What Industrial Applications Benefit Most from Carbon Capture Technologies

OCT 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Background and Objectives

Carbon capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in various industrial settings. The fundamental principle behind carbon capture involves the separation of carbon dioxide (CO2) from industrial processes or directly from the atmosphere, followed by its storage or utilization to prevent release into the environment. This technology emerged in response to growing concerns about climate change and the need to reduce greenhouse gas emissions while maintaining industrial productivity.

The historical development of carbon capture can be traced back to the 1970s when it was first used in natural gas processing. However, significant advancements occurred in the 1990s with the implementation of large-scale projects in the energy sector. The technology has since diversified into three main approaches: post-combustion capture, pre-combustion capture, and oxy-fuel combustion, each offering distinct advantages depending on the industrial application.

Current technological trends indicate a shift toward more cost-effective and energy-efficient capture methods, with innovations in solvents, sorbents, and membrane technologies leading the way. Research is increasingly focused on reducing the energy penalty associated with carbon capture processes, which has historically been a significant barrier to widespread adoption.

The primary objective of carbon capture technology implementation is to enable industrial decarbonization while maintaining economic viability. Industries with high carbon emissions, such as power generation, cement production, steel manufacturing, and chemical processing, represent prime targets for these technologies. The goal is to achieve substantial CO2 emission reductions (typically 80-95%) from these sources while minimizing operational cost increases.

Another critical objective is the development of versatile carbon capture solutions that can be retrofitted to existing industrial facilities as well as integrated into new plant designs. This adaptability is essential for addressing emissions from the vast infrastructure of established industrial operations worldwide.

Looking forward, the technology aims to evolve beyond simple capture and storage toward creating value-added pathways through carbon utilization. This includes converting captured CO2 into useful products such as building materials, chemicals, and synthetic fuels, potentially transforming carbon capture from a cost center into a revenue-generating opportunity for industries.

The ultimate technological goal remains achieving carbon neutrality or even negative emissions in hard-to-abate industrial sectors, contributing significantly to global climate mitigation efforts while enabling continued industrial growth and development in a carbon-constrained world.

The historical development of carbon capture can be traced back to the 1970s when it was first used in natural gas processing. However, significant advancements occurred in the 1990s with the implementation of large-scale projects in the energy sector. The technology has since diversified into three main approaches: post-combustion capture, pre-combustion capture, and oxy-fuel combustion, each offering distinct advantages depending on the industrial application.

Current technological trends indicate a shift toward more cost-effective and energy-efficient capture methods, with innovations in solvents, sorbents, and membrane technologies leading the way. Research is increasingly focused on reducing the energy penalty associated with carbon capture processes, which has historically been a significant barrier to widespread adoption.

The primary objective of carbon capture technology implementation is to enable industrial decarbonization while maintaining economic viability. Industries with high carbon emissions, such as power generation, cement production, steel manufacturing, and chemical processing, represent prime targets for these technologies. The goal is to achieve substantial CO2 emission reductions (typically 80-95%) from these sources while minimizing operational cost increases.

Another critical objective is the development of versatile carbon capture solutions that can be retrofitted to existing industrial facilities as well as integrated into new plant designs. This adaptability is essential for addressing emissions from the vast infrastructure of established industrial operations worldwide.

Looking forward, the technology aims to evolve beyond simple capture and storage toward creating value-added pathways through carbon utilization. This includes converting captured CO2 into useful products such as building materials, chemicals, and synthetic fuels, potentially transforming carbon capture from a cost center into a revenue-generating opportunity for industries.

The ultimate technological goal remains achieving carbon neutrality or even negative emissions in hard-to-abate industrial sectors, contributing significantly to global climate mitigation efforts while enabling continued industrial growth and development in a carbon-constrained world.

Industrial Market Demand Analysis

Carbon capture technologies are experiencing a surge in market demand across multiple industrial sectors as global climate policies become increasingly stringent. The power generation industry represents the largest potential market for carbon capture technologies, with coal and natural gas power plants facing mounting pressure to reduce emissions while maintaining energy security. According to recent market analyses, power generation accounts for approximately 40% of global CO2 emissions from industrial sources, creating an urgent need for retrofitting existing infrastructure with carbon capture capabilities.

