk factor, prompting research into solid-state alternatives beginning in the early 2000s. Solid-state battery technology represents a paradigm shift in battery safety design, eliminating flammable components entirely rather than merely mitigating their risks.

Current safety objectives in battery technology development focus on several key parameters: thermal runaway prevention, resistance to mechanical damage, stability under extreme environmental conditions, and fail-safe mechanisms that prevent cascading failures. These objectives are increasingly important as batteries scale up for electric vehicle and grid storage applications, where the consequences of failure are more severe.

For lithium phosphate batteries, safety objectives center on maintaining their inherent thermal stability advantages while improving energy density. The primary goal is to develop systems that physically cannot enter thermal runaway conditions regardless of abuse conditions. This includes innovations in cell design, advanced battery management systems, and improved manufacturing quality control.

Solid-state battery safety objectives are more ambitious, aiming to create fundamentally intrinsically safe energy storage systems. The elimination of liquid electrolytes addresses the root cause of many safety incidents, potentially enabling batteries that remain stable even when physically damaged. Research objectives include developing solid electrolytes with high ionic conductivity at room temperature, stable interfaces between electrodes and electrolytes, and manufacturing processes suitable for mass production.

Regulatory frameworks have evolved alongside these technological developments, with standards bodies such as UL, IEC, and UN establishing increasingly stringent safety requirements. These standards now encompass abuse testing protocols that simulate real-world failure scenarios, from nail penetration tests to thermal shock evaluations.

Market Demand Analysis for Safer Battery Technologies

The global battery market is witnessing a significant shift towards safer energy storage solutions, driven primarily by increasing concerns over battery safety incidents in consumer electronics, electric vehicles, and grid storage applications. Current market analysis indicates that safety has become a paramount consideration for both manufacturers and consumers, often outweighing factors like energy density and cost in purchase decisions. This trend is particularly evident in the electric vehicle sector, where high-profile thermal runaway incidents have heightened consumer awareness and regulatory scrutiny.

Market research data reveals that the demand for safer battery technologies is expected to grow at a compound annual growth rate of 24% through 2030, substantially outpacing the overall battery market growth rate of 18%. This accelerated growth is attributed to stringent safety regulations being implemented across major markets including the European Union, China, and the United States, which are establishing more rigorous safety standards for battery technologies in various applications.

Consumer surveys indicate a willingness to pay premium prices for demonstrably safer battery technologies, with 67% of potential electric vehicle buyers citing safety as their primary concern when considering a purchase. This represents a significant shift from five years ago when range anxiety and cost were the dominant concerns. Similarly, in the consumer electronics sector, manufacturers are increasingly marketing safety features as key differentiators in their product offerings.

The industrial and grid storage segments are also showing strong demand signals for enhanced battery safety, particularly in densely populated areas and critical infrastructure applications. Insurance companies have begun offering reduced premiums for systems utilizing safer battery chemistries, creating additional market incentives for adoption.

Regional analysis shows varying demand patterns, with Asian markets focusing on high energy density solutions with improved safety, while European markets demonstrate stronger preference for inherently safe chemistries even at the expense of some performance metrics. North American markets appear to be seeking a balance between these approaches, with safety improvements that don't significantly compromise performance or increase costs.

The competitive landscape is responding to these market signals, with traditional lithium-ion manufacturers investing heavily in safety enhancements while solid-state battery startups are attracting unprecedented levels of venture capital. Major automotive OEMs have announced strategic partnerships and investments specifically targeting safer battery technologies, signaling strong industry confidence in market demand for these solutions.

Market research data reveals that the demand for safer battery technologies is expected to grow at a compound annual growth rate of 24% through 2030, substantially outpacing the overall battery market growth rate of 18%. This accelerated growth is attributed to stringent safety regulations being implemented across major markets including the European Union, China, and the United States, which are establishing more rigorous safety standards for battery technologies in various applications.

Consumer surveys indicate a willingness to pay premium prices for demonstrably safer battery technologies, with 67% of potential electric vehicle buyers citing safety as their primary concern when considering a purchase. This represents a significant shift from five years ago when range anxiety and cost were the dominant concerns. Similarly, in the consumer electronics sector, manufacturers are increasingly marketing safety features as key differentiators in their product offerings.

The industrial and grid storage segments are also showing strong demand signals for enhanced battery safety, particularly in densely populated areas and critical infrastructure applications. Insurance companies have begun offering reduced premiums for systems utilizing safer battery chemistries, creating additional market incentives for adoption.

Regional analysis shows varying demand patterns, with Asian markets focusing on high energy density solutions with improved safety, while European markets demonstrate stronger preference for inherently safe chemistries even at the expense of some performance metrics. North American markets appear to be seeking a balance between these approaches, with safety improvements that don't significantly compromise performance or increase costs.

