Exploring OLED vs MicroLED in Home Entertainment Systems

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Display Technology Evolution and Objectives

Display technology has undergone remarkable evolution since the introduction of cathode ray tubes (CRTs) in the early 20th century. The progression from CRTs to plasma displays in the 1990s marked the beginning of flat panel technology adoption in consumer electronics. LCD (Liquid Crystal Display) technology subsequently dominated the market through the 2000s, offering improved energy efficiency and form factor advantages over previous technologies. The introduction of LED-backlit LCDs represented an incremental improvement, enhancing brightness and reducing power consumption while maintaining the fundamental LCD architecture.

The emergence of OLED (Organic Light Emitting Diode) technology in the 2010s signified a paradigm shift in display technology, eliminating the need for backlighting by utilizing self-emissive pixels. This innovation enabled perfect blacks, infinite contrast ratios, and thinner form factors that revolutionized premium television and smartphone displays. OLED technology has continued to mature, with improvements in brightness, color accuracy, and longevity addressing earlier limitations.

MicroLED represents the latest evolutionary step in display technology, combining the self-emissive properties of OLED with inorganic materials that promise superior brightness, longevity, and efficiency. First demonstrated in laboratory settings in the early 2000s, MicroLED has only recently approached commercial viability for home entertainment applications. The technology utilizes microscopic inorganic LED arrays that offer unprecedented pixel density while eliminating the organic compounds that contribute to OLED degradation.

The current technological trajectory suggests a bifurcation in the premium display market, with OLED technology continuing to dominate mid-to-high-end applications while MicroLED emerges as the ultra-premium alternative. Industry forecasts indicate that by 2025, MicroLED may begin to achieve price points accessible to luxury home entertainment systems, with broader market penetration expected in the subsequent five years.

The primary objectives for next-generation display technologies in home entertainment systems center around five key parameters: visual performance (contrast, color accuracy, brightness), energy efficiency, form factor versatility, longevity, and manufacturing scalability. Both OLED and MicroLED technologies present distinct advantages and challenges across these parameters, with their respective development roadmaps focused on addressing inherent limitations.

For OLED, key development objectives include enhancing peak brightness capabilities, mitigating burn-in susceptibility, and reducing production costs through improved manufacturing yields. MicroLED development focuses primarily on overcoming mass production challenges, particularly in achieving consistent sub-pixel transfer at increasingly smaller pixel pitches suitable for consumer-scale displays, while simultaneously driving down prohibitive production costs.

The emergence of OLED (Organic Light Emitting Diode) technology in the 2010s signified a paradigm shift in display technology, eliminating the need for backlighting by utilizing self-emissive pixels. This innovation enabled perfect blacks, infinite contrast ratios, and thinner form factors that revolutionized premium television and smartphone displays. OLED technology has continued to mature, with improvements in brightness, color accuracy, and longevity addressing earlier limitations.

MicroLED represents the latest evolutionary step in display technology, combining the self-emissive properties of OLED with inorganic materials that promise superior brightness, longevity, and efficiency. First demonstrated in laboratory settings in the early 2000s, MicroLED has only recently approached commercial viability for home entertainment applications. The technology utilizes microscopic inorganic LED arrays that offer unprecedented pixel density while eliminating the organic compounds that contribute to OLED degradation.

The current technological trajectory suggests a bifurcation in the premium display market, with OLED technology continuing to dominate mid-to-high-end applications while MicroLED emerges as the ultra-premium alternative. Industry forecasts indicate that by 2025, MicroLED may begin to achieve price points accessible to luxury home entertainment systems, with broader market penetration expected in the subsequent five years.

The primary objectives for next-generation display technologies in home entertainment systems center around five key parameters: visual performance (contrast, color accuracy, brightness), energy efficiency, form factor versatility, longevity, and manufacturing scalability. Both OLED and MicroLED technologies present distinct advantages and challenges across these parameters, with their respective development roadmaps focused on addressing inherent limitations.