The cement industry emerges as another critical market segment, responsible for roughly 8% of global carbon emissions. The production process inherently generates CO2 through both fuel combustion and limestone calcination, making carbon capture technologies particularly valuable. With global cement production continuing to rise to meet infrastructure development needs, especially in emerging economies, the industry faces dual pressures of increasing production while reducing environmental impact.

Steel manufacturing represents a third major market opportunity, contributing about 7% of global industrial emissions. The blast furnace process fundamental to steel production releases significant amounts of CO2 that could be captured and either stored or utilized. With steel demand projected to increase by 30% by 2050, carbon capture technologies offer a pathway to sustainable production without compromising economic growth in this sector.

The chemical industry, particularly ammonia and ethylene production, demonstrates strong potential for carbon capture integration. These processes often already separate CO2 as part of their production cycles, making them technically advantageous early adopters. The concentrated CO2 streams in these facilities allow for more cost-effective capture compared to dilute sources.

Oil and gas operations present another significant market, with natural gas processing facilities already employing carbon capture to meet product specifications. Enhanced oil recovery using captured CO2 creates a built-in utilization pathway that improves the economics of deployment in this sector.

Market analysis indicates that industries with high-concentration CO2 streams, such as natural gas processing, hydrogen production, and bioethanol production, offer the most immediate economic viability for carbon capture technologies. These sectors benefit from lower capture costs due to the concentrated nature of their emissions, with capture costs potentially 50-60% lower than in dilute applications like power generation.

Regional market variations are substantial, with demand particularly strong in industrial clusters where multiple emission sources can share carbon transport and storage infrastructure, significantly reducing overall costs. Policy incentives, including carbon pricing mechanisms and tax credits like the 45Q in the United States, are increasingly driving market growth across all industrial sectors.

The cement industry emerges as another critical market segment, responsible for roughly 8% of global carbon emissions. The production process inherently generates CO2 through both fuel combustion and limestone calcination, making carbon capture technologies particularly valuable. With global cement production continuing to rise to meet infrastructure development needs, especially in emerging economies, the industry faces dual pressures of increasing production while reducing environmental impact.

Steel manufacturing represents a third major market opportunity, contributing about 7% of global industrial emissions. The blast furnace process fundamental to steel production releases significant amounts of CO2 that could be captured and either stored or utilized. With steel demand projected to increase by 30% by 2050, carbon capture technologies offer a pathway to sustainable production without compromising economic growth in this sector.

The chemical industry, particularly ammonia and ethylene production, demonstrates strong potential for carbon capture integration. These processes often already separate CO2 as part of their production cycles, making them technically advantageous early adopters. The concentrated CO2 streams in these facilities allow for more cost-effective capture compared to dilute sources.

Oil and gas operations present another significant market, with natural gas processing facilities already employing carbon capture to meet product specifications. Enhanced oil recovery using captured CO2 creates a built-in utilization pathway that improves the economics of deployment in this sector.

Market analysis indicates that industries with high-concentration CO2 streams, such as natural gas processing, hydrogen production, and bioethanol production, offer the most immediate economic viability for carbon capture technologies. These sectors benefit from lower capture costs due to the concentrated nature of their emissions, with capture costs potentially 50-60% lower than in dilute applications like power generation.

Regional market variations are substantial, with demand particularly strong in industrial clusters where multiple emission sources can share carbon transport and storage infrastructure, significantly reducing overall costs. Policy incentives, including carbon pricing mechanisms and tax credits like the 45Q in the United States, are increasingly driving market growth across all industrial sectors.

Global Carbon Capture Status and Challenges

Carbon capture technologies have evolved significantly over the past three decades, progressing from theoretical concepts to commercial-scale implementations. The global carbon capture landscape currently features approximately 30 large-scale facilities in operation, with a combined annual capture capacity of around 40 million tonnes of CO2. Despite this progress, this represents less than 0.1% of global carbon emissions, highlighting the substantial gap between current deployment and climate mitigation requirements.