The competitive landscape is responding to these market signals, with traditional lithium-ion manufacturers investing heavily in safety enhancements while solid-state battery startups are attracting unprecedented levels of venture capital. Major automotive OEMs have announced strategic partnerships and investments specifically targeting safer battery technologies, signaling strong industry confidence in market demand for these solutions.

Current State and Challenges in Battery Safety

Battery safety remains a critical concern in the energy storage industry, with both lithium phosphate (LFP) and solid-state technologies representing different approaches to addressing these challenges. Currently, LFP batteries have established themselves as a safer alternative to traditional lithium-ion batteries with nickel-manganese-cobalt (NMC) or nickel-cobalt-aluminum (NCA) cathodes, primarily due to their enhanced thermal stability and reduced risk of thermal runaway.

The global battery safety landscape shows significant regional variations in regulatory frameworks and safety standards. While countries like Japan and South Korea have implemented stringent safety protocols, emerging markets often operate with less comprehensive regulatory oversight, creating inconsistencies in global safety practices. This fragmentation presents challenges for manufacturers operating across multiple markets.

Thermal management remains one of the most significant technical challenges for both LFP and emerging solid-state technologies. LFP batteries, while more thermally stable than other lithium-ion variants, still require sophisticated cooling systems in high-power applications. Current solid-state prototypes face different thermal challenges, particularly at interfaces between solid electrolytes and electrodes where resistance can generate localized heating.

Manufacturing consistency presents another major hurdle. For LFP batteries, impurities introduced during production can create potential failure points, while solid-state batteries face challenges in achieving uniform electrolyte layers and maintaining consistent interfaces during scaling. The precision required for solid-state manufacturing currently limits production volumes and increases costs.

Dendrite formation, a primary cause of internal short circuits, remains problematic across battery technologies. While LFP chemistry reduces but does not eliminate this risk, solid-state batteries theoretically offer superior resistance to dendrite growth. However, practical implementations have revealed that certain solid electrolytes can still develop conductive pathways under specific operating conditions.

Aging and degradation mechanisms represent another critical safety challenge. Current LFP batteries experience capacity fade and increased internal resistance over time, potentially leading to unpredictable behavior in aged systems. Solid-state technologies lack long-term field data, creating uncertainty about their degradation patterns and end-of-life safety profiles.

The industry also faces significant diagnostic limitations. Current non-destructive testing methods cannot reliably detect all potential failure modes, particularly microscopic defects in solid electrolytes or early-stage dendrite formation. This diagnostic gap complicates quality control and predictive maintenance efforts for both technologies.

The global battery safety landscape shows significant regional variations in regulatory frameworks and safety standards. While countries like Japan and South Korea have implemented stringent safety protocols, emerging markets often operate with less comprehensive regulatory oversight, creating inconsistencies in global safety practices. This fragmentation presents challenges for manufacturers operating across multiple markets.

Thermal management remains one of the most significant technical challenges for both LFP and emerging solid-state technologies. LFP batteries, while more thermally stable than other lithium-ion variants, still require sophisticated cooling systems in high-power applications. Current solid-state prototypes face different thermal challenges, particularly at interfaces between solid electrolytes and electrodes where resistance can generate localized heating.

Manufacturing consistency presents another major hurdle. For LFP batteries, impurities introduced during production can create potential failure points, while solid-state batteries face challenges in achieving uniform electrolyte layers and maintaining consistent interfaces during scaling. The precision required for solid-state manufacturing currently limits production volumes and increases costs.

Dendrite formation, a primary cause of internal short circuits, remains problematic across battery technologies. While LFP chemistry reduces but does not eliminate this risk, solid-state batteries theoretically offer superior resistance to dendrite growth. However, practical implementations have revealed that certain solid electrolytes can still develop conductive pathways under specific operating conditions.

Aging and degradation mechanisms represent another critical safety challenge. Current LFP batteries experience capacity fade and increased internal resistance over time, potentially leading to unpredictable behavior in aged systems. Solid-state technologies lack long-term field data, creating uncertainty about their degradation patterns and end-of-life safety profiles.

The industry also faces significant diagnostic limitations. Current non-destructive testing methods cannot reliably detect all potential failure modes, particularly microscopic defects in solid electrolytes or early-stage dendrite formation. This diagnostic gap complicates quality control and predictive maintenance efforts for both technologies.

