OLED vs MicroLED: Predictive Insights into Technology Transformation

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Display Technology Evolution and Objectives

Display technology has undergone remarkable evolution since the introduction of cathode ray tubes (CRTs) in the early 20th century. The progression from CRTs to liquid crystal displays (LCDs) marked the first major shift in display technology, enabling thinner, more energy-efficient screens. The subsequent development of plasma display panels (PDPs) in the 1990s and early 2000s offered improved contrast ratios and viewing angles, though these were eventually overshadowed by advancements in LCD technology.

The introduction of organic light-emitting diode (OLED) technology in the early 2000s represented a paradigm shift in display capabilities. Unlike LCDs that require backlighting, OLED pixels emit their own light when electrical current is applied, allowing for true blacks, higher contrast ratios, and thinner form factors. This self-emissive property has positioned OLED as the premium display technology for smartphones, televisions, and other consumer electronics over the past decade.

MicroLED technology, emerging in the late 2010s, represents the next potential evolutionary leap in display technology. Building on the self-emissive principle of OLEDs, MicroLEDs utilize inorganic gallium nitride (GaN) LEDs at microscopic scales. This fundamental material difference addresses several limitations of OLED technology, particularly regarding brightness capabilities, energy efficiency, and long-term durability.

The current technological trajectory suggests a gradual transition from OLED to MicroLED in premium display applications, with each technology finding specific niches based on their respective strengths. The primary objective of this evolution is to achieve displays with perfect contrast ratios, expanded color gamuts approaching the full visible spectrum, microsecond response times, and significantly reduced power consumption.

Additional objectives driving display technology development include enhanced durability with lifespans exceeding 100,000 hours without degradation, ultra-high brightness capabilities exceeding 5,000 nits for outdoor visibility, and manufacturing scalability to enable cost-effective production across various screen sizes from smartwatches to wall-sized displays.

The convergence of these technological advancements aims to create display systems that can seamlessly adapt to diverse environmental conditions while delivering immersive visual experiences indistinguishable from reality. This evolution is further propelled by emerging applications in augmented reality (AR), virtual reality (VR), and mixed reality (MR), which demand displays with unprecedented combinations of resolution, refresh rate, brightness, and power efficiency.

The introduction of organic light-emitting diode (OLED) technology in the early 2000s represented a paradigm shift in display capabilities. Unlike LCDs that require backlighting, OLED pixels emit their own light when electrical current is applied, allowing for true blacks, higher contrast ratios, and thinner form factors. This self-emissive property has positioned OLED as the premium display technology for smartphones, televisions, and other consumer electronics over the past decade.

MicroLED technology, emerging in the late 2010s, represents the next potential evolutionary leap in display technology. Building on the self-emissive principle of OLEDs, MicroLEDs utilize inorganic gallium nitride (GaN) LEDs at microscopic scales. This fundamental material difference addresses several limitations of OLED technology, particularly regarding brightness capabilities, energy efficiency, and long-term durability.

The current technological trajectory suggests a gradual transition from OLED to MicroLED in premium display applications, with each technology finding specific niches based on their respective strengths. The primary objective of this evolution is to achieve displays with perfect contrast ratios, expanded color gamuts approaching the full visible spectrum, microsecond response times, and significantly reduced power consumption.

Additional objectives driving display technology development include enhanced durability with lifespans exceeding 100,000 hours without degradation, ultra-high brightness capabilities exceeding 5,000 nits for outdoor visibility, and manufacturing scalability to enable cost-effective production across various screen sizes from smartwatches to wall-sized displays.

The convergence of these technological advancements aims to create display systems that can seamlessly adapt to diverse environmental conditions while delivering immersive visual experiences indistinguishable from reality. This evolution is further propelled by emerging applications in augmented reality (AR), virtual reality (VR), and mixed reality (MR), which demand displays with unprecedented combinations of resolution, refresh rate, brightness, and power efficiency.

Market Demand Analysis for Advanced Display Technologies

The display technology market is witnessing unprecedented growth driven by increasing consumer demand for superior visual experiences across multiple device categories. Current market analysis indicates that the global advanced display technology sector is expanding at a compound annual growth rate of approximately 8%, with particular acceleration in premium smartphone, television, and wearable device segments.