The geographical distribution of carbon capture projects reveals significant concentration in North America and Europe, with emerging activities in China, Australia, and the Middle East. The United States leads in terms of operational facilities, largely due to favorable policy frameworks including the 45Q tax credits and substantial government funding through initiatives like the Infrastructure Investment and Jobs Act.

Technical challenges continue to impede widespread adoption of carbon capture technologies. Energy penalties remain a critical obstacle, with current capture processes requiring 15-30% of a power plant's energy output, significantly reducing operational efficiency. Cost barriers persist as well, with capture costs ranging from $40-120 per tonne of CO2 depending on the industry and technology employed, making economic viability difficult without substantial policy support or carbon pricing.

Infrastructure limitations present another significant challenge. The global CO2 transport pipeline network spans only about 8,000 kilometers, predominantly in North America, creating bottlenecks for captured carbon transportation. Similarly, geological storage capacity, while theoretically abundant, faces practical constraints related to site characterization, monitoring requirements, and regulatory approvals.

Regulatory frameworks remain inconsistent across regions, creating uncertainty for project developers and investors. While some jurisdictions have established comprehensive regulatory regimes for carbon capture and storage, many countries lack clear legal frameworks for CO2 storage liability, monitoring requirements, and permitting processes.

Public acceptance issues further complicate deployment, with concerns about safety, environmental impacts, and the perception that carbon capture extends fossil fuel dependence. These social license challenges have delayed or halted several high-profile projects, particularly in Europe.

Recent technological innovations show promise in addressing these challenges, including advanced solvents that reduce energy penalties, novel membrane materials that lower capture costs, and direct air capture technologies that can address emissions from distributed sources. However, these innovations require further development and scale-up to achieve commercial viability and meaningful climate impact.

The geographical distribution of carbon capture projects reveals significant concentration in North America and Europe, with emerging activities in China, Australia, and the Middle East. The United States leads in terms of operational facilities, largely due to favorable policy frameworks including the 45Q tax credits and substantial government funding through initiatives like the Infrastructure Investment and Jobs Act.

Technical challenges continue to impede widespread adoption of carbon capture technologies. Energy penalties remain a critical obstacle, with current capture processes requiring 15-30% of a power plant's energy output, significantly reducing operational efficiency. Cost barriers persist as well, with capture costs ranging from $40-120 per tonne of CO2 depending on the industry and technology employed, making economic viability difficult without substantial policy support or carbon pricing.

Infrastructure limitations present another significant challenge. The global CO2 transport pipeline network spans only about 8,000 kilometers, predominantly in North America, creating bottlenecks for captured carbon transportation. Similarly, geological storage capacity, while theoretically abundant, faces practical constraints related to site characterization, monitoring requirements, and regulatory approvals.

Regulatory frameworks remain inconsistent across regions, creating uncertainty for project developers and investors. While some jurisdictions have established comprehensive regulatory regimes for carbon capture and storage, many countries lack clear legal frameworks for CO2 storage liability, monitoring requirements, and permitting processes.

Public acceptance issues further complicate deployment, with concerns about safety, environmental impacts, and the perception that carbon capture extends fossil fuel dependence. These social license challenges have delayed or halted several high-profile projects, particularly in Europe.

Recent technological innovations show promise in addressing these challenges, including advanced solvents that reduce energy penalties, novel membrane materials that lower capture costs, and direct air capture technologies that can address emissions from distributed sources. However, these innovations require further development and scale-up to achieve commercial viability and meaningful climate impact.

Current Carbon Capture Implementation Solutions

01 Chemical absorption methods for carbon capture

Chemical absorption is a widely used method for capturing carbon dioxide from various sources. This approach involves the use of liquid solvents, such as amines, that chemically react with CO2. The process typically consists of an absorption step where CO2 is captured by the solvent and a regeneration step where the CO2 is released and the solvent is recycled. These systems can be optimized for different industrial applications and can achieve high capture efficiencies.- Chemical absorption methods for carbon capture: Chemical absorption is a widely used method for carbon capture that involves the use of solvents to absorb CO2 from flue gases. These processes typically use amine-based solvents that chemically react with CO2, allowing for its separation from other gases. The captured CO2 can then be released through heating, and the regenerated solvent can be reused. This technology is particularly effective for post-combustion capture from power plants and industrial facilities.

