What Are the Functional Benefits of OLED vs MicroLED

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and MicroLED Technology Evolution and Objectives

Display technology has undergone significant evolution over the past decades, with OLED (Organic Light-Emitting Diode) emerging in the early 1990s as a revolutionary advancement over traditional LCD displays. The technology offered self-emissive pixels, eliminating the need for backlighting and enabling thinner, more flexible displays with superior contrast ratios. OLED technology has since matured through several generations, with improvements in materials, manufacturing processes, and energy efficiency.

MicroLED represents the next frontier in display technology, first demonstrated in the early 2000s but only recently approaching commercial viability. This technology utilizes microscopic inorganic LED arrays to create self-emissive displays that promise to overcome some of OLED's limitations. The evolution of MicroLED has been characterized by progressive miniaturization of LED components and advancements in mass transfer techniques necessary for practical manufacturing.

Both technologies share the objective of delivering superior visual experiences through self-emissive pixels, but they approach this goal through fundamentally different material systems and manufacturing processes. OLED utilizes organic compounds that emit light when electricity is applied, while MicroLED employs inorganic gallium nitride-based LEDs at a microscopic scale.

The technical objectives driving OLED development have focused on addressing inherent limitations such as limited lifespan, particularly for blue OLEDs, burn-in susceptibility, and brightness constraints. Recent innovations have targeted improved quantum efficiency, reduced power consumption, and enhanced durability through advanced encapsulation techniques and material science breakthroughs.

For MicroLED, the primary technical objectives center on overcoming manufacturing challenges, particularly the mass transfer process required to place millions of microscopic LEDs precisely on a substrate. Additional goals include improving yield rates, reducing production costs, and enhancing energy efficiency to levels that surpass OLED technology.

The convergence of these technologies has created a competitive landscape where each offers distinct advantages. OLED currently dominates in flexibility, mature manufacturing, and cost-effectiveness for certain applications, while MicroLED promises superior brightness, longevity, and efficiency. The industry trajectory suggests a period of coexistence, with each technology finding optimal application in different market segments based on specific performance requirements.

Looking forward, both technologies are expected to continue evolving along parallel paths, with OLED focusing on material improvements and manufacturing efficiencies, while MicroLED development concentrates on scaling production capabilities and reducing costs to achieve broader market adoption. The ultimate objective for both technologies remains the creation of displays that deliver perfect color reproduction, infinite contrast, maximum energy efficiency, and extended operational lifespans.

MicroLED represents the next frontier in display technology, first demonstrated in the early 2000s but only recently approaching commercial viability. This technology utilizes microscopic inorganic LED arrays to create self-emissive displays that promise to overcome some of OLED's limitations. The evolution of MicroLED has been characterized by progressive miniaturization of LED components and advancements in mass transfer techniques necessary for practical manufacturing.

Both technologies share the objective of delivering superior visual experiences through self-emissive pixels, but they approach this goal through fundamentally different material systems and manufacturing processes. OLED utilizes organic compounds that emit light when electricity is applied, while MicroLED employs inorganic gallium nitride-based LEDs at a microscopic scale.

The technical objectives driving OLED development have focused on addressing inherent limitations such as limited lifespan, particularly for blue OLEDs, burn-in susceptibility, and brightness constraints. Recent innovations have targeted improved quantum efficiency, reduced power consumption, and enhanced durability through advanced encapsulation techniques and material science breakthroughs.

For MicroLED, the primary technical objectives center on overcoming manufacturing challenges, particularly the mass transfer process required to place millions of microscopic LEDs precisely on a substrate. Additional goals include improving yield rates, reducing production costs, and enhancing energy efficiency to levels that surpass OLED technology.

The convergence of these technologies has created a competitive landscape where each offers distinct advantages. OLED currently dominates in flexibility, mature manufacturing, and cost-effectiveness for certain applications, while MicroLED promises superior brightness, longevity, and efficiency. The industry trajectory suggests a period of coexistence, with each technology finding optimal application in different market segments based on specific performance requirements.

Looking forward, both technologies are expected to continue evolving along parallel paths, with OLED focusing on material improvements and manufacturing efficiencies, while MicroLED development concentrates on scaling production capabilities and reducing costs to achieve broader market adoption. The ultimate objective for both technologies remains the creation of displays that deliver perfect color reproduction, infinite contrast, maximum energy efficiency, and extended operational lifespans.

