Reduced Graphene Oxide in Transparent Conductive Films

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

rGO TCF Background and Objectives

Transparent conductive films (TCFs) have emerged as critical components in modern electronic devices, enabling the development of touchscreens, displays, solar cells, and flexible electronics. Historically, indium tin oxide (ITO) has dominated this market due to its excellent combination of optical transparency and electrical conductivity. However, ITO faces significant limitations including brittleness, scarcity of indium resources, and high processing temperatures, which have driven extensive research into alternative materials.

Reduced graphene oxide (rGO) represents one of the most promising alternatives in TCF technology. The journey of graphene-based TCFs began with the groundbreaking isolation of graphene in 2004 by Geim and Novoselov, which earned them the Nobel Prize in Physics in 2010. Since then, research has focused on developing scalable production methods for graphene-based materials that maintain their exceptional properties while enabling industrial-scale manufacturing.

Graphene oxide (GO), an oxidized form of graphene, offers excellent solution processability but poor conductivity. The reduction process to create rGO aims to restore the conductive properties while maintaining the processing advantages. This technological evolution has seen significant advancements over the past decade, with various reduction methods including thermal, chemical, and photocatalytic approaches being developed and refined.

The primary objective of rGO TCF technology development is to achieve a balance of high optical transparency (>90%) and low sheet resistance (<100 Ω/sq) that can compete with or surpass ITO performance. Additionally, researchers aim to develop rGO TCFs that offer mechanical flexibility, environmental stability, and compatibility with large-area, low-cost manufacturing processes such as roll-to-roll printing.

Current technological trends indicate a shift toward hybrid systems that combine rGO with other nanomaterials such as metal nanowires or conductive polymers to overcome the limitations of single-material approaches. These hybrid systems leverage synergistic effects to enhance both conductivity and transparency beyond what can be achieved with rGO alone.

The development trajectory of rGO TCFs is closely aligned with broader industry trends toward flexible, wearable, and sustainable electronics. As devices become increasingly integrated into everyday objects and environments, the demand for TCFs that can conform to curved surfaces and withstand mechanical stress continues to grow. Furthermore, the push toward sustainable manufacturing has highlighted the potential of carbon-based materials like rGO as environmentally preferable alternatives to rare metal-based conductors.

Looking forward, the technical goals for rGO TCFs include not only performance improvements but also addressing scalability challenges, enhancing long-term stability, and reducing production costs to enable widespread commercial adoption across multiple electronic device categories.

Reduced graphene oxide (rGO) represents one of the most promising alternatives in TCF technology. The journey of graphene-based TCFs began with the groundbreaking isolation of graphene in 2004 by Geim and Novoselov, which earned them the Nobel Prize in Physics in 2010. Since then, research has focused on developing scalable production methods for graphene-based materials that maintain their exceptional properties while enabling industrial-scale manufacturing.

Graphene oxide (GO), an oxidized form of graphene, offers excellent solution processability but poor conductivity. The reduction process to create rGO aims to restore the conductive properties while maintaining the processing advantages. This technological evolution has seen significant advancements over the past decade, with various reduction methods including thermal, chemical, and photocatalytic approaches being developed and refined.

The primary objective of rGO TCF technology development is to achieve a balance of high optical transparency (>90%) and low sheet resistance (<100 Ω/sq) that can compete with or surpass ITO performance. Additionally, researchers aim to develop rGO TCFs that offer mechanical flexibility, environmental stability, and compatibility with large-area, low-cost manufacturing processes such as roll-to-roll printing.

Current technological trends indicate a shift toward hybrid systems that combine rGO with other nanomaterials such as metal nanowires or conductive polymers to overcome the limitations of single-material approaches. These hybrid systems leverage synergistic effects to enhance both conductivity and transparency beyond what can be achieved with rGO alone.

The development trajectory of rGO TCFs is closely aligned with broader industry trends toward flexible, wearable, and sustainable electronics. As devices become increasingly integrated into everyday objects and environments, the demand for TCFs that can conform to curved surfaces and withstand mechanical stress continues to grow. Furthermore, the push toward sustainable manufacturing has highlighted the potential of carbon-based materials like rGO as environmentally preferable alternatives to rare metal-based conductors.

