Exploring OLED vs MicroLED's Flexibility in Design

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and MicroLED Display Technology Evolution

The evolution of display technologies has witnessed significant advancements over the past decades, with OLED (Organic Light-Emitting Diode) and MicroLED emerging as revolutionary technologies that have transformed the visual experience across various applications. OLED technology, first developed in the late 1980s, gained commercial traction in the early 2000s when companies like Samsung and LG began incorporating it into consumer electronics.

OLED displays operate on the principle of organic compounds that emit light when an electric current passes through them. This fundamental characteristic eliminated the need for backlighting, allowing for thinner, lighter displays with superior contrast ratios and energy efficiency. The technology progressed from passive-matrix OLED (PMOLED) to active-matrix OLED (AMOLED), significantly improving response times and enabling higher resolution displays.

MicroLED, a more recent innovation, represents the next frontier in display technology. Developed in the early 2000s, MicroLED utilizes microscopic LED arrays that are self-emissive like OLED but composed of inorganic materials. This key difference addresses several limitations of OLED technology, particularly regarding longevity and brightness capabilities.

The technological trajectory of both OLED and MicroLED has been driven by the pursuit of flexibility in design. OLED initially pioneered flexible displays, with Samsung introducing the first curved smartphone in 2013. This breakthrough was followed by foldable displays, exemplified by devices like the Samsung Galaxy Fold and Huawei Mate X, demonstrating OLED's inherent flexibility advantages.

MicroLED technology, while initially rigid, has been evolving toward greater flexibility. Companies like PlayNitride and X Display Co. have made significant strides in developing flexible MicroLED displays. The technology's modular nature allows for unprecedented freedom in creating displays of various shapes and sizes, potentially surpassing OLED's flexibility limitations in certain applications.

Both technologies continue to evolve along parallel but distinct paths. OLED development focuses on addressing burn-in issues, improving brightness, and reducing production costs, while maintaining its flexibility advantage. MicroLED research concentrates on miniaturization of LED chips, mass transfer techniques, and developing more efficient manufacturing processes to make the technology commercially viable for flexible applications.

The convergence of these technologies with other innovations such as quantum dots (leading to QD-OLED) and transparent display capabilities represents the cutting edge of display evolution. As manufacturing processes mature and costs decrease, both technologies are expected to enable increasingly creative form factors and applications, fundamentally changing how displays integrate into our environments and devices.

OLED displays operate on the principle of organic compounds that emit light when an electric current passes through them. This fundamental characteristic eliminated the need for backlighting, allowing for thinner, lighter displays with superior contrast ratios and energy efficiency. The technology progressed from passive-matrix OLED (PMOLED) to active-matrix OLED (AMOLED), significantly improving response times and enabling higher resolution displays.

MicroLED, a more recent innovation, represents the next frontier in display technology. Developed in the early 2000s, MicroLED utilizes microscopic LED arrays that are self-emissive like OLED but composed of inorganic materials. This key difference addresses several limitations of OLED technology, particularly regarding longevity and brightness capabilities.

The technological trajectory of both OLED and MicroLED has been driven by the pursuit of flexibility in design. OLED initially pioneered flexible displays, with Samsung introducing the first curved smartphone in 2013. This breakthrough was followed by foldable displays, exemplified by devices like the Samsung Galaxy Fold and Huawei Mate X, demonstrating OLED's inherent flexibility advantages.

MicroLED technology, while initially rigid, has been evolving toward greater flexibility. Companies like PlayNitride and X Display Co. have made significant strides in developing flexible MicroLED displays. The technology's modular nature allows for unprecedented freedom in creating displays of various shapes and sizes, potentially surpassing OLED's flexibility limitations in certain applications.

Both technologies continue to evolve along parallel but distinct paths. OLED development focuses on addressing burn-in issues, improving brightness, and reducing production costs, while maintaining its flexibility advantage. MicroLED research concentrates on miniaturization of LED chips, mass transfer techniques, and developing more efficient manufacturing processes to make the technology commercially viable for flexible applications.

