Strategies for surge capacity during clinical rollouts: modular cleanrooms and portable manufacturing cells

SEP 2, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Modular Cleanroom Evolution and Objectives

The evolution of modular cleanrooms represents a significant technological advancement in controlled environment manufacturing, particularly for pharmaceutical and biotechnology applications. Traditional cleanroom facilities, characterized by permanent structures with fixed capacities, have dominated the industry for decades. However, the increasing demand for rapid deployment capabilities during public health emergencies and clinical trials has catalyzed innovation in this field.

Modular cleanroom technology emerged in the 1980s with basic prefabricated panels, evolving significantly through the 1990s and 2000s with improved materials and design methodologies. The contemporary generation of modular cleanrooms incorporates advanced features such as integrated HVAC systems, automated monitoring capabilities, and reconfigurable layouts that can be rapidly deployed and validated.

The primary objective of modern modular cleanroom development is to establish surge capacity for biopharmaceutical manufacturing during critical periods such as clinical trials, pandemic responses, or market entry phases. These systems aim to provide ISO-compliant environments (typically Class 7 or 8) that can be operational within weeks rather than the months or years required for conventional cleanroom construction.

Technical objectives for modular cleanroom systems include achieving rapid deployment capabilities (typically 8-12 weeks from order to operation), maintaining regulatory compliance across multiple jurisdictions, and ensuring scalability to accommodate varying production volumes. Additionally, these systems must demonstrate cost-effectiveness, with capital expenditure reductions of 30-50% compared to traditional cleanroom construction.

The technological trajectory shows a clear trend toward increased modularity, with contemporary systems featuring standardized components that can be assembled in various configurations to meet specific manufacturing requirements. This standardization facilitates validation processes and enables more predictable performance across different installation sites.

Energy efficiency represents another critical objective in modular cleanroom evolution, with modern systems incorporating advanced air handling units, energy recovery systems, and intelligent control algorithms that optimize resource utilization while maintaining required cleanliness classifications. Recent innovations have demonstrated energy consumption reductions of up to 40% compared to conventional cleanroom designs.

Future development objectives include enhanced integration with Industry 4.0 technologies, incorporating IoT sensors, real-time monitoring systems, and predictive maintenance capabilities. These advancements aim to further improve operational efficiency, reduce validation timelines, and enhance the adaptability of modular cleanrooms to changing manufacturing requirements.

Modular cleanroom technology emerged in the 1980s with basic prefabricated panels, evolving significantly through the 1990s and 2000s with improved materials and design methodologies. The contemporary generation of modular cleanrooms incorporates advanced features such as integrated HVAC systems, automated monitoring capabilities, and reconfigurable layouts that can be rapidly deployed and validated.

The primary objective of modern modular cleanroom development is to establish surge capacity for biopharmaceutical manufacturing during critical periods such as clinical trials, pandemic responses, or market entry phases. These systems aim to provide ISO-compliant environments (typically Class 7 or 8) that can be operational within weeks rather than the months or years required for conventional cleanroom construction.

Technical objectives for modular cleanroom systems include achieving rapid deployment capabilities (typically 8-12 weeks from order to operation), maintaining regulatory compliance across multiple jurisdictions, and ensuring scalability to accommodate varying production volumes. Additionally, these systems must demonstrate cost-effectiveness, with capital expenditure reductions of 30-50% compared to traditional cleanroom construction.

The technological trajectory shows a clear trend toward increased modularity, with contemporary systems featuring standardized components that can be assembled in various configurations to meet specific manufacturing requirements. This standardization facilitates validation processes and enables more predictable performance across different installation sites.

Energy efficiency represents another critical objective in modular cleanroom evolution, with modern systems incorporating advanced air handling units, energy recovery systems, and intelligent control algorithms that optimize resource utilization while maintaining required cleanliness classifications. Recent innovations have demonstrated energy consumption reductions of up to 40% compared to conventional cleanroom designs.