Market Demand Analysis for Advanced Display Technologies

The display technology market is witnessing a significant shift towards advanced solutions, with OLED and MicroLED emerging as frontrunners in premium display segments. Current market analysis indicates robust growth for both technologies, with the global OLED market valued at approximately 38 billion USD in 2022 and projected to reach 72 billion USD by 2027, representing a compound annual growth rate of 13.6%. Meanwhile, the nascent MicroLED market, though smaller at about 2.7 billion USD in 2022, is forecasted to grow at an accelerated rate of 78.3% annually, potentially reaching 42 billion USD by 2027.

Consumer electronics remains the primary demand driver, with smartphones accounting for over 60% of OLED panel shipments. However, automotive displays represent the fastest-growing segment, with premium vehicle manufacturers increasingly adopting these advanced technologies for their enhanced visibility and design flexibility. Market research indicates that 87% of flagship smartphones now incorporate OLED technology, while MicroLED is gaining traction in ultra-premium televisions and commercial signage applications.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with South Korea and China leading OLED production, while Taiwan and Japan are establishing strong positions in MicroLED development. North America and Europe represent the largest consumer markets for premium display products, with particularly strong demand in the luxury consumer electronics and automotive sectors.

Industry surveys indicate that consumers are increasingly prioritizing display quality when making purchasing decisions, with 73% of smartphone buyers citing display performance as "very important" or "extremely important." Key demand factors include color accuracy, brightness capabilities, power efficiency, and form factor flexibility. OLED currently dominates in applications requiring flexibility and deep blacks, while MicroLED is preferred where extreme brightness and longevity are paramount.

Enterprise adoption is also accelerating, particularly in sectors requiring high-reliability displays such as medical imaging, aerospace, and defense. These professional markets value the superior contrast ratio of OLED and the exceptional brightness and durability of MicroLED, with procurement decisions increasingly influenced by total cost of ownership rather than initial acquisition costs.

Market forecasts suggest a period of technology coexistence rather than direct replacement, with OLED maintaining dominance in mid-range to premium mobile devices and flexible applications, while MicroLED gradually captures ultra-premium fixed display segments. This bifurcation is expected to continue through at least 2028, after which manufacturing scale economies may enable broader MicroLED adoption across more price-sensitive segments.

Consumer electronics remains the primary demand driver, with smartphones accounting for over 60% of OLED panel shipments. However, automotive displays represent the fastest-growing segment, with premium vehicle manufacturers increasingly adopting these advanced technologies for their enhanced visibility and design flexibility. Market research indicates that 87% of flagship smartphones now incorporate OLED technology, while MicroLED is gaining traction in ultra-premium televisions and commercial signage applications.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub, with South Korea and China leading OLED production, while Taiwan and Japan are establishing strong positions in MicroLED development. North America and Europe represent the largest consumer markets for premium display products, with particularly strong demand in the luxury consumer electronics and automotive sectors.

Industry surveys indicate that consumers are increasingly prioritizing display quality when making purchasing decisions, with 73% of smartphone buyers citing display performance as "very important" or "extremely important." Key demand factors include color accuracy, brightness capabilities, power efficiency, and form factor flexibility. OLED currently dominates in applications requiring flexibility and deep blacks, while MicroLED is preferred where extreme brightness and longevity are paramount.

Enterprise adoption is also accelerating, particularly in sectors requiring high-reliability displays such as medical imaging, aerospace, and defense. These professional markets value the superior contrast ratio of OLED and the exceptional brightness and durability of MicroLED, with procurement decisions increasingly influenced by total cost of ownership rather than initial acquisition costs.

Market forecasts suggest a period of technology coexistence rather than direct replacement, with OLED maintaining dominance in mid-range to premium mobile devices and flexible applications, while MicroLED gradually captures ultra-premium fixed display segments. This bifurcation is expected to continue through at least 2028, after which manufacturing scale economies may enable broader MicroLED adoption across more price-sensitive segments.

Current Technical Limitations and Challenges in Display Technologies

Despite significant advancements in display technologies, both OLED and MicroLED face distinct technical limitations that impact their widespread adoption and functional performance. OLED technology continues to struggle with limited lifespan issues, particularly with blue OLED materials degrading faster than red and green counterparts, resulting in color shift over time. This differential aging necessitates complex compensation algorithms that add to processing requirements and manufacturing complexity.

