OLED vs MicroLED and Their Role in Energy Optimization

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and MicroLED Technology Evolution and Objectives

The evolution of display technologies has witnessed significant advancements over the past decades, with OLED (Organic Light-Emitting Diode) emerging as a dominant technology in the 2010s. OLED technology originated in the late 1980s at Eastman Kodak, with the first commercial applications appearing in small displays during the early 2000s. The technology's fundamental principle relies on organic compounds that emit light when an electric current passes through them, eliminating the need for backlighting and enabling thinner, more flexible displays.

MicroLED represents the next frontier in display technology, conceptualized in the early 2000s but only gaining significant traction in the past decade. Unlike OLEDs, MicroLEDs utilize inorganic gallium nitride-based materials to create microscopic LED arrays, each pixel being a self-emissive unit measuring less than 100 micrometers. This fundamental difference in materials science underpins many of the comparative advantages between these technologies.

The technological trajectory for both OLED and MicroLED has been driven by several key objectives: enhanced energy efficiency, improved display performance, manufacturing scalability, and environmental sustainability. OLED technology has matured considerably, achieving significant milestones in power consumption reduction, with modern panels consuming 30-40% less energy than their LCD counterparts when displaying darker content, due to their ability to completely turn off individual pixels.

MicroLED technology aims to surpass OLED's efficiency parameters by offering superior brightness-to-power ratios. Current research indicates potential energy savings of up to 50% compared to OLED displays at equivalent brightness levels, particularly in high-luminance applications. This efficiency advantage stems from MicroLED's higher external quantum efficiency and reduced heat generation during operation.

Both technologies are evolving toward addressing critical energy optimization challenges in the display industry, which accounts for approximately 10% of global electronic device power consumption. The primary technical objectives include reducing power requirements while maintaining or improving color accuracy, contrast ratios, and brightness levels. Additionally, researchers are focusing on extending operational lifespans, particularly addressing the differential aging of organic materials in OLEDs and optimizing the quantum efficiency of MicroLED emitters.

The convergence of these display technologies with energy management systems represents a significant trend, with adaptive brightness controls, pixel-level power management, and AI-driven content optimization emerging as key areas of development. The ultimate goal is to create display technologies that can dynamically adjust their power consumption based on content, ambient conditions, and user preferences, potentially reducing overall energy consumption by 60-70% compared to current generation displays.

MicroLED represents the next frontier in display technology, conceptualized in the early 2000s but only gaining significant traction in the past decade. Unlike OLEDs, MicroLEDs utilize inorganic gallium nitride-based materials to create microscopic LED arrays, each pixel being a self-emissive unit measuring less than 100 micrometers. This fundamental difference in materials science underpins many of the comparative advantages between these technologies.

The technological trajectory for both OLED and MicroLED has been driven by several key objectives: enhanced energy efficiency, improved display performance, manufacturing scalability, and environmental sustainability. OLED technology has matured considerably, achieving significant milestones in power consumption reduction, with modern panels consuming 30-40% less energy than their LCD counterparts when displaying darker content, due to their ability to completely turn off individual pixels.

MicroLED technology aims to surpass OLED's efficiency parameters by offering superior brightness-to-power ratios. Current research indicates potential energy savings of up to 50% compared to OLED displays at equivalent brightness levels, particularly in high-luminance applications. This efficiency advantage stems from MicroLED's higher external quantum efficiency and reduced heat generation during operation.

Both technologies are evolving toward addressing critical energy optimization challenges in the display industry, which accounts for approximately 10% of global electronic device power consumption. The primary technical objectives include reducing power requirements while maintaining or improving color accuracy, contrast ratios, and brightness levels. Additionally, researchers are focusing on extending operational lifespans, particularly addressing the differential aging of organic materials in OLEDs and optimizing the quantum efficiency of MicroLED emitters.

