V6 Engine vs Plug-In Hybrid: Drivability Assessment

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V6 Engine and PHEV Technology Evolution

The evolution of V6 engines and Plug-In Hybrid Electric Vehicles (PHEVs) represents a fascinating technological journey that highlights the automotive industry's response to changing market demands, regulatory pressures, and environmental concerns. The V6 engine, first introduced in the early 20th century, has undergone significant refinements over decades, evolving from simple naturally aspirated designs to sophisticated turbocharged and direct-injection powerplants that balance performance with efficiency.

In the 1990s, V6 engines began incorporating variable valve timing and multi-point fuel injection systems, dramatically improving both power output and fuel economy. The 2000s saw the widespread adoption of aluminum construction to reduce weight, while direct injection technology enabled more precise fuel delivery and combustion control. More recent developments include cylinder deactivation systems that allow V6 engines to operate as smaller engines under light loads, further enhancing fuel efficiency without sacrificing the power available when needed.

Parallel to this evolution, PHEV technology emerged as a bridge between conventional internal combustion engines and fully electric vehicles. The first commercially successful PHEV, the Chevrolet Volt, debuted in 2010, featuring a small gasoline engine working primarily as a generator for its electric drive system. This represented a fundamental shift in powertrain architecture, prioritizing electric propulsion while maintaining the convenience of gasoline refueling.

PHEV technology has rapidly advanced since then, with significant improvements in battery energy density, electric motor efficiency, and power electronics. Modern PHEVs typically offer 30-50 miles of all-electric range, compared to just 10-15 miles a decade ago. Integration between combustion engines and electric systems has become increasingly sophisticated, with seamless transitions between power sources and intelligent energy management systems that optimize efficiency based on driving conditions and routes.

The convergence of these technologies has created interesting hybrid architectures, such as V6 PHEVs that combine the smooth power delivery of six-cylinder engines with the instant torque and efficiency benefits of electric motors. These systems represent the culmination of both evolutionary paths, offering a compelling blend of performance, efficiency, and reduced environmental impact.

Recent technological advancements include the development of dedicated hybrid transmissions, regenerative braking systems with increased energy recovery capabilities, and predictive energy management systems that use GPS and traffic data to optimize powertrain operation. The integration of these technologies continues to evolve, with manufacturers exploring various configurations to meet specific performance targets and regulatory requirements.

In the 1990s, V6 engines began incorporating variable valve timing and multi-point fuel injection systems, dramatically improving both power output and fuel economy. The 2000s saw the widespread adoption of aluminum construction to reduce weight, while direct injection technology enabled more precise fuel delivery and combustion control. More recent developments include cylinder deactivation systems that allow V6 engines to operate as smaller engines under light loads, further enhancing fuel efficiency without sacrificing the power available when needed.

Parallel to this evolution, PHEV technology emerged as a bridge between conventional internal combustion engines and fully electric vehicles. The first commercially successful PHEV, the Chevrolet Volt, debuted in 2010, featuring a small gasoline engine working primarily as a generator for its electric drive system. This represented a fundamental shift in powertrain architecture, prioritizing electric propulsion while maintaining the convenience of gasoline refueling.

PHEV technology has rapidly advanced since then, with significant improvements in battery energy density, electric motor efficiency, and power electronics. Modern PHEVs typically offer 30-50 miles of all-electric range, compared to just 10-15 miles a decade ago. Integration between combustion engines and electric systems has become increasingly sophisticated, with seamless transitions between power sources and intelligent energy management systems that optimize efficiency based on driving conditions and routes.

The convergence of these technologies has created interesting hybrid architectures, such as V6 PHEVs that combine the smooth power delivery of six-cylinder engines with the instant torque and efficiency benefits of electric motors. These systems represent the culmination of both evolutionary paths, offering a compelling blend of performance, efficiency, and reduced environmental impact.

Recent technological advancements include the development of dedicated hybrid transmissions, regenerative braking systems with increased energy recovery capabilities, and predictive energy management systems that use GPS and traffic data to optimize powertrain operation. The integration of these technologies continues to evolve, with manufacturers exploring various configurations to meet specific performance targets and regulatory requirements.

