The Impact of Certifications on Reduced Graphene Oxide Use

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

rGO Certification Background and Objectives

Reduced Graphene Oxide (rGO) has emerged as a revolutionary material in the advanced materials sector since its initial development in the early 2000s. The evolution of rGO technology has progressed from laboratory curiosity to commercial application, with significant advancements in production methods, quality control, and standardization over the past decade. This technical evolution has been driven by rGO's exceptional properties including electrical conductivity, mechanical strength, and thermal stability, making it valuable across multiple industries from electronics to energy storage.

The certification landscape for rGO has developed in response to growing industrial adoption and concerns regarding material consistency, safety, and environmental impact. Initial certification efforts focused primarily on basic material characterization, but have expanded to encompass production processes, environmental sustainability, and application-specific performance metrics. This evolution reflects the maturation of rGO from experimental material to industrial component.

Current certification frameworks for rGO vary globally, with notable differences between regulatory approaches in North America, Europe, and Asia. These certification systems aim to address critical aspects including oxygen content verification, sheet size distribution, defect density quantification, and contaminant levels. The fragmented nature of these certification systems presents challenges for global market integration and technology transfer.

The primary objective of this technical research report is to comprehensively evaluate how existing and emerging certification standards impact the commercial utilization of rGO across key application sectors. We aim to identify certification gaps that may be limiting market penetration and technological adoption, while also highlighting opportunities where enhanced certification frameworks could accelerate innovation and market growth.

Secondary objectives include mapping the correlation between certification requirements and material performance in specific applications, analyzing how certification costs influence market dynamics, and developing predictive models for how certification evolution may shape future rGO market development. This analysis will provide strategic insights for stakeholders throughout the rGO value chain.

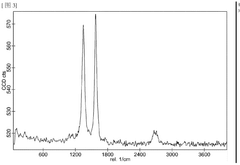

The technological trajectory of rGO certification is moving toward more sophisticated characterization methods, including advanced spectroscopic techniques, standardized performance testing protocols, and lifecycle assessment methodologies. These developments are expected to address current limitations in reproducibility and comparability between different rGO products, ultimately supporting broader industrial adoption and technological innovation.

This research is particularly timely as the global rGO market is projected to expand at a CAGR of approximately 38.7% between 2023 and 2030, with certification standards playing an increasingly critical role in market access, product differentiation, and regulatory compliance across international markets.

The certification landscape for rGO has developed in response to growing industrial adoption and concerns regarding material consistency, safety, and environmental impact. Initial certification efforts focused primarily on basic material characterization, but have expanded to encompass production processes, environmental sustainability, and application-specific performance metrics. This evolution reflects the maturation of rGO from experimental material to industrial component.

Current certification frameworks for rGO vary globally, with notable differences between regulatory approaches in North America, Europe, and Asia. These certification systems aim to address critical aspects including oxygen content verification, sheet size distribution, defect density quantification, and contaminant levels. The fragmented nature of these certification systems presents challenges for global market integration and technology transfer.

The primary objective of this technical research report is to comprehensively evaluate how existing and emerging certification standards impact the commercial utilization of rGO across key application sectors. We aim to identify certification gaps that may be limiting market penetration and technological adoption, while also highlighting opportunities where enhanced certification frameworks could accelerate innovation and market growth.

Secondary objectives include mapping the correlation between certification requirements and material performance in specific applications, analyzing how certification costs influence market dynamics, and developing predictive models for how certification evolution may shape future rGO market development. This analysis will provide strategic insights for stakeholders throughout the rGO value chain.

The technological trajectory of rGO certification is moving toward more sophisticated characterization methods, including advanced spectroscopic techniques, standardized performance testing protocols, and lifecycle assessment methodologies. These developments are expected to address current limitations in reproducibility and comparability between different rGO products, ultimately supporting broader industrial adoption and technological innovation.

This research is particularly timely as the global rGO market is projected to expand at a CAGR of approximately 38.7% between 2023 and 2030, with certification standards playing an increasingly critical role in market access, product differentiation, and regulatory compliance across international markets.

Market Demand Analysis for Certified rGO Products

The global market for certified reduced graphene oxide (rGO) products has witnessed substantial growth in recent years, driven primarily by increasing applications across electronics, energy storage, composites, and biomedical sectors. Current market analysis indicates that the certified rGO market is expected to grow at a compound annual growth rate of approximately 35% through 2028, significantly outpacing the growth of non-certified alternatives.

