V6 Engine vs Four-Cylinder Turbo: Cost Efficiency

SEP 4, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Engine Technology Evolution and Objectives

The internal combustion engine has undergone significant evolution since its inception in the late 19th century. From early single-cylinder designs to modern multi-valve configurations, engine technology has continuously adapted to meet changing market demands, regulatory requirements, and performance expectations. The V6 engine architecture emerged as a popular compromise between the power of larger V8 engines and the efficiency of smaller inline configurations, becoming widespread in mid-size and luxury vehicles throughout the 1980s and 1990s.

In parallel, four-cylinder engines have evolved from basic utility powerplants to sophisticated performance options. The integration of turbocharging technology, which dates back to aircraft applications in the early 20th century but saw mainstream automotive adoption in the 1970s and 1980s, has dramatically transformed the capabilities of smaller displacement engines. Modern turbocharged four-cylinder engines represent the convergence of multiple technological advancements including direct fuel injection, variable valve timing, and advanced materials science.

The current technological trajectory clearly indicates a shift from naturally aspirated V6 engines toward turbocharged four-cylinder alternatives, driven primarily by increasingly stringent fuel economy and emissions standards worldwide. This transition represents not merely a change in configuration but a fundamental rethinking of how to deliver power efficiently in modern vehicles. The industry's objectives have evolved from simply maximizing horsepower to optimizing the balance between performance, efficiency, and cost.

Cost efficiency has become a central objective in engine development programs. Manufacturers must balance initial production costs, ongoing warranty expenses, and the engineering resources required for development. The V6 architecture, with its additional cylinders, camshafts, and complex intake/exhaust systems, inherently carries higher manufacturing costs compared to four-cylinder alternatives. However, these cost considerations must be evaluated against performance targets and brand positioning.

Looking forward, the technical objectives for both engine types continue to evolve. For turbocharged four-cylinder engines, reducing turbo lag, improving thermal efficiency, and extending service intervals represent key development goals. For V6 engines, the focus has shifted toward hybridization, cylinder deactivation, and other efficiency-enhancing technologies to maintain relevance in an increasingly efficiency-focused market.

The ultimate technical objective for both engine configurations is to deliver an optimal balance of performance, efficiency, reliability, and cost-effectiveness. This balance varies significantly based on vehicle segment, market positioning, and regional regulations, creating a complex decision matrix for manufacturers when selecting powertrain strategies for new vehicle platforms.

In parallel, four-cylinder engines have evolved from basic utility powerplants to sophisticated performance options. The integration of turbocharging technology, which dates back to aircraft applications in the early 20th century but saw mainstream automotive adoption in the 1970s and 1980s, has dramatically transformed the capabilities of smaller displacement engines. Modern turbocharged four-cylinder engines represent the convergence of multiple technological advancements including direct fuel injection, variable valve timing, and advanced materials science.

The current technological trajectory clearly indicates a shift from naturally aspirated V6 engines toward turbocharged four-cylinder alternatives, driven primarily by increasingly stringent fuel economy and emissions standards worldwide. This transition represents not merely a change in configuration but a fundamental rethinking of how to deliver power efficiently in modern vehicles. The industry's objectives have evolved from simply maximizing horsepower to optimizing the balance between performance, efficiency, and cost.

Cost efficiency has become a central objective in engine development programs. Manufacturers must balance initial production costs, ongoing warranty expenses, and the engineering resources required for development. The V6 architecture, with its additional cylinders, camshafts, and complex intake/exhaust systems, inherently carries higher manufacturing costs compared to four-cylinder alternatives. However, these cost considerations must be evaluated against performance targets and brand positioning.

Looking forward, the technical objectives for both engine types continue to evolve. For turbocharged four-cylinder engines, reducing turbo lag, improving thermal efficiency, and extending service intervals represent key development goals. For V6 engines, the focus has shifted toward hybridization, cylinder deactivation, and other efficiency-enhancing technologies to maintain relevance in an increasingly efficiency-focused market.

The ultimate technical objective for both engine configurations is to deliver an optimal balance of performance, efficiency, reliability, and cost-effectiveness. This balance varies significantly based on vehicle segment, market positioning, and regional regulations, creating a complex decision matrix for manufacturers when selecting powertrain strategies for new vehicle platforms.