Market Demand Analysis for V6 and PHEV Vehicles

The global automotive market is experiencing a significant shift in consumer preferences, with increasing demand for both performance and sustainability. V6 engines have traditionally dominated the premium and sports vehicle segments, valued for their smooth power delivery and balanced performance characteristics. However, plug-in hybrid electric vehicles (PHEVs) are rapidly gaining market share as consumers seek vehicles that combine performance with improved fuel efficiency and reduced environmental impact.

Market research indicates that the global PHEV market is projected to grow at a compound annual growth rate of 30.6% between 2021 and 2028, significantly outpacing the growth rate of conventional internal combustion engine vehicles. This growth is primarily driven by stringent government regulations on emissions, increasing fuel prices, and growing environmental consciousness among consumers. In contrast, the market for V6-powered vehicles is experiencing modest growth, primarily in luxury segments and regions where fuel economy regulations are less stringent.

Consumer surveys reveal a notable shift in purchasing criteria, with 68% of premium vehicle buyers now considering fuel efficiency as a "very important" factor, compared to just 42% five years ago. Performance remains crucial, with 74% of buyers in this segment citing acceleration and driving dynamics as key decision factors. This dual demand creates a complex market landscape where manufacturers must balance performance expectations with efficiency requirements.

Regional variations in market demand are significant. In Europe, where emission regulations are particularly strict, PHEV sales have increased by 43% year-over-year, while V6 engine vehicle sales have declined by 12%. In North America, the transition is more gradual, with PHEV sales growing at 28% annually while V6 engines maintain popularity in trucks and premium SUVs. Asian markets show the most dramatic shift, with China leading PHEV adoption due to government incentives and urban emission restrictions.

Fleet operators and corporate buyers represent another significant market segment, with total cost of ownership increasingly driving purchasing decisions. Analysis shows that while PHEVs typically command a 15-20% price premium over comparable V6 models, the reduced operating costs can offset this difference within 3-4 years of ownership, depending on usage patterns and local energy prices.

Consumer perception of drivability remains a critical factor influencing market adoption. While 82% of V6 owners cite engine response and driving feel as satisfying aspects of ownership, PHEV technology has made significant strides in this area. Recent consumer satisfaction surveys indicate that 76% of PHEV owners rate the driving experience as equal to or better than previous conventional vehicles they have owned, suggesting that the perceived performance gap is narrowing.

Market research indicates that the global PHEV market is projected to grow at a compound annual growth rate of 30.6% between 2021 and 2028, significantly outpacing the growth rate of conventional internal combustion engine vehicles. This growth is primarily driven by stringent government regulations on emissions, increasing fuel prices, and growing environmental consciousness among consumers. In contrast, the market for V6-powered vehicles is experiencing modest growth, primarily in luxury segments and regions where fuel economy regulations are less stringent.

Consumer surveys reveal a notable shift in purchasing criteria, with 68% of premium vehicle buyers now considering fuel efficiency as a "very important" factor, compared to just 42% five years ago. Performance remains crucial, with 74% of buyers in this segment citing acceleration and driving dynamics as key decision factors. This dual demand creates a complex market landscape where manufacturers must balance performance expectations with efficiency requirements.

Regional variations in market demand are significant. In Europe, where emission regulations are particularly strict, PHEV sales have increased by 43% year-over-year, while V6 engine vehicle sales have declined by 12%. In North America, the transition is more gradual, with PHEV sales growing at 28% annually while V6 engines maintain popularity in trucks and premium SUVs. Asian markets show the most dramatic shift, with China leading PHEV adoption due to government incentives and urban emission restrictions.

Fleet operators and corporate buyers represent another significant market segment, with total cost of ownership increasingly driving purchasing decisions. Analysis shows that while PHEVs typically command a 15-20% price premium over comparable V6 models, the reduced operating costs can offset this difference within 3-4 years of ownership, depending on usage patterns and local energy prices.

Consumer perception of drivability remains a critical factor influencing market adoption. While 82% of V6 owners cite engine response and driving feel as satisfying aspects of ownership, PHEV technology has made significant strides in this area. Recent consumer satisfaction surveys indicate that 76% of PHEV owners rate the driving experience as equal to or better than previous conventional vehicles they have owned, suggesting that the perceived performance gap is narrowing.

Technical Challenges in Drivability Performance

Drivability performance represents a critical aspect of vehicle engineering that directly impacts consumer satisfaction and market acceptance. When comparing V6 engines with plug-in hybrid systems, several significant technical challenges emerge that require innovative solutions and careful engineering considerations.