Future development objectives include enhanced integration with Industry 4.0 technologies, incorporating IoT sensors, real-time monitoring systems, and predictive maintenance capabilities. These advancements aim to further improve operational efficiency, reduce validation timelines, and enhance the adaptability of modular cleanrooms to changing manufacturing requirements.

Market Demand Analysis for Flexible Clinical Manufacturing

The global market for flexible clinical manufacturing solutions is experiencing unprecedented growth, driven by the increasing complexity of biopharmaceuticals and the need for rapid response to public health emergencies. Current market valuations indicate that the modular cleanroom sector is expanding at a compound annual growth rate of 7.8%, with particular acceleration in portable manufacturing solutions for cell and gene therapies.

Demand for flexible manufacturing capabilities has intensified significantly following the COVID-19 pandemic, which exposed critical vulnerabilities in traditional pharmaceutical supply chains. Healthcare systems and biopharmaceutical companies are now prioritizing surge capacity solutions that can be rapidly deployed during clinical trials or emergency situations. This shift represents a fundamental change in manufacturing strategy from centralized, fixed facilities to distributed, adaptable production networks.

Regional market analysis reveals varying adoption rates, with North America currently leading implementation of modular manufacturing technologies, followed by Europe and rapidly growing interest in Asia-Pacific markets. Particularly strong demand exists in emerging economies where building permanent GMP facilities presents prohibitive costs and regulatory hurdles. These markets view portable manufacturing cells as a strategic pathway to develop domestic production capabilities while maintaining compliance with international standards.

The clinical trial landscape is evolving toward more personalized therapies requiring smaller batch sizes and greater manufacturing flexibility. This trend has created a specialized market segment for portable manufacturing cells that can produce advanced therapy medicinal products (ATMPs) in close proximity to clinical sites. Market research indicates that approximately 40% of clinical-stage cell and gene therapy companies are actively exploring flexible manufacturing solutions to address production bottlenecks.

Contract development and manufacturing organizations (CDMOs) represent another significant market driver, as they seek to differentiate their service offerings through flexible manufacturing capabilities. The ability to rapidly scale production volumes without major capital investments provides these organizations with competitive advantages in securing new client partnerships.

Healthcare systems and government agencies have emerged as important stakeholders following pandemic preparedness initiatives. Many countries are establishing strategic reserves of modular manufacturing capacity that can be activated during public health emergencies. This government-driven demand is creating stable, long-term market opportunities for providers of flexible manufacturing solutions.

Market forecasts suggest continued strong growth through 2030, with particular expansion in solutions that integrate advanced process analytical technologies (PAT) and automated quality control systems. The convergence of flexible manufacturing with digital technologies represents the highest-value market segment, as it addresses both production capacity and regulatory compliance challenges simultaneously.

Demand for flexible manufacturing capabilities has intensified significantly following the COVID-19 pandemic, which exposed critical vulnerabilities in traditional pharmaceutical supply chains. Healthcare systems and biopharmaceutical companies are now prioritizing surge capacity solutions that can be rapidly deployed during clinical trials or emergency situations. This shift represents a fundamental change in manufacturing strategy from centralized, fixed facilities to distributed, adaptable production networks.

Regional market analysis reveals varying adoption rates, with North America currently leading implementation of modular manufacturing technologies, followed by Europe and rapidly growing interest in Asia-Pacific markets. Particularly strong demand exists in emerging economies where building permanent GMP facilities presents prohibitive costs and regulatory hurdles. These markets view portable manufacturing cells as a strategic pathway to develop domestic production capabilities while maintaining compliance with international standards.

The clinical trial landscape is evolving toward more personalized therapies requiring smaller batch sizes and greater manufacturing flexibility. This trend has created a specialized market segment for portable manufacturing cells that can produce advanced therapy medicinal products (ATMPs) in close proximity to clinical sites. Market research indicates that approximately 40% of clinical-stage cell and gene therapy companies are actively exploring flexible manufacturing solutions to address production bottlenecks.

