Carbon Capture Technologies and Thermal Management Strategies

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Evolution and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications across various industries. The journey began in the 1970s with early experiments in capturing carbon dioxide from industrial flue gases, primarily motivated by enhanced oil recovery applications rather than climate concerns. By the 1990s, as climate change awareness grew, carbon capture research expanded substantially, leading to the first large-scale demonstration projects in the early 2000s.

The evolution of carbon capture technologies can be categorized into three distinct generations. First-generation technologies focused on post-combustion capture using amine-based solvents, which remain widely implemented despite their energy intensity. Second-generation approaches introduced pre-combustion capture and oxyfuel combustion, offering improved efficiency but requiring significant plant modifications. The emerging third-generation technologies include direct air capture, membrane-based systems, and novel sorbent materials that promise dramatically reduced energy penalties.

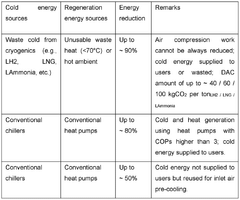

Thermal management has been a critical aspect throughout this evolution, as traditional carbon capture processes are notoriously energy-intensive. Early systems required up to 30% of a power plant's energy output just for the capture process, creating a significant efficiency penalty. Recent technological advances have focused on reducing this thermal burden through process integration, waste heat recovery, and the development of sorbents with lower regeneration energy requirements.

The primary objective of current carbon capture research is to develop economically viable systems that can be deployed at scale across various industries. This includes reducing the energy penalty below 10%, decreasing capital costs by at least 50% compared to first-generation systems, and ensuring capture rates above 90% while maintaining operational reliability. Additional objectives include minimizing water consumption, reducing physical footprint, and ensuring compatibility with existing infrastructure.

Another crucial objective is addressing the full carbon capture, utilization, and storage (CCUS) value chain. This encompasses not only capture technology but also compression, transportation, utilization pathways, and secure geological storage solutions. The integration of these elements into a cohesive system represents a significant technical challenge that requires interdisciplinary approaches and cross-sector collaboration.

Looking forward, research objectives are increasingly focused on developing carbon-negative technologies that can actively reduce atmospheric CO2 concentrations, moving beyond merely mitigating new emissions. This ambitious goal requires breakthrough innovations in both capture technology and thermal management strategies to create systems that are energetically favorable and economically sustainable at global deployment scales.

The evolution of carbon capture technologies can be categorized into three distinct generations. First-generation technologies focused on post-combustion capture using amine-based solvents, which remain widely implemented despite their energy intensity. Second-generation approaches introduced pre-combustion capture and oxyfuel combustion, offering improved efficiency but requiring significant plant modifications. The emerging third-generation technologies include direct air capture, membrane-based systems, and novel sorbent materials that promise dramatically reduced energy penalties.

Thermal management has been a critical aspect throughout this evolution, as traditional carbon capture processes are notoriously energy-intensive. Early systems required up to 30% of a power plant's energy output just for the capture process, creating a significant efficiency penalty. Recent technological advances have focused on reducing this thermal burden through process integration, waste heat recovery, and the development of sorbents with lower regeneration energy requirements.

The primary objective of current carbon capture research is to develop economically viable systems that can be deployed at scale across various industries. This includes reducing the energy penalty below 10%, decreasing capital costs by at least 50% compared to first-generation systems, and ensuring capture rates above 90% while maintaining operational reliability. Additional objectives include minimizing water consumption, reducing physical footprint, and ensuring compatibility with existing infrastructure.

Another crucial objective is addressing the full carbon capture, utilization, and storage (CCUS) value chain. This encompasses not only capture technology but also compression, transportation, utilization pathways, and secure geological storage solutions. The integration of these elements into a cohesive system represents a significant technical challenge that requires interdisciplinary approaches and cross-sector collaboration.

Looking forward, research objectives are increasingly focused on developing carbon-negative technologies that can actively reduce atmospheric CO2 concentrations, moving beyond merely mitigating new emissions. This ambitious goal requires breakthrough innovations in both capture technology and thermal management strategies to create systems that are energetically favorable and economically sustainable at global deployment scales.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures. As of 2023, the market size has reached approximately $7 billion, with projections indicating expansion to $20 billion by 2030, representing a compound annual growth rate of 16.3%. This growth trajectory is supported by substantial government investments, with the United States allocating $12 billion for carbon capture development through the Infrastructure Investment and Jobs Act, and the European Union committing €10 billion through various climate initiatives.