Looking forward, the technical goals for rGO TCFs include not only performance improvements but also addressing scalability challenges, enhancing long-term stability, and reducing production costs to enable widespread commercial adoption across multiple electronic device categories.

Market Analysis for Transparent Conductive Films

The transparent conductive film (TCF) market has been experiencing significant growth, driven by the expanding electronics industry and increasing demand for touchscreen devices. Currently valued at approximately 5.6 billion USD in 2023, the market is projected to reach 8.7 billion USD by 2028, representing a compound annual growth rate (CAGR) of 9.2%. This growth trajectory is primarily fueled by the widespread adoption of smartphones, tablets, wearable devices, and other consumer electronics that require high-performance touch interfaces.

Indium Tin Oxide (ITO) has traditionally dominated the TCF market, accounting for nearly 70% of market share due to its excellent combination of optical transparency and electrical conductivity. However, the market is witnessing a gradual shift toward alternative materials, including reduced graphene oxide (rGO), due to several critical factors. The limited supply and rising cost of indium, coupled with the brittle nature of ITO that makes it unsuitable for flexible electronics, are driving manufacturers to seek alternatives.

The reduced graphene oxide segment within the TCF market is growing at an accelerated rate of approximately 17.5% annually, significantly outpacing the overall market growth. This surge is attributed to rGO's exceptional properties, including flexibility, mechanical strength, and potential for cost-effective mass production. The Asia-Pacific region, particularly China, South Korea, and Japan, leads in both production and consumption of rGO-based transparent conductive films, accounting for 58% of the global market.

End-use segmentation reveals that consumer electronics remains the largest application sector for TCF, representing 45% of the market, followed by displays (27%), photovoltaics (15%), and automotive applications (8%). The remaining 5% encompasses emerging applications in smart windows, healthcare devices, and aerospace technologies. Within these segments, rGO-based films are gaining the most traction in flexible displays and wearable technology, where mechanical flexibility is paramount.

Market analysis indicates that price sensitivity varies significantly across application segments. While consumer electronics manufacturers prioritize performance and are willing to pay premium prices for superior TCFs, the solar industry remains highly cost-conscious, creating different market entry points for rGO-based solutions. The average price point for high-quality rGO films currently ranges from $8-12 per square meter, compared to $15-20 for traditional ITO films.

Customer demand is increasingly focused on films that offer not only high transparency (>90%) and low sheet resistance (<100 Ω/sq) but also flexibility, durability, and environmental sustainability. This shift in requirements presents a significant opportunity for rGO-based solutions, which can potentially meet these specifications while addressing the sustainability concerns associated with traditional ITO production.

Indium Tin Oxide (ITO) has traditionally dominated the TCF market, accounting for nearly 70% of market share due to its excellent combination of optical transparency and electrical conductivity. However, the market is witnessing a gradual shift toward alternative materials, including reduced graphene oxide (rGO), due to several critical factors. The limited supply and rising cost of indium, coupled with the brittle nature of ITO that makes it unsuitable for flexible electronics, are driving manufacturers to seek alternatives.

The reduced graphene oxide segment within the TCF market is growing at an accelerated rate of approximately 17.5% annually, significantly outpacing the overall market growth. This surge is attributed to rGO's exceptional properties, including flexibility, mechanical strength, and potential for cost-effective mass production. The Asia-Pacific region, particularly China, South Korea, and Japan, leads in both production and consumption of rGO-based transparent conductive films, accounting for 58% of the global market.

End-use segmentation reveals that consumer electronics remains the largest application sector for TCF, representing 45% of the market, followed by displays (27%), photovoltaics (15%), and automotive applications (8%). The remaining 5% encompasses emerging applications in smart windows, healthcare devices, and aerospace technologies. Within these segments, rGO-based films are gaining the most traction in flexible displays and wearable technology, where mechanical flexibility is paramount.

Market analysis indicates that price sensitivity varies significantly across application segments. While consumer electronics manufacturers prioritize performance and are willing to pay premium prices for superior TCFs, the solar industry remains highly cost-conscious, creating different market entry points for rGO-based solutions. The average price point for high-quality rGO films currently ranges from $8-12 per square meter, compared to $15-20 for traditional ITO films.