Contract development and manufacturing organizations (CDMOs) represent another significant market driver, as they seek to differentiate their service offerings through flexible manufacturing capabilities. The ability to rapidly scale production volumes without major capital investments provides these organizations with competitive advantages in securing new client partnerships.

Healthcare systems and government agencies have emerged as important stakeholders following pandemic preparedness initiatives. Many countries are establishing strategic reserves of modular manufacturing capacity that can be activated during public health emergencies. This government-driven demand is creating stable, long-term market opportunities for providers of flexible manufacturing solutions.

Market forecasts suggest continued strong growth through 2030, with particular expansion in solutions that integrate advanced process analytical technologies (PAT) and automated quality control systems. The convergence of flexible manufacturing with digital technologies represents the highest-value market segment, as it addresses both production capacity and regulatory compliance challenges simultaneously.

Current Challenges in Surge Capacity Technologies

The surge capacity landscape for clinical rollouts faces significant technological and operational challenges that impede rapid deployment of manufacturing capabilities during high-demand periods. Traditional cleanroom facilities require extensive construction time, typically 12-24 months from planning to validation, creating a critical bottleneck for emergency response scenarios. This timeline proves particularly problematic for novel therapeutics and vaccines where speed-to-market directly impacts public health outcomes.

Infrastructure flexibility represents another major challenge, as conventional pharmaceutical manufacturing facilities are designed with fixed capacities and limited reconfiguration capabilities. When demand surges unexpectedly, these rigid systems cannot scale production without substantial capital investment and regulatory revalidation processes, which can extend timelines by 6-12 months even under accelerated protocols.

Regulatory compliance presents a formidable barrier to surge capacity implementation. Current Good Manufacturing Practice (cGMP) standards require extensive documentation and validation for any manufacturing environment changes. The regulatory framework, while essential for product safety, was not designed with rapid deployment scenarios in mind, creating tension between speed and compliance requirements.

Supply chain vulnerabilities further complicate surge capacity efforts. The specialized equipment, HEPA filtration systems, and cleanroom materials required for modular and portable solutions often face extended lead times of 3-6 months during normal conditions, which can double during global demand spikes. This dependency on specialized components creates single points of failure throughout the manufacturing ecosystem.

Technical integration challenges persist between portable manufacturing cells and existing facility infrastructure. Incompatible utility connections, data management systems, and monitoring technologies often require custom engineering solutions that delay deployment. The lack of standardization across portable manufacturing platforms further exacerbates these integration issues.

Workforce limitations represent an often-overlooked constraint, as specialized personnel with cleanroom operation expertise remain in short supply globally. Training new operators typically requires 2-3 months for basic competency, creating a human resource bottleneck that technology alone cannot address.

Cost considerations remain prohibitive for many organizations. Current modular cleanroom solutions average $1,500-3,000 per square foot compared to $800-1,500 for traditional construction, creating financial barriers to adoption despite long-term flexibility benefits. The high capital expenditure required for surge capacity technologies often faces resistance in budget-constrained environments, particularly when the return on investment depends on uncertain future demand scenarios.

Infrastructure flexibility represents another major challenge, as conventional pharmaceutical manufacturing facilities are designed with fixed capacities and limited reconfiguration capabilities. When demand surges unexpectedly, these rigid systems cannot scale production without substantial capital investment and regulatory revalidation processes, which can extend timelines by 6-12 months even under accelerated protocols.

Regulatory compliance presents a formidable barrier to surge capacity implementation. Current Good Manufacturing Practice (cGMP) standards require extensive documentation and validation for any manufacturing environment changes. The regulatory framework, while essential for product safety, was not designed with rapid deployment scenarios in mind, creating tension between speed and compliance requirements.

