Tungsten And Its Role In High-Performance Tools

Tungsten Technology Evolution

Tungsten technology has undergone significant evolution since its discovery in the late 18th century. Initially recognized for its high melting point and hardness, tungsten's potential in high-performance tools was not fully realized until the early 20th century. The development of powder metallurgy techniques in the 1920s marked a crucial turning point, enabling the production of tungsten carbide, a material that revolutionized the tooling industry.

The 1930s and 1940s saw rapid advancements in tungsten carbide technology, with the introduction of cobalt as a binder material, significantly improving the toughness and durability of tungsten-based tools. This period also witnessed the emergence of cemented carbides, which combined tungsten carbide particles with metallic binders, further enhancing the material's properties for cutting and wear-resistant applications.

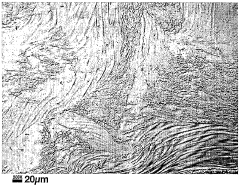

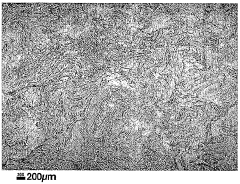

The post-World War II era brought about a surge in research and development, leading to the refinement of tungsten alloys and composites. The 1950s and 1960s saw the introduction of submicron grain sizes in tungsten carbide, dramatically increasing the hardness and wear resistance of cutting tools. This period also marked the beginning of tungsten's application in high-temperature aerospace components.

The 1970s and 1980s witnessed the advent of coating technologies, particularly chemical vapor deposition (CVD) and physical vapor deposition (PVD) techniques. These innovations allowed for the application of thin, wear-resistant coatings on tungsten carbide tools, significantly extending their lifespan and performance in extreme cutting conditions.

The late 20th and early 21st centuries have been characterized by continuous improvements in tungsten-based materials. Nanostructured tungsten composites, developed in the 1990s, offered unprecedented combinations of strength and toughness. The 2000s saw the integration of advanced computational modeling and simulation techniques in tungsten alloy design, enabling the creation of materials with tailored properties for specific applications.

Recent developments in tungsten technology have focused on sustainability and resource efficiency. Researchers are exploring methods to reduce tungsten consumption through improved recycling processes and the development of alternative materials. Additionally, there is growing interest in tungsten's potential in emerging fields such as additive manufacturing and energy storage, opening new avenues for innovation in high-performance tools and beyond.

Market Demand Analysis

The market demand for tungsten in high-performance tools continues to grow steadily, driven by several key factors. The aerospace, automotive, and manufacturing industries are primary consumers of tungsten-based tools due to their superior hardness, wear resistance, and high-temperature performance. In aerospace, the increasing production of commercial and military aircraft requires advanced cutting tools capable of machining tough alloys used in engine components and structural parts. The automotive sector's shift towards lightweight materials and electric vehicles has also boosted demand for tungsten carbide tools, essential for precision machining of complex parts.

In the manufacturing industry, the trend towards automation and high-precision production has further intensified the need for tungsten-based tools. These tools offer longer life spans and maintain their cutting edge under extreme conditions, reducing downtime and improving overall productivity. The electronics industry, particularly in the production of semiconductors and printed circuit boards, relies heavily on tungsten carbide micro-drills and end mills for their exceptional performance in creating intricate designs.

The construction and mining sectors represent another significant market for tungsten-based tools. As infrastructure projects grow in scale and complexity, there is an increasing demand for durable drilling and cutting equipment capable of handling hard rock and concrete. In mining operations, tungsten carbide tools are indispensable for their ability to withstand harsh environments and maintain efficiency in extracting minerals.

The global tungsten market size was valued at approximately $3.5 billion in 2020, with projections indicating growth to reach $5.7 billion by 2027. This growth is largely attributed to the expanding applications of tungsten in high-performance tools across various industries. The Asia-Pacific region, particularly China, dominates the tungsten market, accounting for over 80% of global production. However, concerns over supply chain stability and geopolitical factors have led to increased efforts in developing alternative sources and recycling technologies in other regions.

Despite the positive market outlook, challenges persist. The volatility in tungsten prices, influenced by factors such as trade policies and production quotas, can impact the cost-effectiveness of tungsten-based tools. Additionally, environmental concerns associated with tungsten mining and processing have prompted research into more sustainable extraction methods and the development of alternative materials. These factors are shaping the market dynamics and driving innovation in the tungsten industry, as manufacturers seek to balance performance requirements with sustainability goals.

Current Challenges

Despite tungsten's remarkable properties and its crucial role in high-performance tools, the industry faces several significant challenges in its application and development. One of the primary obstacles is the material's high melting point, which, while advantageous for many applications, poses difficulties in processing and shaping. Traditional manufacturing methods often struggle to efficiently work with tungsten, leading to increased production costs and limitations in design complexity.

