V6 Engine vs Hybrid Engine: Power Efficiency Comparison

SEP 4, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V6 and Hybrid Engine Evolution Background

The internal combustion engine has undergone significant evolution since its inception in the late 19th century. The V6 engine, characterized by its V-shaped cylinder arrangement, emerged in the 1950s as manufacturers sought more compact and efficient alternatives to inline and V8 configurations. The first production V6 engine was introduced by Lancia in 1950, featuring a 60-degree V-angle design that balanced performance with space efficiency. Throughout the 1960s and 1970s, V6 engines gained popularity in North America and Europe as fuel economy concerns grew following the oil crises.

By the 1980s, V6 engines had become mainstream, with manufacturers implementing technologies such as fuel injection, variable valve timing, and turbocharging to enhance performance while improving efficiency. The 1990s saw further refinements with the introduction of aluminum block construction, reducing weight and improving power-to-weight ratios. Modern V6 engines typically displace between 2.5 and 4.0 liters, producing anywhere from 200 to over 400 horsepower depending on application and level of forced induction.

Hybrid technology, meanwhile, traces its conceptual roots to the early 20th century, though practical implementation only materialized in the late 1990s. The watershed moment came in 1997 when Toyota introduced the Prius in Japan, followed by Honda's Insight in 1999, marking the first mass-produced hybrid vehicles. These early hybrids utilized a parallel hybrid system where both the internal combustion engine and electric motor could directly power the wheels.

The 2000s witnessed rapid advancement in hybrid technology, with the introduction of more sophisticated power-split systems that optimized the interaction between combustion engines and electric motors. Toyota's Hybrid Synergy Drive and Ford's similar system represented significant leaps in efficiency and reliability. By 2010, plug-in hybrid electric vehicles (PHEVs) entered the market, offering extended electric-only range and further reducing fuel consumption.

Current hybrid systems paired with V6 engines represent a convergence of these evolutionary paths. Luxury and performance brands like Lexus, Acura, and Porsche have developed sophisticated hybrid systems that use V6 engines as their combustion component, delivering both high performance and improved efficiency. These systems typically employ the V6 for high-load situations while utilizing electric power for low-speed operation and to fill torque gaps in the combustion engine's power delivery.

The technological progression of both V6 and hybrid systems has been driven by increasingly stringent emissions regulations, consumer demand for fuel efficiency, and the competitive pressure to deliver enhanced performance without sacrificing economy. This dual evolution provides the essential context for comparing modern V6 and hybrid powertrains in terms of power efficiency.

By the 1980s, V6 engines had become mainstream, with manufacturers implementing technologies such as fuel injection, variable valve timing, and turbocharging to enhance performance while improving efficiency. The 1990s saw further refinements with the introduction of aluminum block construction, reducing weight and improving power-to-weight ratios. Modern V6 engines typically displace between 2.5 and 4.0 liters, producing anywhere from 200 to over 400 horsepower depending on application and level of forced induction.

Hybrid technology, meanwhile, traces its conceptual roots to the early 20th century, though practical implementation only materialized in the late 1990s. The watershed moment came in 1997 when Toyota introduced the Prius in Japan, followed by Honda's Insight in 1999, marking the first mass-produced hybrid vehicles. These early hybrids utilized a parallel hybrid system where both the internal combustion engine and electric motor could directly power the wheels.

The 2000s witnessed rapid advancement in hybrid technology, with the introduction of more sophisticated power-split systems that optimized the interaction between combustion engines and electric motors. Toyota's Hybrid Synergy Drive and Ford's similar system represented significant leaps in efficiency and reliability. By 2010, plug-in hybrid electric vehicles (PHEVs) entered the market, offering extended electric-only range and further reducing fuel consumption.

Current hybrid systems paired with V6 engines represent a convergence of these evolutionary paths. Luxury and performance brands like Lexus, Acura, and Porsche have developed sophisticated hybrid systems that use V6 engines as their combustion component, delivering both high performance and improved efficiency. These systems typically employ the V6 for high-load situations while utilizing electric power for low-speed operation and to fill torque gaps in the combustion engine's power delivery.

The technological progression of both V6 and hybrid systems has been driven by increasingly stringent emissions regulations, consumer demand for fuel efficiency, and the competitive pressure to deliver enhanced performance without sacrificing economy. This dual evolution provides the essential context for comparing modern V6 and hybrid powertrains in terms of power efficiency.

Market Demand Analysis for Efficient Powertrains

The global automotive market is witnessing a significant shift toward more efficient powertrain technologies, driven primarily by stringent emission regulations, rising fuel costs, and increasing environmental consciousness among consumers. The comparison between traditional V6 engines and hybrid powertrains represents a critical decision point for manufacturers and consumers alike in this evolving landscape.

Market research indicates that hybrid vehicle sales have been growing at a compound annual growth rate of 16% globally since 2015, with particularly strong performance in Asia-Pacific and European markets. This growth trajectory is expected to continue as more countries announce plans to phase out internal combustion engines within the next 10-20 years.

Consumer surveys reveal that fuel efficiency has risen to become the second most important purchasing consideration after price, surpassing traditional priorities such as performance and brand loyalty. This shift is particularly pronounced among urban consumers and younger demographics, who demonstrate greater willingness to pay premium prices for hybrid technology.