The convergence of these technologies with other innovations such as quantum dots (leading to QD-OLED) and transparent display capabilities represents the cutting edge of display evolution. As manufacturing processes mature and costs decrease, both technologies are expected to enable increasingly creative form factors and applications, fundamentally changing how displays integrate into our environments and devices.

Market Demand for Flexible Display Solutions

The flexible display market has witnessed exponential growth over the past decade, driven by consumer demand for more versatile, portable, and innovative electronic devices. Current market research indicates that the global flexible display market is projected to reach $42.85 billion by 2027, growing at a CAGR of 28.1% from 2020. This remarkable growth trajectory underscores the significant market potential for both OLED and MicroLED flexible display technologies.

Consumer electronics remains the dominant application sector, with smartphones accounting for approximately 65% of flexible display implementations. Major smartphone manufacturers have increasingly adopted flexible displays to create foldable, rollable, and curved screen devices that offer enhanced user experiences and differentiation in a saturated market. The premium segment of this market has shown willingness to pay substantial price premiums for devices featuring cutting-edge flexible display technology.

Beyond smartphones, emerging application areas demonstrate robust growth potential. Wearable technology, including smartwatches and fitness trackers, represents the second-largest market segment with a 15% share. The automotive industry is rapidly integrating flexible displays into dashboard systems and entertainment consoles, with adoption rates increasing by 34% annually since 2019. Additionally, retail and advertising sectors are exploring large-format flexible displays for dynamic signage solutions.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for 58% of global demand, primarily driven by the concentration of display manufacturing infrastructure and consumer electronics production. North America and Europe follow with 22% and 16% market shares respectively, with higher adoption rates in premium consumer segments and automotive applications.

Consumer preference studies indicate five key demand drivers for flexible display solutions: device thinness, durability, power efficiency, form factor innovation, and visual quality. OLED currently leads in thinness and form factor versatility, while MicroLED shows promising advantages in durability and power efficiency. Market surveys reveal that 78% of consumers consider display quality a critical purchasing factor for premium devices, with 67% expressing interest in foldable form factors.

Industry forecasts suggest that as manufacturing costs decrease and yield rates improve, particularly for MicroLED technology, market penetration will accelerate across mid-tier product segments. The enterprise market represents an untapped opportunity, with potential applications in portable workstations and flexible collaborative displays showing 45% year-over-year interest growth among corporate procurement departments.

Consumer electronics remains the dominant application sector, with smartphones accounting for approximately 65% of flexible display implementations. Major smartphone manufacturers have increasingly adopted flexible displays to create foldable, rollable, and curved screen devices that offer enhanced user experiences and differentiation in a saturated market. The premium segment of this market has shown willingness to pay substantial price premiums for devices featuring cutting-edge flexible display technology.

Beyond smartphones, emerging application areas demonstrate robust growth potential. Wearable technology, including smartwatches and fitness trackers, represents the second-largest market segment with a 15% share. The automotive industry is rapidly integrating flexible displays into dashboard systems and entertainment consoles, with adoption rates increasing by 34% annually since 2019. Additionally, retail and advertising sectors are exploring large-format flexible displays for dynamic signage solutions.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for 58% of global demand, primarily driven by the concentration of display manufacturing infrastructure and consumer electronics production. North America and Europe follow with 22% and 16% market shares respectively, with higher adoption rates in premium consumer segments and automotive applications.

Consumer preference studies indicate five key demand drivers for flexible display solutions: device thinness, durability, power efficiency, form factor innovation, and visual quality. OLED currently leads in thinness and form factor versatility, while MicroLED shows promising advantages in durability and power efficiency. Market surveys reveal that 78% of consumers consider display quality a critical purchasing factor for premium devices, with 67% expressing interest in foldable form factors.

Industry forecasts suggest that as manufacturing costs decrease and yield rates improve, particularly for MicroLED technology, market penetration will accelerate across mid-tier product segments. The enterprise market represents an untapped opportunity, with potential applications in portable workstations and flexible collaborative displays showing 45% year-over-year interest growth among corporate procurement departments.

