Analysis of OLED vs MicroLED Display Performance Metrics

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and MicroLED Display Evolution and Objectives

Display technology has undergone significant evolution over the past decades, transitioning from CRT to LCD, and now advancing toward OLED and MicroLED technologies. OLED (Organic Light Emitting Diode) technology emerged commercially in the early 2000s, pioneered by companies like Sony and Samsung, offering superior contrast ratios and thinner form factors compared to traditional LCD displays. The technology matured rapidly through the 2010s, becoming mainstream in smartphones, televisions, and wearable devices.

MicroLED represents the next frontier in display technology, with roots dating back to the early 2000s when researchers began exploring the potential of microscopic inorganic LED arrays. Unlike OLED, which uses organic compounds that emit light when electricity is applied, MicroLED utilizes tiny, non-organic LED lights to create pixels. This fundamental difference drives many of the performance distinctions between these technologies.

The evolution trajectory of both technologies has been shaped by increasing consumer demands for higher resolution, better color accuracy, reduced power consumption, and enhanced durability. OLED has established itself as the premium display solution in many consumer electronics, while MicroLED is positioned as its potential successor, promising to overcome some of OLED's inherent limitations such as burn-in and limited brightness.

Current technical objectives for OLED development include extending panel lifespan, improving blue pixel efficiency, reducing manufacturing costs, and enhancing brightness capabilities. For MicroLED, the primary objectives revolve around overcoming mass production challenges, reducing pixel pitch to enable higher resolution displays, improving transfer yield rates, and achieving cost parity with existing technologies.

Industry roadmaps suggest OLED will continue dominating the premium display market for the next 3-5 years, with incremental improvements in efficiency and durability. Meanwhile, MicroLED is expected to gradually penetrate high-end markets before potentially achieving mainstream adoption in the latter half of this decade, contingent upon manufacturing breakthroughs.

Both technologies are evolving toward greater energy efficiency, with research focused on reducing power consumption while maintaining or improving visual performance. Additionally, form factor innovation remains a key objective, with flexible, foldable, and even rollable displays representing significant development targets for both OLED and emerging MicroLED implementations.

The convergence of these display technologies with other emerging technologies such as augmented reality and virtual reality further shapes their evolution path, driving requirements for higher pixel densities, faster refresh rates, and reduced latency to enable immersive visual experiences across various application domains.

MicroLED represents the next frontier in display technology, with roots dating back to the early 2000s when researchers began exploring the potential of microscopic inorganic LED arrays. Unlike OLED, which uses organic compounds that emit light when electricity is applied, MicroLED utilizes tiny, non-organic LED lights to create pixels. This fundamental difference drives many of the performance distinctions between these technologies.

The evolution trajectory of both technologies has been shaped by increasing consumer demands for higher resolution, better color accuracy, reduced power consumption, and enhanced durability. OLED has established itself as the premium display solution in many consumer electronics, while MicroLED is positioned as its potential successor, promising to overcome some of OLED's inherent limitations such as burn-in and limited brightness.

Current technical objectives for OLED development include extending panel lifespan, improving blue pixel efficiency, reducing manufacturing costs, and enhancing brightness capabilities. For MicroLED, the primary objectives revolve around overcoming mass production challenges, reducing pixel pitch to enable higher resolution displays, improving transfer yield rates, and achieving cost parity with existing technologies.

Industry roadmaps suggest OLED will continue dominating the premium display market for the next 3-5 years, with incremental improvements in efficiency and durability. Meanwhile, MicroLED is expected to gradually penetrate high-end markets before potentially achieving mainstream adoption in the latter half of this decade, contingent upon manufacturing breakthroughs.

Both technologies are evolving toward greater energy efficiency, with research focused on reducing power consumption while maintaining or improving visual performance. Additionally, form factor innovation remains a key objective, with flexible, foldable, and even rollable displays representing significant development targets for both OLED and emerging MicroLED implementations.

The convergence of these display technologies with other emerging technologies such as augmented reality and virtual reality further shapes their evolution path, driving requirements for higher pixel densities, faster refresh rates, and reduced latency to enable immersive visual experiences across various application domains.

Market Demand Analysis for Advanced Display Technologies

The global display technology market is witnessing a significant shift towards advanced solutions, with OLED and MicroLED emerging as frontrunners in premium display segments. Market research indicates that the advanced display market is projected to reach $167 billion by 2025, growing at a CAGR of 8.4% from 2020. This growth is primarily driven by increasing consumer demand for superior visual experiences across multiple device categories.