- Direct air capture technologies: Direct air capture (DAC) technologies extract CO2 directly from the atmosphere rather than from point sources like power plants. These systems typically use sorbent materials or chemical solutions that selectively capture CO2 from ambient air. Once captured, the CO2 can be released through heating or pressure changes, then compressed for storage or utilization. DAC is particularly valuable for addressing distributed emissions and potentially achieving negative emissions by removing historical CO2.

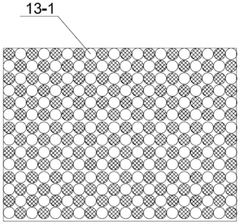

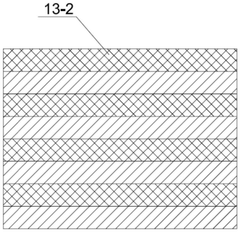

- Membrane-based carbon capture systems: Membrane-based carbon capture systems utilize selective membranes that allow CO2 to pass through while blocking other gases. These membranes can be made from polymers, ceramics, or composite materials with specific pore sizes and chemical properties designed to maximize CO2 selectivity and permeability. Membrane systems offer advantages including lower energy requirements, compact design, and continuous operation without the need for regeneration cycles that are common in solvent-based systems.

- Solid sorbent carbon capture technologies: Solid sorbent technologies use porous materials such as activated carbon, zeolites, metal-organic frameworks (MOFs), or amine-functionalized solids to adsorb CO2. These materials can be engineered with high surface areas and specific chemical properties to enhance CO2 selectivity and capacity. The captured CO2 is typically released through temperature or pressure swing processes, allowing the sorbent to be regenerated and reused. Solid sorbents often require less energy for regeneration compared to liquid solvents.

- Carbon capture utilization and storage (CCUS) integration: CCUS integration focuses on not only capturing carbon dioxide but also utilizing or permanently storing it. Captured CO2 can be used in enhanced oil recovery, converted into valuable products like fuels or chemicals, or permanently sequestered in geological formations. These integrated systems aim to create economic value from captured carbon while reducing net emissions. The approach includes transportation infrastructure, utilization pathways, and monitoring systems to ensure long-term storage security.

02 Direct air capture technologies

Direct air capture (DAC) technologies are designed to extract carbon dioxide directly from the atmosphere. These systems use various sorbents or solutions that selectively capture CO2 from ambient air. After capture, the CO2 can be released through heating or other processes, allowing for the regeneration of the capture material. DAC technologies are particularly valuable for addressing distributed emissions and can be deployed in various locations regardless of emission sources.Expand Specific Solutions03 Membrane-based carbon capture systems

Membrane-based systems utilize selective permeable barriers that allow CO2 to pass through while blocking other gases. These membranes can be made from various materials including polymers, ceramics, or hybrid materials, each offering different selectivity and permeability characteristics. Membrane technology offers advantages such as lower energy requirements, compact design, and continuous operation capability, making it suitable for both industrial applications and smaller-scale implementations.Expand Specific Solutions04 Biological carbon capture methods

Biological carbon capture utilizes natural biological processes to remove CO2 from the atmosphere or flue gases. These methods include algae-based systems, engineered microorganisms, and enhanced plant growth techniques. The captured carbon can be stored in biomass or converted into useful products. Biological approaches often offer additional benefits such as production of biofuels, food supplements, or other valuable compounds while simultaneously capturing carbon dioxide.Expand Specific Solutions05 Carbon mineralization and geological storage