The fundamental challenge lies in the inherently different power delivery characteristics between conventional V6 engines and plug-in hybrid powertrains. V6 engines provide consistent, predictable power delivery with well-established throttle response patterns that drivers have grown accustomed to over decades. In contrast, plug-in hybrid systems must seamlessly integrate power from both internal combustion engines and electric motors, creating complex power management scenarios.

Transitional smoothness presents a major hurdle in hybrid systems. The switch between electric-only mode and combined power modes often creates perceptible jerks or hesitations that negatively impact the driving experience. Engineers must develop sophisticated control algorithms to ensure these transitions remain imperceptible to drivers while maintaining optimal efficiency.

Throttle response calibration differs significantly between these powertrain types. V6 engines feature direct mechanical linkages (or electronic throttle controls designed to mimic mechanical feel), whereas hybrid systems must coordinate multiple power sources with varying response times. The challenge involves creating a consistent throttle feel despite the underlying complexity of power source switching.

Torque management represents another critical challenge. Plug-in hybrids can deliver instantaneous electric torque, which provides excellent initial acceleration but requires careful modulation to maintain traction and prevent wheel spin. Conversely, V6 engines build torque more progressively, creating different drivability characteristics that must be carefully engineered.

NVH (Noise, Vibration, Harshness) management differs substantially between these powertrain types. The transition from silent electric operation to combustion engine engagement in hybrids can be jarring without proper damping systems and sound insulation. V6 engines maintain consistent NVH profiles that drivers find predictable and often emotionally engaging.

Regenerative braking systems in hybrids create another layer of complexity for drivability engineers. Blending traditional friction braking with regenerative systems while maintaining natural pedal feel and predictable deceleration rates requires sophisticated control systems that V6-powered vehicles don't need.

Weight distribution and dynamic handling characteristics also present significant challenges. The additional battery weight in plug-in hybrids typically alters the vehicle's center of gravity and weight distribution, requiring suspension and steering calibrations that differ from those optimized for V6 powertrains.

The fundamental challenge lies in the inherently different power delivery characteristics between conventional V6 engines and plug-in hybrid powertrains. V6 engines provide consistent, predictable power delivery with well-established throttle response patterns that drivers have grown accustomed to over decades. In contrast, plug-in hybrid systems must seamlessly integrate power from both internal combustion engines and electric motors, creating complex power management scenarios.

Transitional smoothness presents a major hurdle in hybrid systems. The switch between electric-only mode and combined power modes often creates perceptible jerks or hesitations that negatively impact the driving experience. Engineers must develop sophisticated control algorithms to ensure these transitions remain imperceptible to drivers while maintaining optimal efficiency.

Throttle response calibration differs significantly between these powertrain types. V6 engines feature direct mechanical linkages (or electronic throttle controls designed to mimic mechanical feel), whereas hybrid systems must coordinate multiple power sources with varying response times. The challenge involves creating a consistent throttle feel despite the underlying complexity of power source switching.

Torque management represents another critical challenge. Plug-in hybrids can deliver instantaneous electric torque, which provides excellent initial acceleration but requires careful modulation to maintain traction and prevent wheel spin. Conversely, V6 engines build torque more progressively, creating different drivability characteristics that must be carefully engineered.

NVH (Noise, Vibration, Harshness) management differs substantially between these powertrain types. The transition from silent electric operation to combustion engine engagement in hybrids can be jarring without proper damping systems and sound insulation. V6 engines maintain consistent NVH profiles that drivers find predictable and often emotionally engaging.

Regenerative braking systems in hybrids create another layer of complexity for drivability engineers. Blending traditional friction braking with regenerative systems while maintaining natural pedal feel and predictable deceleration rates requires sophisticated control systems that V6-powered vehicles don't need.

Weight distribution and dynamic handling characteristics also present significant challenges. The additional battery weight in plug-in hybrids typically alters the vehicle's center of gravity and weight distribution, requiring suspension and steering calibrations that differ from those optimized for V6 powertrains.