Consumer electronics remains the dominant application sector, with smartphones accounting for approximately 40% of advanced display implementations. The demand for OLED displays in smartphones has seen remarkable growth, with penetration rates increasing from 31% in 2019 to 45% in 2022, as manufacturers prioritize thinner form factors and enhanced visual quality.

Television represents another crucial market segment, where premium display technologies are gaining traction. The high-end TV market (units priced above $1,500) has grown by 24% annually since 2018, with OLED TVs capturing 20% of this premium segment. MicroLED is positioned to disrupt this space, though currently limited to ultra-premium price points above $80,000 for large-format displays.

Commercial applications present substantial growth opportunities, with digital signage, automotive displays, and AR/VR devices driving demand for advanced display technologies. The automotive display market alone is expected to grow at 11.3% CAGR through 2026, as vehicle manufacturers integrate larger, more sophisticated display systems into their designs.

Regional analysis reveals Asia-Pacific as the manufacturing powerhouse, while North America and Europe lead in technology adoption for premium applications. China has emerged as both a major producer and consumer, with domestic display manufacturers rapidly closing the technology gap with Korean and Japanese incumbents.

Consumer preference surveys indicate five key demand drivers for next-generation displays: visual quality (color accuracy, contrast ratio), energy efficiency, durability, form factor flexibility, and price accessibility. OLED currently leads in the first four categories for most applications, while MicroLED promises superior performance in brightness, longevity, and efficiency at scale.

Industry forecasts suggest that while OLED will maintain market dominance through 2025, MicroLED is expected to capture 15% of the premium display market by 2028 as manufacturing costs decrease. This transition will likely begin in large-format applications before gradually expanding to smaller devices as production yields improve and costs decline.

Consumer electronics remains the dominant application sector, with smartphones accounting for approximately 40% of advanced display implementations. The demand for OLED displays in smartphones has seen remarkable growth, with penetration rates increasing from 31% in 2019 to 45% in 2022, as manufacturers prioritize thinner form factors and enhanced visual quality.

Television represents another crucial market segment, where premium display technologies are gaining traction. The high-end TV market (units priced above $1,500) has grown by 24% annually since 2018, with OLED TVs capturing 20% of this premium segment. MicroLED is positioned to disrupt this space, though currently limited to ultra-premium price points above $80,000 for large-format displays.

Commercial applications present substantial growth opportunities, with digital signage, automotive displays, and AR/VR devices driving demand for advanced display technologies. The automotive display market alone is expected to grow at 11.3% CAGR through 2026, as vehicle manufacturers integrate larger, more sophisticated display systems into their designs.

Regional analysis reveals Asia-Pacific as the manufacturing powerhouse, while North America and Europe lead in technology adoption for premium applications. China has emerged as both a major producer and consumer, with domestic display manufacturers rapidly closing the technology gap with Korean and Japanese incumbents.

Consumer preference surveys indicate five key demand drivers for next-generation displays: visual quality (color accuracy, contrast ratio), energy efficiency, durability, form factor flexibility, and price accessibility. OLED currently leads in the first four categories for most applications, while MicroLED promises superior performance in brightness, longevity, and efficiency at scale.

Industry forecasts suggest that while OLED will maintain market dominance through 2025, MicroLED is expected to capture 15% of the premium display market by 2028 as manufacturing costs decrease. This transition will likely begin in large-format applications before gradually expanding to smaller devices as production yields improve and costs decline.

Current Technical Limitations and Challenges in Display Technologies

Despite significant advancements in display technologies, both OLED and MicroLED face substantial technical limitations that impede their widespread adoption and optimal performance. OLED displays continue to struggle with limited lifespan, particularly for blue OLED materials which degrade faster than red and green counterparts, leading to color shift over time. This differential aging creates noticeable display inconsistencies, especially in applications requiring sustained high brightness.

Burn-in remains a persistent challenge for OLED technology, where static images can cause permanent ghost impressions on the screen. While manufacturers have implemented various compensation algorithms, these solutions only mitigate rather than eliminate the fundamental material degradation issue. Additionally, OLED displays exhibit reduced efficiency at high brightness levels, resulting in increased power consumption and heat generation when operating at peak luminance.

