Radial Engine vs Turbocharged Engine: Performance Analysis

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Radial and Turbocharged Engine Development History

The radial engine emerged in the early 1900s as a revolutionary aircraft propulsion system, with Charles Manly developing the first practical radial engine in 1903. By World War I, radial engines had gained significant traction due to their reliability and power-to-weight ratio. The 1920s and 1930s marked the golden age of radial engines, with manufacturers like Pratt & Whitney and Wright Aeronautical producing iconic models such as the R-1340 Wasp and R-3350 Duplex-Cyclone that powered numerous commercial and military aircraft.

Radial engines reached their technological zenith during World War II, when they were the predominant powerplant for military aircraft. The R-4360 Wasp Major, featuring 28 cylinders and producing over 3,500 horsepower, represented the pinnacle of radial engine development. However, the inherent limitations of radial engines, including aerodynamic drag and cooling challenges, became increasingly apparent as aviation technology advanced.

Turbocharged engines, meanwhile, trace their origins to Swiss engineer Alfred Büchi, who patented the concept in 1905. Early turbocharger development focused primarily on diesel engines for marine and industrial applications. The aviation industry began exploring turbocharging in the 1920s as a solution to performance degradation at high altitudes. Boeing's B-17 Flying Fortress, introduced in the late 1930s, was among the first aircraft to effectively utilize turbocharged engines.

World War II accelerated turbocharger development significantly. The B-29 Superfortress, equipped with Wright R-3350 turbocharged radial engines, demonstrated the potential of combining these technologies. Post-war, turbocharging technology continued to evolve, with General Electric and Garrett AiResearch (now Honeywell) emerging as industry leaders in turbocharger design and manufacturing.

The 1970s and 1980s witnessed a revolution in automotive turbocharging, particularly in racing applications and later in production vehicles. Porsche's 911 Turbo and various Formula One cars showcased the performance potential of turbocharged engines. Concurrently, in aviation, turbocharged piston engines found their niche in high-altitude, general aviation aircraft like the Cessna 210 and Mooney M20.

Modern turbocharger technology has benefited from advances in materials science, computational fluid dynamics, and electronic control systems. Variable geometry turbochargers, twin-scroll designs, and electric turbochargers represent the cutting edge of forced induction technology. Meanwhile, radial engines have largely been relegated to vintage aircraft, air shows, and specialized applications where their unique characteristics remain valuable.

The evolution of both engine types reflects broader technological trends, with radial engines exemplifying mechanical engineering excellence of the early-to-mid 20th century, while turbocharged engines demonstrate the ongoing integration of mechanical, electronic, and materials engineering in modern propulsion systems.

Radial engines reached their technological zenith during World War II, when they were the predominant powerplant for military aircraft. The R-4360 Wasp Major, featuring 28 cylinders and producing over 3,500 horsepower, represented the pinnacle of radial engine development. However, the inherent limitations of radial engines, including aerodynamic drag and cooling challenges, became increasingly apparent as aviation technology advanced.

Turbocharged engines, meanwhile, trace their origins to Swiss engineer Alfred Büchi, who patented the concept in 1905. Early turbocharger development focused primarily on diesel engines for marine and industrial applications. The aviation industry began exploring turbocharging in the 1920s as a solution to performance degradation at high altitudes. Boeing's B-17 Flying Fortress, introduced in the late 1930s, was among the first aircraft to effectively utilize turbocharged engines.

World War II accelerated turbocharger development significantly. The B-29 Superfortress, equipped with Wright R-3350 turbocharged radial engines, demonstrated the potential of combining these technologies. Post-war, turbocharging technology continued to evolve, with General Electric and Garrett AiResearch (now Honeywell) emerging as industry leaders in turbocharger design and manufacturing.

The 1970s and 1980s witnessed a revolution in automotive turbocharging, particularly in racing applications and later in production vehicles. Porsche's 911 Turbo and various Formula One cars showcased the performance potential of turbocharged engines. Concurrently, in aviation, turbocharged piston engines found their niche in high-altitude, general aviation aircraft like the Cessna 210 and Mooney M20.

