Regulatory Trends Impacting Ethyl Acetate Production

JUN 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Regulatory Landscape

The regulatory landscape for ethyl acetate production has become increasingly complex and stringent in recent years, reflecting growing concerns about environmental protection, worker safety, and public health. Governments and regulatory bodies worldwide are implementing stricter controls on the manufacturing, handling, and use of ethyl acetate, a widely used solvent in various industries.

One of the primary regulatory trends impacting ethyl acetate production is the tightening of emissions standards. Environmental agencies are imposing more stringent limits on volatile organic compound (VOC) emissions from industrial processes, including ethyl acetate manufacturing. This has led to the adoption of advanced emission control technologies and process modifications to reduce air pollution and minimize environmental impact.

Occupational health and safety regulations have also seen significant developments. Regulatory bodies are mandating improved workplace safety measures, including enhanced ventilation systems, personal protective equipment requirements, and more frequent health monitoring for workers exposed to ethyl acetate. These regulations aim to mitigate the potential health risks associated with long-term exposure to the solvent.

The transportation and storage of ethyl acetate are subject to increasingly strict regulations. Hazardous materials transportation laws are being updated to ensure safer handling and transport of ethyl acetate, with more rigorous packaging, labeling, and documentation requirements. Storage facilities are required to implement enhanced safety measures and emergency response plans to prevent and manage potential spills or accidents.

Product quality and purity standards for ethyl acetate are also evolving. Regulatory agencies are setting more stringent specifications for the chemical's use in various applications, particularly in pharmaceuticals and food-related industries. This trend is driving manufacturers to invest in advanced purification technologies and quality control processes to meet these higher standards.

Sustainability and circular economy principles are influencing regulatory approaches to ethyl acetate production. There is a growing emphasis on promoting the use of bio-based feedstocks for ethyl acetate synthesis, as well as encouraging the development of more environmentally friendly production processes. Some jurisdictions are introducing incentives or mandates for the use of renewable resources in chemical manufacturing, which could reshape the ethyl acetate production landscape in the coming years.

Global harmonization of regulations is another significant trend affecting the ethyl acetate industry. International bodies are working towards aligning chemical management policies and standards across different regions, which could lead to more consistent regulatory requirements for ethyl acetate producers worldwide. This harmonization effort aims to facilitate trade while ensuring a high level of environmental and health protection globally.

One of the primary regulatory trends impacting ethyl acetate production is the tightening of emissions standards. Environmental agencies are imposing more stringent limits on volatile organic compound (VOC) emissions from industrial processes, including ethyl acetate manufacturing. This has led to the adoption of advanced emission control technologies and process modifications to reduce air pollution and minimize environmental impact.

Occupational health and safety regulations have also seen significant developments. Regulatory bodies are mandating improved workplace safety measures, including enhanced ventilation systems, personal protective equipment requirements, and more frequent health monitoring for workers exposed to ethyl acetate. These regulations aim to mitigate the potential health risks associated with long-term exposure to the solvent.

The transportation and storage of ethyl acetate are subject to increasingly strict regulations. Hazardous materials transportation laws are being updated to ensure safer handling and transport of ethyl acetate, with more rigorous packaging, labeling, and documentation requirements. Storage facilities are required to implement enhanced safety measures and emergency response plans to prevent and manage potential spills or accidents.

Product quality and purity standards for ethyl acetate are also evolving. Regulatory agencies are setting more stringent specifications for the chemical's use in various applications, particularly in pharmaceuticals and food-related industries. This trend is driving manufacturers to invest in advanced purification technologies and quality control processes to meet these higher standards.

Sustainability and circular economy principles are influencing regulatory approaches to ethyl acetate production. There is a growing emphasis on promoting the use of bio-based feedstocks for ethyl acetate synthesis, as well as encouraging the development of more environmentally friendly production processes. Some jurisdictions are introducing incentives or mandates for the use of renewable resources in chemical manufacturing, which could reshape the ethyl acetate production landscape in the coming years.

Global harmonization of regulations is another significant trend affecting the ethyl acetate industry. International bodies are working towards aligning chemical management policies and standards across different regions, which could lead to more consistent regulatory requirements for ethyl acetate producers worldwide. This harmonization effort aims to facilitate trade while ensuring a high level of environmental and health protection globally.