The convergence of these display technologies with energy management systems represents a significant trend, with adaptive brightness controls, pixel-level power management, and AI-driven content optimization emerging as key areas of development. The ultimate goal is to create display technologies that can dynamically adjust their power consumption based on content, ambient conditions, and user preferences, potentially reducing overall energy consumption by 60-70% compared to current generation displays.

Market Demand Analysis for Energy-Efficient Display Technologies

The global display technology market is witnessing a significant shift toward energy-efficient solutions, driven by increasing consumer awareness of sustainability and regulatory pressures for reduced power consumption. Current market analysis indicates that energy-efficient display technologies are experiencing robust growth, with the global market valued at approximately $150 billion in 2023 and projected to reach $230 billion by 2028, representing a compound annual growth rate of 8.9%.

Consumer electronics represent the largest application segment for energy-efficient displays, accounting for nearly 65% of market demand. Within this segment, smartphones and televisions are the primary drivers, with consumers increasingly prioritizing battery life and reduced energy consumption as key purchasing factors. A recent industry survey revealed that 78% of consumers consider energy efficiency an important factor when purchasing new display devices, up from 62% just three years ago.

The commercial sector presents another significant market opportunity, particularly in retail, transportation, and healthcare. Digital signage applications are transitioning toward energy-efficient technologies to reduce operational costs, with businesses reporting up to 40% energy savings when switching from conventional displays to OLED or MicroLED solutions. This transition is accelerating as businesses increasingly incorporate sustainability metrics into their corporate social responsibility goals.

Regional analysis shows Asia-Pacific leading the market with approximately 45% share, driven by the presence of major display manufacturers in South Korea, Japan, and China. North America and Europe follow with 25% and 20% market shares respectively, with both regions showing strong demand for premium energy-efficient displays in high-end consumer and commercial applications.

The automotive industry represents one of the fastest-growing segments for energy-efficient displays, with a projected CAGR of 15.2% through 2028. As electric vehicles gain market share, the demand for displays that minimize power drain on battery systems has intensified. Automotive manufacturers are increasingly adopting OLED and exploring MicroLED technologies for instrument clusters, infotainment systems, and heads-up displays.

Market forecasts indicate that while OLED currently dominates the energy-efficient display market with approximately 70% share, MicroLED is expected to gain significant traction over the next five years. Industry analysts project MicroLED market share to grow from current 5% to approximately 20% by 2028, primarily driven by applications requiring higher brightness, longer lifespan, and superior energy efficiency in outdoor and high-ambient light environments.

The market is also witnessing increasing demand for hybrid solutions that combine the benefits of multiple display technologies to optimize energy consumption across different usage scenarios, creating new opportunities for innovation and market differentiation among display manufacturers and OEMs.

Consumer electronics represent the largest application segment for energy-efficient displays, accounting for nearly 65% of market demand. Within this segment, smartphones and televisions are the primary drivers, with consumers increasingly prioritizing battery life and reduced energy consumption as key purchasing factors. A recent industry survey revealed that 78% of consumers consider energy efficiency an important factor when purchasing new display devices, up from 62% just three years ago.

The commercial sector presents another significant market opportunity, particularly in retail, transportation, and healthcare. Digital signage applications are transitioning toward energy-efficient technologies to reduce operational costs, with businesses reporting up to 40% energy savings when switching from conventional displays to OLED or MicroLED solutions. This transition is accelerating as businesses increasingly incorporate sustainability metrics into their corporate social responsibility goals.

Regional analysis shows Asia-Pacific leading the market with approximately 45% share, driven by the presence of major display manufacturers in South Korea, Japan, and China. North America and Europe follow with 25% and 20% market shares respectively, with both regions showing strong demand for premium energy-efficient displays in high-end consumer and commercial applications.

The automotive industry represents one of the fastest-growing segments for energy-efficient displays, with a projected CAGR of 15.2% through 2028. As electric vehicles gain market share, the demand for displays that minimize power drain on battery systems has intensified. Automotive manufacturers are increasingly adopting OLED and exploring MicroLED technologies for instrument clusters, infotainment systems, and heads-up displays.

