Solid-state sodium battery market dynamics in electric vehicles

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Battery Technology Evolution and Objectives

Sodium-ion battery technology has evolved significantly since its conceptual inception in the 1980s. Initially overshadowed by lithium-ion batteries, sodium-based energy storage systems have experienced renewed interest due to growing concerns about lithium resource limitations and cost escalations. The fundamental working principle of sodium batteries mirrors that of lithium-ion systems, involving sodium ion movement between electrodes during charge-discharge cycles, but with distinct material requirements and performance characteristics.

The evolution trajectory began with room-temperature sodium-sulfur batteries in the 1980s, followed by sodium-nickel chloride (ZEBRA) batteries in the 1990s. The 2000s witnessed significant advancements in electrode materials, particularly layered oxide cathodes and carbon-based anodes. The 2010s marked a pivotal shift with breakthrough developments in hard carbon anodes, Prussian blue analogs, and polyanionic compounds as cathode materials, substantially improving energy density and cycle life.

Recent years have seen accelerated progress in solid-state sodium battery technology, addressing the safety concerns associated with liquid electrolytes. This advancement represents a critical evolutionary step, as solid electrolytes potentially offer enhanced safety profiles, wider operating temperature ranges, and improved energy density—attributes particularly valuable for electric vehicle applications.

The primary technical objectives for solid-state sodium batteries in the electric vehicle sector focus on achieving competitive energy density (targeting >200 Wh/kg at the cell level), extended cycle life (>2000 cycles at 80% capacity retention), rapid charging capabilities (80% charge in <30 minutes), and wide operating temperature ranges (-20°C to 60°C). Additionally, cost reduction remains paramount, with targets below $80/kWh at scale to achieve price parity with conventional vehicles.

Safety enhancement constitutes another critical objective, with solid electrolytes expected to eliminate thermal runaway risks inherent in liquid electrolyte systems. Manufacturing scalability represents a significant technical goal, requiring processes compatible with existing production infrastructure to minimize capital investment requirements for commercialization.

The technology evolution pathway is increasingly focused on developing sodium-based alternatives that can match or exceed lithium-ion performance metrics while offering substantial cost advantages and resource sustainability. Current research emphasizes novel electrolyte compositions, interface engineering to reduce resistance at solid-solid interfaces, and advanced cathode materials with higher sodium storage capacity.

The ultimate objective is establishing solid-state sodium batteries as a viable, sustainable alternative to lithium-ion technologies in electric vehicles, particularly in mass-market segments where cost sensitivity outweighs performance requirements, and in regions with limited lithium resource access but abundant sodium availability.

The evolution trajectory began with room-temperature sodium-sulfur batteries in the 1980s, followed by sodium-nickel chloride (ZEBRA) batteries in the 1990s. The 2000s witnessed significant advancements in electrode materials, particularly layered oxide cathodes and carbon-based anodes. The 2010s marked a pivotal shift with breakthrough developments in hard carbon anodes, Prussian blue analogs, and polyanionic compounds as cathode materials, substantially improving energy density and cycle life.

Recent years have seen accelerated progress in solid-state sodium battery technology, addressing the safety concerns associated with liquid electrolytes. This advancement represents a critical evolutionary step, as solid electrolytes potentially offer enhanced safety profiles, wider operating temperature ranges, and improved energy density—attributes particularly valuable for electric vehicle applications.

The primary technical objectives for solid-state sodium batteries in the electric vehicle sector focus on achieving competitive energy density (targeting >200 Wh/kg at the cell level), extended cycle life (>2000 cycles at 80% capacity retention), rapid charging capabilities (80% charge in <30 minutes), and wide operating temperature ranges (-20°C to 60°C). Additionally, cost reduction remains paramount, with targets below $80/kWh at scale to achieve price parity with conventional vehicles.

Safety enhancement constitutes another critical objective, with solid electrolytes expected to eliminate thermal runaway risks inherent in liquid electrolyte systems. Manufacturing scalability represents a significant technical goal, requiring processes compatible with existing production infrastructure to minimize capital investment requirements for commercialization.