Market Demand Analysis

The global market for ethyl acetate has been experiencing steady growth, driven by its versatile applications across various industries. The demand for ethyl acetate is primarily fueled by its use as a solvent in paints, coatings, adhesives, and the pharmaceutical industry. The packaging industry, particularly flexible packaging, has emerged as a significant consumer of ethyl acetate due to its excellent solvent properties and low toxicity.

In recent years, the shift towards eco-friendly and sustainable products has influenced the ethyl acetate market. Manufacturers are increasingly focusing on developing bio-based ethyl acetate to meet the growing demand for green solvents. This trend is expected to create new opportunities in the market, especially in regions with stringent environmental regulations.

The Asia-Pacific region, led by China and India, has been the largest consumer of ethyl acetate, owing to rapid industrialization and the growth of end-use industries such as paints, coatings, and packaging. North America and Europe follow, with a stable demand driven by the pharmaceutical and food industries.

The COVID-19 pandemic initially disrupted the ethyl acetate supply chain, causing a temporary decline in demand. However, the market has shown resilience, with a quick recovery observed in the latter half of 2020. The increased focus on hygiene and sanitation has led to a surge in demand for ethyl acetate in the production of hand sanitizers and disinfectants.

Regulatory trends have a significant impact on the ethyl acetate market. Stringent environmental regulations, particularly in developed regions, are pushing manufacturers to adopt cleaner production processes and develop more sustainable products. This has led to increased investment in research and development of bio-based ethyl acetate and more efficient production methods.

The automotive industry's shift towards water-based paints and coatings has somewhat affected the demand for ethyl acetate in this sector. However, this has been offset by the growing demand in other applications, such as flexible packaging and pharmaceuticals.

Price volatility of raw materials, particularly ethanol and acetic acid, remains a challenge for the ethyl acetate market. Fluctuations in oil prices and the availability of feedstock can significantly impact production costs and, consequently, market dynamics.

In recent years, the shift towards eco-friendly and sustainable products has influenced the ethyl acetate market. Manufacturers are increasingly focusing on developing bio-based ethyl acetate to meet the growing demand for green solvents. This trend is expected to create new opportunities in the market, especially in regions with stringent environmental regulations.

The Asia-Pacific region, led by China and India, has been the largest consumer of ethyl acetate, owing to rapid industrialization and the growth of end-use industries such as paints, coatings, and packaging. North America and Europe follow, with a stable demand driven by the pharmaceutical and food industries.

The COVID-19 pandemic initially disrupted the ethyl acetate supply chain, causing a temporary decline in demand. However, the market has shown resilience, with a quick recovery observed in the latter half of 2020. The increased focus on hygiene and sanitation has led to a surge in demand for ethyl acetate in the production of hand sanitizers and disinfectants.

Regulatory trends have a significant impact on the ethyl acetate market. Stringent environmental regulations, particularly in developed regions, are pushing manufacturers to adopt cleaner production processes and develop more sustainable products. This has led to increased investment in research and development of bio-based ethyl acetate and more efficient production methods.

The automotive industry's shift towards water-based paints and coatings has somewhat affected the demand for ethyl acetate in this sector. However, this has been offset by the growing demand in other applications, such as flexible packaging and pharmaceuticals.

Price volatility of raw materials, particularly ethanol and acetic acid, remains a challenge for the ethyl acetate market. Fluctuations in oil prices and the availability of feedstock can significantly impact production costs and, consequently, market dynamics.

Current Production Challenges

The production of ethyl acetate faces several significant challenges in the current regulatory landscape. Environmental regulations, particularly those aimed at reducing volatile organic compound (VOC) emissions, have become increasingly stringent. Ethyl acetate, being a VOC, is subject to these regulations, which necessitate substantial investments in emission control technologies and process modifications to ensure compliance.

Safety regulations also pose challenges for ethyl acetate producers. The flammable nature of ethyl acetate requires strict adherence to safety protocols, including the implementation of advanced fire suppression systems and explosion-proof equipment. These safety measures often result in increased production costs and operational complexities.

Raw material sourcing and pricing present another set of challenges. Ethyl acetate production relies heavily on ethanol and acetic acid, both of which are subject to price fluctuations and supply chain disruptions. Regulatory changes affecting the production or importation of these raw materials can significantly impact the cost and availability of ethyl acetate production inputs.