MicroLED technology, while promising, faces its own set of formidable challenges. Mass transfer yield during manufacturing represents perhaps the most significant barrier to commercialization. The process of precisely placing millions of microscopic LED chips onto a substrate with near-perfect accuracy presents unprecedented manufacturing complexity. Current defect rates in this process significantly impact production costs and scalability.

Miniaturization of LED chips to sub-10 micron sizes introduces quantum efficiency droop and electrical performance degradation. As LED size decreases, the ratio of edge defects to active area increases substantially, reducing overall efficiency. Color consistency across millions of individual emitters also presents a major challenge, requiring sophisticated compensation techniques and driving complexity.

Heat management in high-density MicroLED displays remains problematic, particularly for high-brightness applications. Unlike OLED where each pixel dissipates heat individually, MicroLED displays can create concentrated heat zones that affect performance and longevity. The thermal management solutions required add complexity to the already challenging form factor constraints.

Both technologies face significant challenges in flexible display applications. OLED encapsulation layers must simultaneously protect sensitive organic materials while maintaining flexibility, creating inherent durability concerns. MicroLED implementations on flexible substrates face even greater hurdles due to the rigid nature of inorganic LED materials and the risk of connection failures during repeated flexing.

Cost remains perhaps the most significant barrier for both technologies. OLED manufacturing has achieved economies of scale for smaller displays but continues to face yield challenges for larger panels. MicroLED production costs remain prohibitively high due to complex manufacturing processes, specialized equipment requirements, and currently low yields, limiting its market penetration to premium segments.

Burn-in remains a persistent challenge for OLED technology, where static images can cause permanent ghost impressions on the screen. While manufacturers have implemented various compensation algorithms, these solutions only mitigate rather than eliminate the fundamental material degradation issue. Additionally, OLED displays exhibit reduced efficiency at high brightness levels, resulting in increased power consumption and heat generation when operating at peak luminance.

MicroLED technology, while promising, faces its own set of formidable challenges. Mass transfer yield during manufacturing represents perhaps the most significant barrier to commercialization. The process of precisely placing millions of microscopic LED chips onto a substrate with near-perfect accuracy presents unprecedented manufacturing complexity. Current defect rates in this process significantly impact production costs and scalability.

Miniaturization of LED chips to sub-10 micron sizes introduces quantum efficiency droop and electrical performance degradation. As LED size decreases, the ratio of edge defects to active area increases substantially, reducing overall efficiency. Color consistency across millions of individual emitters also presents a major challenge, requiring sophisticated compensation techniques and driving complexity.

Heat management in high-density MicroLED displays remains problematic, particularly for high-brightness applications. Unlike OLED where each pixel dissipates heat individually, MicroLED displays can create concentrated heat zones that affect performance and longevity. The thermal management solutions required add complexity to the already challenging form factor constraints.

Both technologies face significant challenges in flexible display applications. OLED encapsulation layers must simultaneously protect sensitive organic materials while maintaining flexibility, creating inherent durability concerns. MicroLED implementations on flexible substrates face even greater hurdles due to the rigid nature of inorganic LED materials and the risk of connection failures during repeated flexing.

Cost remains perhaps the most significant barrier for both technologies. OLED manufacturing has achieved economies of scale for smaller displays but continues to face yield challenges for larger panels. MicroLED production costs remain prohibitively high due to complex manufacturing processes, specialized equipment requirements, and currently low yields, limiting its market penetration to premium segments.

Comparative Analysis of OLED vs MicroLED Solutions

01 Brightness and luminance efficiency metrics

OLED and MicroLED displays are evaluated based on their brightness capabilities and luminance efficiency. These metrics measure how efficiently the displays convert electrical power into visible light. MicroLEDs typically offer higher brightness levels suitable for outdoor viewing, while OLEDs excel in power efficiency at lower brightness levels. Advanced measurement techniques are used to quantify candela per square meter (cd/m²) output and energy consumption ratios across different operating conditions.- Brightness and luminance efficiency metrics: OLED and MicroLED displays are evaluated based on their brightness capabilities and luminance efficiency. These metrics measure how efficiently the displays convert electrical power into visible light. MicroLEDs typically offer higher brightness levels compared to OLEDs, making them suitable for high-brightness applications. The luminance efficiency is measured in candela per ampere or lumen per watt, indicating how much light is produced per unit of electrical input.