Burn-in remains a persistent challenge for OLED displays, especially in static interface elements, creating permanent image retention that degrades user experience in professional and consumer applications. Additionally, OLED brightness capabilities, while improved, still fall short of LCD and MicroLED alternatives in high-ambient light environments, limiting outdoor usability.

MicroLED technology faces its own set of formidable challenges, primarily centered around manufacturing complexity. The mass transfer process—moving millions of microscopic LED chips precisely onto substrates—presents unprecedented yield management difficulties. Current defect rates significantly impact production costs, with even minor placement errors affecting entire display performance.

Miniaturization constraints represent another significant hurdle for MicroLED. As pixel densities increase for high-resolution displays, achieving consistent electrical and optical performance at ever-smaller LED sizes becomes exponentially more difficult. Sub-pixel dimensions below 10 microns introduce quantum effects that alter emission characteristics and efficiency.

Heat dissipation presents challenges for both technologies but manifests differently. OLED displays generate heat during operation that accelerates material degradation, while MicroLED's higher power efficiency is partially offset by thermal management complexities in ultra-high-density configurations, requiring sophisticated thermal design solutions.

Color reproduction accuracy presents different challenges across these technologies. OLED displays achieve excellent color gamut but struggle with color consistency at varying brightness levels. MicroLED systems face challenges in achieving uniform color performance across millions of individual emitters, requiring advanced calibration systems that add to manufacturing complexity.

Power efficiency trade-offs exist in both technologies. OLED's pixel-level power control offers excellent efficiency for dark content but consumes more power for bright scenes. MicroLED promises superior efficiency but currently requires additional power for driving electronics that partially offsets its theoretical advantages in practical implementations.

Burn-in remains a persistent challenge for OLED displays, especially in static interface elements, creating permanent image retention that degrades user experience in professional and consumer applications. Additionally, OLED brightness capabilities, while improved, still fall short of LCD and MicroLED alternatives in high-ambient light environments, limiting outdoor usability.

MicroLED technology faces its own set of formidable challenges, primarily centered around manufacturing complexity. The mass transfer process—moving millions of microscopic LED chips precisely onto substrates—presents unprecedented yield management difficulties. Current defect rates significantly impact production costs, with even minor placement errors affecting entire display performance.

Miniaturization constraints represent another significant hurdle for MicroLED. As pixel densities increase for high-resolution displays, achieving consistent electrical and optical performance at ever-smaller LED sizes becomes exponentially more difficult. Sub-pixel dimensions below 10 microns introduce quantum effects that alter emission characteristics and efficiency.

Heat dissipation presents challenges for both technologies but manifests differently. OLED displays generate heat during operation that accelerates material degradation, while MicroLED's higher power efficiency is partially offset by thermal management complexities in ultra-high-density configurations, requiring sophisticated thermal design solutions.

Color reproduction accuracy presents different challenges across these technologies. OLED displays achieve excellent color gamut but struggle with color consistency at varying brightness levels. MicroLED systems face challenges in achieving uniform color performance across millions of individual emitters, requiring advanced calibration systems that add to manufacturing complexity.

Power efficiency trade-offs exist in both technologies. OLED's pixel-level power control offers excellent efficiency for dark content but consumes more power for bright scenes. MicroLED promises superior efficiency but currently requires additional power for driving electronics that partially offsets its theoretical advantages in practical implementations.

Comparative Analysis of OLED and MicroLED Technical Solutions

01 Energy efficiency and power consumption advantages

OLED and MicroLED display technologies offer significant energy efficiency benefits compared to traditional display technologies. OLEDs can selectively illuminate only the pixels needed, consuming less power when displaying darker content. MicroLEDs provide even greater power efficiency through their high luminous efficiency and precise pixel control. These technologies enable longer battery life in portable devices and reduced energy consumption in larger displays, making them ideal for mobile devices and energy-conscious applications.- Energy efficiency and power consumption advantages: OLED and MicroLED display technologies offer significant energy efficiency benefits compared to traditional display technologies. OLEDs consume power only for illuminated pixels, providing power savings especially when displaying dark content. MicroLEDs offer even greater energy efficiency with their high luminous efficacy and precise pixel control. These technologies enable longer battery life in portable devices and reduced power consumption in larger displays, making them ideal for mobile devices and energy-conscious applications.