The technology evolution pathway is increasingly focused on developing sodium-based alternatives that can match or exceed lithium-ion performance metrics while offering substantial cost advantages and resource sustainability. Current research emphasizes novel electrolyte compositions, interface engineering to reduce resistance at solid-solid interfaces, and advanced cathode materials with higher sodium storage capacity.

The ultimate objective is establishing solid-state sodium batteries as a viable, sustainable alternative to lithium-ion technologies in electric vehicles, particularly in mass-market segments where cost sensitivity outweighs performance requirements, and in regions with limited lithium resource access but abundant sodium availability.

EV Market Demand for Solid-state Sodium Batteries

The global electric vehicle market is experiencing unprecedented growth, with annual sales projected to reach 26.8 million units by 2030, representing a compound annual growth rate of approximately 21% from 2023 to 2030. This rapid expansion is creating substantial demand for advanced battery technologies that can overcome the limitations of current lithium-ion solutions. Solid-state sodium batteries have emerged as a promising alternative that addresses several critical market needs in the EV sector.

Range anxiety remains one of the primary barriers to EV adoption, with consumers consistently expressing concern about limited driving distances between charges. Market research indicates that 78% of potential EV buyers consider range capability as a decisive factor in their purchasing decisions. Solid-state sodium batteries offer theoretical energy densities up to 30% higher than conventional lithium-ion batteries, potentially extending vehicle range significantly without increasing battery size or weight.

Cost considerations represent another crucial market driver. As EV manufacturers aim to achieve price parity with internal combustion engine vehicles, battery costs remain a significant component of overall vehicle pricing. The raw material cost advantage of sodium (being 97% less expensive than lithium) positions solid-state sodium batteries as an economically attractive option. Market analysts estimate that widespread adoption could reduce battery pack costs by 20-25%, making EVs more accessible to middle-market consumers.

Safety concerns continue to influence consumer perception and regulatory frameworks in the EV market. Recent industry surveys reveal that 65% of prospective EV buyers express concerns about battery fire risks. The inherent safety advantages of solid-state sodium batteries—including non-flammable electrolytes and greater thermal stability—directly address these market concerns and align with increasingly stringent safety regulations being implemented across major automotive markets.

Charging speed represents another critical market demand, with 82% of current EV owners identifying faster charging as their most desired improvement. Solid-state sodium battery technology demonstrates potential for significantly reduced charging times, with laboratory prototypes achieving 80% charge in under 15 minutes—a performance metric that would substantially enhance consumer acceptance and practical usability of EVs.

Environmental sustainability has become a market differentiator as consumers increasingly factor ecological impact into purchasing decisions. The greater abundance and lower environmental footprint of sodium extraction compared to lithium mining resonates with the 73% of consumers who report considering environmental factors when evaluating vehicle options. This alignment with sustainability values represents a significant market advantage for sodium-based battery technologies in the evolving EV landscape.

Range anxiety remains one of the primary barriers to EV adoption, with consumers consistently expressing concern about limited driving distances between charges. Market research indicates that 78% of potential EV buyers consider range capability as a decisive factor in their purchasing decisions. Solid-state sodium batteries offer theoretical energy densities up to 30% higher than conventional lithium-ion batteries, potentially extending vehicle range significantly without increasing battery size or weight.

Cost considerations represent another crucial market driver. As EV manufacturers aim to achieve price parity with internal combustion engine vehicles, battery costs remain a significant component of overall vehicle pricing. The raw material cost advantage of sodium (being 97% less expensive than lithium) positions solid-state sodium batteries as an economically attractive option. Market analysts estimate that widespread adoption could reduce battery pack costs by 20-25%, making EVs more accessible to middle-market consumers.

Safety concerns continue to influence consumer perception and regulatory frameworks in the EV market. Recent industry surveys reveal that 65% of prospective EV buyers express concerns about battery fire risks. The inherent safety advantages of solid-state sodium batteries—including non-flammable electrolytes and greater thermal stability—directly address these market concerns and align with increasingly stringent safety regulations being implemented across major automotive markets.

Charging speed represents another critical market demand, with 82% of current EV owners identifying faster charging as their most desired improvement. Solid-state sodium battery technology demonstrates potential for significantly reduced charging times, with laboratory prototypes achieving 80% charge in under 15 minutes—a performance metric that would substantially enhance consumer acceptance and practical usability of EVs.

