The Role of Vector Engineering in Expanding Gene Therapy Efficacies

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Vector Engineering Background and Objectives

Gene therapy has evolved significantly since its conceptual inception in the 1970s, transitioning from theoretical possibility to clinical reality. The fundamental premise involves delivering therapeutic genetic material to target cells to correct genetic abnormalities or introduce new genetic functions. Vector engineering represents the cornerstone of this therapeutic approach, serving as the delivery vehicle that determines efficacy, safety, and specificity of gene therapy applications.

The historical trajectory of vector development reveals a progressive refinement from early viral vectors with significant immunogenicity concerns to increasingly sophisticated systems with enhanced targeting capabilities and reduced side effects. Initial vectors derived from retroviruses and adenoviruses provided proof-of-concept but faced limitations including insertional mutagenesis and immune responses. The subsequent development of adeno-associated viral (AAV) vectors marked a significant advancement due to their improved safety profile and long-term gene expression capabilities.

Current vector engineering focuses on addressing four primary challenges: improving tissue specificity, enhancing transduction efficiency, reducing immunogenicity, and increasing payload capacity. These objectives align with the broader goal of expanding gene therapy applications beyond monogenic disorders to complex conditions including cancer, cardiovascular diseases, and neurodegenerative disorders.

The technological evolution in this field has been accelerated by parallel advancements in genomics, proteomics, and computational biology. Modern vector engineering incorporates rational design principles, directed evolution techniques, and high-throughput screening methodologies to develop vectors with customized properties for specific therapeutic applications.

Recent breakthroughs in CRISPR-Cas9 technology have further expanded vector engineering possibilities, enabling precise genome editing capabilities when delivered via appropriately designed vectors. This synergistic relationship between delivery systems and editing technologies represents a frontier in gene therapy development.

The primary objective of contemporary vector engineering research is to develop a versatile toolkit of delivery systems capable of addressing diverse therapeutic needs across different tissue types, disease states, and patient populations. This includes creating vectors that can navigate biological barriers such as the blood-brain barrier, evade immune surveillance, and achieve cell-type specific targeting through surface modification and genetic engineering.

Success in these engineering efforts would significantly expand the therapeutic window of gene therapy, potentially transforming treatment paradigms for previously intractable conditions and enabling more personalized therapeutic approaches based on individual genetic profiles and disease characteristics.

The historical trajectory of vector development reveals a progressive refinement from early viral vectors with significant immunogenicity concerns to increasingly sophisticated systems with enhanced targeting capabilities and reduced side effects. Initial vectors derived from retroviruses and adenoviruses provided proof-of-concept but faced limitations including insertional mutagenesis and immune responses. The subsequent development of adeno-associated viral (AAV) vectors marked a significant advancement due to their improved safety profile and long-term gene expression capabilities.

Current vector engineering focuses on addressing four primary challenges: improving tissue specificity, enhancing transduction efficiency, reducing immunogenicity, and increasing payload capacity. These objectives align with the broader goal of expanding gene therapy applications beyond monogenic disorders to complex conditions including cancer, cardiovascular diseases, and neurodegenerative disorders.

The technological evolution in this field has been accelerated by parallel advancements in genomics, proteomics, and computational biology. Modern vector engineering incorporates rational design principles, directed evolution techniques, and high-throughput screening methodologies to develop vectors with customized properties for specific therapeutic applications.

Recent breakthroughs in CRISPR-Cas9 technology have further expanded vector engineering possibilities, enabling precise genome editing capabilities when delivered via appropriately designed vectors. This synergistic relationship between delivery systems and editing technologies represents a frontier in gene therapy development.

The primary objective of contemporary vector engineering research is to develop a versatile toolkit of delivery systems capable of addressing diverse therapeutic needs across different tissue types, disease states, and patient populations. This includes creating vectors that can navigate biological barriers such as the blood-brain barrier, evade immune surveillance, and achieve cell-type specific targeting through surface modification and genetic engineering.

