How OLED vs MicroLED Influence Market Adoption

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and MicroLED Display Technology Evolution

The evolution of display technologies has witnessed significant milestones over the past decades, with OLED (Organic Light-Emitting Diode) and MicroLED emerging as revolutionary advancements. OLED technology, first conceptualized in the 1970s, saw commercial implementation in the early 2000s, offering superior contrast ratios, flexibility, and energy efficiency compared to traditional LCD displays. The technology matured rapidly between 2010-2020, becoming mainstream in premium smartphones, televisions, and wearable devices.

MicroLED represents the next frontier in display technology, with its development beginning in the early 2000s but gaining significant momentum only in the past decade. Unlike OLED, which uses organic compounds that emit light when electricity is applied, MicroLED utilizes microscopic inorganic LED arrays, offering potentially superior brightness, longevity, and energy efficiency. Companies like Samsung, Apple, and Sony have invested heavily in MicroLED research since 2015, recognizing its potential to overcome OLED's limitations.

The technical evolution of OLED has focused on addressing burn-in issues, improving brightness capabilities, and reducing production costs. Notable advancements include the development of WOLED (White OLED) technology by LG Display, which combines white OLED with color filters to enhance manufacturing efficiency. Samsung's implementation of RGB OLED pixels in small displays has dominated the mobile market, while innovations in materials science have extended OLED lifespans significantly.

MicroLED's technical progression has centered on overcoming manufacturing challenges, particularly in mass transfer techniques required to place millions of microscopic LEDs precisely. Recent breakthroughs include improved pick-and-place technologies, fluidic assembly methods, and laser transfer approaches that promise to make large-scale production economically viable. The pixel density and miniaturization capabilities have improved exponentially since 2018, with prototypes now demonstrating resolutions comparable to premium OLED displays.

The convergence point between these technologies is increasingly evident in hybrid approaches. Samsung's QD-OLED technology, for instance, combines quantum dots with OLED to enhance color performance while maintaining OLED's contrast advantages. Similarly, mini-LED backlighting (a precursor to true MicroLED) has emerged as an intermediate solution in premium LCD displays, offering improved local dimming capabilities that narrow the performance gap with OLED.

Looking forward, the technical roadmap suggests OLED will continue dominating flexible and foldable display applications in the near term, while MicroLED gradually overcomes production challenges to capture premium large-format display markets. The evolution trajectory indicates that by 2025-2027, MicroLED may reach price points that enable broader market adoption beyond current ultra-premium segments.

MicroLED represents the next frontier in display technology, with its development beginning in the early 2000s but gaining significant momentum only in the past decade. Unlike OLED, which uses organic compounds that emit light when electricity is applied, MicroLED utilizes microscopic inorganic LED arrays, offering potentially superior brightness, longevity, and energy efficiency. Companies like Samsung, Apple, and Sony have invested heavily in MicroLED research since 2015, recognizing its potential to overcome OLED's limitations.

The technical evolution of OLED has focused on addressing burn-in issues, improving brightness capabilities, and reducing production costs. Notable advancements include the development of WOLED (White OLED) technology by LG Display, which combines white OLED with color filters to enhance manufacturing efficiency. Samsung's implementation of RGB OLED pixels in small displays has dominated the mobile market, while innovations in materials science have extended OLED lifespans significantly.

MicroLED's technical progression has centered on overcoming manufacturing challenges, particularly in mass transfer techniques required to place millions of microscopic LEDs precisely. Recent breakthroughs include improved pick-and-place technologies, fluidic assembly methods, and laser transfer approaches that promise to make large-scale production economically viable. The pixel density and miniaturization capabilities have improved exponentially since 2018, with prototypes now demonstrating resolutions comparable to premium OLED displays.

