Optimize Diesel Particulate Filter for Fuel Economy

SEP 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DPF Technology Background and Optimization Goals

Diesel Particulate Filters (DPFs) emerged in the 1980s as a response to increasingly stringent emission regulations targeting particulate matter from diesel engines. The technology has evolved significantly over the past four decades, transitioning from simple ceramic monolith structures to advanced systems incorporating multiple filtration mechanisms and regeneration strategies. Initially designed solely for emissions compliance, modern DPFs must now balance regulatory requirements with fuel economy considerations, creating a complex engineering challenge.

The evolution of DPF technology has been characterized by improvements in filter substrate materials, moving from cordierite to silicon carbide and aluminum titanate for enhanced thermal durability and reduced backpressure. Parallel developments in catalyst coatings have enabled passive regeneration at lower temperatures, reducing the frequency of active regeneration events that typically consume additional fuel.

Current DPF systems face a fundamental trade-off between filtration efficiency and backpressure. Higher filtration efficiency generally results in increased backpressure, which negatively impacts engine performance and fuel economy. This relationship has driven research toward optimizing pore structure, wall thickness, and channel geometry to minimize flow restriction while maintaining particulate capture efficiency.

The primary goal of DPF optimization for fuel economy is to reduce the parasitic losses associated with exhaust backpressure while maintaining compliance with emissions regulations. Studies indicate that poorly optimized DPF systems can increase fuel consumption by 2-5%, representing a significant operational cost over a vehicle's lifetime. Secondary optimization goals include reducing the frequency and duration of active regeneration events, which typically require post-injection of fuel and can increase consumption by up to 3% during the regeneration process.

Recent technological trends point toward integrated emission control systems that combine DPFs with selective catalytic reduction (SCR) and other aftertreatment components to achieve synergistic effects. These integrated systems aim to optimize the overall performance of the exhaust aftertreatment system rather than focusing on individual components in isolation.

The optimization of DPFs for fuel economy must also consider the entire vehicle duty cycle, as the impact of backpressure varies significantly with engine load and speed. This necessitates a holistic approach to DPF design that accounts for real-world operating conditions rather than focusing solely on standardized test cycles.

Looking forward, the industry trajectory suggests continued refinement of DPF technology with increased focus on predictive control strategies, advanced materials, and geometric optimizations that can further reduce the fuel economy penalty while meeting increasingly stringent emission standards across global markets.

The evolution of DPF technology has been characterized by improvements in filter substrate materials, moving from cordierite to silicon carbide and aluminum titanate for enhanced thermal durability and reduced backpressure. Parallel developments in catalyst coatings have enabled passive regeneration at lower temperatures, reducing the frequency of active regeneration events that typically consume additional fuel.

Current DPF systems face a fundamental trade-off between filtration efficiency and backpressure. Higher filtration efficiency generally results in increased backpressure, which negatively impacts engine performance and fuel economy. This relationship has driven research toward optimizing pore structure, wall thickness, and channel geometry to minimize flow restriction while maintaining particulate capture efficiency.

The primary goal of DPF optimization for fuel economy is to reduce the parasitic losses associated with exhaust backpressure while maintaining compliance with emissions regulations. Studies indicate that poorly optimized DPF systems can increase fuel consumption by 2-5%, representing a significant operational cost over a vehicle's lifetime. Secondary optimization goals include reducing the frequency and duration of active regeneration events, which typically require post-injection of fuel and can increase consumption by up to 3% during the regeneration process.

Recent technological trends point toward integrated emission control systems that combine DPFs with selective catalytic reduction (SCR) and other aftertreatment components to achieve synergistic effects. These integrated systems aim to optimize the overall performance of the exhaust aftertreatment system rather than focusing on individual components in isolation.

The optimization of DPFs for fuel economy must also consider the entire vehicle duty cycle, as the impact of backpressure varies significantly with engine load and speed. This necessitates a holistic approach to DPF design that accounts for real-world operating conditions rather than focusing solely on standardized test cycles.