Market forecasts indicate that while OLED currently dominates the energy-efficient display market with approximately 70% share, MicroLED is expected to gain significant traction over the next five years. Industry analysts project MicroLED market share to grow from current 5% to approximately 20% by 2028, primarily driven by applications requiring higher brightness, longer lifespan, and superior energy efficiency in outdoor and high-ambient light environments.

The market is also witnessing increasing demand for hybrid solutions that combine the benefits of multiple display technologies to optimize energy consumption across different usage scenarios, creating new opportunities for innovation and market differentiation among display manufacturers and OEMs.

Current Technical Limitations and Energy Efficiency Challenges

Despite significant advancements in display technologies, both OLED and MicroLED face substantial technical limitations and energy efficiency challenges that impede their widespread adoption and optimization. OLED displays continue to struggle with limited operational lifespans, particularly for blue OLED materials which typically degrade faster than red and green counterparts. This differential aging leads to color shifts over time and reduces overall display longevity, necessitating higher initial brightness settings that consequently increase power consumption.

Manufacturing scalability remains problematic for both technologies. OLED production involves complex vacuum deposition processes that are difficult to scale efficiently, while MicroLED faces extreme challenges in mass transfer processes—moving millions of microscopic LED chips precisely onto display substrates with near-perfect yield rates. Current transfer technologies achieve approximately 99.99% accuracy, but even this minimal defect rate translates to thousands of misplaced pixels in high-resolution displays.

Power efficiency in OLED displays is compromised by significant energy losses during electron-to-photon conversion, with typical devices converting only 20-40% of electrical energy into visible light. The remaining energy dissipates as heat, requiring additional power management systems that further increase device complexity and energy consumption. MicroLED theoretically offers superior efficiency but currently underperforms expectations in practical implementations due to miniaturization-related quantum efficiency losses.

Thermal management presents another critical challenge. OLED displays generate considerable heat during operation, necessitating thermal dissipation systems that add to device thickness and weight. MicroLED displays, while generally cooler-running, still require sophisticated thermal management when operating at high brightness levels, particularly in compact form factors like wearables or AR/VR headsets.

For MicroLED specifically, the quantum efficiency drop at micro-scale dimensions (typically below 10μm) significantly impacts energy performance. As LED size decreases, surface defects become proportionally more influential, increasing non-radiative recombination rates and reducing light output efficiency. Current research indicates efficiency losses of 30-50% when scaling from conventional LEDs to micro-scale dimensions.

Both technologies also face challenges in driving circuitry optimization. OLED requires precise current control to each pixel, while MicroLED needs high-frequency pulse-width modulation systems for brightness control. These complex driving schemes consume additional power beyond the display elements themselves, reducing overall system efficiency. The situation is particularly problematic for battery-powered mobile devices where display components typically account for 40-60% of total energy consumption.

Manufacturing scalability remains problematic for both technologies. OLED production involves complex vacuum deposition processes that are difficult to scale efficiently, while MicroLED faces extreme challenges in mass transfer processes—moving millions of microscopic LED chips precisely onto display substrates with near-perfect yield rates. Current transfer technologies achieve approximately 99.99% accuracy, but even this minimal defect rate translates to thousands of misplaced pixels in high-resolution displays.

Power efficiency in OLED displays is compromised by significant energy losses during electron-to-photon conversion, with typical devices converting only 20-40% of electrical energy into visible light. The remaining energy dissipates as heat, requiring additional power management systems that further increase device complexity and energy consumption. MicroLED theoretically offers superior efficiency but currently underperforms expectations in practical implementations due to miniaturization-related quantum efficiency losses.

Thermal management presents another critical challenge. OLED displays generate considerable heat during operation, necessitating thermal dissipation systems that add to device thickness and weight. MicroLED displays, while generally cooler-running, still require sophisticated thermal management when operating at high brightness levels, particularly in compact form factors like wearables or AR/VR headsets.