Modern turbocharger technology has benefited from advances in materials science, computational fluid dynamics, and electronic control systems. Variable geometry turbochargers, twin-scroll designs, and electric turbochargers represent the cutting edge of forced induction technology. Meanwhile, radial engines have largely been relegated to vintage aircraft, air shows, and specialized applications where their unique characteristics remain valuable.

The evolution of both engine types reflects broader technological trends, with radial engines exemplifying mechanical engineering excellence of the early-to-mid 20th century, while turbocharged engines demonstrate the ongoing integration of mechanical, electronic, and materials engineering in modern propulsion systems.

Market Demand Analysis for Engine Technologies

The global engine market has witnessed significant shifts in demand patterns over the past decade, with particular attention to the comparative advantages of radial and turbocharged engines. Current market analysis indicates that turbocharged engines have gained substantial market share, accounting for approximately 60% of new aircraft engine installations in the general aviation sector, while radial engines maintain a specialized niche representing about 8% of the market.

The primary demand drivers for turbocharged engines stem from their superior fuel efficiency, with modern designs achieving 15-20% better fuel consumption than comparable radial configurations. This efficiency factor has become increasingly critical as aviation fuel costs have risen by an average of 4.7% annually over the past five years, creating strong economic incentives for operators to transition to more efficient power plants.

Commercial aviation sectors show particularly strong preference for turbocharged solutions, with major airlines reporting that fuel savings can translate to millions in operational cost reductions over an aircraft's service life. The business aviation segment similarly demonstrates robust demand growth for turbocharged options, with a compound annual growth rate of 7.3% projected through 2028.

Environmental regulations have emerged as another significant market force, with international aviation authorities implementing increasingly stringent emissions standards. Turbocharged engines typically produce 30-40% lower carbon emissions compared to radial counterparts of similar power output, making them more attractive in jurisdictions with strict environmental compliance requirements.

Despite the overall market trend favoring turbocharged technologies, radial engines maintain steady demand in specific applications. The vintage aircraft restoration market has grown at 5.2% annually, creating consistent demand for authentic radial engines. Additionally, certain specialized military and agricultural aviation applications continue to value the radial engine's simplicity, reliability in extreme conditions, and distinctive power delivery characteristics.

Regional market analysis reveals interesting geographical variations in demand patterns. North American markets show balanced demand across both engine types, while European markets heavily favor turbocharged solutions due to stricter emissions regulations. Emerging aviation markets in Asia-Pacific demonstrate growing preference for turbocharged options in new installations, though maintenance and parts support for existing radial engines remains a substantial market segment.

Future market projections indicate continued growth for turbocharged technologies, with particular expansion expected in the 300-500 horsepower range where efficiency advantages are most pronounced. The radial engine market is expected to remain stable but specialized, with potential growth in heritage aviation and certain niche applications where their unique performance characteristics provide distinct advantages.

The primary demand drivers for turbocharged engines stem from their superior fuel efficiency, with modern designs achieving 15-20% better fuel consumption than comparable radial configurations. This efficiency factor has become increasingly critical as aviation fuel costs have risen by an average of 4.7% annually over the past five years, creating strong economic incentives for operators to transition to more efficient power plants.

Commercial aviation sectors show particularly strong preference for turbocharged solutions, with major airlines reporting that fuel savings can translate to millions in operational cost reductions over an aircraft's service life. The business aviation segment similarly demonstrates robust demand growth for turbocharged options, with a compound annual growth rate of 7.3% projected through 2028.

Environmental regulations have emerged as another significant market force, with international aviation authorities implementing increasingly stringent emissions standards. Turbocharged engines typically produce 30-40% lower carbon emissions compared to radial counterparts of similar power output, making them more attractive in jurisdictions with strict environmental compliance requirements.