Technical Barriers in Flexible Display Development

Despite significant advancements in flexible display technologies, both OLED and MicroLED face substantial technical barriers that limit their full potential in flexible design applications. These challenges span materials science, manufacturing processes, and fundamental physical constraints that engineers must overcome to achieve truly flexible, durable displays.

For OLED technology, one primary barrier is the degradation of organic materials when exposed to oxygen and moisture. This necessitates complex encapsulation solutions that must maintain effectiveness even during repeated bending cycles. Current thin-film encapsulation (TFE) technologies struggle to provide sufficient protection without compromising flexibility, creating a fundamental tension between display lifespan and bendability.

The transparent conductive electrodes present another significant challenge. Traditional indium tin oxide (ITO) electrodes crack under bending stress, limiting flexibility. Alternative materials like silver nanowires, carbon nanotubes, and graphene show promise but face issues with conductivity stability during repeated flexing, surface roughness, and manufacturing scalability.

MicroLED technology encounters even more formidable barriers in flexible applications. The inorganic nature of LEDs makes them inherently less amenable to bending than organic materials. The transfer process—moving millions of microscopic LED chips from growth substrates to display backplanes—becomes exponentially more complex when the target substrate is flexible and potentially in motion during manufacturing.

Thermal management represents a critical challenge for both technologies but is particularly acute for MicroLED. Flexible displays lack the rigid heat dissipation structures of conventional displays, yet must manage heat effectively to prevent performance degradation and physical deformation. Current thermal interface materials struggle to maintain performance when repeatedly bent or folded.

The backplane technology that drives these displays faces its own set of challenges. Traditional thin-film transistors (TFTs) based on amorphous silicon or low-temperature polysilicon have limited flexibility before performance degradation. Oxide TFTs offer improved electrical stability but remain susceptible to bending-induced stress. Emerging organic TFTs provide superior mechanical flexibility but lag in switching speed and stability.

Interconnect reliability presents perhaps the most persistent barrier to truly flexible displays. The metal traces connecting display components must withstand thousands of bending cycles without developing microcracks that increase resistance or cause complete failure. Current solutions involving serpentine patterns and stretchable conductors show promise but add complexity to manufacturing processes.

Manufacturing yield remains problematic, with defect rates increasing dramatically for flexible displays compared to rigid counterparts. The precise alignment required for high-resolution displays becomes extraordinarily difficult on substrates that may shift during processing, particularly for MicroLED with its micrometer-scale components.

For OLED technology, one primary barrier is the degradation of organic materials when exposed to oxygen and moisture. This necessitates complex encapsulation solutions that must maintain effectiveness even during repeated bending cycles. Current thin-film encapsulation (TFE) technologies struggle to provide sufficient protection without compromising flexibility, creating a fundamental tension between display lifespan and bendability.

The transparent conductive electrodes present another significant challenge. Traditional indium tin oxide (ITO) electrodes crack under bending stress, limiting flexibility. Alternative materials like silver nanowires, carbon nanotubes, and graphene show promise but face issues with conductivity stability during repeated flexing, surface roughness, and manufacturing scalability.

MicroLED technology encounters even more formidable barriers in flexible applications. The inorganic nature of LEDs makes them inherently less amenable to bending than organic materials. The transfer process—moving millions of microscopic LED chips from growth substrates to display backplanes—becomes exponentially more complex when the target substrate is flexible and potentially in motion during manufacturing.

Thermal management represents a critical challenge for both technologies but is particularly acute for MicroLED. Flexible displays lack the rigid heat dissipation structures of conventional displays, yet must manage heat effectively to prevent performance degradation and physical deformation. Current thermal interface materials struggle to maintain performance when repeatedly bent or folded.