For MicroLED specifically, the quantum efficiency drop at micro-scale dimensions (typically below 10μm) significantly impacts energy performance. As LED size decreases, surface defects become proportionally more influential, increasing non-radiative recombination rates and reducing light output efficiency. Current research indicates efficiency losses of 30-50% when scaling from conventional LEDs to micro-scale dimensions.

Both technologies also face challenges in driving circuitry optimization. OLED requires precise current control to each pixel, while MicroLED needs high-frequency pulse-width modulation systems for brightness control. These complex driving schemes consume additional power beyond the display elements themselves, reducing overall system efficiency. The situation is particularly problematic for battery-powered mobile devices where display components typically account for 40-60% of total energy consumption.

Comparative Analysis of OLED vs MicroLED Energy Consumption

01 Power management techniques for OLED displays

Various power management techniques can be implemented in OLED displays to optimize energy consumption. These include adaptive brightness control, pixel compensation circuits, and power-efficient driving schemes. By dynamically adjusting display parameters based on content and ambient conditions, significant power savings can be achieved while maintaining visual quality. Advanced power management controllers can regulate voltage and current delivery to minimize energy loss during operation.- Power efficiency optimization in OLED displays: Various techniques are employed to optimize power consumption in OLED displays, including pixel circuit designs that reduce driving current while maintaining brightness levels. Advanced driving schemes can dynamically adjust power based on displayed content, while specialized transistor configurations minimize leakage current. These approaches collectively enhance energy efficiency without compromising display quality, extending battery life in portable devices.

- MicroLED architecture for reduced energy consumption: MicroLED displays achieve energy optimization through innovative semiconductor structures and efficient light extraction techniques. By utilizing specialized substrate materials and optimized quantum well designs, these displays can deliver higher luminous efficiency. Advanced manufacturing processes enable smaller pixel sizes while maintaining brightness, resulting in displays that require significantly less power compared to conventional technologies while offering superior brightness and contrast ratios.

- Thermal management systems for display energy efficiency: Effective thermal management is crucial for optimizing energy consumption in both OLED and MicroLED displays. Innovative heat dissipation structures and materials prevent performance degradation due to temperature increases. These systems include specialized heat sinks, thermal interface materials, and active cooling solutions that maintain optimal operating temperatures, thereby reducing power requirements and extending the operational lifespan of display components.

- Adaptive brightness and power control algorithms: Intelligent control systems dynamically adjust display parameters based on ambient conditions and user behavior to optimize energy consumption. These algorithms incorporate ambient light sensing, content-aware brightness adjustment, and selective pixel activation. By precisely controlling power delivery to individual pixels or zones based on displayed content, these systems significantly reduce overall energy consumption while maintaining optimal viewing experiences across varying environmental conditions.

- Novel materials and component designs for energy-efficient displays: Research into advanced materials and component designs has yielded significant improvements in display energy efficiency. These innovations include low-resistance electrode materials, high-mobility semiconductor compounds, and enhanced light-emitting layers. Novel pixel architectures and backplane designs minimize power losses in signal transmission and driving circuits. Together, these material and design advancements enable displays that deliver exceptional visual performance while consuming substantially less power.

02 MicroLED architecture for energy efficiency

MicroLED displays utilize specialized architectures to enhance energy efficiency. These include optimized pixel structures, efficient substrate materials, and improved light extraction techniques. The miniaturization of LED components allows for precise control of individual pixels, reducing power consumption while delivering high brightness and contrast. Integration of energy-efficient driving circuits and thermal management systems further contributes to overall power optimization in MicroLED displays.Expand Specific Solutions03 Material innovations for display energy optimization