The industrial sector currently dominates carbon capture applications, accounting for 65% of the market share. Power generation follows at 25%, with the remaining 10% distributed across various applications including direct air capture. This distribution reflects the prioritization of high-emission point sources where carbon capture technologies can achieve maximum impact with relative cost-efficiency.

Geographically, North America leads the market with 40% share, followed by Europe at 35%, Asia-Pacific at 20%, and other regions comprising the remaining 5%. China's rapid industrialization coupled with ambitious carbon neutrality goals is expected to significantly alter this distribution in the coming decade, potentially positioning Asia-Pacific as the dominant market region by 2035.

From a technology perspective, post-combustion capture currently dominates with 70% market share due to its retrofit compatibility with existing infrastructure. Pre-combustion and oxy-fuel combustion technologies hold 20% and 10% respectively, though these proportions are expected to shift as newer technologies mature and gain commercial viability.

The market landscape features both established industrial giants and innovative startups. Major players include Mitsubishi Heavy Industries, Fluor Corporation, and Aker Solutions, collectively controlling approximately 45% of the market. However, venture capital investment in carbon capture startups has surged, reaching $1.9 billion in 2022, a 300% increase from 2020 levels.

Customer segments are diversifying beyond traditional heavy industry and power generation. Emerging segments include cement production, steel manufacturing, and chemical processing, collectively representing the fastest-growing market segment with 22% annual growth. Additionally, voluntary carbon markets are creating new demand channels, with corporate carbon neutrality pledges driving investment in carbon removal technologies as a complement to reduction strategies.

The industrial sector currently dominates carbon capture applications, accounting for 65% of the market share. Power generation follows at 25%, with the remaining 10% distributed across various applications including direct air capture. This distribution reflects the prioritization of high-emission point sources where carbon capture technologies can achieve maximum impact with relative cost-efficiency.

Geographically, North America leads the market with 40% share, followed by Europe at 35%, Asia-Pacific at 20%, and other regions comprising the remaining 5%. China's rapid industrialization coupled with ambitious carbon neutrality goals is expected to significantly alter this distribution in the coming decade, potentially positioning Asia-Pacific as the dominant market region by 2035.

From a technology perspective, post-combustion capture currently dominates with 70% market share due to its retrofit compatibility with existing infrastructure. Pre-combustion and oxy-fuel combustion technologies hold 20% and 10% respectively, though these proportions are expected to shift as newer technologies mature and gain commercial viability.

The market landscape features both established industrial giants and innovative startups. Major players include Mitsubishi Heavy Industries, Fluor Corporation, and Aker Solutions, collectively controlling approximately 45% of the market. However, venture capital investment in carbon capture startups has surged, reaching $1.9 billion in 2022, a 300% increase from 2020 levels.

Customer segments are diversifying beyond traditional heavy industry and power generation. Emerging segments include cement production, steel manufacturing, and chemical processing, collectively representing the fastest-growing market segment with 22% annual growth. Additionally, voluntary carbon markets are creating new demand channels, with corporate carbon neutrality pledges driving investment in carbon removal technologies as a complement to reduction strategies.

Technical Barriers in Carbon Capture and Thermal Management

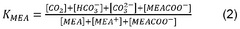

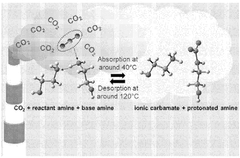

Carbon capture technologies face significant technical barriers that currently limit their widespread adoption. The high energy requirements for carbon capture processes represent a major challenge, with current technologies requiring 25-40% of a power plant's energy output for operation. This energy penalty substantially reduces overall system efficiency and increases operational costs. Additionally, the chemical solvents commonly used in post-combustion capture, such as monoethanolamine (MEA), suffer from degradation issues when exposed to oxygen and other impurities in flue gas, necessitating frequent replacement and increasing operational expenses.