The brittleness of tungsten at room temperature is another major concern. This characteristic restricts its use in certain applications where impact resistance or ductility is required. Researchers and engineers are continuously seeking ways to improve tungsten's toughness without compromising its other desirable properties, such as hardness and wear resistance.

Environmental and health concerns associated with tungsten processing and disposal present additional challenges. The extraction and refining of tungsten can have significant environmental impacts, and there are ongoing efforts to develop more sustainable and eco-friendly production methods. Moreover, the potential health effects of tungsten exposure, particularly in nanoparticle form, are still being studied, necessitating careful handling and safety protocols in industrial settings.

The global supply chain for tungsten is another area of concern. With a significant portion of the world's tungsten reserves concentrated in a few countries, particularly China, there are risks associated with supply disruptions and price volatility. This has led to increased interest in developing alternative sources and recycling technologies to ensure a stable supply for high-performance tool manufacturing.

Technological limitations in alloying tungsten with other materials also present challenges. While tungsten alloys offer improved properties for specific applications, achieving the optimal balance of characteristics often requires complex metallurgical processes. Researchers are working on developing new alloying techniques and compositions to enhance tungsten's performance in various tool applications.

The high cost of tungsten compared to some alternative materials is a persistent issue for manufacturers. This cost factor often limits the widespread adoption of tungsten-based tools in certain industries, particularly where price sensitivity is high. Developing more cost-effective production methods and exploring ways to reduce material waste during manufacturing are ongoing priorities for the industry.

Tungsten-Based Solutions

01 Tungsten deposition methods

Various methods for depositing tungsten on substrates, including chemical vapor deposition (CVD) and atomic layer deposition (ALD). These techniques are used to create thin films of tungsten for applications in semiconductor manufacturing and other industries.- Tungsten deposition methods: Various methods for depositing tungsten on substrates, including chemical vapor deposition (CVD) and atomic layer deposition (ALD). These techniques are used to create thin films of tungsten for applications in semiconductor manufacturing and other industries.

- Tungsten-based alloys and composites: Development of tungsten-based alloys and composite materials with enhanced properties, such as improved strength, hardness, and thermal stability. These materials find applications in aerospace, defense, and high-temperature industrial processes.

- Tungsten in electronic devices: Utilization of tungsten in electronic devices, particularly in the fabrication of integrated circuits and microelectronics. This includes the use of tungsten as interconnects, gate electrodes, and diffusion barriers in semiconductor devices.

- Tungsten processing and recycling: Methods for processing tungsten ores, refining tungsten, and recycling tungsten-containing materials. These processes aim to improve the efficiency of tungsten production and reduce environmental impact through sustainable practices.

- Tungsten surface treatment and modification: Techniques for modifying the surface properties of tungsten and tungsten-based materials, including etching, polishing, and coating processes. These treatments enhance the performance and durability of tungsten components in various applications.

02 Tungsten-based alloys and composites

Development of tungsten-based alloys and composite materials with enhanced properties, such as improved strength, hardness, and thermal stability. These materials find applications in aerospace, defense, and high-temperature industrial processes.Expand Specific Solutions03 Tungsten in semiconductor devices

Utilization of tungsten in semiconductor devices, including its use as interconnects, gate electrodes, and diffusion barriers. The integration of tungsten in advanced semiconductor manufacturing processes to improve device performance and reliability.Expand Specific Solutions04 Tungsten processing and recycling

Methods for processing tungsten ores, refining tungsten, and recycling tungsten-containing materials. These processes aim to improve the efficiency of tungsten production and reduce environmental impact through sustainable practices.Expand Specific Solutions05 Tungsten in lighting and electronics

Applications of tungsten in lighting technologies, such as incandescent and halogen lamps, as well as in electronic components. This includes the use of tungsten filaments, electrodes, and other specialized parts in various electronic devices.Expand Specific Solutions

Key Industry Players

The tungsten industry for high-performance tools is in a mature stage, with a global market size expected to reach $5.5 billion by 2027. The technology is well-established, with ongoing innovations focusing on enhancing material properties and manufacturing processes. Key players like Kennametal, Inc., Sandvik Intellectual Property AB, and Applied Materials, Inc. are at the forefront of technological advancements. These companies, along with research institutions such as Central South University and University of Science & Technology Beijing, are driving progress in tungsten-based tool development. The competitive landscape is characterized by a mix of established manufacturers and emerging specialized firms, with a growing emphasis on sustainability and advanced applications in aerospace, automotive, and electronics industries.

Kennametal, Inc.

Applied Materials, Inc.