Looking forward, the industry trajectory suggests continued refinement of DPF technology with increased focus on predictive control strategies, advanced materials, and geometric optimizations that can further reduce the fuel economy penalty while meeting increasingly stringent emission standards across global markets.

Market Demand Analysis for Fuel-Efficient DPF Systems

The global market for fuel-efficient Diesel Particulate Filter (DPF) systems has experienced significant growth driven by increasingly stringent emission regulations and the automotive industry's focus on improving fuel economy. Current market valuation for advanced DPF systems stands at approximately 12 billion USD, with projections indicating a compound annual growth rate of 8.3% through 2028.

Primary market demand stems from commercial vehicle manufacturers seeking to comply with Euro 6/VI, China VI, and US EPA emission standards while minimizing the fuel economy penalties traditionally associated with DPF systems. Fleet operators represent another substantial market segment, as fuel costs typically constitute 30-40% of their operational expenses. Even a 2-3% improvement in fuel efficiency through optimized DPF systems translates to considerable cost savings over vehicle lifetimes.

Regional analysis reveals Europe as the dominant market for fuel-efficient DPF systems, accounting for 38% of global demand, followed by North America (27%) and Asia-Pacific (25%). The fastest growth is occurring in emerging markets like India and Brazil, where tightening emission regulations are creating new demand centers with projected growth rates exceeding 12% annually.

Market research indicates three distinct customer segments with varying priorities: premium commercial vehicle manufacturers focusing on performance optimization, mass-market manufacturers seeking cost-effective compliance solutions, and aftermarket customers requiring retrofit options with demonstrable fuel savings. Each segment presents unique requirements and price sensitivities that influence product development strategies.

Industry surveys reveal that customers are willing to pay a premium of 15-20% for DPF systems that can demonstrate a 5% or greater improvement in fuel economy compared to conventional systems. This price elasticity creates significant market opportunities for innovative solutions that effectively balance filtration efficiency with reduced backpressure.

The market landscape is further shaped by the increasing adoption of predictive maintenance systems and telematics integration, with 67% of fleet operators expressing interest in DPF systems that provide real-time performance data and optimize regeneration cycles based on actual driving conditions rather than fixed intervals.

Long-term market trends indicate growing demand for multi-functional filtration systems that simultaneously address particulate matter, NOx, and CO2 emissions while minimizing fuel penalties. This convergence of emission control and fuel efficiency represents the highest-value market segment, with potential to command premium pricing and establish technological leadership in the increasingly competitive automotive supplier ecosystem.

Primary market demand stems from commercial vehicle manufacturers seeking to comply with Euro 6/VI, China VI, and US EPA emission standards while minimizing the fuel economy penalties traditionally associated with DPF systems. Fleet operators represent another substantial market segment, as fuel costs typically constitute 30-40% of their operational expenses. Even a 2-3% improvement in fuel efficiency through optimized DPF systems translates to considerable cost savings over vehicle lifetimes.

Regional analysis reveals Europe as the dominant market for fuel-efficient DPF systems, accounting for 38% of global demand, followed by North America (27%) and Asia-Pacific (25%). The fastest growth is occurring in emerging markets like India and Brazil, where tightening emission regulations are creating new demand centers with projected growth rates exceeding 12% annually.

Market research indicates three distinct customer segments with varying priorities: premium commercial vehicle manufacturers focusing on performance optimization, mass-market manufacturers seeking cost-effective compliance solutions, and aftermarket customers requiring retrofit options with demonstrable fuel savings. Each segment presents unique requirements and price sensitivities that influence product development strategies.

Industry surveys reveal that customers are willing to pay a premium of 15-20% for DPF systems that can demonstrate a 5% or greater improvement in fuel economy compared to conventional systems. This price elasticity creates significant market opportunities for innovative solutions that effectively balance filtration efficiency with reduced backpressure.