Environmental sustainability has become a market differentiator as consumers increasingly factor ecological impact into purchasing decisions. The greater abundance and lower environmental footprint of sodium extraction compared to lithium mining resonates with the 73% of consumers who report considering environmental factors when evaluating vehicle options. This alignment with sustainability values represents a significant market advantage for sodium-based battery technologies in the evolving EV landscape.

Global Solid-state Sodium Battery Development Status

Solid-state sodium batteries have emerged as a promising alternative to conventional lithium-ion batteries in the electric vehicle (EV) sector. The global development landscape shows significant regional variations, with Asia, particularly China, Japan, and South Korea, leading in research output and patent filings. These countries have established robust research ecosystems combining academic institutions, government laboratories, and industrial partners focused on sodium battery technology.

European countries, especially Germany, France, and the UK, have also made substantial contributions through targeted research programs and public-private partnerships. The European Union's Horizon Europe framework has allocated specific funding for solid-state sodium battery research, recognizing its strategic importance for the region's automotive industry and energy transition goals.

North America presents a more fragmented landscape, with the United States showing strong fundamental research capabilities through national laboratories and universities, but less coordinated industrial implementation compared to Asian counterparts. Recent policy shifts, including the Inflation Reduction Act, have begun to stimulate greater investment in alternative battery technologies, including sodium-based systems.

From a technological maturity perspective, solid-state sodium batteries remain predominantly in the research and early development phase globally. Laboratory prototypes have demonstrated promising energy densities of 150-200 Wh/kg, still below commercial lithium-ion batteries but with significant improvement potential. Cycle life has reached 1,000+ cycles in controlled environments, approaching practical application thresholds.

The industrial landscape features both established battery manufacturers expanding their portfolios and specialized startups focused exclusively on sodium battery technology. Companies like CATL, BYD, and Panasonic have announced sodium battery development programs, while startups such as Natron Energy, Faradion (now acquired by Reliance Industries), and Tiamat are pursuing specialized sodium battery solutions.

Manufacturing capacity remains limited, with most production confined to pilot lines and small-scale facilities producing cells for testing and validation. The first gigafactory-scale production facilities dedicated to sodium batteries are in planning stages in China and Europe, with projected operational dates in the 2024-2026 timeframe.

Standardization efforts are still nascent, with technical committees beginning to address the specific requirements and testing protocols for solid-state sodium batteries. This represents a critical development area as the technology approaches commercialization phases and requires integration into existing vehicle platforms and charging infrastructure.

European countries, especially Germany, France, and the UK, have also made substantial contributions through targeted research programs and public-private partnerships. The European Union's Horizon Europe framework has allocated specific funding for solid-state sodium battery research, recognizing its strategic importance for the region's automotive industry and energy transition goals.

North America presents a more fragmented landscape, with the United States showing strong fundamental research capabilities through national laboratories and universities, but less coordinated industrial implementation compared to Asian counterparts. Recent policy shifts, including the Inflation Reduction Act, have begun to stimulate greater investment in alternative battery technologies, including sodium-based systems.

From a technological maturity perspective, solid-state sodium batteries remain predominantly in the research and early development phase globally. Laboratory prototypes have demonstrated promising energy densities of 150-200 Wh/kg, still below commercial lithium-ion batteries but with significant improvement potential. Cycle life has reached 1,000+ cycles in controlled environments, approaching practical application thresholds.

The industrial landscape features both established battery manufacturers expanding their portfolios and specialized startups focused exclusively on sodium battery technology. Companies like CATL, BYD, and Panasonic have announced sodium battery development programs, while startups such as Natron Energy, Faradion (now acquired by Reliance Industries), and Tiamat are pursuing specialized sodium battery solutions.

Manufacturing capacity remains limited, with most production confined to pilot lines and small-scale facilities producing cells for testing and validation. The first gigafactory-scale production facilities dedicated to sodium batteries are in planning stages in China and Europe, with projected operational dates in the 2024-2026 timeframe.

Standardization efforts are still nascent, with technical committees beginning to address the specific requirements and testing protocols for solid-state sodium batteries. This represents a critical development area as the technology approaches commercialization phases and requires integration into existing vehicle platforms and charging infrastructure.