Comparative Safety Solutions: LFP vs Solid-State

01 Safety mechanisms in solid-state lithium phosphate batteries

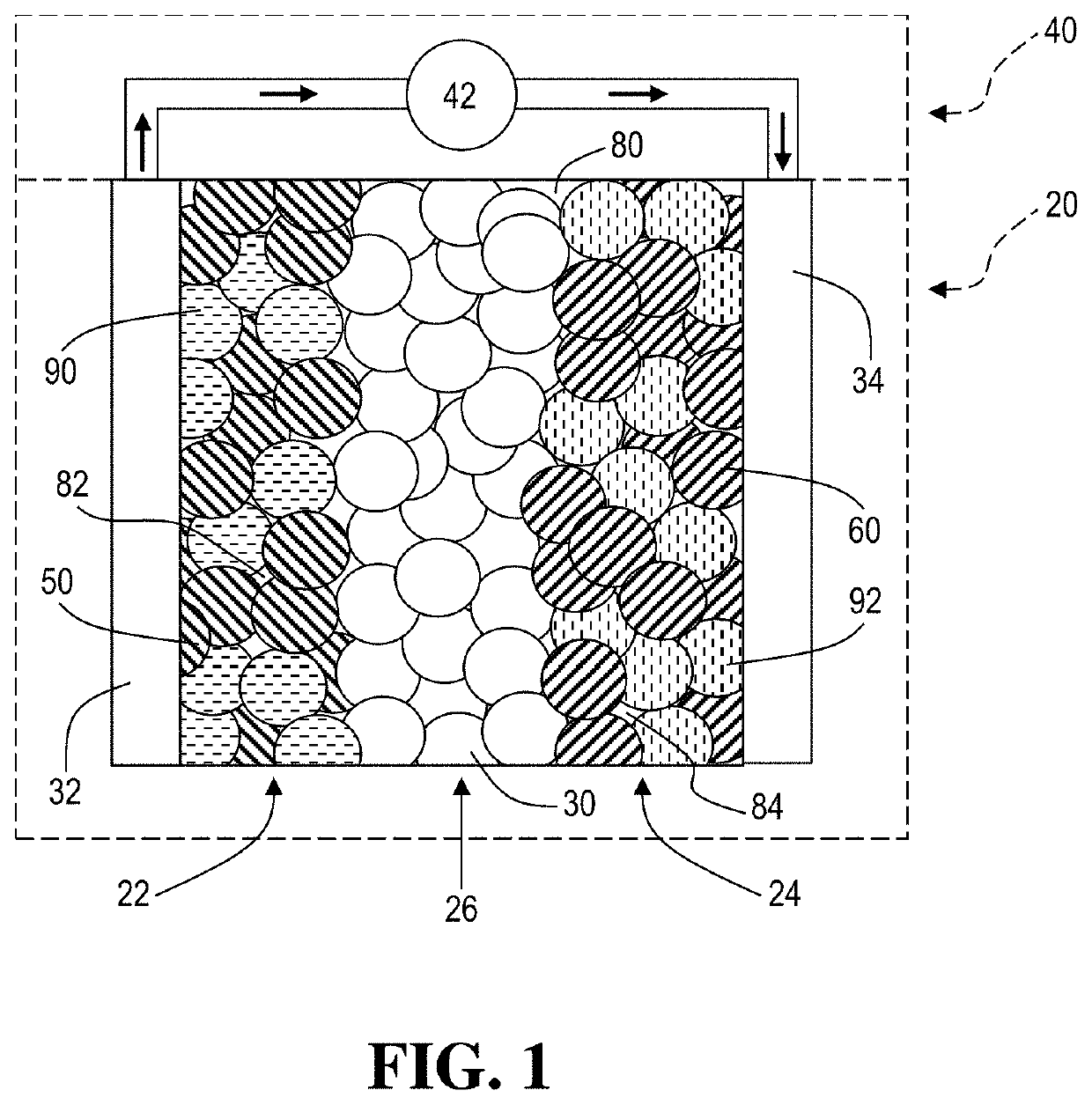

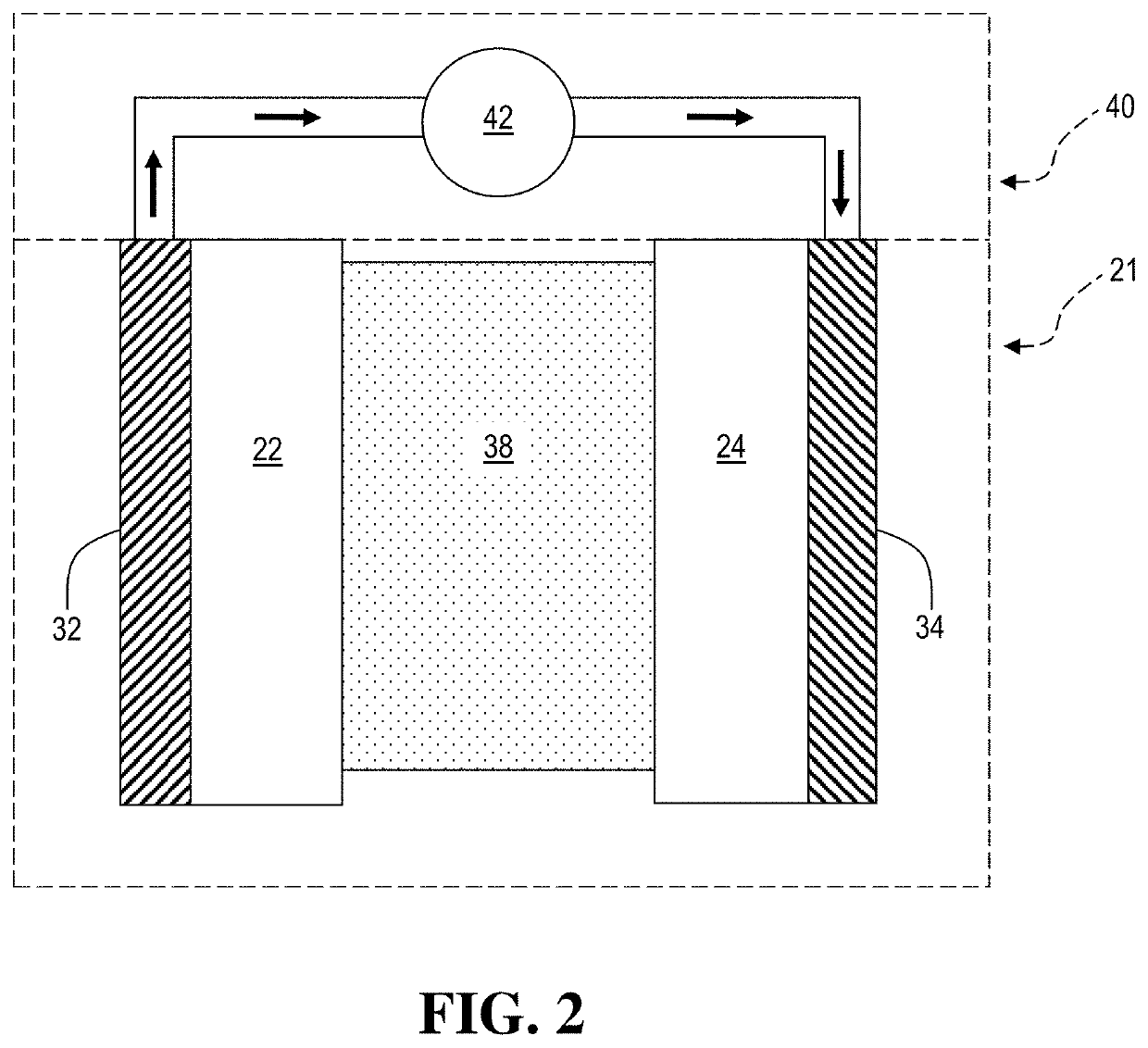

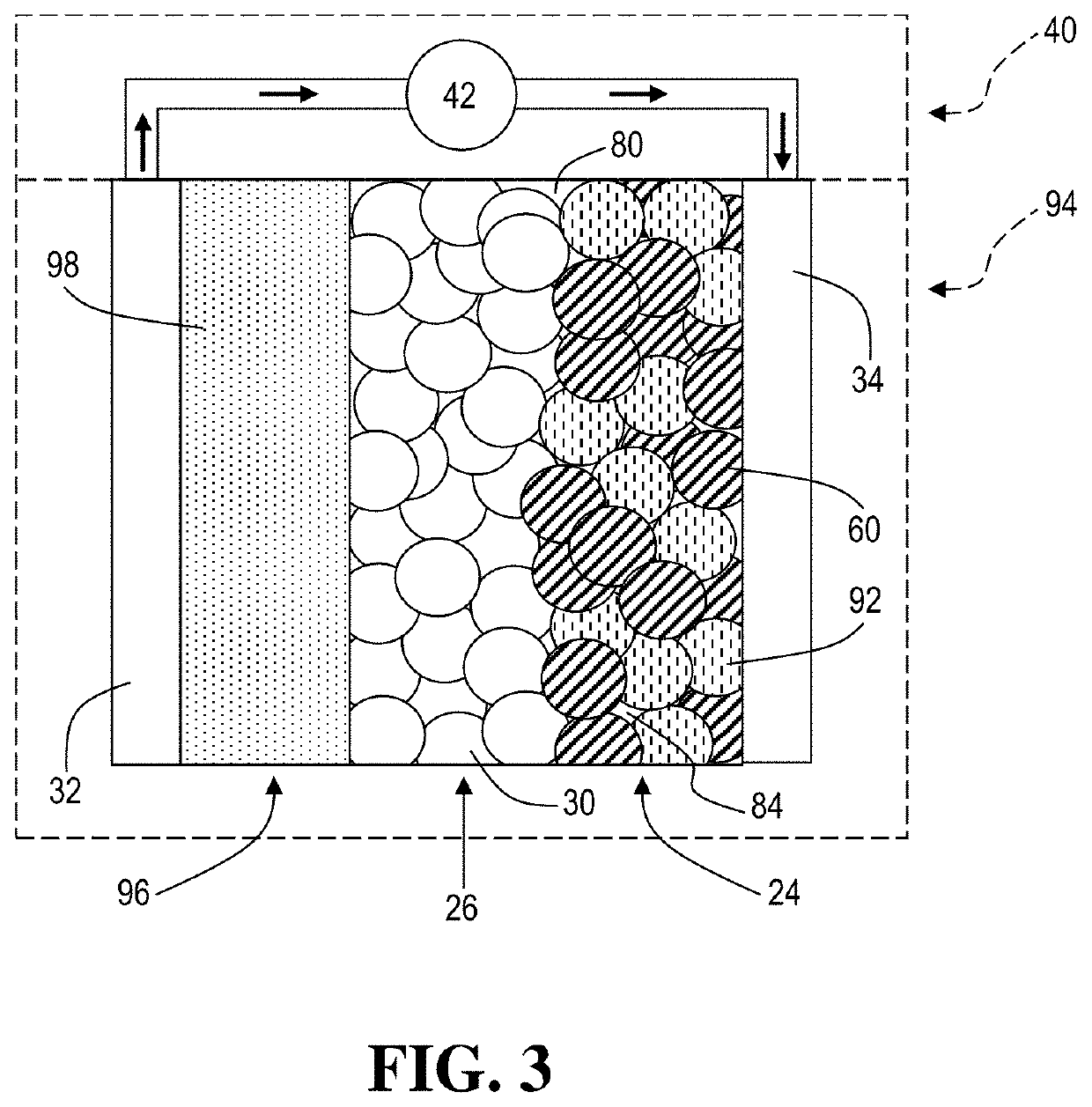

Solid-state lithium phosphate batteries incorporate various safety mechanisms to prevent thermal runaway and enhance overall safety. These include specialized separators, thermal management systems, and protective circuits that monitor battery conditions. The solid electrolyte itself serves as a safety feature by eliminating flammable liquid components, reducing the risk of fire and explosion during mechanical damage or overheating events.- Safety mechanisms in solid-state lithium phosphate batteries: Solid-state lithium phosphate batteries incorporate various safety mechanisms to prevent thermal runaway and enhance overall safety. These include specialized separators, thermal management systems, and protective circuits that monitor battery conditions. The solid electrolyte itself serves as a safety feature by eliminating flammable liquid components, reducing the risk of fire and explosion during mechanical damage or overheating events.

- Structural improvements for battery safety: Structural design enhancements in lithium phosphate and solid-state batteries significantly improve safety profiles. These include reinforced casings, pressure relief mechanisms, and internal structural supports that prevent physical deformation. Advanced electrode architectures minimize dendrite formation, while specialized interfaces between components reduce resistance and heat generation during operation, thereby decreasing safety risks associated with thermal events.