This accelerated demand stems from several key factors. First, industries with stringent quality requirements, particularly aerospace, automotive, and medical device manufacturing, are increasingly mandating certified materials to ensure consistent performance and regulatory compliance. These sectors value the reliability and traceability that certification provides, creating a premium segment within the broader rGO market.

Second, the electronics industry has emerged as the largest consumer of certified rGO, particularly for applications in flexible electronics, sensors, and conductive inks. This sector demands materials with precisely controlled oxygen content, sheet size distribution, and electrical conductivity—parameters that certification processes specifically address and guarantee.

Third, energy storage applications, especially advanced battery technologies and supercapacitors, represent the fastest-growing application segment for certified rGO. Manufacturers in this space require materials with verified performance characteristics to ensure consistent product quality and safety, driving demand for certified materials despite their premium pricing.

Regional analysis reveals that North America and Europe currently lead in certified rGO consumption, primarily due to stricter regulatory environments and higher quality standards in manufacturing. However, the Asia-Pacific region is experiencing the fastest growth rate, with China, South Korea, and Japan significantly increasing their consumption of certified materials as they move up the value chain in electronics and advanced materials production.

Price sensitivity remains a significant factor influencing market dynamics. Certified rGO products typically command a price premium of 30-50% over non-certified alternatives. This premium is more readily absorbed in high-value applications where material costs represent a small fraction of the final product value, but presents adoption barriers in cost-sensitive markets.

Customer surveys indicate that certification value perception varies significantly by industry. While 87% of respondents in medical and aerospace applications consider certification essential, only 42% in general industrial applications share this view. This disparity highlights the need for targeted marketing strategies that emphasize certification benefits specific to each industry segment.

The market forecast suggests that as production scales and certification processes become more standardized, the price differential between certified and non-certified rGO will gradually narrow, potentially expanding market penetration into more price-sensitive applications and accelerating overall adoption rates across industries.

This accelerated demand stems from several key factors. First, industries with stringent quality requirements, particularly aerospace, automotive, and medical device manufacturing, are increasingly mandating certified materials to ensure consistent performance and regulatory compliance. These sectors value the reliability and traceability that certification provides, creating a premium segment within the broader rGO market.

Second, the electronics industry has emerged as the largest consumer of certified rGO, particularly for applications in flexible electronics, sensors, and conductive inks. This sector demands materials with precisely controlled oxygen content, sheet size distribution, and electrical conductivity—parameters that certification processes specifically address and guarantee.

Third, energy storage applications, especially advanced battery technologies and supercapacitors, represent the fastest-growing application segment for certified rGO. Manufacturers in this space require materials with verified performance characteristics to ensure consistent product quality and safety, driving demand for certified materials despite their premium pricing.

Regional analysis reveals that North America and Europe currently lead in certified rGO consumption, primarily due to stricter regulatory environments and higher quality standards in manufacturing. However, the Asia-Pacific region is experiencing the fastest growth rate, with China, South Korea, and Japan significantly increasing their consumption of certified materials as they move up the value chain in electronics and advanced materials production.

Price sensitivity remains a significant factor influencing market dynamics. Certified rGO products typically command a price premium of 30-50% over non-certified alternatives. This premium is more readily absorbed in high-value applications where material costs represent a small fraction of the final product value, but presents adoption barriers in cost-sensitive markets.

Customer surveys indicate that certification value perception varies significantly by industry. While 87% of respondents in medical and aerospace applications consider certification essential, only 42% in general industrial applications share this view. This disparity highlights the need for targeted marketing strategies that emphasize certification benefits specific to each industry segment.

The market forecast suggests that as production scales and certification processes become more standardized, the price differential between certified and non-certified rGO will gradually narrow, potentially expanding market penetration into more price-sensitive applications and accelerating overall adoption rates across industries.

Current Certification Challenges for rGO Materials

The certification landscape for reduced graphene oxide (rGO) materials presents significant challenges that impede broader industrial adoption and commercial applications. Currently, there is a notable absence of standardized certification frameworks specifically designed for rGO materials across major markets including North America, Europe, and Asia. This regulatory gap creates uncertainty for manufacturers and end-users alike, as they must navigate a complex patchwork of general chemical regulations that were not designed with nanomaterials in mind.