Consumer preferences are shifting decisively toward thinner, lighter, and more energy-efficient displays with enhanced color accuracy, contrast ratios, and brightness levels. This trend is especially pronounced in the high-end smartphone market, where manufacturers compete intensely on display quality as a key differentiating factor. The automotive industry represents another rapidly growing market segment, with advanced displays becoming central to modern vehicle interfaces and entertainment systems.

OLED technology currently dominates the premium display market due to its superior contrast ratios, color reproduction, and form factor flexibility. Market research indicates that OLED displays command approximately 70% of the premium smartphone display market, with Samsung Display and LG Display as the primary manufacturers. The television sector has also seen significant OLED adoption, particularly in the high-end segment where consumers prioritize picture quality over price considerations.

MicroLED technology, though still in earlier commercialization stages, is generating substantial market interest due to its potential advantages in brightness, longevity, and energy efficiency. Market forecasts suggest that MicroLED displays could capture up to 15% of the premium display market within five years, with initial adoption focused on ultra-high-end televisions, commercial signage, and specialized applications requiring exceptional brightness and durability.

Regional analysis reveals varying adoption patterns, with East Asian markets showing stronger preference for cutting-edge display technologies in mobile devices, while North American and European consumers demonstrate greater willingness to invest in premium television display technologies. The commercial display sector, including digital signage and professional monitors, represents another significant growth area for advanced display technologies.

Supply chain considerations are increasingly influencing market dynamics, with manufacturers seeking to secure reliable access to rare earth materials and specialized manufacturing equipment. This has accelerated vertical integration strategies among major display producers and device manufacturers, particularly as MicroLED production requires substantial new manufacturing infrastructure investments.

Consumer willingness to pay premium prices for advanced display technologies varies significantly by device category and region. Survey data indicates that smartphone users typically accept a 15-25% price premium for devices featuring superior display technology, while television purchasers demonstrate even greater price elasticity for perceived visual quality improvements.

Consumer preferences are shifting decisively toward thinner, lighter, and more energy-efficient displays with enhanced color accuracy, contrast ratios, and brightness levels. This trend is especially pronounced in the high-end smartphone market, where manufacturers compete intensely on display quality as a key differentiating factor. The automotive industry represents another rapidly growing market segment, with advanced displays becoming central to modern vehicle interfaces and entertainment systems.

OLED technology currently dominates the premium display market due to its superior contrast ratios, color reproduction, and form factor flexibility. Market research indicates that OLED displays command approximately 70% of the premium smartphone display market, with Samsung Display and LG Display as the primary manufacturers. The television sector has also seen significant OLED adoption, particularly in the high-end segment where consumers prioritize picture quality over price considerations.

MicroLED technology, though still in earlier commercialization stages, is generating substantial market interest due to its potential advantages in brightness, longevity, and energy efficiency. Market forecasts suggest that MicroLED displays could capture up to 15% of the premium display market within five years, with initial adoption focused on ultra-high-end televisions, commercial signage, and specialized applications requiring exceptional brightness and durability.

Regional analysis reveals varying adoption patterns, with East Asian markets showing stronger preference for cutting-edge display technologies in mobile devices, while North American and European consumers demonstrate greater willingness to invest in premium television display technologies. The commercial display sector, including digital signage and professional monitors, represents another significant growth area for advanced display technologies.

Supply chain considerations are increasingly influencing market dynamics, with manufacturers seeking to secure reliable access to rare earth materials and specialized manufacturing equipment. This has accelerated vertical integration strategies among major display producers and device manufacturers, particularly as MicroLED production requires substantial new manufacturing infrastructure investments.

Consumer willingness to pay premium prices for advanced display technologies varies significantly by device category and region. Survey data indicates that smartphone users typically accept a 15-25% price premium for devices featuring superior display technology, while television purchasers demonstrate even greater price elasticity for perceived visual quality improvements.

OLED vs MicroLED: Current Status and Technical Challenges

OLED technology currently dominates the high-end display market with mature manufacturing processes and widespread adoption across smartphones, TVs, and wearables. Samsung and LG Display lead OLED production, with Chinese manufacturers rapidly expanding capacity. OLED displays offer excellent color reproduction, perfect blacks, flexibility, and energy efficiency for dark content. However, they face persistent challenges including limited brightness (typically 500-1000 nits), blue pixel degradation leading to burn-in issues, and relatively high production costs despite recent improvements.