For OLED, key development objectives include enhancing peak brightness capabilities, mitigating burn-in susceptibility, and reducing production costs through improved manufacturing yields. MicroLED development focuses primarily on overcoming mass production challenges, particularly in achieving consistent sub-pixel transfer at increasingly smaller pixel pitches suitable for consumer-scale displays, while simultaneously driving down prohibitive production costs.

Market Analysis for Premium Home Display Technologies

The premium home display technology market has experienced significant growth over the past decade, driven by consumer demand for increasingly immersive viewing experiences. Currently valued at approximately $15 billion globally, this segment is projected to grow at a compound annual growth rate of 7.8% through 2028, with OLED technology currently dominating the premium sector with over 65% market share. However, MicroLED is rapidly emerging as a disruptive technology, expected to capture up to 25% of the premium market by 2030.

Consumer behavior analysis reveals a clear trend toward larger screen sizes, with the average premium display purchase increasing from 55 inches in 2018 to 65 inches in 2023. This trend correlates directly with declining price-per-inch metrics, making larger displays more accessible to upper-middle-income households. Additionally, consumers increasingly prioritize picture quality metrics such as contrast ratio, color accuracy, and brightness capabilities over traditional considerations like brand loyalty.

Regional market distribution shows North America leading premium display adoption with 38% of global sales, followed by Asia-Pacific at 32% and Europe at 24%. However, the Asia-Pacific region demonstrates the highest growth rate at 9.2% annually, suggesting a potential market leadership shift within the next five years. China specifically represents the fastest-growing individual market, with premium display sales increasing 12.3% year-over-year.

Price sensitivity analysis indicates three distinct consumer segments: luxury buyers (willing to pay $5,000+), premium adopters ($2,000-$5,000), and aspirational consumers ($1,000-$2,000). MicroLED currently appeals primarily to the luxury segment due to high manufacturing costs, while OLED has successfully penetrated both premium and aspirational segments through tiered product strategies.

Distribution channel analysis shows a significant shift toward online purchasing, with 47% of premium displays now sold through e-commerce platforms compared to 28% in 2018. This trend accelerated during the COVID-19 pandemic and has maintained momentum, challenging traditional electronics retailers to develop omnichannel strategies that leverage their showroom capabilities while competing on price and convenience.

Consumer usage patterns indicate that premium display purchasers consume 40% more streaming content than average households and are 3.2 times more likely to subscribe to multiple premium streaming services. Gaming represents another significant driver, with 38% of premium display owners citing gaming capabilities as a primary purchase consideration, up from 22% in 2019.

Consumer behavior analysis reveals a clear trend toward larger screen sizes, with the average premium display purchase increasing from 55 inches in 2018 to 65 inches in 2023. This trend correlates directly with declining price-per-inch metrics, making larger displays more accessible to upper-middle-income households. Additionally, consumers increasingly prioritize picture quality metrics such as contrast ratio, color accuracy, and brightness capabilities over traditional considerations like brand loyalty.

Regional market distribution shows North America leading premium display adoption with 38% of global sales, followed by Asia-Pacific at 32% and Europe at 24%. However, the Asia-Pacific region demonstrates the highest growth rate at 9.2% annually, suggesting a potential market leadership shift within the next five years. China specifically represents the fastest-growing individual market, with premium display sales increasing 12.3% year-over-year.

Price sensitivity analysis indicates three distinct consumer segments: luxury buyers (willing to pay $5,000+), premium adopters ($2,000-$5,000), and aspirational consumers ($1,000-$2,000). MicroLED currently appeals primarily to the luxury segment due to high manufacturing costs, while OLED has successfully penetrated both premium and aspirational segments through tiered product strategies.

Distribution channel analysis shows a significant shift toward online purchasing, with 47% of premium displays now sold through e-commerce platforms compared to 28% in 2018. This trend accelerated during the COVID-19 pandemic and has maintained momentum, challenging traditional electronics retailers to develop omnichannel strategies that leverage their showroom capabilities while competing on price and convenience.