The backplane technology that drives these displays faces its own set of challenges. Traditional thin-film transistors (TFTs) based on amorphous silicon or low-temperature polysilicon have limited flexibility before performance degradation. Oxide TFTs offer improved electrical stability but remain susceptible to bending-induced stress. Emerging organic TFTs provide superior mechanical flexibility but lag in switching speed and stability.

Interconnect reliability presents perhaps the most persistent barrier to truly flexible displays. The metal traces connecting display components must withstand thousands of bending cycles without developing microcracks that increase resistance or cause complete failure. Current solutions involving serpentine patterns and stretchable conductors show promise but add complexity to manufacturing processes.

Manufacturing yield remains problematic, with defect rates increasing dramatically for flexible displays compared to rigid counterparts. The precise alignment required for high-resolution displays becomes extraordinarily difficult on substrates that may shift during processing, particularly for MicroLED with its micrometer-scale components.

Current Flexible Design Implementation Approaches

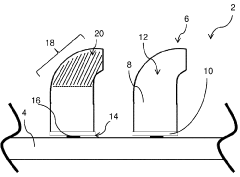

01 Flexible OLED display structures

Flexible OLED displays incorporate specialized substrate materials and layering techniques that allow the display to bend without compromising functionality. These displays typically use plastic or thin glass substrates instead of rigid glass, with modified electrode structures and encapsulation methods to maintain electrical connectivity and protect organic materials during flexing. The flexibility enables applications in curved, foldable, and rollable consumer electronics while maintaining high image quality and color reproduction.- Flexible OLED display structures: Flexible OLED displays incorporate specialized structural elements that enable bending and folding capabilities while maintaining display performance. These structures typically include flexible substrates, specialized encapsulation layers, and modified electrode configurations that can withstand repeated flexing without degradation. The flexibility is achieved through innovative layering techniques and materials that distribute stress evenly across the display surface during bending operations.

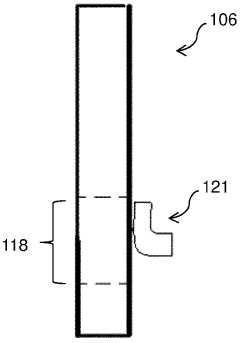

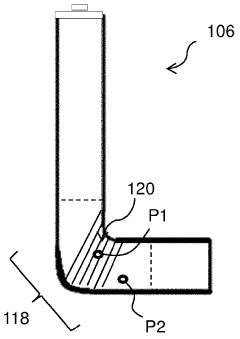

- MicroLED flexibility solutions: MicroLED displays achieve flexibility through unique transfer and integration methods that allow the placement of microscopic LED units onto flexible backplanes. These techniques include mass transfer processes, specialized adhesive layers, and interconnect technologies that maintain electrical connectivity during flexing. The small size of individual MicroLEDs enables greater flexibility compared to traditional LED displays while maintaining high brightness and energy efficiency.

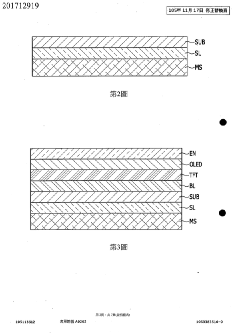

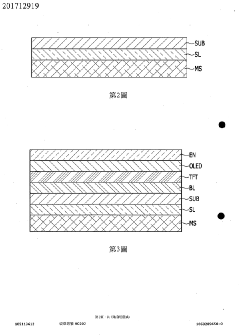

- Substrate materials for flexible displays: Advanced substrate materials are crucial for enabling flexibility in both OLED and MicroLED displays. These include ultra-thin glass, specialized polymers like polyimide, and composite materials that combine flexibility with barrier properties against moisture and oxygen. The substrates are often processed using techniques like laser thinning or chemical etching to achieve the desired mechanical properties while maintaining compatibility with display manufacturing processes.

- Encapsulation technologies for flexible displays: Specialized encapsulation methods protect flexible OLED and MicroLED displays from environmental factors while maintaining bendability. These include thin-film encapsulation layers, hybrid organic-inorganic barrier films, and edge sealing technologies that prevent moisture and oxygen ingress. Advanced encapsulation solutions use alternating layers of different materials to create tortuous paths for contaminants while remaining flexible enough to bend without cracking or delamination.