Customer demand is increasingly focused on films that offer not only high transparency (>90%) and low sheet resistance (<100 Ω/sq) but also flexibility, durability, and environmental sustainability. This shift in requirements presents a significant opportunity for rGO-based solutions, which can potentially meet these specifications while addressing the sustainability concerns associated with traditional ITO production.

rGO Technology Status and Challenges

The global landscape of reduced graphene oxide (rGO) technology in transparent conductive films presents a complex picture of significant progress alongside persistent challenges. Currently, rGO-based transparent conductive films have achieved sheet resistances ranging from 100-1000 Ω/sq with optical transmittance of 80-90%, which remains inferior to the industry standard indium tin oxide (ITO) that offers <10 Ω/sq resistance with >90% transmittance. This performance gap represents the primary technical hurdle for widespread commercial adoption.

Production scalability constitutes another major challenge. Laboratory-scale synthesis methods such as chemical vapor deposition (CVD) and modified Hummers method produce high-quality rGO but face significant barriers in scaling to industrial volumes. The reduction process of graphene oxide to rGO introduces defects and disrupts the sp² carbon network, compromising electrical conductivity. Current reduction techniques—thermal, chemical, and photocatalytic—each present trade-offs between efficiency, environmental impact, and final material quality.

Quality consistency remains problematic across large-area films, with variations in thickness, defect density, and oxygen functional group distribution leading to unpredictable electrical and optical properties. This inconsistency severely impacts manufacturing yield and device performance reliability, particularly for applications requiring precise specifications such as touchscreens and solar cells.

Geographically, research leadership in rGO technology is distributed across North America, Europe, and East Asia. The United States and China lead in patent filings and research publications, with South Korea and Japan making significant contributions to industrial applications. European research centers, particularly in the UK and Germany, focus on fundamental understanding of rGO properties and novel reduction methods.

Environmental concerns present additional challenges, as conventional reduction processes often employ hazardous chemicals like hydrazine. Recent research has shifted toward greener reduction methods using environmentally benign reducing agents such as ascorbic acid, but these approaches typically result in lower conductivity performance.

Integration challenges persist when incorporating rGO films into device manufacturing processes. The films' mechanical properties—flexibility and adhesion to substrates—require optimization for compatibility with roll-to-roll processing. Additionally, long-term stability issues, including oxidation in ambient conditions and degradation under UV exposure, limit the operational lifetime of rGO-based devices.

Despite these challenges, recent breakthroughs in hybrid systems combining rGO with metal nanowires or conductive polymers show promise for overcoming the conductivity-transparency trade-off, potentially opening new application pathways while research continues to address the fundamental limitations.

Production scalability constitutes another major challenge. Laboratory-scale synthesis methods such as chemical vapor deposition (CVD) and modified Hummers method produce high-quality rGO but face significant barriers in scaling to industrial volumes. The reduction process of graphene oxide to rGO introduces defects and disrupts the sp² carbon network, compromising electrical conductivity. Current reduction techniques—thermal, chemical, and photocatalytic—each present trade-offs between efficiency, environmental impact, and final material quality.

Quality consistency remains problematic across large-area films, with variations in thickness, defect density, and oxygen functional group distribution leading to unpredictable electrical and optical properties. This inconsistency severely impacts manufacturing yield and device performance reliability, particularly for applications requiring precise specifications such as touchscreens and solar cells.

Geographically, research leadership in rGO technology is distributed across North America, Europe, and East Asia. The United States and China lead in patent filings and research publications, with South Korea and Japan making significant contributions to industrial applications. European research centers, particularly in the UK and Germany, focus on fundamental understanding of rGO properties and novel reduction methods.

Environmental concerns present additional challenges, as conventional reduction processes often employ hazardous chemicals like hydrazine. Recent research has shifted toward greener reduction methods using environmentally benign reducing agents such as ascorbic acid, but these approaches typically result in lower conductivity performance.

Integration challenges persist when incorporating rGO films into device manufacturing processes. The films' mechanical properties—flexibility and adhesion to substrates—require optimization for compatibility with roll-to-roll processing. Additionally, long-term stability issues, including oxidation in ambient conditions and degradation under UV exposure, limit the operational lifetime of rGO-based devices.