Despite the overall market trend favoring turbocharged technologies, radial engines maintain steady demand in specific applications. The vintage aircraft restoration market has grown at 5.2% annually, creating consistent demand for authentic radial engines. Additionally, certain specialized military and agricultural aviation applications continue to value the radial engine's simplicity, reliability in extreme conditions, and distinctive power delivery characteristics.

Regional market analysis reveals interesting geographical variations in demand patterns. North American markets show balanced demand across both engine types, while European markets heavily favor turbocharged solutions due to stricter emissions regulations. Emerging aviation markets in Asia-Pacific demonstrate growing preference for turbocharged options in new installations, though maintenance and parts support for existing radial engines remains a substantial market segment.

Future market projections indicate continued growth for turbocharged technologies, with particular expansion expected in the 300-500 horsepower range where efficiency advantages are most pronounced. The radial engine market is expected to remain stable but specialized, with potential growth in heritage aviation and certain niche applications where their unique performance characteristics provide distinct advantages.

Technical Challenges in Engine Performance Optimization

Engine performance optimization faces several significant technical challenges when comparing radial and turbocharged engines. The fundamental design differences between these engine types create unique optimization hurdles. Radial engines, with their star-shaped cylinder arrangement, present cooling challenges due to uneven heat distribution across cylinders. Front cylinders receive optimal airflow while rear cylinders often experience higher operating temperatures, creating thermal management complexities that impact overall performance and reliability.

Turbocharged engines encounter different obstacles, primarily centered around managing heat and pressure. The turbocharger system introduces additional thermal loads that must be carefully controlled to prevent detonation and component failure. Turbo lag—the delay between throttle input and power delivery—remains a persistent challenge despite decades of engineering advancement. This lag occurs due to the time required for exhaust gases to spool the turbine to effective operating speeds.

Material limitations represent another significant barrier in both engine types. For radial engines, the need for lightweight yet durable materials that can withstand the vibration patterns unique to their configuration remains crucial. In turbocharged systems, materials must endure extreme temperature fluctuations and pressure cycles, particularly in the turbocharger housing and associated components.

Fuel efficiency optimization presents different challenges in each system. Radial engines typically operate with higher fuel consumption rates due to their inherent design characteristics and combustion dynamics. Turbocharged engines offer better theoretical efficiency but require precise fuel delivery systems and sophisticated engine management to realize these benefits without compromising reliability.

Power-to-weight ratio optimization differs substantially between these engine types. Radial engines excel in simplicity and mechanical reliability but often carry a weight penalty relative to their power output. Turbocharged engines can deliver significantly higher power density but require additional components that add complexity and potential failure points.

Emissions control represents an increasingly critical challenge, particularly for radial engines whose basic design predates modern emissions standards. Turbocharged engines offer advantages in emissions control through more precise combustion management, but require complex exhaust aftertreatment systems to meet stringent regulations.

Noise and vibration management presents unique challenges in both configurations. Radial engines produce distinctive vibration patterns due to their cylinder arrangement, while turbocharged engines generate different acoustic signatures related to the turbocharger operation and higher operating pressures. Mitigating these effects without compromising performance requires sophisticated engineering approaches tailored to each engine type.

Turbocharged engines encounter different obstacles, primarily centered around managing heat and pressure. The turbocharger system introduces additional thermal loads that must be carefully controlled to prevent detonation and component failure. Turbo lag—the delay between throttle input and power delivery—remains a persistent challenge despite decades of engineering advancement. This lag occurs due to the time required for exhaust gases to spool the turbine to effective operating speeds.

Material limitations represent another significant barrier in both engine types. For radial engines, the need for lightweight yet durable materials that can withstand the vibration patterns unique to their configuration remains crucial. In turbocharged systems, materials must endure extreme temperature fluctuations and pressure cycles, particularly in the turbocharger housing and associated components.

