Reduced Graphene Oxide vs Carbon Black in Conductive Inks

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

rGO and CB Conductive Inks Background

Conductive inks represent a significant advancement in printed electronics, offering versatile applications across multiple industries. Among the various conductive materials used in these inks, Reduced Graphene Oxide (rGO) and Carbon Black (CB) have emerged as prominent candidates with distinct characteristics and performance profiles.

The development of conductive inks dates back to the 1980s, initially dominated by silver-based formulations. However, the high cost of precious metals prompted research into carbon-based alternatives. Carbon Black, derived from the incomplete combustion of heavy petroleum products, has been utilized in conductive applications for decades due to its relatively low cost and established manufacturing processes.

Reduced Graphene Oxide represents a more recent innovation in the conductive materials landscape. Following the groundbreaking isolation of graphene in 2004 by Geim and Novoselov, researchers began exploring oxidized graphene derivatives as practical alternatives for large-scale applications. The reduction of graphene oxide to create rGO emerged as a scalable approach to harness graphene-like properties in printable formulations.

The fundamental difference between these materials lies in their structure: Carbon Black consists of quasi-spherical nanoparticles with dimensions typically ranging from 20-300nm, while rGO features two-dimensional sheet-like structures with lateral dimensions of several micrometers and thickness of a few nanometers. This structural distinction significantly influences their electrical, mechanical, and rheological properties in ink formulations.

Market trends indicate a growing interest in both materials, with CB maintaining dominance in established applications due to its cost-effectiveness and production maturity. Meanwhile, rGO is gaining traction in high-performance applications where its superior conductivity and mechanical properties justify the higher cost.

The technical evolution of these materials has followed different trajectories. CB manufacturing has focused on optimizing particle size distribution and surface chemistry to enhance dispersion stability and conductivity. In contrast, rGO research has concentrated on developing efficient reduction methods to restore the conductive properties of graphene while maintaining processability in liquid dispersions.

Recent advancements have explored hybrid systems combining both materials to leverage their complementary properties. These developments aim to address the persistent challenges in conductive ink formulation: balancing electrical performance, printability, adhesion, and cost-effectiveness across diverse substrate materials and printing technologies.

Understanding the comparative advantages and limitations of rGO and CB provides essential context for evaluating their potential in next-generation printed electronic applications, from flexible displays to wearable sensors and energy storage devices.

The development of conductive inks dates back to the 1980s, initially dominated by silver-based formulations. However, the high cost of precious metals prompted research into carbon-based alternatives. Carbon Black, derived from the incomplete combustion of heavy petroleum products, has been utilized in conductive applications for decades due to its relatively low cost and established manufacturing processes.

Reduced Graphene Oxide represents a more recent innovation in the conductive materials landscape. Following the groundbreaking isolation of graphene in 2004 by Geim and Novoselov, researchers began exploring oxidized graphene derivatives as practical alternatives for large-scale applications. The reduction of graphene oxide to create rGO emerged as a scalable approach to harness graphene-like properties in printable formulations.

The fundamental difference between these materials lies in their structure: Carbon Black consists of quasi-spherical nanoparticles with dimensions typically ranging from 20-300nm, while rGO features two-dimensional sheet-like structures with lateral dimensions of several micrometers and thickness of a few nanometers. This structural distinction significantly influences their electrical, mechanical, and rheological properties in ink formulations.

Market trends indicate a growing interest in both materials, with CB maintaining dominance in established applications due to its cost-effectiveness and production maturity. Meanwhile, rGO is gaining traction in high-performance applications where its superior conductivity and mechanical properties justify the higher cost.

The technical evolution of these materials has followed different trajectories. CB manufacturing has focused on optimizing particle size distribution and surface chemistry to enhance dispersion stability and conductivity. In contrast, rGO research has concentrated on developing efficient reduction methods to restore the conductive properties of graphene while maintaining processability in liquid dispersions.

Recent advancements have explored hybrid systems combining both materials to leverage their complementary properties. These developments aim to address the persistent challenges in conductive ink formulation: balancing electrical performance, printability, adhesion, and cost-effectiveness across diverse substrate materials and printing technologies.

Understanding the comparative advantages and limitations of rGO and CB provides essential context for evaluating their potential in next-generation printed electronic applications, from flexible displays to wearable sensors and energy storage devices.