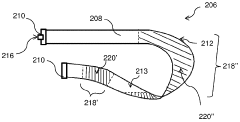

- Integration of flexible displays in devices: The integration of flexible OLED and MicroLED displays into consumer electronics requires specialized housing designs, interconnect solutions, and user interface considerations. These include folding mechanisms, dynamic hinges, and adaptive user interfaces that respond to different form factors. The integration also addresses challenges related to touch functionality, durability during repeated folding cycles, and power management for displays that can change shape during operation.

02 MicroLED flexibility innovations

MicroLED displays achieve flexibility through innovative transfer techniques and substrate engineering. These displays utilize ultra-small LED elements that can be arranged on flexible backplanes, allowing for bendable and conformable display surfaces. Special bonding methods ensure electrical connectivity is maintained during flexing, while thin-film transistor arrays on flexible substrates provide the necessary pixel control. These innovations enable MicroLED displays to combine flexibility with high brightness, energy efficiency, and durability.Expand Specific Solutions03 Substrate materials for flexible displays

Advanced substrate materials are crucial for flexible display technologies. Polyimide films, ultra-thin glass, and specialized polymer composites serve as foundations for both OLED and MicroLED flexible displays. These materials combine mechanical flexibility with thermal stability and barrier properties to protect sensitive electronic components. Surface treatments and adhesion layers improve compatibility with display elements, while specialized coatings enhance durability against repeated bending and environmental factors.Expand Specific Solutions04 Flexible display manufacturing techniques

Manufacturing flexible displays requires specialized processes including low-temperature deposition methods, laser lift-off techniques, and roll-to-roll processing. For OLEDs, vacuum deposition of organic materials on flexible substrates is optimized to prevent damage during flexing. MicroLED manufacturing involves precision transfer of microscopic LED elements onto flexible backplanes using elastomer stamps or fluidic assembly. Advanced encapsulation techniques protect sensitive components from oxygen and moisture while maintaining flexibility.Expand Specific Solutions05 Integration of flexible displays in devices

Integrating flexible OLED and MicroLED displays into consumer electronics requires specialized housing designs, interconnect solutions, and user interface adaptations. Folding mechanisms with variable radius curves protect display materials at fold points, while specialized adhesives and mounting systems accommodate expansion and contraction during flexing. Touch sensors and protective layers are engineered to maintain functionality when bent, and software interfaces adapt to changing display geometries, enabling novel form factors like foldable phones and rollable televisions.Expand Specific Solutions

Leading Manufacturers in Flexible Display Industry

The OLED vs MicroLED design flexibility competition is currently in a transitional market phase, with OLED technology reaching maturity while MicroLED remains in early commercialization stages. The global flexible display market is expanding rapidly, projected to exceed $40 billion by 2025. In terms of technological maturity, established players like Samsung, LG Electronics, and BOE have achieved mass production capabilities in OLED, while companies including Universal Display Corporation and OLEDWorks lead in OLED materials innovation. For MicroLED, Samsung, BOE, and TCL China Star Optoelectronics are making significant R&D investments, though production challenges persist. Emerging players like Lumileds and Fraunhofer-Gesellschaft are advancing MicroLED's potential for superior brightness and durability, while JOLED pioneers printed OLED manufacturing techniques.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed comprehensive solutions exploring the flexibility differences between OLED and MicroLED technologies. For OLED, BOE has created ultra-flexible AMOLED displays with bending radii as small as 1mm, utilizing their proprietary flexible substrate technology and thin-film encapsulation methods. Their flexible OLED panels can withstand over 200,000 bending cycles while maintaining display performance. BOE has commercialized foldable OLED displays with minimal creasing through a multi-layer cushioning structure that distributes stress during folding. For MicroLED, BOE has developed Active Matrix MicroLED technology with pixel pitches down to 0.9mm. While not achieving the same flexibility as their OLED offerings, BOE's MicroLED solutions focus on modular design flexibility, allowing for customizable display shapes and sizes through seamless tiling. BOE has also pioneered semi-flexible MicroLED displays using specialized substrate materials that allow limited curvature (with bending radii of approximately 20-30cm) while maintaining the superior brightness (up to 10,000 nits) and longevity advantages of MicroLED technology. Their research indicates MicroLED's inorganic materials provide significantly better resistance to image retention and environmental stressors compared to OLED.