Energy efficiency regulations are becoming more prevalent, pushing manufacturers to optimize their production processes. This often requires substantial capital investments in new equipment and technologies to meet energy consumption targets, which can be particularly challenging for smaller producers with limited resources.

Waste management regulations have also become more stringent, requiring producers to implement more sophisticated waste treatment and disposal methods. This includes the proper handling of byproducts and the development of recycling processes to minimize environmental impact, adding another layer of complexity to production operations.

Product quality and purity standards continue to evolve, driven by both regulatory requirements and customer demands. Meeting these standards often necessitates investments in advanced purification technologies and quality control systems, which can strain production resources and increase operational costs.

Transportation and storage regulations for hazardous materials have become more complex, affecting the entire supply chain of ethyl acetate production. Compliance with these regulations requires specialized equipment, training, and documentation, adding to the overall production and distribution costs.

Lastly, the global nature of the ethyl acetate market means that producers must navigate a complex web of international regulations. Differences in regulatory standards between countries can create trade barriers and compliance challenges, particularly for companies operating in multiple jurisdictions or exporting to diverse markets.

Safety regulations also pose challenges for ethyl acetate producers. The flammable nature of ethyl acetate requires strict adherence to safety protocols, including the implementation of advanced fire suppression systems and explosion-proof equipment. These safety measures often result in increased production costs and operational complexities.

Raw material sourcing and pricing present another set of challenges. Ethyl acetate production relies heavily on ethanol and acetic acid, both of which are subject to price fluctuations and supply chain disruptions. Regulatory changes affecting the production or importation of these raw materials can significantly impact the cost and availability of ethyl acetate production inputs.

Energy efficiency regulations are becoming more prevalent, pushing manufacturers to optimize their production processes. This often requires substantial capital investments in new equipment and technologies to meet energy consumption targets, which can be particularly challenging for smaller producers with limited resources.

Waste management regulations have also become more stringent, requiring producers to implement more sophisticated waste treatment and disposal methods. This includes the proper handling of byproducts and the development of recycling processes to minimize environmental impact, adding another layer of complexity to production operations.

Product quality and purity standards continue to evolve, driven by both regulatory requirements and customer demands. Meeting these standards often necessitates investments in advanced purification technologies and quality control systems, which can strain production resources and increase operational costs.

Transportation and storage regulations for hazardous materials have become more complex, affecting the entire supply chain of ethyl acetate production. Compliance with these regulations requires specialized equipment, training, and documentation, adding to the overall production and distribution costs.

Lastly, the global nature of the ethyl acetate market means that producers must navigate a complex web of international regulations. Differences in regulatory standards between countries can create trade barriers and compliance challenges, particularly for companies operating in multiple jurisdictions or exporting to diverse markets.

Existing Compliance Solutions

01 Production and purification of ethyl acetate

Various methods and processes for producing and purifying ethyl acetate are described. These include distillation techniques, reactive distillation, and the use of specific catalysts to improve yield and purity. The processes aim to optimize the production of ethyl acetate while minimizing byproducts and energy consumption.- Production and purification of ethyl acetate: Various methods and processes for producing and purifying ethyl acetate are described. These include distillation techniques, reactive distillation, and the use of specific catalysts to improve yield and efficiency. The processes aim to obtain high-purity ethyl acetate while minimizing energy consumption and waste production.

- Applications of ethyl acetate in chemical processes: Ethyl acetate is utilized in various chemical processes and applications. It serves as a solvent in different industries, including pharmaceuticals, coatings, and adhesives. The compound is also used as a reactant or intermediate in the synthesis of other chemicals and materials.

- Ethyl acetate in extraction and separation processes: Ethyl acetate is employed in extraction and separation processes for various compounds. It is used as a solvent for liquid-liquid extraction, particularly in the isolation of natural products and pharmaceutical compounds. The compound's properties make it suitable for selective extraction and purification of target molecules.

- Environmental and safety considerations for ethyl acetate: Research and development efforts focus on improving the environmental impact and safety aspects of ethyl acetate production and use. This includes developing greener production methods, reducing emissions, and implementing safety measures for handling and storage of the compound in industrial settings.

- Novel catalysts and reaction systems for ethyl acetate synthesis: Innovative catalysts and reaction systems are being developed to enhance the synthesis of ethyl acetate. These advancements aim to improve reaction rates, selectivity, and overall process efficiency. Novel catalytic materials and reactor designs are explored to optimize the production of ethyl acetate.