Fleet operators and commercial vehicle sectors are increasingly evaluating total cost of ownership models that favor hybrid powertrains despite their higher initial acquisition costs. Analysis shows that the breakeven point for hybrid vehicles compared to V6-powered alternatives has decreased from approximately 7 years in 2010 to under 4 years in current market conditions, primarily due to fuel savings and reduced maintenance requirements.

Regional market variations show significant differences in adoption rates. European markets demonstrate stronger preference for hybrid powertrains due to higher fuel costs and urban emission zones. North American consumers continue to value the performance aspects of V6 engines, though hybrid adoption is accelerating in coastal urban centers. Asian markets show the fastest growth trajectory for hybrid technologies, particularly in Japan and China.

Industry forecasts project that by 2025, vehicles with some form of electrification (including mild hybrids, full hybrids, and plug-in hybrids) will represent over 40% of global new vehicle sales. This represents a fundamental market restructuring that is forcing traditional manufacturers to reconsider their powertrain development strategies and investment priorities.

The commercial vehicle segment presents a particularly interesting case study, with logistics companies increasingly adopting hybrid powertrains for urban delivery applications while maintaining V6 diesel options for long-haul transportation. This bifurcation of the market highlights how specific use cases continue to influence powertrain selection despite the overall trend toward electrification.

Market research indicates that hybrid vehicle sales have been growing at a compound annual growth rate of 16% globally since 2015, with particularly strong performance in Asia-Pacific and European markets. This growth trajectory is expected to continue as more countries announce plans to phase out internal combustion engines within the next 10-20 years.

Consumer surveys reveal that fuel efficiency has risen to become the second most important purchasing consideration after price, surpassing traditional priorities such as performance and brand loyalty. This shift is particularly pronounced among urban consumers and younger demographics, who demonstrate greater willingness to pay premium prices for hybrid technology.

Fleet operators and commercial vehicle sectors are increasingly evaluating total cost of ownership models that favor hybrid powertrains despite their higher initial acquisition costs. Analysis shows that the breakeven point for hybrid vehicles compared to V6-powered alternatives has decreased from approximately 7 years in 2010 to under 4 years in current market conditions, primarily due to fuel savings and reduced maintenance requirements.

Regional market variations show significant differences in adoption rates. European markets demonstrate stronger preference for hybrid powertrains due to higher fuel costs and urban emission zones. North American consumers continue to value the performance aspects of V6 engines, though hybrid adoption is accelerating in coastal urban centers. Asian markets show the fastest growth trajectory for hybrid technologies, particularly in Japan and China.

Industry forecasts project that by 2025, vehicles with some form of electrification (including mild hybrids, full hybrids, and plug-in hybrids) will represent over 40% of global new vehicle sales. This represents a fundamental market restructuring that is forcing traditional manufacturers to reconsider their powertrain development strategies and investment priorities.

The commercial vehicle segment presents a particularly interesting case study, with logistics companies increasingly adopting hybrid powertrains for urban delivery applications while maintaining V6 diesel options for long-haul transportation. This bifurcation of the market highlights how specific use cases continue to influence powertrain selection despite the overall trend toward electrification.

Current Technical Challenges in Engine Efficiency

The pursuit of engine efficiency faces significant technical barriers in both traditional V6 and hybrid engine designs. Current V6 engines struggle with thermodynamic limitations, with most modern internal combustion engines converting only 20-35% of fuel energy into useful mechanical work. The remaining energy dissipates as heat through exhaust gases and cooling systems, representing a fundamental challenge to efficiency improvement within the Carnot cycle constraints.

Friction losses present another major obstacle, accounting for approximately 15% of energy losses in V6 engines. Despite advancements in lubricants and materials science, moving components continue to generate significant mechanical resistance, particularly during cold starts and under varying load conditions.

Hybrid engines face their own set of challenges, primarily in energy conversion efficiency. The process of converting mechanical energy to electrical energy in generators, storing it in batteries, and then converting it back to mechanical energy through electric motors introduces cumulative efficiency losses at each conversion stage. Current hybrid systems typically experience 10-20% energy loss during these conversion processes.

Battery technology limitations severely constrain hybrid engine performance. Current lithium-ion batteries offer energy densities of 100-265 Wh/kg, significantly lower than gasoline's approximately 12,000 Wh/kg. This fundamental disparity creates challenges in weight management, packaging, and overall vehicle design. Additionally, battery performance degradation over time and in extreme temperature conditions remains problematic.

Thermal management represents a critical challenge for both engine types but manifests differently. V6 engines require sophisticated cooling systems to maintain optimal operating temperatures, while hybrid systems must balance the thermal needs of both combustion components and electrical systems, including battery temperature regulation to prevent degradation and ensure safety.

Control system complexity has increased exponentially in hybrid architectures. Engineers must develop algorithms that seamlessly integrate combustion and electric propulsion systems while optimizing for multiple objectives: power delivery, fuel efficiency, emissions control, and battery longevity. This multi-variable optimization problem requires sophisticated computing resources and extensive validation testing.

Weight distribution and packaging efficiency present significant engineering challenges, particularly in hybrid designs where additional components (batteries, motors, power electronics) must be integrated without compromising vehicle dynamics or interior space. The added weight of hybrid components (typically 100-300 kg) directly impacts efficiency gains, creating a technological paradox where efficiency-enhancing components add mass that reduces overall efficiency.