Current Drivability Assessment Methodologies

01 Hybrid powertrain control strategies for V6 engines

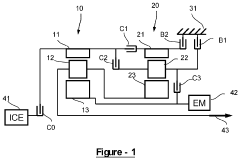

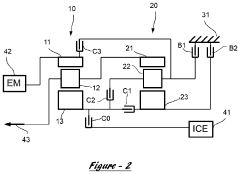

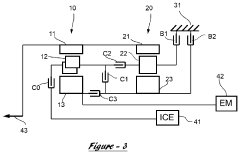

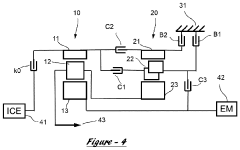

Control strategies specifically designed for hybrid powertrains with V6 engines focus on optimizing the interaction between the internal combustion engine and electric motors. These strategies include torque distribution algorithms, power management systems, and drive mode selection to enhance drivability. Advanced control units monitor various parameters such as vehicle speed, battery state of charge, and driver input to seamlessly transition between electric, hybrid, and combustion-only operation, resulting in improved responsiveness and smoother acceleration.- Hybrid powertrain integration with V6 engines: Integration of V6 engines with hybrid electric systems to create plug-in hybrid powertrains that optimize drivability. This approach combines the power of internal combustion engines with electric motors to provide smooth acceleration, improved fuel efficiency, and reduced emissions. The integration includes specialized control systems that manage the transition between combustion and electric power modes to ensure seamless operation and enhanced driving experience.

- Control strategies for hybrid powertrain drivability: Advanced control algorithms and strategies specifically designed to optimize the drivability of V6 engine and plug-in hybrid powertrains. These control systems manage power distribution between the combustion engine and electric motors, optimize gear shifting, and adjust torque delivery based on driving conditions. The strategies focus on minimizing jerks during mode transitions, providing responsive acceleration, and maintaining consistent performance across different operating conditions.

- Thermal management systems for hybrid powertrains: Specialized thermal management systems designed for V6 engine and plug-in hybrid powertrains to maintain optimal operating temperatures for both the combustion engine and electric components. These systems help improve drivability by ensuring that all powertrain components operate within their ideal temperature ranges, preventing performance degradation due to overheating or cold operation. Effective thermal management contributes to consistent power delivery, improved efficiency, and extended component lifespan.

- Transmission and drivetrain optimization for hybrid vehicles: Specialized transmission and drivetrain configurations designed to handle the unique power delivery characteristics of V6 engine and plug-in hybrid powertrains. These systems include modified gear ratios, clutch mechanisms, and power transfer units that efficiently manage the combined torque from combustion and electric power sources. The optimized drivetrain components ensure smooth power delivery, reduce vibration, and enhance overall vehicle drivability across various driving conditions.

- Driver assistance and adaptive systems for hybrid powertrains: Advanced driver assistance and adaptive systems specifically designed for V6 engine and plug-in hybrid powertrains to enhance drivability. These systems include predictive energy management, adaptive driving modes, and intelligent power distribution based on route information and driving patterns. The technologies continuously monitor driving conditions and driver inputs to optimize powertrain performance, providing a more intuitive and responsive driving experience while maximizing efficiency and performance.

02 Integration of V6 engines with plug-in hybrid systems

The integration of V6 engines with plug-in hybrid systems involves specific design considerations to ensure optimal performance and drivability. This includes the physical arrangement of components, power transfer mechanisms, and cooling systems. The integration focuses on balancing the power output of the V6 engine with electric motors to provide sufficient torque across various driving conditions while maintaining efficiency. Special attention is given to the transmission systems that need to handle both power sources effectively.Expand Specific Solutions03 Drivability enhancement through torque management

Torque management systems in V6 hybrid powertrains are designed to deliver smooth and responsive driving experiences. These systems coordinate the torque delivery from both the V6 engine and electric motors to eliminate jerking or hesitation during acceleration or mode transitions. Advanced algorithms predict driver intentions and adjust power delivery accordingly, while also managing torque during regenerative braking to maintain vehicle stability and comfort. This approach ensures consistent drivability across various driving conditions and battery charge states.Expand Specific Solutions04 Thermal management for hybrid V6 powertrains

Thermal management systems are crucial for maintaining optimal performance and drivability in V6 plug-in hybrid powertrains. These systems regulate the temperature of the engine, electric motors, battery packs, and power electronics to ensure consistent operation under various conditions. Advanced cooling circuits may include multiple loops with different temperature requirements, intelligent control valves, and heat recovery systems. Proper thermal management prevents performance degradation, extends component life, and ensures consistent drivability regardless of ambient conditions or driving demands.Expand Specific Solutions05 Transmission technologies for V6 hybrid drivability