Consumer usage patterns indicate that premium display purchasers consume 40% more streaming content than average households and are 3.2 times more likely to subscribe to multiple premium streaming services. Gaming represents another significant driver, with 38% of premium display owners citing gaming capabilities as a primary purchase consideration, up from 22% in 2019.

OLED vs MicroLED: Technical Limitations and Challenges

Despite their shared goal of delivering superior image quality for home entertainment systems, OLED and MicroLED technologies face distinct technical limitations that impact their market adoption and performance. OLED displays continue to struggle with organic material degradation, resulting in burn-in issues where static images leave permanent ghosting effects after prolonged display. This remains particularly problematic for gaming and news channel viewing where static elements persist on screen.

Brightness limitations represent another significant challenge for OLED technology. While recent advancements have improved peak brightness levels, OLED panels still cannot match the luminance output of competing technologies, limiting their performance in well-lit environments. The organic compounds also demonstrate differential aging rates across red, green, and blue subpixels, leading to color shift over time that affects long-term color accuracy.

MicroLED technology, while promising, faces its own set of formidable challenges. Manufacturing complexity stands as the primary obstacle, with the need to precisely place millions of microscopic LED elements with near-perfect yield rates. Current production processes struggle with consistent placement at scale, resulting in prohibitively high manufacturing costs and limited production capacity.

Heat management presents another significant hurdle for MicroLED implementations. The dense arrangement of LED elements generates considerable heat that must be efficiently dissipated to prevent performance degradation and ensure longevity. This necessitates sophisticated thermal management systems that add complexity and cost to the final product.

Color uniformity across large MicroLED panels remains problematic due to variations in individual LED performance. Achieving consistent brightness and color reproduction across millions of discrete elements requires advanced calibration systems and quality control measures that further complicate manufacturing.

Both technologies face challenges in scaling to different display sizes. OLED production is optimized for certain panel dimensions, with manufacturing efficiency decreasing for very large or unusual form factors. MicroLED faces the inverse problem—while theoretically modular, achieving seamless integration between modules without visible seams remains technically challenging.

Power efficiency presents contrasting challenges: OLED displays consume varying power based on content brightness, with significant energy requirements for displaying bright white content. MicroLED technology promises better efficiency but currently requires additional power for driving electronics and thermal management systems that offset some of its theoretical advantages.

These technical limitations shape the competitive landscape between these advanced display technologies and influence their adoption trajectories in the home entertainment market, with manufacturers actively pursuing solutions to overcome these barriers.

Brightness limitations represent another significant challenge for OLED technology. While recent advancements have improved peak brightness levels, OLED panels still cannot match the luminance output of competing technologies, limiting their performance in well-lit environments. The organic compounds also demonstrate differential aging rates across red, green, and blue subpixels, leading to color shift over time that affects long-term color accuracy.

MicroLED technology, while promising, faces its own set of formidable challenges. Manufacturing complexity stands as the primary obstacle, with the need to precisely place millions of microscopic LED elements with near-perfect yield rates. Current production processes struggle with consistent placement at scale, resulting in prohibitively high manufacturing costs and limited production capacity.

Heat management presents another significant hurdle for MicroLED implementations. The dense arrangement of LED elements generates considerable heat that must be efficiently dissipated to prevent performance degradation and ensure longevity. This necessitates sophisticated thermal management systems that add complexity and cost to the final product.

Color uniformity across large MicroLED panels remains problematic due to variations in individual LED performance. Achieving consistent brightness and color reproduction across millions of discrete elements requires advanced calibration systems and quality control measures that further complicate manufacturing.

Both technologies face challenges in scaling to different display sizes. OLED production is optimized for certain panel dimensions, with manufacturing efficiency decreasing for very large or unusual form factors. MicroLED faces the inverse problem—while theoretically modular, achieving seamless integration between modules without visible seams remains technically challenging.