The market landscape is further shaped by the increasing adoption of predictive maintenance systems and telematics integration, with 67% of fleet operators expressing interest in DPF systems that provide real-time performance data and optimize regeneration cycles based on actual driving conditions rather than fixed intervals.

Long-term market trends indicate growing demand for multi-functional filtration systems that simultaneously address particulate matter, NOx, and CO2 emissions while minimizing fuel penalties. This convergence of emission control and fuel efficiency represents the highest-value market segment, with potential to command premium pricing and establish technological leadership in the increasingly competitive automotive supplier ecosystem.

Current DPF Technology Challenges and Limitations

Despite significant advancements in Diesel Particulate Filter (DPF) technology over the past two decades, several critical challenges and limitations persist that directly impact fuel economy. The fundamental design conflict remains: while DPFs must effectively capture particulate matter (PM) to meet increasingly stringent emissions regulations, the resulting backpressure creates additional load on the engine, increasing fuel consumption by 2-5% under normal operating conditions.

Current substrate materials, predominantly cordierite and silicon carbide, present an ongoing compromise between thermal durability and pressure drop characteristics. Silicon carbide offers superior thermal properties but typically generates higher backpressure than cordierite alternatives, creating a technical dilemma for manufacturers seeking optimal fuel efficiency.

Filter loading dynamics represent another significant challenge. As soot accumulates within the DPF, backpressure increases progressively, creating a variable negative impact on fuel economy throughout the operational cycle. This variability complicates engine calibration efforts and often results in conservative approaches that prioritize emissions compliance over fuel efficiency optimization.

Regeneration strategies continue to pose substantial challenges for fuel economy. Active regeneration events, necessary to oxidize accumulated soot, typically require additional fuel injection to raise exhaust temperatures, directly increasing fuel consumption by 2-8% depending on regeneration frequency and duration. The timing and frequency of these events remain difficult to optimize across diverse driving conditions.

Thermal management inefficiencies further compound these challenges. Current DPF systems often experience significant heat loss during operation and regeneration, requiring additional energy input to maintain optimal temperatures. This thermal inefficiency translates directly to increased fuel consumption, particularly in cold-start and low-load driving scenarios.

Sensor technology limitations also impact DPF performance optimization. Current pressure and temperature sensors lack the precision and reliability needed for truly adaptive regeneration strategies, often resulting in premature or delayed regeneration events that negatively impact fuel economy.

Integration challenges with other aftertreatment components (SCR systems, DOCs) create system-level inefficiencies. The positioning and thermal interactions between these components frequently result in suboptimal thermal management and increased system backpressure, both detrimental to fuel economy.

Manufacturing constraints continue to limit innovation in filter geometry and channel design. While advanced asymmetric channel designs and variable cell density configurations have demonstrated potential for reducing backpressure while maintaining filtration efficiency, production scalability and cost considerations have restricted widespread implementation of these promising technologies.

Current substrate materials, predominantly cordierite and silicon carbide, present an ongoing compromise between thermal durability and pressure drop characteristics. Silicon carbide offers superior thermal properties but typically generates higher backpressure than cordierite alternatives, creating a technical dilemma for manufacturers seeking optimal fuel efficiency.

Filter loading dynamics represent another significant challenge. As soot accumulates within the DPF, backpressure increases progressively, creating a variable negative impact on fuel economy throughout the operational cycle. This variability complicates engine calibration efforts and often results in conservative approaches that prioritize emissions compliance over fuel efficiency optimization.

Regeneration strategies continue to pose substantial challenges for fuel economy. Active regeneration events, necessary to oxidize accumulated soot, typically require additional fuel injection to raise exhaust temperatures, directly increasing fuel consumption by 2-8% depending on regeneration frequency and duration. The timing and frequency of these events remain difficult to optimize across diverse driving conditions.