Success in these engineering efforts would significantly expand the therapeutic window of gene therapy, potentially transforming treatment paradigms for previously intractable conditions and enabling more personalized therapeutic approaches based on individual genetic profiles and disease characteristics.

Gene Therapy Market Analysis

The gene therapy market has experienced remarkable growth in recent years, driven by significant advancements in vector engineering technologies. As of 2023, the global gene therapy market is valued at approximately $7.8 billion, with projections indicating a compound annual growth rate (CAGR) of 16.6% through 2030, potentially reaching $25.3 billion by the end of the decade.

North America currently dominates the market landscape, accounting for roughly 48% of global revenue, followed by Europe at 28% and Asia-Pacific at 18%. This regional distribution reflects the concentration of research institutions, biotechnology companies, and favorable regulatory frameworks in these areas.

Vector engineering plays a pivotal role in market dynamics, with viral vectors representing approximately 70% of the current market share. Among viral vectors, adeno-associated virus (AAV) vectors lead with 40% market share, followed by lentiviral vectors at 25%. The remaining market is distributed among adenoviral, retroviral, and emerging non-viral vector technologies.

The therapeutic application landscape shows oncology as the largest segment (35%), followed by rare genetic disorders (30%), neurological conditions (15%), cardiovascular diseases (10%), and other applications (10%). This distribution highlights the versatility of gene therapy approaches across different disease categories.

Key market drivers include increasing prevalence of genetic disorders, growing investment in research and development, and favorable regulatory pathways for orphan drugs. The FDA has approved 25 gene therapy products to date, with an additional 400+ candidates in various stages of clinical trials globally.

Challenges affecting market growth include high treatment costs, with current therapies ranging from $373,000 to $2.1 million per patient, manufacturing complexities, and concerns regarding long-term safety and efficacy. These factors have created significant barriers to widespread adoption despite clinical promise.

Reimbursement models are evolving to accommodate these high-cost treatments, with innovative approaches such as outcomes-based agreements and installment payment plans gaining traction among payers and healthcare systems. Approximately 40% of approved gene therapies now have some form of alternative payment model in place.

The competitive landscape features established pharmaceutical companies like Novartis, Roche, and Pfizer alongside specialized biotech firms such as BioMarin, bluebird bio, and Spark Therapeutics. Recent years have seen significant merger and acquisition activity, with over $15 billion in deals completed in the past three years, indicating strong industry confidence in the future market potential.

North America currently dominates the market landscape, accounting for roughly 48% of global revenue, followed by Europe at 28% and Asia-Pacific at 18%. This regional distribution reflects the concentration of research institutions, biotechnology companies, and favorable regulatory frameworks in these areas.

Vector engineering plays a pivotal role in market dynamics, with viral vectors representing approximately 70% of the current market share. Among viral vectors, adeno-associated virus (AAV) vectors lead with 40% market share, followed by lentiviral vectors at 25%. The remaining market is distributed among adenoviral, retroviral, and emerging non-viral vector technologies.

The therapeutic application landscape shows oncology as the largest segment (35%), followed by rare genetic disorders (30%), neurological conditions (15%), cardiovascular diseases (10%), and other applications (10%). This distribution highlights the versatility of gene therapy approaches across different disease categories.

Key market drivers include increasing prevalence of genetic disorders, growing investment in research and development, and favorable regulatory pathways for orphan drugs. The FDA has approved 25 gene therapy products to date, with an additional 400+ candidates in various stages of clinical trials globally.

Challenges affecting market growth include high treatment costs, with current therapies ranging from $373,000 to $2.1 million per patient, manufacturing complexities, and concerns regarding long-term safety and efficacy. These factors have created significant barriers to widespread adoption despite clinical promise.

Reimbursement models are evolving to accommodate these high-cost treatments, with innovative approaches such as outcomes-based agreements and installment payment plans gaining traction among payers and healthcare systems. Approximately 40% of approved gene therapies now have some form of alternative payment model in place.