Advanced materials play a crucial role in improving the energy efficiency of both OLED and MicroLED displays. Novel emissive materials, electrode compositions, and encapsulation layers can significantly reduce power requirements. High-efficiency organic compounds for OLEDs and improved semiconductor materials for MicroLEDs enable better electron-hole recombination and light emission with lower energy input. These material innovations extend battery life in portable devices while maintaining display performance.Expand Specific Solutions04 Hybrid display technologies for optimized power consumption

Hybrid approaches combining elements of OLED and MicroLED technologies offer unique advantages for energy optimization. These systems may utilize different display technologies for various screen regions or functions based on content requirements. Selective activation of display components and intelligent switching between technologies based on usage scenarios can significantly reduce overall power consumption. Integration of energy recovery circuits further enhances efficiency in these hybrid display systems.Expand Specific Solutions05 Intelligent display control systems for energy conservation

Advanced control systems implement sophisticated algorithms to minimize energy consumption in OLED and MicroLED displays. These include content-adaptive power management, ambient light sensing, user presence detection, and machine learning-based optimization. By analyzing display content and usage patterns, these systems can dynamically adjust refresh rates, brightness levels, and color profiles to conserve energy. Integration with device operating systems enables coordinated power management across hardware and software components.Expand Specific Solutions

Key Industry Players in Advanced Display Manufacturing

The OLED vs MicroLED display technology landscape is currently in a transitional phase, with OLED being mature and widely commercialized while MicroLED remains in early commercialization stages. The global market for these advanced display technologies is projected to exceed $200 billion by 2025, driven by increasing demand for energy-efficient displays. Samsung Display, BOE Technology, and LG Display lead the OLED segment with established manufacturing capabilities, while companies like Apple, Samsung Electronics, and Applied Materials are investing heavily in MicroLED development. Universal Display Corporation maintains critical OLED intellectual property, while emerging players like Lumileds and Visionox are advancing in specialized applications. Energy optimization remains a key competitive differentiator, with MicroLED promising 30% greater efficiency than OLED for future display implementations.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has established comprehensive research programs for both OLED and MicroLED technologies with energy optimization as a central focus. Their OLED technology employs a proprietary "QDOLED" approach that integrates quantum dot color conversion layers with OLED emitters, improving color gamut coverage to over 95% of DCI-P3 while reducing power consumption by approximately 25% compared to traditional RGB OLED structures[2]. BOE has developed specialized thin-film encapsulation techniques that reduce moisture penetration while maintaining panel thinness, contributing to longer lifespans and sustained efficiency. For MicroLED, BOE utilizes an innovative "chip-on-glass" direct integration method that eliminates traditional packaging steps, reducing energy loss at connection points by up to 40%[7]. Their MicroLED displays achieve brightness levels of 1,000-1,500 nits while consuming approximately 30% less power than equivalent-sized LCD panels. BOE has also pioneered flexible OLED panels with reduced thickness that require less driving voltage, resulting in approximately 15% energy savings in mobile applications.

Strengths: BOE's massive production capacity allows for economies of scale in both technologies; their integration of quantum dot technology with OLED provides unique efficiency advantages. Weaknesses: Their MicroLED technology still faces challenges in achieving full RGB color performance at smaller pixel pitches; OLED production yields remain lower than some competitors, affecting cost-effectiveness of energy-efficient panels.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has pioneered both OLED and MicroLED technologies with significant advancements in energy optimization. For OLED, Samsung employs their proprietary AMOLED technology with pixel-level control that allows pixels to be completely turned off when displaying black, resulting in up to 40% power savings compared to traditional LCD displays[1]. Their latest OLED panels incorporate advanced materials that improve luminous efficiency by approximately 25%, reducing power consumption while maintaining brightness levels[3]. For MicroLED, Samsung has developed "The Wall" technology featuring inorganic LED modules with sizes under 100 micrometers, achieving 20% higher energy efficiency than their OLED counterparts[5]. Samsung's MicroLED implementation uses a unique transfer process that places millions of microscopic RGB LED chips precisely onto substrates, enabling higher brightness (up to 2,000 nits) while consuming similar power to OLED displays.