Scale-up challenges present another critical barrier, as laboratory-proven technologies often encounter unforeseen complications when implemented at industrial scale. The massive volumes of CO2 that need processing from large emission sources require robust systems capable of handling variable gas compositions and flow rates while maintaining capture efficiency. Material limitations also constrain progress, with current sorbents and membranes exhibiting insufficient selectivity, capacity, and durability under real-world conditions.

In thermal management, heat transfer inefficiencies remain a persistent challenge. Current heat exchanger designs struggle to effectively manage the substantial thermal loads generated during carbon capture processes, particularly in post-combustion systems where temperature swings between absorption and desorption stages can be significant. The corrosive nature of capture media further complicates thermal management by accelerating equipment degradation and reducing operational lifespans.

Integration challenges between carbon capture systems and existing infrastructure create additional barriers. Retrofitting carbon capture technologies to existing power plants and industrial facilities requires complex engineering solutions to address space constraints, compatibility issues, and operational disruptions. The parasitic load imposed by capture systems necessitates careful thermal integration to minimize efficiency losses.

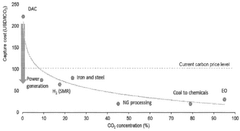

For direct air capture technologies, the extremely dilute concentration of CO2 in ambient air (approximately 412 ppm) presents unique thermal management challenges. The energy required to overcome the entropy of dilution is thermodynamically significant, making efficient thermal management critical for economic viability. Current systems struggle with the trade-off between capture efficiency and energy consumption.

Cross-cutting challenges include the management of waste heat, optimization of temperature gradients, and development of advanced materials capable of withstanding thermal cycling while maintaining performance. Innovative approaches such as process intensification and heat integration show promise but require further development to overcome current limitations in thermal management for carbon capture applications.

Scale-up challenges present another critical barrier, as laboratory-proven technologies often encounter unforeseen complications when implemented at industrial scale. The massive volumes of CO2 that need processing from large emission sources require robust systems capable of handling variable gas compositions and flow rates while maintaining capture efficiency. Material limitations also constrain progress, with current sorbents and membranes exhibiting insufficient selectivity, capacity, and durability under real-world conditions.

In thermal management, heat transfer inefficiencies remain a persistent challenge. Current heat exchanger designs struggle to effectively manage the substantial thermal loads generated during carbon capture processes, particularly in post-combustion systems where temperature swings between absorption and desorption stages can be significant. The corrosive nature of capture media further complicates thermal management by accelerating equipment degradation and reducing operational lifespans.

Integration challenges between carbon capture systems and existing infrastructure create additional barriers. Retrofitting carbon capture technologies to existing power plants and industrial facilities requires complex engineering solutions to address space constraints, compatibility issues, and operational disruptions. The parasitic load imposed by capture systems necessitates careful thermal integration to minimize efficiency losses.

For direct air capture technologies, the extremely dilute concentration of CO2 in ambient air (approximately 412 ppm) presents unique thermal management challenges. The energy required to overcome the entropy of dilution is thermodynamically significant, making efficient thermal management critical for economic viability. Current systems struggle with the trade-off between capture efficiency and energy consumption.

Cross-cutting challenges include the management of waste heat, optimization of temperature gradients, and development of advanced materials capable of withstanding thermal cycling while maintaining performance. Innovative approaches such as process intensification and heat integration show promise but require further development to overcome current limitations in thermal management for carbon capture applications.

Current Carbon Capture and Thermal Management Approaches

01 Direct Air Capture Technologies

Direct air capture (DAC) technologies involve systems designed to extract carbon dioxide directly from the atmosphere. These technologies utilize various sorbents and chemical processes to capture CO2 from ambient air, which can then be stored or utilized. Advanced DAC systems incorporate thermal management strategies to optimize energy consumption during the capture and regeneration phases, making the overall process more efficient and cost-effective.- Direct Air Capture Technologies: Direct air capture (DAC) technologies are designed to extract carbon dioxide directly from the atmosphere. These systems typically use sorbent materials or chemical processes to selectively capture CO2 from ambient air. The captured carbon can then be stored underground or utilized in various applications. Advanced DAC systems incorporate energy-efficient designs and innovative materials to reduce operational costs and increase capture efficiency.