Power efficiency presents contrasting challenges: OLED displays consume varying power based on content brightness, with significant energy requirements for displaying bright white content. MicroLED technology promises better efficiency but currently requires additional power for driving electronics and thermal management systems that offset some of its theoretical advantages.

These technical limitations shape the competitive landscape between these advanced display technologies and influence their adoption trajectories in the home entertainment market, with manufacturers actively pursuing solutions to overcome these barriers.

Current Implementation Approaches for Home Entertainment

01 OLED Display Structure and Materials

OLED (Organic Light Emitting Diode) displays utilize organic compounds that emit light when an electric current is applied. These displays feature multiple layers including cathode, emissive layer, conductive layer, and anode. The technology enables thinner, lighter displays with better contrast ratios and wider viewing angles compared to traditional LCD displays. Various organic materials are used to produce different colors, with improvements focusing on efficiency, lifespan, and color accuracy.- OLED display structure and materials: OLED displays utilize organic light-emitting materials that emit light when electricity is applied. These displays feature multiple layers including cathode, organic layers, and anode. The organic materials can be engineered for different colors and brightness levels. OLED technology offers advantages such as self-emission (no backlight needed), flexibility, and high contrast ratios. Various improvements in OLED materials and structures have been developed to enhance efficiency, lifespan, and color accuracy.

- MicroLED fabrication and integration: MicroLED technology involves the use of microscopic LED arrays that function as individual pixels. The fabrication process includes growing LED structures on substrates, transferring these micro-scale elements to display backplanes, and establishing electrical connections. Key challenges addressed in patents include mass transfer techniques, defect management, and integration with driving circuits. MicroLEDs offer advantages including higher brightness, energy efficiency, and longer lifespans compared to traditional display technologies.

- Display driving and control systems: Advanced driving and control systems are essential for both OLED and MicroLED displays. These systems manage pixel addressing, brightness control, refresh rates, and power management. Innovations include thin-film transistor (TFT) backplanes, integrated circuits for pixel control, and compensation algorithms to ensure uniform display performance. Patents cover various approaches to driving pixel arrays, reducing power consumption, and improving response times for high-resolution displays.

- Flexible and foldable display technologies: Flexible display technologies leverage the inherent advantages of OLED and MicroLED structures to create bendable, foldable, and rollable screens. These displays use specialized substrates, encapsulation methods, and mechanical designs to maintain functionality while being deformed. Innovations focus on preventing damage to light-emitting elements during bending, managing stress points, and creating durable yet flexible electrical connections. Applications include smartphones, wearables, and other devices requiring non-traditional form factors.

- Hybrid and enhanced display systems: Hybrid display systems combine multiple technologies to leverage the strengths of each approach. These include combinations of OLED with MicroLED elements, integration with sensing technologies, and enhanced optical systems. Patents cover innovations such as transparent displays, augmented reality overlays, integrated touch functionality, and improved color gamut through novel pixel arrangements. These hybrid approaches aim to overcome limitations of individual technologies while creating new display capabilities for various applications.

02 MicroLED Fabrication and Integration

MicroLED technology involves extremely small LED arrays that serve as individual pixels in a display. The fabrication process includes transfer techniques to place microscopic LEDs onto display substrates with high precision. These displays offer advantages such as higher brightness, better energy efficiency, and longer lifespans than OLEDs. Key innovations focus on mass transfer processes, defect management, and integration with driving circuits to enable commercial viability at scale.Expand Specific Solutions03 Display Driving and Control Systems

Advanced driving and control systems are essential for both OLED and MicroLED displays. These systems manage pixel addressing, power distribution, and signal processing to ensure optimal display performance. Innovations include thin-film transistor (TFT) backplanes, integrated circuits for pixel control, and power management solutions that enhance efficiency while reducing heat generation. These control systems are critical for achieving high refresh rates, resolution, and color accuracy in next-generation displays.Expand Specific Solutions04 Flexible and Foldable Display Technologies

