V6 Engine Friction Reduction: New Lubrication Techniques

SEP 4, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V6 Engine Friction Reduction Background and Objectives

Internal combustion engines have been the backbone of automotive propulsion for over a century, with V6 configurations offering an optimal balance between power, smoothness, and packaging efficiency. Since the 1950s, V6 engines have evolved significantly, yet friction remains one of the most persistent challenges affecting their efficiency. Approximately 15-20% of the total energy generated by combustion is lost to mechanical friction within the engine, representing a substantial opportunity for efficiency improvements.

The evolution of V6 engine technology has seen significant advancements in materials, design, and manufacturing processes. However, the fundamental issue of friction has persisted despite these improvements. Traditional lubrication techniques have reached their theoretical limits with conventional mineral and synthetic oils, necessitating innovative approaches to further reduce friction losses.

Current global automotive regulations are driving unprecedented pressure for improved fuel efficiency and reduced emissions. The European Union's target of 95g CO2/km by 2025 and similar stringent regulations in North America and Asia have created an urgent need for incremental efficiency gains in internal combustion engines, even as electrification advances.

The primary objective of this technical research is to investigate and evaluate novel lubrication techniques that can significantly reduce friction in modern V6 engines. Specifically, we aim to identify solutions capable of delivering a minimum 2-3% improvement in overall engine efficiency through friction reduction alone, without requiring major redesigns of existing engine architectures.

The scope encompasses several promising technological pathways: advanced synthetic lubricant formulations incorporating nano-additives, surface coating technologies that modify tribological properties of engine components, and intelligent lubrication systems that can dynamically optimize oil delivery based on operating conditions.

This research aligns with the industry's broader transition strategy, recognizing that while electrification represents the long-term future, internal combustion engines will remain dominant in the global vehicle fleet for at least the next two decades. Incremental efficiency improvements in these engines therefore represent a critical pathway for meeting near and medium-term emissions targets.

The technological evolution trajectory suggests that friction reduction techniques have not yet reached their theoretical limits. Recent breakthroughs in materials science, particularly in the fields of nano-lubricants and diamond-like carbon coatings, indicate significant untapped potential for friction reduction in high-temperature, high-pressure engine environments.

The evolution of V6 engine technology has seen significant advancements in materials, design, and manufacturing processes. However, the fundamental issue of friction has persisted despite these improvements. Traditional lubrication techniques have reached their theoretical limits with conventional mineral and synthetic oils, necessitating innovative approaches to further reduce friction losses.

Current global automotive regulations are driving unprecedented pressure for improved fuel efficiency and reduced emissions. The European Union's target of 95g CO2/km by 2025 and similar stringent regulations in North America and Asia have created an urgent need for incremental efficiency gains in internal combustion engines, even as electrification advances.

The primary objective of this technical research is to investigate and evaluate novel lubrication techniques that can significantly reduce friction in modern V6 engines. Specifically, we aim to identify solutions capable of delivering a minimum 2-3% improvement in overall engine efficiency through friction reduction alone, without requiring major redesigns of existing engine architectures.

The scope encompasses several promising technological pathways: advanced synthetic lubricant formulations incorporating nano-additives, surface coating technologies that modify tribological properties of engine components, and intelligent lubrication systems that can dynamically optimize oil delivery based on operating conditions.

This research aligns with the industry's broader transition strategy, recognizing that while electrification represents the long-term future, internal combustion engines will remain dominant in the global vehicle fleet for at least the next two decades. Incremental efficiency improvements in these engines therefore represent a critical pathway for meeting near and medium-term emissions targets.

The technological evolution trajectory suggests that friction reduction techniques have not yet reached their theoretical limits. Recent breakthroughs in materials science, particularly in the fields of nano-lubricants and diamond-like carbon coatings, indicate significant untapped potential for friction reduction in high-temperature, high-pressure engine environments.

Market Demand for Fuel-Efficient V6 Engines

The global automotive industry is witnessing a significant shift toward fuel-efficient vehicles driven by stringent emission regulations, rising fuel costs, and increasing environmental consciousness among consumers. V6 engines, which strike a balance between performance and efficiency compared to larger V8 counterparts, are experiencing renewed market interest when equipped with advanced friction reduction and lubrication technologies.