The competitive landscape features established pharmaceutical companies like Novartis, Roche, and Pfizer alongside specialized biotech firms such as BioMarin, bluebird bio, and Spark Therapeutics. Recent years have seen significant merger and acquisition activity, with over $15 billion in deals completed in the past three years, indicating strong industry confidence in the future market potential.

Current Vector Technologies and Challenges

Gene therapy vector technologies have evolved significantly over the past three decades, with several platforms now established as clinical standards. Viral vectors remain the predominant delivery vehicles, with adeno-associated viruses (AAVs), lentiviruses, and adenoviruses leading clinical applications. AAVs have gained prominence due to their safety profile, low immunogenicity, and ability to provide long-term gene expression in non-dividing cells. Lentiviral vectors excel in integrating genetic material into the host genome, making them suitable for ex vivo cell therapies. Adenoviral vectors, while more immunogenic, offer large packaging capacity and high transduction efficiency.

Non-viral vectors have emerged as promising alternatives, including lipid nanoparticles (LNPs), which gained significant attention following their success in mRNA vaccine delivery. Other non-viral approaches include polymer-based systems, exosomes, and physical methods such as electroporation and sonoporation. These technologies address some limitations of viral vectors but generally demonstrate lower transduction efficiency in vivo.

Despite remarkable progress, current vector technologies face substantial challenges that limit broader application of gene therapies. Manufacturing scalability remains a critical bottleneck, particularly for viral vectors, where production processes are complex and yields often insufficient for treating prevalent diseases. The cost of vector production directly impacts therapy pricing, contributing to the prohibitive costs of approved gene therapies that often exceed $1-2 million per treatment.

Immunogenicity presents another significant hurdle, as pre-existing immunity to common viral vectors like AAVs can neutralize therapeutic efficacy and prevent re-administration. This issue particularly affects adult populations, where AAV antibodies are prevalent. Vector tropism limitations also restrict therapeutic applications, as most current vectors lack precise tissue targeting capabilities, leading to off-target effects and requiring higher doses to achieve therapeutic outcomes.

Packaging capacity constraints, especially in AAVs (limited to approximately 4.7kb), prevent delivery of larger therapeutic genes or complex regulatory elements. This limitation has necessitated development of dual-vector systems and gene-splitting approaches, which introduce additional complexity and reduced efficiency.

Safety concerns persist across vector platforms, including insertional mutagenesis risks with integrating vectors and potential genotoxicity. Long-term expression control mechanisms remain underdeveloped, limiting the ability to regulate therapeutic gene expression in response to physiological needs or to terminate expression if adverse effects occur.

These challenges collectively represent the frontier of vector engineering research, where innovations in molecular design, manufacturing processes, and delivery strategies are urgently needed to expand the reach and effectiveness of gene therapy approaches.

Non-viral vectors have emerged as promising alternatives, including lipid nanoparticles (LNPs), which gained significant attention following their success in mRNA vaccine delivery. Other non-viral approaches include polymer-based systems, exosomes, and physical methods such as electroporation and sonoporation. These technologies address some limitations of viral vectors but generally demonstrate lower transduction efficiency in vivo.

Despite remarkable progress, current vector technologies face substantial challenges that limit broader application of gene therapies. Manufacturing scalability remains a critical bottleneck, particularly for viral vectors, where production processes are complex and yields often insufficient for treating prevalent diseases. The cost of vector production directly impacts therapy pricing, contributing to the prohibitive costs of approved gene therapies that often exceed $1-2 million per treatment.

Immunogenicity presents another significant hurdle, as pre-existing immunity to common viral vectors like AAVs can neutralize therapeutic efficacy and prevent re-administration. This issue particularly affects adult populations, where AAV antibodies are prevalent. Vector tropism limitations also restrict therapeutic applications, as most current vectors lack precise tissue targeting capabilities, leading to off-target effects and requiring higher doses to achieve therapeutic outcomes.