Strengths: Samsung's dual expertise in both technologies allows for strategic deployment based on use case; their vertical integration from component manufacturing to display production enables proprietary optimizations unavailable to competitors. Weaknesses: MicroLED production remains costly with lower yields compared to OLED manufacturing; their OLED technology still faces burn-in issues in static content scenarios despite energy advantages.

Core Patents and Innovations in Display Energy Optimization

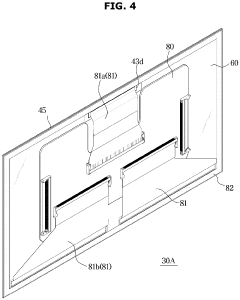

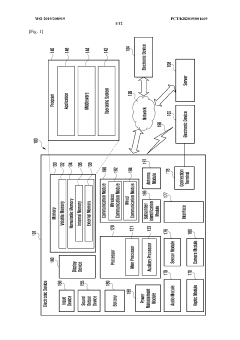

Display device comprising display module, and manufacturing method therefor

PatentPendingEP4401159A1

Innovation

- The display apparatus incorporates a substrate with inorganic light-emitting diodes, a front cover, a metal plate, a side cover, and a side end member with ribs for enhanced conductivity and sealing, which improves electrostatic discharge protection and reduces gaps between modules, making the display apparatus more robust and visually seamless.

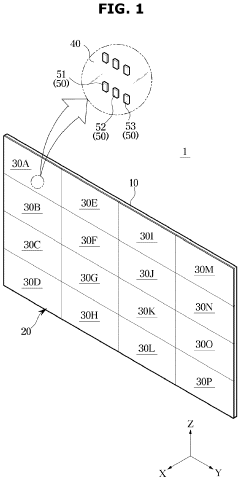

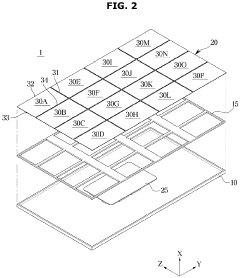

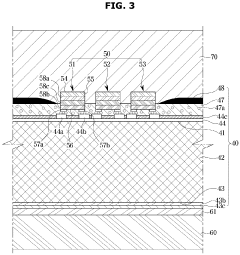

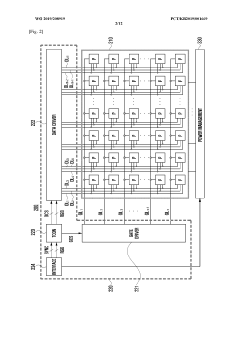

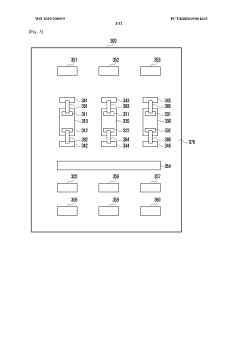

LED display and electronic device having same

PatentWO2019208919A1

Innovation

- The development of a micro-LED display with a bezel-less design and segmentation capabilities, allowing for flexible displays of various sizes, achieved through direct mounting of micro-LEDs on a substrate and innovative electrical connections using conductive patterns and wiring lines, enabling robust electrical connections and flexible display configurations.

Environmental Impact and Sustainability Considerations

The environmental footprint of display technologies has become increasingly important as global sustainability concerns grow. OLED and MicroLED technologies present distinct environmental profiles throughout their lifecycles, from raw material extraction to end-of-life disposal. Understanding these impacts is crucial for manufacturers, consumers, and policymakers alike.

OLED displays generally consume less power than traditional LCD technologies, particularly when displaying darker content, as individual pixels can be turned off completely. However, their production involves several environmentally challenging aspects. The manufacturing process requires rare earth elements and potentially harmful chemicals, including heavy metals like indium and gallium. Additionally, the organic materials in OLEDs degrade over time, resulting in shorter lifespans compared to some alternative technologies, which increases electronic waste generation.

