Advanced Flexible OLED Encapsulation Materials: An Evaluation

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED Encapsulation Evolution and Objectives

Organic Light-Emitting Diode (OLED) technology has undergone significant evolution since its inception in the late 1980s. The journey began with rigid OLED displays that offered superior visual performance compared to traditional LCD technology but were limited by their inflexibility and vulnerability to environmental factors. The critical turning point came with the development of flexible OLED technology in the early 2000s, which opened new possibilities for display applications but simultaneously introduced unprecedented challenges in device protection.

Encapsulation technology, the protective barrier that shields OLED materials from moisture and oxygen, has evolved in parallel with OLED development. Early encapsulation solutions relied on rigid glass barriers with desiccant materials, which were effective but incompatible with flexible display requirements. This limitation drove research toward thin-film encapsulation (TFE) technologies that could maintain protection while accommodating bending and folding operations.

The evolution of OLED encapsulation can be categorized into three distinct generations. First-generation solutions utilized glass lid encapsulation with calcium oxide desiccants, offering excellent protection but no flexibility. Second-generation approaches introduced multi-layer structures combining inorganic and organic materials, achieving moderate flexibility with acceptable barrier properties. Current third-generation technologies employ advanced hybrid systems with atomic layer deposition (ALD) and specialized polymer materials to achieve ultra-thin, highly flexible barriers with superior performance characteristics.

The primary objective of modern OLED encapsulation research is to develop materials and processes that simultaneously address five critical requirements: exceptional barrier properties against water vapor and oxygen (water vapor transmission rate below 10^-6 g/m²/day), mechanical flexibility supporting repeated bending cycles (>200,000 cycles at 1mm radius), optical transparency (>90% in visible spectrum), thermal stability across operating conditions (-40°C to 85°C), and compatibility with high-volume manufacturing processes.

Additionally, emerging flexible OLED applications in wearable technology, automotive displays, and foldable consumer electronics have expanded encapsulation objectives to include resistance to more extreme environmental conditions, enhanced durability against physical impact, and reduced thickness to enable more compact device designs. The industry is also increasingly focused on developing environmentally sustainable encapsulation materials that reduce reliance on rare elements and improve end-of-life recyclability.

The trajectory of encapsulation technology development is now moving toward "active" barrier systems that not only prevent environmental ingress but also actively mitigate damage through self-healing mechanisms and integrated sensor capabilities for real-time monitoring of barrier integrity.

Encapsulation technology, the protective barrier that shields OLED materials from moisture and oxygen, has evolved in parallel with OLED development. Early encapsulation solutions relied on rigid glass barriers with desiccant materials, which were effective but incompatible with flexible display requirements. This limitation drove research toward thin-film encapsulation (TFE) technologies that could maintain protection while accommodating bending and folding operations.

The evolution of OLED encapsulation can be categorized into three distinct generations. First-generation solutions utilized glass lid encapsulation with calcium oxide desiccants, offering excellent protection but no flexibility. Second-generation approaches introduced multi-layer structures combining inorganic and organic materials, achieving moderate flexibility with acceptable barrier properties. Current third-generation technologies employ advanced hybrid systems with atomic layer deposition (ALD) and specialized polymer materials to achieve ultra-thin, highly flexible barriers with superior performance characteristics.

The primary objective of modern OLED encapsulation research is to develop materials and processes that simultaneously address five critical requirements: exceptional barrier properties against water vapor and oxygen (water vapor transmission rate below 10^-6 g/m²/day), mechanical flexibility supporting repeated bending cycles (>200,000 cycles at 1mm radius), optical transparency (>90% in visible spectrum), thermal stability across operating conditions (-40°C to 85°C), and compatibility with high-volume manufacturing processes.

Additionally, emerging flexible OLED applications in wearable technology, automotive displays, and foldable consumer electronics have expanded encapsulation objectives to include resistance to more extreme environmental conditions, enhanced durability against physical impact, and reduced thickness to enable more compact device designs. The industry is also increasingly focused on developing environmentally sustainable encapsulation materials that reduce reliance on rare elements and improve end-of-life recyclability.

