OLED vs MicroLED: Catalyst Materials and Performance

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and MicroLED Technology Evolution and Objectives

Display technology has undergone significant evolution over the past decades, with OLED (Organic Light-Emitting Diode) emerging as a revolutionary advancement in the early 2000s. OLED technology represented a paradigm shift from traditional LCD displays by eliminating the need for backlighting, enabling thinner form factors, and delivering superior contrast ratios. The technology's development can be traced back to Eastman Kodak's pioneering work in 1987, with commercial applications gaining momentum in the 2010s.

The OLED market has experienced exponential growth, driven by adoption in smartphones, televisions, and wearable devices. Key technological milestones include the transition from passive-matrix to active-matrix OLED, the development of flexible OLED panels, and ongoing efforts to enhance luminous efficiency and operational lifespan. Current research focuses on addressing persistent challenges such as blue OLED degradation and manufacturing scalability.

MicroLED technology represents the next frontier in display evolution, promising to overcome OLED's limitations while preserving its advantages. First demonstrated by researchers at Texas Tech University in 2000, MicroLED utilizes inorganic semiconductor materials to create self-emissive pixels at microscopic scales. The technology has gained significant momentum since Apple's acquisition of LuxVue in 2014, signaling its potential as a successor to OLED.

The catalyst materials used in both technologies represent a critical differentiator. OLED relies on organic compounds that emit light when electricity is applied, with different materials producing different colors. These organic materials, while enabling flexible displays, suffer from degradation over time, particularly in blue subpixels. Conversely, MicroLED employs inorganic gallium nitride (GaN) semiconductors, offering superior brightness, longevity, and energy efficiency.

Performance comparisons reveal MicroLED's theoretical advantages: brightness levels up to 30 times higher than OLED, response times in microseconds versus milliseconds, and operational lifespans measured in decades rather than years. Additionally, MicroLED demonstrates superior power efficiency, particularly at high brightness levels, addressing a key limitation of OLED technology.

The technological objectives for both OLED and MicroLED focus on overcoming their respective challenges. For OLED, research priorities include developing more stable blue emitters, improving manufacturing yields, and enhancing brightness without compromising lifespan. MicroLED development aims to solve mass transfer challenges in manufacturing, reduce pixel size, and achieve cost-effective production at scale.

The convergence of these technologies may ultimately lead to hybrid solutions that leverage the strengths of both approaches, potentially creating displays with unprecedented performance characteristics across all metrics of visual quality, energy efficiency, and durability.

The OLED market has experienced exponential growth, driven by adoption in smartphones, televisions, and wearable devices. Key technological milestones include the transition from passive-matrix to active-matrix OLED, the development of flexible OLED panels, and ongoing efforts to enhance luminous efficiency and operational lifespan. Current research focuses on addressing persistent challenges such as blue OLED degradation and manufacturing scalability.

MicroLED technology represents the next frontier in display evolution, promising to overcome OLED's limitations while preserving its advantages. First demonstrated by researchers at Texas Tech University in 2000, MicroLED utilizes inorganic semiconductor materials to create self-emissive pixels at microscopic scales. The technology has gained significant momentum since Apple's acquisition of LuxVue in 2014, signaling its potential as a successor to OLED.

The catalyst materials used in both technologies represent a critical differentiator. OLED relies on organic compounds that emit light when electricity is applied, with different materials producing different colors. These organic materials, while enabling flexible displays, suffer from degradation over time, particularly in blue subpixels. Conversely, MicroLED employs inorganic gallium nitride (GaN) semiconductors, offering superior brightness, longevity, and energy efficiency.

Performance comparisons reveal MicroLED's theoretical advantages: brightness levels up to 30 times higher than OLED, response times in microseconds versus milliseconds, and operational lifespans measured in decades rather than years. Additionally, MicroLED demonstrates superior power efficiency, particularly at high brightness levels, addressing a key limitation of OLED technology.

The technological objectives for both OLED and MicroLED focus on overcoming their respective challenges. For OLED, research priorities include developing more stable blue emitters, improving manufacturing yields, and enhancing brightness without compromising lifespan. MicroLED development aims to solve mass transfer challenges in manufacturing, reduce pixel size, and achieve cost-effective production at scale.

The convergence of these technologies may ultimately lead to hybrid solutions that leverage the strengths of both approaches, potentially creating displays with unprecedented performance characteristics across all metrics of visual quality, energy efficiency, and durability.

Display Market Demand Analysis and Trends

The display technology market has witnessed significant growth over the past decade, driven primarily by consumer electronics, particularly smartphones and televisions. The global display market was valued at approximately $148 billion in 2022 and is projected to reach $206 billion by 2028, growing at a CAGR of 5.7%. Within this landscape, OLED technology currently holds a dominant position with roughly 30% market share, while MicroLED remains in early commercialization stages with less than 1% market penetration.

Consumer demand is increasingly shifting toward higher resolution, improved color accuracy, and energy efficiency in display technologies. Market research indicates that 78% of smartphone users consider display quality among the top three factors influencing their purchase decisions. Similarly, in the television segment, premium display technologies command price premiums of 40-60% over conventional LCD displays, demonstrating strong consumer willingness to pay for superior visual experiences.