- Color gamut and color accuracy performance: Color performance is a critical metric for display technologies. Both OLED and MicroLED displays are evaluated on their color gamut coverage (the range of colors they can reproduce) and color accuracy (how precisely they can reproduce specific colors). MicroLEDs can achieve wider color gamuts due to their narrow emission spectra, while OLEDs excel in color accuracy due to their pixel-level control. These metrics are typically measured against standard color spaces such as DCI-P3, Adobe RGB, or Rec. 2020.

- Power consumption and energy efficiency: Power consumption is a crucial performance metric for display technologies, especially in portable devices. OLED displays consume power proportionally to the content displayed, with darker content requiring less power. MicroLEDs promise even greater energy efficiency due to their higher external quantum efficiency. The energy efficiency of these displays is typically measured in watts per unit area or power consumption per specific brightness level, allowing for comparison between different display technologies.

- Response time and refresh rate capabilities: Response time measures how quickly pixels can change states, affecting motion clarity and reducing blur in fast-moving content. Both OLED and MicroLED displays offer superior response times compared to LCD technology, with pixels capable of switching states in microseconds rather than milliseconds. This enables higher refresh rates, which is particularly important for gaming, VR applications, and reducing motion blur. The refresh rate capability is typically measured in Hertz (Hz) and indicates how many times per second the display can update its image.

- Lifespan and degradation characteristics: The operational lifespan of display technologies is a critical performance metric for manufacturers and consumers. OLED displays are known to suffer from differential aging, where pixels degrade at different rates depending on usage, potentially leading to burn-in. MicroLED technology promises longer lifespans with more consistent performance over time. Lifespan metrics typically measure the time until brightness decreases to a certain percentage of the original value (often 50% or 70%), and are affected by factors such as operating temperature, brightness settings, and usage patterns.

02 Color gamut and color accuracy performance

Color performance metrics for OLED and MicroLED displays include color gamut coverage (percentage of standard color spaces like DCI-P3 or Rec.2020), color accuracy (Delta E values), and color consistency across viewing angles. MicroLEDs typically offer wider color gamuts due to their narrow spectral emission, while OLEDs provide excellent color accuracy with deep blacks. Both technologies are evaluated for color shift under different viewing conditions and color volume capabilities in HDR content reproduction.Expand Specific Solutions03 Response time and refresh rate capabilities

Response time metrics measure how quickly pixels can change states, affecting motion clarity and reducing blur in fast-moving content. MicroLEDs and OLEDs both offer superior response times compared to traditional LCD technology, with sub-millisecond pixel transitions. High refresh rates (120Hz and beyond) are achievable with both technologies, though implementation methods differ. Testing protocols measure gray-to-gray transition speeds and persistence, which impact perceived motion resolution and gaming performance.Expand Specific Solutions04 Power efficiency and thermal management

Power consumption metrics evaluate display efficiency across various content types and brightness levels. OLEDs consume less power when displaying dark content due to their emissive nature, while MicroLEDs offer better efficiency at high brightness levels. Thermal management solutions are critical for both technologies to maintain consistent performance and longevity. Advanced testing methods measure power draw per unit area, heat dissipation characteristics, and efficiency degradation over time under different operating conditions.Expand Specific Solutions05 Lifespan and reliability assessment

Longevity metrics for OLED and MicroLED displays include accelerated aging tests to predict useful life, measuring brightness degradation over time (particularly blue subpixel decay in OLEDs), and burn-in resistance. MicroLEDs generally offer superior lifespan characteristics but face manufacturing yield challenges. Testing protocols simulate years of usage to evaluate how display performance metrics change over time, including color shift, brightness reduction, and uniformity degradation under various environmental conditions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The OLED vs MicroLED display technology landscape is currently in a transitional phase, with OLED being mature and widely commercialized while MicroLED remains in early commercialization stages. The global market for these advanced display technologies is projected to exceed $200 billion by 2025, driven by demand for higher performance displays in consumer electronics and automotive applications. In terms of technical maturity, established players like Samsung, LG Display, and BOE have achieved mass production capabilities in OLED, while MicroLED development is being aggressively pursued by Samsung, Apple, and specialized companies like eLux and X Display Co. Technology. Chinese manufacturers including TCL/China Star Optoelectronics and BOE are rapidly closing the technology gap with significant investments in both technologies, particularly in flexible display applications.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed comprehensive portfolios in both OLED and MicroLED technologies with distinct performance characteristics. Their OLED technology includes both rigid and flexible displays, with their latest flexible OLED panels achieving brightness levels of 600-800 nits while consuming approximately 20% less power than previous generations. BOE's OLED displays feature response times under 0.1ms and support 10-bit color depth covering over 100% of the DCI-P3 color space. For MicroLED, BOE has developed an active matrix driving technology using glass substrates with TFT backplanes, achieving pixel densities of over 100 PPI. Their MicroLED prototypes demonstrate brightness levels exceeding 1,500 nits with contrast ratios approaching OLED quality. BOE's glass-based MicroLED technology shows particular promise for medium-sized displays (10-27 inches), with power efficiency improvements of approximately 30% compared to traditional LCD displays of similar size and resolution. Their MicroLED displays maintain over 90% brightness after 50,000 hours of operation, significantly outperforming OLED longevity metrics.