Packaging capacity constraints, especially in AAVs (limited to approximately 4.7kb), prevent delivery of larger therapeutic genes or complex regulatory elements. This limitation has necessitated development of dual-vector systems and gene-splitting approaches, which introduce additional complexity and reduced efficiency.

Safety concerns persist across vector platforms, including insertional mutagenesis risks with integrating vectors and potential genotoxicity. Long-term expression control mechanisms remain underdeveloped, limiting the ability to regulate therapeutic gene expression in response to physiological needs or to terminate expression if adverse effects occur.

These challenges collectively represent the frontier of vector engineering research, where innovations in molecular design, manufacturing processes, and delivery strategies are urgently needed to expand the reach and effectiveness of gene therapy approaches.

Current Vector Design Strategies

01 Neural network optimization for vector engineering

Advanced neural network algorithms are employed to optimize vector engineering processes, enhancing efficacy and precision. These systems utilize machine learning techniques to predict optimal vector configurations, analyze performance metrics, and continuously improve engineering outcomes. The optimization frameworks incorporate feedback mechanisms that adapt to changing conditions and requirements, resulting in more efficient vector designs with improved target specificity and reduced off-target effects.- Neural network optimization for vector engineering: Neural networks can be optimized for vector engineering applications by implementing specialized algorithms that enhance computational efficiency and accuracy. These systems utilize machine learning techniques to analyze complex vector data, enabling more effective pattern recognition and prediction capabilities. The optimization process involves adjusting network parameters, implementing dimensionality reduction techniques, and employing adaptive learning rates to improve performance in vector-based applications.

- Vector-based medical and neural stimulation systems: Vector engineering principles are applied in medical technologies, particularly for neural stimulation and treatment systems. These approaches utilize directional vectors to precisely target specific neural pathways or tissues, improving therapeutic outcomes while minimizing side effects. The systems incorporate computational models that optimize stimulation parameters based on patient-specific anatomical data and response patterns, allowing for personalized treatment protocols in neurological and other medical applications.

- Communication system vector optimization: Vector engineering techniques are employed in communication systems to optimize signal transmission and reception. These methods involve the manipulation of signal vectors to enhance data throughput, reduce interference, and improve overall system reliability. Advanced algorithms analyze and adjust vector parameters in real-time, adapting to changing channel conditions and network demands. This approach enables more efficient spectrum utilization and supports higher data rates in wireless and wired communication networks.

- Genetic vector engineering for biological applications: Genetic vector engineering involves the design and optimization of vectors for gene delivery and expression in biological systems. These techniques enable precise modification of genetic material for research, therapeutic, and agricultural applications. Advanced computational methods are used to predict vector behavior, optimize transfection efficiency, and minimize unwanted immune responses. The engineering process incorporates considerations of vector size, promoter strength, and tissue specificity to achieve targeted gene expression with improved safety profiles.

- Vector-based data analysis and simulation systems: Vector-based approaches are implemented in data analysis and simulation systems to process complex multidimensional information efficiently. These systems utilize vector mathematics to represent relationships between data points, enabling more intuitive visualization and interpretation of complex datasets. Advanced vector engineering techniques support real-time simulations, predictive modeling, and decision support systems across various industries. The integration of vector processing with machine learning enhances pattern recognition capabilities and improves the accuracy of predictive analytics.

02 Viral vector delivery systems

Engineered viral vectors serve as efficient delivery systems for genetic material in therapeutic applications. These systems are designed with modified capsid proteins and envelope structures to enhance target cell specificity, improve transduction efficiency, and reduce immunogenicity. Advanced vector engineering techniques focus on optimizing payload capacity, stability, and tissue tropism to achieve more effective gene transfer while minimizing safety concerns associated with viral vectors.Expand Specific Solutions03 Computational modeling for vector performance prediction

Computational modeling frameworks are developed to predict vector performance before physical implementation. These models integrate multiple parameters including vector design elements, target environment characteristics, and biological constraints to simulate vector behavior and efficacy. Machine learning algorithms analyze historical vector performance data to identify patterns and correlations that inform future designs, significantly reducing development time and resources while improving success rates in vector engineering applications.Expand Specific Solutions04 Non-viral vector engineering techniques