Friction losses present another major obstacle, accounting for approximately 15% of energy losses in V6 engines. Despite advancements in lubricants and materials science, moving components continue to generate significant mechanical resistance, particularly during cold starts and under varying load conditions.

Hybrid engines face their own set of challenges, primarily in energy conversion efficiency. The process of converting mechanical energy to electrical energy in generators, storing it in batteries, and then converting it back to mechanical energy through electric motors introduces cumulative efficiency losses at each conversion stage. Current hybrid systems typically experience 10-20% energy loss during these conversion processes.

Battery technology limitations severely constrain hybrid engine performance. Current lithium-ion batteries offer energy densities of 100-265 Wh/kg, significantly lower than gasoline's approximately 12,000 Wh/kg. This fundamental disparity creates challenges in weight management, packaging, and overall vehicle design. Additionally, battery performance degradation over time and in extreme temperature conditions remains problematic.

Thermal management represents a critical challenge for both engine types but manifests differently. V6 engines require sophisticated cooling systems to maintain optimal operating temperatures, while hybrid systems must balance the thermal needs of both combustion components and electrical systems, including battery temperature regulation to prevent degradation and ensure safety.

Control system complexity has increased exponentially in hybrid architectures. Engineers must develop algorithms that seamlessly integrate combustion and electric propulsion systems while optimizing for multiple objectives: power delivery, fuel efficiency, emissions control, and battery longevity. This multi-variable optimization problem requires sophisticated computing resources and extensive validation testing.

Weight distribution and packaging efficiency present significant engineering challenges, particularly in hybrid designs where additional components (batteries, motors, power electronics) must be integrated without compromising vehicle dynamics or interior space. The added weight of hybrid components (typically 100-300 kg) directly impacts efficiency gains, creating a technological paradox where efficiency-enhancing components add mass that reduces overall efficiency.

Comparative Analysis of V6 vs Hybrid Architectures

01 Hybrid powertrain integration with V6 engines

Integration of hybrid systems with V6 engines combines the power of internal combustion engines with electric motors to enhance overall efficiency. These systems typically include energy recovery mechanisms during braking and deceleration, power management controllers that optimize the distribution between combustion and electric power sources, and specialized transmission systems designed to handle both power sources. This integration allows for improved fuel economy while maintaining the performance characteristics of V6 engines.- Hybrid powertrain integration with V6 engines: Integration of hybrid systems with V6 engines combines conventional internal combustion power with electric propulsion to enhance overall efficiency. These systems typically incorporate electric motors, power controllers, and battery systems that work in conjunction with the V6 engine to optimize power delivery and reduce fuel consumption. The hybrid components can be configured in parallel, series, or power-split arrangements to maximize the efficiency benefits while maintaining performance characteristics.

- Engine control systems for efficiency optimization: Advanced control systems are implemented to optimize the operation of V6 and hybrid engines for maximum efficiency. These systems utilize sensors, electronic control units, and sophisticated algorithms to manage fuel injection, ignition timing, valve timing, and the coordination between combustion and electric power sources. By continuously monitoring operating conditions and adjusting parameters in real-time, these control systems can significantly improve fuel economy and reduce emissions while maintaining performance targets.

- Cylinder deactivation and variable displacement technologies: Cylinder deactivation technologies allow V6 engines to operate on fewer cylinders during light load conditions, effectively reducing displacement and improving fuel efficiency. When full power is not required, the system can deactivate specific cylinders by cutting fuel supply and keeping valves closed, reducing pumping losses and improving thermal efficiency. In hybrid configurations, this technology can be coordinated with electric power to provide seamless transitions between different operating modes.

- Energy recovery and regenerative systems: Energy recovery systems capture and repurpose energy that would otherwise be lost in conventional powertrains. These systems include regenerative braking, which converts kinetic energy during deceleration into electrical energy stored in batteries, and waste heat recovery systems that capture thermal energy from exhaust gases. When integrated with V6 engines in hybrid configurations, these technologies significantly improve overall system efficiency by recapturing energy that would traditionally be dissipated as heat.

- Transmission and power distribution optimization: Specialized transmission systems and power distribution mechanisms are designed to optimize the efficiency of V6 and hybrid powertrains. These include continuously variable transmissions, multi-speed automatic transmissions with hybrid integration, and power-split devices that efficiently distribute power between the combustion engine and electric motors. Advanced clutch systems and torque converters are also implemented to minimize power losses during various operating conditions, ensuring that power is delivered efficiently across all driving scenarios.