Supply chain vulnerabilities further complicate surge capacity efforts. The specialized equipment, HEPA filtration systems, and cleanroom materials required for modular and portable solutions often face extended lead times of 3-6 months during normal conditions, which can double during global demand spikes. This dependency on specialized components creates single points of failure throughout the manufacturing ecosystem.

Technical integration challenges persist between portable manufacturing cells and existing facility infrastructure. Incompatible utility connections, data management systems, and monitoring technologies often require custom engineering solutions that delay deployment. The lack of standardization across portable manufacturing platforms further exacerbates these integration issues.

Workforce limitations represent an often-overlooked constraint, as specialized personnel with cleanroom operation expertise remain in short supply globally. Training new operators typically requires 2-3 months for basic competency, creating a human resource bottleneck that technology alone cannot address.

Cost considerations remain prohibitive for many organizations. Current modular cleanroom solutions average $1,500-3,000 per square foot compared to $800-1,500 for traditional construction, creating financial barriers to adoption despite long-term flexibility benefits. The high capital expenditure required for surge capacity technologies often faces resistance in budget-constrained environments, particularly when the return on investment depends on uncertain future demand scenarios.

Existing Surge Capacity Implementation Strategies

01 Modular cleanroom design and construction

Modular cleanrooms are designed with prefabricated components that can be easily assembled, disassembled, and reconfigured to meet changing manufacturing needs. These cleanrooms feature standardized wall panels, ceiling systems, and flooring that can be quickly installed to create controlled environments. The modular approach allows for rapid deployment in response to surge capacity requirements, with the ability to scale up or down as needed. These systems often include integrated filtration, lighting, and environmental control systems that maintain required cleanliness classifications.- Modular cleanroom design for flexible manufacturing: Modular cleanroom systems that can be easily assembled, disassembled, and reconfigured to accommodate changing manufacturing needs. These systems feature standardized components that allow for rapid deployment and scalability, making them ideal for surge capacity requirements. The modular design enables manufacturers to quickly expand or contract their cleanroom space based on production demands, while maintaining required cleanliness standards and environmental controls.

- Portable manufacturing cells with integrated environmental control: Self-contained manufacturing cells that incorporate their own environmental control systems, allowing for portable and rapid deployment manufacturing capabilities. These units include integrated HVAC, filtration, and monitoring systems to maintain cleanroom conditions regardless of the surrounding environment. The portable nature of these cells enables them to be transported to different locations as needed, providing surge manufacturing capacity during emergencies or peak demand periods.

- Electrical and connectivity solutions for modular manufacturing environments: Specialized electrical systems and connectivity solutions designed for modular cleanrooms and portable manufacturing cells. These systems feature quick-connect power distribution, data networking capabilities, and safety mechanisms that allow for rapid setup and reconfiguration. The electrical infrastructure is designed to support surge capacity by enabling fast installation and validation of manufacturing equipment without compromising cleanroom integrity or operational safety.

- Monitoring and control systems for cleanroom environments: Advanced monitoring and control systems specifically designed for modular cleanrooms that ensure environmental parameters remain within specifications during surge capacity operations. These systems include sensors for particle counts, pressure differentials, temperature, and humidity, along with automated control mechanisms to maintain cleanroom classifications. Real-time monitoring capabilities allow for immediate response to environmental changes, ensuring product quality even during rapid scaling of manufacturing capacity.

- Specialized equipment and fixtures for portable manufacturing: Purpose-built equipment and fixtures designed specifically for use in modular cleanrooms and portable manufacturing cells. These components are engineered to be compact, easily transportable, and quickly installable while maintaining cleanroom compatibility. Features include specialized mounting systems, space-efficient designs, and materials that minimize particulate generation. These innovations enable rapid deployment of manufacturing capabilities in response to surge capacity requirements while maintaining product quality and cleanliness standards.

