Ethyl Acetate and Environmental Compliance Strategies

JUN 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ethyl Acetate Overview

Ethyl acetate, a versatile organic compound with the chemical formula CH3COOC2H5, plays a significant role in various industries due to its unique properties and applications. This colorless liquid ester is characterized by its fruity odor and low toxicity, making it a preferred choice in many manufacturing processes.

The production of ethyl acetate primarily involves the esterification of ethanol with acetic acid, catalyzed by sulfuric acid. This process, known as Fischer esterification, is widely used in industrial settings. Alternatively, ethyl acetate can be synthesized through the Tishchenko reaction, which involves the dimerization of acetaldehyde in the presence of an aluminum alkoxide catalyst.

In the chemical industry, ethyl acetate serves as an important solvent and intermediate. Its excellent solvency properties make it ideal for use in paints, coatings, and adhesives, where it facilitates the dissolution and application of various resins and polymers. The pharmaceutical sector utilizes ethyl acetate in the production of drugs and as an extraction solvent in the purification of antibiotics.

The food and beverage industry also benefits from ethyl acetate's properties. It is naturally present in many fruits and is used as a flavoring agent to enhance the aroma of various products. In the production of decaffeinated coffee and tea, ethyl acetate serves as an efficient and relatively safe extraction solvent for caffeine removal.

From an environmental perspective, ethyl acetate is considered less harmful compared to many other organic solvents. It has a lower ozone depletion potential and is not classified as a hazardous air pollutant. However, its volatile organic compound (VOC) status necessitates careful handling and emission control in industrial applications to comply with environmental regulations.

The global market for ethyl acetate has been steadily growing, driven by increasing demand from end-use industries such as packaging, automotive, and electronics. Asia-Pacific region, particularly China and India, has emerged as a major consumer and producer of ethyl acetate, reflecting the shift in manufacturing activities to these countries.

As industries strive for more sustainable practices, research into bio-based ethyl acetate production has gained momentum. This approach involves using renewable feedstocks and bio-catalytic processes, aligning with the principles of green chemistry and circular economy. Such innovations are expected to shape the future landscape of ethyl acetate production and utilization.

The production of ethyl acetate primarily involves the esterification of ethanol with acetic acid, catalyzed by sulfuric acid. This process, known as Fischer esterification, is widely used in industrial settings. Alternatively, ethyl acetate can be synthesized through the Tishchenko reaction, which involves the dimerization of acetaldehyde in the presence of an aluminum alkoxide catalyst.

In the chemical industry, ethyl acetate serves as an important solvent and intermediate. Its excellent solvency properties make it ideal for use in paints, coatings, and adhesives, where it facilitates the dissolution and application of various resins and polymers. The pharmaceutical sector utilizes ethyl acetate in the production of drugs and as an extraction solvent in the purification of antibiotics.

The food and beverage industry also benefits from ethyl acetate's properties. It is naturally present in many fruits and is used as a flavoring agent to enhance the aroma of various products. In the production of decaffeinated coffee and tea, ethyl acetate serves as an efficient and relatively safe extraction solvent for caffeine removal.

From an environmental perspective, ethyl acetate is considered less harmful compared to many other organic solvents. It has a lower ozone depletion potential and is not classified as a hazardous air pollutant. However, its volatile organic compound (VOC) status necessitates careful handling and emission control in industrial applications to comply with environmental regulations.

The global market for ethyl acetate has been steadily growing, driven by increasing demand from end-use industries such as packaging, automotive, and electronics. Asia-Pacific region, particularly China and India, has emerged as a major consumer and producer of ethyl acetate, reflecting the shift in manufacturing activities to these countries.

As industries strive for more sustainable practices, research into bio-based ethyl acetate production has gained momentum. This approach involves using renewable feedstocks and bio-catalytic processes, aligning with the principles of green chemistry and circular economy. Such innovations are expected to shape the future landscape of ethyl acetate production and utilization.

Market Analysis

The global market for ethyl acetate has been experiencing steady growth, driven by its versatile applications across various industries. As a key solvent and intermediate in the production of paints, coatings, adhesives, and pharmaceuticals, ethyl acetate's demand is closely tied to the performance of these end-use sectors. The market size was valued at approximately 3.5 million tons in 2020, with projections indicating a compound annual growth rate (CAGR) of around 5% through 2025.