The convergence point between these technologies is increasingly evident in hybrid approaches. Samsung's QD-OLED technology, for instance, combines quantum dots with OLED to enhance color performance while maintaining OLED's contrast advantages. Similarly, mini-LED backlighting (a precursor to true MicroLED) has emerged as an intermediate solution in premium LCD displays, offering improved local dimming capabilities that narrow the performance gap with OLED.

Looking forward, the technical roadmap suggests OLED will continue dominating flexible and foldable display applications in the near term, while MicroLED gradually overcomes production challenges to capture premium large-format display markets. The evolution trajectory indicates that by 2025-2027, MicroLED may reach price points that enable broader market adoption beyond current ultra-premium segments.

Market Demand Analysis for Advanced Display Technologies

The display technology market is witnessing a significant shift as advanced technologies like OLED and MicroLED compete for dominance. Current market analysis indicates that the global advanced display market reached approximately $148 billion in 2022, with projections suggesting growth to $206 billion by 2027, representing a compound annual growth rate of 6.8%. This growth is primarily driven by increasing consumer demand for superior visual experiences across multiple device categories.

Consumer electronics remains the largest segment for advanced display technologies, with smartphones accounting for nearly 40% of OLED panel shipments. The premium smartphone market has almost completely transitioned to OLED technology, with Apple's iPhone and Samsung's Galaxy series leading this trend. Meanwhile, MicroLED remains primarily positioned in the ultra-premium segment, with limited market penetration due to high production costs.

Television displays represent another crucial market segment, where OLED has established a strong presence in the high-end market. LG Display dominates OLED TV panel production, while Samsung has focused on developing QD-OLED hybrid technology. The MicroLED television market remains nascent but shows promise in the luxury segment, with Samsung's The Wall and Sony's Crystal LED displays commanding premium prices above $100,000 for large formats.

Automotive displays are emerging as a high-growth segment for advanced display technologies. The automotive display market is expected to grow at 12.3% CAGR through 2027, driven by increasing integration of digital cockpits and infotainment systems. OLED technology is gaining traction in premium vehicles, while MicroLED is being explored for next-generation head-up displays and instrument clusters due to its superior brightness and durability.

Wearable devices represent another significant growth area, with smartwatches and AR/VR headsets driving demand for energy-efficient, high-resolution displays. OLED currently dominates this segment due to its flexibility and power efficiency, though MicroLED is positioned as the potential successor technology once production costs decrease.

Regional analysis reveals that Asia-Pacific leads in both production and consumption of advanced display technologies, with South Korea, Japan, and China serving as manufacturing hubs. North America and Europe represent significant markets for premium display products, with higher adoption rates for cutting-edge technologies in consumer and professional applications.

Consumer preference surveys indicate that display quality ranks among the top three purchase considerations for smartphones, televisions, and computers. However, price sensitivity remains high, creating a significant barrier for widespread MicroLED adoption in the near term, while OLED continues to benefit from decreasing production costs and expanding manufacturing capacity.

Consumer electronics remains the largest segment for advanced display technologies, with smartphones accounting for nearly 40% of OLED panel shipments. The premium smartphone market has almost completely transitioned to OLED technology, with Apple's iPhone and Samsung's Galaxy series leading this trend. Meanwhile, MicroLED remains primarily positioned in the ultra-premium segment, with limited market penetration due to high production costs.

Television displays represent another crucial market segment, where OLED has established a strong presence in the high-end market. LG Display dominates OLED TV panel production, while Samsung has focused on developing QD-OLED hybrid technology. The MicroLED television market remains nascent but shows promise in the luxury segment, with Samsung's The Wall and Sony's Crystal LED displays commanding premium prices above $100,000 for large formats.

Automotive displays are emerging as a high-growth segment for advanced display technologies. The automotive display market is expected to grow at 12.3% CAGR through 2027, driven by increasing integration of digital cockpits and infotainment systems. OLED technology is gaining traction in premium vehicles, while MicroLED is being explored for next-generation head-up displays and instrument clusters due to its superior brightness and durability.