The trajectory of encapsulation technology development is now moving toward "active" barrier systems that not only prevent environmental ingress but also actively mitigate damage through self-healing mechanisms and integrated sensor capabilities for real-time monitoring of barrier integrity.

Market Demand Analysis for Flexible OLED Displays

The flexible OLED display market has experienced remarkable growth in recent years, driven by increasing consumer demand for innovative form factors in electronic devices. Market research indicates that the global flexible OLED market reached approximately $25.7 billion in 2022 and is projected to grow at a compound annual growth rate of 19.8% through 2028, potentially reaching $76.3 billion by the end of the forecast period.

Smartphone manufacturers represent the largest demand segment, accounting for over 65% of flexible OLED applications. This dominance stems from the technology's ability to enable foldable, rollable, and curved display designs that differentiate premium devices in an increasingly saturated market. Samsung and Apple remain the leading procurers of flexible OLED panels, with Chinese manufacturers like Xiaomi, OPPO, and Vivo rapidly increasing their adoption rates.

Wearable technology constitutes the second-largest application segment, with smartwatches and fitness trackers benefiting from flexible displays that conform to the wrist and maximize screen real estate in limited form factors. This segment is expected to grow at 24.3% annually through 2028, outpacing the overall market growth rate.

Consumer preferences are increasingly favoring devices with larger screen-to-body ratios, enhanced durability, and novel form factors. Market surveys indicate that 78% of premium smartphone buyers consider display quality a critical purchasing factor, with 42% specifically expressing interest in foldable or flexible display technologies.

The automotive sector represents an emerging high-potential market for flexible OLED displays. Luxury vehicle manufacturers are incorporating curved OLED panels in dashboard systems and entertainment consoles. Industry analysts project automotive applications to grow at 31.7% annually, albeit from a smaller base.

A critical market challenge remains the high production costs associated with flexible OLED manufacturing, particularly in the encapsulation process. Current thin-film encapsulation (TFE) technologies add significant cost premiums compared to rigid display alternatives. Market data suggests that encapsulation materials and processes account for approximately 17-22% of total flexible OLED production costs.

Regional analysis reveals Asia-Pacific dominates both production and consumption of flexible OLED displays, with South Korea, China, and Japan leading manufacturing capacity. North America and Europe represent significant consumer markets, particularly for premium devices incorporating this technology.

Smartphone manufacturers represent the largest demand segment, accounting for over 65% of flexible OLED applications. This dominance stems from the technology's ability to enable foldable, rollable, and curved display designs that differentiate premium devices in an increasingly saturated market. Samsung and Apple remain the leading procurers of flexible OLED panels, with Chinese manufacturers like Xiaomi, OPPO, and Vivo rapidly increasing their adoption rates.

Wearable technology constitutes the second-largest application segment, with smartwatches and fitness trackers benefiting from flexible displays that conform to the wrist and maximize screen real estate in limited form factors. This segment is expected to grow at 24.3% annually through 2028, outpacing the overall market growth rate.

Consumer preferences are increasingly favoring devices with larger screen-to-body ratios, enhanced durability, and novel form factors. Market surveys indicate that 78% of premium smartphone buyers consider display quality a critical purchasing factor, with 42% specifically expressing interest in foldable or flexible display technologies.

The automotive sector represents an emerging high-potential market for flexible OLED displays. Luxury vehicle manufacturers are incorporating curved OLED panels in dashboard systems and entertainment consoles. Industry analysts project automotive applications to grow at 31.7% annually, albeit from a smaller base.

A critical market challenge remains the high production costs associated with flexible OLED manufacturing, particularly in the encapsulation process. Current thin-film encapsulation (TFE) technologies add significant cost premiums compared to rigid display alternatives. Market data suggests that encapsulation materials and processes account for approximately 17-22% of total flexible OLED production costs.

Regional analysis reveals Asia-Pacific dominates both production and consumption of flexible OLED displays, with South Korea, China, and Japan leading manufacturing capacity. North America and Europe represent significant consumer markets, particularly for premium devices incorporating this technology.

