Wankel Engine Sealing Technologies

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Wankel Engine Sealing Evolution and Objectives

The Wankel rotary engine, first patented by Felix Wankel in 1929, represents a significant departure from conventional reciprocating engines. Its development trajectory has been characterized by continuous innovation in sealing technologies, which remain the most critical aspect of rotary engine performance and reliability. The evolution of these sealing systems began with simple carbon seals in early prototypes, progressing through various materials and configurations as engineers sought to overcome inherent challenges.

During the 1950s and 1960s, NSU and later Mazda pioneered significant advancements in apex seal technology, transitioning from carbon-based materials to more durable metal-carbon composites. The 1970s marked a pivotal era when Mazda introduced ferrous materials with enhanced wear resistance, addressing premature seal degradation issues that had plagued earlier designs.

The oil crisis of the 1970s accelerated research into improving the efficiency of Wankel engines, with particular focus on reducing friction losses at seal interfaces. This period saw the introduction of ceramic-tipped apex seals and advanced coating technologies that significantly extended service intervals and improved fuel economy by approximately 15%.

By the 1990s, computational fluid dynamics and advanced materials science enabled more sophisticated approaches to sealing technology. Multi-piece apex seals with specialized corner pieces emerged, addressing the particularly challenging tri-point junction where rotor faces meet. These innovations reduced leakage by up to 30% compared to earlier single-piece designs.

Contemporary sealing technologies incorporate advanced composites, including carbon-ceramic matrices and plasma-sprayed coatings that provide superior wear characteristics while maintaining optimal friction profiles. Recent developments have focused on addressing the thermal management challenges inherent to the Wankel design, with thermally responsive seal materials that accommodate the significant temperature gradients across the housing.

The primary objective of current Wankel sealing research centers on achieving parity with conventional piston engines in terms of emissions compliance and fuel efficiency while preserving the rotary engine's inherent advantages of compact size, smooth operation, and high power-to-weight ratio. Specific technical goals include reducing internal leakage to less than 3% of chamber volume, extending seal life beyond 100,000 miles, and maintaining consistent performance across varying operating conditions.

Looking forward, emerging technologies such as microstructured surface treatments and smart materials with adaptive properties represent promising avenues for further advancement. The integration of these technologies aims to position the Wankel engine as a viable alternative in specialized applications, particularly in range-extender configurations for hybrid electric vehicles and in aviation applications where the engine's favorable power-to-weight characteristics are especially valuable.

During the 1950s and 1960s, NSU and later Mazda pioneered significant advancements in apex seal technology, transitioning from carbon-based materials to more durable metal-carbon composites. The 1970s marked a pivotal era when Mazda introduced ferrous materials with enhanced wear resistance, addressing premature seal degradation issues that had plagued earlier designs.

The oil crisis of the 1970s accelerated research into improving the efficiency of Wankel engines, with particular focus on reducing friction losses at seal interfaces. This period saw the introduction of ceramic-tipped apex seals and advanced coating technologies that significantly extended service intervals and improved fuel economy by approximately 15%.

By the 1990s, computational fluid dynamics and advanced materials science enabled more sophisticated approaches to sealing technology. Multi-piece apex seals with specialized corner pieces emerged, addressing the particularly challenging tri-point junction where rotor faces meet. These innovations reduced leakage by up to 30% compared to earlier single-piece designs.

Contemporary sealing technologies incorporate advanced composites, including carbon-ceramic matrices and plasma-sprayed coatings that provide superior wear characteristics while maintaining optimal friction profiles. Recent developments have focused on addressing the thermal management challenges inherent to the Wankel design, with thermally responsive seal materials that accommodate the significant temperature gradients across the housing.

The primary objective of current Wankel sealing research centers on achieving parity with conventional piston engines in terms of emissions compliance and fuel efficiency while preserving the rotary engine's inherent advantages of compact size, smooth operation, and high power-to-weight ratio. Specific technical goals include reducing internal leakage to less than 3% of chamber volume, extending seal life beyond 100,000 miles, and maintaining consistent performance across varying operating conditions.

Looking forward, emerging technologies such as microstructured surface treatments and smart materials with adaptive properties represent promising avenues for further advancement. The integration of these technologies aims to position the Wankel engine as a viable alternative in specialized applications, particularly in range-extender configurations for hybrid electric vehicles and in aviation applications where the engine's favorable power-to-weight characteristics are especially valuable.