MicroLED represents the emerging challenger technology, currently in early commercialization phases. Samsung, Sony, and Apple have demonstrated MicroLED prototypes, with Samsung's The Wall being among the first commercial products. MicroLED offers superior brightness (potentially exceeding 5000 nits), theoretically unlimited lifespan, better energy efficiency, and perfect blacks comparable to OLED. The technology uses inorganic gallium nitride (GaN) LEDs at microscopic scale (under 100 micrometers), enabling self-emissive pixels without organic materials' degradation issues.

The primary technical challenges for MicroLED adoption center around manufacturing complexity. Mass transfer of millions of tiny LED chips with near-perfect yield remains problematic, with current defect rates significantly higher than established display technologies. The industry is exploring various approaches including pick-and-place methods, laser transfer, and fluid assembly techniques, but none has achieved the necessary combination of speed, accuracy, and cost-effectiveness for mass production.

Color uniformity presents another significant hurdle for MicroLED. Variations in LED performance across red, green, and blue subpixels require sophisticated compensation algorithms and binning processes. Additionally, the miniaturization of LED chips introduces quantum efficiency challenges, particularly for red LEDs, which experience efficiency droop at smaller dimensions.

Cost remains prohibitive for mainstream MicroLED adoption, with current prices approximately 10-20 times higher than premium OLED displays. The complex manufacturing process, low yields, and expensive materials contribute to this cost barrier. Industry analysts project that MicroLED may require 3-5 more years of development before reaching price points suitable for consumer electronics beyond ultra-premium segments.

Geographically, South Korea leads in OLED technology, while MicroLED development is more distributed across Taiwan, the United States, and South Korea. China is rapidly investing in both technologies to reduce dependence on foreign display suppliers, with significant government backing for domestic innovation in next-generation display technologies.

MicroLED represents the emerging challenger technology, currently in early commercialization phases. Samsung, Sony, and Apple have demonstrated MicroLED prototypes, with Samsung's The Wall being among the first commercial products. MicroLED offers superior brightness (potentially exceeding 5000 nits), theoretically unlimited lifespan, better energy efficiency, and perfect blacks comparable to OLED. The technology uses inorganic gallium nitride (GaN) LEDs at microscopic scale (under 100 micrometers), enabling self-emissive pixels without organic materials' degradation issues.

The primary technical challenges for MicroLED adoption center around manufacturing complexity. Mass transfer of millions of tiny LED chips with near-perfect yield remains problematic, with current defect rates significantly higher than established display technologies. The industry is exploring various approaches including pick-and-place methods, laser transfer, and fluid assembly techniques, but none has achieved the necessary combination of speed, accuracy, and cost-effectiveness for mass production.

Color uniformity presents another significant hurdle for MicroLED. Variations in LED performance across red, green, and blue subpixels require sophisticated compensation algorithms and binning processes. Additionally, the miniaturization of LED chips introduces quantum efficiency challenges, particularly for red LEDs, which experience efficiency droop at smaller dimensions.

Cost remains prohibitive for mainstream MicroLED adoption, with current prices approximately 10-20 times higher than premium OLED displays. The complex manufacturing process, low yields, and expensive materials contribute to this cost barrier. Industry analysts project that MicroLED may require 3-5 more years of development before reaching price points suitable for consumer electronics beyond ultra-premium segments.

Geographically, South Korea leads in OLED technology, while MicroLED development is more distributed across Taiwan, the United States, and South Korea. China is rapidly investing in both technologies to reduce dependence on foreign display suppliers, with significant government backing for domestic innovation in next-generation display technologies.

Technical Comparison of OLED and MicroLED Solutions

01 OLED display technology advancements

Organic Light Emitting Diode (OLED) technology has evolved significantly with improvements in efficiency, brightness, and lifespan. These displays offer advantages such as self-emission, flexibility, and superior contrast ratios. Recent advancements include the development of transparent OLEDs, foldable displays, and integration with touch functionality. The technology enables thinner form factors and reduced power consumption compared to traditional LCD displays.- OLED display technology advancements: Organic Light Emitting Diode (OLED) technology has evolved significantly with improvements in efficiency, brightness, and lifespan. These displays offer advantages such as self-illumination, flexibility, and superior contrast ratios. Recent advancements include the development of transparent OLEDs, foldable displays, and integration with touch functionality. The technology enables thinner form factors and reduced power consumption compared to traditional LCD displays.