Innovative Tungsten Tech

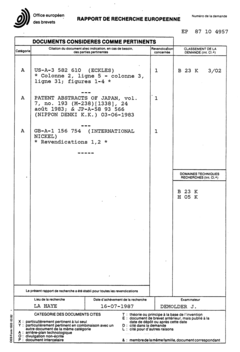

- A tungsten alloy composition comprising 3% to 27% rhenium, 0.03% to 3% hafnium, and 0.002% to 0.2% carbon, which provides excellent high-temperature wear resistance and toughness through the addition of rhenium and hafnium carbide, suitable for use in tools like friction stir weld tools and drill bits.

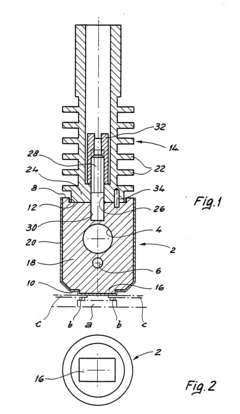

- A welding tool with a tungsten body covered by a layer of titanium nitride (TiN) is used, providing enhanced hardness and protection against oxidation, combined with a handle made from materials with similar expansion coefficients to ensure precise and reliable soldering.

Supply Chain Analysis

The supply chain for tungsten in high-performance tools is complex and globally distributed. Tungsten ore is primarily mined in China, which accounts for over 80% of global production. Other significant producers include Vietnam, Russia, and Bolivia. The ore undergoes several processing stages before reaching tool manufacturers.

Initial processing involves concentration and reduction of tungsten ore into ammonium paratungstate (APT) or tungsten oxide. This step often occurs near mining sites to reduce transportation costs. China dominates this stage due to its abundant ore resources and processing capacity.

Intermediate processing converts APT or tungsten oxide into tungsten powder or tungsten carbide powder. This stage requires specialized equipment and expertise. While China remains a major player, countries like Japan, Germany, and the United States have significant capabilities in this area, leveraging their advanced manufacturing technologies.

Tool manufacturers then use these powders to produce high-performance cutting tools, drill bits, and wear-resistant components. This final stage is more geographically diverse, with major tool producers located in Europe, North America, and East Asia.

The tungsten supply chain faces several challenges. Resource concentration in China poses geopolitical risks and potential supply disruptions. Environmental concerns associated with tungsten mining and processing have led to stricter regulations, impacting production costs and availability.

Recycling plays an increasingly important role in the tungsten supply chain. Advanced recycling technologies allow for the recovery of tungsten from used tools and scrap, reducing dependence on primary mining. Countries with strong manufacturing bases, such as Germany and Japan, are leaders in tungsten recycling.

The COVID-19 pandemic highlighted vulnerabilities in the global tungsten supply chain. Disruptions in mining and processing operations, coupled with transportation bottlenecks, led to temporary shortages and price volatility. This has prompted efforts to diversify supply sources and increase stockpiling of critical materials.

Looking ahead, the tungsten supply chain is likely to see continued efforts towards diversification and sustainability. Emerging technologies in extraction and processing, coupled with increased recycling rates, may help alleviate supply pressures and environmental concerns associated with tungsten production for high-performance tools.

Environmental Impact

The environmental impact of tungsten mining and its use in high-performance tools is a critical consideration in the industry. Tungsten extraction processes can lead to significant environmental degradation, including soil erosion, water pollution, and habitat destruction. Open-pit mining, the most common method for tungsten extraction, often results in large-scale landscape alterations and the generation of substantial waste rock.

Water contamination is a major concern in tungsten mining operations. The process can release heavy metals and other pollutants into nearby water sources, affecting both aquatic ecosystems and human communities that rely on these water supplies. Acid mine drainage, a common byproduct of tungsten mining, can persist for decades after mine closure, continuing to impact water quality long after operations have ceased.

Air quality is another environmental factor affected by tungsten mining and processing. Dust emissions from mining activities and processing plants can lead to respiratory issues in nearby communities and negatively impact local flora and fauna. Additionally, the energy-intensive nature of tungsten processing contributes to greenhouse gas emissions, further exacerbating climate change concerns.

The production of tungsten carbide, a key component in many high-performance tools, also presents environmental challenges. The sintering process used to create tungsten carbide tools requires high temperatures, consuming significant amounts of energy and contributing to carbon emissions. Furthermore, the use of cobalt as a binder in tungsten carbide production raises additional environmental and health concerns due to its toxicity and the often problematic sourcing practices associated with cobalt mining.

Recycling and proper disposal of tungsten-containing tools and products are crucial for mitigating environmental impacts. While tungsten is highly recyclable, the complex nature of many high-performance tools can make separation and recovery challenging. Improper disposal of tungsten-containing products can lead to soil and water contamination, as tungsten compounds can leach into the environment over time.

Efforts to reduce the environmental footprint of tungsten in high-performance tools include developing more efficient mining and processing techniques, exploring alternative binders to replace cobalt, and improving recycling technologies. Additionally, research into substitute materials that can match tungsten's performance while offering better environmental profiles is ongoing, though finding suitable alternatives for all applications remains challenging due to tungsten's unique properties.