Wearable devices represent another significant growth area, with smartwatches and AR/VR headsets driving demand for energy-efficient, high-resolution displays. OLED currently dominates this segment due to its flexibility and power efficiency, though MicroLED is positioned as the potential successor technology once production costs decrease.

Regional analysis reveals that Asia-Pacific leads in both production and consumption of advanced display technologies, with South Korea, Japan, and China serving as manufacturing hubs. North America and Europe represent significant markets for premium display products, with higher adoption rates for cutting-edge technologies in consumer and professional applications.

Consumer preference surveys indicate that display quality ranks among the top three purchase considerations for smartphones, televisions, and computers. However, price sensitivity remains high, creating a significant barrier for widespread MicroLED adoption in the near term, while OLED continues to benefit from decreasing production costs and expanding manufacturing capacity.

Technical Challenges and Limitations in Display Technologies

Despite significant advancements in display technologies, both OLED and MicroLED face substantial technical challenges that impact their market adoption trajectories. OLED technology continues to struggle with limited operational lifespan, particularly for blue OLED materials which degrade faster than red and green counterparts, leading to color shifting over time. This differential aging necessitates complex compensation algorithms that increase manufacturing complexity and cost.

Water and oxygen sensitivity remains a critical vulnerability for OLED panels, requiring sophisticated encapsulation techniques to prevent pixel degradation. Even with advanced thin-film encapsulation methods, complete protection remains elusive, affecting long-term reliability in consumer products.

Power efficiency presents another significant hurdle, especially for large-format OLED displays. While OLED offers pixel-level control, high brightness scenarios can lead to substantial power consumption and heat generation, potentially accelerating material degradation and limiting application in outdoor environments where high brightness is essential.

MicroLED technology, while promising superior performance, faces even more formidable manufacturing challenges. The mass transfer process—moving millions of microscopic LED chips from growth substrates to display backplanes—remains inefficient at production scale. Current pick-and-place technologies struggle to achieve the necessary throughput while maintaining acceptable yield rates, significantly impacting production costs.

Pixel size miniaturization presents another substantial barrier. As display resolutions increase, MicroLED dimensions must decrease proportionally, complicating both manufacturing and electrical efficiency. Sub-10μm LEDs exhibit reduced quantum efficiency due to surface defects becoming proportionally more significant at smaller scales.

Color consistency across millions of individual LED elements represents a formidable quality control challenge. Unlike OLED, where materials are deposited uniformly, each MicroLED must be individually tested and binned for color and brightness, requiring sophisticated inspection and correction systems that further increase production complexity.

Heat management also presents different challenges for each technology. OLED displays generate heat across their entire active area, while MicroLEDs concentrate heat at each emitter point, requiring different thermal management approaches. MicroLED's higher overall efficiency partially mitigates this issue, but localized heating can still affect performance in high-brightness applications.

These technical limitations directly influence manufacturing yields, production costs, and ultimately market adoption rates. OLED's mature but still-evolving manufacturing processes offer better immediate economic viability despite longevity concerns, while MicroLED's superior performance characteristics remain constrained by production challenges that currently limit its market penetration primarily to premium segments where cost sensitivity is lower.

Water and oxygen sensitivity remains a critical vulnerability for OLED panels, requiring sophisticated encapsulation techniques to prevent pixel degradation. Even with advanced thin-film encapsulation methods, complete protection remains elusive, affecting long-term reliability in consumer products.

Power efficiency presents another significant hurdle, especially for large-format OLED displays. While OLED offers pixel-level control, high brightness scenarios can lead to substantial power consumption and heat generation, potentially accelerating material degradation and limiting application in outdoor environments where high brightness is essential.

MicroLED technology, while promising superior performance, faces even more formidable manufacturing challenges. The mass transfer process—moving millions of microscopic LED chips from growth substrates to display backplanes—remains inefficient at production scale. Current pick-and-place technologies struggle to achieve the necessary throughput while maintaining acceptable yield rates, significantly impacting production costs.