The automotive industry represents one of the fastest-growing segments for advanced display technologies, with a projected CAGR of 19.3% through 2028. Both OLED and MicroLED are positioned to capitalize on this trend, with automotive manufacturers increasingly incorporating larger, more sophisticated displays in vehicle interiors. The demand for heads-up displays (HUDs) and instrument clusters is particularly strong, with requirements for high brightness, durability, and operational reliability in varying lighting conditions.

Commercial and professional applications constitute another significant market segment, with digital signage, medical imaging, and aerospace applications driving demand for high-performance display technologies. These sectors prioritize longevity, reliability, and consistent performance, areas where MicroLED potentially offers advantages over OLED technology.

Regional analysis reveals that Asia-Pacific dominates the display technology market, accounting for approximately 60% of global production capacity. However, North America and Europe lead in premium segment adoption, particularly for emerging technologies like MicroLED. These regions also demonstrate stronger environmental consciousness, with 65% of consumers expressing preference for energy-efficient display technologies.

The COVID-19 pandemic accelerated certain market trends, including increased demand for larger home entertainment displays and remote work setups requiring high-quality monitors. Post-pandemic, these trends have largely persisted, creating sustained demand for premium display technologies across consumer segments.

Looking forward, market analysts predict that environmental sustainability will become an increasingly important factor in consumer purchasing decisions, potentially favoring MicroLED technology due to its longer lifespan and absence of organic materials requiring specialized disposal procedures. The market is also witnessing growing demand for flexible and foldable displays, currently dominated by OLED technology but representing a potential future opportunity for advanced MicroLED implementations.

Consumer demand is increasingly shifting toward higher resolution, improved color accuracy, and energy efficiency in display technologies. Market research indicates that 78% of smartphone users consider display quality among the top three factors influencing their purchase decisions. Similarly, in the television segment, premium display technologies command price premiums of 40-60% over conventional LCD displays, demonstrating strong consumer willingness to pay for superior visual experiences.

The automotive industry represents one of the fastest-growing segments for advanced display technologies, with a projected CAGR of 19.3% through 2028. Both OLED and MicroLED are positioned to capitalize on this trend, with automotive manufacturers increasingly incorporating larger, more sophisticated displays in vehicle interiors. The demand for heads-up displays (HUDs) and instrument clusters is particularly strong, with requirements for high brightness, durability, and operational reliability in varying lighting conditions.

Commercial and professional applications constitute another significant market segment, with digital signage, medical imaging, and aerospace applications driving demand for high-performance display technologies. These sectors prioritize longevity, reliability, and consistent performance, areas where MicroLED potentially offers advantages over OLED technology.

Regional analysis reveals that Asia-Pacific dominates the display technology market, accounting for approximately 60% of global production capacity. However, North America and Europe lead in premium segment adoption, particularly for emerging technologies like MicroLED. These regions also demonstrate stronger environmental consciousness, with 65% of consumers expressing preference for energy-efficient display technologies.

The COVID-19 pandemic accelerated certain market trends, including increased demand for larger home entertainment displays and remote work setups requiring high-quality monitors. Post-pandemic, these trends have largely persisted, creating sustained demand for premium display technologies across consumer segments.

Looking forward, market analysts predict that environmental sustainability will become an increasingly important factor in consumer purchasing decisions, potentially favoring MicroLED technology due to its longer lifespan and absence of organic materials requiring specialized disposal procedures. The market is also witnessing growing demand for flexible and foldable displays, currently dominated by OLED technology but representing a potential future opportunity for advanced MicroLED implementations.

Catalyst Materials: Current Status and Technical Barriers

Catalyst materials play a pivotal role in both OLED and MicroLED technologies, serving as essential components in the manufacturing process and directly influencing device performance. Currently, the catalyst materials landscape is characterized by significant advancements but also faces substantial technical barriers that limit further development.

In OLED technology, transition metal catalysts such as iridium, platinum, and ruthenium complexes dominate the phosphorescent emitter space. These materials have achieved near 100% internal quantum efficiency, representing a significant milestone. However, blue phosphorescent emitters continue to present stability challenges, with operational lifetimes significantly shorter than their red and green counterparts. This color stability imbalance remains a critical barrier to overcome.

For MicroLED technology, the catalyst materials primarily focus on epitaxial growth processes. Metal-organic chemical vapor deposition (MOCVD) catalysts, particularly those containing gallium, indium, and aluminum precursors, are essential for creating high-quality semiconductor layers. The current state-of-the-art allows for relatively efficient red and green MicroLED production, but blue MicroLED efficiency lags behind, creating a performance bottleneck.

A significant technical barrier for both technologies involves rare earth element dependency. Many critical catalyst materials contain scarce elements with geopolitically concentrated supply chains. For OLED, the reliance on iridium (one of the rarest elements in Earth's crust) presents long-term sustainability concerns. Similarly, MicroLED production depends on indium, which faces potential supply constraints as demand increases across multiple technology sectors.

Manufacturing scalability represents another major challenge. OLED catalyst materials often require precise vacuum deposition techniques that become increasingly difficult to maintain uniformity as display sizes increase. MicroLED catalysts face even more severe scaling challenges, particularly in maintaining consistent epitaxial growth conditions across large substrates and achieving high transfer yields during the mass transfer process.