Current Solid-state Sodium Battery Solutions

01 Solid-state electrolyte materials for sodium batteries

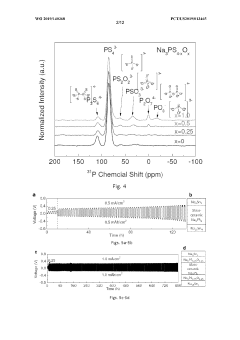

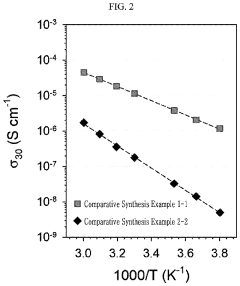

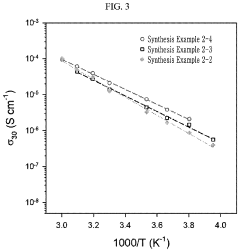

Various solid-state electrolyte materials are being developed specifically for sodium batteries to improve ionic conductivity and electrochemical stability. These materials include sodium-based ceramics, polymer electrolytes, and composite materials that facilitate efficient sodium ion transport while preventing dendrite formation. The solid-state electrolytes enable higher energy density and improved safety compared to liquid electrolyte systems.- Solid electrolyte materials for sodium batteries: Various solid electrolyte materials can be used in sodium batteries to enable ion transport while maintaining structural integrity. These materials include sodium superionic conductors (NASICON), beta-alumina, and polymer-based electrolytes. The solid electrolytes offer advantages such as improved safety by eliminating flammable liquid electrolytes, enhanced thermal stability, and prevention of dendrite formation that can cause short circuits in batteries.

- Electrode materials for solid-state sodium batteries: Specialized electrode materials are developed for solid-state sodium batteries to optimize performance. These include sodium-containing cathode materials like sodium transition metal oxides and phosphates, as well as anode materials compatible with sodium-ion transport. The electrode materials are designed to maintain good contact with the solid electrolyte, accommodate volume changes during cycling, and provide high energy density while ensuring stable electrochemical performance.

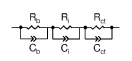

- Interface engineering in solid-state sodium batteries: Interface engineering focuses on optimizing the contact between electrodes and solid electrolytes to reduce resistance and improve ion transport. Techniques include surface coatings, buffer layers, and specialized manufacturing processes to ensure intimate contact between components. Proper interface design helps minimize impedance, prevent side reactions, and enhance the overall performance and cycle life of solid-state sodium batteries.

- Manufacturing processes for solid-state sodium batteries: Specialized manufacturing techniques are employed to produce solid-state sodium batteries with optimal performance. These include dry and wet processing methods, sintering techniques for solid electrolytes, and advanced assembly processes to ensure good contact between components. The manufacturing processes focus on controlling material properties, minimizing contamination, and creating uniform, defect-free structures to enhance battery performance and reliability.

- Performance enhancement strategies for solid-state sodium batteries: Various strategies are employed to enhance the performance of solid-state sodium batteries, including doping of electrolyte materials to improve ionic conductivity, composite electrolyte structures to optimize mechanical and electrochemical properties, and novel cell designs to maximize energy density. These approaches aim to address challenges such as low ionic conductivity at room temperature, mechanical stress during cycling, and limited power capability compared to conventional liquid electrolyte batteries.

02 Electrode design and interface engineering

Advanced electrode designs and interface engineering techniques are crucial for solid-state sodium batteries. This includes developing specialized cathode and anode materials compatible with sodium ion transport, optimizing the electrode-electrolyte interfaces to reduce resistance, and creating structures that accommodate volume changes during cycling. These innovations help maintain good contact between components and enhance overall battery performance.Expand Specific Solutions03 Manufacturing processes for solid-state sodium batteries

Novel manufacturing processes are being developed to produce solid-state sodium batteries at scale. These include specialized techniques for layer deposition, sintering methods to create dense electrolyte layers, and assembly processes that ensure proper contact between battery components. The manufacturing innovations focus on reducing production costs while maintaining high quality and performance standards.Expand Specific Solutions04 Performance enhancement additives and dopants