- MicroLED display innovations: MicroLED technology represents the next generation of display technology, offering superior brightness, energy efficiency, and color accuracy. These displays utilize microscopic LED arrays that are self-emissive, providing better contrast and response times than traditional displays. Recent innovations include improved manufacturing processes to reduce production costs, enhanced pixel density, and solutions for mass transfer of tiny LED chips to display substrates.

- Transition from OLED to MicroLED technologies: The industry is witnessing a gradual transition from OLED to MicroLED display technologies. This transformation is driven by MicroLED's advantages in brightness, power efficiency, and longevity. The transition involves overcoming technical challenges such as mass production difficulties, yield rates, and cost barriers. Hybrid approaches combining elements of both technologies are being developed as intermediate solutions during this technological evolution.

- Manufacturing and production innovations: Significant innovations in manufacturing processes are enabling the commercialization of advanced display technologies. These include new deposition methods for OLED materials, improved transfer techniques for MicroLED chips, and enhanced quality control systems. Automation and precision robotics play crucial roles in achieving the necessary accuracy for these microscopic components. Novel approaches to increase yield rates and reduce production costs are being developed to make these technologies more accessible to the mass market.

- Integration with smart devices and IoT systems: Advanced display technologies are being integrated with smart devices and Internet of Things (IoT) systems, creating new use cases and applications. This integration enables enhanced user interfaces, augmented reality experiences, and context-aware displays. The displays are being designed to work seamlessly with various sensors, wireless connectivity options, and power management systems. These integrated solutions are transforming industries including consumer electronics, automotive, healthcare, and retail.

02 MicroLED display innovations

MicroLED technology represents the next generation of display technology, offering superior brightness, energy efficiency, and color accuracy. These displays utilize microscopic LED arrays that are self-emissive and provide higher pixel density. MicroLED displays feature improved durability, longer lifespan, and faster response times compared to OLED. Recent innovations focus on manufacturing processes to reduce production costs and enable mass production of these high-performance displays.Expand Specific Solutions03 Transition from OLED to MicroLED technologies

The transition from OLED to MicroLED display technologies involves significant manufacturing and design challenges. This transformation requires new production methods, materials, and equipment. Companies are developing hybrid approaches that leverage the strengths of both technologies during the transition period. The shift is driven by demands for higher brightness, better energy efficiency, and improved durability in next-generation displays for various applications including smartphones, televisions, and wearable devices.Expand Specific Solutions04 Display integration with smart devices

The integration of advanced display technologies with smart devices is transforming user interaction experiences. Both OLED and MicroLED displays are being incorporated into various smart devices including smartphones, wearables, automotive displays, and smart home systems. These integrations enable new functionalities such as under-display cameras, edge-to-edge screens, and curved or foldable interfaces. The displays are also being optimized for specific applications like augmented reality and virtual reality systems.Expand Specific Solutions05 Manufacturing and production innovations

Manufacturing innovations are critical for the mass production and cost reduction of advanced display technologies. New production techniques include improved deposition methods, transfer processes for MicroLED arrays, and automated quality control systems. Manufacturers are developing specialized equipment to handle the precise placement of microscopic components required for these displays. These innovations address challenges such as yield rates, uniformity, and scalability while reducing production costs to make advanced displays more accessible to the consumer market.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The OLED vs MicroLED display technology landscape is currently in a transitional phase, with OLED reaching maturity while MicroLED remains in early commercialization. The global market for these advanced display technologies is projected to exceed $200 billion by 2025, driven by demand for higher performance displays in consumer electronics and automotive applications. In terms of technological maturity, companies like Samsung Electronics, BOE Technology, and LG Display (via Global OLED Technology) have established strong OLED manufacturing capabilities, while MicroLED development is being pioneered by Samsung, Apple, and specialized players like Lumileds. Traditional display manufacturers including Japan Display and TCL China Star Optoelectronics are investing heavily to bridge the technology gap, while materials innovators such as Universal Display Corporation and Applied Materials provide critical components for both technologies.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed comprehensive solutions in both OLED and MicroLED technologies. Their OLED strategy includes flexible AMOLED panels utilizing LTPO (Low-Temperature Polycrystalline Oxide) backplane technology that enables variable refresh rates from 1-120Hz, reducing power consumption by up to 30%[3]. For MicroLED, BOE employs a hybrid integration approach combining traditional LED manufacturing with semiconductor processes. Their proprietary "active matrix driving architecture" allows for individual pixel control with response times under 1 microsecond. BOE has achieved MicroLED chips sized below 30 micrometers with a pitch of 0.12mm for ultra-high resolution displays. The company has invested over $7.5 billion in dedicated MicroLED production lines and has demonstrated working prototypes with brightness exceeding 3,500 nits while maintaining power efficiency comparable to OLED[4]. Their glass-based transfer technology enables placement accuracy within ±1.5 micrometers.