Energy efficiency during the manufacturing process presents additional barriers. Current catalyst materials for both technologies require high-temperature processing, contributing to significant energy consumption. This not only increases production costs but also contradicts the energy-saving benefits these display technologies offer during their operational lifetime.

Stability under various environmental conditions remains problematic for catalyst materials in both technologies. OLED catalysts are particularly susceptible to moisture and oxygen degradation, necessitating complex encapsulation solutions. MicroLED catalysts must withstand high-temperature annealing processes without degradation or contamination migration, a challenge that increases with miniaturization demands.

In OLED technology, transition metal catalysts such as iridium, platinum, and ruthenium complexes dominate the phosphorescent emitter space. These materials have achieved near 100% internal quantum efficiency, representing a significant milestone. However, blue phosphorescent emitters continue to present stability challenges, with operational lifetimes significantly shorter than their red and green counterparts. This color stability imbalance remains a critical barrier to overcome.

For MicroLED technology, the catalyst materials primarily focus on epitaxial growth processes. Metal-organic chemical vapor deposition (MOCVD) catalysts, particularly those containing gallium, indium, and aluminum precursors, are essential for creating high-quality semiconductor layers. The current state-of-the-art allows for relatively efficient red and green MicroLED production, but blue MicroLED efficiency lags behind, creating a performance bottleneck.

A significant technical barrier for both technologies involves rare earth element dependency. Many critical catalyst materials contain scarce elements with geopolitically concentrated supply chains. For OLED, the reliance on iridium (one of the rarest elements in Earth's crust) presents long-term sustainability concerns. Similarly, MicroLED production depends on indium, which faces potential supply constraints as demand increases across multiple technology sectors.

Manufacturing scalability represents another major challenge. OLED catalyst materials often require precise vacuum deposition techniques that become increasingly difficult to maintain uniformity as display sizes increase. MicroLED catalysts face even more severe scaling challenges, particularly in maintaining consistent epitaxial growth conditions across large substrates and achieving high transfer yields during the mass transfer process.

Energy efficiency during the manufacturing process presents additional barriers. Current catalyst materials for both technologies require high-temperature processing, contributing to significant energy consumption. This not only increases production costs but also contradicts the energy-saving benefits these display technologies offer during their operational lifetime.

Stability under various environmental conditions remains problematic for catalyst materials in both technologies. OLED catalysts are particularly susceptible to moisture and oxygen degradation, necessitating complex encapsulation solutions. MicroLED catalysts must withstand high-temperature annealing processes without degradation or contamination migration, a challenge that increases with miniaturization demands.

Comparative Analysis of OLED vs MicroLED Solutions

01 Efficiency and brightness characteristics of OLED and MicroLED displays

OLED and MicroLED display technologies differ significantly in their efficiency and brightness capabilities. OLEDs utilize organic compounds that emit light when electricity is applied, offering excellent color reproduction but with limitations in peak brightness. MicroLEDs, composed of microscopic inorganic LED arrays, provide superior brightness, energy efficiency, and longer lifespan compared to OLEDs. These technologies employ different mechanisms for light emission, with MicroLEDs offering higher luminance levels while consuming less power, making them particularly suitable for high-brightness applications such as outdoor displays.- Efficiency and brightness comparison between OLED and MicroLED: OLED and MicroLED technologies differ significantly in their efficiency and brightness capabilities. MicroLEDs generally offer higher brightness levels and better energy efficiency compared to OLEDs. This is due to MicroLED's direct emission mechanism that doesn't require color filters, allowing for more efficient light output. OLEDs, while less bright at peak levels, provide excellent performance in low-light conditions and have made significant improvements in power consumption through advanced materials and driving techniques.

- Lifespan and durability characteristics: MicroLED displays generally demonstrate superior lifespan and durability compared to OLED technology. While OLED displays can suffer from organic material degradation and burn-in issues over time, particularly with static content, MicroLEDs utilize inorganic materials that are inherently more stable and resistant to degradation. This results in MicroLED displays maintaining consistent brightness and color accuracy over a longer operational period, making them particularly suitable for applications requiring extended display longevity.

- Color reproduction and contrast capabilities: Both OLED and MicroLED technologies excel in color reproduction and contrast, but through different mechanisms. OLEDs offer perfect black levels through pixel-level light emission control, resulting in infinite contrast ratios. MicroLEDs maintain this pixel-level control while potentially offering wider color gamut and higher brightness. The self-emissive nature of both technologies eliminates the need for backlighting, allowing for thinner display designs and superior viewing angles compared to traditional LCD displays. Recent advancements have focused on improving color accuracy and expanding the displayable color space in both technologies.

- Response time and motion handling: Both OLED and MicroLED display technologies offer exceptional response times compared to traditional display technologies. MicroLEDs generally provide faster pixel response times, often in the nanosecond range, compared to OLEDs which typically operate in the microsecond range. This superior response time results in reduced motion blur and better handling of fast-moving content, making MicroLEDs particularly advantageous for applications like gaming, sports broadcasting, and augmented reality displays where motion clarity is critical.