- Superior visual performance characteristics: Both OLED and MicroLED technologies deliver exceptional visual performance with perfect black levels, infinite contrast ratios, and wide color gamuts. MicroLEDs provide higher brightness capabilities, making them suitable for high ambient light environments, while OLEDs excel in color accuracy and viewing angles. These technologies enable HDR content display with remarkable detail in both bright and dark scenes, creating more immersive viewing experiences across various applications from smartphones to large-format displays.

- Form factor and design flexibility: The thin, lightweight nature of OLED and MicroLED technologies enables innovative form factors and design possibilities. These self-emissive displays eliminate the need for backlighting systems, allowing for ultra-thin profiles and flexible or foldable displays. MicroLEDs offer modular design capabilities for scalable display sizes, while OLEDs can be manufactured on flexible substrates enabling curved, rollable, and conformable displays. This flexibility opens new possibilities for product design across consumer electronics, automotive interfaces, and wearable technology.

- Response time and motion performance: OLED and MicroLED displays feature exceptionally fast response times, typically measured in microseconds, eliminating motion blur and image persistence issues common in other display technologies. This superior motion handling makes them ideal for gaming, sports viewing, and other fast-motion content. The near-instantaneous pixel switching enables smoother scrolling, reduced latency for touch interactions, and better performance in virtual reality applications where motion clarity is critical for user experience and comfort.

- Durability and operational lifespan: MicroLED technology offers superior durability and longer operational lifespan compared to OLED displays. MicroLEDs are resistant to burn-in issues that can affect OLEDs with static content display, and they maintain brightness levels more consistently over their lifetime. Both technologies can be engineered with protective layers to enhance durability against environmental factors. Recent advancements have improved OLED longevity through more stable organic materials and compensation algorithms, while MicroLEDs inherently offer robust performance in challenging environments like automotive and outdoor displays.

02 Superior display quality and performance characteristics

Both OLED and MicroLED technologies deliver exceptional display quality with perfect blacks, high contrast ratios, and wide color gamuts. MicroLEDs offer superior brightness capabilities, making them suitable for high ambient light environments, while OLEDs excel in producing deep blacks by completely turning off pixels. These technologies provide faster response times than traditional LCDs, reducing motion blur and making them ideal for gaming and fast-motion content. The high refresh rates and pixel density contribute to sharper images and smoother visual experiences.Expand Specific Solutions03 Form factor flexibility and design innovations

The thin, lightweight nature of OLED and MicroLED technologies enables innovative form factors not possible with conventional displays. These technologies can be implemented on flexible substrates, allowing for curved, foldable, and rollable displays. The self-emissive nature eliminates the need for backlighting, resulting in ultra-thin profiles. MicroLEDs offer modular design capabilities for scalable display sizes, while OLEDs enable edge-to-edge displays with minimal bezels. These characteristics open new possibilities for device design across consumer electronics, automotive displays, and wearable technology.Expand Specific Solutions04 Durability and environmental performance

MicroLED technology offers exceptional durability with longer lifespans than OLED displays, showing minimal degradation over time. Both technologies demonstrate improved resistance to environmental factors compared to traditional displays, with MicroLEDs particularly excelling in harsh conditions. These displays maintain performance across wider temperature ranges and show greater resistance to humidity. Additionally, the manufacturing processes for newer generations of these technologies are becoming more environmentally friendly, with reduced use of harmful chemicals and improved recyclability of components.Expand Specific Solutions05 Integration capabilities and specialized applications

OLED and MicroLED technologies offer enhanced integration capabilities with other electronic components, enabling advanced functionalities. These displays can incorporate under-display sensors, cameras, and fingerprint readers while maintaining display quality. The technologies support specialized applications like transparent displays, augmented reality interfaces, and automotive heads-up displays. MicroLEDs excel in high-brightness applications like outdoor signage and automotive displays, while OLEDs are particularly suitable for premium consumer electronics requiring thin form factors and vibrant colors. Both technologies enable more seamless integration of displays into various environments and use cases.Expand Specific Solutions