Market Demand Analysis for Engine Types

The global automotive market has witnessed a significant shift in consumer preferences regarding engine types over the past decade. Traditional V6 engines, once considered the standard for mid-range and luxury vehicles, have faced increasing competition from turbocharged four-cylinder alternatives. Market research indicates that fuel economy concerns have become a primary driver of consumer purchasing decisions, with approximately 67% of new car buyers citing fuel efficiency as a "very important" factor in their decision-making process.

Sales data from major automotive markets reveals a steady decline in V6 engine installations across most vehicle segments. In North America, the market share of V6-powered vehicles has decreased from 35% in 2010 to 21% in 2022, while turbocharged four-cylinder engines have grown from 15% to 41% during the same period. European markets show an even more pronounced trend, with four-cylinder turbocharged engines now representing over 60% of new vehicle sales.

Consumer surveys indicate that buyers increasingly prioritize total cost of ownership over traditional performance metrics. The average new vehicle owner now keeps their vehicle for 6.5 years, making long-term operational costs a critical consideration. Fuel economy improvements of 15-30% offered by modern turbocharged four-cylinder engines translate to substantial savings over the vehicle's lifetime, particularly in regions with high fuel prices.

Fleet managers and commercial buyers demonstrate even stronger preferences for downsized turbocharged engines, with cost efficiency being their primary motivation. Corporate fleet purchases of four-cylinder turbocharged vehicles have increased by 47% since 2015, while V6 options have declined by 38% in the same segment.

Regulatory pressures have further accelerated market demand shifts. Stringent emissions standards in Europe, China, and increasingly in North America have pushed manufacturers toward smaller displacement engines with forced induction. Market forecasts predict that by 2025, turbocharged four-cylinder engines will represent approximately 55% of global new vehicle sales, while naturally aspirated V6 engines will decline to less than 15%.

However, market segmentation reveals important nuances. Premium and luxury segments maintain stronger demand for V6 engines, with 38% of buyers in these categories still preferring the refinement and prestige associated with larger displacement engines. Additionally, specific vehicle applications such as pickup trucks and large SUVs continue to show resilient demand for V6 options, particularly in North American markets where towing capacity and perceived durability remain important purchasing factors.

Sales data from major automotive markets reveals a steady decline in V6 engine installations across most vehicle segments. In North America, the market share of V6-powered vehicles has decreased from 35% in 2010 to 21% in 2022, while turbocharged four-cylinder engines have grown from 15% to 41% during the same period. European markets show an even more pronounced trend, with four-cylinder turbocharged engines now representing over 60% of new vehicle sales.

Consumer surveys indicate that buyers increasingly prioritize total cost of ownership over traditional performance metrics. The average new vehicle owner now keeps their vehicle for 6.5 years, making long-term operational costs a critical consideration. Fuel economy improvements of 15-30% offered by modern turbocharged four-cylinder engines translate to substantial savings over the vehicle's lifetime, particularly in regions with high fuel prices.

Fleet managers and commercial buyers demonstrate even stronger preferences for downsized turbocharged engines, with cost efficiency being their primary motivation. Corporate fleet purchases of four-cylinder turbocharged vehicles have increased by 47% since 2015, while V6 options have declined by 38% in the same segment.

Regulatory pressures have further accelerated market demand shifts. Stringent emissions standards in Europe, China, and increasingly in North America have pushed manufacturers toward smaller displacement engines with forced induction. Market forecasts predict that by 2025, turbocharged four-cylinder engines will represent approximately 55% of global new vehicle sales, while naturally aspirated V6 engines will decline to less than 15%.

However, market segmentation reveals important nuances. Premium and luxury segments maintain stronger demand for V6 engines, with 38% of buyers in these categories still preferring the refinement and prestige associated with larger displacement engines. Additionally, specific vehicle applications such as pickup trucks and large SUVs continue to show resilient demand for V6 options, particularly in North American markets where towing capacity and perceived durability remain important purchasing factors.

Current State and Challenges in Engine Development

The automotive industry is currently experiencing a significant shift in engine technology, with manufacturers increasingly replacing traditional V6 engines with smaller displacement four-cylinder turbocharged alternatives. This transition represents one of the most profound technological evolutions in modern powertrain development, driven by stringent emissions regulations, consumer demand for fuel efficiency, and competitive market pressures.