Thermal management inefficiencies further compound these challenges. Current DPF systems often experience significant heat loss during operation and regeneration, requiring additional energy input to maintain optimal temperatures. This thermal inefficiency translates directly to increased fuel consumption, particularly in cold-start and low-load driving scenarios.

Sensor technology limitations also impact DPF performance optimization. Current pressure and temperature sensors lack the precision and reliability needed for truly adaptive regeneration strategies, often resulting in premature or delayed regeneration events that negatively impact fuel economy.

Integration challenges with other aftertreatment components (SCR systems, DOCs) create system-level inefficiencies. The positioning and thermal interactions between these components frequently result in suboptimal thermal management and increased system backpressure, both detrimental to fuel economy.

Manufacturing constraints continue to limit innovation in filter geometry and channel design. While advanced asymmetric channel designs and variable cell density configurations have demonstrated potential for reducing backpressure while maintaining filtration efficiency, production scalability and cost considerations have restricted widespread implementation of these promising technologies.

Current DPF Optimization Solutions

01 Regeneration strategies for DPF to improve fuel economy

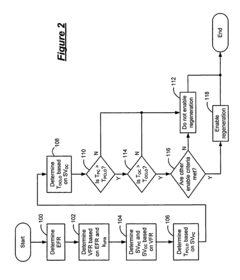

Various regeneration strategies can be employed to improve the fuel economy of vehicles equipped with diesel particulate filters (DPF). These strategies include optimizing the timing and duration of regeneration cycles, using advanced control algorithms to determine the optimal regeneration conditions, and implementing passive regeneration techniques that utilize exhaust heat. Effective regeneration management reduces the frequency of active regeneration events, which typically consume additional fuel, thereby improving overall fuel economy.- Regeneration strategies for DPF to improve fuel economy: Various regeneration strategies can be employed to improve the fuel economy of vehicles equipped with diesel particulate filters (DPF). These strategies include optimizing the timing and frequency of regeneration cycles, controlling the temperature during regeneration, and implementing advanced control algorithms. Proper regeneration management helps reduce the fuel penalty associated with DPF systems by minimizing unnecessary regeneration events and optimizing the combustion process during regeneration.

- Fuel additives to enhance DPF performance and fuel economy: Specialized fuel additives can be incorporated into diesel fuel to improve the efficiency of diesel particulate filters and enhance overall fuel economy. These additives can lower the soot combustion temperature, facilitate more complete regeneration, reduce ash accumulation, and improve the combustion process. By optimizing the DPF operation through chemical means, these additives help maintain filter performance while minimizing the fuel consumption impact of the filtration system.

- Advanced DPF design and materials for reduced backpressure: Innovative designs and materials for diesel particulate filters can significantly reduce exhaust backpressure, which directly impacts fuel economy. These advancements include optimized filter cell structures, improved substrate materials, enhanced catalyst coatings, and novel filter geometries. By minimizing the restriction to exhaust flow while maintaining high filtration efficiency, these design improvements help reduce the fuel consumption penalty typically associated with DPF systems.

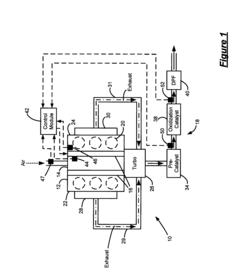

- Integration of DPF with other emission control systems: Integrating diesel particulate filters with other emission control systems, such as selective catalytic reduction (SCR) or diesel oxidation catalysts (DOC), can optimize overall system performance and fuel economy. These integrated systems allow for more efficient thermal management, reduced system complexity, and improved coordination between different emission control components. By sharing resources and optimizing the operation of the entire exhaust aftertreatment system, this integration approach helps minimize the fuel economy impact of emission control technologies.