Current Encapsulation Technologies and Barriers

The current landscape of OLED encapsulation technologies is dominated by several approaches, each with distinct advantages and limitations. Thin-film encapsulation (TFE) has emerged as the leading solution for flexible OLEDs, typically employing alternating layers of inorganic and organic materials. The inorganic layers (commonly Al2O3, SiO2, or SiNx) provide excellent barrier properties with water vapor transmission rates (WVTR) below 10^-6 g/m²/day, while organic layers (often based on polyacrylates) compensate for mechanical stress during flexing. This multi-layer approach has proven effective but remains costly and complex to manufacture at scale.

Glass-based encapsulation, while offering superior barrier properties, presents significant limitations for flexible applications due to its inherent rigidity. Recent innovations in ultra-thin glass (UTG) with thicknesses below 100 μm show promise but face challenges in handling and integration processes.

Hybrid encapsulation systems combining barrier films with edge sealants represent another significant approach. These systems utilize high-performance barrier films with specialized edge sealing materials to prevent lateral moisture ingress. However, achieving consistent edge sealing without compromising flexibility remains problematic, particularly at bend radii below 3 mm.

The primary technical barriers in current encapsulation technologies center around four critical challenges. First, the trade-off between barrier performance and flexibility continues to limit application potential. As bend radius requirements decrease below 1 mm for foldable devices, maintaining barrier integrity becomes exponentially more difficult.

Second, manufacturing scalability presents significant hurdles. Current high-performance encapsulation processes often require specialized equipment and precise control conditions, leading to low throughput and high costs. Atomic Layer Deposition (ALD) processes, while excellent for creating high-quality barrier layers, face particular challenges in scaling to mass production.

Third, long-term reliability under repeated mechanical stress remains inadequately addressed. Most encapsulation solutions show degradation in barrier properties after repeated flexing cycles, with performance declining significantly after 100,000-200,000 cycles – insufficient for consumer device lifespans.

Finally, material compatibility issues persist between encapsulation layers and OLED components. Interface adhesion problems, thermal expansion mismatches, and chemical interactions can lead to delamination or accelerated degradation pathways that compromise device longevity.

These limitations have driven intensive research into next-generation materials including nanocomposites, 2D materials like graphene and hexagonal boron nitride, and self-healing polymers that could potentially overcome current barriers while enabling truly flexible and durable OLED displays.

Glass-based encapsulation, while offering superior barrier properties, presents significant limitations for flexible applications due to its inherent rigidity. Recent innovations in ultra-thin glass (UTG) with thicknesses below 100 μm show promise but face challenges in handling and integration processes.

Hybrid encapsulation systems combining barrier films with edge sealants represent another significant approach. These systems utilize high-performance barrier films with specialized edge sealing materials to prevent lateral moisture ingress. However, achieving consistent edge sealing without compromising flexibility remains problematic, particularly at bend radii below 3 mm.

The primary technical barriers in current encapsulation technologies center around four critical challenges. First, the trade-off between barrier performance and flexibility continues to limit application potential. As bend radius requirements decrease below 1 mm for foldable devices, maintaining barrier integrity becomes exponentially more difficult.

Second, manufacturing scalability presents significant hurdles. Current high-performance encapsulation processes often require specialized equipment and precise control conditions, leading to low throughput and high costs. Atomic Layer Deposition (ALD) processes, while excellent for creating high-quality barrier layers, face particular challenges in scaling to mass production.

Third, long-term reliability under repeated mechanical stress remains inadequately addressed. Most encapsulation solutions show degradation in barrier properties after repeated flexing cycles, with performance declining significantly after 100,000-200,000 cycles – insufficient for consumer device lifespans.

Finally, material compatibility issues persist between encapsulation layers and OLED components. Interface adhesion problems, thermal expansion mismatches, and chemical interactions can lead to delamination or accelerated degradation pathways that compromise device longevity.

These limitations have driven intensive research into next-generation materials including nanocomposites, 2D materials like graphene and hexagonal boron nitride, and self-healing polymers that could potentially overcome current barriers while enabling truly flexible and durable OLED displays.