Specialized transmission technologies are developed to optimize the drivability of V6 plug-in hybrid powertrains. These include continuously variable transmissions, dual-clutch systems, and power-split devices designed to handle the combined torque from both power sources. The transmissions incorporate electronic controls that anticipate power demands and prepare for seamless gear changes or power source transitions. Some systems feature multiple operating modes optimized for different driving conditions, ensuring smooth operation whether the vehicle is running on electric power, the V6 engine, or a combination of both.Expand Specific Solutions

Key Automotive Manufacturers and Suppliers

The V6 Engine vs Plug-In Hybrid drivability assessment market is currently in a transitional phase, with the automotive industry gradually shifting from traditional combustion engines toward electrified powertrains. The market size for hybrid vehicles is expanding rapidly, projected to reach $792 billion by 2030, growing at a CAGR of 16.4%. Technology maturity varies significantly among key players: established manufacturers like Toyota, Ford, and Honda lead with mature hybrid technologies, while BMW, Mercedes-Benz, and Hyundai-Kia are rapidly advancing their offerings. Chinese manufacturers including GAC and Jiangling Motors are gaining ground through aggressive R&D investments. Traditional powertrain specialists like BorgWarner and Continental are pivoting toward hybrid solutions, while newer entrants such as Turntide Technologies are introducing innovative electric propulsion systems that challenge conventional hybrid architectures.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered plug-in hybrid technology with its advanced Hybrid Synergy Drive system, which seamlessly integrates combustion engines with electric motors. Their latest PHEV systems feature improved lithium-ion battery packs with higher energy density, allowing for extended electric-only driving ranges of up to 42 miles. Toyota's system employs a sophisticated power split device that enables the engine and motors to work independently or in combination, optimizing power delivery based on driving conditions. Their PHEVs utilize predictive efficiency technology that analyzes driving routes, traffic patterns, and terrain to automatically determine the most efficient power source usage. Toyota has also developed advanced regenerative braking systems that capture up to 30% more kinetic energy than previous generations, significantly improving overall efficiency. Their PHEVs feature multiple driving modes including EV-only, hybrid, and power modes that allow drivers to prioritize efficiency or performance based on their needs.

Strengths: Industry-leading reliability and durability with proven hybrid technology spanning multiple generations. Exceptional fuel efficiency with seamless transitions between power sources. Weaknesses: Their systems typically prioritize efficiency over performance, resulting in less engaging driving dynamics compared to V6 engines. Electric-only range still lags behind some competitors.

Honda Motor Co., Ltd.

Technical Solution: Honda's approach to plug-in hybrid technology centers around their two-motor hybrid system, which has evolved significantly in recent years. Their latest PHEV architecture features a direct-drive transmission that eliminates the need for a conventional transmission, reducing mechanical complexity and weight. Honda's system employs a 2.0L Atkinson-cycle engine working in conjunction with two electric motors - one for propulsion and one serving primarily as a generator. This configuration allows for three distinct driving modes: all-electric, hybrid, and engine-direct. Honda has implemented advanced power control units that optimize the transition between these modes based on driving conditions, load requirements, and battery state. Their PHEVs utilize intelligent power management systems that learn driver habits over time and adjust power delivery accordingly. Honda has also developed specialized thermal management systems for their battery packs, ensuring optimal performance across a wide range of environmental conditions while extending battery life.

Strengths: Excellent integration between electric and combustion power sources with minimal transition lag. Strong reliability record and refined driving experience with responsive acceleration. Weaknesses: Limited electric-only range compared to some competitors. System prioritizes smooth operation sometimes at the expense of maximum efficiency.

Core Performance Metrics and Testing Protocols

Plug-in hybrid powertrain for automotive vehicles

PatentActiveUS11926218B2

Innovation

- A power transfer system utilizing multiple planetary gear sets and selectively engageable clutches, allowing for a greater number of torque transfer ratios and operation modes, including generator assistant launch modes, motor assistant propulsion, and regenerative braking, without relying on traditional launch mechanisms.