- Thermal management solutions for battery safety: Effective thermal management systems are crucial for maintaining safety in both lithium phosphate and solid-state batteries. These solutions include phase-change materials, cooling channels, heat-dissipating components, and temperature monitoring systems. Advanced thermal management prevents localized hotspots and ensures uniform temperature distribution throughout the battery pack, significantly reducing the risk of thermal runaway events even under extreme operating conditions.

- Advanced electrolyte formulations for enhanced safety: Innovative electrolyte formulations play a critical role in improving battery safety. For solid-state batteries, non-flammable ceramic and polymer electrolytes eliminate fire hazards associated with liquid electrolytes. In lithium phosphate batteries, flame-retardant additives and stabilizing compounds enhance safety by suppressing combustion and preventing electrolyte decomposition at high temperatures. These advanced formulations maintain performance while significantly reducing safety risks.

- Battery management systems for safety monitoring: Sophisticated battery management systems (BMS) are essential for ensuring the safe operation of lithium phosphate and solid-state batteries. These systems continuously monitor critical parameters including temperature, voltage, current, and state of charge. Advanced algorithms detect abnormal conditions and implement protective measures such as current limitation or circuit disconnection. Machine learning capabilities enable predictive safety management by identifying potential failure patterns before they become critical issues.

02 Electrolyte composition for improved battery safety

Advanced electrolyte formulations enhance the safety profile of lithium phosphate batteries. Non-flammable solid electrolytes, including ceramic, polymer, and composite materials, eliminate the risk associated with liquid electrolyte leakage and combustion. These solid electrolytes also prevent dendrite formation that can cause short circuits, while maintaining high ionic conductivity necessary for battery performance.Expand Specific Solutions03 Structural design innovations for battery safety

Innovative structural designs in lithium phosphate and solid-state batteries significantly improve safety characteristics. These include multi-layer protection systems, reinforced cell casings, and pressure relief mechanisms that prevent catastrophic failure. Some designs incorporate physical barriers between cells to prevent thermal propagation, while others feature compartmentalized structures that isolate potential failure points.Expand Specific Solutions04 Thermal management systems for battery safety

Advanced thermal management systems are crucial for maintaining safe operating temperatures in lithium phosphate and solid-state batteries. These systems include phase-change materials, active cooling circuits, and heat-dissipating structures that prevent overheating. Some designs incorporate temperature sensors and control algorithms that adjust charging rates based on thermal conditions, preventing dangerous temperature spikes during operation.Expand Specific Solutions05 Manufacturing processes for enhanced battery safety