Market Analysis for Conductive Ink Applications

The conductive ink market has experienced significant growth in recent years, driven by expanding applications in printed electronics, flexible displays, photovoltaics, and smart packaging. Currently valued at approximately $3.8 billion globally, the market is projected to reach $5.6 billion by 2027, representing a compound annual growth rate of 8.1%. This growth trajectory is primarily fueled by increasing demand for miniaturized electronic components and the rising adoption of Internet of Things (IoT) devices across various industries.

Within this expanding market, carbon-based conductive inks represent a substantial segment, with carbon black historically dominating due to its cost-effectiveness and established manufacturing processes. Carbon black conductive inks currently hold approximately 40% of the carbon-based conductive ink market share, valued at around $580 million annually. These inks are predominantly utilized in applications where moderate conductivity is acceptable, such as RFID antennas, membrane switches, and certain types of sensors.

Reduced graphene oxide (rGO) conductive inks, though representing a smaller market segment (approximately $120 million), are experiencing accelerated growth rates of 15-20% annually. This growth is driven by applications requiring superior electrical conductivity, flexibility, and thermal stability. Key application areas include high-performance flexible electronics, advanced sensors, and next-generation energy storage devices.

Industry analysis reveals distinct market segmentation based on performance requirements. High-volume, cost-sensitive applications such as RFID tags and simple circuits continue to favor carbon black formulations. Conversely, premium electronic applications including flexible displays, advanced wearable technology, and high-frequency communication devices increasingly specify rGO-based inks despite their higher cost structure.

Regional market distribution shows Asia-Pacific leading with 45% market share, followed by North America (28%) and Europe (22%). China, South Korea, and Japan are particularly significant manufacturing hubs for conductive ink applications, while North America and Europe lead in research and development of advanced formulations.

End-user industry analysis indicates that consumer electronics represents the largest application segment (38%), followed by automotive (22%), healthcare devices (15%), and smart packaging (12%). The automotive sector specifically shows the highest growth potential for premium conductive ink solutions as vehicle electronics content continues to increase with electrification and advanced driver assistance systems.

Market forecasts suggest that while carbon black will maintain dominance in high-volume applications through 2025, rGO-based formulations will continue gaining market share, particularly in emerging applications requiring superior performance characteristics. This trend is expected to accelerate as manufacturing scale increases and production costs for rGO-based inks decrease.

Within this expanding market, carbon-based conductive inks represent a substantial segment, with carbon black historically dominating due to its cost-effectiveness and established manufacturing processes. Carbon black conductive inks currently hold approximately 40% of the carbon-based conductive ink market share, valued at around $580 million annually. These inks are predominantly utilized in applications where moderate conductivity is acceptable, such as RFID antennas, membrane switches, and certain types of sensors.

Reduced graphene oxide (rGO) conductive inks, though representing a smaller market segment (approximately $120 million), are experiencing accelerated growth rates of 15-20% annually. This growth is driven by applications requiring superior electrical conductivity, flexibility, and thermal stability. Key application areas include high-performance flexible electronics, advanced sensors, and next-generation energy storage devices.

Industry analysis reveals distinct market segmentation based on performance requirements. High-volume, cost-sensitive applications such as RFID tags and simple circuits continue to favor carbon black formulations. Conversely, premium electronic applications including flexible displays, advanced wearable technology, and high-frequency communication devices increasingly specify rGO-based inks despite their higher cost structure.

Regional market distribution shows Asia-Pacific leading with 45% market share, followed by North America (28%) and Europe (22%). China, South Korea, and Japan are particularly significant manufacturing hubs for conductive ink applications, while North America and Europe lead in research and development of advanced formulations.

End-user industry analysis indicates that consumer electronics represents the largest application segment (38%), followed by automotive (22%), healthcare devices (15%), and smart packaging (12%). The automotive sector specifically shows the highest growth potential for premium conductive ink solutions as vehicle electronics content continues to increase with electrification and advanced driver assistance systems.

Market forecasts suggest that while carbon black will maintain dominance in high-volume applications through 2025, rGO-based formulations will continue gaining market share, particularly in emerging applications requiring superior performance characteristics. This trend is expected to accelerate as manufacturing scale increases and production costs for rGO-based inks decrease.