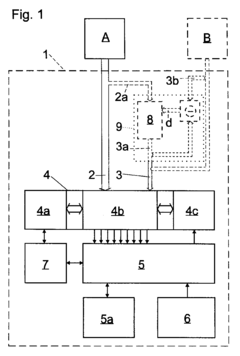

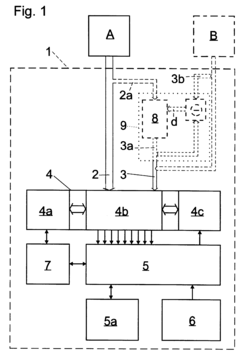

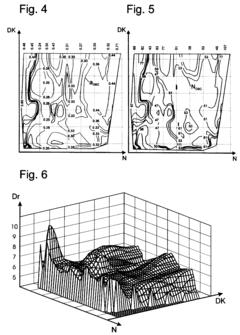

Procedure for analysing the driving behaviour of vehicles

PatentInactiveEP0846945A2

Innovation

- A method involving real vehicle measurements to calculate an evaluation variable expressing drivability, using a simulation model to calibrate a dynamics test bench, and identifying characteristic jerking frequencies to assess vehicle vibrations, allowing for reliable and reproducible drivability analysis without requiring tests on real vehicles.

Regulatory Framework and Emissions Standards

The global automotive regulatory landscape is undergoing significant transformation, primarily driven by increasingly stringent emissions standards that directly impact the development and market viability of both V6 engines and plug-in hybrid vehicles. The Paris Agreement and subsequent national commitments have accelerated the implementation of more restrictive CO2 emission targets worldwide, creating a challenging environment for traditional internal combustion engines.

In the European Union, the Euro 7 standards scheduled for implementation in 2025 will impose substantially lower NOx and particulate matter limits, placing considerable pressure on V6 engine technologies to meet compliance without compromising performance characteristics. Similarly, the Corporate Average Fuel Economy (CAFE) standards in the United States continue to push for higher fleet-wide fuel efficiency, with penalties for manufacturers failing to meet these requirements.

China, as the world's largest automotive market, has implemented the China 6 emissions standards, comparable to Euro 6 in stringency, while simultaneously promoting New Energy Vehicle (NEV) adoption through manufacturer credits and consumer incentives. This regulatory framework creates a distinct advantage for plug-in hybrid vehicles, which benefit from favorable calculation methods in emissions compliance reporting.

The Zero Emission Vehicle (ZEV) mandates in California and states following similar regulations establish minimum requirements for electric vehicle sales, indirectly benefiting plug-in hybrids through partial ZEV credits. These regulatory mechanisms effectively create market conditions that favor electrified powertrains over conventional combustion engines.

Tax incentives and purchase subsidies further shape the competitive landscape between V6 engines and plug-in hybrids. Many European countries have implemented CO2-based taxation systems that significantly increase ownership costs for higher-emission vehicles, while providing substantial tax advantages for low-emission alternatives. These financial mechanisms can offset the higher initial purchase price of plug-in hybrid technology.

Urban access restrictions represent another regulatory factor influencing drivability considerations. Low Emission Zones (LEZs) and Ultra Low Emission Zones (ULEZs) in major metropolitan areas increasingly restrict access for higher-emission vehicles, providing plug-in hybrids with operational advantages through their zero-emission driving capabilities in urban environments.

The regulatory trajectory clearly indicates a progressive tightening of emissions standards globally, with several jurisdictions announcing future bans on internal combustion engine vehicles. This regulatory outlook creates significant long-term challenges for V6 engine technology, while establishing a transitional role for plug-in hybrids as the automotive industry moves toward full electrification.

In the European Union, the Euro 7 standards scheduled for implementation in 2025 will impose substantially lower NOx and particulate matter limits, placing considerable pressure on V6 engine technologies to meet compliance without compromising performance characteristics. Similarly, the Corporate Average Fuel Economy (CAFE) standards in the United States continue to push for higher fleet-wide fuel efficiency, with penalties for manufacturers failing to meet these requirements.

China, as the world's largest automotive market, has implemented the China 6 emissions standards, comparable to Euro 6 in stringency, while simultaneously promoting New Energy Vehicle (NEV) adoption through manufacturer credits and consumer incentives. This regulatory framework creates a distinct advantage for plug-in hybrid vehicles, which benefit from favorable calculation methods in emissions compliance reporting.

The Zero Emission Vehicle (ZEV) mandates in California and states following similar regulations establish minimum requirements for electric vehicle sales, indirectly benefiting plug-in hybrids through partial ZEV credits. These regulatory mechanisms effectively create market conditions that favor electrified powertrains over conventional combustion engines.