02 Engine control systems for optimizing V6 and hybrid efficiency

Advanced control systems are essential for maximizing the efficiency of both V6 engines and hybrid powertrains. These systems utilize real-time data monitoring, adaptive algorithms, and predictive modeling to optimize combustion parameters, electric power deployment, and energy recovery. Control strategies include variable valve timing adjustment, cylinder deactivation management, and intelligent battery charge/discharge cycles based on driving conditions and power demands, resulting in significant improvements in fuel economy and reduced emissions.Expand Specific Solutions03 Mechanical design innovations for V6 hybrid systems

Innovative mechanical designs enhance the efficiency of V6 hybrid systems through optimized component integration and reduced energy losses. These innovations include lightweight materials for engine blocks and components, reduced friction surfaces, improved thermal management systems, and compact packaging of hybrid components. Specialized crankshaft designs, balanced power delivery systems, and optimized combustion chamber geometries work together to maximize energy conversion efficiency while minimizing vibration and mechanical losses.Expand Specific Solutions04 Energy recovery and storage systems for hybrid V6 powertrains

Energy recovery and storage systems are critical components in hybrid V6 powertrains that capture, store, and redeploy energy that would otherwise be lost. These systems include regenerative braking mechanisms, high-efficiency battery technologies, ultracapacitors for rapid energy storage and release, and intelligent energy management systems. Advanced thermal management for battery systems and optimized power electronics contribute to improved overall system efficiency by ensuring that recovered energy is stored and utilized with minimal losses.Expand Specific Solutions05 Drive mode optimization for V6 hybrid efficiency

Drive mode optimization strategies enhance the efficiency of V6 hybrid systems by intelligently selecting the most efficient power source or combination based on driving conditions. These strategies include electric-only operation at low speeds, V6 engine operation at highway speeds, combined power for acceleration, and specialized modes for specific conditions such as city driving or mountain ascents. Adaptive learning algorithms continuously refine these strategies based on driver behavior, route characteristics, and environmental conditions to maximize overall powertrain efficiency.Expand Specific Solutions

Key Automotive Manufacturers and Engine Suppliers

The V6 vs Hybrid Engine power efficiency comparison market is in a transitional growth phase, with global automotive powertrain market valued at approximately $700 billion. Traditional V6 technology represents mature technology, while hybrid systems are in rapid growth stage with increasing adoption. Toyota leads hybrid innovation with established Hybrid Synergy Drive technology, followed by Honda's i-MMD system. Ford, GM, and Hyundai-Kia have made significant advancements in hybrid efficiency, with Hyundai's Smartstream powertrains gaining market share. Chinese manufacturers like Geely and GAC are rapidly closing the technology gap, while European players ZF and BAE Systems focus on specialized hybrid applications for commercial vehicles. The competitive landscape shows traditional OEMs investing heavily in hybrid technology to meet efficiency regulations.

GM Global Technology Operations LLC

Technical Solution: GM has developed a sophisticated two-mode hybrid system specifically designed to compete with traditional V6 engines while offering superior efficiency. Their technology utilizes a combination of two electric motors integrated with a conventional engine and a complex electronic continuously variable transmission (e-CVT). This system allows for pure electric operation at low speeds, engine-only operation at highway speeds, and combined power for acceleration. GM's hybrid technology demonstrates approximately 25-30% improvement in fuel efficiency compared to their V6 counterparts while maintaining comparable power outputs. Their latest systems incorporate cylinder deactivation technology that works in conjunction with the hybrid system, allowing the engine to operate on fewer cylinders when full power isn't needed. GM has also implemented advanced battery management systems that optimize power delivery and battery longevity, addressing one of the key concerns with hybrid powertrains. Their power management algorithms continuously adjust the power split between electric and combustion sources to maximize efficiency based on driving conditions.

Strengths: Excellent highway fuel economy; maintains strong towing capabilities unlike some hybrid systems; seamless transition between power modes. Weaknesses: More complex transmission system requiring specialized maintenance; higher initial cost compared to conventional V6 engines; slightly reduced cargo space in some vehicle implementations due to battery placement.

Ford Global Technologies LLC

Technical Solution: Ford has developed a PowerSplit hybrid architecture that directly competes with traditional V6 engines in their lineup. Their system combines a smaller displacement Atkinson-cycle engine with dual electric motors and a planetary gear set that functions as an electronically controlled continuously variable transmission. Ford's hybrid technology demonstrates 30-40% improvement in fuel efficiency compared to their V6 engines while delivering comparable power outputs. Their system features regenerative braking that captures up to 94% of braking energy that would otherwise be lost as heat. Ford has implemented sophisticated power management software that continuously optimizes the power split between combustion and electric sources based on driver demand and conditions. Their hybrid system incorporates active noise cancellation and enhanced sound insulation to compensate for the different operating characteristics compared to V6 engines. Ford has also developed hybrid-specific calibration for their electronic power-assisted steering systems to maintain the driving feel that V6 customers expect while operating with the hybrid powertrain. Recent iterations include advanced lithium-ion battery technology that offers improved power density and thermal management compared to earlier nickel-metal hydride systems.

Strengths: Excellent city fuel economy ratings; smooth power delivery; well-integrated regenerative braking system that feels natural to drivers. Weaknesses: More complex powertrain requiring specialized service knowledge; slightly reduced towing capacity compared to V6 alternatives in some applications; higher initial manufacturing cost affecting vehicle price point.