Technical Challenges in Conductive Ink Development

The development of conductive inks faces several significant technical challenges that impact their performance, manufacturability, and commercial viability. For reduced graphene oxide (rGO) and carbon black (CB) based conductive inks, these challenges manifest in distinct ways due to their inherent material properties.

Viscosity control represents a primary challenge in conductive ink formulation. rGO-based inks often exhibit complex rheological behaviors due to the two-dimensional nature of graphene sheets, which can stack and entangle. This creates difficulties in maintaining consistent flow properties during printing processes. Carbon black inks, while more established, struggle with achieving optimal particle dispersion at higher loadings without excessive viscosity increases.

Particle dispersion stability presents another critical hurdle. rGO tends to restack due to π-π interactions between graphene sheets, reducing effective surface area and conductivity over time. Carbon black particles, being spherical, face agglomeration issues that can create inhomogeneous conductive networks and printing defects. Both materials require sophisticated stabilization strategies involving surfactants or polymer additives.

Conductivity-to-loading ratio optimization remains challenging for both materials. rGO theoretically offers superior conductivity at lower loadings, but achieving complete reduction without damaging the graphene structure is technically difficult. Carbon black requires higher loading percentages to achieve comparable conductivity, which negatively impacts ink rheology and mechanical properties of the final printed film.

Adhesion to various substrates presents significant challenges, particularly for flexible electronics applications. The surface chemistry of rGO and carbon black differs substantially, requiring tailored binder systems. rGO's sheet-like structure can provide better mechanical interlocking with substrates but may suffer from poor wetting on hydrophobic surfaces. Carbon black formulations typically require higher binder content, which can compromise conductivity.

Environmental stability poses long-term performance concerns. rGO-based inks may experience conductivity degradation through re-oxidation when exposed to environmental conditions. Carbon black inks generally offer better oxidative stability but may suffer from mechanical degradation and conductivity loss through repeated flexing or environmental stress.

Manufacturing scalability represents perhaps the most significant commercial challenge. rGO production remains costly and difficult to standardize at industrial scales, with batch-to-batch variations in reduction levels and sheet sizes. Carbon black benefits from established production infrastructure but faces limitations in achieving the higher conductivities needed for advanced applications without compromising printability.

Viscosity control represents a primary challenge in conductive ink formulation. rGO-based inks often exhibit complex rheological behaviors due to the two-dimensional nature of graphene sheets, which can stack and entangle. This creates difficulties in maintaining consistent flow properties during printing processes. Carbon black inks, while more established, struggle with achieving optimal particle dispersion at higher loadings without excessive viscosity increases.

Particle dispersion stability presents another critical hurdle. rGO tends to restack due to π-π interactions between graphene sheets, reducing effective surface area and conductivity over time. Carbon black particles, being spherical, face agglomeration issues that can create inhomogeneous conductive networks and printing defects. Both materials require sophisticated stabilization strategies involving surfactants or polymer additives.

Conductivity-to-loading ratio optimization remains challenging for both materials. rGO theoretically offers superior conductivity at lower loadings, but achieving complete reduction without damaging the graphene structure is technically difficult. Carbon black requires higher loading percentages to achieve comparable conductivity, which negatively impacts ink rheology and mechanical properties of the final printed film.

Adhesion to various substrates presents significant challenges, particularly for flexible electronics applications. The surface chemistry of rGO and carbon black differs substantially, requiring tailored binder systems. rGO's sheet-like structure can provide better mechanical interlocking with substrates but may suffer from poor wetting on hydrophobic surfaces. Carbon black formulations typically require higher binder content, which can compromise conductivity.

Environmental stability poses long-term performance concerns. rGO-based inks may experience conductivity degradation through re-oxidation when exposed to environmental conditions. Carbon black inks generally offer better oxidative stability but may suffer from mechanical degradation and conductivity loss through repeated flexing or environmental stress.

Manufacturing scalability represents perhaps the most significant commercial challenge. rGO production remains costly and difficult to standardize at industrial scales, with batch-to-batch variations in reduction levels and sheet sizes. Carbon black benefits from established production infrastructure but faces limitations in achieving the higher conductivities needed for advanced applications without compromising printability.