Despite these challenges, recent breakthroughs in hybrid systems combining rGO with metal nanowires or conductive polymers show promise for overcoming the conductivity-transparency trade-off, potentially opening new application pathways while research continues to address the fundamental limitations.

Current rGO Film Fabrication Methods

01 Synthesis methods for transparent conductive reduced graphene oxide films

Various methods can be employed to synthesize transparent conductive reduced graphene oxide films with optimized properties. These include chemical reduction processes, thermal reduction techniques, and specialized deposition methods that control the thickness and uniformity of the films. The synthesis approach significantly impacts the resulting transparency and conductivity balance, with controlled reduction processes yielding films with higher optical transmittance while maintaining good electrical conductivity.- Reduction methods for graphene oxide to enhance conductivity: Various reduction methods can be applied to graphene oxide to remove oxygen-containing functional groups, thereby restoring the sp2 carbon network and enhancing electrical conductivity. These methods include chemical reduction using reducing agents, thermal reduction at different temperatures, and photochemical reduction using light sources. The degree of reduction directly affects the balance between transparency and conductivity, with more complete reduction typically yielding higher conductivity but potentially lower transparency.

- Transparent conductive films using reduced graphene oxide: Reduced graphene oxide can be processed into transparent conductive films for applications in electronics, displays, and touch screens. These films offer a balance of optical transparency and electrical conductivity that can be tuned through processing parameters. The film thickness, reduction degree, and deposition method significantly impact the performance characteristics. Various techniques such as spin coating, spray coating, and vacuum filtration are employed to create uniform films with controlled thickness for optimal transparency-conductivity trade-offs.

- Doping strategies to improve conductivity while maintaining transparency: Doping reduced graphene oxide with various elements or compounds can significantly enhance its electrical conductivity without substantially compromising optical transparency. Common dopants include nitrogen, boron, metals, and metal oxides. The doping process modifies the electronic structure of reduced graphene oxide, creating additional charge carriers or reducing sheet resistance. This approach enables the fine-tuning of optoelectronic properties for specific applications requiring both high transparency and conductivity.

- Hybrid materials combining reduced graphene oxide with other conductive materials: Hybrid materials that combine reduced graphene oxide with other conductive materials such as carbon nanotubes, conductive polymers, or metal nanowires can achieve superior transparency-conductivity balance. These composite structures leverage the complementary properties of each component, with reduced graphene oxide providing a conductive network while the secondary material enhances overall performance. The synergistic effects in these hybrid systems often result in better conductivity at a given transparency level compared to single-component materials.

- Processing techniques to optimize transparency-conductivity trade-off: Specialized processing techniques can optimize the inherent trade-off between transparency and conductivity in reduced graphene oxide materials. These include controlled layer stacking, interface engineering, and post-processing treatments such as annealing or compression. The morphology and microstructure of reduced graphene oxide significantly impact its performance, with techniques that minimize defects and ensure uniform reduction yielding better results. Advanced patterning methods can also create structures that maximize light transmission while maintaining conductive pathways.

02 Doping strategies to enhance conductivity while maintaining transparency

Doping reduced graphene oxide with various elements or compounds can significantly enhance its electrical conductivity without substantially compromising optical transparency. Common dopants include nitrogen, boron, metals, and metal oxides. These dopants modify the electronic structure of reduced graphene oxide, increasing charge carrier concentration and mobility. The doping concentration and distribution must be carefully controlled to achieve an optimal balance between transparency and conductivity for specific applications.Expand Specific Solutions03 Structural modifications for improved transparency-conductivity trade-off

Structural modifications of reduced graphene oxide can improve the transparency-conductivity trade-off. These include controlling the degree of reduction, creating patterned structures, developing hierarchical architectures, and manipulating defect densities. By optimizing the microstructure and morphology, it's possible to create pathways for efficient electron transport while minimizing light absorption. Techniques such as controlled oxidation, laser patterning, and template-assisted growth can be employed to achieve desired structural characteristics.Expand Specific Solutions04 Composite materials incorporating reduced graphene oxide for enhanced properties