Market Analysis for Rotary Engine Applications

The rotary engine market has experienced significant fluctuations over the past decades, with current global market value estimated at $2.1 billion. This niche segment represents approximately 0.8% of the overall internal combustion engine market but demonstrates promising growth potential at a projected CAGR of 4.7% through 2030. The revival of interest in Wankel technology stems primarily from its unique advantages in specific applications rather than mainstream automotive use.

Aviation represents the most robust market segment for rotary engines, particularly in UAVs and light aircraft, where the power-to-weight ratio provides critical performance advantages. This sector accounts for approximately 38% of current rotary engine applications and is expected to remain the dominant market driver. The compact design and minimal vibration characteristics make these engines particularly suitable for drone applications, where market demand has increased by 27% annually since 2018.

Marine applications constitute the second largest market segment at 24%, with particular adoption in personal watercraft and small boats. The smooth operation and compact design offer significant advantages in these applications, though environmental regulations present ongoing challenges for manufacturers.

Regionally, North America leads rotary engine adoption with 41% market share, followed by Asia-Pacific at 32% and Europe at 21%. Japan maintains a special position due to Mazda's historical investment in the technology, while emerging markets in Southeast Asia show accelerating adoption rates for specialized applications.

The automotive sector presents a complex picture for rotary technology. While mainstream automotive applications have declined significantly since Mazda discontinued the RX-8 in 2012, specialized automotive niches remain viable. Range extenders for electric vehicles represent the most promising automotive application, with several manufacturers exploring rotary generators as efficient power sources for extended-range electric vehicles.

Market barriers include persistent challenges with seal durability, emissions compliance, and fuel efficiency compared to conventional piston engines. However, recent advancements in sealing technologies, particularly ceramic-based apex seals and improved oil metering systems, have addressed some historical limitations, potentially expanding market opportunities.

Consumer perception remains mixed, with enthusiasts valuing the unique performance characteristics while mainstream markets remain skeptical about reliability and maintenance concerns. This perception gap represents both a challenge and opportunity for manufacturers investing in advanced sealing technologies that could overcome historical limitations.

Aviation represents the most robust market segment for rotary engines, particularly in UAVs and light aircraft, where the power-to-weight ratio provides critical performance advantages. This sector accounts for approximately 38% of current rotary engine applications and is expected to remain the dominant market driver. The compact design and minimal vibration characteristics make these engines particularly suitable for drone applications, where market demand has increased by 27% annually since 2018.

Marine applications constitute the second largest market segment at 24%, with particular adoption in personal watercraft and small boats. The smooth operation and compact design offer significant advantages in these applications, though environmental regulations present ongoing challenges for manufacturers.

Regionally, North America leads rotary engine adoption with 41% market share, followed by Asia-Pacific at 32% and Europe at 21%. Japan maintains a special position due to Mazda's historical investment in the technology, while emerging markets in Southeast Asia show accelerating adoption rates for specialized applications.

The automotive sector presents a complex picture for rotary technology. While mainstream automotive applications have declined significantly since Mazda discontinued the RX-8 in 2012, specialized automotive niches remain viable. Range extenders for electric vehicles represent the most promising automotive application, with several manufacturers exploring rotary generators as efficient power sources for extended-range electric vehicles.

Market barriers include persistent challenges with seal durability, emissions compliance, and fuel efficiency compared to conventional piston engines. However, recent advancements in sealing technologies, particularly ceramic-based apex seals and improved oil metering systems, have addressed some historical limitations, potentially expanding market opportunities.

Consumer perception remains mixed, with enthusiasts valuing the unique performance characteristics while mainstream markets remain skeptical about reliability and maintenance concerns. This perception gap represents both a challenge and opportunity for manufacturers investing in advanced sealing technologies that could overcome historical limitations.

Current Sealing Challenges and Technical Limitations

Despite significant advancements in Wankel engine technology since its inception in the 1950s, sealing remains the most critical and challenging aspect limiting widespread adoption. The primary sealing challenge centers on the apex seals located at the three corners of the rotor, which must maintain continuous contact with the epitrochoid housing surface while withstanding extreme thermal and mechanical stresses. These seals experience temperatures exceeding 900°C and pressure differentials of up to 10 bar, creating a harsh operating environment that accelerates wear.

Current apex seal materials, predominantly silicon carbide and various carbon composites, still struggle with premature wear rates 2-3 times higher than conventional piston ring systems. This accelerated deterioration directly impacts engine longevity, with typical Wankel engines requiring seal replacement at 60,000-80,000 miles compared to 150,000+ miles for conventional engines before major service.