Tax incentives and purchase subsidies further shape the competitive landscape between V6 engines and plug-in hybrids. Many European countries have implemented CO2-based taxation systems that significantly increase ownership costs for higher-emission vehicles, while providing substantial tax advantages for low-emission alternatives. These financial mechanisms can offset the higher initial purchase price of plug-in hybrid technology.

Urban access restrictions represent another regulatory factor influencing drivability considerations. Low Emission Zones (LEZs) and Ultra Low Emission Zones (ULEZs) in major metropolitan areas increasingly restrict access for higher-emission vehicles, providing plug-in hybrids with operational advantages through their zero-emission driving capabilities in urban environments.

The regulatory trajectory clearly indicates a progressive tightening of emissions standards globally, with several jurisdictions announcing future bans on internal combustion engine vehicles. This regulatory outlook creates significant long-term challenges for V6 engine technology, while establishing a transitional role for plug-in hybrids as the automotive industry moves toward full electrification.

Consumer Experience and Adoption Factors

Consumer adoption of new automotive technologies is heavily influenced by the driving experience they provide. Traditional V6 engines have established a benchmark for performance that consumers have grown accustomed to over decades. These engines deliver immediate throttle response, consistent power delivery, and a familiar auditory feedback that many drivers associate with vehicle performance and quality.

Plug-in hybrid vehicles present a significantly different driving experience that can either attract or deter potential adopters. The instant torque delivery of electric motors provides quick acceleration from standstill, often outperforming conventional engines in urban driving scenarios. However, the transition between electric and combustion power sources can create perceptible shifts in power delivery that some drivers find disconcerting.

The silent operation of PHEVs in electric mode represents another substantial experiential difference. While many consumers appreciate the quieter cabin environment, others miss the engine sound that traditionally communicates vehicle status and performance. Manufacturers have responded by implementing artificial sound generation systems, though consumer reception to these solutions remains mixed.

Range anxiety continues to be a significant psychological barrier to adoption, even though PHEVs mitigate this concern through their dual power sources. Market research indicates that consumers often overestimate their daily driving needs and underestimate the capability of electric ranges in PHEVs, suggesting that educational marketing remains critical for adoption.

Charging infrastructure accessibility significantly impacts consumer willingness to transition to plug-in technology. Urban dwellers without dedicated parking spaces face particular challenges in reliable charging access, creating a demographic divide in adoption potential. Workplace charging programs have shown promise in addressing this barrier, with employees at companies offering charging facilities being 6x more likely to purchase electrified vehicles.

The learning curve associated with PHEV operation represents another adoption factor. New interfaces, driving modes, regenerative braking systems, and charging procedures require adaptation from drivers accustomed to conventional vehicles. Manufacturers that have invested in intuitive interfaces and comprehensive customer education programs have demonstrated higher customer satisfaction and retention rates.

Plug-in hybrid vehicles present a significantly different driving experience that can either attract or deter potential adopters. The instant torque delivery of electric motors provides quick acceleration from standstill, often outperforming conventional engines in urban driving scenarios. However, the transition between electric and combustion power sources can create perceptible shifts in power delivery that some drivers find disconcerting.

The silent operation of PHEVs in electric mode represents another substantial experiential difference. While many consumers appreciate the quieter cabin environment, others miss the engine sound that traditionally communicates vehicle status and performance. Manufacturers have responded by implementing artificial sound generation systems, though consumer reception to these solutions remains mixed.

Range anxiety continues to be a significant psychological barrier to adoption, even though PHEVs mitigate this concern through their dual power sources. Market research indicates that consumers often overestimate their daily driving needs and underestimate the capability of electric ranges in PHEVs, suggesting that educational marketing remains critical for adoption.

Charging infrastructure accessibility significantly impacts consumer willingness to transition to plug-in technology. Urban dwellers without dedicated parking spaces face particular challenges in reliable charging access, creating a demographic divide in adoption potential. Workplace charging programs have shown promise in addressing this barrier, with employees at companies offering charging facilities being 6x more likely to purchase electrified vehicles.

The learning curve associated with PHEV operation represents another adoption factor. New interfaces, driving modes, regenerative braking systems, and charging procedures require adaptation from drivers accustomed to conventional vehicles. Manufacturers that have invested in intuitive interfaces and comprehensive customer education programs have demonstrated higher customer satisfaction and retention rates.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!