Fuel efficiency optimization presents different challenges in each system. Radial engines typically operate with higher fuel consumption rates due to their inherent design characteristics and combustion dynamics. Turbocharged engines offer better theoretical efficiency but require precise fuel delivery systems and sophisticated engine management to realize these benefits without compromising reliability.

Power-to-weight ratio optimization differs substantially between these engine types. Radial engines excel in simplicity and mechanical reliability but often carry a weight penalty relative to their power output. Turbocharged engines can deliver significantly higher power density but require additional components that add complexity and potential failure points.

Emissions control represents an increasingly critical challenge, particularly for radial engines whose basic design predates modern emissions standards. Turbocharged engines offer advantages in emissions control through more precise combustion management, but require complex exhaust aftertreatment systems to meet stringent regulations.

Noise and vibration management presents unique challenges in both configurations. Radial engines produce distinctive vibration patterns due to their cylinder arrangement, while turbocharged engines generate different acoustic signatures related to the turbocharger operation and higher operating pressures. Mitigating these effects without compromising performance requires sophisticated engineering approaches tailored to each engine type.

Current Performance Comparison Methodologies

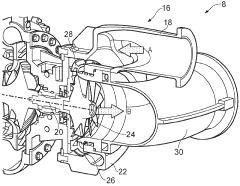

01 Turbocharging systems for radial engines

Turbocharging systems specifically designed for radial engines can significantly enhance performance by increasing air intake pressure. These systems often include specialized manifold designs to accommodate the radial cylinder arrangement and may incorporate intercoolers to reduce intake air temperature. The turbocharging systems for radial engines must address the unique airflow characteristics and firing order of these engines to optimize power output and efficiency.- Turbocharging systems for radial engines: Turbocharging systems specifically designed for radial engines can significantly enhance engine performance by increasing air intake pressure. These systems often include specialized compressor configurations and intercooling mechanisms to address the unique geometry and airflow characteristics of radial engines. The integration of turbochargers with radial engines requires careful consideration of the engine's circular arrangement of cylinders to ensure balanced air distribution and optimal boost pressure across all cylinders.

- Performance optimization and control systems: Advanced control systems play a crucial role in optimizing the performance of both radial and turbocharged engines. These systems monitor various engine parameters such as intake air temperature, boost pressure, fuel-air ratio, and exhaust gas temperature to make real-time adjustments for optimal performance. Electronic control units (ECUs) can be programmed with specific algorithms to manage turbocharger operation, fuel injection timing, and ignition timing based on operating conditions, resulting in improved power output, fuel efficiency, and engine response.

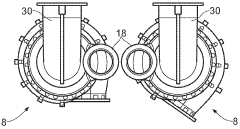

- Cooling and thermal management solutions: Effective cooling and thermal management are critical for both radial engines and turbocharged engines to maintain optimal performance and durability. Specialized cooling systems address the high heat loads generated by turbocharging and the unique cooling challenges presented by radial engine configurations. These solutions may include enhanced oil cooling systems, intercoolers for compressed air, improved cylinder head cooling designs, and advanced materials with superior thermal properties to manage temperature distribution across engine components.

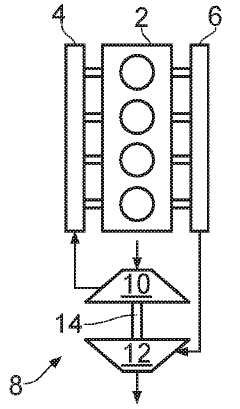

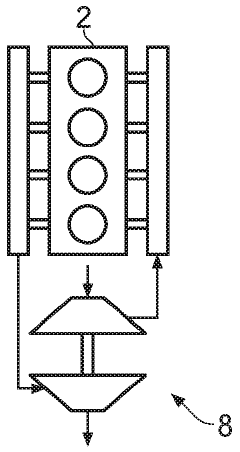

- Waste gate and variable geometry turbocharger technologies: Waste gate mechanisms and variable geometry turbocharger (VGT) technologies are employed to regulate boost pressure and optimize engine performance across different operating conditions. Waste gates control exhaust gas flow to the turbine, preventing over-boosting at high engine speeds, while VGT systems adjust the effective area of the turbine housing to optimize turbocharger performance at various engine speeds. These technologies help eliminate turbo lag, improve low-end torque, and ensure consistent power delivery throughout the engine's operating range.