The paint and coatings industry remains the largest consumer of ethyl acetate, accounting for nearly 40% of the total market share. This sector's growth is fueled by increasing construction activities and automotive production in emerging economies. The adhesives industry follows closely, with a market share of about 30%, driven by the packaging and woodworking sectors.

Geographically, Asia-Pacific dominates the ethyl acetate market, representing over 50% of global consumption. China and India are the key growth drivers in this region, owing to their rapidly expanding manufacturing sectors and increasing domestic demand. North America and Europe hold significant market shares as well, with mature industries and stringent environmental regulations shaping their consumption patterns.

The market dynamics are influenced by several factors, including raw material prices, environmental regulations, and technological advancements. The volatility in acetic acid and ethanol prices, the primary raw materials for ethyl acetate production, has a direct impact on market profitability. Additionally, the growing emphasis on sustainable and bio-based alternatives is creating both challenges and opportunities for market players.

Environmental compliance strategies are becoming increasingly crucial in the ethyl acetate market. Stringent regulations on volatile organic compound (VOC) emissions in developed regions are pushing manufacturers to invest in cleaner production technologies and develop low-VOC formulations. This trend is expected to drive innovation in the industry, potentially leading to the development of more environmentally friendly ethyl acetate-based products.

The competitive landscape of the ethyl acetate market is characterized by the presence of both global chemical giants and regional players. Key market participants are focusing on capacity expansions, strategic partnerships, and technological innovations to maintain their market positions. The growing demand from emerging economies and the shift towards sustainable production methods are likely to shape the future competitive strategies in this market.

The paint and coatings industry remains the largest consumer of ethyl acetate, accounting for nearly 40% of the total market share. This sector's growth is fueled by increasing construction activities and automotive production in emerging economies. The adhesives industry follows closely, with a market share of about 30%, driven by the packaging and woodworking sectors.

Geographically, Asia-Pacific dominates the ethyl acetate market, representing over 50% of global consumption. China and India are the key growth drivers in this region, owing to their rapidly expanding manufacturing sectors and increasing domestic demand. North America and Europe hold significant market shares as well, with mature industries and stringent environmental regulations shaping their consumption patterns.

The market dynamics are influenced by several factors, including raw material prices, environmental regulations, and technological advancements. The volatility in acetic acid and ethanol prices, the primary raw materials for ethyl acetate production, has a direct impact on market profitability. Additionally, the growing emphasis on sustainable and bio-based alternatives is creating both challenges and opportunities for market players.

Environmental compliance strategies are becoming increasingly crucial in the ethyl acetate market. Stringent regulations on volatile organic compound (VOC) emissions in developed regions are pushing manufacturers to invest in cleaner production technologies and develop low-VOC formulations. This trend is expected to drive innovation in the industry, potentially leading to the development of more environmentally friendly ethyl acetate-based products.

The competitive landscape of the ethyl acetate market is characterized by the presence of both global chemical giants and regional players. Key market participants are focusing on capacity expansions, strategic partnerships, and technological innovations to maintain their market positions. The growing demand from emerging economies and the shift towards sustainable production methods are likely to shape the future competitive strategies in this market.

Technical Challenges

The production and use of ethyl acetate face several significant technical challenges, particularly in the context of environmental compliance strategies. One of the primary issues is the volatile organic compound (VOC) emissions associated with its manufacture and application. Ethyl acetate is highly volatile, and its release into the atmosphere contributes to air pollution and the formation of ground-level ozone. This necessitates the development and implementation of advanced emission control technologies and process optimizations to minimize environmental impact.

Another challenge lies in the energy-intensive nature of ethyl acetate production. The traditional manufacturing process, which involves the esterification of ethanol and acetic acid, requires substantial energy input, leading to increased carbon footprint and operational costs. Improving energy efficiency in production processes while maintaining product quality and yield is a complex technical hurdle that industry players are actively addressing.