02 Portable manufacturing cells for rapid deployment

Portable manufacturing cells are self-contained production units that can be transported to different locations and quickly set up to address surge capacity needs. These cells are designed with all necessary equipment, utilities, and control systems integrated into a compact footprint. They can be deployed in existing facilities or as standalone units, providing immediate production capability without extensive site preparation. The portable nature allows for strategic positioning of manufacturing resources in response to changing demand or emergency situations.Expand Specific Solutions03 Electrical and connectivity systems for cleanroom environments

Specialized electrical systems are designed for cleanroom environments to support surge capacity manufacturing while maintaining contamination control. These systems include specialized power distribution units, grounding systems, and connectivity solutions that can be rapidly deployed and reconfigured. The electrical infrastructure is designed to support sensitive manufacturing equipment while adhering to cleanroom standards. Features include sealed electrical components, specialized cabling systems, and quick-connect interfaces that facilitate rapid setup and modification.Expand Specific Solutions04 Environmental control and monitoring systems

Advanced environmental control and monitoring systems are essential components of modular cleanrooms and portable manufacturing cells. These systems regulate temperature, humidity, air pressure, and particulate levels to maintain required cleanliness classifications. They incorporate sensors, controllers, and filtration systems that can be quickly calibrated for different manufacturing processes. Real-time monitoring capabilities allow for immediate detection of environmental deviations, ensuring product quality during surge capacity operations. The systems are designed for plug-and-play installation to support rapid deployment scenarios.Expand Specific Solutions05 Scalable infrastructure for surge manufacturing capacity

Scalable infrastructure solutions enable rapid expansion of manufacturing capabilities during surge demand periods. These systems include modular utility connections, expandable air handling units, and reconfigurable production layouts that can be quickly adapted to changing requirements. The infrastructure is designed with standardized interfaces that allow for seamless integration of additional modules or equipment. Features include quick-connect utility systems, mobile equipment platforms, and flexible space utilization concepts that maximize production capacity while maintaining required environmental controls.Expand Specific Solutions

Leading Vendors in Modular Cleanroom Industry

The modular cleanroom and portable manufacturing cell market for clinical surge capacity is in a growth phase, characterized by increasing demand for flexible, rapid-deployment solutions in pharmaceutical manufacturing. The global market is expanding significantly, driven by pandemic preparedness initiatives and the rise of personalized medicine requiring agile production capabilities. From a technological maturity perspective, the field shows varied development stages across players. Cytiva and G-CON Manufacturing lead with established prefabricated cleanroom solutions, while Germfree Laboratories and Just-Evotec Biologics offer advanced modular manufacturing systems. Companies like Multiply Labs and Innovation Associates are pushing boundaries with robotic pharmaceutical manufacturing, while traditional equipment providers such as Sartorius Stedim and Hamilton Bonaduz support these modular approaches with compatible technologies.

G-CON Manufacturing, Inc.

Technical Solution: G-CON pioneered the POD® technology, which consists of prefabricated, autonomous cleanroom systems that can be rapidly deployed for clinical manufacturing. Their PODs are pre-engineered, pre-qualified, and factory-tested modular cleanrooms that arrive on-site ready to operate after connection to facility utilities. The PODs can be configured in various sizes (from 100 to 1,500 square feet) and classifications (ISO 5-9), allowing scalable manufacturing capacity during clinical trials. G-CON's systems feature built-in air handling units, fire suppression systems, and environmental monitoring capabilities, enabling autonomous operation. Their PODs can be interconnected to create comprehensive manufacturing suites or deployed individually to address specific capacity needs. The company has implemented rapid deployment models that can reduce traditional cleanroom construction timelines by up to 50%, with some installations completed in as little as 4-6 months compared to conventional 12-18 month timeframes.

Strengths: Highly portable and prefabricated systems that significantly reduce deployment time; autonomous operation capabilities; scalable configurations that can adapt to changing clinical demands. Weaknesses: Higher initial capital investment compared to traditional construction; potential limitations in customization for highly specialized processes; requires careful site preparation for utility connections.