Carbon mineralization involves converting CO2 into stable mineral carbonates through reaction with metal oxides, typically found in certain rock types. This process can occur naturally but can be accelerated through various engineered approaches. Geological storage involves injecting captured CO2 into suitable underground formations such as depleted oil and gas reservoirs or saline aquifers. These methods provide long-term, secure storage solutions for captured carbon dioxide, effectively removing it from the carbon cycle for thousands of years.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Carbon capture technologies are evolving rapidly across industrial sectors, with the market currently in its growth phase. The global carbon capture market, valued at approximately $7 billion, is projected to expand significantly as industries face increasing regulatory pressure to reduce emissions. Power generation, cement production, and petrochemical industries benefit most substantially from these technologies. Companies like China Petroleum & Chemical Corp. (Sinopec) and Saudi Aramco are leading implementation in the oil and gas sector, while State Grid Corp. of China and NuScale Power are advancing applications in power generation. Academic institutions including Zhejiang University and Arizona State University are driving innovation through research partnerships with industry players. The technology is approaching commercial maturity in select applications, though cost remains a significant barrier to widespread adoption.

China Petroleum & Chemical Corp.

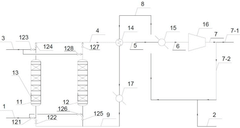

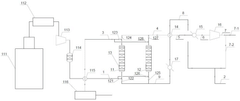

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed comprehensive carbon capture technologies specifically tailored for oil refineries and petrochemical plants. Their approach integrates post-combustion capture systems using advanced amine-based solvents that can achieve CO2 capture rates of up to 90% from flue gases. Sinopec has implemented large-scale CCUS (Carbon Capture, Utilization and Storage) projects, including the Qilu-Shengli Oilfield CCUS project which captures 1 million tons of CO2 annually from petrochemical operations and injects it for enhanced oil recovery (EOR). Their technology includes specialized absorption towers with structured packing materials that increase contact efficiency while reducing energy penalties to approximately 2.5 GJ/ton CO2 captured, significantly lower than earlier generation systems.

Strengths: Proven large-scale implementation with integration into existing industrial infrastructure; dual benefits of carbon reduction and enhanced oil recovery; extensive experience in handling industrial-scale gas processing. Weaknesses: Technology remains energy-intensive despite improvements; primarily focused on applications within petroleum industry rather than broader industrial applications.

Saudi Arabian Oil Co.

Technical Solution: Saudi Aramco has developed proprietary carbon capture technologies focused on high-concentration CO2 sources in natural gas processing and hydrogen production facilities. Their approach centers on advanced pressure swing adsorption (PSA) and membrane separation technologies that can selectively capture CO2 from mixed gas streams with purities exceeding 98%. Aramco's mobile carbon capture system can be deployed at various industrial sites, capturing CO2 directly from combustion sources with reported capture costs of $40-60 per ton. The company has implemented these technologies at their Hawiyah NGL plant, capturing approximately 500,000 tons of CO2 annually. Their carbon capture roadmap includes integration with concrete curing processes, where captured CO2 is mineralized into construction materials, creating permanent carbon sequestration while producing valuable products.

Strengths: Highly efficient capture from concentrated industrial sources; mobile capture units provide flexibility across different industrial applications; integration with concrete manufacturing creates permanent sequestration pathways. Weaknesses: Less experience with dilute CO2 streams from power generation; higher implementation costs compared to conventional technologies; geographic concentration of expertise primarily in Middle East operations.

Core Carbon Capture Patents and Technical Innovations

Carbon dioxide trapping and utilizing method and device and application thereof

PatentPendingCN119896962A

Innovation

- A fixed bed reactor is used, combining the catalyst and heat storage body, and the in-situ capture and conversion of CO2 is achieved through switching between the adsorption reactor and the conversion reactor. The temperature is controlled by the dual-functional materials of the catalyst and the heat storage body to achieve the comprehensive utilization of heat absorption and release.