Core Innovations in Engine Power Efficiency

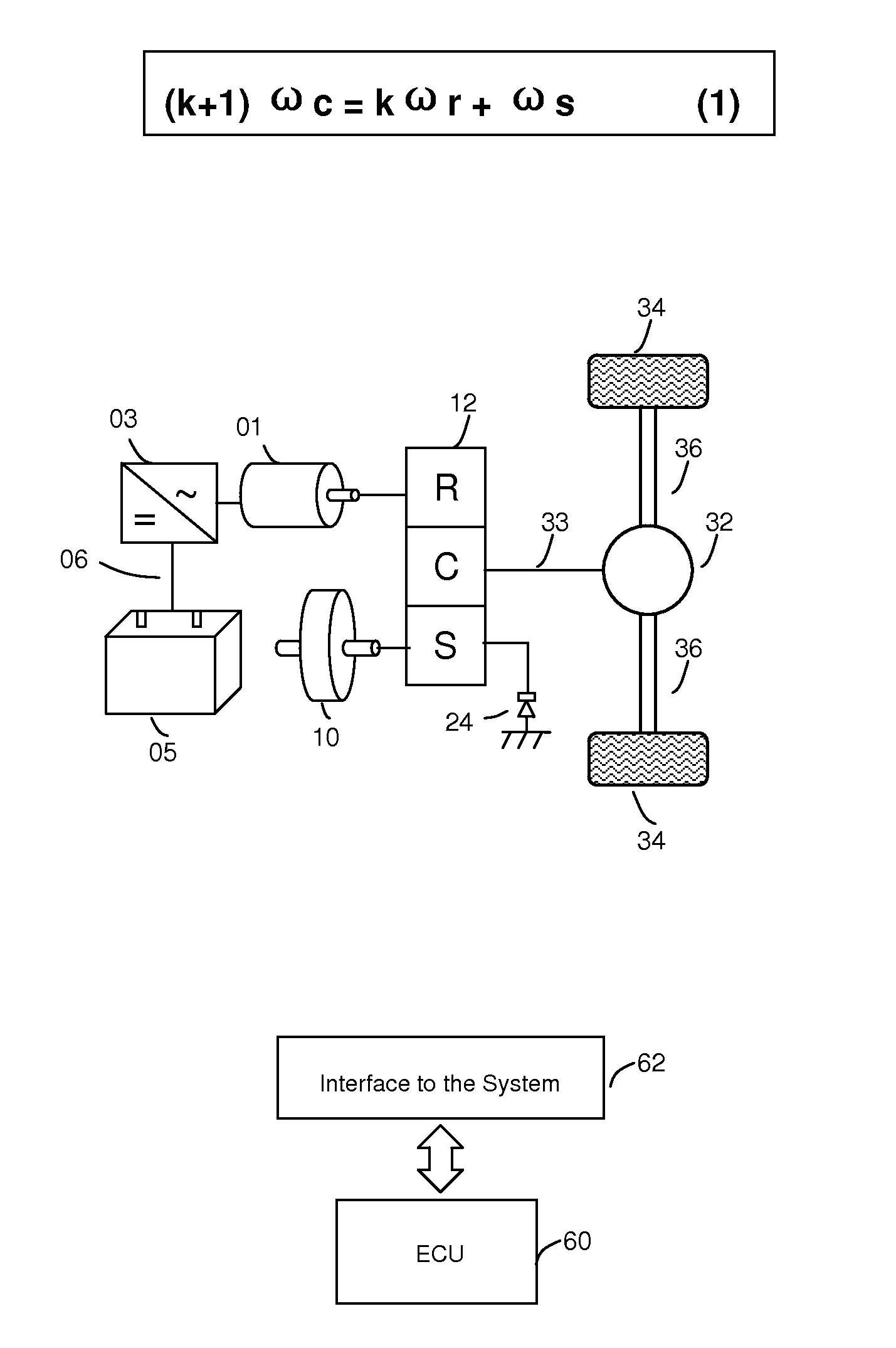

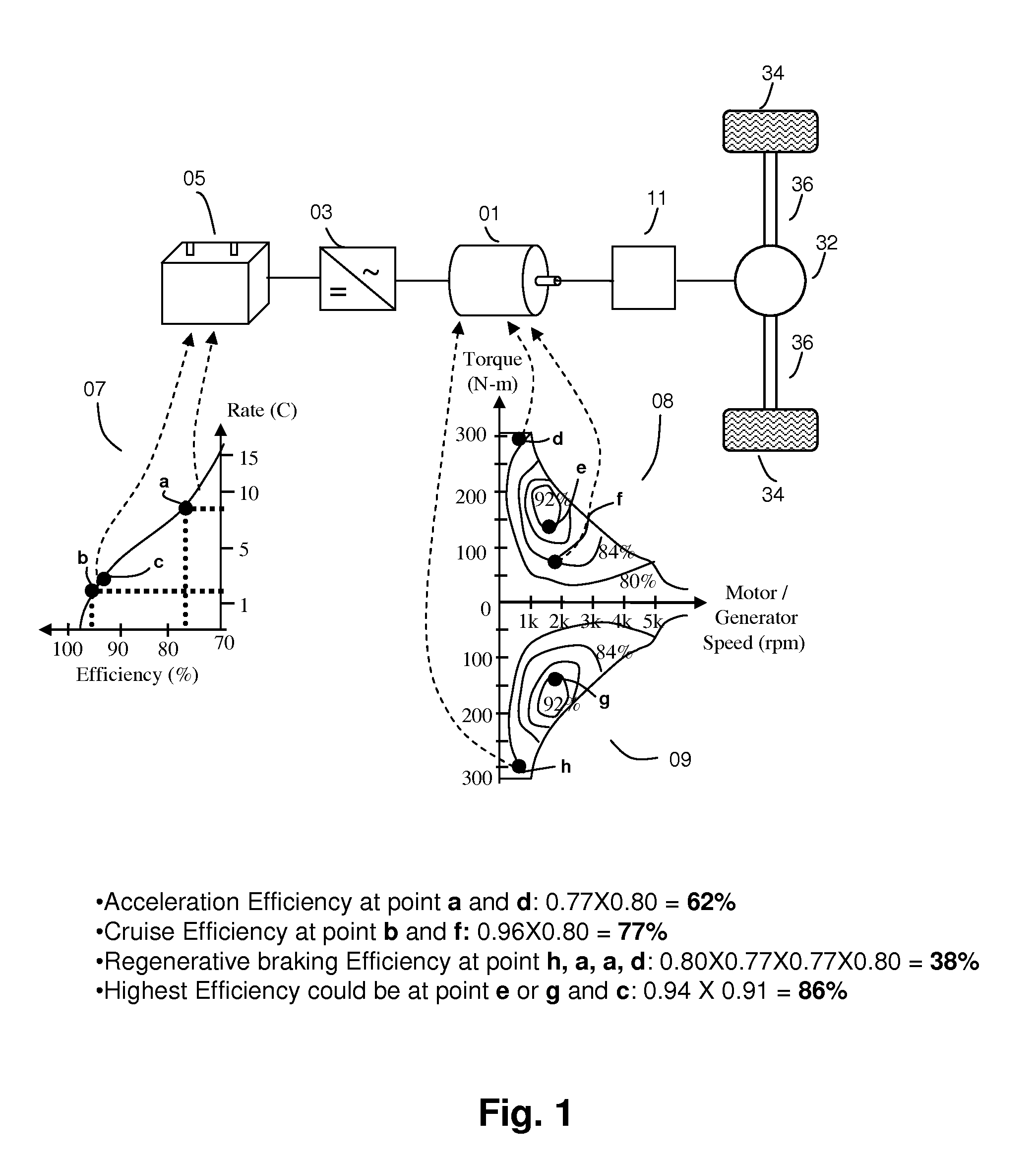

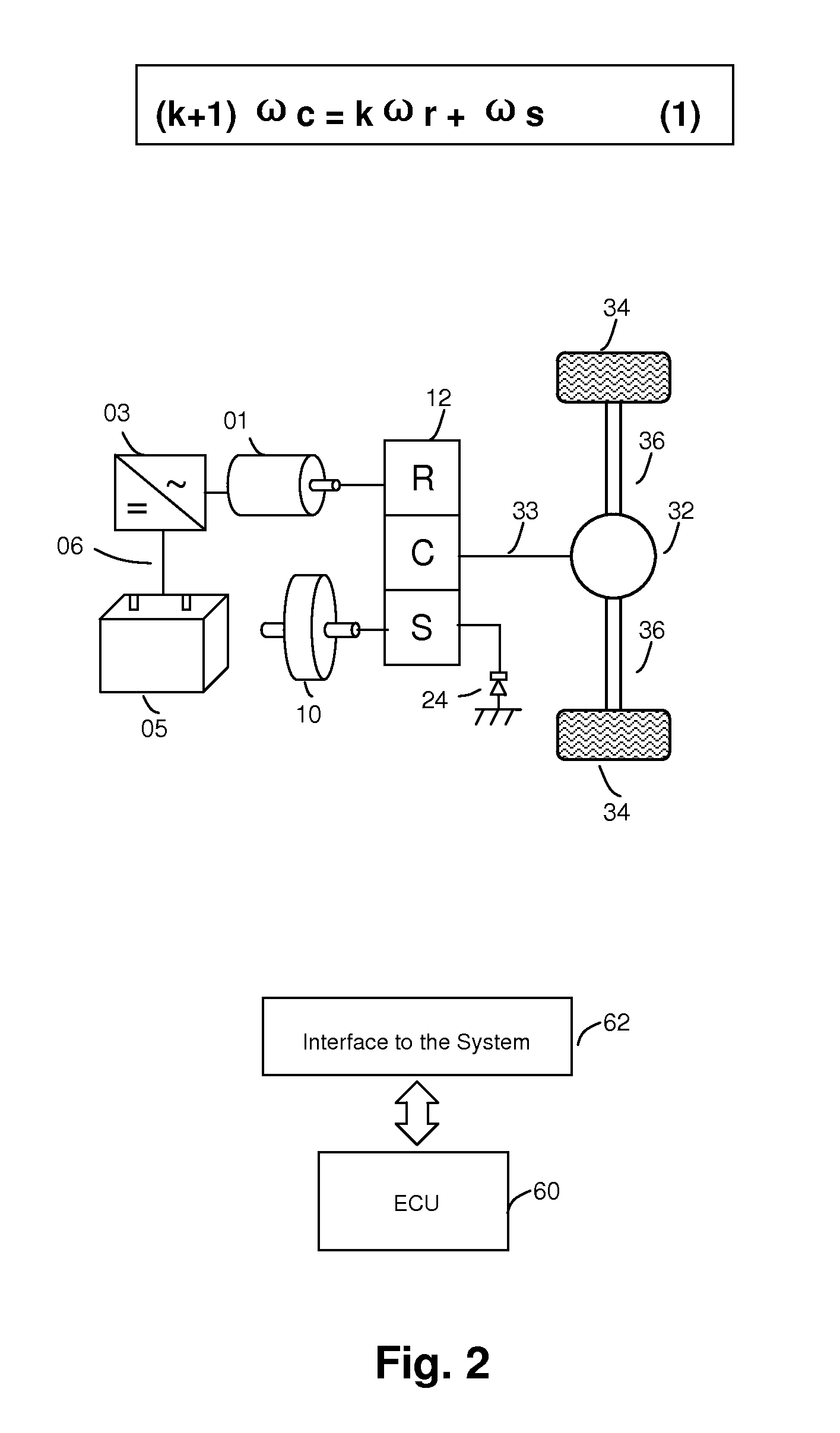

Hybrid engine system

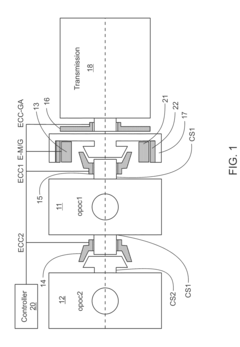

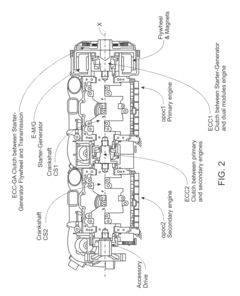

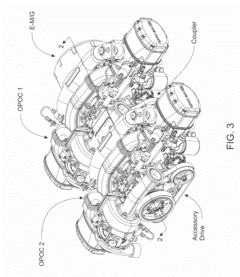

PatentInactiveUS8337359B2

Innovation

- A hybrid vehicle drive system utilizing two prime mover modules, a primary engine for maximum efficiency and a secondary engine for maximum power, combined with an electric motor/generator for supplemental power, allowing for efficient power transfer and control scenarios based on driving conditions, enabling a 'Limp Home' mode and zero emissions operation.

Powertrain and Method for a Kinetic Hybrid Vehicle

PatentInactiveUS20120196713A1

Innovation

- The use of a four-port compound power split continuously variable transmission (CVT) that connects the final drive to its own independent port, allowing the flywheel, engine, and motor/generator to share ports, eliminating the need for a separate engine transmission and minimizing energy conversion losses through direct mechanical energy transfer.

Environmental Impact and Emissions Regulations

The environmental impact of internal combustion engines versus hybrid powertrains represents a critical consideration in modern automotive engineering. Traditional V6 engines, while offering robust power delivery, typically produce significantly higher levels of greenhouse gas emissions compared to their hybrid counterparts. Carbon dioxide (CO2) emissions from V6 engines generally range from 200-300g/km, whereas comparable hybrid systems can reduce these figures by 25-40% through their ability to operate in electric-only mode for portions of the driving cycle.