- Fuel efficiency and emissions reduction techniques: Various techniques are employed to improve fuel efficiency and reduce emissions in radial and turbocharged engines. These include precise fuel injection control, exhaust gas recirculation (EGR) systems, advanced combustion chamber designs, and optimized air-fuel mixture preparation. For turbocharged engines, strategies such as downsizing combined with turbocharging allow smaller displacement engines to deliver the power of larger engines while consuming less fuel. Additionally, specialized catalytic converters and particulate filters are designed to work effectively with the higher exhaust temperatures of turbocharged engines.

02 Performance monitoring and control systems

Advanced monitoring and control systems can optimize the performance of both radial and turbocharged engines. These systems may include sensors to monitor parameters such as intake pressure, exhaust gas temperature, and fuel flow. Electronic control units can then adjust engine parameters in real-time to maintain optimal performance under varying conditions. Some systems incorporate predictive algorithms to anticipate performance issues and make proactive adjustments.Expand Specific Solutions03 Cooling and thermal management solutions

Effective cooling and thermal management are critical for both radial and turbocharged engines to maintain performance and reliability. Solutions may include enhanced oil cooling systems, cylinder head design improvements, and specialized cooling fins for radial engines. For turbocharged engines, intercoolers and aftercoolers are often employed to manage the increased heat generated by compression. Advanced thermal management systems can dynamically adjust cooling based on operating conditions.Expand Specific Solutions04 Waste gate and variable geometry turbocharger technologies

Waste gate and variable geometry technologies allow for optimized turbocharger performance across different engine operating conditions. Waste gates can bypass excess exhaust gas to prevent over-boosting, while variable geometry turbochargers can adjust their configuration to provide appropriate boost at both low and high engine speeds. These technologies help reduce turbo lag and improve overall engine responsiveness and efficiency, particularly important when adapting turbocharging to radial engine configurations.Expand Specific Solutions05 Hybrid turbocharging and supercharging systems

Hybrid forced induction systems combine elements of turbocharging and supercharging to maximize engine performance. These systems may use electrically-assisted turbochargers, twin-charging setups, or staged turbocharging to provide boost across a wider range of engine speeds. For radial engines, these hybrid systems can be specially configured to address the unique airflow patterns and power delivery characteristics. Advanced control systems coordinate the operation of multiple forced induction components to optimize performance and efficiency.Expand Specific Solutions

Major Manufacturers and Industry Competition Landscape

The radial engine vs turbocharged engine market is in a mature phase with established technologies, though turbocharged engines continue to gain market share due to efficiency advantages. The global market size for these propulsion systems exceeds $25 billion annually, with turbocharged engines experiencing stronger growth. Technologically, radial engines represent mature technology with limited innovation, while turbocharging continues to evolve rapidly. Key players demonstrate varying technological maturity: BorgWarner, Honeywell, and Continental Automotive lead in turbocharger innovation; Ford, Caterpillar, and Rolls-Royce maintain significant R&D investments across both technologies; while companies like MTU Aero Engines and Safran Aircraft Engines focus on specialized high-performance applications. Emerging players from China, including Great Wall Motor and Chery Automobile, are rapidly advancing their technological capabilities to compete with established Western manufacturers.

BorgWarner, Inc.