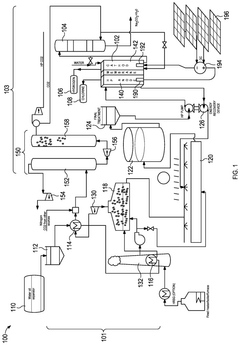

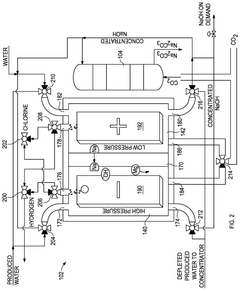

A system for utilizing oil and gas field produced water and captured carbon dioxide to produce high-value products

PatentPendingUS20250162891A1

Innovation

- A system and method that involves preparing saturated produced water from an oil and gas field and capturing carbon dioxide, then using an electrolyzer with a semipermeable membrane to produce sodium hydroxide and hydrogen gas, which are subsequently used to convert the carbon dioxide into sodium carbonate or sodium bicarbonate in a conversion chamber.

Regulatory Framework and Carbon Pricing Mechanisms

The global regulatory landscape for carbon capture technologies is rapidly evolving, with significant implications for industrial adoption. Carbon pricing mechanisms have emerged as primary policy instruments driving implementation across sectors. The European Union's Emissions Trading System (EU ETS) represents the world's largest carbon market, establishing a cap-and-trade framework that effectively monetizes carbon emissions and incentivizes capture technologies. Similarly, carbon taxes in countries like Sweden, Norway, and Canada have created direct financial incentives for emissions reduction through technological solutions.

Regulatory frameworks vary substantially by region, creating complex compliance environments for multinational industrial operators. In the United States, the 45Q tax credit provides up to $50 per metric ton of CO2 sequestered, significantly improving the economics of carbon capture projects in high-emission industries. Meanwhile, China's nascent emissions trading scheme, while currently limited to the power sector, signals future regulatory expansion that will likely encompass additional industrial applications.

Industry-specific regulations further shape technology adoption patterns. The cement and steel sectors face increasingly stringent emissions standards under various national climate policies, accelerating interest in capture solutions. For oil and gas operations, regulations addressing fugitive emissions and flaring have created additional compliance incentives for implementing carbon capture systems at extraction and processing facilities.

The interplay between voluntary corporate commitments and mandatory regulations creates a dynamic implementation landscape. Many industries are proactively adopting carbon capture technologies in anticipation of stricter future regulations, particularly in jurisdictions with clear carbon reduction roadmaps. This regulatory foresight is especially evident in the chemical manufacturing and power generation sectors, where capital-intensive facilities require long-term planning horizons.

Emerging regulatory innovations include carbon border adjustment mechanisms, which aim to prevent "carbon leakage" by imposing carbon-equivalent tariffs on imports from regions with less stringent climate policies. These mechanisms are particularly relevant for trade-exposed industries like aluminum, fertilizer production, and petrochemicals, potentially accelerating global adoption of carbon capture technologies regardless of local regulatory frameworks.

The financial sector's regulatory environment is also evolving to incorporate climate risk, with implications for carbon-intensive industries. Climate-related financial disclosure requirements increasingly influence capital allocation decisions, creating additional incentives for industries to demonstrate viable decarbonization pathways that often include carbon capture technologies as essential components of their emissions reduction strategies.

Regulatory frameworks vary substantially by region, creating complex compliance environments for multinational industrial operators. In the United States, the 45Q tax credit provides up to $50 per metric ton of CO2 sequestered, significantly improving the economics of carbon capture projects in high-emission industries. Meanwhile, China's nascent emissions trading scheme, while currently limited to the power sector, signals future regulatory expansion that will likely encompass additional industrial applications.

Industry-specific regulations further shape technology adoption patterns. The cement and steel sectors face increasingly stringent emissions standards under various national climate policies, accelerating interest in capture solutions. For oil and gas operations, regulations addressing fugitive emissions and flaring have created additional compliance incentives for implementing carbon capture systems at extraction and processing facilities.

The interplay between voluntary corporate commitments and mandatory regulations creates a dynamic implementation landscape. Many industries are proactively adopting carbon capture technologies in anticipation of stricter future regulations, particularly in jurisdictions with clear carbon reduction roadmaps. This regulatory foresight is especially evident in the chemical manufacturing and power generation sectors, where capital-intensive facilities require long-term planning horizons.