Non-viral vector systems offer advantages in terms of safety, manufacturing scalability, and reduced immunogenicity compared to viral alternatives. Engineering approaches focus on enhancing transfection efficiency through modifications to lipid nanoparticles, polymeric carriers, and inorganic nanostructures. Advanced formulation strategies incorporate targeting ligands, cell-penetrating peptides, and stimuli-responsive elements to improve cellular uptake, endosomal escape, and payload protection, resulting in more effective non-viral vector systems for gene delivery applications.Expand Specific Solutions05 Vector engineering for targeted gene editing

Specialized vector systems are engineered to deliver gene editing components such as CRISPR-Cas9, TALENs, or zinc finger nucleases with high precision. These vectors incorporate elements that enhance targeting specificity, reduce off-target effects, and improve editing efficiency. Engineering strategies focus on optimizing vector architecture to facilitate the co-delivery of multiple components, temporal control of expression, and tissue-specific activity, enabling more precise genetic modifications for therapeutic applications and research purposes.Expand Specific Solutions

Leading Companies in Vector Engineering

Vector engineering plays a pivotal role in the evolving gene therapy landscape, which is currently transitioning from early-stage development to commercial maturity. The global gene therapy market is projected to reach significant scale, with vector technologies being critical enablers. Technical maturity varies across vector platforms, with companies like Oxford Biomedica and bluebird bio demonstrating advanced lentiviral vector capabilities, while Spark Therapeutics and Biogen lead in AAV vector development. Academic institutions including Cincinnati Children's Hospital, University of Pennsylvania, and Oregon Health & Science University contribute fundamental research advancing vector design. The competitive landscape features established pharmaceutical companies alongside specialized biotechs like Apellis Pharmaceuticals and Vascular Biogenics, creating a dynamic ecosystem where innovation in vector engineering directly correlates with therapeutic efficacy and commercial potential.

Oxford Biomedica (UK) Ltd.

Technical Solution: Oxford Biomedica has pioneered the LentiVector® platform, a proprietary lentiviral vector delivery system specifically engineered for enhanced gene therapy applications. Their platform incorporates advanced vector engineering techniques including pseudotyping with modified envelope proteins to broaden tropism, self-inactivating (SIN) designs to improve safety profiles, and codon optimization strategies to enhance transgene expression. The company has implemented a scalable manufacturing process using suspension cell culture systems that significantly increases vector yield while maintaining quality. Their vectors feature improved genome integration profiles with reduced insertional mutagenesis risk through careful promoter selection and insulator elements. Oxford Biomedica has successfully applied these engineered vectors in treatments for neurodegenerative disorders, ocular diseases, and hematological conditions, demonstrating consistent therapeutic protein expression levels over extended periods.

Strengths: Industry-leading lentiviral vector technology with proven clinical efficacy; robust manufacturing capabilities at commercial scale; extensive intellectual property portfolio. Weaknesses: Higher production costs compared to some viral vectors; limited tissue tropism despite engineering efforts; potential immunogenicity concerns with repeated administration.

bluebird bio, Inc.

Technical Solution: Bluebird bio has developed the proprietary LentiGlobin® gene therapy platform, which utilizes engineered lentiviral vectors to deliver functional genes to hematopoietic stem cells. Their vector engineering approach focuses on optimizing the beta-globin gene expression cassette with specialized regulatory elements including the beta-globin promoter, enhancers, and a 3' UTR designed for erythroid-specific expression. The company has pioneered a unique chromatin insulator technology (cHS4) to prevent transcriptional silencing and reduce positional effects of genome integration. Their manufacturing process incorporates a transient transfection system with four plasmids to produce self-inactivating lentiviral vectors with enhanced safety profiles. Bluebird's vectors demonstrate stable gene transfer into long-term repopulating cells with minimal genotoxicity, enabling durable therapeutic protein expression in conditions like beta-thalassemia and sickle cell disease.