Current Formulation Approaches

01 Conductive composites combining reduced graphene oxide and carbon black

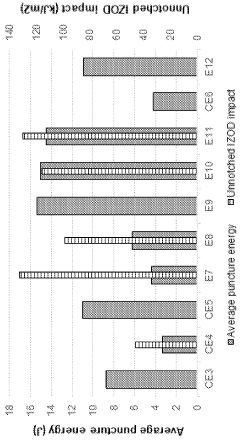

Composites that incorporate both reduced graphene oxide (rGO) and carbon black (CB) can achieve enhanced electrical conductivity through synergistic effects. The combination of these two carbon materials creates effective conductive networks with improved electron transport pathways. These composites typically show higher conductivity than either material alone due to the complementary properties: rGO provides 2D conductive sheets while carbon black forms 3D conductive networks between the sheets.- Composite materials combining reduced graphene oxide and carbon black: Composite materials that combine reduced graphene oxide (rGO) and carbon black exhibit enhanced electrical conductivity compared to either material alone. The synergistic effect between these carbon-based materials creates efficient electron pathways, resulting in superior conductive properties. These composites can be formulated with specific ratios to optimize conductivity for various applications including electrodes, sensors, and energy storage devices.

- Reduction methods for graphene oxide to enhance conductivity: Various reduction methods can be employed to convert graphene oxide to reduced graphene oxide with improved conductivity. These include thermal reduction, chemical reduction using reducing agents, and electrochemical reduction processes. The degree of reduction significantly impacts the electrical properties, with more thoroughly reduced graphene oxide exhibiting conductivity closer to that of pristine graphene. When combined with carbon black, properly reduced graphene oxide creates highly conductive networks.

- Surface functionalization and modification techniques: Surface functionalization and modification of reduced graphene oxide and carbon black can significantly alter their conductive properties. Introducing specific functional groups or dopants can enhance electron mobility and interfacial interactions between the materials. These modifications can be tailored to improve dispersion in various matrices, prevent agglomeration, and create more effective conductive networks. Controlled surface chemistry enables optimization of electrical conductivity for specific applications.

- Conductive ink and coating formulations: Reduced graphene oxide and carbon black can be formulated into conductive inks and coatings with tunable electrical properties. These formulations typically include dispersing agents, binders, and solvents that maintain the conductive network while providing appropriate rheological properties. The ratio between reduced graphene oxide and carbon black, along with processing parameters, determines the final conductivity. These conductive formulations can be applied through various methods including printing, spraying, and dip-coating.

- Applications in energy storage and conversion devices: The combination of reduced graphene oxide and carbon black is particularly valuable in energy storage and conversion devices due to their complementary conductive properties. These materials are used in electrodes for batteries, supercapacitors, and fuel cells, where high electrical conductivity is crucial for performance. The hybrid structures provide enhanced surface area, improved charge transfer kinetics, and better mechanical stability compared to single-component systems, resulting in devices with higher power density and longer cycle life.

02 Manufacturing methods for rGO-carbon black conductive materials

Various manufacturing processes have been developed to optimize the conductivity of rGO-carbon black materials. These include chemical reduction methods, thermal reduction processes, and specialized mixing techniques to ensure homogeneous dispersion. Some approaches involve the simultaneous reduction of graphene oxide and integration with carbon black particles, while others focus on surface modification of either component to enhance interfacial interactions. The processing parameters significantly impact the final conductivity properties of these composite materials.Expand Specific Solutions03 Applications in energy storage devices

The combination of reduced graphene oxide and carbon black has shown significant advantages in energy storage applications, particularly in supercapacitors and lithium-ion batteries. These composite materials provide improved electrode conductivity, enhanced charge transfer rates, and better cycling stability. The synergistic effect between rGO and carbon black creates more efficient pathways for ion and electron transport, resulting in higher energy and power densities in storage devices.Expand Specific Solutions04 Thermal conductivity enhancement

Beyond electrical conductivity, reduced graphene oxide and carbon black composites also demonstrate enhanced thermal conductivity properties. These materials can efficiently dissipate heat in electronic components and thermal management systems. The thermal conductivity can be tuned by adjusting the ratio of rGO to carbon black and their dispersion quality. This property makes these composites valuable in applications requiring both electrical conductivity and heat dissipation capabilities.Expand Specific Solutions05 Surface functionalization for improved conductivity