Strengths: BOE has strong manufacturing infrastructure that allows vertical integration from components to finished displays. Their flexible OLED technology offers excellent form factor advantages for mobile applications. Weaknesses: BOE's MicroLED technology still faces mass transfer challenges and higher production costs compared to established display technologies, limiting immediate commercial viability for consumer products.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced OLED and MicroLED display technologies with significant performance differences. Their OLED technology features self-emitting pixels that eliminate the need for backlighting, resulting in perfect blacks and infinite contrast ratios. Samsung's latest OLED displays achieve brightness levels of 1,000-1,500 nits with power efficiency improvements of 25% compared to previous generations. For MicroLED, Samsung has pioneered modular "The Wall" technology using inorganic gallium nitride-based LEDs sized under 50 micrometers, achieving brightness levels exceeding 2,000 nits with 100% DCI-P3 color gamut coverage. Their MicroLED displays demonstrate 20% higher energy efficiency than conventional LED displays while offering a lifespan of over 100,000 hours without degradation, significantly outperforming OLED's typical 30,000-hour lifespan before brightness reduction.

Strengths: Samsung leads in both technologies with manufacturing scale advantages and proprietary pixel architectures. Their MicroLED technology offers superior brightness, longevity, and burn-in resistance compared to OLED. Weaknesses: MicroLED production costs remain prohibitively high for mainstream adoption, with manufacturing complexity around microscopic LED placement and yield challenges.

Critical Patents and Technical Innovations in Display Technology

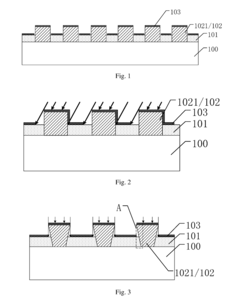

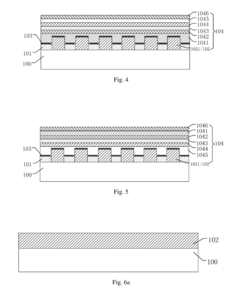

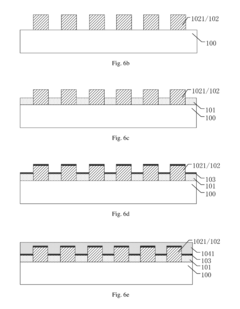

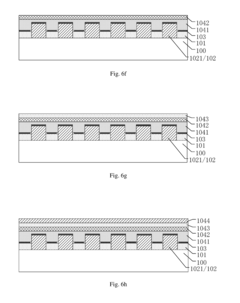

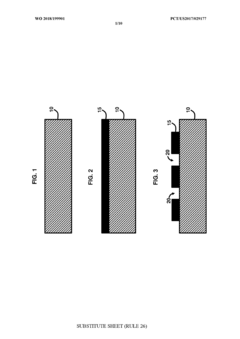

Organic light emitting diode array substrate, manufacturing method thereof and display device

PatentActiveUS20190013336A1

Innovation

- An OLED array substrate with a base substrate, a first electrode pattern, and an insulating layer, where the first electrodes protrude above the insulating layer forming a step, and an anti-oxidant conductive film is applied, disconnected at the step, preventing short-circuiting and improving charge carrier distribution.