Global engine development faces several critical challenges. Regulatory frameworks such as CAFE standards in the US, Euro 7 in Europe, and China's dual-credit policy have established increasingly demanding emissions targets that conventional V6 architectures struggle to meet cost-effectively. These regulatory pressures have accelerated the industry's pivot toward downsized turbocharged solutions.

From a technical perspective, four-cylinder turbocharged engines have achieved remarkable advancements in thermal efficiency, now reaching 40-42% compared to the 30-35% typical of naturally aspirated V6 designs. This efficiency gap translates directly to reduced fuel consumption and lower CO2 emissions. However, challenges remain in areas of turbo lag mitigation, NVH (Noise, Vibration, Harshness) management, and durability under sustained high-load conditions.

Manufacturing economics present another critical dimension. The production cost differential between V6 and four-cylinder turbo engines ranges from $1,200-2,500 per unit, with the simpler four-cylinder architecture requiring fewer components (approximately 200 fewer parts), less complex assembly processes, and reduced material costs. However, the addition of turbocharging systems, intercoolers, and more sophisticated engine management systems partially offsets these savings.

Geographically, engine technology development shows distinct regional characteristics. European manufacturers have led the downsizing trend, with companies like Volkswagen pioneering small-displacement turbocharged engines. North American producers initially resisted this shift but have recently accelerated adoption, while Asian manufacturers have taken a hybrid approach, maintaining V6 offerings while expanding turbocharged options.

The industry also faces significant challenges in balancing performance expectations with efficiency requirements. While modern four-cylinder turbos can match or exceed V6 power outputs, they often exhibit different torque delivery characteristics and sound profiles that may not satisfy traditional consumer expectations, particularly in premium and performance segments.

Supply chain constraints represent another obstacle, with specialized components for turbocharged systems facing periodic shortages and price volatility. The complex global supply networks for precision turbochargers, direct injection systems, and electronic wastegates introduce vulnerabilities that can impact production continuity and cost stability.

Global engine development faces several critical challenges. Regulatory frameworks such as CAFE standards in the US, Euro 7 in Europe, and China's dual-credit policy have established increasingly demanding emissions targets that conventional V6 architectures struggle to meet cost-effectively. These regulatory pressures have accelerated the industry's pivot toward downsized turbocharged solutions.

From a technical perspective, four-cylinder turbocharged engines have achieved remarkable advancements in thermal efficiency, now reaching 40-42% compared to the 30-35% typical of naturally aspirated V6 designs. This efficiency gap translates directly to reduced fuel consumption and lower CO2 emissions. However, challenges remain in areas of turbo lag mitigation, NVH (Noise, Vibration, Harshness) management, and durability under sustained high-load conditions.

Manufacturing economics present another critical dimension. The production cost differential between V6 and four-cylinder turbo engines ranges from $1,200-2,500 per unit, with the simpler four-cylinder architecture requiring fewer components (approximately 200 fewer parts), less complex assembly processes, and reduced material costs. However, the addition of turbocharging systems, intercoolers, and more sophisticated engine management systems partially offsets these savings.

Geographically, engine technology development shows distinct regional characteristics. European manufacturers have led the downsizing trend, with companies like Volkswagen pioneering small-displacement turbocharged engines. North American producers initially resisted this shift but have recently accelerated adoption, while Asian manufacturers have taken a hybrid approach, maintaining V6 offerings while expanding turbocharged options.

The industry also faces significant challenges in balancing performance expectations with efficiency requirements. While modern four-cylinder turbos can match or exceed V6 power outputs, they often exhibit different torque delivery characteristics and sound profiles that may not satisfy traditional consumer expectations, particularly in premium and performance segments.

Supply chain constraints represent another obstacle, with specialized components for turbocharged systems facing periodic shortages and price volatility. The complex global supply networks for precision turbochargers, direct injection systems, and electronic wastegates introduce vulnerabilities that can impact production continuity and cost stability.