Surface functionalization techniques can significantly enhance the conductivity of reduced graphene oxide and carbon black composites. Chemical treatments, doping with heteroatoms, and addition of metal nanoparticles can modify the electronic properties of these carbon materials. These modifications can reduce contact resistance between particles, create additional conductive pathways, and improve the overall network connectivity. Functionalization also helps achieve better dispersion and stronger interfacial interactions between the components.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The conductive ink market is currently in a growth phase, with increasing demand driven by printed electronics applications. The competition between Reduced Graphene Oxide (rGO) and Carbon Black technologies represents a key technological battleground. Leading players like Nanotech Energy and The Sixth Element are advancing rGO technology, offering superior conductivity and flexibility, while established companies such as Cabot Corporation and 3M continue to optimize Carbon Black solutions for cost-effectiveness. The market is witnessing technological convergence as companies like LG Chem and BASF develop hybrid formulations. With the printed electronics market projected to reach $19 billion by 2025, companies are strategically positioning through patent portfolios and application-specific formulations to capture market share in this evolving landscape.

Nanotech Energy, Inc.

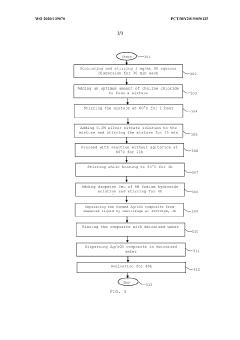

Technical Solution: Nanotech Energy has developed proprietary graphene-based conductive inks utilizing reduced graphene oxide (rGO) technology. Their approach involves a specialized reduction process that preserves the structural integrity of graphene sheets while achieving high conductivity. The company's patented formulation combines rGO with environmentally friendly solvents and proprietary additives to create flexible, highly conductive inks that can be applied through various printing methods including screen printing, inkjet, and gravure. Their technology achieves sheet resistances as low as 10 ohms/square at thicknesses below 10 microns, significantly outperforming traditional carbon black inks which typically require much higher loading to achieve similar conductivity[1]. Nanotech's rGO inks maintain conductivity even after multiple bending cycles (>1000 cycles at 5mm radius), making them suitable for flexible electronics applications. The company has also developed UV-curable versions that enable rapid processing without thermal curing steps.

Strengths: Superior electrical conductivity at lower loading percentages compared to carbon black; excellent flexibility and adhesion to various substrates; environmentally friendly formulation with reduced VOCs; maintains performance under mechanical stress. Weaknesses: Higher production cost compared to carbon black inks; requires specialized processing equipment; shelf stability may be limited without proper formulation; batch-to-batch consistency challenges in large-scale production.

AGFA NV

Technical Solution: AGFA has developed a comprehensive portfolio of conductive ink technologies, including both carbon black and reduced graphene oxide formulations. Their ORGACON™ line features carbon black conductive inks optimized for screen printing applications, while their newer graphene-enhanced products represent their move into advanced materials. AGFA's approach to rGO involves a proprietary chemical reduction process that maintains the structural integrity of graphene sheets while achieving high conductivity. Their hybrid formulations combine the cost advantages of carbon black with the performance benefits of rGO, creating inks with sheet resistances ranging from 20-100 ohms/square at practical coating thicknesses[3]. AGFA has particularly focused on the stability of their dispersions, developing proprietary surfactant systems that prevent reagglomeration of both carbon black and rGO particles. Their water-based formulations have gained significant traction in printed electronics applications where environmental considerations are paramount. The company has also developed specialized grades for RFID antennas, EMI shielding, and transparent conductive applications, demonstrating the versatility of their technology platform.

Strengths: Balanced performance-to-cost ratio through hybrid formulations; extensive printing expertise and application knowledge; water-based options with reduced environmental impact; compatibility with industrial-scale printing processes. Weaknesses: Performance of hybrid formulations falls between pure carbon black and pure rGO options; water-based formulations may have drying/curing limitations; requires careful formulation to maintain dispersion stability over time; moderate flexibility compared to pure rGO solutions.

Key Patents and Scientific Breakthroughs

Method of synthesizing solvent-free silver reduced graphene oxide hybrid conductive ink

PatentWO2020139070A1

Innovation

- A solvent-free method involving the preparation of an aqueous graphene oxide solution with sonication, addition of a quaternary ammonium compound, heating, and use of silver nitrate and a reducing agent to form silver-reduced graphene oxide (Ag/rGO) hybrid conductive ink, utilizing deionized water as a dispersant to enhance dispersity and prevent agglomeration.