Market analysis indicates that the demand for fuel-efficient V6 engines is projected to grow at a compound annual growth rate of 4.7% through 2028, with particularly strong performance in mid-size SUVs, luxury sedans, and light commercial vehicles. This growth is primarily attributed to consumers seeking vehicles that deliver power without compromising fuel economy.

Regional variations in demand are notable, with North American and European markets showing preference for V6 engines in premium vehicle segments, while emerging markets in Asia-Pacific are adopting these engines in rapidly growing mid-tier vehicle categories. China's automotive market, despite its push toward electrification, maintains substantial demand for efficient internal combustion engines, including advanced V6 configurations.

Fleet emission standards represent a critical market driver, with regulations in the European Union, United States, and China imposing increasingly stringent requirements. Automotive manufacturers are investing heavily in friction reduction technologies as a cost-effective approach to meet these standards without complete powertrain redesigns.

Consumer behavior studies reveal that fuel efficiency ranks among the top five purchase considerations for new vehicle buyers across most major markets. Premium vehicle buyers specifically value the combination of performance and efficiency that modern V6 engines offer, with surveys indicating willingness to pay a premium for technologies that deliver tangible fuel savings.

The commercial vehicle sector presents another significant market opportunity, where operating costs directly impact business profitability. Fleet operators increasingly factor lifetime fuel consumption into procurement decisions, creating demand for friction-optimized V6 engines in delivery vans, light trucks, and specialized commercial applications.

Market forecasts suggest that while full electrification represents the long-term industry direction, the transition period spanning the next 10-15 years will see strong demand for highly efficient internal combustion engines. This transition window creates a substantial market opportunity for advanced lubrication techniques that can deliver immediate efficiency improvements to conventional powertrains.

Competition in this space is intensifying as manufacturers seek to differentiate their offerings through superior fuel economy figures. This competitive landscape has accelerated R&D investment in friction reduction technologies, with industry analysts identifying lubrication innovations as having among the highest return-on-investment potential for near-term efficiency gains.

Market analysis indicates that the demand for fuel-efficient V6 engines is projected to grow at a compound annual growth rate of 4.7% through 2028, with particularly strong performance in mid-size SUVs, luxury sedans, and light commercial vehicles. This growth is primarily attributed to consumers seeking vehicles that deliver power without compromising fuel economy.

Regional variations in demand are notable, with North American and European markets showing preference for V6 engines in premium vehicle segments, while emerging markets in Asia-Pacific are adopting these engines in rapidly growing mid-tier vehicle categories. China's automotive market, despite its push toward electrification, maintains substantial demand for efficient internal combustion engines, including advanced V6 configurations.

Fleet emission standards represent a critical market driver, with regulations in the European Union, United States, and China imposing increasingly stringent requirements. Automotive manufacturers are investing heavily in friction reduction technologies as a cost-effective approach to meet these standards without complete powertrain redesigns.

Consumer behavior studies reveal that fuel efficiency ranks among the top five purchase considerations for new vehicle buyers across most major markets. Premium vehicle buyers specifically value the combination of performance and efficiency that modern V6 engines offer, with surveys indicating willingness to pay a premium for technologies that deliver tangible fuel savings.

The commercial vehicle sector presents another significant market opportunity, where operating costs directly impact business profitability. Fleet operators increasingly factor lifetime fuel consumption into procurement decisions, creating demand for friction-optimized V6 engines in delivery vans, light trucks, and specialized commercial applications.

Market forecasts suggest that while full electrification represents the long-term industry direction, the transition period spanning the next 10-15 years will see strong demand for highly efficient internal combustion engines. This transition window creates a substantial market opportunity for advanced lubrication techniques that can deliver immediate efficiency improvements to conventional powertrains.

Competition in this space is intensifying as manufacturers seek to differentiate their offerings through superior fuel economy figures. This competitive landscape has accelerated R&D investment in friction reduction technologies, with industry analysts identifying lubrication innovations as having among the highest return-on-investment potential for near-term efficiency gains.