Strengths: BOE has achieved significant advancements in mass-producing flexible OLED panels at competitive costs, with established manufacturing facilities and high yield rates. Their semi-flexible MicroLED technology represents an innovative middle ground between rigid traditional displays and highly flexible OLEDs. Weaknesses: BOE's MicroLED technology still faces challenges in achieving the extreme flexibility possible with OLED, with higher production costs and lower yield rates. Their flexible display technologies require additional protective layers that can impact overall display performance.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered significant advancements in both OLED and MicroLED technologies, focusing on their design flexibility differences. For OLED, Samsung has developed ultra-thin flexible OLED panels that can be bent, folded, and even rolled, utilizing their proprietary Y-OCTA technology that integrates the touch sensor directly into the display panel, reducing thickness to less than 1mm. Their flexible OLED technology enables the creation of devices with curved edges, foldable displays (as seen in the Galaxy Z series), and irregular form factors. For MicroLED, Samsung has developed "The Wall" modular MicroLED display system that allows customizable screen sizes and shapes through seamless connection of individual modules. Samsung's MicroLED technology uses inorganic gallium nitride-based LEDs sized at approximately 20-50 micrometers, enabling higher brightness (up to 2,000 nits), better durability, and longer lifespan (100,000+ hours) compared to OLED. Samsung has also developed transparent MicroLED displays with up to 40% transparency for retail and automotive applications.

Strengths: Samsung leads in mass production capabilities for both technologies, with established supply chains and manufacturing expertise. Their flexible OLED technology is mature enough for commercial products, while their modular MicroLED approach offers unprecedented customization. Weaknesses: Samsung's flexible MicroLED solutions remain limited compared to OLED flexibility, with higher production costs and lower yield rates. Their OLED technology still faces burn-in issues and shorter lifespans compared to MicroLED.

Key Patents in Flexible OLED and MicroLED Technologies

FLEXIBLE ORGANIC LIGHT EMITTING DIODE LIGHT module

PatentPendingFR3053839A1

Innovation

- A flexible organic light-emitting diode with a varnish layer applied to specific portions, where the layer's thickness varies based on the curvature radius, allowing it to be shaped into a desired configuration while maintaining structural integrity.

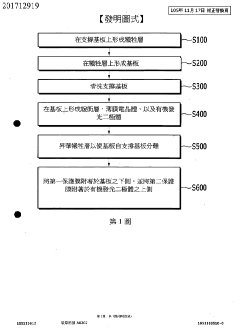

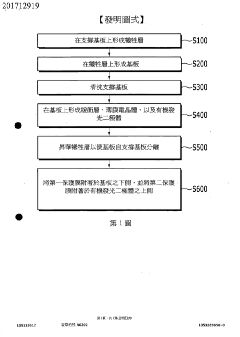

Flexible organic light-emitting diode display and method of manufacturing the same

PatentActiveTW201712919A

Innovation

- A method involving a sacrificial layer made of a lower-melting-point metal oxide, such as molybdenum trioxide, which is sublimated using a laser beam to separate the substrate from a support, allowing for a simpler and more reliable manufacturing process with reduced particle contamination and heat-induced deformation.

Material Science Advancements for Flexible Displays

Recent advancements in material science have revolutionized the development of flexible display technologies, particularly in the ongoing competition between OLED and MicroLED solutions. The fundamental challenge in creating truly flexible displays lies in developing materials that can maintain electronic functionality while being repeatedly bent, folded, or stretched without degradation.