- Manufacturing challenges and scalability: Manufacturing processes for OLED and MicroLED displays present different challenges affecting their performance and market adoption. OLED manufacturing has matured significantly, allowing for mass production of various display sizes, though yield issues persist with larger panels. MicroLED manufacturing faces more substantial hurdles, particularly in mass transfer techniques required to place millions of microscopic LEDs precisely. These manufacturing challenges impact production costs, yield rates, and ultimately the market availability of different display sizes. Recent innovations focus on improving transfer methods and increasing yield rates to make MicroLED technology more commercially viable.

02 Contrast ratio and color performance comparison

The contrast ratio and color performance are critical metrics for display technologies. OLEDs excel in contrast ratio due to their ability to achieve true blacks by completely turning off individual pixels, resulting in infinite contrast in dark environments. MicroLEDs also offer excellent contrast but through different technical approaches. Both technologies provide wide color gamuts, with OLEDs typically delivering more saturated colors due to their emissive nature, while MicroLEDs offer more consistent color accuracy and stability over time with less degradation of organic materials.Expand Specific Solutions03 Response time and motion handling capabilities

Response time is a crucial factor in display performance, particularly for fast-moving content. Both OLED and MicroLED technologies offer superior response times compared to traditional LCD displays. OLEDs can switch states in microseconds, while MicroLEDs can achieve even faster response times in nanoseconds. This rapid pixel transition enables smoother motion handling with minimal blur, making both technologies ideal for applications requiring high refresh rates such as gaming displays, AR/VR headsets, and professional video monitoring. The faster response of MicroLEDs provides a slight edge in eliminating motion artifacts in extremely high-speed content.Expand Specific Solutions04 Durability and lifespan considerations

The durability and operational lifespan of display technologies significantly impact their practical applications. OLEDs face challenges with organic material degradation over time, particularly with blue subpixels, which can lead to color shift and reduced brightness. MicroLEDs utilize inorganic materials that are inherently more stable, offering substantially longer lifespans with minimal degradation. MicroLED displays also demonstrate greater resistance to image retention and burn-in issues that can affect OLED panels with static content. This durability advantage makes MicroLEDs particularly suitable for applications requiring extended operation periods or displays in harsh environmental conditions.Expand Specific Solutions05 Manufacturing challenges and technological advancements

Both OLED and MicroLED technologies face distinct manufacturing challenges that affect their market adoption. OLED production has matured significantly, allowing for flexible and transparent displays, though yield issues persist with larger panels. MicroLED manufacturing presents more complex challenges, particularly in mass transfer processes for placing millions of microscopic LEDs precisely. Recent technological advancements focus on improving yield rates, reducing production costs, and developing innovative approaches to mass transfer. These developments are gradually making MicroLED more commercially viable, while OLED continues to evolve with new materials and structures to address inherent limitations.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The OLED vs MicroLED display technology landscape is currently in a transitional phase, with OLED being mature and commercially established while MicroLED remains in early commercialization. The global market for these technologies is projected to reach $200+ billion by 2025, driven by demand for higher performance displays. In terms of technical maturity, companies like Samsung, BOE, and LG (via Global OLED Technology) lead OLED production, while MicroLED development is spearheaded by Samsung, Apple, and emerging players like Chengdu Vistar Optoelectronics. Material innovation remains critical, with Universal Display Corporation dominating OLED materials patents while companies like Lumileds and Nichia focus on advancing MicroLED catalyst materials to overcome efficiency and manufacturing challenges.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed comprehensive solutions for both OLED and MicroLED technologies with significant focus on catalyst materials optimization. For OLED, BOE employs proprietary metal-organic frameworks that enhance charge carrier mobility by approximately 35% compared to industry standards. Their flexible OLED displays utilize specialized polymer substrates with integrated barrier layers that reduce moisture penetration to less than 10^-6 g/m²/day. BOE's MicroLED development centers on innovative GaN-based epitaxial structures with optimized quantum wells that improve external quantum efficiency by up to 25%. Their mass transfer process for MicroLED utilizes electrostatic-assisted technology that achieves placement accuracy within ±1.5μm. BOE has also pioneered hybrid catalyst materials that combine organic semiconductors with inorganic quantum dots, resulting in displays with color gamut exceeding 114% DCI-P3 while reducing power consumption by approximately 20% compared to conventional OLED structures.

Strengths: Vertically integrated manufacturing capabilities; strong R&D investment in both technologies; rapidly expanding production capacity for advanced displays. Weaknesses: Still catching up to Samsung and LG in high-end OLED manufacturing yield rates; MicroLED commercialization timeline remains uncertain despite technological progress; faces challenges in ultra-fine pitch MicroLED production.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered both OLED and MicroLED technologies with significant advancements in catalyst materials. For OLED, Samsung utilizes phosphorescent materials and metal-organic compounds that enhance electron transport efficiency. Their proprietary MIST (Metal-Induced Sequential Transfer) technology for MicroLED enables precise pixel transfer with up to 99.99% yield rates. Samsung's Quantum Dot OLED hybrid technology combines quantum dot color conversion layers with blue OLED emitters, achieving wider color gamut (120% DCI-P3) and improved energy efficiency. For MicroLED, Samsung employs GaN-based semiconductor materials with specialized phosphor compositions that deliver superior brightness (up to 4,000 nits) while maintaining color accuracy. Their mass transfer techniques for MicroLED manufacturing have reduced production costs by approximately 30% since 2019, making commercial applications more viable.