The sourcing of raw materials for ethyl acetate production also presents challenges. As the demand for bio-based and sustainable chemicals grows, there is increasing pressure to shift from petroleum-derived feedstocks to renewable sources. However, developing economically viable and scalable processes for bio-based ethyl acetate production remains a significant technical challenge, requiring innovations in biotechnology and process engineering.

Water contamination is another critical concern in ethyl acetate production and usage. The compound's high solubility in water means that improper handling or disposal can lead to water pollution. Developing effective wastewater treatment technologies and implementing closed-loop systems to minimize water consumption and contamination are ongoing technical challenges for the industry.

Furthermore, the safe handling and storage of ethyl acetate pose technical difficulties due to its flammability and potential for forming explosive mixtures with air. Designing and implementing robust safety systems, including advanced fire suppression technologies and vapor recovery systems, is crucial for compliance with stringent safety regulations and environmental standards.

Recycling and recovery of ethyl acetate from industrial processes present additional technical challenges. While recycling is essential for reducing waste and improving resource efficiency, the separation of ethyl acetate from complex mixtures and the purification of recovered solvent to meet quality standards for reuse are technically demanding processes that require continuous innovation.

Lastly, the development of alternative, more environmentally friendly solvents to replace ethyl acetate in various applications is an ongoing challenge. While ethyl acetate is considered less harmful than many other organic solvents, the search for even greener alternatives with similar performance characteristics continues to drive research and development efforts in the chemical industry.

Another challenge lies in the energy-intensive nature of ethyl acetate production. The traditional manufacturing process, which involves the esterification of ethanol and acetic acid, requires substantial energy input, leading to increased carbon footprint and operational costs. Improving energy efficiency in production processes while maintaining product quality and yield is a complex technical hurdle that industry players are actively addressing.

The sourcing of raw materials for ethyl acetate production also presents challenges. As the demand for bio-based and sustainable chemicals grows, there is increasing pressure to shift from petroleum-derived feedstocks to renewable sources. However, developing economically viable and scalable processes for bio-based ethyl acetate production remains a significant technical challenge, requiring innovations in biotechnology and process engineering.

Water contamination is another critical concern in ethyl acetate production and usage. The compound's high solubility in water means that improper handling or disposal can lead to water pollution. Developing effective wastewater treatment technologies and implementing closed-loop systems to minimize water consumption and contamination are ongoing technical challenges for the industry.

Furthermore, the safe handling and storage of ethyl acetate pose technical difficulties due to its flammability and potential for forming explosive mixtures with air. Designing and implementing robust safety systems, including advanced fire suppression technologies and vapor recovery systems, is crucial for compliance with stringent safety regulations and environmental standards.

Recycling and recovery of ethyl acetate from industrial processes present additional technical challenges. While recycling is essential for reducing waste and improving resource efficiency, the separation of ethyl acetate from complex mixtures and the purification of recovered solvent to meet quality standards for reuse are technically demanding processes that require continuous innovation.

Lastly, the development of alternative, more environmentally friendly solvents to replace ethyl acetate in various applications is an ongoing challenge. While ethyl acetate is considered less harmful than many other organic solvents, the search for even greener alternatives with similar performance characteristics continues to drive research and development efforts in the chemical industry.

Current Solutions

01 Production and purification of ethyl acetate

Various methods for producing and purifying ethyl acetate are described, including esterification processes, distillation techniques, and the use of catalysts. These processes aim to improve yield, efficiency, and purity of the final product.- Production and purification of ethyl acetate: Various methods and processes for producing and purifying ethyl acetate are described. These include esterification reactions, distillation techniques, and the use of specific catalysts or reactants to improve yield and purity.

- Applications of ethyl acetate in industrial processes: Ethyl acetate is utilized in diverse industrial applications, including as a solvent in chemical reactions, as a component in coatings and adhesives, and in the production of various materials such as plastics and textiles.

- Ethyl acetate in pharmaceutical and cosmetic formulations: The use of ethyl acetate in pharmaceutical and cosmetic products is explored, including its role as a solvent for active ingredients, as an excipient in drug formulations, and as a component in personal care products.