Composite materials incorporating reduced graphene oxide with other materials can achieve enhanced transparency and conductivity properties. Common composite components include conductive polymers, metal nanowires, carbon nanotubes, and metal oxides. These hybrid structures leverage synergistic effects between the components, where reduced graphene oxide provides a conductive network while the secondary materials contribute additional functionality or bridge gaps between graphene sheets. The composition ratio and interface engineering are critical factors in optimizing these composite materials.Expand Specific Solutions05 Applications leveraging the transparency-conductivity balance of reduced graphene oxide

The unique combination of transparency and conductivity in reduced graphene oxide enables various applications across multiple industries. These include transparent electrodes for solar cells, touch screens, and displays; sensors with optical transparency; electromagnetic shielding materials that maintain visibility; transparent heaters; and smart windows. Each application requires specific optimization of the transparency-conductivity balance, with some prioritizing higher transparency while others demand enhanced conductivity depending on the functional requirements.Expand Specific Solutions

Leading Companies in rGO Film Industry

The transparent conductive film market utilizing Reduced Graphene Oxide (rGO) is currently in its growth phase, with an expanding market size driven by increasing demand for flexible electronics and touch screens. The technology is approaching maturity but still faces challenges in mass production and performance consistency. Leading players include Global Graphene Group and Nanotek Instruments focusing on graphene raw materials commercialization, while established electronics manufacturers like BOE Technology, LG Display, and Ricoh are integrating rGO into their product development. Academic institutions such as National University of Singapore and KAIST are advancing fundamental research, while industrial players like Sumitomo Metal Mining and Nitto Denko are developing manufacturing processes to scale production for commercial applications.

GLOBAL GRAPHENE GROUP INC

Technical Solution: Global Graphene Group has developed a proprietary reduced graphene oxide (rGO) production process that enables mass production of high-quality transparent conductive films (TCFs). Their technology involves a controlled reduction method that preserves the structural integrity of graphene sheets while achieving optimal conductivity. The company's approach includes a solution-based deposition technique that allows for uniform coating on various substrates including PET, glass, and flexible polymers. Their rGO films demonstrate transparency levels exceeding 90% with sheet resistance below 100 Ω/sq, making them competitive with traditional ITO films. The company has also developed composite formulations incorporating metal nanowires with rGO to enhance conductivity while maintaining high transparency, creating hybrid films that offer improved performance in touchscreen and display applications.

Strengths: Scalable manufacturing process allowing industrial-scale production; proprietary reduction methods that preserve graphene quality; ability to produce films with balanced transparency-conductivity properties. Weaknesses: Higher cost compared to traditional ITO solutions; challenges in achieving uniform conductivity across large-area films; potential long-term stability issues in certain environmental conditions.

BOE Technology Group Co., Ltd.

Technical Solution: BOE Technology has developed an innovative hybrid reduced graphene oxide transparent conductive film technology that combines solution-processed rGO with metal grid structures. Their approach involves a precisely controlled reduction process that maintains the structural integrity of graphene oxide while achieving optimal electrical properties. BOE's technology features a multi-stage deposition and patterning process that creates hierarchical conductive networks, enhancing electron mobility across the film. The company has implemented specialized surface treatments that improve the work function matching between rGO films and adjacent layers in display devices. Their rGO films demonstrate transparency exceeding 92% with sheet resistance below 100 Ω/sq, suitable for various touch panel and display applications. BOE has successfully integrated these films into prototype flexible OLED displays, demonstrating compatibility with existing manufacturing processes and superior mechanical durability under repeated flexing conditions.

Strengths: Integration of rGO with complementary conductive structures; optimized work function for display applications; compatibility with existing manufacturing infrastructure; excellent mechanical flexibility. Weaknesses: Complex multi-stage manufacturing process; challenges in achieving uniform performance across very large area substrates; higher material costs compared to traditional solutions.

Key Patents in rGO Transparent Film Technology

Method for producing reduced graphene oxide film

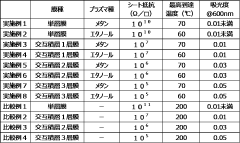

PatentInactiveJP2023043064A

Innovation

- A method involving low-temperature plasma treatment is used to produce reduced graphene oxide films, allowing for high electrical conductivity while avoiding high-temperature processes.