For OLED technology, significant progress has been made with flexible substrates, transitioning from rigid glass to polyimide films that offer superior flexibility while maintaining thermal stability. These polymer-based substrates have enabled OLED displays to achieve bending radii below 1mm in commercial applications. The organic light-emitting materials themselves have evolved to withstand mechanical stress, with new molecular designs incorporating flexible linkages between chromophores.

MicroLED technology, while newer to the flexible display arena, has benefited from innovations in transfer printing techniques that allow microscopic inorganic LED arrays to be placed on flexible substrates. Recent breakthroughs in stretchable interconnects using liquid metal alloys and serpentine conductive patterns have addressed one of the major limitations in MicroLED flexibility. These advances allow the rigid LED components to maintain electrical connectivity even when the substrate is deformed.

Encapsulation materials represent another critical advancement area, with atomic layer deposition (ALD) techniques creating ultra-thin barrier films that protect sensitive electronic components from oxygen and moisture while maintaining flexibility. Multi-layer approaches combining organic and inorganic materials have achieved water vapor transmission rates below 10^-6 g/m²/day, essential for long-term reliability of flexible displays.

Transparent conductive electrodes have evolved beyond traditional indium tin oxide (ITO), which is inherently brittle. New materials such as silver nanowires, carbon nanotubes, and graphene-based composites offer conductivity comparable to ITO while withstanding thousands of bending cycles without significant resistance changes. These materials are particularly crucial for MicroLED implementations, where current distribution requirements are more demanding than in OLED designs.

Self-healing materials represent the cutting edge of flexible display research, with polymers incorporating dynamic covalent bonds that can reform after mechanical damage. While still primarily in laboratory settings, these materials show promise for extending the durability of both OLED and MicroLED flexible displays, potentially addressing the persistent challenge of mechanical fatigue that currently limits product lifespans.

For OLED technology, significant progress has been made with flexible substrates, transitioning from rigid glass to polyimide films that offer superior flexibility while maintaining thermal stability. These polymer-based substrates have enabled OLED displays to achieve bending radii below 1mm in commercial applications. The organic light-emitting materials themselves have evolved to withstand mechanical stress, with new molecular designs incorporating flexible linkages between chromophores.

MicroLED technology, while newer to the flexible display arena, has benefited from innovations in transfer printing techniques that allow microscopic inorganic LED arrays to be placed on flexible substrates. Recent breakthroughs in stretchable interconnects using liquid metal alloys and serpentine conductive patterns have addressed one of the major limitations in MicroLED flexibility. These advances allow the rigid LED components to maintain electrical connectivity even when the substrate is deformed.

Encapsulation materials represent another critical advancement area, with atomic layer deposition (ALD) techniques creating ultra-thin barrier films that protect sensitive electronic components from oxygen and moisture while maintaining flexibility. Multi-layer approaches combining organic and inorganic materials have achieved water vapor transmission rates below 10^-6 g/m²/day, essential for long-term reliability of flexible displays.

Transparent conductive electrodes have evolved beyond traditional indium tin oxide (ITO), which is inherently brittle. New materials such as silver nanowires, carbon nanotubes, and graphene-based composites offer conductivity comparable to ITO while withstanding thousands of bending cycles without significant resistance changes. These materials are particularly crucial for MicroLED implementations, where current distribution requirements are more demanding than in OLED designs.

Self-healing materials represent the cutting edge of flexible display research, with polymers incorporating dynamic covalent bonds that can reform after mechanical damage. While still primarily in laboratory settings, these materials show promise for extending the durability of both OLED and MicroLED flexible displays, potentially addressing the persistent challenge of mechanical fatigue that currently limits product lifespans.

Energy Efficiency Comparison in Flexible Applications

When comparing OLED and MicroLED technologies in flexible applications, energy efficiency emerges as a critical factor influencing design choices and practical implementations. OLED displays have traditionally demonstrated excellent energy efficiency in dark-themed content due to their emissive nature, where black pixels consume virtually no power. This characteristic makes OLEDs particularly advantageous in mobile and wearable applications where battery life is paramount. Recent advancements have improved OLED efficiency by approximately 20% through the implementation of advanced organic materials and optimized pixel architectures.