Multiply Labs, Inc.

Technical Solution: Multiply Labs has developed a robotic manufacturing platform specifically designed for cell therapy production that addresses surge capacity challenges through modular automation. Their system utilizes independent robotic manufacturing modules housed within isolator technology, creating what they call "robotic cells" that can operate as independent manufacturing units. Each cell contains precision robotics capable of performing complex cell therapy manufacturing steps with minimal human intervention. The company's approach allows for rapid capacity scaling by simply adding additional robotic cells to meet increased demand during clinical trials. Their technology incorporates advanced environmental monitoring systems and closed-processing techniques that maintain sterility while reducing cleanroom classification requirements. Multiply Labs has demonstrated that their robotic cells can reduce manufacturing footprint requirements by up to 80% compared to traditional cleanroom setups, while also enabling parallel processing of multiple patient samples simultaneously. The system features standardized interfaces that allow for rapid reconfiguration when transitioning between different therapy types or production scales.

Strengths: Highly automated solution that reduces labor requirements and human error; compact footprint that maximizes manufacturing capacity in limited spaces; flexibility to handle multiple therapy types. Weaknesses: High initial technology investment; potential limitations in handling certain complex manual manipulations; dependency on specialized maintenance expertise for robotic systems.

Key Innovations in Portable Manufacturing Cell Design

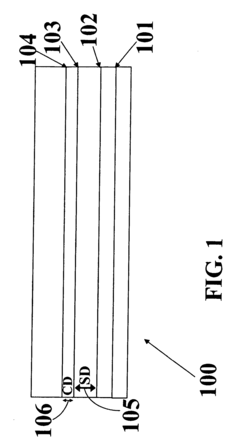

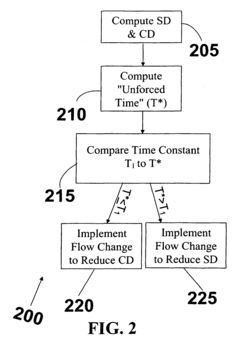

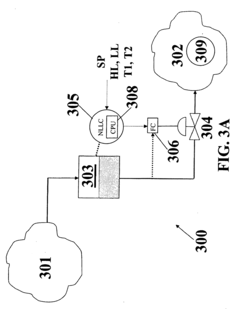

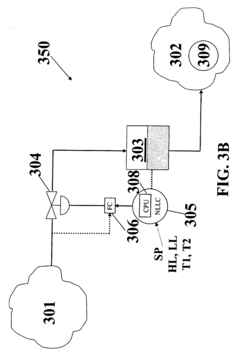

Process controller having improved surge capacity control and related methodology

PatentInactiveEP2017686B1

Innovation

- A non-linear level controller (NLLC) method that computes parameters for capacity deviation and setpoint deviation, adjusting inlet or outlet flows based on calculated unforced times to maintain optimal surge capacity, allowing for explicit control of high and low liquid levels and handling non-linear processes effectively.

Regulatory Compliance for Temporary Clinical Manufacturing

Regulatory compliance represents a critical challenge when implementing temporary manufacturing solutions such as modular cleanrooms and portable manufacturing cells during clinical rollouts. These temporary facilities must adhere to the same stringent regulatory standards as permanent manufacturing sites, despite their transient nature and rapid deployment requirements.

The regulatory landscape for temporary clinical manufacturing spans multiple jurisdictions and agencies, including FDA, EMA, PMDA, and other national regulatory bodies. Each authority maintains specific requirements regarding facility design, environmental controls, personnel flow, and contamination prevention that must be satisfied regardless of the facility's permanence. Temporary facilities face additional scrutiny regarding structural integrity, material compatibility, and validation protocols.