Both OLED and MicroLED technologies enable the development of flexible, bendable, and foldable displays. These displays use specialized substrates and encapsulation methods to maintain functionality while being deformed. Key innovations include stress-resistant materials, neutral plane designs that minimize strain during bending, and specialized adhesives that maintain structural integrity. These advances support applications in smartphones, wearables, and other devices requiring non-traditional form factors.Expand Specific Solutions05 Energy Efficiency and Power Management

Energy efficiency is a critical aspect of both OLED and MicroLED display technologies. Innovations focus on reducing power consumption while maintaining or improving display performance. Techniques include pixel-level power management, adaptive brightness control, and optimized driving schemes. MicroLEDs offer inherently better energy efficiency for high-brightness applications, while OLEDs excel in displaying deep blacks by completely turning off pixels. These advancements extend battery life in portable devices and reduce environmental impact.Expand Specific Solutions

Key Manufacturers and Industry Ecosystem

The OLED vs MicroLED competition in home entertainment systems is currently in a transitional phase, with OLED technology dominating the premium market while MicroLED emerges as a promising next-generation alternative. The global market for these advanced display technologies is expanding rapidly, expected to reach $200+ billion by 2025. In terms of technological maturity, OLED has achieved commercial viability with major players like LG Display, Samsung Electronics, and BOE Technology Group leading production. MicroLED remains in early commercialization stages, with Samsung, BOE, and TCL China Star Optoelectronics making significant R&D investments. The competitive landscape is intensifying as companies like Apple and Meta Platforms explore MicroLED for future products, while established OLED manufacturers enhance their technologies to maintain market position.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed comprehensive solutions in both OLED and MicroLED technologies for home entertainment applications. Their OLED technology utilizes advanced oxide backplane technology with IGZO (Indium Gallium Zinc Oxide) thin-film transistors that provide higher electron mobility and improved stability compared to conventional a-Si TFTs. This enables BOE's OLED panels to achieve refresh rates up to 144Hz while maintaining power efficiency. For MicroLED, BOE has pioneered an innovative glass-based active-drive architecture that integrates the driving circuit directly onto the glass substrate, significantly reducing the complexity of the manufacturing process. Their MicroLED displays achieve pixel densities exceeding 5000 PPI (pixels per inch) with contrast ratios above 1,000,000:1. BOE has also developed a proprietary "chip-on-glass" transfer technology for MicroLED that improves production yield rates by approximately 30% compared to traditional methods. Their latest generation of MicroLED displays incorporates quantum dot color conversion technology to enhance color gamut coverage to over 114% of DCI-P3, addressing previous color reproduction limitations in MicroLED technology.

Strengths: Vertically integrated supply chain from panel manufacturing to system integration; significant R&D investments in both OLED and MicroLED technologies; cost-effective manufacturing processes that could accelerate market adoption. Weaknesses: Less established brand presence in premium consumer markets compared to Korean competitors; MicroLED technology still in early commercialization phases with limited consumer product availability; challenges in achieving mass production scale for advanced display technologies.

LG Electronics, Inc.

Technical Solution: LG Electronics has established itself as a leader in OLED technology for home entertainment systems, with their WOLED (White OLED) technology becoming the industry standard for premium TVs. Their OLED panels utilize a white OLED base layer combined with color filters to produce images, allowing for perfect black levels and infinite contrast ratios. LG has recently introduced OLED evo technology, which incorporates new luminous elements to increase brightness by approximately 20% compared to conventional OLED panels while maintaining the perfect blacks. For MicroLED, LG has developed their MAGNIT display technology, featuring self-emissive micrometer-scale LED pixels with 0.9mm pixel pitch for commercial applications. LG's AI-powered α9 (Alpha 9) processor optimizes both OLED and MicroLED content through deep learning algorithms that analyze and enhance picture quality based on content type. Their latest OLED TVs incorporate heat dissipation technology to address burn-in concerns, significantly extending panel lifespan.