Conductive thin film and transparent electrode including graphene oxide and carbon nanotube, and methods of producing the same

PatentInactiveUS20130306915A1

Innovation

- A method for preparing a conductive thin film using reduced graphene oxide and carbon nanotubes by coating a substrate with a dispersion liquid containing modified graphene oxide and carbon nanotubes, followed by exposure to a vapor of a halogen-containing reducing agent, allowing for low-temperature processing and mass production, while improving electrical conductivity and transmittance.

Environmental Impact of rGO Production

The production of reduced graphene oxide (rGO) for transparent conductive films presents significant environmental considerations that must be addressed as this technology scales. Traditional methods of rGO production often involve harsh chemical processes, particularly the use of strong oxidizing agents like potassium permanganate and sulfuric acid in the Hummers method. These chemicals pose substantial environmental risks including water pollution and hazardous waste generation if not properly managed.

Energy consumption represents another critical environmental factor in rGO production. The thermal reduction process commonly employed to convert graphene oxide to rGO requires considerable energy input, contributing to carbon emissions when fossil fuel energy sources are utilized. Studies indicate that the energy footprint of rGO production can range from 1.5 to 3.0 GJ per kilogram, depending on the specific reduction technique employed.

Water usage in rGO manufacturing processes presents additional environmental challenges. The production cycle typically requires multiple washing steps to remove impurities and residual chemicals, consuming approximately 5,000-10,000 liters of water per kilogram of rGO produced. This substantial water footprint raises concerns about resource sustainability in regions facing water scarcity.

Recent advancements have focused on developing greener reduction methods to mitigate these environmental impacts. Eco-friendly reducing agents such as ascorbic acid, glucose, and plant extracts have demonstrated promising results in laboratory settings, potentially reducing toxic waste generation by 40-60% compared to conventional methods. Additionally, microwave-assisted and photocatalytic reduction techniques have emerged as energy-efficient alternatives that can decrease energy consumption by up to 30%.

Life cycle assessment (LCA) studies comparing rGO with traditional transparent conductive materials like indium tin oxide (ITO) reveal complex environmental trade-offs. While rGO production may have higher initial environmental impacts, the material's longer lifespan and potential for recycling could result in lower lifetime environmental costs. Furthermore, as production scales increase, efficiency improvements and technological innovations are expected to progressively reduce environmental impacts.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of nanomaterial production, including rGO. The European Union's REACH regulations and similar initiatives in North America and Asia are establishing guidelines for responsible manufacturing practices, waste management protocols, and emissions controls specific to graphene-based materials production.

Energy consumption represents another critical environmental factor in rGO production. The thermal reduction process commonly employed to convert graphene oxide to rGO requires considerable energy input, contributing to carbon emissions when fossil fuel energy sources are utilized. Studies indicate that the energy footprint of rGO production can range from 1.5 to 3.0 GJ per kilogram, depending on the specific reduction technique employed.

Water usage in rGO manufacturing processes presents additional environmental challenges. The production cycle typically requires multiple washing steps to remove impurities and residual chemicals, consuming approximately 5,000-10,000 liters of water per kilogram of rGO produced. This substantial water footprint raises concerns about resource sustainability in regions facing water scarcity.

Recent advancements have focused on developing greener reduction methods to mitigate these environmental impacts. Eco-friendly reducing agents such as ascorbic acid, glucose, and plant extracts have demonstrated promising results in laboratory settings, potentially reducing toxic waste generation by 40-60% compared to conventional methods. Additionally, microwave-assisted and photocatalytic reduction techniques have emerged as energy-efficient alternatives that can decrease energy consumption by up to 30%.

Life cycle assessment (LCA) studies comparing rGO with traditional transparent conductive materials like indium tin oxide (ITO) reveal complex environmental trade-offs. While rGO production may have higher initial environmental impacts, the material's longer lifespan and potential for recycling could result in lower lifetime environmental costs. Furthermore, as production scales increase, efficiency improvements and technological innovations are expected to progressively reduce environmental impacts.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of nanomaterial production, including rGO. The European Union's REACH regulations and similar initiatives in North America and Asia are establishing guidelines for responsible manufacturing practices, waste management protocols, and emissions controls specific to graphene-based materials production.