Key Industry Players in OLED and MicroLED Development

The OLED vs MicroLED display technology landscape is currently in a transitional phase, with OLED being mature and widely commercialized while MicroLED remains in early commercialization stages. The global market for these advanced display technologies is projected to exceed $200 billion by 2025, driven by demand for higher performance displays. In terms of technical maturity, companies like Samsung Electronics and BOE Technology have established OLED manufacturing at scale, while MicroLED development is being actively pursued by Samsung, Apple, and specialized players like X Display Co. and Rayleigh Vision Intelligence. Key semiconductor and equipment providers such as Applied Materials and Intel are developing critical manufacturing technologies to address MicroLED's current challenges in mass production efficiency and cost reduction.

BOE Technology Group Co., Ltd.

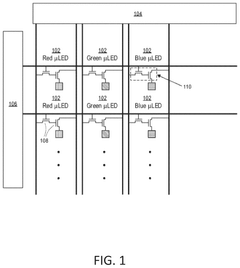

Technical Solution: BOE has developed a comprehensive portfolio spanning both OLED and MicroLED technologies. Their OLED solution employs a flexible thin-film transistor backplane with organic light-emitting materials arranged in RGB subpixel configurations. BOE's latest OLED panels achieve response times below 0.1ms and can be manufactured with thickness under 1mm, enabling foldable and rollable applications. Their power consumption is approximately 40% lower than comparable LCD panels. For MicroLED, BOE utilizes a chip-on-board process with inorganic semiconductor materials, achieving brightness levels exceeding 3,000 nits while maintaining a contrast ratio of over 1,000,000:1. Their MicroLED displays incorporate a proprietary active-matrix driving system that enables individual pixel control with refresh rates up to 240Hz. BOE has demonstrated MicroLED prototypes with pixel densities reaching 1,500 PPI (pixels per inch) for AR/VR applications.

Strengths: BOE offers competitive manufacturing scale with multiple production lines dedicated to both technologies, allowing cost optimization. Their OLED technology excels in flexibility and form factor versatility, while their MicroLED development focuses on high brightness and longevity. Weaknesses: BOE's OLED technology still lags behind Samsung in color accuracy and efficiency metrics. Their MicroLED manufacturing process faces challenges with mass transfer techniques and yield rates, resulting in higher production costs and limited commercial availability.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered OLED technology for over a decade and recently advanced MicroLED development. Their OLED technology utilizes organic compounds that emit light when electricity is applied, offering perfect blacks through pixel-by-pixel illumination. Samsung's latest OLED displays achieve up to 1,500 nits brightness with power efficiency improvements of 25% over previous generations. For MicroLED, Samsung has developed "The Wall" using inorganic gallium nitride-based LEDs measuring under 50 micrometers, enabling modular displays with brightness exceeding 2,000 nits and a lifespan of approximately 100,000 hours. Samsung's quantum dot integration enhances color volume to nearly 100% of DCI-P3 color space in both technologies, with their MicroLED achieving a 20% wider color gamut than conventional LED displays.

Strengths: Samsung leads in mass production capabilities for both technologies, with established supply chains and manufacturing expertise. Their OLED technology offers superior contrast ratios and viewing angles, while their MicroLED development focuses on modular scalability and brightness. Weaknesses: Samsung's OLED displays still face burn-in concerns with static images and have shorter lifespans than MicroLED. Their MicroLED technology remains significantly more expensive to produce and faces manufacturing yield challenges at smaller pixel sizes.

Patent Landscape and Technical Innovations in Display Technologies

Organic light emitting diode with light extracting layer

PatentWO2014158969A1

Innovation

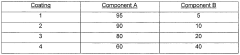

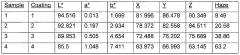

- A light extraction substrate with a nanoparticle-containing coating layer is applied to the inner surface of the OLED device, scattering light and reducing the waveguide effect, allowing more light to be emitted. The coating material can include polymeric or silicon-containing materials with nanoparticles like titania, applied using methods such as spin coating, to enhance light transmission and scattering.