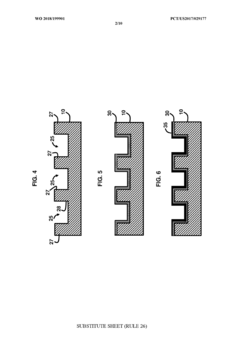

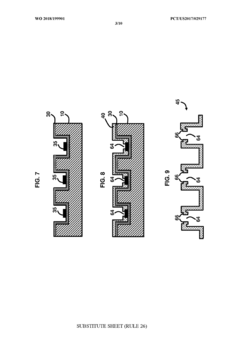

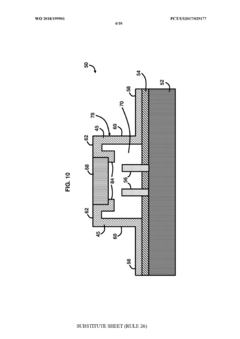

Micro light-emitting diode display with 3D orifice plating and light filtering

PatentWO2018199901A1

Innovation

- A 3D orifice plating with a metal housing and integrated RGB filters is used, where the electroplating process creates a non-transparent metal housing with specific orifices and notches for filters, allowing direct light transmission through translucent filters without refraction, enabling improved light concentration and filtering.

Power Efficiency and Environmental Impact Assessment

Power efficiency represents a critical differentiator between OLED and MicroLED display technologies, with significant implications for device design and environmental sustainability. OLED displays demonstrate variable power consumption that directly correlates with content being displayed—showing black pixels requires virtually no power as these pixels are simply turned off. This characteristic makes OLEDs particularly efficient when displaying darker content, providing substantial energy savings in applications like smartphones with dark mode interfaces.

MicroLED technology, while still evolving, promises superior power efficiency across broader use cases. Initial measurements indicate that MicroLED displays can achieve up to 30% greater energy efficiency compared to OLEDs when displaying full-brightness white content—a traditional weakness for OLED panels. This efficiency advantage stems from MicroLED's fundamentally different light emission mechanism, which doesn't suffer from the same current-driven efficiency losses as organic materials in OLEDs.

From an environmental impact perspective, the manufacturing processes for these technologies present distinct challenges. OLED production typically involves organic solvents and potentially hazardous materials that require careful handling and disposal protocols. The shorter lifespan of OLED displays (typically 14,000-30,000 hours before significant brightness degradation) also contributes to electronic waste concerns as devices require more frequent replacement.

MicroLED manufacturing currently demands extremely precise assembly processes with higher energy requirements, but the finished products offer substantially longer operational lifespans exceeding 100,000 hours. This extended durability significantly reduces the environmental footprint over the product lifecycle despite potentially higher initial production impacts.

Both technologies are advancing toward more sustainable production methods. OLED manufacturers have implemented solvent recovery systems and transitioned to less harmful materials, reducing their environmental footprint by approximately 25% over the past five years. MicroLED production is focusing on improving transfer processes and yield rates, which would substantially decrease manufacturing energy requirements.

Heat generation during operation represents another important environmental consideration. OLED displays typically generate less heat than traditional LCD technology but more than MicroLED displays under certain operating conditions. MicroLED's superior thermal performance reduces cooling requirements in applications ranging from smartphones to automotive displays, further enhancing overall system efficiency.

As these technologies continue to mature, lifecycle assessments indicate that MicroLED displays may ultimately offer the more environmentally sustainable option due to their exceptional longevity and efficiency, despite current manufacturing complexities that are expected to improve with scale and innovation.

MicroLED technology, while still evolving, promises superior power efficiency across broader use cases. Initial measurements indicate that MicroLED displays can achieve up to 30% greater energy efficiency compared to OLEDs when displaying full-brightness white content—a traditional weakness for OLED panels. This efficiency advantage stems from MicroLED's fundamentally different light emission mechanism, which doesn't suffer from the same current-driven efficiency losses as organic materials in OLEDs.

From an environmental impact perspective, the manufacturing processes for these technologies present distinct challenges. OLED production typically involves organic solvents and potentially hazardous materials that require careful handling and disposal protocols. The shorter lifespan of OLED displays (typically 14,000-30,000 hours before significant brightness degradation) also contributes to electronic waste concerns as devices require more frequent replacement.

MicroLED manufacturing currently demands extremely precise assembly processes with higher energy requirements, but the finished products offer substantially longer operational lifespans exceeding 100,000 hours. This extended durability significantly reduces the environmental footprint over the product lifecycle despite potentially higher initial production impacts.

Both technologies are advancing toward more sustainable production methods. OLED manufacturers have implemented solvent recovery systems and transitioned to less harmful materials, reducing their environmental footprint by approximately 25% over the past five years. MicroLED production is focusing on improving transfer processes and yield rates, which would substantially decrease manufacturing energy requirements.