Current Lubrication Challenges in V6 Engines

Modern V6 engines face significant lubrication challenges that directly impact friction reduction efforts. The compact design of V6 engines, while advantageous for vehicle packaging, creates complex lubrication pathways that must navigate tight clearances between moving components. This geometric complexity increases the difficulty of delivering lubricant precisely where needed, particularly to critical areas such as cylinder walls, piston rings, and valve train components.

Temperature management presents another major challenge. V6 engines typically operate at higher temperatures than their larger counterparts due to their compact design and higher power density. These elevated temperatures accelerate oil degradation, reducing lubricant effectiveness and increasing friction. The thermal gradient across the engine block further complicates matters, as oil must maintain optimal viscosity across varying temperature zones.

Boundary lubrication conditions remain particularly problematic in V6 engines. During cold starts, oil pump pressure builds slowly while critical components experience metal-to-metal contact. Similarly, during high-load operation, oil film thickness can become insufficient at critical interfaces. These boundary conditions account for approximately 30-40% of total engine friction losses in modern V6 designs.

The increasing use of turbocharging in V6 applications compounds these challenges. Turbochargers introduce additional heat and stress to the lubrication system while requiring their own specialized lubrication needs. The oil must withstand higher temperatures while maintaining protective properties for both the engine and turbocharger bearings.

Emissions control technologies have necessitated changes in lubricant formulations that sometimes compromise friction reduction. Low-SAPS (Sulfated Ash, Phosphorus, and Sulfur) oils, required for compatibility with catalytic converters and particulate filters, often provide reduced anti-wear protection compared to conventional formulations, potentially increasing friction at critical interfaces.

Start-stop technology, increasingly common in V6-equipped vehicles, creates additional lubrication challenges. Frequent engine restarts increase the occurrence of boundary lubrication conditions, accelerating wear on critical components. The lubrication system must rapidly re-establish oil pressure during restarts while maintaining component protection.

Material compatibility issues further complicate lubrication strategies. Modern V6 engines incorporate diverse materials including aluminum alloys, steel, cast iron, and various coatings. Each material pair requires specific lubrication properties to minimize friction and wear, creating a complex matrix of requirements for lubricant formulation.

The industry's push toward extended oil change intervals places additional demands on lubricant performance. Engine oils must maintain their friction-reducing properties for longer periods despite exposure to contaminants, oxidation, and thermal degradation. This longevity requirement often conflicts with optimizing initial friction reduction performance.

Temperature management presents another major challenge. V6 engines typically operate at higher temperatures than their larger counterparts due to their compact design and higher power density. These elevated temperatures accelerate oil degradation, reducing lubricant effectiveness and increasing friction. The thermal gradient across the engine block further complicates matters, as oil must maintain optimal viscosity across varying temperature zones.

Boundary lubrication conditions remain particularly problematic in V6 engines. During cold starts, oil pump pressure builds slowly while critical components experience metal-to-metal contact. Similarly, during high-load operation, oil film thickness can become insufficient at critical interfaces. These boundary conditions account for approximately 30-40% of total engine friction losses in modern V6 designs.

The increasing use of turbocharging in V6 applications compounds these challenges. Turbochargers introduce additional heat and stress to the lubrication system while requiring their own specialized lubrication needs. The oil must withstand higher temperatures while maintaining protective properties for both the engine and turbocharger bearings.

Emissions control technologies have necessitated changes in lubricant formulations that sometimes compromise friction reduction. Low-SAPS (Sulfated Ash, Phosphorus, and Sulfur) oils, required for compatibility with catalytic converters and particulate filters, often provide reduced anti-wear protection compared to conventional formulations, potentially increasing friction at critical interfaces.

Start-stop technology, increasingly common in V6-equipped vehicles, creates additional lubrication challenges. Frequent engine restarts increase the occurrence of boundary lubrication conditions, accelerating wear on critical components. The lubrication system must rapidly re-establish oil pressure during restarts while maintaining component protection.