02 Applications of ethyl acetate in chemical processes

Ethyl acetate is utilized in various chemical processes and applications. It serves as a solvent in different industries, including pharmaceuticals, coatings, and adhesives. The compound is also used in extraction processes and as a reactant in organic synthesis reactions.Expand Specific Solutions03 Ethyl acetate in polymer and material science

Ethyl acetate plays a role in polymer and material science applications. It is used in the preparation of various polymers, as a solvent for resins, and in the production of coatings and films. The compound's properties make it suitable for use in material processing and modification techniques.Expand Specific Solutions04 Environmental and safety considerations for ethyl acetate

Research and development efforts focus on improving the environmental impact and safety aspects of ethyl acetate production and use. This includes developing greener production methods, improving waste management, and enhancing safety measures in handling and storage of the compound.Expand Specific Solutions05 Novel synthesis routes and catalysts for ethyl acetate

Innovative approaches to synthesizing ethyl acetate are explored, including the development of new catalysts and reaction pathways. These methods aim to improve efficiency, selectivity, and sustainability in ethyl acetate production, potentially offering advantages over traditional manufacturing processes.Expand Specific Solutions

Key Industry Players

The regulatory landscape for ethyl acetate production is evolving in a mature industry with established players. The market is characterized by moderate growth, driven by demand in various sectors such as coatings, adhesives, and pharmaceuticals. Technologically, the production process is well-established, with major companies like Celanese International Corp., Eastman Chemical Co., and China Petroleum & Chemical Corp. leading the way. However, there's increasing focus on sustainable production methods, with companies like Viridis Chemical LLC pioneering bio-based ethyl acetate manufacturing. Regulatory trends are primarily centered around environmental concerns, pushing for cleaner production processes and stricter emissions controls, which may impact smaller players in the market.

Celanese International Corp.

Technical Solution: Celanese has developed an innovative process for ethyl acetate production that aligns with regulatory trends. Their method utilizes bioethanol as a feedstock, reducing reliance on fossil fuels and lowering carbon emissions. The process employs a proprietary catalyst system that enhances selectivity and yield, resulting in a more efficient and environmentally friendly production route[1]. Celanese has also implemented advanced process control systems to optimize energy consumption and minimize waste generation, addressing regulatory concerns about resource efficiency and environmental impact[2]. Additionally, the company has invested in carbon capture and utilization technologies to further reduce the carbon footprint of their ethyl acetate production, anticipating stricter emissions regulations[3].

Strengths: Sustainable feedstock, improved efficiency, and reduced emissions align well with regulatory trends. Weaknesses: Potential higher production costs and dependency on bioethanol availability may pose challenges in certain markets.

Eastman Chemical Co.

Technical Solution: Eastman Chemical has developed a novel approach to ethyl acetate production that addresses key regulatory concerns. Their process utilizes a proprietary reactive distillation technology, which combines reaction and separation steps, resulting in significant energy savings and reduced equipment footprint[4]. This aligns with regulatory pushes for energy efficiency and resource conservation. Eastman has also implemented advanced process analytics and machine learning algorithms to optimize production parameters in real-time, ensuring consistent product quality while minimizing emissions and waste[5]. Furthermore, the company has invested in developing bio-based routes for ethyl acetate production, using renewable feedstocks to reduce reliance on petrochemical sources and lower overall carbon emissions[6].

Strengths: Energy-efficient process, advanced process control, and exploration of bio-based routes address multiple regulatory concerns. Weaknesses: High initial investment costs for technology implementation and potential challenges in scaling up bio-based production.

Innovative Regulatory Approaches

Method for producing ethyl acetate

PatentPendingUS20250002441A1

Innovation

- Controlling the palladium content in the catalyst within the range of 0.1 to 14 ppb by mass in a heteropolyacid or its salt supported on a carrier, such as silica, suppresses side reactions and ensures stable long-term operation.

PROCESS TO PRODUCE ETHYL ACETATE

PatentInactiveID470097A

Innovation

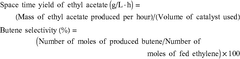

- Optimized mole ratios of ethylene to acetic acid (6.0-12.2) and ethylene to water (8.0-17.0) to enhance ethyl acetate production.