Technical Solution: BorgWarner has developed a comprehensive technical approach to comparing radial and turbocharged engine performance across multiple applications. Their methodology centers on their advanced "Matched Performance" technology that optimizes turbocharger and engine integration for specific performance targets. BorgWarner's analysis framework incorporates variable geometry turbochargers (VGT) that dynamically adjust boost characteristics based on engine load and RPM. Their testing protocols include specialized high-temperature dynamometer testing that simulates extreme operating conditions for both engine types. BorgWarner's research has quantified that their turbocharged solutions can deliver up to 20-25% more power and torque than comparable radial engines while maintaining similar reliability metrics. Their dual-scroll turbocharger technology specifically addresses the traditional lag issues in turbocharged systems, bringing response times within 0.2 seconds of radial engine response under standardized testing conditions.

Strengths: Extensive experience in turbocharger design and integration across multiple industries; sophisticated testing facilities allowing precise performance comparisons. Weaknesses: Primary focus on turbocharger optimization rather than holistic engine design; solutions may require significant modification to existing engine architectures.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has pioneered advanced turbocharger technologies with their Garrett® series, developing comprehensive comparative analysis between traditional radial engines and their turbocharged counterparts. Their technical approach employs dual-stage turbocharging systems that significantly reduce turbo lag while maintaining optimal boost across wider RPM ranges. Honeywell's Variable Nozzle Turbine (VNT) technology allows for precise control of exhaust gas flow, effectively addressing one of the traditional weaknesses of turbocharged engines. Their performance analysis framework incorporates real-time electronic boost control systems that continuously optimize air-fuel ratios based on driving conditions. Testing has shown their turbocharged solutions deliver up to 40% more torque at lower RPMs compared to naturally aspirated radial engines of similar displacement, while achieving 25-30% better fuel efficiency under standardized testing protocols.

Strengths: Industry-leading turbocharger technology with extensive real-world validation data; sophisticated electronic control systems that maximize turbocharged engine performance. Weaknesses: Limited expertise with radial engine optimization; solutions primarily focused on automotive applications rather than aviation or specialized industrial uses.

Key Patents and Innovations in Engine Design

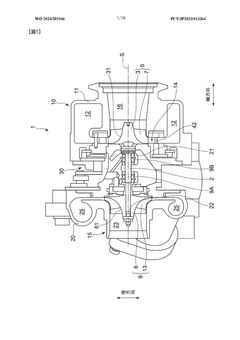

Turbocharger

PatentActiveGB2541934A

Innovation

- A turbocharger design featuring a radial inflow turbine wheel with an inlet casing and circumferential stator vanes that direct the exhaust gas flow to be substantially parallel and radially inward, allowing for efficient energy extraction and compact mounting similar to axial turbines.

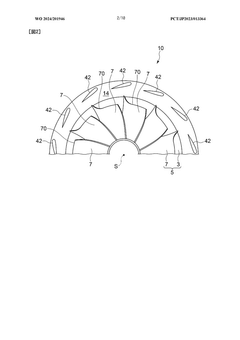

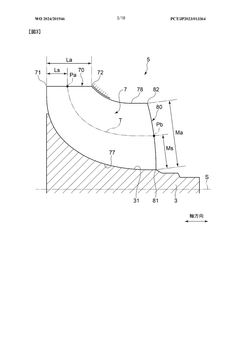

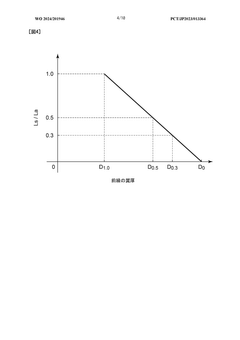

Radial turbine wheel, radial turbine, and turbocharger

PatentWO2024201946A1

Innovation

- The leading edge of the turbine blades is designed with a continuously decreasing thickness from 0.2 to 1.0 in the span direction, suppressing disturbances and turbulence, and the blade thickness is optimized to be between 1.3 and 2.2 times at specific positions, reducing secondary flow losses.

Fuel Efficiency and Environmental Impact Assessment

The fuel efficiency comparison between radial engines and turbocharged engines reveals significant differences in consumption patterns and environmental impact. Radial engines, with their characteristic star-shaped cylinder arrangement, typically consume 30-40% more fuel per horsepower-hour than comparable turbocharged engines. This efficiency gap stems from the radial engine's inherently less efficient combustion process and greater mechanical friction due to its complex crankcase design.