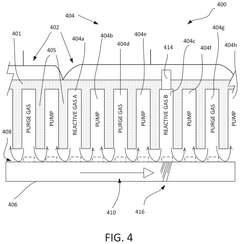

Semiconductor smoothing apparatus and method

PatentActiveUS12119435B2

Innovation

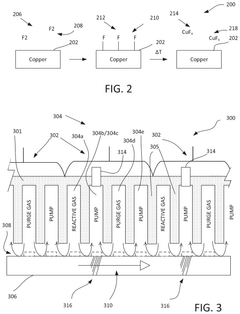

- A semiconductor manufacturing apparatus with discrete open chambers is used to smooth copper surfaces on large substrates, employing reactive plasma or ionic gases to form volatile compounds that are then vaporized and removed, followed by purging, to achieve atomic-level smoothness of copper contact pads, enabling effective bonding between micro-LED elements and the display backplane.

Energy Efficiency and Power Consumption Comparison

Energy efficiency represents a critical differentiating factor between OLED and MicroLED display technologies, with significant implications for device design, battery life, and environmental impact. OLED displays demonstrate superior energy efficiency in dark or black-dominant content scenarios due to their self-emissive pixel structure. When displaying black content, OLED pixels can be completely turned off, consuming virtually zero power for those specific pixels. This characteristic makes OLED particularly efficient for applications with dark themes or content with significant black areas.

MicroLED, while also self-emissive, currently exhibits different efficiency characteristics across its operational range. At maximum brightness levels, MicroLED displays can achieve better energy efficiency than OLEDs, particularly when displaying bright or white-dominant content. However, this advantage diminishes at lower brightness settings that are common in everyday usage scenarios. The power consumption curve of MicroLED technology shows promising developments but remains less optimized than OLED in many practical usage conditions.

The color reproduction process also impacts energy consumption differently between these technologies. OLEDs typically utilize white light emission combined with color filters, which introduces some energy loss in the filtering process. MicroLED employs direct RGB emission, potentially offering better theoretical efficiency in color reproduction, though current implementation challenges somewhat offset this advantage.

Heat generation represents another dimension of energy efficiency comparison. OLED displays generally produce less heat during operation compared to conventional LCD displays but more than ideal MicroLED implementations. MicroLED's theoretical advantage in heat dissipation remains partially unrealized in current commercial products due to manufacturing and integration challenges. Lower heat generation translates directly to energy savings and improved device longevity.

Battery life implications vary significantly by device type and usage pattern. In mobile devices displaying predominantly dark content, OLEDs deliver substantial battery life advantages. For always-on displays with static bright elements, MicroLED holds potential for greater efficiency once manufacturing processes mature. Current benchmark testing indicates that OLED maintains a 15-30% energy efficiency advantage in typical mixed-content usage scenarios, though this gap is narrowing with each MicroLED iteration.

Environmental considerations extend beyond operational power consumption to include manufacturing energy requirements and material sustainability. While OLED manufacturing has been optimized over decades, MicroLED production currently demands more energy-intensive processes. However, the potentially longer operational lifespan of MicroLED displays may offset this initial environmental cost over the complete product lifecycle.

MicroLED, while also self-emissive, currently exhibits different efficiency characteristics across its operational range. At maximum brightness levels, MicroLED displays can achieve better energy efficiency than OLEDs, particularly when displaying bright or white-dominant content. However, this advantage diminishes at lower brightness settings that are common in everyday usage scenarios. The power consumption curve of MicroLED technology shows promising developments but remains less optimized than OLED in many practical usage conditions.

The color reproduction process also impacts energy consumption differently between these technologies. OLEDs typically utilize white light emission combined with color filters, which introduces some energy loss in the filtering process. MicroLED employs direct RGB emission, potentially offering better theoretical efficiency in color reproduction, though current implementation challenges somewhat offset this advantage.

Heat generation represents another dimension of energy efficiency comparison. OLED displays generally produce less heat during operation compared to conventional LCD displays but more than ideal MicroLED implementations. MicroLED's theoretical advantage in heat dissipation remains partially unrealized in current commercial products due to manufacturing and integration challenges. Lower heat generation translates directly to energy savings and improved device longevity.

Battery life implications vary significantly by device type and usage pattern. In mobile devices displaying predominantly dark content, OLEDs deliver substantial battery life advantages. For always-on displays with static bright elements, MicroLED holds potential for greater efficiency once manufacturing processes mature. Current benchmark testing indicates that OLED maintains a 15-30% energy efficiency advantage in typical mixed-content usage scenarios, though this gap is narrowing with each MicroLED iteration.