Pixel size miniaturization presents another substantial barrier. As display resolutions increase, MicroLED dimensions must decrease proportionally, complicating both manufacturing and electrical efficiency. Sub-10μm LEDs exhibit reduced quantum efficiency due to surface defects becoming proportionally more significant at smaller scales.

Color consistency across millions of individual LED elements represents a formidable quality control challenge. Unlike OLED, where materials are deposited uniformly, each MicroLED must be individually tested and binned for color and brightness, requiring sophisticated inspection and correction systems that further increase production complexity.

Heat management also presents different challenges for each technology. OLED displays generate heat across their entire active area, while MicroLEDs concentrate heat at each emitter point, requiring different thermal management approaches. MicroLED's higher overall efficiency partially mitigates this issue, but localized heating can still affect performance in high-brightness applications.

These technical limitations directly influence manufacturing yields, production costs, and ultimately market adoption rates. OLED's mature but still-evolving manufacturing processes offer better immediate economic viability despite longevity concerns, while MicroLED's superior performance characteristics remain constrained by production challenges that currently limit its market penetration primarily to premium segments where cost sensitivity is lower.

Current Implementation Solutions for OLED and MicroLED

01 OLED technology advancements and applications

OLED (Organic Light Emitting Diode) technology has seen significant advancements in recent years, particularly in display applications. These displays offer advantages such as high contrast ratios, wide viewing angles, and flexibility. The technology has been widely adopted in smartphones, televisions, and wearable devices due to its thin form factor and energy efficiency. Recent innovations focus on improving OLED lifespan, brightness, and manufacturing processes to enhance market adoption.- OLED display technology advancements: OLED (Organic Light Emitting Diode) technology has seen significant advancements in recent years, driving market adoption. These improvements include enhanced efficiency, longer lifespan, and better color reproduction. OLED displays offer advantages such as flexibility, thinness, and self-emissive pixels that eliminate the need for backlighting, resulting in deeper blacks and higher contrast ratios. These features have contributed to OLED's growing market share in premium smartphones, televisions, and other consumer electronics.

- MicroLED display technology innovations: MicroLED displays utilize microscopic LED arrays to create self-emissive pixels, offering advantages such as higher brightness, better energy efficiency, and longer lifespan compared to other display technologies. Recent innovations have focused on overcoming manufacturing challenges, particularly in mass transfer processes for placing millions of tiny LEDs precisely. These advancements are enabling MicroLED to enter various market segments, from smartwatches and AR/VR headsets to large-format displays and automotive applications.

- Market adoption trends and consumer applications: The adoption of OLED and MicroLED technologies is expanding across various consumer applications. OLED has achieved significant market penetration in smartphones, wearables, and premium televisions, while MicroLED is emerging in high-end displays and specialized applications. Consumer preferences for thinner devices, better visual quality, and energy efficiency are driving this adoption. Market analysis indicates growing consumer awareness and willingness to pay premium prices for these advanced display technologies, particularly in flagship products and luxury segments.

- Manufacturing processes and cost reduction strategies: Innovations in manufacturing processes are critical for wider market adoption of OLED and MicroLED technologies. These include improved deposition methods for OLED materials, more efficient mass transfer techniques for MicroLED, and novel approaches to quality control. Cost reduction strategies focus on increasing yield rates, developing more efficient production equipment, and scaling up manufacturing capacity. These advancements are gradually reducing the price premium associated with these technologies, making them accessible to broader market segments.

- Integration with emerging technologies and future applications: OLED and MicroLED displays are increasingly being integrated with other emerging technologies, creating new market opportunities. These include flexible and foldable displays, transparent displays for augmented reality applications, and integration with advanced touch and sensing capabilities. The combination with AI-driven content optimization, energy management systems, and Internet of Things connectivity is expanding the potential applications. Future growth areas include automotive displays, medical imaging, smart home interfaces, and advanced wearable devices.