Nitrogen oxides (NOx) and particulate matter emissions also demonstrate marked differences between these powertrain technologies. V6 engines, particularly those utilizing direct injection, face increasing challenges in meeting stringent NOx regulations without complex aftertreatment systems. Hybrid powertrains, by reducing reliance on combustion processes, inherently produce lower NOx emissions and require less extensive exhaust treatment technology.

Global emissions regulations continue to evolve rapidly, creating a complex regulatory landscape that heavily influences powertrain development strategies. The European Union's Euro 7 standards, expected to be implemented by 2025, will further reduce permissible NOx and particulate limits, potentially rendering conventional V6 technology economically unviable without significant technological advancement. Similarly, China's implementation of China 6 standards and the United States' Tier 3 regulations are progressively tightening emissions requirements.

Corporate Average Fuel Economy (CAFE) standards in various markets have become increasingly stringent, with fleet-wide targets that effectively mandate the inclusion of hybrid and electric technologies. Manufacturers must balance their product portfolios to achieve these targets, often using hybrid vehicles to offset the higher emissions of conventional powertrains in larger vehicle segments.

The lifecycle environmental assessment of both powertrain types reveals additional complexities. While hybrids demonstrate clear advantages in operational emissions, their production phase typically generates 15-20% higher carbon footprint due to battery manufacturing processes and rare earth elements required for electric motors. This production-phase impact partially offsets the operational benefits, though total lifecycle emissions still favor hybrid technology by approximately 20-30% over comparable V6 engines.

Regulatory incentives and penalties increasingly shape market dynamics, with many jurisdictions implementing tax benefits for lower-emission vehicles while imposing substantial penalties on manufacturers exceeding fleet emissions targets. These economic instruments are accelerating the transition toward hybrid and electric powertrains, creating market conditions where the efficiency advantages of hybrid systems translate directly to competitive advantages for manufacturers.

Nitrogen oxides (NOx) and particulate matter emissions also demonstrate marked differences between these powertrain technologies. V6 engines, particularly those utilizing direct injection, face increasing challenges in meeting stringent NOx regulations without complex aftertreatment systems. Hybrid powertrains, by reducing reliance on combustion processes, inherently produce lower NOx emissions and require less extensive exhaust treatment technology.

Global emissions regulations continue to evolve rapidly, creating a complex regulatory landscape that heavily influences powertrain development strategies. The European Union's Euro 7 standards, expected to be implemented by 2025, will further reduce permissible NOx and particulate limits, potentially rendering conventional V6 technology economically unviable without significant technological advancement. Similarly, China's implementation of China 6 standards and the United States' Tier 3 regulations are progressively tightening emissions requirements.