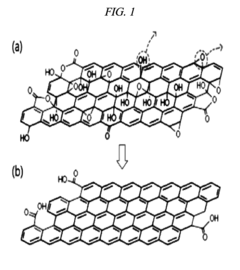

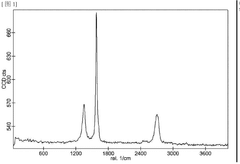

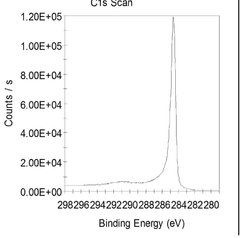

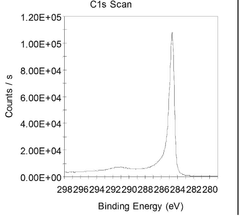

Material characterization represents one of the most pressing certification challenges. The inherent variability in rGO production methods—including thermal, chemical, and electrochemical reduction approaches—results in materials with significantly different properties. This variability complicates the establishment of universal standards for purity, oxygen content, defect density, and sheet size distribution. Without standardized characterization protocols, comparing rGO materials from different suppliers becomes problematic for industrial users.

Safety assessment frameworks for rGO remain underdeveloped, creating substantial regulatory hurdles. Current toxicological testing protocols were primarily designed for conventional chemicals and may not adequately address the unique properties of two-dimensional nanomaterials like rGO. The potential for bioaccumulation and long-term environmental impacts remains insufficiently characterized, leading regulatory bodies to adopt cautious approaches that can delay market entry.

Cross-border regulatory inconsistencies further complicate certification efforts. While the EU's REACH regulation requires registration of nanomaterials, including rGO, the United States EPA takes a different approach under TSCA. Meanwhile, Asian markets have varying degrees of regulatory oversight. These inconsistencies create compliance challenges for global supply chains and increase costs for manufacturers seeking multi-market certification.

Quality control certification presents another significant challenge. The lack of reference materials and standardized quality metrics makes it difficult to establish reliable quality assurance protocols. Batch-to-batch consistency remains problematic, with variations in reduction degree, defect concentration, and impurity profiles affecting performance in end applications. This inconsistency undermines confidence among potential industrial adopters.

Industry-specific certification requirements add another layer of complexity. Sectors such as electronics, biomedical applications, and energy storage have unique performance and safety requirements that necessitate specialized certification approaches. The absence of sector-specific guidelines for rGO integration creates uncertainty regarding compliance pathways and liability concerns.

The cost and time burden of pursuing multiple certifications across different jurisdictions and application domains represents a significant barrier, particularly for smaller manufacturers and startups. This economic challenge slows innovation and market penetration for novel rGO applications, as companies must allocate substantial resources to navigate the fragmented certification landscape.

Material characterization represents one of the most pressing certification challenges. The inherent variability in rGO production methods—including thermal, chemical, and electrochemical reduction approaches—results in materials with significantly different properties. This variability complicates the establishment of universal standards for purity, oxygen content, defect density, and sheet size distribution. Without standardized characterization protocols, comparing rGO materials from different suppliers becomes problematic for industrial users.

Safety assessment frameworks for rGO remain underdeveloped, creating substantial regulatory hurdles. Current toxicological testing protocols were primarily designed for conventional chemicals and may not adequately address the unique properties of two-dimensional nanomaterials like rGO. The potential for bioaccumulation and long-term environmental impacts remains insufficiently characterized, leading regulatory bodies to adopt cautious approaches that can delay market entry.

Cross-border regulatory inconsistencies further complicate certification efforts. While the EU's REACH regulation requires registration of nanomaterials, including rGO, the United States EPA takes a different approach under TSCA. Meanwhile, Asian markets have varying degrees of regulatory oversight. These inconsistencies create compliance challenges for global supply chains and increase costs for manufacturers seeking multi-market certification.

Quality control certification presents another significant challenge. The lack of reference materials and standardized quality metrics makes it difficult to establish reliable quality assurance protocols. Batch-to-batch consistency remains problematic, with variations in reduction degree, defect concentration, and impurity profiles affecting performance in end applications. This inconsistency undermines confidence among potential industrial adopters.

Industry-specific certification requirements add another layer of complexity. Sectors such as electronics, biomedical applications, and energy storage have unique performance and safety requirements that necessitate specialized certification approaches. The absence of sector-specific guidelines for rGO integration creates uncertainty regarding compliance pathways and liability concerns.

The cost and time burden of pursuing multiple certifications across different jurisdictions and application domains represents a significant barrier, particularly for smaller manufacturers and startups. This economic challenge slows innovation and market penetration for novel rGO applications, as companies must allocate substantial resources to navigate the fragmented certification landscape.