Specialized manufacturing techniques improve the safety profile of lithium phosphate and solid-state batteries. These include precision assembly methods that minimize internal defects, advanced quality control processes, and contamination-free production environments. Some processes focus on creating uniform interfaces between battery components to prevent localized stress points and potential failure sites, while others employ novel sintering techniques for solid electrolytes that enhance mechanical stability.Expand Specific Solutions

Key Industry Players in Advanced Battery Technologies

The lithium phosphate versus solid-state battery safety landscape is currently in a transitional phase, with the market expanding rapidly as electric vehicle adoption accelerates globally. While lithium phosphate technology represents a mature solution with established safety credentials, solid-state batteries remain in early commercialization stages but promise superior safety profiles through elimination of flammable liquid electrolytes. Key players like Samsung SDI, Toyota, and QuantumScape are leading solid-state battery development, with significant research contributions from academic institutions including Lawrence Berkeley National Laboratory and University of California. Traditional battery manufacturers such as CATL, LG Chem, and Murata are strategically investing in both technologies, recognizing the dual market trajectory. The competitive landscape is further intensified by automotive manufacturers like Hyundai-Kia establishing vertical integration capabilities to secure battery technology advantages.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed advanced lithium iron phosphate (LFP) battery technology with proprietary cell designs that enhance safety and performance. Their LFP batteries utilize olivine-structured cathodes (LiFePO4) combined with optimized electrolyte formulations to improve thermal stability. Samsung's LFP cells incorporate flame-retardant additives in the electrolyte and specialized separator materials that provide additional protection against thermal runaway. The company has implemented a multi-layer safety system including mechanical safety features, thermal management systems, and battery management algorithms that continuously monitor cell conditions. Samsung SDI's LFP batteries have demonstrated thermal stability up to 500°C without combustion in safety tests, significantly higher than conventional lithium-ion batteries. Additionally, they've developed a "Z-folding" technique for electrode assembly that improves energy density while maintaining the inherent safety benefits of LFP chemistry[5][6]. Samsung is also researching hybrid approaches that combine LFP with solid-state elements to further enhance safety profiles.

Strengths: Excellent thermal stability; lower cost than solid-state alternatives; mature manufacturing processes; long cycle life (2000+ cycles); no reliance on cobalt or nickel. Weaknesses: Lower energy density compared to solid-state batteries; slower charging rates; reduced performance in cold temperatures; heavier weight for equivalent energy storage.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered solid-state battery technology with over 1,000 patents related to solid-state batteries. Their approach focuses on sulfide-based solid electrolytes that enable higher energy density and faster charging capabilities compared to conventional lithium-ion batteries. Toyota's solid-state battery design eliminates the need for liquid electrolytes by using solid electrolyte materials that conduct lithium ions between electrodes. This architecture significantly reduces the risk of thermal runaway and fire hazards associated with conventional batteries. Toyota has demonstrated prototype vehicles with solid-state batteries that can achieve a full charge in approximately 10 minutes while offering a driving range of over 500 km. The company plans to commercialize this technology in hybrid vehicles first before expanding to full electric vehicles, with initial production targeted for mid-decade[1][2].

Strengths: Superior safety profile with virtually eliminated risk of thermal runaway; higher energy density (potentially 2-3x conventional lithium-ion); faster charging capabilities; longer cycle life; better performance in extreme temperatures. Weaknesses: Higher manufacturing costs; challenges with electrolyte-electrode interfaces; mass production scalability issues; limited real-world performance data.

Critical Safety Mechanisms and Failure Analysis

Solid-state battery

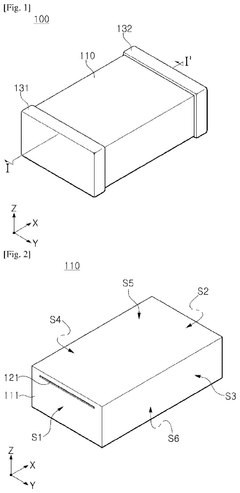

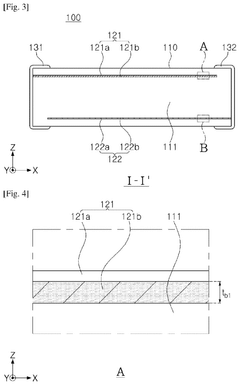

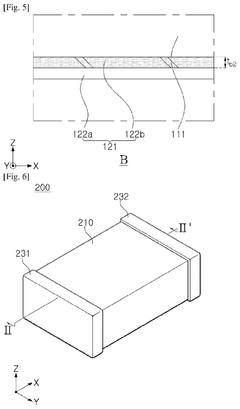

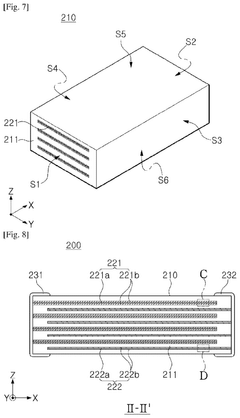

PatentPendingUS20240322163A1

Innovation

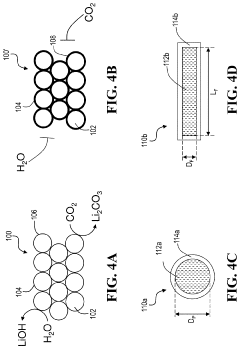

- A solid-state battery design incorporating a lithium cobalt phosphate (LCP) positive electrode active material layer, a lithium aluminum germanium phosphate (LAGP) solid electrolyte layer, and a negative electrode active material layer comprising lithium germanium phosphate (LGP) and lithium tin phosphate (LSP), which allows for a high operating voltage of 3.5 V or higher and improved reliability.