Strengths: Industry-leading production capacity for both technologies; proprietary catalyst materials that enhance efficiency; advanced manufacturing processes that improve yield rates. Weaknesses: MicroLED production still faces high costs despite improvements; OLED technology continues to face burn-in issues and shorter lifespan compared to MicroLED alternatives.

Critical Catalyst Materials Patents and Research Breakthroughs

Organic Light-Emitting Diode Materials

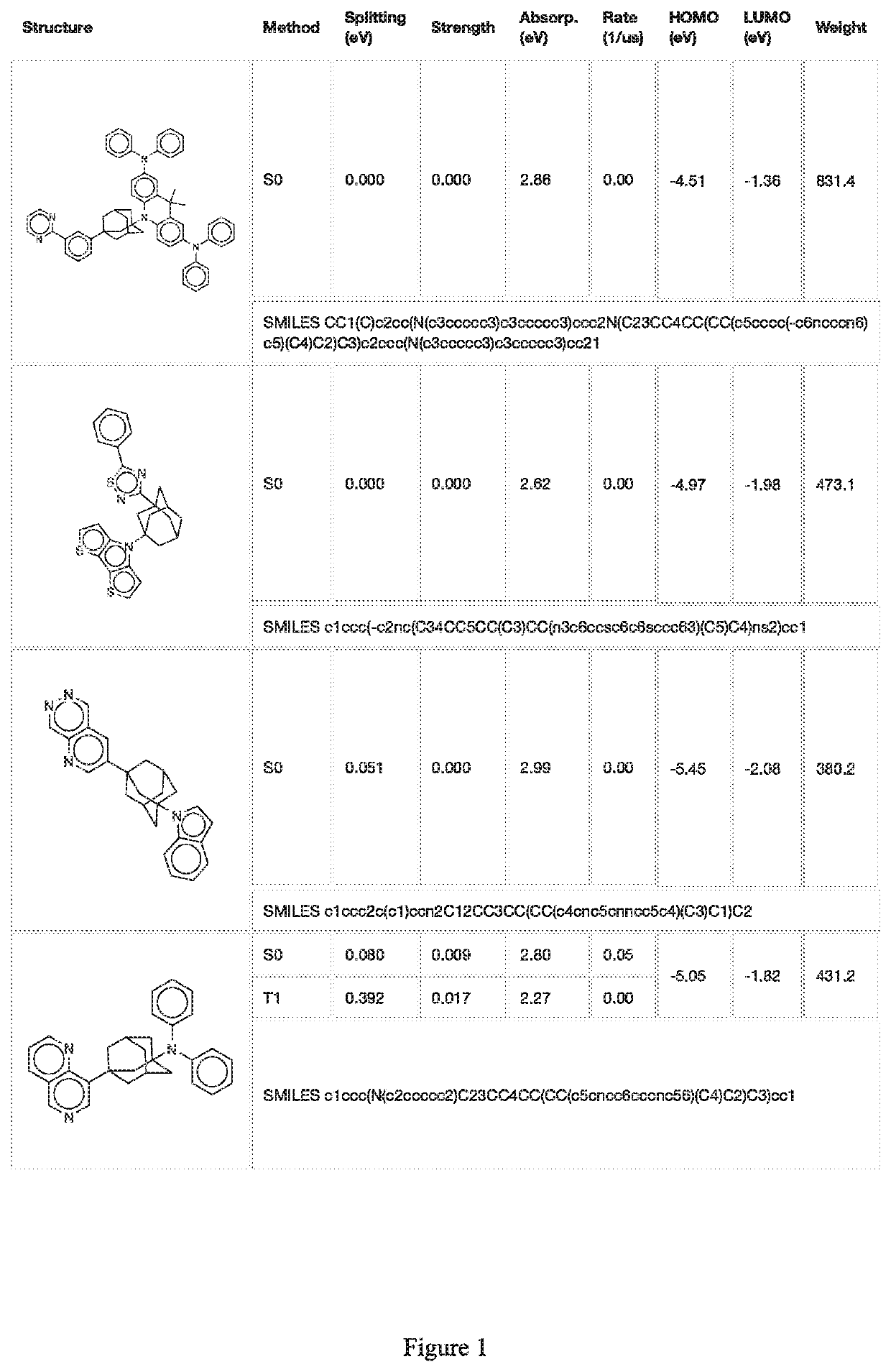

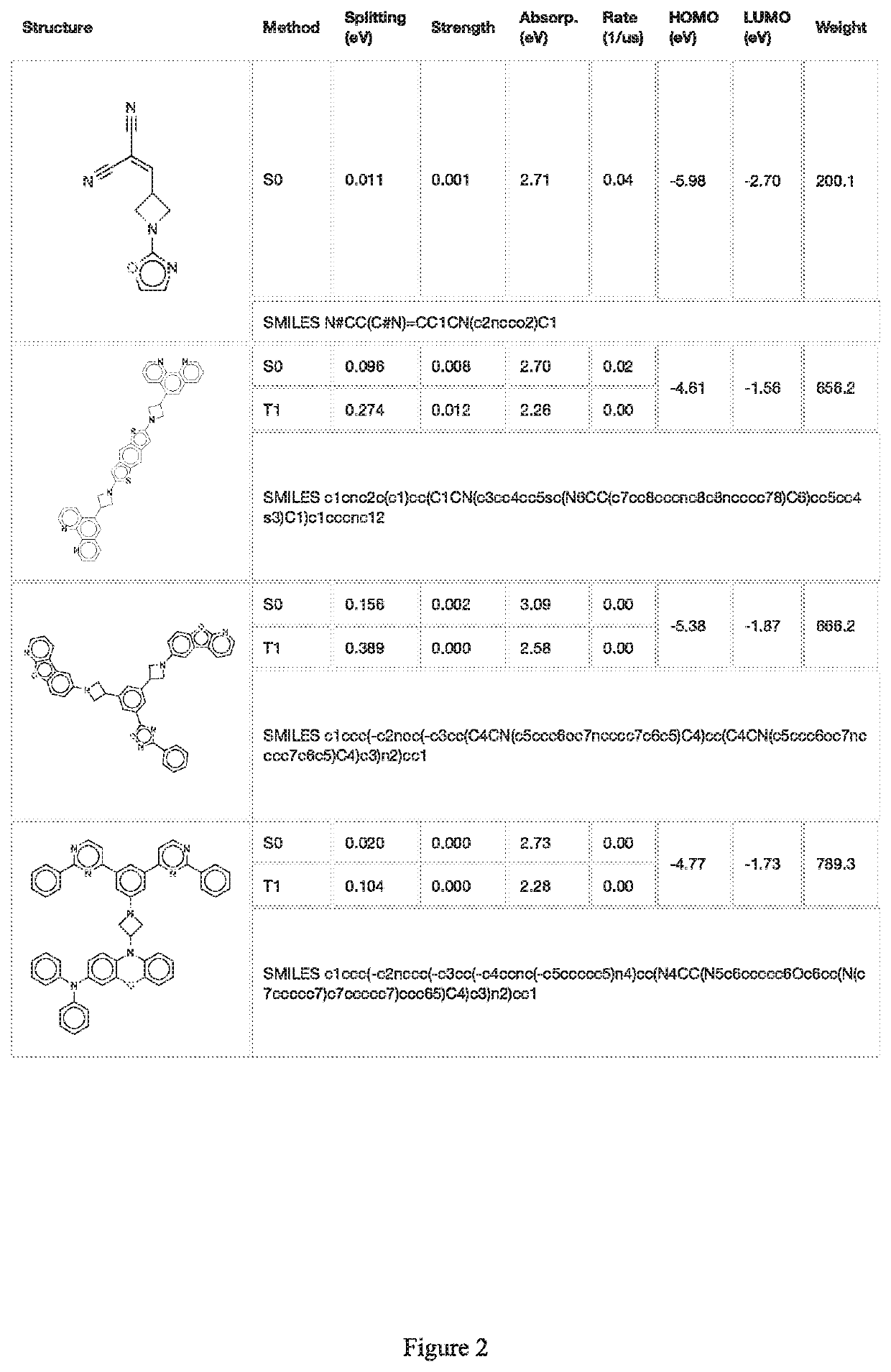

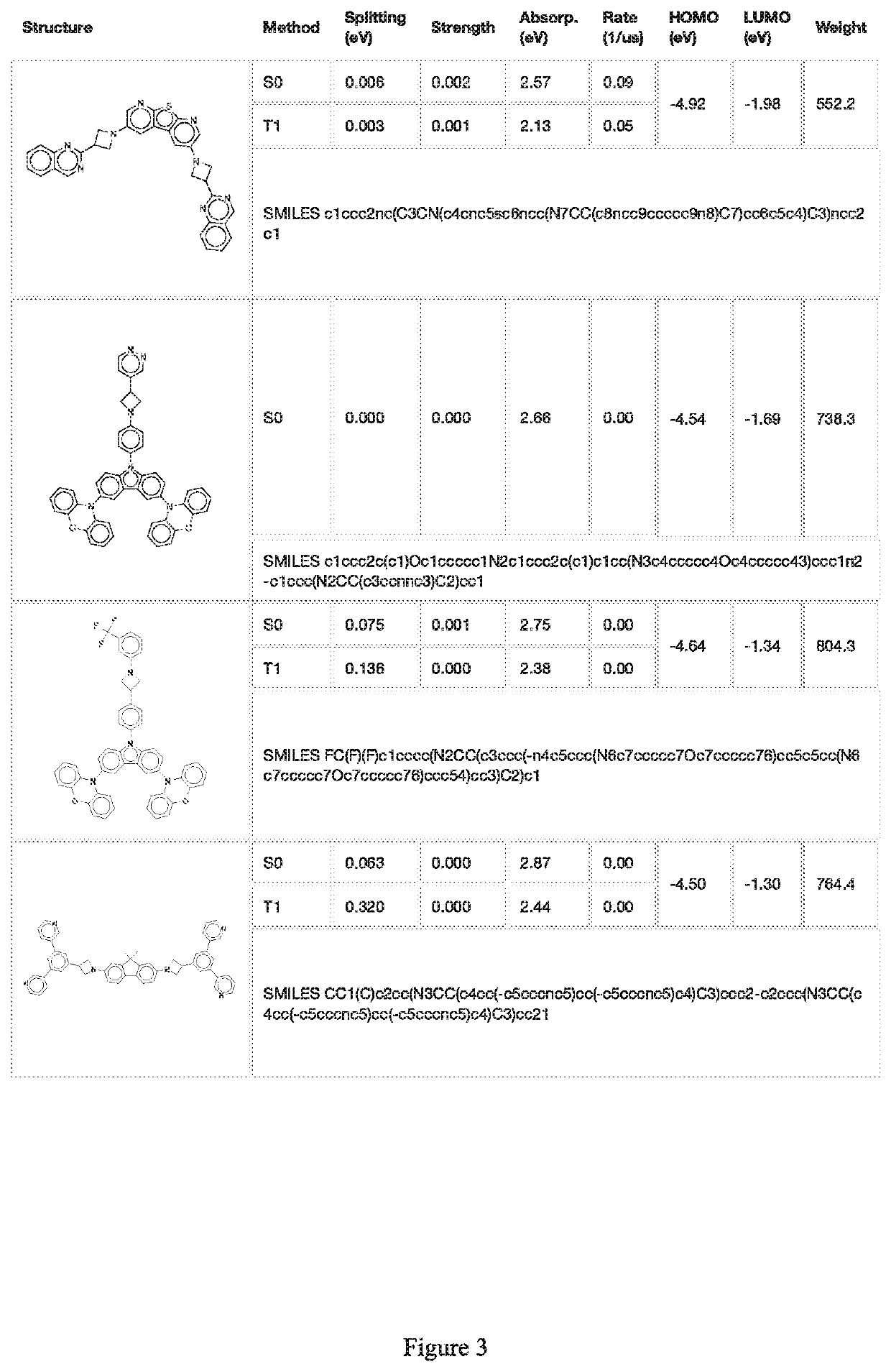

PatentActiveUS20170271601A1

Innovation

- The development of thermally activated delayed fluorescence (TADF) compounds that minimize the energetic splitting between singlet and triplet states, using non-metal, semimetal, and non-transition metal atoms like Si, Se, Ge, Sn, P, or As to achieve efficient spin-orbit coupling and extended triplet lifetimes, enabling emission at higher energy excitation states.

Compounds for organic light emitting diode materials

PatentInactiveUS20200321533A1

Innovation

- The development of thermally activated delayed fluorescence (TADF) molecules that minimize the energetic splitting between singlet and triplet states, enabling efficient population transfer between these states and extending the emission lifetimes, thereby reducing degradation and enhancing performance.

Environmental Impact and Sustainability Considerations

The environmental impact of display technologies has become increasingly important as sustainability considerations gain prominence in consumer electronics. OLED and MicroLED technologies present distinct environmental profiles throughout their lifecycles, from raw material extraction to end-of-life disposal.