02 MicroLED display technology development

MicroLED displays represent the next generation of display technology, offering superior brightness, energy efficiency, and longevity compared to traditional display technologies. These displays utilize microscopic LED arrays that self-illuminate, eliminating the need for backlighting. The technology enables higher pixel density, improved color accuracy, and faster response times. Development efforts are focused on overcoming manufacturing challenges and reducing production costs to accelerate market adoption.Expand Specific Solutions03 Market adoption trends and consumer applications

The market adoption of OLED and MicroLED technologies is driven by consumer demand for improved display quality in various applications. These technologies are increasingly being incorporated into smartphones, smartwatches, televisions, automotive displays, and virtual/augmented reality devices. Consumer preferences for thinner devices, better visual experiences, and energy efficiency are accelerating adoption. Market analysis indicates growing consumer acceptance despite premium pricing, with adoption rates increasing as manufacturing costs decrease.Expand Specific Solutions04 Manufacturing innovations and cost reduction strategies

Innovations in manufacturing processes are critical for wider market adoption of OLED and MicroLED technologies. These include advancements in mass transfer techniques, substrate technologies, and automated production methods. Manufacturers are developing new approaches to reduce production costs while maintaining quality, including improved yield rates and simplified manufacturing steps. These innovations are essential for bringing these advanced display technologies to mainstream price points and expanding market adoption beyond premium products.Expand Specific Solutions05 Integration with emerging technologies and future applications

OLED and MicroLED displays are increasingly being integrated with other emerging technologies to create new applications and market opportunities. These include flexible and foldable displays, transparent displays, and integration with touch and sensing technologies. Future applications extend to smart homes, healthcare monitoring devices, and advanced automotive interfaces. The convergence of these display technologies with artificial intelligence, Internet of Things, and 5G connectivity is opening new market segments and driving adoption in previously untapped areas.Expand Specific Solutions

Key Industry Players in OLED and MicroLED Development

The OLED vs MicroLED market is currently in a transitional phase, with OLED technology reaching maturity while MicroLED remains in early commercialization stages. The global display market is projected to exceed $150 billion by 2025, with OLED holding significant market share led by Samsung Electronics and BOE Technology Group. MicroLED technology, though promising superior brightness, efficiency, and longevity, faces manufacturing challenges and higher costs. Companies like X Display Co., TCL China Star Optoelectronics, and Apple are investing heavily in MicroLED development. The competitive landscape shows established OLED manufacturers (Universal Display Corp., Japan Display) expanding their portfolios while newcomers (Lumileds, Chengdu Vistar) focus on MicroLED innovations to capture future market segments in premium displays for automotive, AR/VR, and high-end consumer electronics.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has established itself as China's largest display manufacturer with significant investments in both OLED and MicroLED technologies. For OLED, BOE operates multiple production lines with a combined capacity exceeding 100,000 substrates per month, focusing on flexible OLED panels for smartphones and larger OLED panels for TVs[1]. Their OLED technology features oxide backplanes for improved electron mobility and power efficiency. In the MicroLED space, BOE has developed active-matrix MicroLED displays with pixel pitches below 0.9mm and has demonstrated prototype smartwatches with MicroLED displays achieving brightness levels over 3,000 nits[2]. BOE's approach to MicroLED involves a proprietary mass transfer process that can handle thousands of MicroLED chips simultaneously, potentially reducing manufacturing costs by up to 40% compared to traditional pick-and-place methods[3]. The company has invested approximately $7.5 billion in advanced display technologies since 2020, with particular emphasis on scaling MicroLED production capabilities while maintaining their strong position in OLED manufacturing.

Strengths: Massive production capacity; strong government backing; vertical integration from materials to finished displays; competitive pricing. Weaknesses: Still catching up to Korean manufacturers in high-end OLED quality; MicroLED mass production capabilities remain limited; intellectual property position not as strong as some competitors.