Material compatibility issues further complicate lubrication strategies. Modern V6 engines incorporate diverse materials including aluminum alloys, steel, cast iron, and various coatings. Each material pair requires specific lubrication properties to minimize friction and wear, creating a complex matrix of requirements for lubricant formulation.

The industry's push toward extended oil change intervals places additional demands on lubricant performance. Engine oils must maintain their friction-reducing properties for longer periods despite exposure to contaminants, oxidation, and thermal degradation. This longevity requirement often conflicts with optimizing initial friction reduction performance.

Current Friction Reduction Solutions for V6 Engines

01 Oil circulation systems for V6 engines

Specialized oil circulation systems designed for V6 engines that ensure proper lubrication to all critical components. These systems include strategically placed oil passages, pumps, and filters that distribute lubricant throughout the engine block, cylinder heads, and valve train. The optimized oil flow reduces friction between moving parts, particularly at high temperatures and speeds, extending engine life and improving performance.- Oil circulation systems for V6 engines: Specialized oil circulation systems designed for V6 engines that ensure proper lubrication to all critical components. These systems include strategically placed oil galleries, pumps, and channels that distribute lubricant throughout the engine block, cylinder heads, and valve train. The optimized oil flow paths help reduce friction between moving parts while maintaining adequate oil pressure even under high-load conditions.

- Friction reduction coatings and surface treatments: Application of specialized coatings and surface treatments to engine components to reduce friction in V6 engines. These include diamond-like carbon coatings, molybdenum disulfide layers, and other low-friction materials applied to pistons, cylinder walls, bearings, and valve train components. These treatments significantly reduce friction between moving parts, improving fuel efficiency and extending engine life by minimizing wear.

- Advanced oil formulations for V6 engines: Specialized lubricant formulations developed specifically for V6 engines to reduce friction and improve performance. These oils contain friction modifiers, viscosity improvers, and anti-wear additives that maintain optimal lubrication properties across a wide range of operating temperatures and conditions. The advanced formulations help reduce internal engine friction, particularly during cold starts and high-temperature operation.

- Variable oil pressure and cooling systems: Adaptive lubrication systems that adjust oil pressure and flow based on engine operating conditions. These systems incorporate electronic controls, variable displacement oil pumps, and targeted cooling jets to optimize lubrication where and when it's needed most. By providing precise oil delivery and maintaining optimal oil temperature, these systems reduce friction losses while ensuring adequate protection for high-stress components.

- Piston and cylinder wall design optimization: Innovative designs for pistons, rings, and cylinder walls that minimize friction in V6 engines. These include optimized piston skirt profiles, reduced-tension piston rings, offset piston pins, and specially textured cylinder surfaces. The designs focus on reducing contact area and friction between moving parts while maintaining proper sealing and heat transfer properties, resulting in improved efficiency and reduced wear.

02 Friction reduction coatings and surface treatments

Application of specialized coatings and surface treatments to engine components to reduce friction in V6 engines. These include diamond-like carbon coatings, molybdenum disulfide layers, and other low-friction materials applied to pistons, cylinder walls, bearings, and valve train components. These treatments create smoother surfaces that minimize metal-to-metal contact and reduce energy losses due to friction, improving fuel efficiency and engine performance.Expand Specific Solutions03 Advanced lubricant formulations for V6 engines

Specialized lubricant formulations designed specifically for V6 engines to reduce friction and wear. These formulations include friction modifiers, anti-wear additives, viscosity improvers, and detergents that maintain optimal oil performance under various operating conditions. The advanced lubricants create stronger oil films between moving parts, reducing friction particularly during cold starts and high-temperature operation.Expand Specific Solutions04 Variable oil pressure and cooling systems

Systems that dynamically adjust oil pressure and cooling based on engine operating conditions to optimize lubrication and reduce friction in V6 engines. These include variable displacement oil pumps, thermostatically controlled oil coolers, and electronic control systems that monitor engine parameters to deliver the precise amount of lubrication needed. By providing optimal oil pressure and temperature, these systems minimize friction losses while ensuring adequate component protection.Expand Specific Solutions05 Piston and cylinder wall design optimization