Strengths: Strong manufacturing infrastructure; advanced LTPO backplane technology; significant R&D investment in both technologies; government backing for technology development. Weaknesses: Less mature intellectual property portfolio in MicroLED compared to some competitors; higher defect rates in early MicroLED production compared to established OLED lines.

Universal Display Corp.

Technical Solution: Universal Display Corporation (UDC) specializes in phosphorescent OLED (PHOLED) materials and technology, which forms the foundation of most commercial OLED displays today. Their proprietary PHOLED technology achieves up to 100% internal quantum efficiency compared to 25% for conventional fluorescent OLEDs, resulting in power consumption reductions of up to 70%[5]. UDC has developed a comprehensive portfolio of emitter materials covering the entire color spectrum, with their latest blue PHOLED emitters achieving lifetimes exceeding 30,000 hours at commercial brightness levels. While primarily focused on OLED, UDC has begun exploring hybrid OLED-MicroLED technologies through their "OVJP" (Organic Vapor Jet Printing) deposition system that could potentially address manufacturing challenges in both technologies. This system enables direct, solvent-free patterning of organic materials with resolution capabilities approaching those needed for MicroLED pixel formation[6]. UDC holds over 5,000 issued and pending patents worldwide related to OLED materials and manufacturing processes.

Strengths: Industry-leading PHOLED materials with superior efficiency; extensive patent portfolio; established licensing business model with major display manufacturers; continuous innovation in emitter materials. Weaknesses: Limited direct involvement in MicroLED development; heavy dependence on OLED technology success; potential vulnerability to alternative display technologies gaining market share.

Breakthrough Patents and Research in Display Technologies

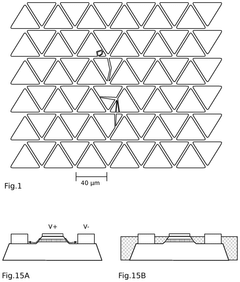

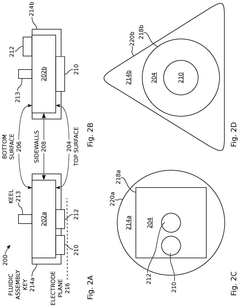

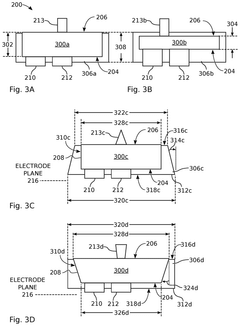

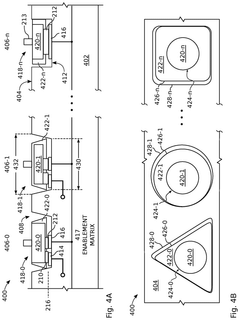

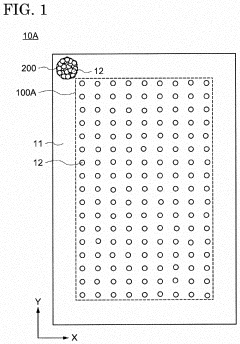

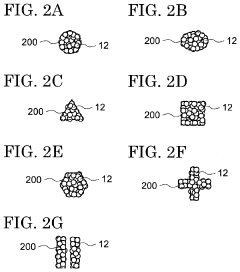

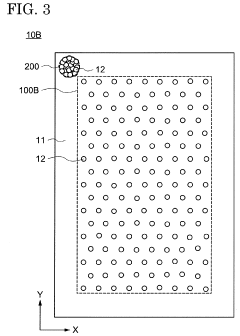

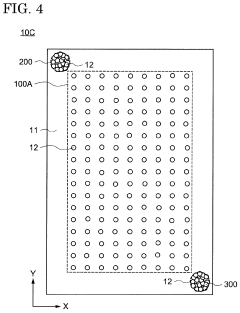

Encapsulated light emitting diodes for selective fluidic assembly

PatentActiveUS12119432B2

Innovation

- The use of partially encapsulated semiconductor-based inorganic micro-LEDs with a patternable polymer encapsulant that protects the LEDs from collisions and optimizes their shape for efficient assembly, allowing for higher speed and yield while preventing defects, and enabling precise alignment of LED colors on a display substrate.