State-of-the-Art Flexible OLED Encapsulation Solutions

01 Inorganic-organic hybrid encapsulation layers

Hybrid encapsulation structures combining inorganic barrier layers with organic buffer layers provide excellent moisture and oxygen barrier properties while maintaining flexibility. The inorganic layers (typically silicon nitride, aluminum oxide, or silicon oxide) provide the primary barrier function, while the organic layers (often acrylates or polysiloxanes) absorb mechanical stress and prevent crack propagation during bending. This alternating structure creates a tortuous path for moisture penetration while accommodating the mechanical stresses of flexible displays.- Thin film encapsulation for flexible OLEDs: Thin film encapsulation (TFE) technology is crucial for flexible OLEDs, providing protection against moisture and oxygen while maintaining flexibility. These structures typically consist of alternating inorganic and organic layers that create an effective barrier while allowing the device to bend. The inorganic layers provide barrier properties while the organic layers accommodate stress during bending, preventing crack propagation and maintaining the integrity of the encapsulation.

- Hybrid organic-inorganic encapsulation materials: Hybrid encapsulation structures combine organic and inorganic materials to achieve both flexibility and barrier properties. The organic components typically include flexible polymers that can withstand mechanical stress, while inorganic components provide excellent barrier properties against moisture and oxygen. These hybrid structures often employ alternating layers of materials with different properties to create a tortuous path for moisture penetration while maintaining the mechanical flexibility required for bendable displays.

- Self-healing encapsulation materials: Self-healing encapsulation materials can repair microcracks that form during bending, ensuring long-term reliability of flexible OLEDs. These materials incorporate components that can flow or react to fill gaps when damage occurs, maintaining barrier properties even after repeated flexing. Some approaches use liquid or gel-like materials that can redistribute under stress, while others employ chemical mechanisms that create new bonds at damaged areas, extending the lifetime of flexible displays.

- Nanocomposite barrier materials: Nanocomposite materials incorporate nanoparticles or nanosheets into polymer matrices to enhance barrier properties while maintaining flexibility. Materials such as graphene, clay nanoplatelets, or metal oxide nanoparticles create tortuous diffusion paths for water and oxygen molecules while allowing the overall structure to remain flexible. These nanocomposites can achieve lower water vapor transmission rates compared to conventional polymers while withstanding mechanical deformation required for flexible displays.

- Edge sealing technologies for flexible OLEDs: Edge sealing technologies address the vulnerability of flexible OLED edges to moisture and oxygen ingress. These approaches include specialized flexible adhesives, foldable barrier films, and gradient material structures that maintain effective sealing during bending. Some technologies employ reinforced edge structures that distribute stress away from critical areas, while others use materials with different elastic properties at the edges compared to the central display area, ensuring complete protection while maintaining overall device flexibility.

02 Thin-film encapsulation technologies

Thin-film encapsulation (TFE) technologies enable ultra-thin, flexible OLED devices by eliminating the need for rigid glass encapsulation. These technologies utilize atomic layer deposition (ALD), plasma-enhanced chemical vapor deposition (PECVD), or other deposition methods to create ultra-thin barrier films with excellent barrier properties. The reduced thickness of these encapsulation layers significantly improves the overall flexibility of the OLED device while maintaining protection against environmental degradation factors.Expand Specific Solutions03 Flexible barrier films with nanoparticles

Incorporating nanoparticles into polymer matrices creates flexible barrier films with enhanced barrier properties. Nanoparticles such as clay, silica, or metal oxides create a tortuous path for moisture and oxygen diffusion while maintaining the flexibility of the polymer matrix. These nanocomposite materials can be applied as thin films using solution processing methods, making them compatible with roll-to-roll manufacturing processes for flexible OLEDs. The nanoparticle concentration and dispersion are optimized to balance barrier performance and mechanical flexibility.Expand Specific Solutions04 Self-healing encapsulation materials