Improved graphene and graphene oxide dispersion by in-SITU chemical modification during processing

PatentWO2023170532A1

Innovation

- In-situ chemical modification of graphene and graphene oxide during processing by reacting their inherent reactive groups with a base additive during melt extrusion, creating a surface-modified form that improves dispersion and distribution within the polymer matrix.

Environmental Impact Assessment

The environmental impact of conductive ink materials represents a critical consideration in their industrial application and market adoption. When comparing Reduced Graphene Oxide (rGO) and Carbon Black (CB), significant differences emerge in their ecological footprints across the entire lifecycle.

Carbon Black production traditionally involves the incomplete combustion of fossil fuels, generating substantial greenhouse gas emissions. The furnace black process, which accounts for approximately 95% of global CB production, releases 2-3 tons of CO2 for every ton of Carbon Black produced. Additionally, the process consumes considerable energy and generates particulate matter that requires extensive filtration systems to prevent air pollution.

In contrast, rGO production methods demonstrate varying environmental profiles. Chemical reduction methods using hydrazine or sodium borohydride generate hazardous waste streams requiring specialized treatment. However, newer green reduction approaches utilizing ascorbic acid, plant extracts, or microwave-assisted reduction significantly lower environmental impact. Thermal reduction methods, while energy-intensive, can be optimized with renewable energy sources to minimize carbon footprints.

Water consumption patterns also differ markedly between these materials. CB manufacturing requires substantial water for cooling and purification processes, with potential for contamination by polycyclic aromatic hydrocarbons (PAHs) and heavy metals. rGO production typically demands less water volume but may introduce graphene nanoplatelets into wastewater, presenting emerging concerns about nanomaterial environmental fate.

End-of-life considerations favor rGO-based conductive inks. While both materials present recycling challenges when incorporated into complex electronic devices, rGO demonstrates superior biodegradability potential compared to Carbon Black. Recent research indicates that certain microorganisms can partially degrade graphene-family materials under specific environmental conditions, whereas CB remains largely persistent.

Life Cycle Assessment (LCA) studies suggest that rGO-based inks may offer 30-45% reduced global warming potential compared to CB alternatives when considering the entire product lifecycle. This advantage becomes particularly pronounced when green synthesis methods and renewable energy sources are employed in rGO production.

Regulatory frameworks increasingly recognize these differences, with several jurisdictions implementing stricter controls on Carbon Black manufacturing emissions while incentivizing development of graphene-based alternatives through green chemistry initiatives and circular economy policies.

Carbon Black production traditionally involves the incomplete combustion of fossil fuels, generating substantial greenhouse gas emissions. The furnace black process, which accounts for approximately 95% of global CB production, releases 2-3 tons of CO2 for every ton of Carbon Black produced. Additionally, the process consumes considerable energy and generates particulate matter that requires extensive filtration systems to prevent air pollution.

In contrast, rGO production methods demonstrate varying environmental profiles. Chemical reduction methods using hydrazine or sodium borohydride generate hazardous waste streams requiring specialized treatment. However, newer green reduction approaches utilizing ascorbic acid, plant extracts, or microwave-assisted reduction significantly lower environmental impact. Thermal reduction methods, while energy-intensive, can be optimized with renewable energy sources to minimize carbon footprints.

Water consumption patterns also differ markedly between these materials. CB manufacturing requires substantial water for cooling and purification processes, with potential for contamination by polycyclic aromatic hydrocarbons (PAHs) and heavy metals. rGO production typically demands less water volume but may introduce graphene nanoplatelets into wastewater, presenting emerging concerns about nanomaterial environmental fate.

End-of-life considerations favor rGO-based conductive inks. While both materials present recycling challenges when incorporated into complex electronic devices, rGO demonstrates superior biodegradability potential compared to Carbon Black. Recent research indicates that certain microorganisms can partially degrade graphene-family materials under specific environmental conditions, whereas CB remains largely persistent.

Life Cycle Assessment (LCA) studies suggest that rGO-based inks may offer 30-45% reduced global warming potential compared to CB alternatives when considering the entire product lifecycle. This advantage becomes particularly pronounced when green synthesis methods and renewable energy sources are employed in rGO production.

Regulatory frameworks increasingly recognize these differences, with several jurisdictions implementing stricter controls on Carbon Black manufacturing emissions while incentivizing development of graphene-based alternatives through green chemistry initiatives and circular economy policies.