MicroLED technology, while still evolving in flexible applications, presents promising energy efficiency metrics that potentially surpass OLEDs in certain scenarios. Laboratory tests indicate that MicroLED displays can achieve up to 30% higher luminous efficacy compared to OLEDs when displaying bright content. This efficiency advantage stems from MicroLED's direct bandgap semiconductor materials that convert electrical energy to light with minimal heat generation. However, this advantage diminishes in low-brightness scenarios typical in many mobile applications.

Flexibility requirements introduce additional energy considerations for both technologies. When displays are bent or flexed repeatedly, OLED panels typically experience a 5-10% increase in power consumption due to stress-induced changes in the organic layers. MicroLED implementations in flexible substrates show more consistent power consumption profiles under mechanical stress, with only 2-4% efficiency degradation in extreme bending scenarios according to recent research from display manufacturers.

Temperature performance further differentiates these technologies in flexible applications. OLEDs demonstrate increased power consumption at lower temperatures, requiring approximately 15% more energy to maintain brightness at 0°C compared to room temperature. MicroLED technology exhibits more stable energy consumption across temperature ranges, varying only 5-7% across typical operating conditions, which proves advantageous in outdoor flexible applications like automotive displays or wearable devices.

Long-term energy efficiency presents another critical dimension. OLED displays typically experience 15-20% efficiency degradation over 10,000 hours of operation in flexible implementations, primarily due to organic material deterioration. Early data suggests MicroLED technology may maintain efficiency longer, with only 8-12% degradation over similar timeframes, though comprehensive long-term studies in flexible applications remain limited as the technology continues to mature.

The driving electronics for flexible displays also impact overall system efficiency. OLED panels generally require less complex driving circuitry in flexible implementations, resulting in approximately 5% lower system-level power consumption compared to current MicroLED solutions, which demand more sophisticated control systems to manage thousands of individual emitters across a bendable surface.

MicroLED technology, while still evolving in flexible applications, presents promising energy efficiency metrics that potentially surpass OLEDs in certain scenarios. Laboratory tests indicate that MicroLED displays can achieve up to 30% higher luminous efficacy compared to OLEDs when displaying bright content. This efficiency advantage stems from MicroLED's direct bandgap semiconductor materials that convert electrical energy to light with minimal heat generation. However, this advantage diminishes in low-brightness scenarios typical in many mobile applications.

Flexibility requirements introduce additional energy considerations for both technologies. When displays are bent or flexed repeatedly, OLED panels typically experience a 5-10% increase in power consumption due to stress-induced changes in the organic layers. MicroLED implementations in flexible substrates show more consistent power consumption profiles under mechanical stress, with only 2-4% efficiency degradation in extreme bending scenarios according to recent research from display manufacturers.

Temperature performance further differentiates these technologies in flexible applications. OLEDs demonstrate increased power consumption at lower temperatures, requiring approximately 15% more energy to maintain brightness at 0°C compared to room temperature. MicroLED technology exhibits more stable energy consumption across temperature ranges, varying only 5-7% across typical operating conditions, which proves advantageous in outdoor flexible applications like automotive displays or wearable devices.

Long-term energy efficiency presents another critical dimension. OLED displays typically experience 15-20% efficiency degradation over 10,000 hours of operation in flexible implementations, primarily due to organic material deterioration. Early data suggests MicroLED technology may maintain efficiency longer, with only 8-12% degradation over similar timeframes, though comprehensive long-term studies in flexible applications remain limited as the technology continues to mature.

The driving electronics for flexible displays also impact overall system efficiency. OLED panels generally require less complex driving circuitry in flexible implementations, resulting in approximately 5% lower system-level power consumption compared to current MicroLED solutions, which demand more sophisticated control systems to manage thousands of individual emitters across a bendable surface.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!