Lithium phosphate coating for lithium lanthanum zirconium oxide solid-state electrolyte powders

PatentInactiveUS20210257656A1

Innovation

- A method involving a phosphoric acid solution is used to coat LLZO particles or nanowires with lithium phosphate (Li3PO4), replacing the non-conductive layers, thereby enhancing lithium ion conductivity and stability against atmospheric reactions, and incorporating the Li3PO4-coated LLZO into electrochemical cells as a solid-state electrolyte or separator material.

Environmental Impact Assessment

The environmental impact of battery technologies extends far beyond their operational safety, encompassing their entire lifecycle from raw material extraction to disposal. When comparing lithium phosphate (LFP) and solid-state batteries, several critical environmental factors emerge.

LFP batteries demonstrate notable environmental advantages in their production phase. They utilize abundant materials like iron and phosphate, reducing dependency on rare earth elements and environmentally destructive mining practices. The extraction process for LFP materials typically generates 30% less carbon emissions compared to traditional lithium-ion batteries with nickel and cobalt components. Additionally, LFP manufacturing requires approximately 20% less energy consumption than conventional lithium-ion battery production.

Solid-state batteries, while still evolving technologically, show promising environmental credentials. Their potential for longer lifespans (estimated at 2-3 times that of conventional batteries) significantly reduces waste generation over time. The absence of liquid electrolytes eliminates the need for certain toxic materials used in traditional battery production, potentially reducing harmful chemical leaching during disposal phases.

Recycling capabilities represent another crucial environmental consideration. Current LFP batteries achieve recycling rates of approximately 50-60%, with established industrial processes for material recovery. Solid-state technologies, however, present both challenges and opportunities in recycling. While their simplified chemistry may facilitate easier separation of components, the novelty of these materials requires development of specialized recycling protocols that do not yet exist at industrial scale.

Water usage patterns differ significantly between these technologies. LFP production typically consumes 15-20 gallons of water per kWh of battery capacity, whereas preliminary assessments suggest solid-state manufacturing could reduce this figure by up to 40% due to different processing requirements and the elimination of certain water-intensive steps.

End-of-life toxicity assessments indicate that LFP batteries present lower environmental hazards than traditional lithium-ion batteries, with minimal heavy metal content. Solid-state batteries potentially offer even lower toxicity profiles, though comprehensive leachate studies remain limited due to their early development stage.

Carbon footprint analysis reveals that LFP batteries generate approximately 65-80 kg CO2-equivalent per kWh of capacity over their lifecycle. Early projections for solid-state technologies suggest potential reductions to 40-60 kg CO2-equivalent per kWh, primarily due to extended lifespan and improved energy efficiency, though these figures require validation as the technology matures and reaches commercial scale.

LFP batteries demonstrate notable environmental advantages in their production phase. They utilize abundant materials like iron and phosphate, reducing dependency on rare earth elements and environmentally destructive mining practices. The extraction process for LFP materials typically generates 30% less carbon emissions compared to traditional lithium-ion batteries with nickel and cobalt components. Additionally, LFP manufacturing requires approximately 20% less energy consumption than conventional lithium-ion battery production.

Solid-state batteries, while still evolving technologically, show promising environmental credentials. Their potential for longer lifespans (estimated at 2-3 times that of conventional batteries) significantly reduces waste generation over time. The absence of liquid electrolytes eliminates the need for certain toxic materials used in traditional battery production, potentially reducing harmful chemical leaching during disposal phases.

Recycling capabilities represent another crucial environmental consideration. Current LFP batteries achieve recycling rates of approximately 50-60%, with established industrial processes for material recovery. Solid-state technologies, however, present both challenges and opportunities in recycling. While their simplified chemistry may facilitate easier separation of components, the novelty of these materials requires development of specialized recycling protocols that do not yet exist at industrial scale.

Water usage patterns differ significantly between these technologies. LFP production typically consumes 15-20 gallons of water per kWh of battery capacity, whereas preliminary assessments suggest solid-state manufacturing could reduce this figure by up to 40% due to different processing requirements and the elimination of certain water-intensive steps.

End-of-life toxicity assessments indicate that LFP batteries present lower environmental hazards than traditional lithium-ion batteries, with minimal heavy metal content. Solid-state batteries potentially offer even lower toxicity profiles, though comprehensive leachate studies remain limited due to their early development stage.