Various additives and dopants are being incorporated into solid-state sodium battery components to enhance performance characteristics. These include conductivity enhancers, stabilizing agents, and interface modifiers that improve ionic transport, extend cycle life, and enhance thermal stability. The strategic use of these additives helps overcome inherent limitations of sodium-based systems and improves overall battery efficiency.Expand Specific Solutions05 Safety and thermal management systems

Specialized safety and thermal management systems are being developed for solid-state sodium batteries to prevent thermal runaway and ensure stable operation under various conditions. These include protective layers, temperature regulation mechanisms, and structural designs that enhance mechanical stability. These innovations address the unique challenges of sodium-based systems while leveraging the inherent safety advantages of solid-state configurations.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid-state sodium battery market for electric vehicles is in an early development stage, characterized by significant research activity but limited commercial deployment. Market size remains modest but is projected to grow substantially as the technology matures, driven by sodium batteries' cost advantages over lithium-ion alternatives. Technical maturity varies across players, with academic institutions like University of Michigan and University of California leading fundamental research, while commercial entities including LG Energy Solution, Samsung Electronics, and Toyota are advancing practical applications. Emerging companies like Ilika Technologies and Nanotek Instruments are developing specialized solutions, while established automotive manufacturers such as Honda, Fisker, and Toyota are exploring integration opportunities. Chinese institutions and companies including SVOLT Energy and Shanghai Institute of Ceramics are rapidly advancing their technological capabilities in this space.

Honda Motor Co., Ltd.

Technical Solution: Honda has developed an innovative solid-state sodium battery technology utilizing a glass-ceramic electrolyte system (Na₃Zr₂Si₂PO₁₂) that exhibits high ionic conductivity (>2 mS/cm) and excellent mechanical stability. Their approach incorporates a proprietary electrode-electrolyte interface design that minimizes contact resistance and enables stable cycling at practical current densities. Honda's cell architecture features a hard carbon anode material with optimized porosity and surface area (>1500 m²/g) that accommodates sodium-ion insertion without significant volume expansion. The company has demonstrated prototype cells with energy densities of approximately 140-160 Wh/kg and exceptional low-temperature performance, maintaining over 80% of room temperature capacity at -20°C. Honda's manufacturing process employs a scalable tape-casting technique combined with a specialized sintering protocol that ensures uniform electrolyte density and minimizes defects. Their technology roadmap indicates integration with Honda's e:Architecture electric vehicle platform beginning in 2026, with initial deployment in urban mobility applications before expanding to their broader EV lineup.

Strengths: Integrated approach combining battery technology with vehicle design; strong expertise in thermal management systems; established automotive manufacturing capabilities. Weaknesses: Relatively lower energy density compared to some competing technologies; less established battery production infrastructure compared to dedicated battery manufacturers; challenges in achieving cost parity with conventional lithium-ion systems.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a proprietary solid-state sodium battery technology that utilizes a sodium superionic conductor (NASICON) ceramic electrolyte combined with a polymer composite interface layer. Their approach focuses on addressing the critical challenges of sodium dendrite formation and interfacial resistance between the solid electrolyte and electrodes. The company has achieved energy densities of approximately 160-180 Wh/kg in their prototype cells, with a target to reach 200+ Wh/kg in commercial versions. LG's manufacturing process incorporates a scalable tape-casting method for the ceramic electrolyte production and has demonstrated stable cycling performance of over 1000 cycles with less than 10% capacity degradation. Their technology operates effectively in a wide temperature range (-20°C to 60°C), making it suitable for various climate conditions. LG has established partnerships with multiple automotive OEMs for testing and validation, with plans for commercial production targeted for 2025-2026.

Strengths: Strong manufacturing infrastructure and supply chain integration; established relationships with major automotive OEMs; advanced R&D capabilities. Weaknesses: Energy density still lower than some competing lithium-based technologies; challenges in scaling production to meet potential demand; relatively higher production costs compared to conventional lithium-ion batteries.

Critical Patents and Technical Breakthroughs

Solid electrolyte for sodium batteries

PatentWO2019140368A1

Innovation

- A new class of sodium oxy-sulfide solid-state electrolytes with a microstructure approaching a continuous glass is developed, providing enhanced chemical stability and mechanical strength, achieved through a low-temperature ball-milling and pressing process, allowing for the formation of a nearly flawless glassy structure that is stable with sodium metal or alloys.