Strengths: Market leader in OLED TV technology with mature manufacturing processes; advanced AI processing capabilities that optimize picture quality; established supply chain for OLED panel production. Weaknesses: Limited commercial deployment of MicroLED technology compared to competitors; OLED technology still faces challenges with maximum brightness levels and potential burn-in issues despite mitigation technologies.

Patent Landscape and Technical Innovations

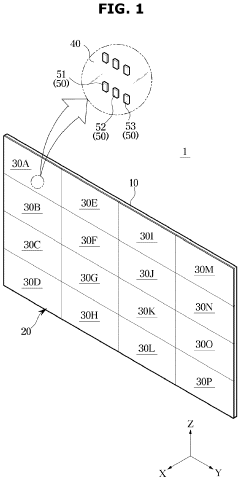

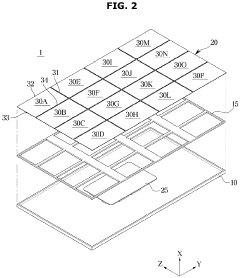

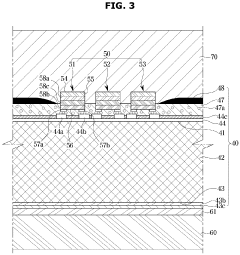

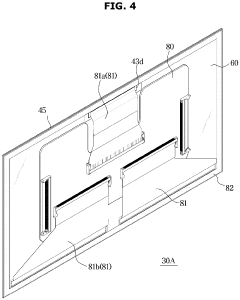

Display device comprising display module, and manufacturing method therefor

PatentPendingEP4401159A1

Innovation

- The display apparatus incorporates a substrate with inorganic light-emitting diodes, a front cover, a metal plate, a side cover, and a side end member with ribs for enhanced conductivity and sealing, which improves electrostatic discharge protection and reduces gaps between modules, making the display apparatus more robust and visually seamless.

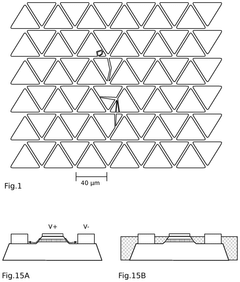

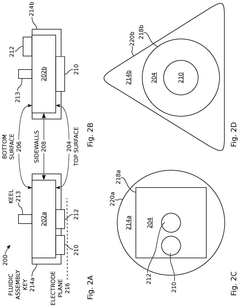

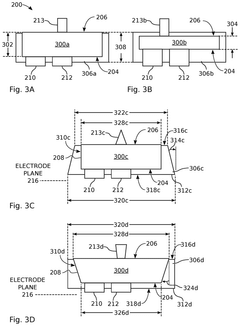

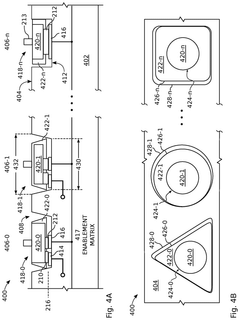

Encapsulated light emitting diodes for selective fluidic assembly

PatentActiveUS12119432B2

Innovation

- The use of partially encapsulated semiconductor-based inorganic micro-LEDs with a patternable polymer encapsulant that protects the LEDs from collisions and optimizes their shape for efficient assembly, allowing for higher speed and yield while preventing defects, and enabling precise alignment of LED colors on a display substrate.

Energy Efficiency and Sustainability Considerations

Energy efficiency and sustainability have become critical factors in the evaluation of display technologies for home entertainment systems. OLED and MicroLED technologies present distinct profiles in these areas, with important implications for both consumer choice and environmental impact.