- Environmental and safety considerations for ethyl acetate: Research and development efforts focus on improving the environmental impact and safety aspects of ethyl acetate production and use. This includes developing greener production methods, reducing emissions, and enhancing handling and storage practices.

- Novel derivatives and modifications of ethyl acetate: Innovations in creating new derivatives or modified forms of ethyl acetate are presented. These modifications aim to enhance its properties or create new compounds with improved characteristics for specific applications.

02 Applications of ethyl acetate in industrial processes

Ethyl acetate is utilized in diverse industrial applications, such as solvent extraction, coating formulations, and as a reaction medium. Its properties make it suitable for use in various manufacturing processes and chemical syntheses.Expand Specific Solutions03 Ethyl acetate in pharmaceutical and cosmetic formulations

The use of ethyl acetate in pharmaceutical and cosmetic products is explored, including its role as a solvent, excipient, or active ingredient. Its applications range from drug delivery systems to personal care products.Expand Specific Solutions04 Environmental and safety considerations for ethyl acetate

Research focuses on developing environmentally friendly processes for ethyl acetate production and use, as well as addressing safety concerns related to its handling and storage. This includes studies on biodegradation, emission control, and risk assessment.Expand Specific Solutions05 Novel derivatives and modifications of ethyl acetate

Investigations into new derivatives and modifications of ethyl acetate are conducted to enhance its properties or create new compounds with improved characteristics for specific applications. This includes chemical modifications and the development of related esters.Expand Specific Solutions

Industry Leaders

The research on Ethyl Acetate and Environmental Compliance Strategies is in a mature stage, with a well-established market and significant industry players. The global ethyl acetate market size is substantial, driven by its widespread use in various industries. Key players like Celanese International Corp., BASF Corp., and Wacker Chemie AG dominate the market, leveraging their advanced technologies and extensive R&D capabilities. The industry is characterized by a focus on sustainable production methods and environmental compliance, with companies like Genomatica, Inc. developing bio-based processes. Academic institutions such as Nanjing Normal University and the Dalian Institute of Chemical Physics are contributing to technological advancements, indicating ongoing innovation in the field.

Celanese International Corp.

Technical Solution: Celanese has developed an innovative process for ethyl acetate production using reactive distillation technology. This method combines esterification and distillation in a single unit operation, significantly improving efficiency and reducing energy consumption. The process utilizes ethanol and acetic acid as raw materials, with a heterogeneous acid catalyst. The reactive distillation column is designed with specific internals to enhance mass transfer and reaction kinetics, resulting in high conversion rates and product purity[1][3]. Additionally, Celanese has implemented advanced process control systems to optimize operating conditions and maintain consistent product quality.

Strengths: High efficiency, reduced energy consumption, improved product purity. Weaknesses: Potential complexity in process control, higher initial capital investment.

BASF Corp.

Technical Solution: BASF has developed a sustainable approach to ethyl acetate production focusing on green chemistry principles. Their process utilizes bio-based feedstocks, specifically bioethanol derived from renewable sources such as corn or sugarcane. The company has also implemented a novel catalyst system that enhances selectivity and reduces byproduct formation. BASF's technology incorporates heat integration strategies to minimize energy consumption and utilizes advanced separation techniques for high-purity product recovery[2][4]. Furthermore, the company has invested in developing biodegradable additives to improve the environmental profile of ethyl acetate-based products.

Strengths: Sustainable raw materials, improved selectivity, energy efficiency. Weaknesses: Potential higher production costs, dependence on agricultural feedstocks.

Key Innovations

Process of low energy consumption for preparing a carboxylic acid ester

PatentWO2012123279A1

Innovation

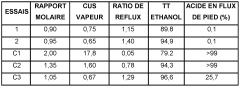

- A process involving the reaction of ethyl alcohol with acetic acid in the presence of a solid acid catalyst, using a reactive distillation system with a centrally placed reaction zone between upper and lower separation zones, optimizing the molar ratio of acetic acid to ethyl alcohol between 0.85 and 0.97, and controlling the reflux ratio between 1.0 and 1.5, significantly reduces energy costs and minimizes acetic acid at the column bottom.