Cost-Performance Analysis of rGO vs ITO Films

The cost-performance ratio of reduced graphene oxide (rGO) compared to indium tin oxide (ITO) represents a critical factor in the commercial viability of transparent conductive films. ITO has dominated the market for decades, with established manufacturing processes and reliable performance metrics. However, the rising cost of indium, classified as a rare earth element with limited global reserves, has created significant price volatility and supply chain concerns for manufacturers.

rGO offers a compelling alternative from a cost perspective, with raw material costs estimated at 30-50% lower than ITO. The carbon-based nature of graphene oxide ensures abundant supply without geopolitical constraints that affect indium. Additionally, the processing of rGO typically requires lower temperatures (200-300°C) compared to ITO (400-600°C), resulting in energy savings of approximately 25-40% during manufacturing.

Performance comparisons reveal that premium ITO films achieve sheet resistance of 10-30 Ω/sq with 85-90% transparency, while current commercial rGO films typically deliver 100-500 Ω/sq at 80-85% transparency. This performance gap remains the primary challenge for widespread rGO adoption. However, recent laboratory breakthroughs have demonstrated rGO films approaching 50 Ω/sq while maintaining 82% transparency, suggesting the performance gap is narrowing.

Lifecycle cost analysis further favors rGO, as its mechanical flexibility results in significantly lower breakage rates in manufacturing and end-use applications. ITO's brittleness leads to yield losses of 5-15% during production, while rGO's flexibility reduces these losses to below 3%. For flexible electronics applications, this advantage becomes even more pronounced, with ITO films showing performance degradation after 1,000-2,000 bending cycles, while rGO maintains performance beyond 10,000 cycles.

Scaling economics also favor rGO, with production costs expected to decrease by 40-60% as manufacturing volumes increase over the next five years. In contrast, ITO costs are projected to rise by 5-10% annually due to resource constraints. The crossover point where rGO becomes both economically and performance competitive with ITO is anticipated within 2-3 years for specific applications like touch sensors and OLED displays.

Environmental impact assessments further strengthen rGO's position, with carbon footprint analyses showing 30-45% lower emissions compared to ITO production processes. This factor increasingly influences procurement decisions as manufacturers adopt sustainability metrics in their supply chain evaluations.

rGO offers a compelling alternative from a cost perspective, with raw material costs estimated at 30-50% lower than ITO. The carbon-based nature of graphene oxide ensures abundant supply without geopolitical constraints that affect indium. Additionally, the processing of rGO typically requires lower temperatures (200-300°C) compared to ITO (400-600°C), resulting in energy savings of approximately 25-40% during manufacturing.

Performance comparisons reveal that premium ITO films achieve sheet resistance of 10-30 Ω/sq with 85-90% transparency, while current commercial rGO films typically deliver 100-500 Ω/sq at 80-85% transparency. This performance gap remains the primary challenge for widespread rGO adoption. However, recent laboratory breakthroughs have demonstrated rGO films approaching 50 Ω/sq while maintaining 82% transparency, suggesting the performance gap is narrowing.

Lifecycle cost analysis further favors rGO, as its mechanical flexibility results in significantly lower breakage rates in manufacturing and end-use applications. ITO's brittleness leads to yield losses of 5-15% during production, while rGO's flexibility reduces these losses to below 3%. For flexible electronics applications, this advantage becomes even more pronounced, with ITO films showing performance degradation after 1,000-2,000 bending cycles, while rGO maintains performance beyond 10,000 cycles.

Scaling economics also favor rGO, with production costs expected to decrease by 40-60% as manufacturing volumes increase over the next five years. In contrast, ITO costs are projected to rise by 5-10% annually due to resource constraints. The crossover point where rGO becomes both economically and performance competitive with ITO is anticipated within 2-3 years for specific applications like touch sensors and OLED displays.

Environmental impact assessments further strengthen rGO's position, with carbon footprint analyses showing 30-45% lower emissions compared to ITO production processes. This factor increasingly influences procurement decisions as manufacturers adopt sustainability metrics in their supply chain evaluations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!