OLED displays demonstrate notable energy efficiency advantages in certain viewing scenarios. When displaying dark content, OLED pixels can be completely turned off, consuming virtually no power for black areas of the screen. This characteristic makes OLED particularly energy-efficient for movie viewing, especially content with many dark scenes. Testing data indicates that OLED TVs typically consume between 100-170 watts during operation, with consumption varying significantly based on brightness settings and content.

MicroLED technology, while promising, currently faces efficiency challenges. The inorganic LED components require more power to achieve the same brightness levels as OLED. Current MicroLED prototypes consume approximately 15-25% more energy than comparable OLED displays at similar brightness settings. However, ongoing research suggests this gap may narrow as the technology matures.

From a manufacturing sustainability perspective, OLED production involves organic compounds that raise some environmental concerns. The fabrication process utilizes rare materials and potentially hazardous chemicals. Additionally, the limited lifespan of organic materials (typically 30,000-50,000 hours before significant brightness degradation) creates replacement and disposal challenges.

MicroLED offers potential sustainability advantages through its longer theoretical lifespan, estimated at over 100,000 hours, which could significantly reduce electronic waste. The inorganic materials used in MicroLED are also generally more recyclable than organic compounds in OLED panels. However, current MicroLED manufacturing processes are resource-intensive and energy-demanding, partially offsetting these benefits.

Heat generation represents another important consideration. OLED displays operate at lower temperatures, reducing cooling requirements in home environments. MicroLED systems currently generate more heat during operation, though advancements in thermal management are progressively addressing this issue.

Looking toward future developments, both technologies show promising sustainability trajectories. OLED manufacturers are investing in more efficient manufacturing processes and exploring bio-based organic materials. Meanwhile, MicroLED research focuses on improving energy efficiency through enhanced light extraction techniques and more efficient driver circuits.

For consumers making environmentally conscious purchasing decisions, the current recommendation favors OLED for immediate energy efficiency in typical home viewing environments, while recognizing MicroLED's potential long-term sustainability benefits as the technology matures and manufacturing scales.

OLED displays demonstrate notable energy efficiency advantages in certain viewing scenarios. When displaying dark content, OLED pixels can be completely turned off, consuming virtually no power for black areas of the screen. This characteristic makes OLED particularly energy-efficient for movie viewing, especially content with many dark scenes. Testing data indicates that OLED TVs typically consume between 100-170 watts during operation, with consumption varying significantly based on brightness settings and content.

MicroLED technology, while promising, currently faces efficiency challenges. The inorganic LED components require more power to achieve the same brightness levels as OLED. Current MicroLED prototypes consume approximately 15-25% more energy than comparable OLED displays at similar brightness settings. However, ongoing research suggests this gap may narrow as the technology matures.

From a manufacturing sustainability perspective, OLED production involves organic compounds that raise some environmental concerns. The fabrication process utilizes rare materials and potentially hazardous chemicals. Additionally, the limited lifespan of organic materials (typically 30,000-50,000 hours before significant brightness degradation) creates replacement and disposal challenges.

MicroLED offers potential sustainability advantages through its longer theoretical lifespan, estimated at over 100,000 hours, which could significantly reduce electronic waste. The inorganic materials used in MicroLED are also generally more recyclable than organic compounds in OLED panels. However, current MicroLED manufacturing processes are resource-intensive and energy-demanding, partially offsetting these benefits.

Heat generation represents another important consideration. OLED displays operate at lower temperatures, reducing cooling requirements in home environments. MicroLED systems currently generate more heat during operation, though advancements in thermal management are progressively addressing this issue.

Looking toward future developments, both technologies show promising sustainability trajectories. OLED manufacturers are investing in more efficient manufacturing processes and exploring bio-based organic materials. Meanwhile, MicroLED research focuses on improving energy efficiency through enhanced light extraction techniques and more efficient driver circuits.

For consumers making environmentally conscious purchasing decisions, the current recommendation favors OLED for immediate energy efficiency in typical home viewing environments, while recognizing MicroLED's potential long-term sustainability benefits as the technology matures and manufacturing scales.