The side seals, which maintain compression between the rotor faces and the side housings, present additional challenges. These seals must accommodate both radial and axial movement while maintaining effective sealing across varying thermal conditions. Current designs using spring-loaded metal or composite materials achieve only 85-90% sealing efficiency compared to the 95%+ efficiency of conventional piston rings.

Oil consumption remains problematic due to the inherent design requiring oil injection directly into the combustion chamber for apex seal lubrication. Modern Wankel engines consume approximately 0.3-0.5 liters of oil per 1,000 kilometers, significantly higher than the 0.05-0.1 liters typical of modern piston engines. This not only increases operating costs but also negatively impacts emissions profiles.

The thermal management challenge presents another significant limitation. The elongated combustion chamber creates uneven temperature distribution, with temperature differentials of up to 200°C across different regions of the housing. This thermal gradient induces housing distortion that compromises seal contact consistency and accelerates wear patterns, particularly at high RPM operation.

Manufacturing precision requirements for both the epitrochoid housing and the seals themselves represent a substantial technical barrier. Current production methods require machining tolerances of ±0.005mm to ensure proper seal function, significantly more precise than the ±0.02mm typical for conventional engine components. This precision requirement increases production costs by approximately 30-40% compared to equivalent power piston engines.

Recent attempts to address these limitations through ceramic coating technologies and advanced composite materials have shown promise in laboratory settings but have yet to demonstrate sufficient durability in real-world applications. The fundamental geometric constraints of the Wankel design continue to present inherent challenges that engineering solutions have thus far only partially mitigated.

Current apex seal materials, predominantly silicon carbide and various carbon composites, still struggle with premature wear rates 2-3 times higher than conventional piston ring systems. This accelerated deterioration directly impacts engine longevity, with typical Wankel engines requiring seal replacement at 60,000-80,000 miles compared to 150,000+ miles for conventional engines before major service.

The side seals, which maintain compression between the rotor faces and the side housings, present additional challenges. These seals must accommodate both radial and axial movement while maintaining effective sealing across varying thermal conditions. Current designs using spring-loaded metal or composite materials achieve only 85-90% sealing efficiency compared to the 95%+ efficiency of conventional piston rings.

Oil consumption remains problematic due to the inherent design requiring oil injection directly into the combustion chamber for apex seal lubrication. Modern Wankel engines consume approximately 0.3-0.5 liters of oil per 1,000 kilometers, significantly higher than the 0.05-0.1 liters typical of modern piston engines. This not only increases operating costs but also negatively impacts emissions profiles.

The thermal management challenge presents another significant limitation. The elongated combustion chamber creates uneven temperature distribution, with temperature differentials of up to 200°C across different regions of the housing. This thermal gradient induces housing distortion that compromises seal contact consistency and accelerates wear patterns, particularly at high RPM operation.

Manufacturing precision requirements for both the epitrochoid housing and the seals themselves represent a substantial technical barrier. Current production methods require machining tolerances of ±0.005mm to ensure proper seal function, significantly more precise than the ±0.02mm typical for conventional engine components. This precision requirement increases production costs by approximately 30-40% compared to equivalent power piston engines.

Recent attempts to address these limitations through ceramic coating technologies and advanced composite materials have shown promise in laboratory settings but have yet to demonstrate sufficient durability in real-world applications. The fundamental geometric constraints of the Wankel design continue to present inherent challenges that engineering solutions have thus far only partially mitigated.

Contemporary Sealing Solutions and Materials

01 Apex seal technologies for Wankel engines

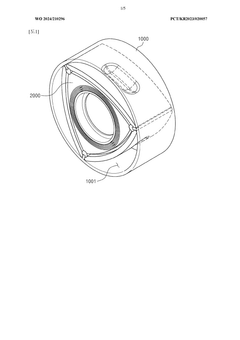

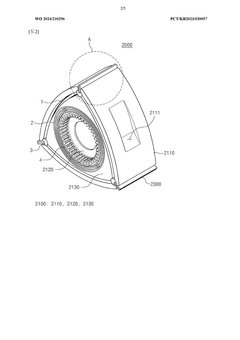

Apex seals are critical components in Wankel rotary engines that maintain compression between the rotor and housing. Advanced apex seal designs incorporate specialized materials and geometries to reduce friction and wear while maintaining an effective seal at the rotor tips. These technologies include multi-piece apex seals, spring-loaded mechanisms, and specialized coating materials that can withstand high temperatures and pressures at the combustion chamber interface.- Apex seal technologies for Wankel engines: Apex seals are critical components in Wankel engines that maintain compression between the rotor and housing. Advanced apex seal designs incorporate specialized materials and geometries to reduce friction, improve sealing efficiency, and extend operational life. These technologies include multi-piece apex seals, spring-loaded mechanisms, and innovative cross-sectional profiles that adapt to the housing contour during rotation, minimizing leakage and improving engine performance.