Manufacturing Scalability Analysis

When comparing the manufacturing scalability of reduced graphene oxide (rGO) and carbon black for conductive ink applications, several critical factors must be considered. Carbon black has established a significant advantage in terms of production scale, with global manufacturing capacity exceeding 18 million tons annually. This mature industry benefits from decades of process optimization, resulting in stable supply chains and relatively low production costs ranging from $0.5 to $3 per kilogram depending on grade and quality.

In contrast, rGO production remains predominantly at laboratory or pilot scale. Current global production capacity is estimated at only several hundred tons annually, with commercial prices ranging from $50 to $200 per kilogram. This substantial cost differential presents a significant barrier to widespread industrial adoption of rGO-based conductive inks, particularly in cost-sensitive applications.

The production processes for these materials differ considerably in complexity and scalability. Carbon black manufacturing employs well-established methods such as furnace black and thermal black processes, which can be operated continuously at high throughput. These processes have been optimized for decades, resulting in consistent quality and reliable production parameters.

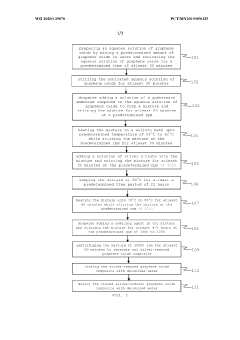

rGO production, however, involves multiple complex steps: graphite oxidation (typically via modified Hummers method), exfoliation, and reduction processes. Each stage presents unique scaling challenges, including handling hazardous chemicals, maintaining consistent oxidation levels, and achieving uniform reduction. Batch-to-batch consistency remains problematic at larger scales, affecting the electrical properties of the resulting conductive inks.

Equipment requirements also differ significantly. Carbon black production utilizes standard industrial equipment with high throughput capabilities. In contrast, rGO production often requires specialized reactors, centrifuges, and filtration systems that are less readily available at industrial scale. The capital investment required for large-scale rGO production facilities is substantially higher relative to production capacity.

Environmental considerations further complicate the scaling of rGO production. The traditional Hummers method generates hazardous waste including strong acids and heavy metals, necessitating comprehensive waste treatment systems. Recent advances in "green" synthesis methods show promise but remain less developed for industrial implementation. Carbon black production, while energy-intensive, benefits from established emission control technologies and regulatory frameworks.

For industrial adoption, these scalability factors significantly favor carbon black in near-term applications where cost sensitivity is high. However, ongoing research into continuous flow processes and environmentally friendly synthesis routes may eventually improve rGO's manufacturing scalability for specialized high-performance applications.

In contrast, rGO production remains predominantly at laboratory or pilot scale. Current global production capacity is estimated at only several hundred tons annually, with commercial prices ranging from $50 to $200 per kilogram. This substantial cost differential presents a significant barrier to widespread industrial adoption of rGO-based conductive inks, particularly in cost-sensitive applications.

The production processes for these materials differ considerably in complexity and scalability. Carbon black manufacturing employs well-established methods such as furnace black and thermal black processes, which can be operated continuously at high throughput. These processes have been optimized for decades, resulting in consistent quality and reliable production parameters.

rGO production, however, involves multiple complex steps: graphite oxidation (typically via modified Hummers method), exfoliation, and reduction processes. Each stage presents unique scaling challenges, including handling hazardous chemicals, maintaining consistent oxidation levels, and achieving uniform reduction. Batch-to-batch consistency remains problematic at larger scales, affecting the electrical properties of the resulting conductive inks.

Equipment requirements also differ significantly. Carbon black production utilizes standard industrial equipment with high throughput capabilities. In contrast, rGO production often requires specialized reactors, centrifuges, and filtration systems that are less readily available at industrial scale. The capital investment required for large-scale rGO production facilities is substantially higher relative to production capacity.

Environmental considerations further complicate the scaling of rGO production. The traditional Hummers method generates hazardous waste including strong acids and heavy metals, necessitating comprehensive waste treatment systems. Recent advances in "green" synthesis methods show promise but remain less developed for industrial implementation. Carbon black production, while energy-intensive, benefits from established emission control technologies and regulatory frameworks.

For industrial adoption, these scalability factors significantly favor carbon black in near-term applications where cost sensitivity is high. However, ongoing research into continuous flow processes and environmentally friendly synthesis routes may eventually improve rGO's manufacturing scalability for specialized high-performance applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!