- Industrial Carbon Capture Systems: Carbon capture technologies specifically designed for industrial applications focus on capturing CO2 emissions from point sources such as power plants, cement factories, and steel mills. These systems typically employ post-combustion, pre-combustion, or oxy-fuel combustion methods to separate carbon dioxide from flue gases. Advanced industrial capture systems integrate with existing infrastructure while minimizing energy penalties and operational disruptions.

- Thermal Management for Carbon Capture: Thermal management strategies are crucial for optimizing carbon capture processes, which often involve significant heat generation or absorption. These strategies include heat integration systems, waste heat recovery, and temperature control mechanisms that improve energy efficiency. Advanced thermal management approaches utilize phase change materials, heat exchangers, and intelligent control systems to maintain optimal operating conditions while reducing the overall energy footprint of carbon capture operations.

- Biological Carbon Sequestration Methods: Biological approaches to carbon capture leverage natural processes such as photosynthesis to remove CO2 from the atmosphere. These methods include enhanced forestry practices, algae cultivation systems, and biochar production. Engineered biological systems can be optimized for carbon capture through genetic modifications or controlled growth conditions. These approaches often provide co-benefits such as soil improvement, biodiversity support, or biomass production while sequestering carbon.

- Integrated Carbon Capture and Utilization Systems: Integrated systems combine carbon capture with utilization pathways to create value from captured CO2. These technologies convert captured carbon into useful products such as building materials, synthetic fuels, or chemical feedstocks. The integration of capture and utilization processes can improve overall economics while reducing net emissions. Advanced systems incorporate catalysts, renewable energy sources, and efficient conversion processes to maximize carbon utilization while minimizing additional energy inputs.

02 Thermal Management in Carbon Capture Systems

Effective thermal management is crucial for carbon capture technologies to operate efficiently. This includes heat recovery systems, thermal integration with industrial processes, and innovative cooling solutions that minimize energy consumption. Advanced thermal management strategies help reduce the parasitic energy load of carbon capture systems, improving their overall performance and economic viability while maintaining optimal operating temperatures for capture materials.Expand Specific Solutions03 Integration of Carbon Capture with Energy Systems

Carbon capture technologies can be integrated with existing energy systems to enhance overall efficiency. This includes combining carbon capture with power generation facilities, utilizing waste heat from industrial processes, and implementing cogeneration systems. Such integration allows for better thermal management, reduced energy penalties, and improved economic performance of carbon capture operations while potentially providing additional benefits like district heating.Expand Specific Solutions04 Novel Materials for Carbon Capture and Thermal Regulation

Advanced materials play a critical role in both carbon capture and thermal management. These include specialized sorbents with high CO2 selectivity, thermally responsive materials that can regulate heat transfer, and composite materials designed for both capture and thermal stability. The development of these materials focuses on improving capture efficiency, reducing regeneration energy, and enhancing durability under various thermal conditions.Expand Specific Solutions05 Monitoring and Control Systems for Optimized Performance

Advanced monitoring and control systems are essential for optimizing the performance of carbon capture technologies and their thermal management. These systems utilize sensors, data analytics, and artificial intelligence to continuously monitor operating conditions, predict performance, and make real-time adjustments. Such intelligent control systems help maintain optimal thermal conditions, maximize capture efficiency, and minimize energy consumption across varying operational scenarios.Expand Specific Solutions