Japan Display, Inc.

Technical Solution: Japan Display Inc. (JDI) has developed a hybrid approach to next-generation display technologies. For OLED, JDI has created eLEAP (enhanced Light Emitting Active-matrix Pressed) technology, which uses a printing method rather than traditional evaporation to deposit OLED materials, reducing manufacturing costs by approximately 30%[1]. Their OLED displays feature LTPS (Low-Temperature Polysilicon) backplanes for higher pixel density and lower power consumption. In the MicroLED space, JDI has focused on small-sized displays for wearables and AR/VR applications, developing MicroLED panels with pixel densities exceeding 1,500 PPI (pixels per inch)[2]. JDI's proprietary "FULL ACTIVE" technology maximizes the display area by minimizing bezels to less than 0.5mm, applicable to both OLED and MicroLED implementations. The company has also pioneered reflective MicroLED displays that consume up to 80% less power than emissive displays while maintaining visibility in bright sunlight, targeting applications in wearables and IoT devices[3]. JDI has invested significantly in developing transparent MicroLED displays with over 80% transparency for automotive HUDs and AR applications.

Strengths: Advanced manufacturing techniques for both technologies; strong position in small to medium displays; innovative approaches to power efficiency. Weaknesses: Financial challenges limiting R&D investment; smaller scale compared to Korean and Chinese competitors; slower transition to mass production of new technologies.

Core Patents and Innovations in Display Technologies

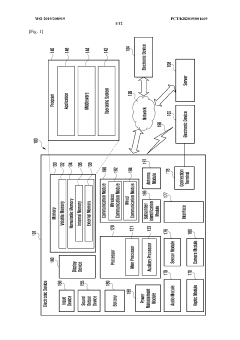

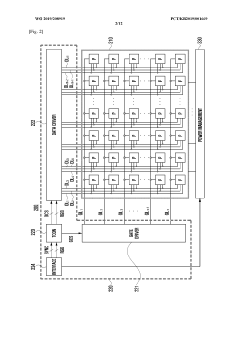

Transfer substrate

PatentInactiveUS20220130707A1

Innovation

- A transfer substrate design featuring a support with a groove portion and an elastic body with projection portions, allowing for the pickup and release of elements through deformation, eliminating the need for large-scale vacuum equipment by creating a closed space for pressure adjustment.

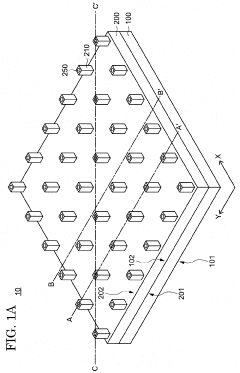

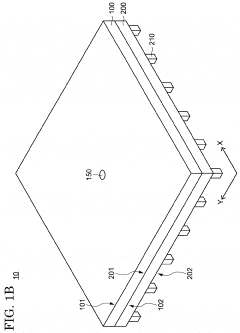

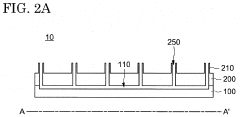

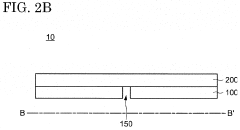

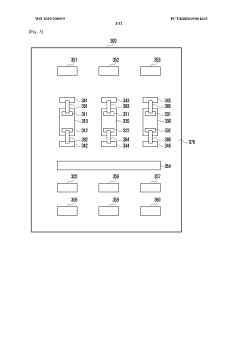

LED display and electronic device having same

PatentWO2019208919A1

Innovation

- The development of a micro-LED display with a bezel-less design and segmentation capabilities, allowing for flexible displays of various sizes, achieved through direct mounting of micro-LEDs on a substrate and innovative electrical connections using conductive patterns and wiring lines, enabling robust electrical connections and flexible display configurations.