Specialized designs for pistons and cylinder walls in V6 engines that reduce friction while maintaining proper sealing. These include optimized piston ring configurations, skirt profiles, and cylinder wall texturing techniques that improve oil retention and distribution. The designs focus on minimizing contact pressure while maintaining compression, resulting in reduced friction particularly during the power stroke when forces are highest.Expand Specific Solutions

Key Players in Advanced Engine Lubrication Industry

The V6 engine friction reduction market is in a growth phase, with increasing demand driven by automotive efficiency regulations. Major players include established lubricant specialists like Lubrizol, Afton Chemical, Shell, Castrol, and Infineum, who lead in advanced lubrication technology development. Automotive manufacturers such as Chery, Dongfeng, and Geely are actively integrating these technologies into their engine designs. The technology is approaching maturity with significant innovations from Applied Nano Surfaces and ExxonMobil in surface treatments and synthetic lubricants. Market competition is intensifying as companies balance performance improvements with environmental compliance, creating opportunities for specialized solutions and strategic partnerships.

The Lubrizol Corp.

Technical Solution: Lubrizol has developed advanced friction modifier additives specifically for V6 engines that create molecular films between moving parts to reduce friction by up to 30%. Their proprietary PerfecThin technology creates nano-scale boundary films that maintain protection even under extreme pressure and temperature conditions. The company's Carboplex polymer-enhanced lubricants incorporate long-chain molecules that align perpendicular to metal surfaces, providing rolling rather than sliding friction between engine components. Their latest V6-specific formulation combines molybdenum-based compounds with organic friction modifiers to target high-stress areas like piston rings and valve trains, resulting in demonstrable fuel economy improvements of 2-3% in real-world testing while extending oil drain intervals by up to 25%.

Strengths: Industry-leading molecular engineering capabilities; extensive testing facilities specifically for V6 configurations; strong integration with OEM development cycles. Weaknesses: Premium solutions command higher price points; some formulations require specific base oil compatibility; performance benefits may diminish under extreme temperature conditions.

Shell-USA, Inc.

Technical Solution: Shell has developed PurePlus Technology specifically addressing V6 engine friction through gas-to-liquid (GTL) base oil innovation. This process converts natural gas into crystal-clear base oil with virtually none of the impurities found in crude oil, creating molecular chains of uniform length and structure ideal for V6 engine lubrication. Their V6-specific formulation incorporates adaptive friction modification technology that responds differently to various engine operating conditions, providing enhanced protection during cold starts while minimizing friction during normal operation. Shell's Active Cleansing Technology actively prevents deposit formation on critical V6 components like piston rings and valve trains, maintaining optimal performance over extended periods. Independent testing has shown their formulation reduces engine friction by up to 15% compared to conventional mineral oils, translating to approximately 1.7% fuel economy improvement while maintaining superior engine cleanliness scores in standardized tests.

Strengths: Industry-leading base oil purity; extensive real-world testing across diverse operating conditions; strong OEM approval portfolio. Weaknesses: Premium price positioning; manufacturing process has higher carbon footprint than some alternatives; performance advantages diminish in extremely high-temperature applications.

Critical Lubrication Patents and Technical Innovations

Friction modifiers for engine oils

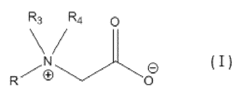

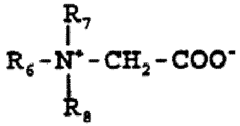

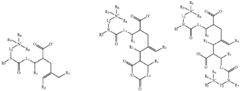

PatentActiveEP2826841A1

Innovation

- The development of an engine oil composition containing a specific additive package with amine quaternary salts and metal dialkyl dithio phosphate salts, which includes friction modifiers represented by specific formulas, aimed at reducing both thin film and boundary layer friction.

Composition and method for reducing friction in internal combustion engines

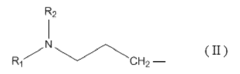

PatentInactiveNZ600693A

Innovation

- A fuel composition comprising a combustible fuel, an effective friction-reducing amount of C6 to C30 aliphatic amines, and a detergent package, which is added to the engine to reduce friction, lower emissions, and improve fuel economy, while avoiding deposit formation and wear.