Carbon footprint analysis reveals that LFP batteries generate approximately 65-80 kg CO2-equivalent per kWh of capacity over their lifecycle. Early projections for solid-state technologies suggest potential reductions to 40-60 kg CO2-equivalent per kWh, primarily due to extended lifespan and improved energy efficiency, though these figures require validation as the technology matures and reaches commercial scale.

Regulatory Compliance Framework

The regulatory landscape for battery technologies is complex and continuously evolving, with significant implications for both lithium phosphate (LFP) and solid-state battery technologies. Current regulatory frameworks primarily focus on safety standards, transportation requirements, and end-of-life management, with varying approaches across different regions.

In the United States, the Department of Transportation (DOT) and the Pipeline and Hazardous Materials Safety Administration (PHMSA) have established specific regulations for lithium-ion batteries under 49 CFR 173.185, which apply to LFP batteries but may require adaptation for solid-state technologies. The UN Manual of Tests and Criteria, specifically UN 38.3, outlines rigorous testing protocols for lithium batteries during transportation, including altitude simulation, thermal testing, vibration, shock, external short circuit, impact, overcharge, and forced discharge tests.

European regulations, particularly the Battery Directive (2006/66/EC) and its recent update, the EU Battery Regulation, introduce more stringent requirements for battery sustainability, carbon footprint declarations, and recycling efficiency. These regulations increasingly emphasize the entire lifecycle assessment of battery technologies, potentially favoring solid-state batteries due to their reduced environmental impact and enhanced safety profile.

For automotive applications, UN Global Technical Regulation No. 20 (GTR 20) establishes safety requirements for electric vehicle batteries, while IEC 62660 and ISO 6469 provide standards for performance and safety testing. Notably, solid-state batteries may require modified testing protocols due to their different failure modes compared to conventional lithium-ion technologies, including LFP.

Emerging regulatory trends indicate a shift toward more comprehensive safety certification processes that consider thermal runaway resistance, fire propagation prevention, and toxic gas emissions during failure events. This evolution may benefit solid-state technology, which inherently addresses many of these safety concerns through its non-flammable electrolyte design.

Compliance costs and timelines differ significantly between the two technologies. LFP batteries benefit from established regulatory pathways and testing protocols, resulting in more predictable certification processes. In contrast, solid-state batteries face regulatory uncertainty due to their novel architecture, potentially requiring new test methodologies and safety standards, which could extend time-to-market but may ultimately result in more favorable regulatory treatment due to their enhanced safety characteristics.

The global harmonization of battery safety standards remains an ongoing challenge, with initiatives like the Global Battery Alliance working to establish consistent international frameworks that could streamline compliance for next-generation technologies like solid-state batteries while ensuring appropriate safety measures for current LFP solutions.

In the United States, the Department of Transportation (DOT) and the Pipeline and Hazardous Materials Safety Administration (PHMSA) have established specific regulations for lithium-ion batteries under 49 CFR 173.185, which apply to LFP batteries but may require adaptation for solid-state technologies. The UN Manual of Tests and Criteria, specifically UN 38.3, outlines rigorous testing protocols for lithium batteries during transportation, including altitude simulation, thermal testing, vibration, shock, external short circuit, impact, overcharge, and forced discharge tests.

European regulations, particularly the Battery Directive (2006/66/EC) and its recent update, the EU Battery Regulation, introduce more stringent requirements for battery sustainability, carbon footprint declarations, and recycling efficiency. These regulations increasingly emphasize the entire lifecycle assessment of battery technologies, potentially favoring solid-state batteries due to their reduced environmental impact and enhanced safety profile.

For automotive applications, UN Global Technical Regulation No. 20 (GTR 20) establishes safety requirements for electric vehicle batteries, while IEC 62660 and ISO 6469 provide standards for performance and safety testing. Notably, solid-state batteries may require modified testing protocols due to their different failure modes compared to conventional lithium-ion technologies, including LFP.

Emerging regulatory trends indicate a shift toward more comprehensive safety certification processes that consider thermal runaway resistance, fire propagation prevention, and toxic gas emissions during failure events. This evolution may benefit solid-state technology, which inherently addresses many of these safety concerns through its non-flammable electrolyte design.

Compliance costs and timelines differ significantly between the two technologies. LFP batteries benefit from established regulatory pathways and testing protocols, resulting in more predictable certification processes. In contrast, solid-state batteries face regulatory uncertainty due to their novel architecture, potentially requiring new test methodologies and safety standards, which could extend time-to-market but may ultimately result in more favorable regulatory treatment due to their enhanced safety characteristics.

The global harmonization of battery safety standards remains an ongoing challenge, with initiatives like the Global Battery Alliance working to establish consistent international frameworks that could streamline compliance for next-generation technologies like solid-state batteries while ensuring appropriate safety measures for current LFP solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!