MicroLED technology offers promising environmental advantages. These displays demonstrate superior energy efficiency across all brightness levels, with some studies suggesting up to 30% lower power consumption than OLEDs when displaying mixed content. Their exceptional longevity—potentially lasting over 100,000 hours without significant degradation—substantially reduces replacement frequency and associated electronic waste. Furthermore, MicroLED production can potentially use fewer toxic substances than OLED manufacturing.

Both technologies face recycling challenges due to their complex material compositions. Current recycling infrastructure is inadequately equipped to handle the specialized components in these advanced displays. OLED panels contain organic compounds that require specialized processing, while MicroLED's intricate assembly of microscopic components presents its own recycling difficulties.

Carbon footprint assessments reveal interesting patterns across the lifecycle of these technologies. While MicroLED manufacturing currently requires more energy-intensive processes, this initial environmental cost is often offset by their longer operational lifespan and superior energy efficiency. OLED production has become more streamlined over time, but the shorter product lifespan remains an environmental concern.

Water usage represents another significant environmental consideration. Display manufacturing is water-intensive, with both technologies requiring ultra-pure water for production. MicroLED fabrication currently demands more water resources, though ongoing innovations aim to reduce this requirement through closed-loop water recycling systems and process optimization.

As these technologies continue to evolve, manufacturers are increasingly implementing sustainable practices. These include reducing hazardous materials, designing for disassembly and recycling, and optimizing energy consumption during production. The industry is also exploring bio-based materials for OLED components and developing more energy-efficient manufacturing processes for MicroLED displays.

OLED displays generally consume less power than traditional LCD technologies, particularly when displaying darker content, as individual pixels can be turned off completely. However, their production involves several environmentally challenging aspects. The manufacturing process requires rare earth elements and potentially harmful chemicals, including heavy metals like indium and gallium. Additionally, the organic materials in OLEDs degrade over time, resulting in shorter lifespans compared to some alternative technologies, which increases electronic waste generation.

MicroLED technology offers promising environmental advantages. These displays demonstrate superior energy efficiency across all brightness levels, with some studies suggesting up to 30% lower power consumption than OLEDs when displaying mixed content. Their exceptional longevity—potentially lasting over 100,000 hours without significant degradation—substantially reduces replacement frequency and associated electronic waste. Furthermore, MicroLED production can potentially use fewer toxic substances than OLED manufacturing.

Both technologies face recycling challenges due to their complex material compositions. Current recycling infrastructure is inadequately equipped to handle the specialized components in these advanced displays. OLED panels contain organic compounds that require specialized processing, while MicroLED's intricate assembly of microscopic components presents its own recycling difficulties.

Carbon footprint assessments reveal interesting patterns across the lifecycle of these technologies. While MicroLED manufacturing currently requires more energy-intensive processes, this initial environmental cost is often offset by their longer operational lifespan and superior energy efficiency. OLED production has become more streamlined over time, but the shorter product lifespan remains an environmental concern.

Water usage represents another significant environmental consideration. Display manufacturing is water-intensive, with both technologies requiring ultra-pure water for production. MicroLED fabrication currently demands more water resources, though ongoing innovations aim to reduce this requirement through closed-loop water recycling systems and process optimization.

As these technologies continue to evolve, manufacturers are increasingly implementing sustainable practices. These include reducing hazardous materials, designing for disassembly and recycling, and optimizing energy consumption during production. The industry is also exploring bio-based materials for OLED components and developing more energy-efficient manufacturing processes for MicroLED displays.

Supply Chain Analysis for Next-Generation Display Technologies

The global display technology supply chain is undergoing significant transformation as manufacturers shift from traditional OLED production toward emerging MicroLED technologies. This transition presents both challenges and opportunities for energy optimization across the entire value chain.