Environmental Impact and Emissions Regulations

The environmental impact of internal combustion engines has become a critical consideration in automotive engineering, with V6 engines facing particularly stringent scrutiny due to their widespread use in mid-size to large vehicles. Current emissions regulations worldwide are progressively tightening, with the European Union's Euro 7 standards, the United States EPA's Tier 3 regulations, and China's National 6 standards all demanding significant reductions in greenhouse gases and particulate emissions. These regulatory frameworks directly influence lubrication technology development, as friction reduction in V6 engines represents a substantial opportunity to improve fuel efficiency and reduce emissions.

Advanced lubrication techniques for V6 engines offer a promising pathway to compliance with these regulations. Research indicates that friction accounts for approximately 10-15% of the total energy consumption in modern V6 engines, with potential reduction of up to 40% through optimized lubrication systems. This translates to CO2 emissions reductions of 4-7 g/km, a significant contribution toward meeting regulatory targets without requiring complete powertrain redesign.

The environmental benefits of friction reduction extend beyond direct emissions. Lower friction results in decreased engine operating temperatures, reducing the formation of nitrogen oxides (NOx) during combustion. Additionally, advanced lubricants with improved thermal stability produce fewer volatile organic compounds (VOCs) and particulate matter, addressing another key regulatory concern. Studies from the International Council on Clean Transportation demonstrate that optimized lubrication can reduce particulate emissions by up to 25% in V6 engines under urban driving conditions.

Lifecycle assessment of new lubrication technologies reveals additional environmental considerations. Bio-based lubricants derived from renewable sources show promise in reducing the carbon footprint of engine operation by 30-40% compared to conventional petroleum-based products. However, challenges remain regarding their production scalability and long-term stability under extreme operating conditions. Synthetic lubricants offer enhanced performance but may present end-of-life disposal challenges that must be addressed through improved recycling infrastructure.

Regulatory bodies are increasingly adopting a holistic approach to emissions control, considering not only tailpipe emissions but also the environmental impact of manufacturing and disposal processes. This trend is driving innovation in environmentally friendly lubricant additives that maintain performance while reducing toxicity. Molybdenum-based friction modifiers, for instance, are being replaced with organic alternatives that deliver comparable friction reduction without the associated heavy metal environmental concerns.

The intersection of emissions regulations and lubrication technology is creating market opportunities for manufacturers who can deliver solutions that address both performance and environmental requirements. As global regulations continue to evolve toward zero-emission targets, friction reduction through advanced lubrication represents a critical transitional technology that extends the environmental viability of V6 engines in the medium term while the industry progresses toward full electrification.

Advanced lubrication techniques for V6 engines offer a promising pathway to compliance with these regulations. Research indicates that friction accounts for approximately 10-15% of the total energy consumption in modern V6 engines, with potential reduction of up to 40% through optimized lubrication systems. This translates to CO2 emissions reductions of 4-7 g/km, a significant contribution toward meeting regulatory targets without requiring complete powertrain redesign.

The environmental benefits of friction reduction extend beyond direct emissions. Lower friction results in decreased engine operating temperatures, reducing the formation of nitrogen oxides (NOx) during combustion. Additionally, advanced lubricants with improved thermal stability produce fewer volatile organic compounds (VOCs) and particulate matter, addressing another key regulatory concern. Studies from the International Council on Clean Transportation demonstrate that optimized lubrication can reduce particulate emissions by up to 25% in V6 engines under urban driving conditions.

Lifecycle assessment of new lubrication technologies reveals additional environmental considerations. Bio-based lubricants derived from renewable sources show promise in reducing the carbon footprint of engine operation by 30-40% compared to conventional petroleum-based products. However, challenges remain regarding their production scalability and long-term stability under extreme operating conditions. Synthetic lubricants offer enhanced performance but may present end-of-life disposal challenges that must be addressed through improved recycling infrastructure.

Regulatory bodies are increasingly adopting a holistic approach to emissions control, considering not only tailpipe emissions but also the environmental impact of manufacturing and disposal processes. This trend is driving innovation in environmentally friendly lubricant additives that maintain performance while reducing toxicity. Molybdenum-based friction modifiers, for instance, are being replaced with organic alternatives that deliver comparable friction reduction without the associated heavy metal environmental concerns.