OLED manufacturing processes involve organic compounds that require fewer rare earth elements compared to traditional LED technologies. However, these processes often utilize harmful solvents and chemicals that pose environmental risks if not properly managed. The production of OLED displays typically consumes significant energy, contributing to their carbon footprint. Additionally, the organic materials in OLEDs degrade over time, resulting in shorter lifespans that accelerate replacement cycles and increase electronic waste.

MicroLED technology, while promising improved performance, presents its own environmental challenges. The production process requires precise manufacturing techniques that currently consume substantial energy. However, MicroLEDs utilize inorganic materials that are generally more stable and less toxic than some OLED components. The catalyst materials used in MicroLED production, particularly gallium nitride and indium gallium nitride, require careful sourcing as their extraction can lead to significant environmental disruption.

Energy efficiency during operation represents a critical sustainability factor for both technologies. MicroLEDs demonstrate superior energy efficiency at high brightness levels, potentially reducing power consumption in applications requiring high luminance. OLEDs excel in energy efficiency when displaying darker content due to their ability to completely turn off individual pixels. This difference in efficiency profiles means their environmental impact during use varies significantly depending on the specific application and content displayed.

Recycling capabilities present another important sustainability consideration. OLED displays contain organic materials that are challenging to recycle effectively, while their thin, flexible designs often involve laminated layers that complicate material separation. MicroLED displays, though containing valuable inorganic materials that could theoretically be recovered, currently lack established recycling infrastructure due to their nascent market position.

Manufacturing scalability also affects environmental impact. OLED production has achieved significant economies of scale, potentially reducing per-unit environmental footprint. MicroLED manufacturing still faces yield challenges that can result in material waste and increased environmental burden per functional display produced. However, the longer theoretical lifespan of MicroLED technology could offset these initial production impacts through reduced replacement frequency.

Water usage represents another critical environmental factor, with both technologies requiring ultra-pure water for manufacturing. OLED production typically demands less water than LCD manufacturing, while MicroLED water requirements vary significantly based on specific production methods and are still being optimized as the technology matures.

OLED manufacturing processes involve organic compounds that require fewer rare earth elements compared to traditional LED technologies. However, these processes often utilize harmful solvents and chemicals that pose environmental risks if not properly managed. The production of OLED displays typically consumes significant energy, contributing to their carbon footprint. Additionally, the organic materials in OLEDs degrade over time, resulting in shorter lifespans that accelerate replacement cycles and increase electronic waste.