Integrated process for the production of acetic acid and vinyl acetate

PatentWO2007092188A8

Innovation

- An integrated process that reacts ethane with oxygen in the presence of a catalyst to produce ethylene and acetic acid, followed by reacting a portion of the ethylene and acetic acid to produce additional acetic acid and subsequently vinyl acetate, utilizing catalysts like Mo, Pd, and other metals in specific ratios to enhance selectivity and yield.

Regulatory Framework

The regulatory framework surrounding ethyl acetate production and use is complex and multifaceted, involving various international, national, and local regulations. At the global level, the United Nations' Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provides a standardized approach to chemical hazard classification and communication. This system influences how ethyl acetate is labeled and handled in international trade.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA) and the Clean Air Act. The Occupational Safety and Health Administration (OSHA) sets workplace exposure limits and safety standards for handling ethyl acetate. The Food and Drug Administration (FDA) regulates its use in food packaging and pharmaceutical applications.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation is a comprehensive framework that applies to ethyl acetate production and import in EU member states. It requires manufacturers and importers to register chemicals and provide safety data. The Classification, Labelling and Packaging (CLP) Regulation aligns the EU system with the GHS.

In Asia, countries like China and Japan have their own chemical regulatory systems. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law both impact ethyl acetate production and use in these major markets.

Environmental compliance strategies for ethyl acetate producers and users must address air emissions, as the compound is classified as a volatile organic compound (VOC). Many jurisdictions have specific VOC emission limits and require the implementation of best available techniques (BAT) to minimize environmental impact. This may include the use of scrubbers, thermal oxidizers, or other emission control technologies.

Waste management is another critical aspect of regulatory compliance. Proper disposal of ethyl acetate-containing waste must adhere to local hazardous waste regulations. In many cases, recycling and recovery processes are encouraged to minimize environmental impact and resource consumption.

Occupational health and safety regulations require proper handling procedures, personal protective equipment, and workplace monitoring for ethyl acetate exposure. Companies must provide adequate training and implement safety protocols to protect workers from potential health risks associated with ethyl acetate exposure.

As environmental regulations continue to evolve, companies in the ethyl acetate industry must stay informed about regulatory changes and proactively adapt their compliance strategies. This may involve investing in cleaner production technologies, improving monitoring and reporting systems, and engaging with regulatory bodies to ensure ongoing compliance and sustainability in their operations.

In the United States, the Environmental Protection Agency (EPA) regulates ethyl acetate under the Toxic Substances Control Act (TSCA) and the Clean Air Act. The Occupational Safety and Health Administration (OSHA) sets workplace exposure limits and safety standards for handling ethyl acetate. The Food and Drug Administration (FDA) regulates its use in food packaging and pharmaceutical applications.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation is a comprehensive framework that applies to ethyl acetate production and import in EU member states. It requires manufacturers and importers to register chemicals and provide safety data. The Classification, Labelling and Packaging (CLP) Regulation aligns the EU system with the GHS.

In Asia, countries like China and Japan have their own chemical regulatory systems. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law both impact ethyl acetate production and use in these major markets.

Environmental compliance strategies for ethyl acetate producers and users must address air emissions, as the compound is classified as a volatile organic compound (VOC). Many jurisdictions have specific VOC emission limits and require the implementation of best available techniques (BAT) to minimize environmental impact. This may include the use of scrubbers, thermal oxidizers, or other emission control technologies.

Waste management is another critical aspect of regulatory compliance. Proper disposal of ethyl acetate-containing waste must adhere to local hazardous waste regulations. In many cases, recycling and recovery processes are encouraged to minimize environmental impact and resource consumption.

Occupational health and safety regulations require proper handling procedures, personal protective equipment, and workplace monitoring for ethyl acetate exposure. Companies must provide adequate training and implement safety protocols to protect workers from potential health risks associated with ethyl acetate exposure.

As environmental regulations continue to evolve, companies in the ethyl acetate industry must stay informed about regulatory changes and proactively adapt their compliance strategies. This may involve investing in cleaner production technologies, improving monitoring and reporting systems, and engaging with regulatory bodies to ensure ongoing compliance and sustainability in their operations.