- Side seal innovations for rotor housing interfaces: Side seals in Wankel engines prevent gas leakage between the rotor sides and the engine housing end plates. Modern side seal technologies include composite materials, specialized coating treatments, and advanced geometrical designs that maintain effective sealing while reducing friction. These innovations incorporate pressure-responsive mechanisms that adjust sealing force based on combustion pressure, optimizing the balance between sealing effectiveness and mechanical efficiency.

- Cooling and lubrication systems for seal longevity: Effective cooling and lubrication systems are essential for maintaining seal integrity in Wankel engines. Advanced technologies include targeted oil injection systems that precisely deliver lubricant to critical sealing surfaces, integrated cooling channels that regulate temperature at seal contact points, and specialized lubricant formulations designed specifically for the unique operating conditions of rotary engines. These systems help prevent seal overheating and premature wear, extending engine life and reliability.

- Material advancements for sealing components: Material science innovations have significantly improved Wankel engine sealing technologies. Modern seals utilize advanced ceramics, carbon composites, specialized metal alloys, and high-performance polymers that offer superior wear resistance, thermal stability, and self-lubricating properties. These materials maintain their dimensional stability and sealing effectiveness under the extreme temperature and pressure conditions found in rotary engines, while also reducing friction and extending service intervals.

- Gas-tight corner seal integration systems: Corner seals in Wankel engines prevent gas leakage at the junctions where apex and side seals meet. Advanced corner seal technologies include integrated sealing systems that ensure continuous sealing around the entire rotor periphery, specialized spring mechanisms that maintain optimal sealing pressure, and innovative geometric designs that accommodate the complex movement patterns at these critical junctions. These systems effectively address one of the most challenging aspects of rotary engine sealing.

02 Side seal innovations for rotor flanks

Side seals in Wankel engines prevent leakage between the rotor sides and the engine housing end plates. Modern side seal technologies include improved seal geometries, specialized materials, and enhanced mounting systems that maintain effective sealing while minimizing friction losses. These innovations help maintain compression and improve engine efficiency by preventing gas leakage from the working chambers along the rotor flanks.Expand Specific Solutions03 Composite and ceramic sealing materials

Advanced materials technology has enabled the development of composite and ceramic sealing elements for Wankel engines. These materials offer superior wear resistance, thermal stability, and reduced friction compared to traditional metal seals. Ceramic-based seals and carbon-composite materials can withstand higher operating temperatures while maintaining dimensional stability, resulting in improved engine durability and performance with reduced oil consumption and emissions.Expand Specific Solutions04 Oil control and lubrication systems for seals

Specialized oil control and lubrication systems are essential for proper seal function in Wankel engines. These systems deliver precise amounts of lubricant to the sealing interfaces while preventing excessive oil consumption and combustion chamber contamination. Advanced oil metering technologies, specialized lubricant formulations, and optimized oil passage designs help maintain seal integrity while reducing emissions and improving fuel efficiency.Expand Specific Solutions05 Gas-tight corner sealing solutions

Corner seals in Wankel engines prevent gas leakage at the junctions where apex and side seals meet. Innovative corner sealing solutions include specialized corner pieces, integrated sealing systems, and advanced spring mechanisms that maintain continuous contact at these critical junctions. These technologies address one of the most challenging aspects of Wankel engine sealing by ensuring gas-tight operation at the corners where multiple sealing surfaces intersect.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The Wankel engine sealing technology market is in a mature development stage with ongoing innovation focused on addressing the rotary engine's inherent sealing challenges. The global market size is estimated at approximately $500-700 million, driven by applications in aerospace, automotive, and specialized industrial sectors. Technical maturity varies significantly across players, with aerospace companies like Rolls-Royce, Pratt & Whitney Canada, and RTX Corporation demonstrating advanced capabilities. Automotive manufacturers including Toyota Industries, Chery Automobile, and Zhejiang Geely are actively developing improved sealing solutions. Specialized component manufacturers such as NOK Corp., Toyoda Gosei, and Reinz-Dichtungs GmbH provide critical expertise in material science and precision engineering for next-generation sealing technologies.