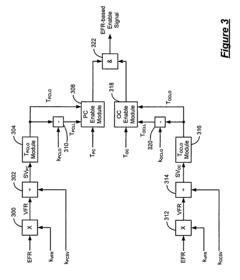

- Engine control strategies to optimize DPF operation and fuel efficiency: Advanced engine control strategies can be implemented to optimize the operation of diesel particulate filters while maintaining or improving fuel efficiency. These strategies include precise fuel injection control, exhaust gas recirculation (EGR) management, turbocharger control, and adaptive engine calibration based on DPF loading conditions. By adjusting engine parameters in response to DPF status, these control approaches help balance the competing demands of emission control and fuel economy.

02 Fuel additives to enhance DPF performance and fuel efficiency

Specialized fuel additives can be incorporated into diesel fuel to improve the performance of diesel particulate filters and enhance fuel economy. These additives can lower the soot combustion temperature, facilitate more complete combustion, reduce the accumulation of particulate matter in the filter, and decrease the frequency of regeneration cycles. By optimizing the combustion process and reducing the need for frequent regeneration, these additives contribute to improved fuel efficiency in vehicles equipped with DPF systems.Expand Specific Solutions03 Advanced DPF design and materials for reduced back pressure

Innovative designs and materials for diesel particulate filters can significantly reduce exhaust back pressure, which is a major contributor to decreased fuel economy in diesel vehicles. These advancements include optimized filter cell structures, improved substrate materials with enhanced porosity, and novel catalyst coatings that promote more efficient particulate matter oxidation. By minimizing the restriction to exhaust flow while maintaining high filtration efficiency, these design improvements help maintain engine performance and fuel economy.Expand Specific Solutions04 Integrated exhaust aftertreatment systems for fuel efficiency

Integrated exhaust aftertreatment systems combine diesel particulate filters with other emission control technologies, such as selective catalytic reduction (SCR) and diesel oxidation catalysts (DOC), to optimize overall system performance and fuel efficiency. These integrated systems enable more efficient thermal management, reduce system complexity, and allow for coordinated control strategies that minimize the fuel economy penalty associated with emission control. The synergistic operation of multiple aftertreatment components can significantly improve fuel efficiency compared to standalone DPF systems.Expand Specific Solutions05 Advanced control strategies and sensors for DPF management

Sophisticated control strategies and sensor technologies play a crucial role in optimizing diesel particulate filter operation for improved fuel economy. These include predictive algorithms that anticipate regeneration needs based on driving conditions, real-time soot load monitoring sensors, and adaptive control systems that adjust engine parameters to minimize the fuel consumption associated with DPF maintenance. By precisely controlling the DPF regeneration process and integrating it with overall engine management, these advanced control strategies help maximize fuel efficiency while maintaining effective particulate filtration.Expand Specific Solutions

Key Industry Players in DPF Development

The diesel particulate filter (DPF) optimization market is currently in a growth phase, with increasing regulatory pressure driving innovation for fuel economy improvements. The global market size is expanding, projected to reach significant value as automotive manufacturers seek to meet stringent emission standards while maintaining performance. Technology maturity varies across players, with established automotive giants like GM, Ford, Stellantis, and Hyundai leading commercial implementation. Specialized companies such as Johnson Matthey, Corning, and Lubrizol are advancing material science solutions, while research institutions like IFP Energies Nouvelles and Rutgers University contribute fundamental innovations. European manufacturers (Peugeot, Renault, Volvo) demonstrate advanced DPF technologies, reflecting the region's early adoption of strict emissions regulations, while Asian players like DENSO are rapidly closing technological gaps.