Strengths: Proven clinical efficacy in genetic blood disorders; sophisticated vector design with lineage-specific expression; established regulatory approval pathway with marketed products. Weaknesses: Complex and expensive manufacturing process; limited to ex vivo applications requiring cell harvesting and reinfusion; potential for variable patient-to-patient efficacy based on stem cell quality.

Key Innovations in Vector Engineering

Vector for gene therapy

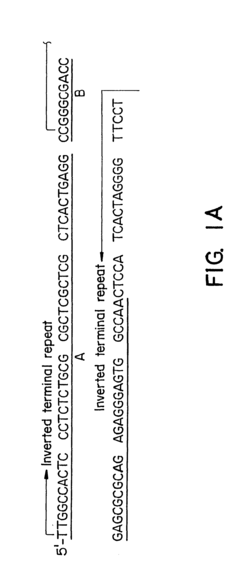

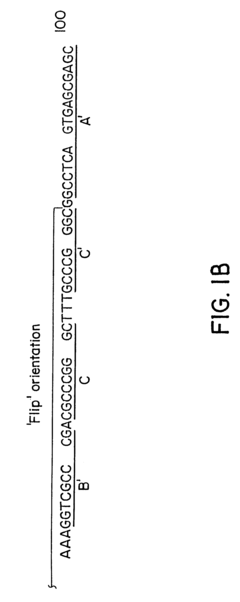

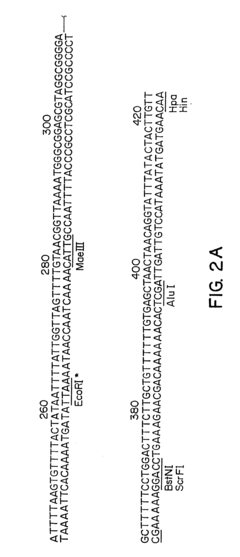

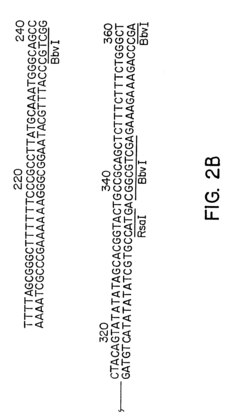

PatentInactiveUS6261834B1

Innovation

- Development of hybrid parvovirus vectors combining AAV and B19 parvovirus features, utilizing AAV inverted terminal repeats for site-specific integration and the B19 p6 promoter for tissue-specific expression, creating vectors that integrate safely and express genes specifically in hematopoietic cells.

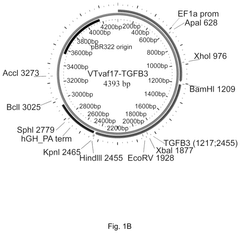

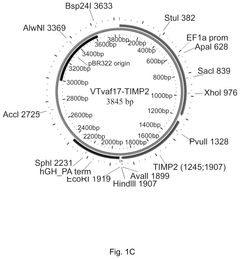

Gene therapy DNA vectors based on VTVAF17

PatentActiveUS12128112B2

Innovation

- Development of gene therapy DNA vectors like VTvaf17 that lack antibiotic resistance genes and viral regulatory elements, utilizing a compact design to efficiently penetrate eukaryotic cells and express therapeutic genes, ensuring safe and effective gene therapy by cloning the coding regions of SKI, TGFB3, TIMP2, and FMOD genes into a plasmid vector without unnecessary sequences, allowing for industrial-scale production.

Regulatory Framework for Gene Therapy Vectors

The regulatory landscape for gene therapy vectors represents a complex and evolving framework that significantly impacts vector engineering strategies and therapeutic applications. Regulatory bodies worldwide, including the FDA, EMA, and NMPA, have established specialized pathways for the evaluation and approval of gene therapy products, with particular emphasis on vector safety, manufacturing consistency, and clinical efficacy.