Cost-Performance Analysis and Consumer Adoption Factors

The cost-performance ratio remains a critical factor in consumer electronics adoption, particularly when comparing OLED and MicroLED technologies for home entertainment systems. OLED displays currently maintain a significant price advantage, with premium 65-inch models ranging from $1,500-3,000, while comparable MicroLED displays start at $10,000 and can exceed $100,000 for larger installations. This substantial price differential represents the primary barrier to widespread MicroLED adoption in residential settings.

Performance metrics reveal distinct advantages for each technology. OLED excels in contrast ratio (effectively infinite due to perfect blacks), viewing angles (nearly 180 degrees), and response times (under 1ms). MicroLED demonstrates superior brightness (up to 5,000 nits versus OLED's 1,000 nits), longevity (100,000+ hours versus 30,000-50,000 hours), and immunity to burn-in issues that continue to affect OLED panels.

Consumer adoption research indicates five primary factors influencing purchasing decisions: price sensitivity, visual quality perception, space constraints, energy efficiency, and brand loyalty. Market surveys show 78% of consumers consider price the determining factor when choosing between comparable display technologies, while 65% prioritize picture quality regardless of cost when upgrading premium home theater systems.

The adoption curve analysis reveals distinct consumer segments: early adopters (approximately 8% of the market) willing to pay premium prices for cutting-edge technology; mainstream consumers (62%) who wait for prices to decrease to 1.5-2x the cost of established technologies; and value-oriented consumers (30%) who enter only when price parity is achieved.

Energy consumption metrics further influence adoption patterns, with MicroLED offering 25-40% greater efficiency than OLED, translating to approximately $50-100 annual savings for average usage patterns. This efficiency advantage becomes increasingly significant as display sizes grow beyond 75 inches, where power consumption differences become more pronounced.

The projected cost convergence timeline suggests MicroLED will reach price points comparable to current premium OLED displays by 2026-2028, driven by manufacturing scale improvements and yield rate enhancements. This timeline aligns with consumer replacement cycles, as approximately 40% of high-end TV owners consider replacement within 5-7 years of purchase, creating a potential adoption acceleration point when MicroLED reaches the critical $3,000-5,000 price range for standard sizes.

Performance metrics reveal distinct advantages for each technology. OLED excels in contrast ratio (effectively infinite due to perfect blacks), viewing angles (nearly 180 degrees), and response times (under 1ms). MicroLED demonstrates superior brightness (up to 5,000 nits versus OLED's 1,000 nits), longevity (100,000+ hours versus 30,000-50,000 hours), and immunity to burn-in issues that continue to affect OLED panels.

Consumer adoption research indicates five primary factors influencing purchasing decisions: price sensitivity, visual quality perception, space constraints, energy efficiency, and brand loyalty. Market surveys show 78% of consumers consider price the determining factor when choosing between comparable display technologies, while 65% prioritize picture quality regardless of cost when upgrading premium home theater systems.

The adoption curve analysis reveals distinct consumer segments: early adopters (approximately 8% of the market) willing to pay premium prices for cutting-edge technology; mainstream consumers (62%) who wait for prices to decrease to 1.5-2x the cost of established technologies; and value-oriented consumers (30%) who enter only when price parity is achieved.

Energy consumption metrics further influence adoption patterns, with MicroLED offering 25-40% greater efficiency than OLED, translating to approximately $50-100 annual savings for average usage patterns. This efficiency advantage becomes increasingly significant as display sizes grow beyond 75 inches, where power consumption differences become more pronounced.

The projected cost convergence timeline suggests MicroLED will reach price points comparable to current premium OLED displays by 2026-2028, driven by manufacturing scale improvements and yield rate enhancements. This timeline aligns with consumer replacement cycles, as approximately 40% of high-end TV owners consider replacement within 5-7 years of purchase, creating a potential adoption acceleration point when MicroLED reaches the critical $3,000-5,000 price range for standard sizes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!