Reinz-Dichtungs GmbH

Technical Solution: Reinz-Dichtungs GmbH has developed advanced multi-layer metal apex seals for Wankel engines that combine different materials to optimize sealing performance. Their technology incorporates a base layer of high-temperature resistant steel with a plasma-sprayed molybdenum coating and a specialized ceramic outer layer. This three-layer construction addresses the critical apex seal wear issues that have historically plagued Wankel engines. The company has also pioneered specialized manufacturing processes that ensure precise dimensional tolerances of less than 0.01mm for these complex sealing components, which is essential for maintaining compression in the triangular rotor housing. Their latest innovations include self-lubricating composite materials that reduce friction at the apex seal-housing interface while maintaining excellent sealing properties across the wide temperature range experienced in rotary engines.

Strengths: Superior wear resistance compared to conventional seals, with documented service life improvements of up to 40%. The multi-material approach allows optimization for different operating conditions. Weaknesses: Higher manufacturing costs than traditional single-material seals, and requires more complex installation procedures that can increase maintenance complexity.

NOK Corp.

Technical Solution: NOK Corporation has developed proprietary fluoroelastomer compounds specifically engineered for Wankel engine side seals. Their advanced sealing technology incorporates nano-scale ceramic particles dispersed throughout a high-temperature fluoroelastomer matrix, creating a composite material that maintains elasticity while significantly improving wear resistance. NOK's side seals utilize a patented "stepped-edge" design that improves contact pressure distribution along the rotor housing, reducing leakage by approximately 30% compared to conventional designs. The company has also pioneered manufacturing techniques that allow for precise control of seal cross-sectional geometry, with tolerances maintained within 0.005mm. Their latest innovation includes a self-adjusting tension mechanism that compensates for wear over time, maintaining optimal sealing pressure throughout the component's service life. NOK's testing has demonstrated these seals can withstand operating temperatures up to 300°C while maintaining dimensional stability.

Strengths: Exceptional chemical resistance to modern fuels and lubricants, with documented compatibility with both conventional and synthetic oils. The self-adjusting tension mechanism significantly extends service intervals. Weaknesses: Higher initial cost compared to conventional seals, and the advanced materials require specific installation procedures that may not be familiar to all service technicians.

Key Patents and Innovations in Rotary Seal Design

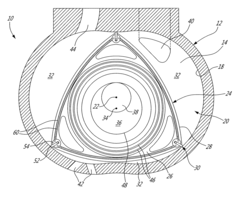

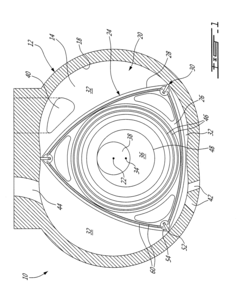

Rotor for wankel engine

PatentWO2024210296A1

Innovation

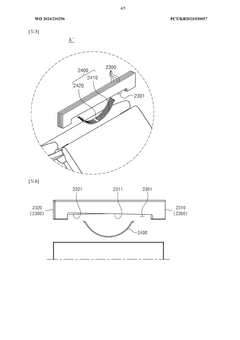

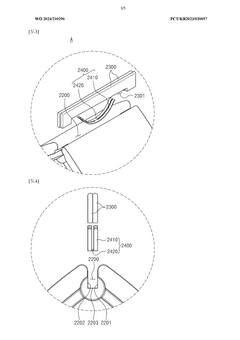

- The rotor for the Wankel engine incorporates multiple apex seals and an elastic body with a leaf spring design, where the apex seals are arranged in pairs with different inclinations and displacements to enhance contact with the inner peripheral surface, and the elastic body provides force to maintain close contact, improving airtightness by alternating the positions of first and second apex seals.