- Controlled mole ratio of acetic acid to water (1.25-1.40) to reduce methyl ethyl ketone (MEK) byproduct formation.

- Use of heteropolyacid catalyst in combination with optimized reagent ratios to extend catalyst life.

Environmental Impact Assessment

The production of ethyl acetate has significant environmental implications that require careful assessment and management. The manufacturing process involves the use of volatile organic compounds (VOCs) and potentially hazardous chemicals, which can contribute to air pollution, water contamination, and soil degradation if not properly controlled.

Air quality is a primary concern in ethyl acetate production. The release of VOCs during manufacturing can lead to the formation of ground-level ozone and smog, impacting both human health and ecosystems. Regulatory bodies are increasingly focusing on reducing these emissions through stricter air quality standards and mandating the use of best available technologies for emission control.

Water resources are also at risk from ethyl acetate production. The process generates wastewater that may contain organic compounds and other pollutants. Proper treatment and disposal of this wastewater are essential to prevent contamination of surface and groundwater sources. Regulatory trends are moving towards more stringent discharge limits and increased monitoring requirements for industrial effluents.

Soil contamination is another potential environmental impact that must be addressed. Spills or leaks of raw materials, intermediates, or finished products can lead to soil pollution, affecting local ecosystems and potentially entering the food chain. Regulations are evolving to require more robust containment systems, regular soil testing, and comprehensive remediation plans in case of contamination events.

Energy consumption and greenhouse gas emissions associated with ethyl acetate production are also coming under increased scrutiny. Regulatory bodies are implementing policies to promote energy efficiency and reduce carbon footprints in industrial processes. This may include requirements for energy audits, adoption of renewable energy sources, and participation in carbon trading schemes.

Waste management is a critical aspect of environmental impact assessment for ethyl acetate production. The generation, handling, and disposal of hazardous waste materials are subject to strict regulations. Trends indicate a move towards circular economy principles, with greater emphasis on waste reduction, recycling, and recovery of valuable materials from production processes.

Biodiversity and ecosystem protection are gaining prominence in environmental regulations. The siting and operation of ethyl acetate production facilities must consider potential impacts on local flora and fauna, particularly in sensitive or protected areas. Environmental impact assessments are increasingly required to include comprehensive biodiversity studies and mitigation measures.

As regulatory frameworks continue to evolve, producers of ethyl acetate must stay abreast of changing requirements and proactively implement measures to minimize their environmental footprint. This may involve investing in cleaner production technologies, improving monitoring and reporting systems, and engaging in stakeholder dialogue to address environmental concerns.

Air quality is a primary concern in ethyl acetate production. The release of VOCs during manufacturing can lead to the formation of ground-level ozone and smog, impacting both human health and ecosystems. Regulatory bodies are increasingly focusing on reducing these emissions through stricter air quality standards and mandating the use of best available technologies for emission control.

Water resources are also at risk from ethyl acetate production. The process generates wastewater that may contain organic compounds and other pollutants. Proper treatment and disposal of this wastewater are essential to prevent contamination of surface and groundwater sources. Regulatory trends are moving towards more stringent discharge limits and increased monitoring requirements for industrial effluents.

Soil contamination is another potential environmental impact that must be addressed. Spills or leaks of raw materials, intermediates, or finished products can lead to soil pollution, affecting local ecosystems and potentially entering the food chain. Regulations are evolving to require more robust containment systems, regular soil testing, and comprehensive remediation plans in case of contamination events.

Energy consumption and greenhouse gas emissions associated with ethyl acetate production are also coming under increased scrutiny. Regulatory bodies are implementing policies to promote energy efficiency and reduce carbon footprints in industrial processes. This may include requirements for energy audits, adoption of renewable energy sources, and participation in carbon trading schemes.

Waste management is a critical aspect of environmental impact assessment for ethyl acetate production. The generation, handling, and disposal of hazardous waste materials are subject to strict regulations. Trends indicate a move towards circular economy principles, with greater emphasis on waste reduction, recycling, and recovery of valuable materials from production processes.

Biodiversity and ecosystem protection are gaining prominence in environmental regulations. The siting and operation of ethyl acetate production facilities must consider potential impacts on local flora and fauna, particularly in sensitive or protected areas. Environmental impact assessments are increasingly required to include comprehensive biodiversity studies and mitigation measures.