Documentation requirements present particular challenges for temporary manufacturing environments. Comprehensive validation master plans must address the unique aspects of modular and portable solutions, including transportation qualification, rapid assembly verification, and environmental stability during operation. Change control procedures require special attention, as temporary facilities may undergo more frequent modifications or relocations than traditional manufacturing sites.

Risk-based approaches have gained regulatory acceptance for temporary manufacturing facilities. This methodology allows manufacturers to identify critical process parameters and quality attributes specific to modular environments, implementing appropriate controls while maintaining regulatory compliance. Regulatory agencies increasingly recognize the need for flexible approaches that maintain product quality and patient safety without unnecessarily hindering innovation in manufacturing technologies.

Pre-approval inspections for temporary facilities typically focus on demonstrating equivalence to permanent manufacturing environments. Manufacturers must provide evidence that temporary solutions maintain the same level of control over critical processes, with particular emphasis on environmental monitoring programs, cleaning validation, and cross-contamination prevention measures.

Recent regulatory guidance documents have begun addressing the specific challenges of temporary manufacturing facilities. The FDA's 2022 guidance on Advanced Manufacturing Technologies acknowledges the role of modular and portable solutions in addressing supply chain vulnerabilities and encourages their development with appropriate quality controls. Similarly, the EMA has published considerations for rapid deployment manufacturing during public health emergencies.

Successful regulatory strategies for temporary clinical manufacturing facilities typically involve early and frequent engagement with regulatory authorities. Pre-submission meetings and ongoing dialogue during facility design and validation help align expectations and identify potential compliance issues before they become obstacles to approval.

The regulatory landscape for temporary clinical manufacturing spans multiple jurisdictions and agencies, including FDA, EMA, PMDA, and other national regulatory bodies. Each authority maintains specific requirements regarding facility design, environmental controls, personnel flow, and contamination prevention that must be satisfied regardless of the facility's permanence. Temporary facilities face additional scrutiny regarding structural integrity, material compatibility, and validation protocols.

Documentation requirements present particular challenges for temporary manufacturing environments. Comprehensive validation master plans must address the unique aspects of modular and portable solutions, including transportation qualification, rapid assembly verification, and environmental stability during operation. Change control procedures require special attention, as temporary facilities may undergo more frequent modifications or relocations than traditional manufacturing sites.

Risk-based approaches have gained regulatory acceptance for temporary manufacturing facilities. This methodology allows manufacturers to identify critical process parameters and quality attributes specific to modular environments, implementing appropriate controls while maintaining regulatory compliance. Regulatory agencies increasingly recognize the need for flexible approaches that maintain product quality and patient safety without unnecessarily hindering innovation in manufacturing technologies.

Pre-approval inspections for temporary facilities typically focus on demonstrating equivalence to permanent manufacturing environments. Manufacturers must provide evidence that temporary solutions maintain the same level of control over critical processes, with particular emphasis on environmental monitoring programs, cleaning validation, and cross-contamination prevention measures.

Recent regulatory guidance documents have begun addressing the specific challenges of temporary manufacturing facilities. The FDA's 2022 guidance on Advanced Manufacturing Technologies acknowledges the role of modular and portable solutions in addressing supply chain vulnerabilities and encourages their development with appropriate quality controls. Similarly, the EMA has published considerations for rapid deployment manufacturing during public health emergencies.

Successful regulatory strategies for temporary clinical manufacturing facilities typically involve early and frequent engagement with regulatory authorities. Pre-submission meetings and ongoing dialogue during facility design and validation help align expectations and identify potential compliance issues before they become obstacles to approval.

Cost-Benefit Analysis of Modular vs Traditional Infrastructure

The economic comparison between modular cleanrooms and traditional manufacturing infrastructure reveals significant differences in initial investment, operational costs, and long-term financial implications. Traditional fixed infrastructure typically requires substantial upfront capital expenditure, with costs ranging from $500-1,000 per square foot for pharmaceutical-grade facilities. These investments are characterized by lengthy construction periods (often 18-36 months) and considerable regulatory approval timelines, creating significant financial exposure before revenue generation begins.