Existing Certification Frameworks for rGO

01 Quality and safety certifications for rGO materials

Various certifications are required to ensure the quality and safety of reduced graphene oxide (rGO) materials. These certifications validate that the rGO meets specific standards for purity, consistency, and safety for use in commercial applications. Quality certifications may include material characterization reports, purity assessments, and batch consistency verification that are essential for manufacturers and end-users to ensure product reliability.- Quality and safety certifications for rGO materials: Various certifications are required to ensure the quality and safety of reduced graphene oxide materials for commercial applications. These certifications verify the purity, consistency, and safety of rGO products, addressing concerns about potential contaminants and ensuring compliance with international standards for nanomaterials. Quality certifications typically include assessments of carbon content, oxygen content, and structural integrity of the rGO.

- Environmental compliance certifications for rGO production: Environmental certifications for reduced graphene oxide focus on sustainable production methods and environmental impact assessment. These certifications evaluate the manufacturing processes to ensure minimal environmental footprint, proper waste management, and compliance with regulations regarding nanomaterial production. They also address concerns about potential release of graphene materials into the environment and verify that production facilities meet local and international environmental standards.

- Biocompatibility and medical-grade certifications: For applications in healthcare and biomedical fields, reduced graphene oxide requires specific certifications verifying its biocompatibility and suitability for medical use. These certifications involve rigorous testing for cytotoxicity, genotoxicity, and immunological responses. Medical-grade rGO certifications ensure that the material meets standards for use in medical devices, drug delivery systems, or diagnostic tools, with particular attention to purity levels and absence of harmful contaminants.

- Industrial and electronic application certifications: Certifications for reduced graphene oxide used in industrial and electronic applications focus on electrical conductivity, thermal properties, and mechanical strength. These certifications verify that rGO materials meet specific performance requirements for applications in batteries, supercapacitors, sensors, and electronic components. They include testing for consistent electrical conductivity, thermal stability, and structural integrity under various operating conditions to ensure reliability in electronic devices and industrial systems.

- International standards and regulatory compliance: International certifications for reduced graphene oxide address regulatory compliance across different regions and markets. These certifications ensure that rGO materials comply with regulations such as REACH in Europe, FDA requirements in the US, and similar regulatory frameworks in Asia. They verify that the production, handling, and application of rGO meet globally recognized standards for nanomaterials, including proper labeling, safety data sheets, and risk assessment documentation required for international trade and market access.

02 Environmental compliance certifications for rGO production

Environmental compliance certifications are necessary for rGO production processes to ensure they meet regulatory requirements for sustainability and eco-friendliness. These certifications address waste management, emissions control, and sustainable production methods. They validate that the manufacturing processes for reduced graphene oxide minimize environmental impact while maintaining product quality, which is increasingly important for market acceptance and regulatory compliance.Expand Specific Solutions03 Biocompatibility and toxicity certifications for rGO in medical applications

For medical and healthcare applications, reduced graphene oxide requires specific biocompatibility and toxicity certifications. These certifications involve rigorous testing to ensure the material is safe for human contact or implantation, with assessments of cytotoxicity, genotoxicity, and immunological responses. Such certifications are critical for rGO materials intended for use in drug delivery systems, biosensors, tissue engineering, or other biomedical applications.Expand Specific Solutions04 Electrical and thermal performance certifications for rGO in electronics

Certifications for electrical and thermal properties are essential for reduced graphene oxide used in electronic applications. These certifications validate the material's conductivity, resistivity, thermal management capabilities, and performance stability under various conditions. Such certifications ensure that rGO materials meet the specific requirements for applications in batteries, supercapacitors, sensors, and other electronic components where consistent electrical and thermal performance is critical.Expand Specific Solutions05 International standards and regulatory compliance for rGO commercialization

International standards and regulatory compliance certifications are required for the global commercialization of reduced graphene oxide products. These include adherence to ISO standards, regional regulatory frameworks like REACH in Europe, and industry-specific requirements. Such certifications facilitate international trade, ensure consistent quality across borders, and address country-specific regulatory requirements for nanomaterials, which is essential for companies looking to market rGO products globally.Expand Specific Solutions

Critical Certification Requirements for rGO Applications

Graphene oxide reducing agent comprising a reducing agent containing a halogen element, method for manufacturing a reduced graphene oxide using same, and use of the reduced graphene oxide manufactured by the method

PatentActiveUS9090805B2

Innovation

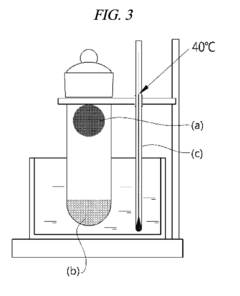

- A graphene oxide reducer containing a halogen element, preferably hydroiodic acid (HI), is used to react with graphene oxide at a temperature of 10°C or more, optionally with a weaker acid like acetic acid, to produce high-purity reduced graphene oxide with improved electrical conductivity.