Vector engineering must navigate these regulatory requirements from the earliest stages of development. Current regulations focus heavily on characterizing vector purity, potency, and identity through standardized assays. Additionally, regulatory frameworks mandate comprehensive testing for replication competence in viral vectors and integration site analysis for vectors with genomic integration potential.

Manufacturing considerations form a critical component of regulatory compliance, with requirements for Good Manufacturing Practice (GMP) facilities and validated production processes. The regulatory burden increases proportionally with the novelty of the vector system, with first-in-class vectors facing more extensive characterization requirements than established platforms.

Risk assessment protocols for gene therapy vectors have evolved significantly, now incorporating sophisticated bioinformatic analyses to predict off-target effects and immunogenicity profiles. Regulatory agencies increasingly require long-term follow-up studies, particularly for integrating vectors, with monitoring periods extending up to 15 years for certain applications.

International harmonization efforts are underway to standardize regulatory approaches across major markets, though significant regional differences persist. The FDA's Regenerative Medicine Advanced Therapy (RMAT) designation and the EMA's Priority Medicines (PRIME) scheme offer accelerated pathways for promising vector-based therapies addressing unmet medical needs.

Recent regulatory trends indicate a shift toward more flexible, adaptive frameworks that accommodate rapid technological advances in vector engineering. Risk-based approaches are gaining prominence, allowing streamlined development pathways for vectors with established safety profiles while maintaining rigorous oversight for novel designs.

Regulatory considerations directly influence vector engineering decisions, from selection of viral serotypes to incorporation of safety elements such as suicide genes or tissue-specific promoters. Successful vector engineering strategies increasingly incorporate regulatory expertise from early development stages, designing vectors with both therapeutic efficacy and regulatory compliance in mind.

The evolving regulatory landscape presents both challenges and opportunities for vector engineering, with successful navigation of these frameworks representing a critical factor in translating innovative vector designs into approved gene therapy products.

Vector engineering must navigate these regulatory requirements from the earliest stages of development. Current regulations focus heavily on characterizing vector purity, potency, and identity through standardized assays. Additionally, regulatory frameworks mandate comprehensive testing for replication competence in viral vectors and integration site analysis for vectors with genomic integration potential.

Manufacturing considerations form a critical component of regulatory compliance, with requirements for Good Manufacturing Practice (GMP) facilities and validated production processes. The regulatory burden increases proportionally with the novelty of the vector system, with first-in-class vectors facing more extensive characterization requirements than established platforms.

Risk assessment protocols for gene therapy vectors have evolved significantly, now incorporating sophisticated bioinformatic analyses to predict off-target effects and immunogenicity profiles. Regulatory agencies increasingly require long-term follow-up studies, particularly for integrating vectors, with monitoring periods extending up to 15 years for certain applications.

International harmonization efforts are underway to standardize regulatory approaches across major markets, though significant regional differences persist. The FDA's Regenerative Medicine Advanced Therapy (RMAT) designation and the EMA's Priority Medicines (PRIME) scheme offer accelerated pathways for promising vector-based therapies addressing unmet medical needs.

Recent regulatory trends indicate a shift toward more flexible, adaptive frameworks that accommodate rapid technological advances in vector engineering. Risk-based approaches are gaining prominence, allowing streamlined development pathways for vectors with established safety profiles while maintaining rigorous oversight for novel designs.

Regulatory considerations directly influence vector engineering decisions, from selection of viral serotypes to incorporation of safety elements such as suicide genes or tissue-specific promoters. Successful vector engineering strategies increasingly incorporate regulatory expertise from early development stages, designing vectors with both therapeutic efficacy and regulatory compliance in mind.

The evolving regulatory landscape presents both challenges and opportunities for vector engineering, with successful navigation of these frameworks representing a critical factor in translating innovative vector designs into approved gene therapy products.