The intersection of emissions regulations and lubrication technology is creating market opportunities for manufacturers who can deliver solutions that address both performance and environmental requirements. As global regulations continue to evolve toward zero-emission targets, friction reduction through advanced lubrication represents a critical transitional technology that extends the environmental viability of V6 engines in the medium term while the industry progresses toward full electrification.

Cost-Benefit Analysis of Advanced Lubrication Systems

The implementation of advanced lubrication systems for V6 engines represents a significant investment that must be carefully evaluated against potential returns. Initial capital expenditure for these systems ranges from $1,500 to $4,000 per engine production line, depending on the sophistication of the technology and scale of implementation. This includes costs for specialized equipment, lubricant delivery systems, and necessary modifications to existing production processes.

Operational costs must also be considered, with premium synthetic lubricants typically commanding a 30-40% price premium over conventional oils. However, this cost differential is partially offset by extended service intervals, which can be increased by 50-100% with advanced formulations. Maintenance costs for lubrication systems themselves add approximately $200-300 annually per production unit.

The benefits side of the equation presents compelling advantages. Friction reduction of 15-25% translates to fuel efficiency improvements of 2-4% in real-world driving conditions. For a vehicle with a 10-year operational lifespan, this represents savings of approximately $800-1,200 in fuel costs at current prices. Additionally, reduced engine wear extends component life by an estimated 20-30%, potentially saving $1,500-2,500 in avoided maintenance and repairs over the vehicle's lifetime.

Environmental benefits provide additional value, though less directly quantifiable. Reduced friction correlates with lower emissions, with studies indicating a 3-5% reduction in CO2 output. This may translate to regulatory compliance benefits and potential carbon credit opportunities in certain markets, estimated at $50-150 per vehicle depending on jurisdiction.

Return on investment calculations indicate that advanced lubrication systems typically achieve breakeven within 2.5-3.5 years of implementation. The net present value analysis, using a standard 8% discount rate, shows positive returns ranging from $500-1,200 per engine over a 10-year period.

Sensitivity analysis reveals that ROI is most heavily influenced by fuel prices and regulatory environments. A 20% increase in fuel costs improves ROI timelines by approximately 8 months, while stringent emissions regulations can accelerate returns by creating additional compliance value. Conversely, in markets with lower fuel costs or less stringent environmental regulations, ROI timelines may extend to 4-5 years.

Operational costs must also be considered, with premium synthetic lubricants typically commanding a 30-40% price premium over conventional oils. However, this cost differential is partially offset by extended service intervals, which can be increased by 50-100% with advanced formulations. Maintenance costs for lubrication systems themselves add approximately $200-300 annually per production unit.

The benefits side of the equation presents compelling advantages. Friction reduction of 15-25% translates to fuel efficiency improvements of 2-4% in real-world driving conditions. For a vehicle with a 10-year operational lifespan, this represents savings of approximately $800-1,200 in fuel costs at current prices. Additionally, reduced engine wear extends component life by an estimated 20-30%, potentially saving $1,500-2,500 in avoided maintenance and repairs over the vehicle's lifetime.

Environmental benefits provide additional value, though less directly quantifiable. Reduced friction correlates with lower emissions, with studies indicating a 3-5% reduction in CO2 output. This may translate to regulatory compliance benefits and potential carbon credit opportunities in certain markets, estimated at $50-150 per vehicle depending on jurisdiction.

Return on investment calculations indicate that advanced lubrication systems typically achieve breakeven within 2.5-3.5 years of implementation. The net present value analysis, using a standard 8% discount rate, shows positive returns ranging from $500-1,200 per engine over a 10-year period.

Sensitivity analysis reveals that ROI is most heavily influenced by fuel prices and regulatory environments. A 20% increase in fuel costs improves ROI timelines by approximately 8 months, while stringent emissions regulations can accelerate returns by creating additional compliance value. Conversely, in markets with lower fuel costs or less stringent environmental regulations, ROI timelines may extend to 4-5 years.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!