Anisotropic conductive film and display device

PatentActiveUS20220102326A1

Innovation

- An anisotropic conductive film with a first region of discretely arranged conductive particles corresponding to electrode patterns and a second region with aggregated conductive particles acting as an alignment marker, facilitating easy alignment with the circuit substrate and reducing production costs by forming alignment markers through conductive particle dispersion.

Supply Chain Analysis and Manufacturing Considerations

The supply chain for display technologies represents a critical factor in determining market adoption and technological evolution. OLED manufacturing has matured significantly over the past decade, with established supply chains centered primarily in East Asia. South Korean companies like Samsung and LG Display dominate high-end OLED production, while Chinese manufacturers have rapidly expanded capacity for mid-range applications. This geographic concentration creates both efficiencies and vulnerabilities, particularly evident during recent global supply chain disruptions.

MicroLED supply chains, by contrast, remain nascent and fragmented. The technology requires specialized equipment and materials that differ substantially from traditional display manufacturing. Key components include micro-scale LED chips, transfer equipment, and advanced backplane technologies. Currently, no fully integrated supply chain exists for mass production, creating significant barriers to commercialization despite the technology's promise.

Manufacturing considerations reveal stark differences between these technologies. OLED production has benefited from years of process optimization, with yields for smartphone-sized panels exceeding 90% for established manufacturers. However, OLED fabrication remains complex, requiring vacuum deposition systems, precise temperature control, and sophisticated encapsulation to protect organic materials from moisture and oxygen degradation.

MicroLED manufacturing faces more fundamental challenges. The mass transfer process—moving millions of microscopic LED chips precisely onto substrates—represents the most significant hurdle. Current approaches include mechanical pick-and-place, laser transfer, and fluid-assisted methods, each with distinct trade-offs between speed, accuracy, and scalability. Defect management is particularly problematic, as a single misplaced LED can render an entire display section defective.

Cost structures differ dramatically between technologies. OLED manufacturing benefits from economies of scale but requires substantial capital investment in specialized equipment. Material costs remain significant, particularly for larger displays. MicroLED production currently involves higher material costs and substantially greater manufacturing complexity, though theoretical advantages in equipment simplicity exist once mass transfer challenges are resolved.

Environmental considerations increasingly influence supply chain decisions. OLED manufacturing involves organic solvents and rare materials with environmental implications. MicroLED production potentially offers reduced hazardous material usage but requires intensive energy consumption during manufacturing. Both technologies face scrutiny regarding end-of-life recyclability, with industry initiatives emerging to address these concerns.

MicroLED supply chains, by contrast, remain nascent and fragmented. The technology requires specialized equipment and materials that differ substantially from traditional display manufacturing. Key components include micro-scale LED chips, transfer equipment, and advanced backplane technologies. Currently, no fully integrated supply chain exists for mass production, creating significant barriers to commercialization despite the technology's promise.

Manufacturing considerations reveal stark differences between these technologies. OLED production has benefited from years of process optimization, with yields for smartphone-sized panels exceeding 90% for established manufacturers. However, OLED fabrication remains complex, requiring vacuum deposition systems, precise temperature control, and sophisticated encapsulation to protect organic materials from moisture and oxygen degradation.

MicroLED manufacturing faces more fundamental challenges. The mass transfer process—moving millions of microscopic LED chips precisely onto substrates—represents the most significant hurdle. Current approaches include mechanical pick-and-place, laser transfer, and fluid-assisted methods, each with distinct trade-offs between speed, accuracy, and scalability. Defect management is particularly problematic, as a single misplaced LED can render an entire display section defective.

Cost structures differ dramatically between technologies. OLED manufacturing benefits from economies of scale but requires substantial capital investment in specialized equipment. Material costs remain significant, particularly for larger displays. MicroLED production currently involves higher material costs and substantially greater manufacturing complexity, though theoretical advantages in equipment simplicity exist once mass transfer challenges are resolved.