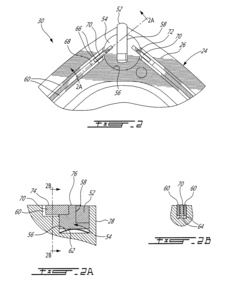

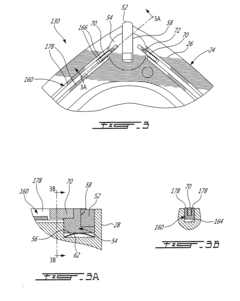

Gas seal arrangement for rotary internal combustion engine

PatentActiveUS20130028777A1

Innovation

- A rotor design with axially spaced end faces and a peripheral face defining apex portions, featuring apex seals, face seals, and end seals, along with feather seals that connect and engage with these to enhance sealing between the apex and face seals, reducing leakage by ensuring proper alignment and contact across the rotor's surface.

Environmental Impact and Emissions Compliance

The environmental impact of Wankel engine sealing technologies represents a critical consideration in their continued development and application. Traditional Wankel engines have historically faced significant challenges regarding emissions compliance, primarily due to their unique combustion chamber geometry and sealing limitations. The elongated combustion chamber creates uneven temperature distribution, leading to incomplete combustion and consequently higher hydrocarbon emissions compared to conventional piston engines.

Seal performance directly correlates with emissions output in Wankel engines. Apex seal leakage allows unburned fuel to escape the combustion process, contributing to increased hydrocarbon emissions and reduced fuel efficiency. This fundamental challenge has positioned Wankel engines at a disadvantage as global emissions standards have become increasingly stringent, particularly with Euro 6, EPA Tier 3, and California's CARB regulations.

Recent advancements in sealing materials have shown promising results in emissions reduction. Silicon nitride and silicon carbide apex seals demonstrate superior thermal stability and reduced friction, allowing for more complete combustion and lower particulate emissions. Additionally, carbon-based composite seals with specialized coatings have shown up to 15% reduction in hydrocarbon emissions in laboratory testing environments.

Modern electronic engine management systems have enabled more precise control over the Wankel's combustion process, partially mitigating emissions concerns. When combined with advanced sealing technologies, these systems can optimize fuel delivery and ignition timing to compensate for sealing inefficiencies, resulting in cleaner exhaust output. Some manufacturers have implemented multi-stage catalytic converters specifically designed for the Wankel's emission profile.

The integration of hybrid systems with Wankel engines presents another pathway to emissions compliance. Using the Wankel as a range extender in hybrid electric vehicles allows operation at optimal efficiency points, reducing the impact of sealing-related emissions. Mazda's SKYACTIV-R technology demonstrates this approach, utilizing improved sealing technologies while operating the engine within narrower parameters to meet modern emissions standards.

Despite these advancements, significant challenges remain. Cold-start emissions continue to be problematic due to seal deformation at varying temperatures. Additionally, the inherent oil consumption related to apex seal lubrication contributes to particulate matter emissions. These challenges have prompted ongoing research into self-lubricating seal materials and advanced cooling systems that maintain more consistent operating temperatures across the housing surface.

As regulations continue to tighten globally, the viability of Wankel engines increasingly depends on breakthrough sealing technologies that can address these fundamental emissions challenges while maintaining the engine's inherent advantages of compact size, smooth operation, and high power-to-weight ratio.

Seal performance directly correlates with emissions output in Wankel engines. Apex seal leakage allows unburned fuel to escape the combustion process, contributing to increased hydrocarbon emissions and reduced fuel efficiency. This fundamental challenge has positioned Wankel engines at a disadvantage as global emissions standards have become increasingly stringent, particularly with Euro 6, EPA Tier 3, and California's CARB regulations.

Recent advancements in sealing materials have shown promising results in emissions reduction. Silicon nitride and silicon carbide apex seals demonstrate superior thermal stability and reduced friction, allowing for more complete combustion and lower particulate emissions. Additionally, carbon-based composite seals with specialized coatings have shown up to 15% reduction in hydrocarbon emissions in laboratory testing environments.

Modern electronic engine management systems have enabled more precise control over the Wankel's combustion process, partially mitigating emissions concerns. When combined with advanced sealing technologies, these systems can optimize fuel delivery and ignition timing to compensate for sealing inefficiencies, resulting in cleaner exhaust output. Some manufacturers have implemented multi-stage catalytic converters specifically designed for the Wankel's emission profile.

The integration of hybrid systems with Wankel engines presents another pathway to emissions compliance. Using the Wankel as a range extender in hybrid electric vehicles allows operation at optimal efficiency points, reducing the impact of sealing-related emissions. Mazda's SKYACTIV-R technology demonstrates this approach, utilizing improved sealing technologies while operating the engine within narrower parameters to meet modern emissions standards.