Industry Leaders in Carbon Capture and Thermal Management

Carbon capture technologies and thermal management strategies are evolving rapidly in a market transitioning from early development to commercial scaling. The global carbon capture market is projected to reach $7-10 billion by 2030, with significant growth potential as climate policies strengthen worldwide. Technologically, the field shows varying maturity levels across different capture methods. Leading players include energy giants like Saudi Aramco and Sinopec, who are leveraging their industrial infrastructure for large-scale implementation, while specialized research entities such as Huaneng Clean Energy Research Institute and Toshiba Energy Systems are driving innovation in capture efficiency and cost reduction. Academic institutions including Tianjin University and University of Melbourne contribute fundamental research, creating a competitive landscape balanced between established energy companies and emerging technology providers focused on improving thermal efficiency and reducing energy penalties.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed an innovative integrated carbon capture, utilization, and storage (CCUS) technology system. Their approach combines pre-combustion, post-combustion, and oxy-fuel combustion capture methods with proprietary solvent formulations that reduce energy penalties by up to 30% compared to conventional amines. Sinopec's Qilu-Shengli CCUS project, China's first million-tonne CCUS project, captures CO2 from petrochemical processes using advanced absorption technology and transports it via pipeline for enhanced oil recovery (EOR). Their thermal management strategy incorporates waste heat recovery systems that integrate with the capture process, reducing the overall energy penalty. Sinopec has also pioneered membrane-based separation technologies that operate at higher temperatures with lower energy requirements than conventional methods, achieving capture rates exceeding 90% while maintaining thermal efficiency.

Strengths: Extensive industrial implementation experience, integrated approach combining capture with utilization pathways, and proprietary solvent technology with reduced energy penalties. Weaknesses: Heavy focus on EOR as utilization pathway which still ultimately releases CO2, and significant infrastructure requirements for full-scale deployment across their extensive operations.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed a multi-faceted carbon capture portfolio centered around their proprietary Convergence® technology platform. This system integrates direct air capture with point-source carbon capture using advanced solid sorbents that operate across varied temperature ranges. Their thermal management approach employs a novel temperature-swing adsorption process that requires 40% less energy than conventional amine-based systems. Aramco's mobile carbon capture technology for vehicles captures up to 25% of emissions directly from exhaust systems through specialized metal-organic frameworks (MOFs) that function effectively at high temperatures. For industrial applications, they've pioneered oxy-combustion technology with integrated waste heat recovery, achieving capture rates above 95%. Their CCUS demonstration at Hawiyah NGL facility captures 500,000 tons of CO2 annually using advanced solvent technology with optimized thermal integration to minimize energy penalties. Aramco is also developing carbon mineralization technologies that convert CO2 into construction materials, providing permanent storage while generating valuable products.

Strengths: Comprehensive approach spanning mobile to industrial applications, significant R&D resources, and integration with existing oil and gas infrastructure. Weaknesses: Primary focus remains on technologies that extend fossil fuel use rather than replacement, and high capital costs for widespread implementation of their advanced capture systems.

Key Patents and Research in Carbon Capture Technologies

Systems and methods for combined carbon capture and thermal energy storage

PatentWO2025095856A1

Innovation

- A method and system for combined carbon capture and thermal energy storage, where CO2 is captured using a carbon capture medium that generates heat through an exothermic reaction, and this heat is utilized for thermal energy storage, with cooling applied to maintain the capture medium at a temperature below the CO2 regeneration temperature.

Methods for chemical process heating with carbon capture

PatentPendingUS20240116757A1

Innovation

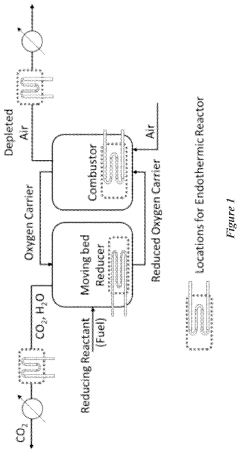

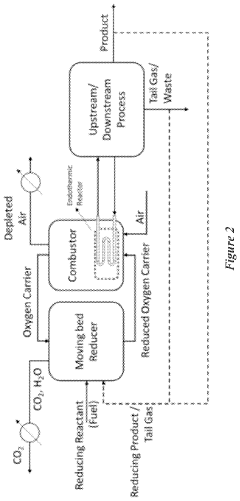

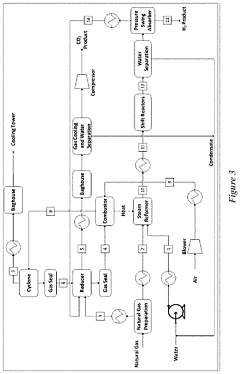

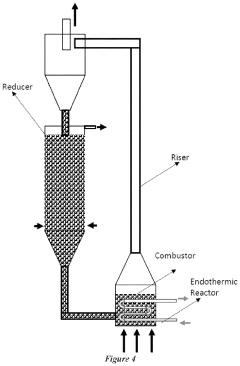

- A counter-current moving bed redox system is employed, utilizing metal oxide-based redox particles that cycle between a reducer and a combustor, allowing for controlled oxidation and reduction states to maximize oxygen utilization and thermal energy generation, which is then used to drive endothermic chemical processes.