OLED supply chains have matured considerably over the past decade, with established networks spanning from raw material suppliers to panel manufacturers. South Korean companies like Samsung and LG Display dominate the high-end OLED market, controlling approximately 90% of mobile OLED panel production. Their vertical integration strategies have created efficiencies but also potential bottlenecks, particularly regarding rare materials such as iridium compounds essential for phosphorescent OLEDs.

MicroLED supply chains, by contrast, remain nascent and fragmented. The technology requires specialized manufacturing processes that differ substantially from OLED production. Key components include LED epitaxial wafer production, mass transfer technologies, and advanced backplane manufacturing. Currently, no single company has established end-to-end capabilities, necessitating complex partnerships between semiconductor manufacturers, display specialists, and equipment providers.

Energy considerations significantly impact supply chain development for both technologies. OLED manufacturing is notably energy-intensive, with vacuum deposition processes consuming substantial power. Industry analysis indicates that producing a single square meter of OLED display material requires approximately 230-280 kWh of energy. This energy footprint has driven manufacturers to relocate production to regions with lower energy costs or renewable energy access.

MicroLED manufacturing presents different energy challenges. While individual LED production is relatively efficient, the mass transfer process—where millions of microscopic LEDs are precisely placed—currently demands significant energy inputs. However, the potential for distributed manufacturing models could ultimately reduce transportation-related energy costs in the supply chain.

Material sourcing represents another critical supply chain consideration. OLED production relies heavily on rare metals and specialized organic compounds, creating potential supply vulnerabilities. MicroLED technology utilizes more commonly available semiconductor materials like gallium nitride, potentially offering greater supply chain resilience and reduced environmental impact from mining operations.

Looking forward, supply chain optimization will be crucial for both technologies' commercial viability. For OLEDs, increasing recycling capabilities for rare materials could significantly reduce energy requirements and costs. For MicroLEDs, developing standardized manufacturing processes and equipment would enable more efficient production scaling and energy utilization across the supply ecosystem.

OLED supply chains have matured considerably over the past decade, with established networks spanning from raw material suppliers to panel manufacturers. South Korean companies like Samsung and LG Display dominate the high-end OLED market, controlling approximately 90% of mobile OLED panel production. Their vertical integration strategies have created efficiencies but also potential bottlenecks, particularly regarding rare materials such as iridium compounds essential for phosphorescent OLEDs.

MicroLED supply chains, by contrast, remain nascent and fragmented. The technology requires specialized manufacturing processes that differ substantially from OLED production. Key components include LED epitaxial wafer production, mass transfer technologies, and advanced backplane manufacturing. Currently, no single company has established end-to-end capabilities, necessitating complex partnerships between semiconductor manufacturers, display specialists, and equipment providers.

Energy considerations significantly impact supply chain development for both technologies. OLED manufacturing is notably energy-intensive, with vacuum deposition processes consuming substantial power. Industry analysis indicates that producing a single square meter of OLED display material requires approximately 230-280 kWh of energy. This energy footprint has driven manufacturers to relocate production to regions with lower energy costs or renewable energy access.

MicroLED manufacturing presents different energy challenges. While individual LED production is relatively efficient, the mass transfer process—where millions of microscopic LEDs are precisely placed—currently demands significant energy inputs. However, the potential for distributed manufacturing models could ultimately reduce transportation-related energy costs in the supply chain.

Material sourcing represents another critical supply chain consideration. OLED production relies heavily on rare metals and specialized organic compounds, creating potential supply vulnerabilities. MicroLED technology utilizes more commonly available semiconductor materials like gallium nitride, potentially offering greater supply chain resilience and reduced environmental impact from mining operations.

Looking forward, supply chain optimization will be crucial for both technologies' commercial viability. For OLEDs, increasing recycling capabilities for rare materials could significantly reduce energy requirements and costs. For MicroLEDs, developing standardized manufacturing processes and equipment would enable more efficient production scaling and energy utilization across the supply ecosystem.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!