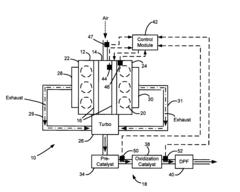

GM Global Technology Operations LLC

Technical Solution: GM has developed a multi-faceted DPF optimization strategy focused on system-level integration and intelligent control algorithms to maximize fuel economy. Their approach includes dynamic regeneration management that uses machine learning algorithms to predict optimal regeneration timing based on historical driving patterns, current conditions, and filter loading status[7]. This predictive capability minimizes unnecessary regeneration events that consume excess fuel. GM's system incorporates variable geometry turbocharging coordinated with DPF management to optimize exhaust temperature and flow characteristics across different engine operating conditions. Their technology also features closed-loop combustion control that dynamically adjusts injection parameters to minimize soot production while maintaining power output, thereby reducing the regeneration frequency requirement. Additionally, GM has implemented selective cylinder deactivation during regeneration events to maintain optimal exhaust temperatures while minimizing fuel consumption[8]. The system also includes intelligent thermal management that leverages waste heat recovery to assist in passive regeneration, further reducing the fuel economy penalty associated with active regeneration events.

Strengths: Holistic integration with powertrain systems allows for coordinated optimization across multiple vehicle subsystems. Their predictive algorithms adapt to individual driving patterns over time, continuously improving efficiency. Weaknesses: System complexity requires sophisticated onboard computing capabilities and extensive calibration. Benefits may be less pronounced in consistently low-load driving conditions where passive regeneration is challenging.

Ford Global Technologies LLC

Technical Solution: Ford has developed an advanced DPF optimization system that integrates multiple strategies to enhance fuel economy while maintaining emission control. Their approach includes active regeneration timing optimization that uses predictive algorithms to determine the most fuel-efficient timing for filter regeneration based on driving conditions and filter loading[1]. Ford's system incorporates variable flow exhaust gas recirculation (EGR) that dynamically adjusts based on engine load and temperature to minimize particulate formation while optimizing combustion efficiency. Additionally, they've implemented intelligent thermal management that precisely controls exhaust temperatures to ensure efficient passive regeneration during normal driving conditions, reducing the need for fuel-consuming active regeneration events[2]. Ford's technology also features advanced pressure drop monitoring with predictive maintenance capabilities that can detect early signs of filter clogging and optimize cleaning cycles accordingly.

Strengths: Comprehensive integration with vehicle systems allows for holistic optimization across various driving conditions. Their predictive regeneration timing significantly reduces fuel penalties associated with DPF cleaning. Weaknesses: System complexity requires sophisticated sensors and control systems that increase initial costs. Performance benefits may vary significantly depending on driving patterns and conditions.

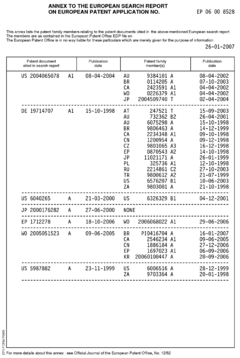

Core DPF Regeneration Technologies

Optimization of hydrocarbon injection during diesel particulate filter (DPF) regeneration

PatentInactiveUS7784275B2

Innovation

- A diesel engine system that determines a light-off temperature based on exhaust flow rate and selectively generates an enable signal for DPF regeneration using catalyst temperatures, ensuring accurate regeneration initiation regardless of operating conditions.

Diesel particulate filter

PatentInactiveEP1716913A3

Innovation

- A diesel particulate filter with a catalyst layer containing a Ce-Zr mixed oxide and a rare earth element, such as La or Nd, in specific mole ratios, which enhances particulate burning rates and thermal resistance, allowing for efficient particulate burning even without catalytic metals, thereby improving fuel economy and maintaining performance over time.

Emissions Regulations Impact on DPF Development

Emissions regulations have been the primary driving force behind the evolution of Diesel Particulate Filter (DPF) technology since its introduction. The regulatory landscape has undergone significant transformation over the past two decades, with increasingly stringent standards being implemented across major markets worldwide.

The European Union has been at the forefront with its Euro emissions standards, progressing from Euro 4 to the current Euro 6d, with each iteration demanding substantial reductions in particulate matter (PM) and nitrogen oxide (NOx) emissions. Similarly, the United States EPA has implemented Tier 3 standards, while China has adopted China 6 regulations. These frameworks have collectively pushed manufacturers to develop more efficient DPF systems.