Manufacturing Cost Analysis and Scalability Comparison

Manufacturing costs represent a critical factor in the adoption trajectory of display technologies. OLED manufacturing has matured significantly over the past decade, with established production processes that have benefited from economies of scale. The average production cost for OLED panels has decreased by approximately 35% since 2015, primarily due to improved yield rates and manufacturing efficiencies. However, OLED production still requires significant capital investment, with a typical Gen 8.5 fab costing between $2-3 billion to establish.

In contrast, MicroLED manufacturing remains in its nascent stages, with production costs estimated to be 3-5 times higher than OLED for comparable display sizes. This cost differential stems primarily from the complex transfer process required to place millions of microscopic LED chips precisely onto substrates. Current MicroLED manufacturing yields range from 60-70% compared to OLED's 85-90%, significantly impacting unit economics. The pick-and-place method currently employed for MicroLED assembly represents a substantial bottleneck, with processing times approximately 8-10 times longer than OLED panel production.

Scalability presents divergent challenges for both technologies. OLED benefits from established infrastructure and supply chains, with over 15 major production facilities globally. Production capacity has expanded at a compound annual growth rate of approximately 27% between 2017-2022. The technology has successfully scaled from small smartphone displays to large television panels, demonstrating versatility across form factors. However, OLED faces diminishing returns in cost reduction, with analysts projecting only 10-15% further cost improvements through 2025.

MicroLED scalability faces more fundamental challenges. Mass transfer techniques remain the primary bottleneck, with current equipment capable of handling only 5-10 million microLEDs per hour, whereas a 4K television requires approximately 25 million individual LEDs. Several promising approaches are emerging, including fluid assembly, laser transfer, and electrostatic assembly, potentially reducing transfer times by 60-80%. Industry forecasts suggest MicroLED manufacturing costs could decrease by 70-75% by 2027 if these technical hurdles are overcome.

The economic inflection point for MicroLED market viability appears to be 3-5 years away, contingent upon manufacturing innovations. Samsung and Apple have invested approximately $4.5 billion and $2.7 billion respectively in MicroLED manufacturing development, signaling strong corporate confidence in eventual cost parity. For market adoption to accelerate, MicroLED manufacturing costs must decrease to within 30% of OLED to justify the performance premium, according to consumer willingness-to-pay studies conducted across major markets.

In contrast, MicroLED manufacturing remains in its nascent stages, with production costs estimated to be 3-5 times higher than OLED for comparable display sizes. This cost differential stems primarily from the complex transfer process required to place millions of microscopic LED chips precisely onto substrates. Current MicroLED manufacturing yields range from 60-70% compared to OLED's 85-90%, significantly impacting unit economics. The pick-and-place method currently employed for MicroLED assembly represents a substantial bottleneck, with processing times approximately 8-10 times longer than OLED panel production.

Scalability presents divergent challenges for both technologies. OLED benefits from established infrastructure and supply chains, with over 15 major production facilities globally. Production capacity has expanded at a compound annual growth rate of approximately 27% between 2017-2022. The technology has successfully scaled from small smartphone displays to large television panels, demonstrating versatility across form factors. However, OLED faces diminishing returns in cost reduction, with analysts projecting only 10-15% further cost improvements through 2025.

MicroLED scalability faces more fundamental challenges. Mass transfer techniques remain the primary bottleneck, with current equipment capable of handling only 5-10 million microLEDs per hour, whereas a 4K television requires approximately 25 million individual LEDs. Several promising approaches are emerging, including fluid assembly, laser transfer, and electrostatic assembly, potentially reducing transfer times by 60-80%. Industry forecasts suggest MicroLED manufacturing costs could decrease by 70-75% by 2027 if these technical hurdles are overcome.