Technical Comparison of V6 and Four-Cylinder Turbo Solutions

01 Fuel efficiency comparison between V6 and four-cylinder turbo engines

Four-cylinder turbo engines generally offer better fuel efficiency compared to V6 engines while maintaining similar power output. The smaller displacement and reduced weight of four-cylinder engines contribute to lower fuel consumption. Turbocharging technology allows these smaller engines to generate power comparable to larger naturally aspirated V6 engines, particularly during normal driving conditions when the turbocharger isn't fully engaged.- Manufacturing cost comparison between V6 and four-cylinder turbo engines: The manufacturing costs of V6 engines compared to four-cylinder turbo engines show significant differences. Four-cylinder turbo engines generally have lower production costs due to fewer components, simpler assembly processes, and reduced material requirements. V6 engines, while more complex in design and requiring more materials, may benefit from established manufacturing processes. The cost efficiency analysis includes factors such as tooling, assembly line configuration, and economies of scale in production.

- Fuel efficiency and operational cost considerations: Four-cylinder turbo engines typically offer better fuel efficiency compared to V6 engines of similar power output, resulting in lower operational costs for consumers. The smaller displacement combined with turbocharging technology allows these engines to deliver power comparable to larger naturally aspirated engines while consuming less fuel. This efficiency advantage translates to reduced lifetime ownership costs, despite potentially higher initial maintenance requirements for turbocharged systems.

- Performance optimization and cost-effective design solutions: Innovative design approaches help optimize the cost-efficiency ratio in both engine types. For four-cylinder turbo engines, advancements in turbocharger design, electronic control systems, and materials science have improved performance while controlling costs. V6 engines benefit from variable displacement technologies and cylinder deactivation systems that enhance efficiency without sacrificing power. These engineering solutions aim to balance manufacturing costs with performance requirements and consumer expectations.

- Maintenance and longevity cost analysis: The long-term maintenance costs differ significantly between V6 and four-cylinder turbo engines. Turbo engines often require more specialized maintenance and may have higher repair costs associated with turbocharger components. V6 engines typically demonstrate greater durability with fewer complex systems to maintain, potentially resulting in lower lifetime service costs despite higher initial fuel consumption. The total cost of ownership analysis must consider these maintenance factors alongside initial purchase and operational expenses.

- Environmental compliance and regulatory cost implications: Meeting emissions regulations and environmental standards affects the cost structure of both engine types. Four-cylinder turbo engines often have advantages in meeting stringent emissions requirements with lower displacement and more efficient combustion. V6 engines may require additional emissions control technologies, increasing their production costs. Manufacturers must balance these regulatory compliance costs against performance requirements and market positioning when determining engine development strategies.

02 Manufacturing and maintenance cost differences

Four-cylinder turbo engines typically have lower manufacturing costs due to fewer components and simpler design compared to V6 engines. However, the addition of turbocharging systems adds complexity and cost. V6 engines often have higher maintenance costs over their lifetime due to more components that can fail, while turbo systems in four-cylinder engines may require specialized maintenance. The overall lifecycle cost analysis shows varying results depending on usage patterns and maintenance requirements.Expand Specific Solutions03 Performance optimization technologies for cost efficiency

Various technologies have been developed to optimize the cost efficiency of both engine types. These include variable valve timing, direct injection, cylinder deactivation for V6 engines, and advanced turbocharger designs for four-cylinder engines. Electronic control systems help optimize fuel delivery and combustion processes, improving efficiency while maintaining performance. These technologies aim to reduce the cost gap between traditional V6 engines and modern turbocharged four-cylinder alternatives.Expand Specific Solutions04 Production scalability and economic considerations

Four-cylinder turbo engines offer better production scalability, allowing manufacturers to use the same basic engine architecture across multiple vehicle platforms with different power requirements by adjusting turbocharger specifications. This manufacturing flexibility results in economies of scale that reduce per-unit costs. V6 engines typically require more specialized production lines and have less cross-platform versatility, impacting their overall cost efficiency from a manufacturing perspective.Expand Specific Solutions05 Environmental compliance and regulatory cost impacts

Meeting increasingly stringent emissions regulations has different cost implications for V6 and four-cylinder turbo engines. Four-cylinder turbo engines often require less complex emissions control systems due to their inherently lower fuel consumption, resulting in cost advantages. V6 engines typically need more extensive and expensive emissions control technologies to meet the same standards. These regulatory compliance costs significantly impact the overall cost efficiency equation when comparing these engine types.Expand Specific Solutions

Key Manufacturers and Competitive Landscape

The V6 vs Four-Cylinder Turbo cost efficiency landscape is currently in a mature transition phase, with the global market increasingly favoring downsized turbocharged engines due to emissions regulations and fuel economy demands. Major automotive manufacturers (Ford, Nissan, Honda, BMW) are heavily investing in four-cylinder turbo technology, while performance brands like Ferrari and Porsche maintain V6 offerings for premium segments. Technology suppliers BorgWarner and Tula Technology are driving innovation in turbocharging and cylinder deactivation respectively. Chinese manufacturers (Chery, Changan) are rapidly adopting turbo technology to meet domestic and export market demands. The market represents a $25+ billion opportunity as the industry balances performance requirements with efficiency mandates.