Sodium Halide-based Nanocomposite, Preparing Method Thereof, and Positive Electrode Active Material, Solid Electrolyte, and All-solid-state Battery Comprising the Same

PatentPendingUS20230411616A1

Innovation

- A sodium halide-based nanocomposite is developed, where a nanosized compound is dispersed in a halide compound to enhance ionic conductivity and interfacial stability, forming a glass-ceramic crystal structure that improves the performance of all-solid-state batteries by activating an interfacial conduction phenomenon.

Supply Chain Analysis and Raw Material Considerations

The solid-state sodium battery supply chain represents a critical component in the evolving electric vehicle market. Unlike lithium-ion batteries, sodium-based technologies rely on more abundant raw materials, potentially alleviating supply constraints that have plagued the EV industry. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, with global reserves widely distributed across multiple regions including China, the United States, India, and various European countries.

The extraction and processing infrastructure for sodium compounds remains less developed than lithium counterparts, creating both challenges and opportunities for early market entrants. Current sodium extraction primarily occurs as a byproduct of chlorine production through brine processing or mining of minerals such as trona. The processing capacity would require significant expansion to meet projected demand for solid-state sodium batteries in EVs.

Key raw materials for solid-state sodium batteries include sodium salts (typically sodium carbonate or sodium hydroxide), solid electrolyte materials (often NASICON-type ceramics, beta-alumina, or sodium-containing sulfides), and cathode materials (typically layered transition metal oxides or Prussian blue analogs). The diversification of material sources represents a strategic advantage over lithium-based systems, potentially reducing geopolitical supply risks.

Manufacturing infrastructure presents a significant bottleneck in the supply chain. While sodium raw materials are abundant, specialized equipment for solid electrolyte production and battery assembly remains limited. Current solid-state manufacturing techniques require precise control of processing conditions, with many companies still operating at pilot scale rather than commercial production volumes.

Regional supply chain development shows varying levels of maturity. China has established early leadership in sodium battery material processing, leveraging existing battery manufacturing expertise. European initiatives focus on creating localized supply chains through research consortia and public-private partnerships, while North American development remains more fragmented with select companies pursuing proprietary technologies.

Recycling infrastructure for sodium batteries remains underdeveloped compared to lithium-ion systems. However, the theoretical recyclability of sodium battery components presents opportunities for circular economy approaches, potentially reducing long-term raw material requirements as the technology matures and deployment scales.

Cost considerations favor sodium-based systems in raw material acquisition, with sodium compounds typically costing 80-90% less than lithium equivalents. However, this advantage is currently offset by higher processing costs for solid electrolytes and specialized manufacturing requirements, creating complex economic trade-offs throughout the supply chain.

The extraction and processing infrastructure for sodium compounds remains less developed than lithium counterparts, creating both challenges and opportunities for early market entrants. Current sodium extraction primarily occurs as a byproduct of chlorine production through brine processing or mining of minerals such as trona. The processing capacity would require significant expansion to meet projected demand for solid-state sodium batteries in EVs.

Key raw materials for solid-state sodium batteries include sodium salts (typically sodium carbonate or sodium hydroxide), solid electrolyte materials (often NASICON-type ceramics, beta-alumina, or sodium-containing sulfides), and cathode materials (typically layered transition metal oxides or Prussian blue analogs). The diversification of material sources represents a strategic advantage over lithium-based systems, potentially reducing geopolitical supply risks.

Manufacturing infrastructure presents a significant bottleneck in the supply chain. While sodium raw materials are abundant, specialized equipment for solid electrolyte production and battery assembly remains limited. Current solid-state manufacturing techniques require precise control of processing conditions, with many companies still operating at pilot scale rather than commercial production volumes.

Regional supply chain development shows varying levels of maturity. China has established early leadership in sodium battery material processing, leveraging existing battery manufacturing expertise. European initiatives focus on creating localized supply chains through research consortia and public-private partnerships, while North American development remains more fragmented with select companies pursuing proprietary technologies.

Recycling infrastructure for sodium batteries remains underdeveloped compared to lithium-ion systems. However, the theoretical recyclability of sodium battery components presents opportunities for circular economy approaches, potentially reducing long-term raw material requirements as the technology matures and deployment scales.