Environmental Policy Impact on Carbon Capture Deployment

Environmental policies have emerged as critical drivers in the development and deployment of carbon capture technologies globally. The regulatory landscape has evolved significantly over the past decade, with major economies implementing various policy instruments to incentivize carbon capture adoption. Carbon pricing mechanisms, including carbon taxes and cap-and-trade systems, have been particularly influential in creating economic incentives for industries to invest in carbon capture solutions. The European Union's Emissions Trading System (EU ETS) represents one of the most mature carbon markets, while similar schemes in Canada, China, and various U.S. states have created regional momentum for carbon capture deployment.

Tax incentives have proven especially effective in accelerating commercial-scale carbon capture projects. The U.S. Section 45Q tax credit, which provides up to $50 per metric ton of CO2 stored permanently, has catalyzed numerous projects since its enhancement in 2018. Similar fiscal incentives in Norway, Australia, and the United Kingdom have created favorable conditions for carbon capture investments, particularly in hard-to-abate industrial sectors.

Direct government funding programs have addressed the high capital costs associated with carbon capture technologies. The EU Innovation Fund, U.S. Department of Energy grants, and similar programs in Canada and Japan have provided crucial financial support for demonstration projects and early commercial deployments. These initiatives have been instrumental in bridging the "valley of death" between pilot projects and commercial viability.

Regulatory standards have also played a significant role in driving carbon capture adoption. Clean fuel standards, emission performance standards for power plants, and industrial emission regulations have created compliance pathways that often favor carbon capture solutions. The increasing stringency of these regulations, particularly in jurisdictions with net-zero commitments, has accelerated technology deployment timelines.

International climate agreements, notably the Paris Agreement, have established the policy framework for national carbon reduction strategies that frequently incorporate carbon capture technologies. The agreement's nationally determined contributions (NDCs) have prompted many countries to include carbon capture in their climate mitigation portfolios, creating policy continuity that supports long-term investment decisions.

Policy uncertainty remains a significant barrier to wider deployment. Projects with multi-decade operational lifespans require stable policy environments to secure financing. Recent policy innovations, including carbon take-back obligations, carbon border adjustment mechanisms, and procurement preferences for low-carbon products, are expanding the policy toolkit available to governments seeking to accelerate carbon capture deployment while addressing thermal management challenges associated with these energy-intensive processes.

Tax incentives have proven especially effective in accelerating commercial-scale carbon capture projects. The U.S. Section 45Q tax credit, which provides up to $50 per metric ton of CO2 stored permanently, has catalyzed numerous projects since its enhancement in 2018. Similar fiscal incentives in Norway, Australia, and the United Kingdom have created favorable conditions for carbon capture investments, particularly in hard-to-abate industrial sectors.

Direct government funding programs have addressed the high capital costs associated with carbon capture technologies. The EU Innovation Fund, U.S. Department of Energy grants, and similar programs in Canada and Japan have provided crucial financial support for demonstration projects and early commercial deployments. These initiatives have been instrumental in bridging the "valley of death" between pilot projects and commercial viability.

Regulatory standards have also played a significant role in driving carbon capture adoption. Clean fuel standards, emission performance standards for power plants, and industrial emission regulations have created compliance pathways that often favor carbon capture solutions. The increasing stringency of these regulations, particularly in jurisdictions with net-zero commitments, has accelerated technology deployment timelines.

International climate agreements, notably the Paris Agreement, have established the policy framework for national carbon reduction strategies that frequently incorporate carbon capture technologies. The agreement's nationally determined contributions (NDCs) have prompted many countries to include carbon capture in their climate mitigation portfolios, creating policy continuity that supports long-term investment decisions.