Manufacturing Scalability and Cost Considerations

Manufacturing scalability and cost considerations represent critical challenges in the advancement of vector engineering for gene therapy applications. Current vector production methods, particularly for adeno-associated virus (AAV) and lentiviral vectors, face significant limitations in meeting commercial-scale demands. Traditional production systems utilizing HEK293 or insect cell platforms achieve relatively low yields, typically in the range of 10^13 to 10^14 viral genomes per batch, which proves insufficient for treating widespread diseases or conducting large clinical trials.

The cost implications of these manufacturing constraints are substantial, with current estimates placing gene therapy production expenses at $5,000-$20,000 per dose for small-scale manufacturing. This translates to treatment costs ranging from $500,000 to over $2 million per patient, creating significant barriers to market access and reimbursement. These economic factors severely limit the commercial viability of gene therapies despite their therapeutic potential.

Recent technological innovations are beginning to address these challenges. Suspension-adapted cell culture systems have demonstrated 3-5 fold improvements in volumetric productivity compared to adherent cell methods. Additionally, the development of stable producer cell lines has shown promise in reducing batch-to-batch variability while increasing production consistency and potentially lowering costs by 30-40% compared to transient transfection methods.

Process intensification strategies, including perfusion bioreactor systems and continuous manufacturing approaches, represent another frontier in improving vector production economics. These methods have demonstrated up to 10-fold increases in cell density and productivity in pilot studies, though challenges in scale-up and regulatory approval remain significant hurdles to widespread implementation.

Downstream processing innovations, particularly advances in chromatography and filtration technologies, have improved vector recovery rates from approximately 30% to over 60% in optimized processes. These improvements directly impact manufacturing economics by increasing final product yield from the same initial production volume, effectively reducing per-dose costs.

The emergence of synthetic biology approaches to vector design also offers promising avenues for manufacturing optimization. Engineered vector sequences with reduced genetic complexity and improved stability characteristics have demonstrated enhanced production yields of 2-3 fold in preliminary studies, while simultaneously improving product quality attributes.

Regulatory considerations further complicate the manufacturing landscape, with stringent requirements for product characterization, purity, and potency adding significant costs to development programs. Industry estimates suggest that regulatory compliance accounts for 25-35% of total manufacturing costs, highlighting the need for standardized analytical methods and regulatory frameworks specifically adapted to gene therapy products.

The cost implications of these manufacturing constraints are substantial, with current estimates placing gene therapy production expenses at $5,000-$20,000 per dose for small-scale manufacturing. This translates to treatment costs ranging from $500,000 to over $2 million per patient, creating significant barriers to market access and reimbursement. These economic factors severely limit the commercial viability of gene therapies despite their therapeutic potential.

Recent technological innovations are beginning to address these challenges. Suspension-adapted cell culture systems have demonstrated 3-5 fold improvements in volumetric productivity compared to adherent cell methods. Additionally, the development of stable producer cell lines has shown promise in reducing batch-to-batch variability while increasing production consistency and potentially lowering costs by 30-40% compared to transient transfection methods.

Process intensification strategies, including perfusion bioreactor systems and continuous manufacturing approaches, represent another frontier in improving vector production economics. These methods have demonstrated up to 10-fold increases in cell density and productivity in pilot studies, though challenges in scale-up and regulatory approval remain significant hurdles to widespread implementation.

Downstream processing innovations, particularly advances in chromatography and filtration technologies, have improved vector recovery rates from approximately 30% to over 60% in optimized processes. These improvements directly impact manufacturing economics by increasing final product yield from the same initial production volume, effectively reducing per-dose costs.

The emergence of synthetic biology approaches to vector design also offers promising avenues for manufacturing optimization. Engineered vector sequences with reduced genetic complexity and improved stability characteristics have demonstrated enhanced production yields of 2-3 fold in preliminary studies, while simultaneously improving product quality attributes.

Regulatory considerations further complicate the manufacturing landscape, with stringent requirements for product characterization, purity, and potency adding significant costs to development programs. Industry estimates suggest that regulatory compliance accounts for 25-35% of total manufacturing costs, highlighting the need for standardized analytical methods and regulatory frameworks specifically adapted to gene therapy products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!