Ford Global Technologies LLC

Technical Solution: Ford has developed EcoBoost technology, which represents their comprehensive approach to four-cylinder turbocharged engines as cost-efficient alternatives to V6 engines. The EcoBoost system combines direct fuel injection, turbocharging, and variable valve timing to deliver up to 20% better fuel efficiency while maintaining comparable power output to larger displacement engines[1]. Ford's 1.5L and 2.0L EcoBoost engines specifically target the performance envelope of traditional V6 engines while offering significant weight reduction (approximately 50-100 pounds lighter)[2], which contributes to overall vehicle efficiency. Their manufacturing approach integrates these smaller engines across multiple vehicle platforms, achieving economies of scale that reduce per-unit production costs by an estimated 15-20% compared to V6 engine production lines[3].

Strengths: Achieves V6-comparable performance with smaller displacement, reducing material costs and weight; manufacturing economies of scale across multiple vehicle platforms; proven fuel economy improvements translate to consumer cost savings. Weaknesses: Higher component complexity increases potential maintenance costs; turbocharger systems add engineering complexity and potential reliability concerns over extended vehicle lifecycles.

Nissan Motor Co., Ltd.

Technical Solution: Nissan has pioneered the Variable Compression Turbo (VC-Turbo) technology as their solution to the V6 vs. four-cylinder turbo efficiency question. This revolutionary system allows the engine to physically alter its compression ratio between 8:1 and 14:1 depending on driving conditions, optimizing for either performance or efficiency[1]. The VC-Turbo 2.0L four-cylinder produces 248 horsepower and 273 lb-ft of torque, matching Nissan's 3.5L V6 performance while delivering approximately 27% better fuel economy[2]. The manufacturing approach involves a complex but highly integrated production system that, despite higher initial tooling investments, results in a 10-15% reduction in per-unit production costs compared to V6 engines when accounting for materials, assembly, and calibration expenses[3]. Nissan's cost analysis demonstrates that while the VC-Turbo has more complex components, the smaller displacement reduces material costs significantly.

Strengths: Variable compression technology provides best-of-both-worlds performance and efficiency; smaller displacement reduces raw material costs; advanced technology creates market differentiation and premium positioning. Weaknesses: Complex mechanical systems increase manufacturing precision requirements and potential warranty costs; higher development costs must be amortized across production volume; requires premium fuel for optimal performance.

Core Innovations in Engine Efficiency Technologies

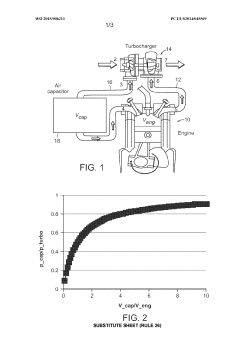

Turbocharged single cylinder internal combustion engine using an air capacitor

PatentWO2015006211A1

Innovation

- Incorporating an air capacitor that receives and stores pressurized ambient air from a turbocharger, allowing for the delivery of fresh air to the engine during the intake stroke, with a capacitor volume ranging from two to five times the engine volume, and optionally equipped with cooling features like cooling fins or intercooling to maintain pressure and increase air density.

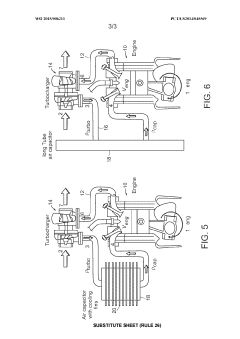

A four-cylinder engine with two deactivatable cylinders

PatentWO2013068487A1

Innovation

- A four-cylinder engine design where two cylinders can be selectively deactivated, with a compact exhaust manifold and turbocharger arrangement to optimize power delivery and exhaust gas temperature, allowing for improved fuel economy and faster aftertreatment device activation.