Policy uncertainty remains a significant barrier to wider deployment. Projects with multi-decade operational lifespans require stable policy environments to secure financing. Recent policy innovations, including carbon take-back obligations, carbon border adjustment mechanisms, and procurement preferences for low-carbon products, are expanding the policy toolkit available to governments seeking to accelerate carbon capture deployment while addressing thermal management challenges associated with these energy-intensive processes.

Economic Viability of Carbon Capture Implementation

The economic viability of carbon capture implementation represents a critical factor in the widespread adoption of these technologies. Current cost estimates for carbon capture range from $40 to $120 per ton of CO2 captured, depending on the technology employed and the specific industrial context. Post-combustion capture technologies typically demonstrate higher costs compared to pre-combustion methods, primarily due to energy penalties and infrastructure requirements.

Financial modeling indicates that without significant policy support or carbon pricing mechanisms, most carbon capture projects struggle to achieve positive returns on investment. The levelized cost of carbon abatement (LCCA) remains substantially higher than current carbon market prices in most regions, creating a fundamental economic barrier to implementation.

Energy penalties associated with carbon capture represent a substantial economic challenge. Most current technologies require 15-30% additional energy input for operation, significantly impacting operational expenses for industrial facilities. This energy requirement translates to approximately $20-35 per ton of CO2 in additional operational costs across various implementation scenarios.

Government incentives play a crucial role in improving economic viability. The 45Q tax credit in the United States, offering up to $50 per ton for geologically sequestered CO2, has stimulated increased interest in carbon capture projects. Similarly, the EU Innovation Fund and various national subsidy programs have begun to address the economic gap, though significant scaling of these mechanisms is required for transformative impact.

Scale economies represent a promising pathway toward cost reduction. Analysis of learning curves suggests that costs could decrease by 10-15% for each doubling of installed capacity. Industrial clusters, where multiple facilities share carbon capture infrastructure, demonstrate potential cost reductions of 20-30% compared to standalone implementations through shared transportation and storage infrastructure.

Integration with existing value chains offers additional economic opportunities. Converting captured carbon into valuable products such as building materials, synthetic fuels, or chemical feedstocks could potentially offset 30-50% of capture costs in optimal scenarios. However, these markets remain relatively limited in scale compared to the volume of emissions requiring management.

Long-term economic modeling suggests that carbon capture costs could decline to $25-60 per ton by 2040 with continued technological development and policy support. This trajectory would significantly enhance economic viability, particularly if accompanied by strengthened carbon pricing mechanisms globally.

Financial modeling indicates that without significant policy support or carbon pricing mechanisms, most carbon capture projects struggle to achieve positive returns on investment. The levelized cost of carbon abatement (LCCA) remains substantially higher than current carbon market prices in most regions, creating a fundamental economic barrier to implementation.

Energy penalties associated with carbon capture represent a substantial economic challenge. Most current technologies require 15-30% additional energy input for operation, significantly impacting operational expenses for industrial facilities. This energy requirement translates to approximately $20-35 per ton of CO2 in additional operational costs across various implementation scenarios.

Government incentives play a crucial role in improving economic viability. The 45Q tax credit in the United States, offering up to $50 per ton for geologically sequestered CO2, has stimulated increased interest in carbon capture projects. Similarly, the EU Innovation Fund and various national subsidy programs have begun to address the economic gap, though significant scaling of these mechanisms is required for transformative impact.

Scale economies represent a promising pathway toward cost reduction. Analysis of learning curves suggests that costs could decrease by 10-15% for each doubling of installed capacity. Industrial clusters, where multiple facilities share carbon capture infrastructure, demonstrate potential cost reductions of 20-30% compared to standalone implementations through shared transportation and storage infrastructure.

Integration with existing value chains offers additional economic opportunities. Converting captured carbon into valuable products such as building materials, synthetic fuels, or chemical feedstocks could potentially offset 30-50% of capture costs in optimal scenarios. However, these markets remain relatively limited in scale compared to the volume of emissions requiring management.

Long-term economic modeling suggests that carbon capture costs could decline to $25-60 per ton by 2040 with continued technological development and policy support. This trajectory would significantly enhance economic viability, particularly if accompanied by strengthened carbon pricing mechanisms globally.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!