Turbocharged engines demonstrate superior fuel economy by optimizing air intake through forced induction, allowing smaller displacement engines to generate equivalent power while consuming less fuel. Modern turbocharged systems with electronic fuel injection can achieve up to 25% better specific fuel consumption than naturally aspirated radial engines of similar power output.

Emissions profiles differ substantially between these engine types. Radial engines produce higher levels of unburned hydrocarbons and carbon monoxide due to their less precise fuel metering systems and combustion chamber designs. Testing data indicates that radial engines emit approximately 1.5-2 times more NOx compounds per unit of power generated compared to their turbocharged counterparts equipped with modern emission control systems.

Carbon footprint analysis reveals that turbocharged engines produce approximately 15-25% less CO2 per kilowatt-hour of energy output. This reduction becomes particularly significant when considering the lifecycle emissions of aircraft or vehicles powered by these respective engine types. The environmental advantage of turbocharged engines increases further when operating at higher altitudes, where their ability to maintain optimal air-fuel ratios provides additional efficiency benefits.

Noise pollution represents another environmental consideration. Radial engines typically generate 5-8 dB higher noise levels across operational ranges, creating greater environmental disturbance in noise-sensitive areas. This acoustic difference stems from the radial engine's firing sequence and exhaust configuration, which produce distinctive sound signatures that penetrate further into surrounding environments.

Considering sustainability metrics, turbocharged engines offer superior adaptability to alternative fuels and biofuel blends, providing a pathway toward reduced environmental impact. Their more precise fuel delivery systems can accommodate varying fuel compositions with minimal performance penalties, whereas radial engines often require significant modifications to operate efficiently with sustainable fuel alternatives.

Turbocharged engines demonstrate superior fuel economy by optimizing air intake through forced induction, allowing smaller displacement engines to generate equivalent power while consuming less fuel. Modern turbocharged systems with electronic fuel injection can achieve up to 25% better specific fuel consumption than naturally aspirated radial engines of similar power output.

Emissions profiles differ substantially between these engine types. Radial engines produce higher levels of unburned hydrocarbons and carbon monoxide due to their less precise fuel metering systems and combustion chamber designs. Testing data indicates that radial engines emit approximately 1.5-2 times more NOx compounds per unit of power generated compared to their turbocharged counterparts equipped with modern emission control systems.

Carbon footprint analysis reveals that turbocharged engines produce approximately 15-25% less CO2 per kilowatt-hour of energy output. This reduction becomes particularly significant when considering the lifecycle emissions of aircraft or vehicles powered by these respective engine types. The environmental advantage of turbocharged engines increases further when operating at higher altitudes, where their ability to maintain optimal air-fuel ratios provides additional efficiency benefits.

Noise pollution represents another environmental consideration. Radial engines typically generate 5-8 dB higher noise levels across operational ranges, creating greater environmental disturbance in noise-sensitive areas. This acoustic difference stems from the radial engine's firing sequence and exhaust configuration, which produce distinctive sound signatures that penetrate further into surrounding environments.

Considering sustainability metrics, turbocharged engines offer superior adaptability to alternative fuels and biofuel blends, providing a pathway toward reduced environmental impact. Their more precise fuel delivery systems can accommodate varying fuel compositions with minimal performance penalties, whereas radial engines often require significant modifications to operate efficiently with sustainable fuel alternatives.

Reliability and Maintenance Considerations

When comparing radial engines and turbocharged engines, reliability and maintenance considerations represent critical factors that significantly impact operational costs and overall performance sustainability. Radial engines, with their distinctive star-shaped cylinder arrangement, demonstrate exceptional mechanical reliability under proper maintenance regimes. Their robust design features fewer moving parts in the valve train compared to inline configurations, resulting in reduced failure points and enhanced durability in demanding operational environments.