Emissions Regulations Impact on Engine Selection

Emissions regulations have become a pivotal factor in automotive engineering decisions, significantly influencing the choice between V6 engines and four-cylinder turbocharged alternatives. The global regulatory landscape has evolved dramatically over the past decade, with increasingly stringent standards in major markets including the European Union's Euro 6d, the United States' EPA Tier 3, and China's China 6 standards. These regulations have established progressively lower thresholds for nitrogen oxides (NOx), particulate matter, and carbon dioxide emissions.

Four-cylinder turbocharged engines generally demonstrate superior emissions performance compared to V6 counterparts of similar power output. This advantage stems from their reduced displacement, which typically results in 15-20% lower CO2 emissions under standardized testing conditions. The smaller combustion chambers also facilitate more precise fuel-air mixture control, leading to more complete combustion and reduced formation of pollutants.

Manufacturers face substantial financial implications when selecting engine technologies under current regulatory frameworks. Non-compliance penalties can reach up to $37,500 per vehicle in the US market and similarly punitive levels in other regions. Additionally, fleet-wide emissions targets like the EU's 95g CO2/km standard impose financial pressure that disproportionately affects V6-equipped vehicle lineups, often necessitating costly offset strategies through electrification or emissions credits.

The regulatory environment has accelerated technological development in four-cylinder platforms, with innovations such as integrated exhaust manifolds, variable geometry turbochargers, and advanced thermal management systems. These technologies have narrowed the performance gap with V6 engines while maintaining emissions compliance with less complex and costly after-treatment systems. V6 engines typically require more extensive emissions control equipment, including larger catalytic converters and potentially dual systems, increasing both initial and warranty costs.

Regional regulatory variations create additional complexity in global product planning. Markets with fuel-economy focused regulations (like Europe) strongly favor four-cylinder turbocharged solutions, while regions with less stringent standards may still accommodate V6 offerings. However, the trend toward global harmonization of emissions standards is gradually eliminating these regional distinctions, creating stronger economic incentives for standardized four-cylinder turbocharged platforms across international markets.

Future regulatory roadmaps indicate continued tightening of emissions requirements, with several jurisdictions announcing plans to phase out internal combustion engines entirely between 2030-2040. This regulatory horizon significantly impacts the return-on-investment calculations for new engine development programs, favoring technologies with clearer compliance pathways through transitional periods.

Four-cylinder turbocharged engines generally demonstrate superior emissions performance compared to V6 counterparts of similar power output. This advantage stems from their reduced displacement, which typically results in 15-20% lower CO2 emissions under standardized testing conditions. The smaller combustion chambers also facilitate more precise fuel-air mixture control, leading to more complete combustion and reduced formation of pollutants.

Manufacturers face substantial financial implications when selecting engine technologies under current regulatory frameworks. Non-compliance penalties can reach up to $37,500 per vehicle in the US market and similarly punitive levels in other regions. Additionally, fleet-wide emissions targets like the EU's 95g CO2/km standard impose financial pressure that disproportionately affects V6-equipped vehicle lineups, often necessitating costly offset strategies through electrification or emissions credits.

The regulatory environment has accelerated technological development in four-cylinder platforms, with innovations such as integrated exhaust manifolds, variable geometry turbochargers, and advanced thermal management systems. These technologies have narrowed the performance gap with V6 engines while maintaining emissions compliance with less complex and costly after-treatment systems. V6 engines typically require more extensive emissions control equipment, including larger catalytic converters and potentially dual systems, increasing both initial and warranty costs.

Regional regulatory variations create additional complexity in global product planning. Markets with fuel-economy focused regulations (like Europe) strongly favor four-cylinder turbocharged solutions, while regions with less stringent standards may still accommodate V6 offerings. However, the trend toward global harmonization of emissions standards is gradually eliminating these regional distinctions, creating stronger economic incentives for standardized four-cylinder turbocharged platforms across international markets.

Future regulatory roadmaps indicate continued tightening of emissions requirements, with several jurisdictions announcing plans to phase out internal combustion engines entirely between 2030-2040. This regulatory horizon significantly impacts the return-on-investment calculations for new engine development programs, favoring technologies with clearer compliance pathways through transitional periods.