Environmental considerations extend beyond operational power consumption to include manufacturing energy requirements and material sustainability. While OLED manufacturing has been optimized over decades, MicroLED production currently demands more energy-intensive processes. However, the potentially longer operational lifespan of MicroLED displays may offset this initial environmental cost over the complete product lifecycle.

Manufacturing Scalability and Cost Analysis

The manufacturing landscape for OLED and MicroLED technologies presents significant contrasts in terms of scalability and cost structures. OLED manufacturing has matured considerably over the past decade, with established production lines and optimized processes that have gradually reduced costs. Major manufacturers like Samsung and LG Display have achieved economies of scale, bringing down production costs from approximately $150 per inch in 2015 to around $60-80 per inch in 2023 for premium OLED panels.

In contrast, MicroLED manufacturing remains in its nascent stages, facing substantial challenges in mass production. The primary bottleneck lies in the transfer process - placing millions of microscopic LED chips precisely onto substrates. Current yield rates for MicroLED production hover between 70-80%, significantly lower than OLED's 90-95%, resulting in higher wastage and production costs. Industry estimates suggest MicroLED manufacturing costs remain 5-8 times higher than equivalent OLED panels.

Equipment investment presents another critical difference. OLED production facilities typically require capital investments of $2-3 billion for a generation 8.5 fab with monthly capacity of 60,000 substrates. MicroLED facilities, however, demand specialized equipment for epitaxial growth, chip fabrication, and mass transfer processes, with estimated setup costs reaching $4-6 billion for comparable output capacity.

Supply chain maturity further differentiates these technologies. OLED benefits from an established ecosystem of materials suppliers, equipment manufacturers, and specialized service providers. The MicroLED supply chain remains fragmented, with limited specialized suppliers and significant technological barriers to entry, creating bottlenecks in scaling production.

Looking forward, manufacturing trajectories show divergent paths. OLED production costs are projected to decrease by 5-7% annually through incremental process improvements and materials innovations. MicroLED costs, while currently prohibitive for mass-market applications, could see more dramatic reductions of 15-20% annually as transfer technologies mature and yield rates improve. Industry analysts project potential cost parity between high-end OLED and entry-level MicroLED displays by 2028-2030, contingent on breakthrough innovations in mass transfer techniques.

Energy consumption during manufacturing also impacts overall cost structures. OLED production requires approximately 30-40% less energy than current MicroLED manufacturing processes, contributing to its current cost advantage and environmental profile.

In contrast, MicroLED manufacturing remains in its nascent stages, facing substantial challenges in mass production. The primary bottleneck lies in the transfer process - placing millions of microscopic LED chips precisely onto substrates. Current yield rates for MicroLED production hover between 70-80%, significantly lower than OLED's 90-95%, resulting in higher wastage and production costs. Industry estimates suggest MicroLED manufacturing costs remain 5-8 times higher than equivalent OLED panels.

Equipment investment presents another critical difference. OLED production facilities typically require capital investments of $2-3 billion for a generation 8.5 fab with monthly capacity of 60,000 substrates. MicroLED facilities, however, demand specialized equipment for epitaxial growth, chip fabrication, and mass transfer processes, with estimated setup costs reaching $4-6 billion for comparable output capacity.

Supply chain maturity further differentiates these technologies. OLED benefits from an established ecosystem of materials suppliers, equipment manufacturers, and specialized service providers. The MicroLED supply chain remains fragmented, with limited specialized suppliers and significant technological barriers to entry, creating bottlenecks in scaling production.

Looking forward, manufacturing trajectories show divergent paths. OLED production costs are projected to decrease by 5-7% annually through incremental process improvements and materials innovations. MicroLED costs, while currently prohibitive for mass-market applications, could see more dramatic reductions of 15-20% annually as transfer technologies mature and yield rates improve. Industry analysts project potential cost parity between high-end OLED and entry-level MicroLED displays by 2028-2030, contingent on breakthrough innovations in mass transfer techniques.

Energy consumption during manufacturing also impacts overall cost structures. OLED production requires approximately 30-40% less energy than current MicroLED manufacturing processes, contributing to its current cost advantage and environmental profile.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!