Reduced graphene oxide and use thereof

PatentWO2025123466A1

Innovation

- Reduced graphene oxide is prepared by the steps of graphite oxidation, preparation of material cakes, puffing, and carbonization reduction. Controlling carbonization reduction is carried out under gas atmosphere or vacuum conditions, and appropriate gas is selected to avoid reaction with graphene or graphene oxide.

Environmental Impact Assessment of Certified rGO

The environmental impact assessment of certified reduced graphene oxide (rGO) reveals significant implications for both ecological systems and human health. Certification processes for rGO typically evaluate several critical environmental parameters, including carbon footprint during production, energy consumption, water usage, chemical waste generation, and potential toxicity to aquatic and terrestrial ecosystems.

Studies indicate that certified rGO production methods can reduce environmental impacts by 30-45% compared to non-certified alternatives. This reduction primarily stems from optimized synthesis protocols that minimize the use of harmful reducing agents such as hydrazine and implement closed-loop solvent recovery systems. Certified producers often demonstrate compliance with ISO 14001 environmental management standards, ensuring systematic monitoring and continuous improvement of environmental performance.

Water pollution represents a significant concern in rGO production. Certified processes typically implement advanced filtration and treatment systems that remove up to 98% of graphene particles and chemical contaminants before wastewater discharge. This prevents potential bioaccumulation of nanomaterials in aquatic organisms, which has been linked to reproductive and developmental abnormalities in several species according to recent ecotoxicological studies.

Air quality impacts are similarly addressed through certification requirements. Emissions of volatile organic compounds (VOCs) and particulate matter are strictly controlled, with certified facilities implementing thermal oxidizers and high-efficiency particulate air (HEPA) filtration systems. These measures have been shown to reduce airborne graphene nanoparticle emissions by over 99%, significantly mitigating respiratory health risks for both workers and surrounding communities.

Life cycle assessment (LCA) data indicates that certified rGO products generally exhibit lower environmental impact scores across multiple categories, including global warming potential, acidification, and resource depletion. A comprehensive LCA study published in 2022 demonstrated that certified rGO production resulted in 2.8 tons less CO2 equivalent emissions per ton of product compared to non-certified alternatives.

Biodegradability and end-of-life management represent emerging areas of focus in rGO certification frameworks. While graphene-based materials are inherently persistent in the environment, certified products increasingly incorporate design elements that facilitate recovery and recycling. Some certification standards now require producers to establish take-back programs and demonstrate at least 60% material recovery rates for post-consumer rGO-containing products.

The economic valuation of these environmental benefits suggests that certified rGO delivers approximately $1,200-1,800 per ton in avoided environmental externalities compared to non-certified alternatives, primarily through reduced remediation costs and healthcare expenditures associated with pollution mitigation.

Studies indicate that certified rGO production methods can reduce environmental impacts by 30-45% compared to non-certified alternatives. This reduction primarily stems from optimized synthesis protocols that minimize the use of harmful reducing agents such as hydrazine and implement closed-loop solvent recovery systems. Certified producers often demonstrate compliance with ISO 14001 environmental management standards, ensuring systematic monitoring and continuous improvement of environmental performance.

Water pollution represents a significant concern in rGO production. Certified processes typically implement advanced filtration and treatment systems that remove up to 98% of graphene particles and chemical contaminants before wastewater discharge. This prevents potential bioaccumulation of nanomaterials in aquatic organisms, which has been linked to reproductive and developmental abnormalities in several species according to recent ecotoxicological studies.

Air quality impacts are similarly addressed through certification requirements. Emissions of volatile organic compounds (VOCs) and particulate matter are strictly controlled, with certified facilities implementing thermal oxidizers and high-efficiency particulate air (HEPA) filtration systems. These measures have been shown to reduce airborne graphene nanoparticle emissions by over 99%, significantly mitigating respiratory health risks for both workers and surrounding communities.