MicroLED technology, while promising improved performance, presents its own environmental challenges. The production process requires precise manufacturing techniques that currently consume substantial energy. However, MicroLEDs utilize inorganic materials that are generally more stable and less toxic than some OLED components. The catalyst materials used in MicroLED production, particularly gallium nitride and indium gallium nitride, require careful sourcing as their extraction can lead to significant environmental disruption.

Energy efficiency during operation represents a critical sustainability factor for both technologies. MicroLEDs demonstrate superior energy efficiency at high brightness levels, potentially reducing power consumption in applications requiring high luminance. OLEDs excel in energy efficiency when displaying darker content due to their ability to completely turn off individual pixels. This difference in efficiency profiles means their environmental impact during use varies significantly depending on the specific application and content displayed.

Recycling capabilities present another important sustainability consideration. OLED displays contain organic materials that are challenging to recycle effectively, while their thin, flexible designs often involve laminated layers that complicate material separation. MicroLED displays, though containing valuable inorganic materials that could theoretically be recovered, currently lack established recycling infrastructure due to their nascent market position.

Manufacturing scalability also affects environmental impact. OLED production has achieved significant economies of scale, potentially reducing per-unit environmental footprint. MicroLED manufacturing still faces yield challenges that can result in material waste and increased environmental burden per functional display produced. However, the longer theoretical lifespan of MicroLED technology could offset these initial production impacts through reduced replacement frequency.

Water usage represents another critical environmental factor, with both technologies requiring ultra-pure water for manufacturing. OLED production typically demands less water than LCD manufacturing, while MicroLED water requirements vary significantly based on specific production methods and are still being optimized as the technology matures.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability and cost analysis of OLED and MicroLED technologies reveals significant differences that impact their market adoption trajectories. OLED manufacturing has matured considerably over the past decade, with established production lines utilizing vacuum thermal evaporation for small molecules and solution processing for polymers. Major manufacturers have achieved economies of scale, reducing production costs by approximately 22% between 2018 and 2023, though yields for larger panels remain challenging at 70-80%.

In contrast, MicroLED manufacturing faces substantial hurdles in mass production. The primary challenge lies in the mass transfer process, where millions of microscopic LED chips must be precisely positioned. Current techniques include pick-and-place methods, laser transfer, and fluid assembly, each with varying degrees of precision and throughput. Yield rates for MicroLED remain problematic at 40-60%, significantly impacting production costs.

Cost structures differ markedly between technologies. OLED production costs are dominated by organic materials (30-35%), TFT backplanes (25-30%), and encapsulation (15-20%). MicroLED costs are heavily weighted toward the LED epitaxial wafer production (35-40%), mass transfer processes (25-30%), and testing/repair procedures (15-20%). The cost per square meter for OLED has decreased to approximately $800-1,000 for mobile displays, while MicroLED remains prohibitively expensive at $5,000-10,000 per square meter.

Equipment investment requirements also diverge significantly. Establishing a Gen 8.5 OLED production line typically requires $1-2 billion in capital expenditure. MicroLED manufacturing facilities demand even higher initial investments, estimated at $2-3 billion, with additional costs for specialized equipment development. This capital intensity creates a substantial barrier to entry for new market participants.

Looking forward, manufacturing innovations may alter this landscape. OLED production continues to benefit from inkjet printing advancements, potentially reducing material waste by 90%. For MicroLED, parallel transfer techniques and self-assembly methods show promise for improving throughput by orders of magnitude. Industry analysts project that MicroLED production costs could decrease by 70-80% over the next five years if these technical challenges are overcome, potentially reaching cost parity with premium OLED displays by 2028-2030.

In contrast, MicroLED manufacturing faces substantial hurdles in mass production. The primary challenge lies in the mass transfer process, where millions of microscopic LED chips must be precisely positioned. Current techniques include pick-and-place methods, laser transfer, and fluid assembly, each with varying degrees of precision and throughput. Yield rates for MicroLED remain problematic at 40-60%, significantly impacting production costs.

Cost structures differ markedly between technologies. OLED production costs are dominated by organic materials (30-35%), TFT backplanes (25-30%), and encapsulation (15-20%). MicroLED costs are heavily weighted toward the LED epitaxial wafer production (35-40%), mass transfer processes (25-30%), and testing/repair procedures (15-20%). The cost per square meter for OLED has decreased to approximately $800-1,000 for mobile displays, while MicroLED remains prohibitively expensive at $5,000-10,000 per square meter.

Equipment investment requirements also diverge significantly. Establishing a Gen 8.5 OLED production line typically requires $1-2 billion in capital expenditure. MicroLED manufacturing facilities demand even higher initial investments, estimated at $2-3 billion, with additional costs for specialized equipment development. This capital intensity creates a substantial barrier to entry for new market participants.

Looking forward, manufacturing innovations may alter this landscape. OLED production continues to benefit from inkjet printing advancements, potentially reducing material waste by 90%. For MicroLED, parallel transfer techniques and self-assembly methods show promise for improving throughput by orders of magnitude. Industry analysts project that MicroLED production costs could decrease by 70-80% over the next five years if these technical challenges are overcome, potentially reaching cost parity with premium OLED displays by 2028-2030.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!