Regulatory focus has shifted from simply controlling the mass of particulate emissions to also addressing particle number, particularly ultrafine particles that pose significant health risks. This shift has necessitated more sophisticated filtration technologies capable of capturing smaller particles while maintaining acceptable backpressure levels.

The trade-off between emissions control and fuel economy presents a significant regulatory challenge. As DPF systems become more effective at capturing particulates, they often create higher backpressure in the exhaust system, which can increase fuel consumption by 2-5% depending on the system design and regeneration strategy.

Regulatory bodies have recognized this challenge, implementing a more holistic approach that considers the entire emissions-fuel economy relationship. The World Harmonized Light Vehicles Test Procedure (WLTP) and Real Driving Emissions (RDE) tests now provide a more realistic assessment of vehicle performance, encouraging manufacturers to optimize DPF systems for both emissions compliance and fuel efficiency.

Future regulatory trends indicate even tighter emissions controls, with Euro 7 standards expected to further reduce allowable particulate emissions while simultaneously demanding improvements in CO2 emissions (directly related to fuel economy). This dual pressure is accelerating innovation in DPF technology, particularly in areas such as advanced substrate materials, catalyst formulations, and intelligent regeneration strategies.

The regulatory environment has also begun to acknowledge the importance of the entire lifecycle of emissions control systems. Newer regulations are starting to address the environmental impact of manufacturing, using, and disposing of DPF systems, creating additional considerations for manufacturers seeking to optimize these components for both regulatory compliance and market competitiveness.

The European Union has been at the forefront with its Euro emissions standards, progressing from Euro 4 to the current Euro 6d, with each iteration demanding substantial reductions in particulate matter (PM) and nitrogen oxide (NOx) emissions. Similarly, the United States EPA has implemented Tier 3 standards, while China has adopted China 6 regulations. These frameworks have collectively pushed manufacturers to develop more efficient DPF systems.

Regulatory focus has shifted from simply controlling the mass of particulate emissions to also addressing particle number, particularly ultrafine particles that pose significant health risks. This shift has necessitated more sophisticated filtration technologies capable of capturing smaller particles while maintaining acceptable backpressure levels.

The trade-off between emissions control and fuel economy presents a significant regulatory challenge. As DPF systems become more effective at capturing particulates, they often create higher backpressure in the exhaust system, which can increase fuel consumption by 2-5% depending on the system design and regeneration strategy.

Regulatory bodies have recognized this challenge, implementing a more holistic approach that considers the entire emissions-fuel economy relationship. The World Harmonized Light Vehicles Test Procedure (WLTP) and Real Driving Emissions (RDE) tests now provide a more realistic assessment of vehicle performance, encouraging manufacturers to optimize DPF systems for both emissions compliance and fuel efficiency.

Future regulatory trends indicate even tighter emissions controls, with Euro 7 standards expected to further reduce allowable particulate emissions while simultaneously demanding improvements in CO2 emissions (directly related to fuel economy). This dual pressure is accelerating innovation in DPF technology, particularly in areas such as advanced substrate materials, catalyst formulations, and intelligent regeneration strategies.

The regulatory environment has also begun to acknowledge the importance of the entire lifecycle of emissions control systems. Newer regulations are starting to address the environmental impact of manufacturing, using, and disposing of DPF systems, creating additional considerations for manufacturers seeking to optimize these components for both regulatory compliance and market competitiveness.

Total Cost of Ownership Analysis for Advanced DPF Systems

When evaluating the economic viability of advanced Diesel Particulate Filter (DPF) systems, Total Cost of Ownership (TCO) analysis provides a comprehensive framework that extends beyond initial acquisition costs. This analysis encompasses the complete financial impact throughout the system's lifecycle, offering stakeholders a holistic view of their investment.

The initial capital expenditure for advanced DPF systems typically ranges from $1,500 to $5,000 depending on vehicle class and system sophistication. While these upfront costs may exceed those of conventional systems by 15-30%, the long-term economic benefits often justify this premium investment.