The economic inflection point for MicroLED market viability appears to be 3-5 years away, contingent upon manufacturing innovations. Samsung and Apple have invested approximately $4.5 billion and $2.7 billion respectively in MicroLED manufacturing development, signaling strong corporate confidence in eventual cost parity. For market adoption to accelerate, MicroLED manufacturing costs must decrease to within 30% of OLED to justify the performance premium, according to consumer willingness-to-pay studies conducted across major markets.

Energy Efficiency and Environmental Impact Assessment

Energy efficiency represents a critical factor in the adoption trajectory of display technologies, with OLED and MicroLED presenting distinctly different environmental profiles. OLED displays demonstrate superior energy efficiency in dark-content scenarios due to their pixel-by-pixel illumination capability, where black pixels consume virtually no power. This characteristic makes OLEDs particularly advantageous for mobile devices and applications with predominantly dark interfaces, potentially reducing energy consumption by 20-40% compared to traditional LCD displays.

MicroLED technology, while still evolving, promises even greater energy efficiency at scale. Current prototypes indicate potential energy savings of 30-50% over OLED displays when displaying mixed content. This efficiency stems from MicroLED's higher luminous efficacy, requiring less power to achieve comparable brightness levels. Additionally, MicroLED displays maintain consistent power consumption regardless of content color, unlike OLEDs which consume more power when displaying bright whites.

From a manufacturing perspective, OLED production currently involves several environmentally concerning processes, including the use of rare earth metals and organic solvents. The industry has made significant strides in reducing harmful chemicals, with major manufacturers reporting a 35% reduction in hazardous material usage since 2015. However, OLED panels remain challenging to recycle due to their complex multi-layer organic structure.

MicroLED manufacturing presents its own environmental challenges, particularly in the precise transfer process required to place millions of microscopic LEDs. This process currently generates substantial material waste, though emerging pick-and-place technologies are improving yield rates from below 70% to above 90% in laboratory settings. The simpler material composition of MicroLEDs, primarily utilizing inorganic compounds, potentially offers better end-of-life recyclability.

Lifecycle assessments indicate that the operational energy efficiency of both technologies significantly outweighs their production environmental impact over a typical 5-7 year usage period. However, as devices become increasingly energy-efficient during operation, manufacturing impacts gain proportional importance in their overall environmental footprint. Market adoption will likely be influenced by regional energy policies, with areas implementing strict energy efficiency standards potentially accelerating the transition toward MicroLED technology once production scales and costs decrease.

MicroLED technology, while still evolving, promises even greater energy efficiency at scale. Current prototypes indicate potential energy savings of 30-50% over OLED displays when displaying mixed content. This efficiency stems from MicroLED's higher luminous efficacy, requiring less power to achieve comparable brightness levels. Additionally, MicroLED displays maintain consistent power consumption regardless of content color, unlike OLEDs which consume more power when displaying bright whites.

From a manufacturing perspective, OLED production currently involves several environmentally concerning processes, including the use of rare earth metals and organic solvents. The industry has made significant strides in reducing harmful chemicals, with major manufacturers reporting a 35% reduction in hazardous material usage since 2015. However, OLED panels remain challenging to recycle due to their complex multi-layer organic structure.

MicroLED manufacturing presents its own environmental challenges, particularly in the precise transfer process required to place millions of microscopic LEDs. This process currently generates substantial material waste, though emerging pick-and-place technologies are improving yield rates from below 70% to above 90% in laboratory settings. The simpler material composition of MicroLEDs, primarily utilizing inorganic compounds, potentially offers better end-of-life recyclability.

Lifecycle assessments indicate that the operational energy efficiency of both technologies significantly outweighs their production environmental impact over a typical 5-7 year usage period. However, as devices become increasingly energy-efficient during operation, manufacturing impacts gain proportional importance in their overall environmental footprint. Market adoption will likely be influenced by regional energy policies, with areas implementing strict energy efficiency standards potentially accelerating the transition toward MicroLED technology once production scales and costs decrease.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!