Environmental considerations increasingly influence supply chain decisions. OLED manufacturing involves organic solvents and rare materials with environmental implications. MicroLED production potentially offers reduced hazardous material usage but requires intensive energy consumption during manufacturing. Both technologies face scrutiny regarding end-of-life recyclability, with industry initiatives emerging to address these concerns.

Environmental Impact and Sustainability of Display Technologies

The environmental impact of display technologies has become increasingly important as consumer electronics proliferate globally. OLED and MicroLED technologies present distinct environmental profiles throughout their lifecycles, from raw material extraction to end-of-life disposal.

OLED displays utilize organic compounds that require fewer rare earth elements compared to traditional LCD technology. However, the manufacturing process involves energy-intensive vacuum deposition techniques and potentially hazardous chemicals. The thin, lightweight nature of OLED panels contributes to reduced transportation emissions and material usage, while their lower power consumption—particularly when displaying dark content—translates to reduced carbon footprints during the usage phase.

MicroLED technology, though still emerging, demonstrates promising sustainability characteristics. The manufacturing process currently demands significant energy input but is expected to become more efficient as the technology matures. MicroLEDs offer exceptional longevity, potentially exceeding 100,000 hours of operation, which substantially reduces replacement frequency and associated electronic waste.

Both technologies face end-of-life challenges. OLED panels contain organic materials that may degrade into environmentally persistent compounds if improperly disposed of. MicroLED displays, while containing fewer toxic substances, incorporate minute LED components that present recycling complexities due to their size and integration with other materials.

Energy efficiency represents a critical sustainability factor. MicroLED displays demonstrate superior efficiency at high brightness levels, while OLEDs perform better when displaying darker content. As global energy consumption from displays continues to rise, this efficiency differential becomes increasingly significant from a sustainability perspective.

Supply chain considerations also impact environmental footprints. OLED production is currently concentrated in East Asia, necessitating global transportation networks. MicroLED manufacturing faces similar geographic concentration but may evolve toward more distributed production as the technology commercializes, potentially reducing transportation emissions.

Water usage presents another environmental concern. OLED manufacturing requires ultra-pure water for production processes, while MicroLED fabrication similarly demands significant water resources. Both industries are implementing water recycling systems, though efficiency varies considerably between manufacturing facilities.

As regulatory frameworks evolve globally, both technologies face increasing pressure to adopt circular economy principles. This includes designing for disassembly, implementing take-back programs, and developing advanced recycling techniques specific to these complex display technologies.

OLED displays utilize organic compounds that require fewer rare earth elements compared to traditional LCD technology. However, the manufacturing process involves energy-intensive vacuum deposition techniques and potentially hazardous chemicals. The thin, lightweight nature of OLED panels contributes to reduced transportation emissions and material usage, while their lower power consumption—particularly when displaying dark content—translates to reduced carbon footprints during the usage phase.

MicroLED technology, though still emerging, demonstrates promising sustainability characteristics. The manufacturing process currently demands significant energy input but is expected to become more efficient as the technology matures. MicroLEDs offer exceptional longevity, potentially exceeding 100,000 hours of operation, which substantially reduces replacement frequency and associated electronic waste.

Both technologies face end-of-life challenges. OLED panels contain organic materials that may degrade into environmentally persistent compounds if improperly disposed of. MicroLED displays, while containing fewer toxic substances, incorporate minute LED components that present recycling complexities due to their size and integration with other materials.

Energy efficiency represents a critical sustainability factor. MicroLED displays demonstrate superior efficiency at high brightness levels, while OLEDs perform better when displaying darker content. As global energy consumption from displays continues to rise, this efficiency differential becomes increasingly significant from a sustainability perspective.

Supply chain considerations also impact environmental footprints. OLED production is currently concentrated in East Asia, necessitating global transportation networks. MicroLED manufacturing faces similar geographic concentration but may evolve toward more distributed production as the technology commercializes, potentially reducing transportation emissions.

Water usage presents another environmental concern. OLED manufacturing requires ultra-pure water for production processes, while MicroLED fabrication similarly demands significant water resources. Both industries are implementing water recycling systems, though efficiency varies considerably between manufacturing facilities.

As regulatory frameworks evolve globally, both technologies face increasing pressure to adopt circular economy principles. This includes designing for disassembly, implementing take-back programs, and developing advanced recycling techniques specific to these complex display technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!