Operational expenses constitute a significant portion of TCO, with fuel consumption being the primary factor. Advanced DPF systems designed for fuel economy optimization demonstrate 2-4% improved fuel efficiency compared to standard models. For a commercial fleet operating at 100,000 miles annually, this translates to approximately $1,200-$2,400 in annual fuel savings per vehicle, based on current diesel prices.

Maintenance costs represent another critical TCO component. Optimized DPF systems require less frequent regeneration cycles, reducing downtime and extending service intervals by up to 25%. The average annual maintenance cost reduction ranges from $300-$800 per vehicle, with additional savings from decreased vehicle downtime estimated at $150-$450 per day avoided.

System longevity significantly impacts TCO calculations. Advanced DPF systems designed for fuel economy typically demonstrate 20-30% longer operational lifespans, postponing replacement costs and improving return on investment. The extended service life represents approximately $1,000-$2,500 in amortized annual savings.

Regulatory compliance costs must also be factored into TCO analysis. Advanced DPF systems meeting stringent emissions standards help operators avoid non-compliance penalties, which can range from $2,000 to $15,000 per violation. Additionally, some jurisdictions offer tax incentives or subsidies for adopting fuel-efficient technologies, potentially offsetting 10-20% of initial system costs.

Resale value considerations complete the TCO picture. Vehicles equipped with advanced fuel-optimized DPF systems typically command 5-10% higher resale values, representing $1,000-$3,000 in retained value for medium-duty commercial vehicles at the end of a five-year ownership period.

Comprehensive TCO analysis reveals that despite higher initial investment, fuel-optimized DPF systems typically achieve break-even within 18-24 months of operation, with net positive returns throughout the remaining service life. Fleet operators can expect 15-25% lower lifetime costs compared to conventional DPF systems, making them economically advantageous for most commercial applications.

The initial capital expenditure for advanced DPF systems typically ranges from $1,500 to $5,000 depending on vehicle class and system sophistication. While these upfront costs may exceed those of conventional systems by 15-30%, the long-term economic benefits often justify this premium investment.

Operational expenses constitute a significant portion of TCO, with fuel consumption being the primary factor. Advanced DPF systems designed for fuel economy optimization demonstrate 2-4% improved fuel efficiency compared to standard models. For a commercial fleet operating at 100,000 miles annually, this translates to approximately $1,200-$2,400 in annual fuel savings per vehicle, based on current diesel prices.

Maintenance costs represent another critical TCO component. Optimized DPF systems require less frequent regeneration cycles, reducing downtime and extending service intervals by up to 25%. The average annual maintenance cost reduction ranges from $300-$800 per vehicle, with additional savings from decreased vehicle downtime estimated at $150-$450 per day avoided.

System longevity significantly impacts TCO calculations. Advanced DPF systems designed for fuel economy typically demonstrate 20-30% longer operational lifespans, postponing replacement costs and improving return on investment. The extended service life represents approximately $1,000-$2,500 in amortized annual savings.

Regulatory compliance costs must also be factored into TCO analysis. Advanced DPF systems meeting stringent emissions standards help operators avoid non-compliance penalties, which can range from $2,000 to $15,000 per violation. Additionally, some jurisdictions offer tax incentives or subsidies for adopting fuel-efficient technologies, potentially offsetting 10-20% of initial system costs.

Resale value considerations complete the TCO picture. Vehicles equipped with advanced fuel-optimized DPF systems typically command 5-10% higher resale values, representing $1,000-$3,000 in retained value for medium-duty commercial vehicles at the end of a five-year ownership period.

Comprehensive TCO analysis reveals that despite higher initial investment, fuel-optimized DPF systems typically achieve break-even within 18-24 months of operation, with net positive returns throughout the remaining service life. Fleet operators can expect 15-25% lower lifetime costs compared to conventional DPF systems, making them economically advantageous for most commercial applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!