Despite these advancements, significant challenges remain. Cold-start emissions continue to be problematic due to seal deformation at varying temperatures. Additionally, the inherent oil consumption related to apex seal lubrication contributes to particulate matter emissions. These challenges have prompted ongoing research into self-lubricating seal materials and advanced cooling systems that maintain more consistent operating temperatures across the housing surface.

As regulations continue to tighten globally, the viability of Wankel engines increasingly depends on breakthrough sealing technologies that can address these fundamental emissions challenges while maintaining the engine's inherent advantages of compact size, smooth operation, and high power-to-weight ratio.

Manufacturing Processes and Cost Analysis

The manufacturing processes for Wankel engine sealing components represent a critical factor in their performance and durability. Traditional apex seal manufacturing involves precision grinding of hardened steel or cast iron, with tolerances typically maintained within 0.001-0.002 mm. More advanced manufacturing techniques have emerged in recent decades, including powder metallurgy processes that allow for the creation of composite materials with superior wear characteristics and thermal stability.

The production of modern ceramic-based seals requires specialized sintering processes at temperatures exceeding 1500°C, followed by precision grinding using diamond tools. This manufacturing complexity significantly impacts production costs, with ceramic apex seals costing approximately 3-5 times more than traditional metal variants. However, their extended service life often justifies this premium in high-performance applications.

Surface coating technologies have become increasingly important in seal manufacturing. Plasma vapor deposition (PVD) and chemical vapor deposition (CVD) processes enable the application of wear-resistant coatings such as titanium nitride (TiN), diamond-like carbon (DLC), and chromium nitride (CrN). These coatings, typically 2-10 micrometers thick, can extend seal life by 30-50% but add approximately 15-25% to manufacturing costs.

Cost analysis reveals that material selection represents 40-45% of total seal manufacturing expenses, with precision machining accounting for 30-35%, and quality control processes consuming 15-20%. The remaining costs are attributed to packaging and logistics. Economy of scale significantly impacts unit costs, with high-volume production potentially reducing per-unit costs by 30-40% compared to limited production runs.

Recent innovations in additive manufacturing show promise for reducing production costs while enabling more complex geometries. Selective laser melting (SLM) and direct metal laser sintering (DMLS) technologies allow for the creation of seals with integrated cooling channels or variable material composition across the seal profile. While these technologies currently add 20-30% to manufacturing costs, they offer potential long-term cost reductions through design optimization and reduced material waste.

The environmental impact of manufacturing processes has gained increasing attention, with manufacturers exploring more sustainable production methods. Water-based coolants have largely replaced oil-based variants in grinding operations, and energy-efficient sintering processes have reduced the carbon footprint of ceramic seal production by approximately 15-20% over the past decade.

The production of modern ceramic-based seals requires specialized sintering processes at temperatures exceeding 1500°C, followed by precision grinding using diamond tools. This manufacturing complexity significantly impacts production costs, with ceramic apex seals costing approximately 3-5 times more than traditional metal variants. However, their extended service life often justifies this premium in high-performance applications.

Surface coating technologies have become increasingly important in seal manufacturing. Plasma vapor deposition (PVD) and chemical vapor deposition (CVD) processes enable the application of wear-resistant coatings such as titanium nitride (TiN), diamond-like carbon (DLC), and chromium nitride (CrN). These coatings, typically 2-10 micrometers thick, can extend seal life by 30-50% but add approximately 15-25% to manufacturing costs.

Cost analysis reveals that material selection represents 40-45% of total seal manufacturing expenses, with precision machining accounting for 30-35%, and quality control processes consuming 15-20%. The remaining costs are attributed to packaging and logistics. Economy of scale significantly impacts unit costs, with high-volume production potentially reducing per-unit costs by 30-40% compared to limited production runs.

Recent innovations in additive manufacturing show promise for reducing production costs while enabling more complex geometries. Selective laser melting (SLM) and direct metal laser sintering (DMLS) technologies allow for the creation of seals with integrated cooling channels or variable material composition across the seal profile. While these technologies currently add 20-30% to manufacturing costs, they offer potential long-term cost reductions through design optimization and reduced material waste.

The environmental impact of manufacturing processes has gained increasing attention, with manufacturers exploring more sustainable production methods. Water-based coolants have largely replaced oil-based variants in grinding operations, and energy-efficient sintering processes have reduced the carbon footprint of ceramic seal production by approximately 15-20% over the past decade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!