Cost considerations favor sodium-based systems in raw material acquisition, with sodium compounds typically costing 80-90% less than lithium equivalents. However, this advantage is currently offset by higher processing costs for solid electrolytes and specialized manufacturing requirements, creating complex economic trade-offs throughout the supply chain.

Cost-Performance Analysis vs Lithium-ion Alternatives

When comparing solid-state sodium batteries (SSNBs) to conventional lithium-ion batteries (LIBs) for electric vehicle applications, cost emerges as a significant advantage. Sodium resources are approximately 1,000 times more abundant than lithium globally, with more geographically distributed reserves. This abundance translates to raw material costs that are 30-50% lower than lithium-based alternatives, potentially reducing overall battery pack costs by 20-30% at scale.

Manufacturing processes for SSNBs can leverage existing lithium-ion production infrastructure with modifications, avoiding complete facility overhauls. The elimination of flammable liquid electrolytes also reduces safety equipment requirements, further decreasing production costs. Current estimates suggest that at mass production, SSNBs could achieve costs below $80/kWh by 2030, compared to the projected $100/kWh for advanced lithium-ion technologies.

Performance metrics present a more nuanced picture. Current SSNB prototypes demonstrate energy densities of 160-200 Wh/kg, compared to 250-300 Wh/kg for commercial LIBs. This translates to approximately 20-30% less range for equivalent battery weight. However, SSNBs exhibit superior thermal stability, operating efficiently across a wider temperature range (-30°C to 80°C) than conventional LIBs (-20°C to 60°C).

Cycle life data shows promising results, with laboratory SSNBs achieving 1,000-1,500 cycles before capacity falls below 80%, comparable to many commercial LIBs. Fast-charging capabilities remain competitive, with some prototypes demonstrating 80% charge in 30 minutes, similar to advanced lithium-ion formulations.

Safety performance represents a decisive advantage for SSNBs. The solid electrolyte eliminates thermal runaway risks associated with liquid electrolytes in LIBs. Testing demonstrates that SSNBs can withstand physical damage, overcharging, and extreme temperatures without combustion, potentially reducing cooling system requirements and protective structures in EV battery packs.

Total cost of ownership calculations suggest that despite lower initial energy density, the extended temperature operating range, improved safety profile, and lower raw material costs could make SSNBs economically advantageous for specific vehicle segments by 2025-2027, particularly in entry-level and mid-range electric vehicles where cost sensitivity outweighs maximum range requirements.

Manufacturing processes for SSNBs can leverage existing lithium-ion production infrastructure with modifications, avoiding complete facility overhauls. The elimination of flammable liquid electrolytes also reduces safety equipment requirements, further decreasing production costs. Current estimates suggest that at mass production, SSNBs could achieve costs below $80/kWh by 2030, compared to the projected $100/kWh for advanced lithium-ion technologies.

Performance metrics present a more nuanced picture. Current SSNB prototypes demonstrate energy densities of 160-200 Wh/kg, compared to 250-300 Wh/kg for commercial LIBs. This translates to approximately 20-30% less range for equivalent battery weight. However, SSNBs exhibit superior thermal stability, operating efficiently across a wider temperature range (-30°C to 80°C) than conventional LIBs (-20°C to 60°C).

Cycle life data shows promising results, with laboratory SSNBs achieving 1,000-1,500 cycles before capacity falls below 80%, comparable to many commercial LIBs. Fast-charging capabilities remain competitive, with some prototypes demonstrating 80% charge in 30 minutes, similar to advanced lithium-ion formulations.

Safety performance represents a decisive advantage for SSNBs. The solid electrolyte eliminates thermal runaway risks associated with liquid electrolytes in LIBs. Testing demonstrates that SSNBs can withstand physical damage, overcharging, and extreme temperatures without combustion, potentially reducing cooling system requirements and protective structures in EV battery packs.

Total cost of ownership calculations suggest that despite lower initial energy density, the extended temperature operating range, improved safety profile, and lower raw material costs could make SSNBs economically advantageous for specific vehicle segments by 2025-2027, particularly in entry-level and mid-range electric vehicles where cost sensitivity outweighs maximum range requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!