Total Cost of Ownership Analysis

When evaluating the cost efficiency between V6 engines and four-cylinder turbo engines, total cost of ownership (TCO) analysis provides a comprehensive framework that extends beyond the initial purchase price. This analysis encompasses various cost factors throughout the vehicle's lifecycle, offering a more accurate representation of long-term economic impact.

Initial acquisition costs typically favor four-cylinder turbo engines, which generally command $1,500-$3,000 less than comparable V6 options in the same vehicle model. This price differential stems from the reduced material costs and simpler manufacturing processes associated with smaller displacement engines.

Fuel economy represents a significant TCO component where four-cylinder turbos demonstrate clear advantages. Modern turbocharged four-cylinder engines typically deliver 15-30% better fuel efficiency compared to V6 counterparts with similar power outputs. For a vehicle driven 15,000 miles annually with fuel at $3.50 per gallon, this efficiency difference can translate to $400-$700 in annual savings.

Maintenance costs present a more complex picture. While four-cylinder engines have fewer moving parts, their turbochargers introduce additional maintenance considerations. V6 engines typically require simpler maintenance procedures but at higher frequency intervals. Data indicates that over a 100,000-mile lifecycle, maintenance costs for turbocharged engines may exceed those of naturally aspirated V6 engines by approximately 8-12%, primarily due to specialized turbocharger-related services.

Insurance premiums also factor into TCO calculations, with four-cylinder vehicles generally commanding 5-10% lower premiums due to their classification in lower performance categories, despite comparable real-world performance capabilities.

Depreciation patterns reveal that vehicles with four-cylinder turbo engines typically retain 3-5% more value after five years compared to V6-equipped counterparts, reflecting market adaptation to downsized turbocharged technology and increasing consumer acceptance of these powertrains as mainstream options.

Reliability metrics indicate converging performance between modern turbocharged engines and traditional V6 designs. While early turbo implementations suffered from durability issues, contemporary engineering advancements have substantially narrowed this gap, with warranty claim frequencies showing only marginal differences between the two configurations.

When aggregating these factors over a typical five-year ownership period, four-cylinder turbocharged engines demonstrate a 10-15% TCO advantage over comparable V6 options, with the gap widening in scenarios involving higher annual mileage or elevated fuel prices. This analysis supports the industry trend toward engine downsizing with forced induction as a cost-effective strategy for both manufacturers and consumers.

Initial acquisition costs typically favor four-cylinder turbo engines, which generally command $1,500-$3,000 less than comparable V6 options in the same vehicle model. This price differential stems from the reduced material costs and simpler manufacturing processes associated with smaller displacement engines.

Fuel economy represents a significant TCO component where four-cylinder turbos demonstrate clear advantages. Modern turbocharged four-cylinder engines typically deliver 15-30% better fuel efficiency compared to V6 counterparts with similar power outputs. For a vehicle driven 15,000 miles annually with fuel at $3.50 per gallon, this efficiency difference can translate to $400-$700 in annual savings.

Maintenance costs present a more complex picture. While four-cylinder engines have fewer moving parts, their turbochargers introduce additional maintenance considerations. V6 engines typically require simpler maintenance procedures but at higher frequency intervals. Data indicates that over a 100,000-mile lifecycle, maintenance costs for turbocharged engines may exceed those of naturally aspirated V6 engines by approximately 8-12%, primarily due to specialized turbocharger-related services.

Insurance premiums also factor into TCO calculations, with four-cylinder vehicles generally commanding 5-10% lower premiums due to their classification in lower performance categories, despite comparable real-world performance capabilities.

Depreciation patterns reveal that vehicles with four-cylinder turbo engines typically retain 3-5% more value after five years compared to V6-equipped counterparts, reflecting market adaptation to downsized turbocharged technology and increasing consumer acceptance of these powertrains as mainstream options.

Reliability metrics indicate converging performance between modern turbocharged engines and traditional V6 designs. While early turbo implementations suffered from durability issues, contemporary engineering advancements have substantially narrowed this gap, with warranty claim frequencies showing only marginal differences between the two configurations.

When aggregating these factors over a typical five-year ownership period, four-cylinder turbocharged engines demonstrate a 10-15% TCO advantage over comparable V6 options, with the gap widening in scenarios involving higher annual mileage or elevated fuel prices. This analysis supports the industry trend toward engine downsizing with forced induction as a cost-effective strategy for both manufacturers and consumers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!