In contrast, modular cleanroom solutions demonstrate a more favorable initial cost structure, typically 15-30% lower in upfront investment. This advantage stems from standardized manufacturing processes, reduced on-site construction requirements, and accelerated deployment timelines of 6-12 months. The financial model shifts from heavy capital expenditure to a more balanced approach that may include leasing options, creating flexibility in balance sheet management.

Operational cost analysis reveals that traditional infrastructure generally offers lower per-unit production costs at maximum capacity utilization, benefiting from economies of scale. However, this advantage diminishes significantly during clinical trial phases or initial commercial rollouts when production volumes remain below capacity. Modular solutions demonstrate superior cost efficiency during these critical early phases, with studies indicating 20-35% lower operational costs during sub-optimal utilization periods.

Risk assessment calculations further favor modular approaches when considering the high failure rate of pharmaceutical candidates in clinical trials. Traditional infrastructure creates substantial sunk costs if product development fails, while modular systems offer reconfiguration options or potential resale value, effectively reducing financial exposure. This risk mitigation aspect translates to an estimated 25-40% reduction in financial risk when properly quantified in net present value calculations.

Long-term financial modeling must also consider scalability dynamics. Traditional infrastructure typically requires significant additional investment for capacity expansion, often at 60-80% of initial costs. Modular systems enable incremental capacity additions at proportionally lower costs, allowing capital deployment to align more closely with actual market demand and revenue streams. This "just-in-time" capacity approach improves return on invested capital metrics by 15-25% over five-year horizons in typical pharmaceutical commercialization scenarios.

The total cost of ownership analysis must additionally factor in regulatory compliance costs, which can be streamlined in pre-validated modular systems, and decommissioning expenses, which are substantially lower for modular installations. When these elements are incorporated into comprehensive financial models, modular solutions demonstrate superior economic performance for products with uncertain demand profiles or those requiring rapid market entry.

In contrast, modular cleanroom solutions demonstrate a more favorable initial cost structure, typically 15-30% lower in upfront investment. This advantage stems from standardized manufacturing processes, reduced on-site construction requirements, and accelerated deployment timelines of 6-12 months. The financial model shifts from heavy capital expenditure to a more balanced approach that may include leasing options, creating flexibility in balance sheet management.

Operational cost analysis reveals that traditional infrastructure generally offers lower per-unit production costs at maximum capacity utilization, benefiting from economies of scale. However, this advantage diminishes significantly during clinical trial phases or initial commercial rollouts when production volumes remain below capacity. Modular solutions demonstrate superior cost efficiency during these critical early phases, with studies indicating 20-35% lower operational costs during sub-optimal utilization periods.

Risk assessment calculations further favor modular approaches when considering the high failure rate of pharmaceutical candidates in clinical trials. Traditional infrastructure creates substantial sunk costs if product development fails, while modular systems offer reconfiguration options or potential resale value, effectively reducing financial exposure. This risk mitigation aspect translates to an estimated 25-40% reduction in financial risk when properly quantified in net present value calculations.

Long-term financial modeling must also consider scalability dynamics. Traditional infrastructure typically requires significant additional investment for capacity expansion, often at 60-80% of initial costs. Modular systems enable incremental capacity additions at proportionally lower costs, allowing capital deployment to align more closely with actual market demand and revenue streams. This "just-in-time" capacity approach improves return on invested capital metrics by 15-25% over five-year horizons in typical pharmaceutical commercialization scenarios.

The total cost of ownership analysis must additionally factor in regulatory compliance costs, which can be streamlined in pre-validated modular systems, and decommissioning expenses, which are substantially lower for modular installations. When these elements are incorporated into comprehensive financial models, modular solutions demonstrate superior economic performance for products with uncertain demand profiles or those requiring rapid market entry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!