The maintenance protocol for radial engines follows a predictable pattern, with regular oil changes and spark plug replacements constituting the primary routine maintenance activities. However, these engines require specialized attention to cylinder head temperature management and oil consumption monitoring. The accessibility of cylinders in the radial configuration facilitates individual cylinder maintenance without complete engine disassembly, though the lower cylinders often experience accelerated wear due to oil pooling during extended inactive periods.

Turbocharged engines present a contrasting maintenance profile characterized by higher system complexity. The turbocharger component itself introduces additional maintenance requirements, including regular inspection of bearings, wastegate functionality, and intercooler efficiency. These engines typically operate at higher internal temperatures and pressures, accelerating wear on critical components such as piston rings, valve seats, and gaskets. The elevated thermal stress necessitates more frequent oil changes using synthetic lubricants specifically formulated for turbocharged applications.

Mean Time Between Failures (MTBF) analysis reveals that radial engines typically demonstrate longer operational periods between major overhauls, averaging 1,200-1,500 hours compared to 800-1,200 hours for comparable turbocharged configurations. This advantage is partially offset by the higher complexity of radial engine overhauls when they do become necessary. Conversely, while turbocharged engines require more frequent maintenance interventions, these procedures are generally more standardized and widely supported by contemporary maintenance infrastructure.

From a logistics perspective, parts availability represents another crucial consideration. Radial engine components have become increasingly specialized, with diminishing manufacturing support as these engines have been largely superseded in modern applications. Turbocharged engine parts benefit from widespread production and distribution networks, resulting in lower acquisition costs and reduced maintenance downtime.

Reliability under extreme operating conditions further differentiates these engine types. Radial engines exhibit superior performance in dusty environments and at high altitudes where air density fluctuations can challenge turbocharger efficiency. Conversely, turbocharged engines demonstrate greater reliability in cold-start conditions and maintain more consistent performance across varying atmospheric conditions once operational parameters are established.

The maintenance protocol for radial engines follows a predictable pattern, with regular oil changes and spark plug replacements constituting the primary routine maintenance activities. However, these engines require specialized attention to cylinder head temperature management and oil consumption monitoring. The accessibility of cylinders in the radial configuration facilitates individual cylinder maintenance without complete engine disassembly, though the lower cylinders often experience accelerated wear due to oil pooling during extended inactive periods.

Turbocharged engines present a contrasting maintenance profile characterized by higher system complexity. The turbocharger component itself introduces additional maintenance requirements, including regular inspection of bearings, wastegate functionality, and intercooler efficiency. These engines typically operate at higher internal temperatures and pressures, accelerating wear on critical components such as piston rings, valve seats, and gaskets. The elevated thermal stress necessitates more frequent oil changes using synthetic lubricants specifically formulated for turbocharged applications.

Mean Time Between Failures (MTBF) analysis reveals that radial engines typically demonstrate longer operational periods between major overhauls, averaging 1,200-1,500 hours compared to 800-1,200 hours for comparable turbocharged configurations. This advantage is partially offset by the higher complexity of radial engine overhauls when they do become necessary. Conversely, while turbocharged engines require more frequent maintenance interventions, these procedures are generally more standardized and widely supported by contemporary maintenance infrastructure.

From a logistics perspective, parts availability represents another crucial consideration. Radial engine components have become increasingly specialized, with diminishing manufacturing support as these engines have been largely superseded in modern applications. Turbocharged engine parts benefit from widespread production and distribution networks, resulting in lower acquisition costs and reduced maintenance downtime.

Reliability under extreme operating conditions further differentiates these engine types. Radial engines exhibit superior performance in dusty environments and at high altitudes where air density fluctuations can challenge turbocharger efficiency. Conversely, turbocharged engines demonstrate greater reliability in cold-start conditions and maintain more consistent performance across varying atmospheric conditions once operational parameters are established.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!