Heat generation during operation represents another important environmental consideration. OLED displays typically generate less heat than traditional LCD technology but more than MicroLED displays under certain operating conditions. MicroLED's superior thermal performance reduces cooling requirements in applications ranging from smartphones to automotive displays, further enhancing overall system efficiency.

As these technologies continue to mature, lifecycle assessments indicate that MicroLED displays may ultimately offer the more environmentally sustainable option due to their exceptional longevity and efficiency, despite current manufacturing complexities that are expected to improve with scale and innovation.

Manufacturing Scalability and Cost Analysis

Manufacturing scalability represents a critical differentiator between OLED and MicroLED display technologies, with significant implications for market adoption and cost structures. OLED manufacturing has matured considerably over the past decade, with established mass production capabilities primarily using vacuum thermal evaporation processes. Major manufacturers like Samsung and LG Display have achieved economies of scale, driving down production costs to approximately $100-150 per square meter for mobile displays, though larger formats remain more expensive.

The yield rates for OLED production have improved substantially, reaching 80-90% for smartphone displays, but larger panels still face yield challenges that impact cost efficiency. Current OLED manufacturing relies heavily on specialized equipment from suppliers like Canon Tokki and Applied Materials, creating potential supply chain bottlenecks that affect scaling capabilities.

MicroLED manufacturing, by contrast, remains in early commercialization stages with significantly higher production costs, estimated at 5-10 times that of comparable OLED displays. The technology faces three primary manufacturing challenges: mass transfer of millions of microscopic LED chips, achieving pixel-perfect yields, and developing cost-effective inspection and repair processes.

Mass transfer techniques for MicroLED include electrostatic transfer, laser-assisted transfer, and fluid-assisted methods, each with varying degrees of throughput and precision. Current yield rates hover between 30-60%, substantially lower than OLED, necessitating complex repair mechanisms that further increase production costs.

Material costs present another significant differential, with MicroLED utilizing more expensive semiconductor materials compared to OLED's organic compounds. However, MicroLED's longer lifespan and higher energy efficiency may offset these higher initial production costs over the product lifecycle.

Industry projections suggest MicroLED manufacturing costs could decrease by 60-70% over the next five years as production techniques mature and economies of scale develop. Companies like Apple, Samsung, and Sony are investing heavily in manufacturing innovations, with particular focus on improving mass transfer techniques and yield rates.

The equipment ecosystem for MicroLED remains underdeveloped compared to OLED, with fewer specialized equipment manufacturers and less standardization across production processes. This presents both a challenge for immediate scaling and an opportunity for new entrants to establish leadership in this emerging manufacturing space.

The yield rates for OLED production have improved substantially, reaching 80-90% for smartphone displays, but larger panels still face yield challenges that impact cost efficiency. Current OLED manufacturing relies heavily on specialized equipment from suppliers like Canon Tokki and Applied Materials, creating potential supply chain bottlenecks that affect scaling capabilities.

MicroLED manufacturing, by contrast, remains in early commercialization stages with significantly higher production costs, estimated at 5-10 times that of comparable OLED displays. The technology faces three primary manufacturing challenges: mass transfer of millions of microscopic LED chips, achieving pixel-perfect yields, and developing cost-effective inspection and repair processes.

Mass transfer techniques for MicroLED include electrostatic transfer, laser-assisted transfer, and fluid-assisted methods, each with varying degrees of throughput and precision. Current yield rates hover between 30-60%, substantially lower than OLED, necessitating complex repair mechanisms that further increase production costs.

Material costs present another significant differential, with MicroLED utilizing more expensive semiconductor materials compared to OLED's organic compounds. However, MicroLED's longer lifespan and higher energy efficiency may offset these higher initial production costs over the product lifecycle.

Industry projections suggest MicroLED manufacturing costs could decrease by 60-70% over the next five years as production techniques mature and economies of scale develop. Companies like Apple, Samsung, and Sony are investing heavily in manufacturing innovations, with particular focus on improving mass transfer techniques and yield rates.

The equipment ecosystem for MicroLED remains underdeveloped compared to OLED, with fewer specialized equipment manufacturers and less standardization across production processes. This presents both a challenge for immediate scaling and an opportunity for new entrants to establish leadership in this emerging manufacturing space.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!