Emerging regulatory innovations include carbon border adjustment mechanisms, which aim to prevent "carbon leakage" by imposing carbon-equivalent tariffs on imports from regions with less stringent climate policies. These mechanisms are particularly relevant for trade-exposed industries like aluminum, fertilizer production, and petrochemicals, potentially accelerating global adoption of carbon capture technologies regardless of local regulatory frameworks.

The financial sector's regulatory environment is also evolving to incorporate climate risk, with implications for carbon-intensive industries. Climate-related financial disclosure requirements increasingly influence capital allocation decisions, creating additional incentives for industries to demonstrate viable decarbonization pathways that often include carbon capture technologies as essential components of their emissions reduction strategies.

Cross-Industry Integration Opportunities

Carbon capture technologies present unique opportunities for integration across multiple industrial sectors, creating synergistic relationships that maximize both economic and environmental benefits. The energy sector stands as a primary integration point, where captured carbon can be utilized for enhanced oil recovery while simultaneously reducing the carbon footprint of fossil fuel extraction. This dual-purpose application creates a compelling business case that helps offset implementation costs while advancing decarbonization goals.

Manufacturing industries can integrate carbon capture systems with chemical production processes, utilizing captured CO2 as a feedstock for producing valuable chemicals like methanol, urea, and polymers. This circular economy approach transforms what was once considered waste into a valuable resource stream, creating new revenue opportunities while reducing environmental impact.

The agricultural sector offers another promising integration pathway, with captured carbon being used to enhance greenhouse growing environments, increasing crop yields by 20-30% in controlled studies. Additionally, CO2 can be mineralized into soil amendments that improve agricultural productivity while permanently sequestering carbon in a stable form.

Construction and building materials represent a rapidly evolving integration opportunity, with emerging technologies enabling the incorporation of captured carbon into concrete, reducing its carbon footprint by up to 70% while maintaining or even improving structural properties. This application is particularly significant given concrete's position as the second most consumed material globally after water.

Cross-sector waste management integration creates additional value, with municipal solid waste incineration facilities implementing carbon capture to significantly reduce emissions while producing purified CO2 streams that can be directed to industrial applications or permanent storage solutions.

Transportation infrastructure presents innovative integration possibilities, with captured carbon being used in road construction materials and even in the production of synthetic fuels that can power hard-to-electrify transportation segments like aviation and heavy shipping.

These cross-industry integration opportunities demonstrate how carbon capture technologies can transcend traditional sector boundaries, creating interconnected systems where one industry's carbon emissions become another's valuable input. The most successful implementations will likely involve collaborative partnerships between traditionally separate industries, supported by policy frameworks that incentivize such cross-sector innovation and cooperation.

Manufacturing industries can integrate carbon capture systems with chemical production processes, utilizing captured CO2 as a feedstock for producing valuable chemicals like methanol, urea, and polymers. This circular economy approach transforms what was once considered waste into a valuable resource stream, creating new revenue opportunities while reducing environmental impact.

The agricultural sector offers another promising integration pathway, with captured carbon being used to enhance greenhouse growing environments, increasing crop yields by 20-30% in controlled studies. Additionally, CO2 can be mineralized into soil amendments that improve agricultural productivity while permanently sequestering carbon in a stable form.

Construction and building materials represent a rapidly evolving integration opportunity, with emerging technologies enabling the incorporation of captured carbon into concrete, reducing its carbon footprint by up to 70% while maintaining or even improving structural properties. This application is particularly significant given concrete's position as the second most consumed material globally after water.

Cross-sector waste management integration creates additional value, with municipal solid waste incineration facilities implementing carbon capture to significantly reduce emissions while producing purified CO2 streams that can be directed to industrial applications or permanent storage solutions.

Transportation infrastructure presents innovative integration possibilities, with captured carbon being used in road construction materials and even in the production of synthetic fuels that can power hard-to-electrify transportation segments like aviation and heavy shipping.

These cross-industry integration opportunities demonstrate how carbon capture technologies can transcend traditional sector boundaries, creating interconnected systems where one industry's carbon emissions become another's valuable input. The most successful implementations will likely involve collaborative partnerships between traditionally separate industries, supported by policy frameworks that incentivize such cross-sector innovation and cooperation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!