As regulatory frameworks continue to evolve, producers of ethyl acetate must stay abreast of changing requirements and proactively implement measures to minimize their environmental footprint. This may involve investing in cleaner production technologies, improving monitoring and reporting systems, and engaging in stakeholder dialogue to address environmental concerns.

Global Trade Implications

The global trade landscape for ethyl acetate is experiencing significant shifts due to evolving regulatory trends. As countries implement stricter environmental and safety regulations, producers and exporters face new challenges in maintaining compliance across different markets. These regulatory changes are reshaping trade flows and impacting the competitive dynamics of the ethyl acetate industry.

One of the key factors influencing global trade is the increasing focus on sustainability and environmental protection. Many countries are implementing more stringent emissions standards and waste management regulations, which directly affect ethyl acetate production processes. This has led to a growing demand for cleaner production technologies and more environmentally friendly alternatives, potentially altering the competitive advantage of traditional producers.

Tariff structures and trade agreements also play a crucial role in shaping the global ethyl acetate market. Changes in import duties and preferential trade agreements can significantly impact the cost-competitiveness of producers in different regions. For instance, recent trade tensions between major economies have led to the imposition of new tariffs, affecting the flow of ethyl acetate and its raw materials across borders.

The harmonization of safety standards and labeling requirements across different regions is another important trend affecting global trade. As regulatory bodies in various countries align their standards, it creates both opportunities and challenges for ethyl acetate producers. While harmonization can simplify compliance processes for exporters, it may also require significant investments in updating production facilities and practices to meet new global standards.

Regulatory changes related to the transportation and storage of ethyl acetate are also impacting international trade. Stricter regulations on the handling of hazardous materials have led to increased costs and logistical challenges for exporters. This has prompted some companies to explore alternative shipping routes or invest in specialized transportation infrastructure to ensure compliance with international safety standards.

The growing emphasis on product traceability and supply chain transparency is another regulatory trend affecting global trade in ethyl acetate. Many countries are implementing stricter requirements for documenting the origin and production processes of chemical products. This trend is driving investments in advanced tracking systems and certification processes, which can impact the competitiveness of producers, particularly those in developing markets.

As regulatory landscapes continue to evolve, ethyl acetate producers and traders must stay informed about changes in different markets and adapt their strategies accordingly. This may involve diversifying production locations, investing in new technologies, or forming strategic partnerships to navigate the complex regulatory environment. The ability to anticipate and respond to these regulatory trends will be crucial for maintaining competitiveness in the global ethyl acetate market.

One of the key factors influencing global trade is the increasing focus on sustainability and environmental protection. Many countries are implementing more stringent emissions standards and waste management regulations, which directly affect ethyl acetate production processes. This has led to a growing demand for cleaner production technologies and more environmentally friendly alternatives, potentially altering the competitive advantage of traditional producers.

Tariff structures and trade agreements also play a crucial role in shaping the global ethyl acetate market. Changes in import duties and preferential trade agreements can significantly impact the cost-competitiveness of producers in different regions. For instance, recent trade tensions between major economies have led to the imposition of new tariffs, affecting the flow of ethyl acetate and its raw materials across borders.

The harmonization of safety standards and labeling requirements across different regions is another important trend affecting global trade. As regulatory bodies in various countries align their standards, it creates both opportunities and challenges for ethyl acetate producers. While harmonization can simplify compliance processes for exporters, it may also require significant investments in updating production facilities and practices to meet new global standards.

Regulatory changes related to the transportation and storage of ethyl acetate are also impacting international trade. Stricter regulations on the handling of hazardous materials have led to increased costs and logistical challenges for exporters. This has prompted some companies to explore alternative shipping routes or invest in specialized transportation infrastructure to ensure compliance with international safety standards.

The growing emphasis on product traceability and supply chain transparency is another regulatory trend affecting global trade in ethyl acetate. Many countries are implementing stricter requirements for documenting the origin and production processes of chemical products. This trend is driving investments in advanced tracking systems and certification processes, which can impact the competitiveness of producers, particularly those in developing markets.

As regulatory landscapes continue to evolve, ethyl acetate producers and traders must stay informed about changes in different markets and adapt their strategies accordingly. This may involve diversifying production locations, investing in new technologies, or forming strategic partnerships to navigate the complex regulatory environment. The ability to anticipate and respond to these regulatory trends will be crucial for maintaining competitiveness in the global ethyl acetate market.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!