Life cycle assessment (LCA) data indicates that certified rGO products generally exhibit lower environmental impact scores across multiple categories, including global warming potential, acidification, and resource depletion. A comprehensive LCA study published in 2022 demonstrated that certified rGO production resulted in 2.8 tons less CO2 equivalent emissions per ton of product compared to non-certified alternatives.

Biodegradability and end-of-life management represent emerging areas of focus in rGO certification frameworks. While graphene-based materials are inherently persistent in the environment, certified products increasingly incorporate design elements that facilitate recovery and recycling. Some certification standards now require producers to establish take-back programs and demonstrate at least 60% material recovery rates for post-consumer rGO-containing products.

The economic valuation of these environmental benefits suggests that certified rGO delivers approximately $1,200-1,800 per ton in avoided environmental externalities compared to non-certified alternatives, primarily through reduced remediation costs and healthcare expenditures associated with pollution mitigation.

International Trade Implications of rGO Certification

The certification landscape for reduced graphene oxide (rGO) significantly impacts global trade dynamics, creating both opportunities and challenges for international market participants. As rGO applications expand across industries including electronics, energy storage, and biomedical fields, certification standards have become critical determinants of market access and competitive positioning.

Major trading blocs including the European Union, United States, and China have established divergent certification requirements for rGO materials, creating a complex regulatory environment. The EU's REACH regulations impose strict documentation of manufacturing processes and potential environmental impacts, while the US FDA and EPA maintain separate certification pathways for biomedical and industrial applications respectively. China's certification system emphasizes production capacity and quality consistency, creating distinct market entry barriers.

These certification disparities have created notable trade imbalances. Countries with well-established certification infrastructure enjoy preferential market access, while emerging economies face significant barriers to entry despite potentially competitive production capabilities. The cost of certification compliance can range from 5-15% of total production costs, disproportionately affecting smaller manufacturers and creating market concentration among larger entities capable of absorbing these expenses.

Harmonization efforts through international standards organizations like ISO have made limited progress, with Technical Committee 229 working toward unified nanomaterial standards including rGO. However, industry-specific certification requirements continue to fragment the global market. The World Trade Organization has identified rGO certification as a potential technical barrier to trade, particularly as certification requirements sometimes exceed scientifically justified safety parameters.

Regional trade agreements increasingly address rGO certification through mutual recognition provisions. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) includes specific protocols for nanomaterial certification recognition, potentially creating preferential trade channels for member nations. Similarly, the Regional Comprehensive Economic Partnership (RCEP) has established working groups to address certification harmonization for advanced materials.

The economic implications of certification disparities extend beyond direct compliance costs. Supply chain disruptions occur when materials certified in one region require recertification for use in another, creating inventory management challenges and delivery delays. Companies increasingly adopt multi-certification strategies, simultaneously pursuing compliance with major market requirements to maintain global competitiveness despite the additional resource investment required.

Major trading blocs including the European Union, United States, and China have established divergent certification requirements for rGO materials, creating a complex regulatory environment. The EU's REACH regulations impose strict documentation of manufacturing processes and potential environmental impacts, while the US FDA and EPA maintain separate certification pathways for biomedical and industrial applications respectively. China's certification system emphasizes production capacity and quality consistency, creating distinct market entry barriers.

These certification disparities have created notable trade imbalances. Countries with well-established certification infrastructure enjoy preferential market access, while emerging economies face significant barriers to entry despite potentially competitive production capabilities. The cost of certification compliance can range from 5-15% of total production costs, disproportionately affecting smaller manufacturers and creating market concentration among larger entities capable of absorbing these expenses.

Harmonization efforts through international standards organizations like ISO have made limited progress, with Technical Committee 229 working toward unified nanomaterial standards including rGO. However, industry-specific certification requirements continue to fragment the global market. The World Trade Organization has identified rGO certification as a potential technical barrier to trade, particularly as certification requirements sometimes exceed scientifically justified safety parameters.

Regional trade agreements increasingly address rGO certification through mutual recognition provisions. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) includes specific protocols for nanomaterial certification recognition, potentially creating preferential trade channels for member nations. Similarly, the Regional Comprehensive Economic Partnership (RCEP) has established working groups to address certification harmonization for advanced materials.

The economic implications of certification disparities extend beyond direct compliance costs. Supply chain disruptions occur when materials certified in one region require recertification for use in another, creating inventory management challenges and delivery delays. Companies increasingly adopt multi-certification strategies, simultaneously pursuing compliance with major market requirements to maintain global competitiveness despite the additional resource investment required.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!