Corporate Average Fuel Economy (CAFE) standards in various markets have become increasingly stringent, with fleet-wide targets that effectively mandate the inclusion of hybrid and electric technologies. Manufacturers must balance their product portfolios to achieve these targets, often using hybrid vehicles to offset the higher emissions of conventional powertrains in larger vehicle segments.

The lifecycle environmental assessment of both powertrain types reveals additional complexities. While hybrids demonstrate clear advantages in operational emissions, their production phase typically generates 15-20% higher carbon footprint due to battery manufacturing processes and rare earth elements required for electric motors. This production-phase impact partially offsets the operational benefits, though total lifecycle emissions still favor hybrid technology by approximately 20-30% over comparable V6 engines.

Regulatory incentives and penalties increasingly shape market dynamics, with many jurisdictions implementing tax benefits for lower-emission vehicles while imposing substantial penalties on manufacturers exceeding fleet emissions targets. These economic instruments are accelerating the transition toward hybrid and electric powertrains, creating market conditions where the efficiency advantages of hybrid systems translate directly to competitive advantages for manufacturers.

Total Cost of Ownership Comparison

When comparing V6 engines and hybrid engines, total cost of ownership (TCO) represents a critical factor in decision-making beyond initial purchase price. The acquisition cost typically favors traditional V6 engines, which generally cost $3,000-$8,000 less than comparable hybrid models. However, this initial price advantage diminishes significantly when examining long-term ownership expenses.

Fuel consumption constitutes the most substantial operational cost difference. Hybrid vehicles demonstrate 30-50% better fuel efficiency compared to V6 counterparts, translating to annual savings of $800-$1,500 for average drivers (15,000 miles/year). At current fuel prices, this efficiency advantage allows hybrid owners to recoup their higher initial investment within 3-5 years of ownership.

Maintenance costs reveal another significant TCO differential. V6 engines require more frequent oil changes, have more complex cooling systems, and contain additional mechanical components prone to wear. Conversely, hybrid systems benefit from regenerative braking that reduces brake wear by up to 50%, extending brake pad and rotor life considerably. However, hybrid-specific components like high-voltage batteries introduce unique maintenance considerations.

Battery replacement represents the most substantial potential expense for hybrid owners. While modern hybrid batteries typically carry 8-10 year warranties, eventual replacement costs range from $2,000-$4,500. This expense must be factored into long-term ownership calculations, though battery longevity continues to improve with technological advancements.

Depreciation patterns also differ significantly between these powertrain options. Historically, hybrids maintained stronger residual values, depreciating 5-10% less over five years compared to equivalent V6 models. This trend has stabilized somewhat as hybrid technology has become more mainstream, but still provides hybrid owners with a financial advantage at resale.

Insurance costs typically run 5-15% higher for hybrid vehicles due to their more complex systems and higher replacement part costs. However, many insurers now offer green vehicle discounts that can partially offset this difference. Additionally, some regions provide tax incentives, reduced registration fees, and other financial benefits for hybrid ownership that can substantially improve the TCO equation.

When analyzed over a 10-year ownership period, hybrid vehicles demonstrate a 15-25% lower total cost of ownership compared to V6 engines in most usage scenarios, with the advantage increasing for drivers with higher annual mileage or those operating primarily in urban environments with frequent stop-and-go driving.

Fuel consumption constitutes the most substantial operational cost difference. Hybrid vehicles demonstrate 30-50% better fuel efficiency compared to V6 counterparts, translating to annual savings of $800-$1,500 for average drivers (15,000 miles/year). At current fuel prices, this efficiency advantage allows hybrid owners to recoup their higher initial investment within 3-5 years of ownership.

Maintenance costs reveal another significant TCO differential. V6 engines require more frequent oil changes, have more complex cooling systems, and contain additional mechanical components prone to wear. Conversely, hybrid systems benefit from regenerative braking that reduces brake wear by up to 50%, extending brake pad and rotor life considerably. However, hybrid-specific components like high-voltage batteries introduce unique maintenance considerations.

Battery replacement represents the most substantial potential expense for hybrid owners. While modern hybrid batteries typically carry 8-10 year warranties, eventual replacement costs range from $2,000-$4,500. This expense must be factored into long-term ownership calculations, though battery longevity continues to improve with technological advancements.

Depreciation patterns also differ significantly between these powertrain options. Historically, hybrids maintained stronger residual values, depreciating 5-10% less over five years compared to equivalent V6 models. This trend has stabilized somewhat as hybrid technology has become more mainstream, but still provides hybrid owners with a financial advantage at resale.

Insurance costs typically run 5-15% higher for hybrid vehicles due to their more complex systems and higher replacement part costs. However, many insurers now offer green vehicle discounts that can partially offset this difference. Additionally, some regions provide tax incentives, reduced registration fees, and other financial benefits for hybrid ownership that can substantially improve the TCO equation.

When analyzed over a 10-year ownership period, hybrid vehicles demonstrate a 15-25% lower total cost of ownership compared to V6 engines in most usage scenarios, with the advantage increasing for drivers with higher annual mileage or those operating primarily in urban environments with frequent stop-and-go driving.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!