Sustainability Impact

The sustainability impact of ethyl acetate production and usage is a critical consideration in environmental compliance strategies. Ethyl acetate, widely used as a solvent in various industries, has both positive and negative effects on sustainability.

From an environmental perspective, ethyl acetate is generally considered less harmful than many other organic solvents. It has a relatively low toxicity and is biodegradable, breaking down into ethanol and acetic acid in the environment. This characteristic reduces its long-term impact on ecosystems compared to more persistent chemicals. Additionally, ethyl acetate has a lower ozone depletion potential than some alternative solvents, contributing to the protection of the Earth's ozone layer.

However, the production and use of ethyl acetate still present sustainability challenges. The manufacturing process, typically involving the esterification of ethanol and acetic acid, requires energy inputs and can generate waste products. Emissions from production facilities and the use of ethyl acetate in industrial processes can contribute to air pollution and the formation of ground-level ozone, impacting local air quality and human health.

Water pollution is another concern, as improper disposal or accidental spills of ethyl acetate can contaminate water sources. While it is less persistent than some other pollutants, high concentrations can still harm aquatic life and potentially affect drinking water quality.

From a resource perspective, the production of ethyl acetate relies on feedstocks derived from both renewable (bio-ethanol) and non-renewable (petroleum-based acetic acid) sources. The shift towards bio-based ethyl acetate production offers potential sustainability benefits by reducing reliance on fossil fuels and lowering the overall carbon footprint.

In terms of climate impact, the volatile organic compound (VOC) nature of ethyl acetate contributes to greenhouse gas emissions when released into the atmosphere. However, compared to some other solvents, its global warming potential is relatively low.

To address these sustainability concerns, industries are implementing various strategies. These include improving production efficiency to reduce energy consumption and waste generation, developing closed-loop systems to minimize emissions and maximize solvent recovery, and exploring greener synthesis routes using renewable feedstocks.

Regulatory compliance plays a crucial role in driving sustainability improvements. Environmental regulations increasingly focus on reducing VOC emissions, promoting the use of less harmful solvents, and enforcing stricter waste management practices. Companies are adapting by investing in emission control technologies, implementing more sustainable production processes, and exploring alternative, more environmentally friendly solvents where possible.

From an environmental perspective, ethyl acetate is generally considered less harmful than many other organic solvents. It has a relatively low toxicity and is biodegradable, breaking down into ethanol and acetic acid in the environment. This characteristic reduces its long-term impact on ecosystems compared to more persistent chemicals. Additionally, ethyl acetate has a lower ozone depletion potential than some alternative solvents, contributing to the protection of the Earth's ozone layer.

However, the production and use of ethyl acetate still present sustainability challenges. The manufacturing process, typically involving the esterification of ethanol and acetic acid, requires energy inputs and can generate waste products. Emissions from production facilities and the use of ethyl acetate in industrial processes can contribute to air pollution and the formation of ground-level ozone, impacting local air quality and human health.

Water pollution is another concern, as improper disposal or accidental spills of ethyl acetate can contaminate water sources. While it is less persistent than some other pollutants, high concentrations can still harm aquatic life and potentially affect drinking water quality.

From a resource perspective, the production of ethyl acetate relies on feedstocks derived from both renewable (bio-ethanol) and non-renewable (petroleum-based acetic acid) sources. The shift towards bio-based ethyl acetate production offers potential sustainability benefits by reducing reliance on fossil fuels and lowering the overall carbon footprint.

In terms of climate impact, the volatile organic compound (VOC) nature of ethyl acetate contributes to greenhouse gas emissions when released into the atmosphere. However, compared to some other solvents, its global warming potential is relatively low.

To address these sustainability concerns, industries are implementing various strategies. These include improving production efficiency to reduce energy consumption and waste generation, developing closed-loop systems to minimize emissions and maximize solvent recovery, and exploring greener synthesis routes using renewable feedstocks.

Regulatory compliance plays a crucial role in driving sustainability improvements. Environmental regulations increasingly focus on reducing VOC emissions, promoting the use of less harmful solvents, and enforcing stricter waste management practices. Companies are adapting by investing in emission control technologies, implementing more sustainable production processes, and exploring alternative, more environmentally friendly solvents where possible.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!