Self-healing materials incorporated into encapsulation layers can repair microcracks that form during bending or flexing of the OLED device. These materials contain microcapsules with healing agents or utilize dynamic chemical bonds that can reform after breaking. When mechanical stress causes cracks in the encapsulation layer, the self-healing mechanism is activated, restoring the barrier properties and extending the lifetime of flexible OLED devices. This technology is particularly valuable for foldable or rollable displays that experience repeated mechanical stress.Expand Specific Solutions05 Edge sealing technologies for flexible OLEDs

Specialized edge sealing technologies prevent lateral ingress of moisture and oxygen in flexible OLED devices. These technologies utilize flexible adhesives, laser sealing methods, or specialized barrier materials applied around the perimeter of the device. The edge sealing materials must maintain flexibility while providing excellent adhesion between the substrate and encapsulation layers during bending. Advanced edge sealing designs incorporate stress-relief structures that accommodate the mechanical deformation during flexing while maintaining the integrity of the seal.Expand Specific Solutions

Leading Companies in Advanced Encapsulation Materials

The flexible OLED encapsulation materials market is currently in a growth phase, with increasing demand driven by the proliferation of flexible display technologies in consumer electronics. The market size is projected to expand significantly, reaching several billion dollars by 2025 as manufacturers seek more durable and efficient barrier solutions. From a technological maturity perspective, the landscape shows varying degrees of advancement. Major players like BOE Technology, LG Chem, and TCL China Star Optoelectronics have established strong positions through significant R&D investments, while companies such as Visionox, Everdisplay Optronics, and Applied Materials are rapidly advancing their encapsulation technologies. Chinese manufacturers are increasingly challenging Korean and Western incumbents, with companies like Wuhan CSOT and Shanghai Tianma developing proprietary thin-film encapsulation solutions to address moisture and oxygen permeation challenges in flexible displays.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a multi-layer thin film encapsulation (TFE) technology for flexible OLED displays that combines inorganic and organic layers. Their approach utilizes alternating layers of Al2O3 and organic polymer materials deposited through atomic layer deposition (ALD) and inkjet printing processes. The inorganic layers provide excellent barrier properties against moisture and oxygen (with water vapor transmission rates below 10^-6 g/m²/day), while the organic layers add flexibility and stress relief. BOE has also pioneered a proprietary edge sealing technology that addresses the vulnerable perimeter of flexible displays, incorporating special moisture-resistant adhesives with nanoparticle fillers that enhance barrier properties while maintaining flexibility[1][3]. Their recent advancements include plasma-enhanced chemical vapor deposition (PECVD) for silicon nitride layers that achieve superior uniformity across large substrates.

Strengths: Industry-leading water vapor barrier performance, scalable manufacturing processes compatible with Gen 8.5+ substrates, and excellent mechanical durability during repeated bending (withstanding over 200,000 bending cycles at 1.5mm radius). Weaknesses: Higher production costs compared to rigid OLED encapsulation, longer processing times due to multiple deposition steps, and challenges with yield rates on larger panels.

LG Chem Ltd.

Technical Solution: LG Chem has developed an advanced hybrid encapsulation system for flexible OLEDs that combines thin-film encapsulation with a supplementary barrier film technology. Their solution features a proprietary "Hybrid Barrier Stack" that incorporates alternating layers of inorganic materials (primarily silicon nitride and aluminum oxide) with specially formulated organic interlayers. The inorganic layers are deposited using optimized plasma-enhanced chemical vapor deposition (PECVD) processes, achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day[2]. LG Chem's innovation lies in their organic interlayers, which utilize a radiation-cured polymer matrix embedded with functionalized nanoparticles that enhance both barrier properties and mechanical flexibility. This technology allows for a thinner overall encapsulation structure (less than 10μm) while maintaining excellent barrier performance and flexibility. Additionally, LG Chem has developed specialized edge sealant materials that prevent lateral moisture ingress at display edges.

Strengths: Exceptional barrier performance with industry-leading WVTR values, superior mechanical durability allowing for smaller bending radii (down to 1mm), and compatibility with roll-to-roll manufacturing processes for potential cost reduction. Weaknesses: Complex multi-step deposition process requiring precise control, higher initial capital investment for manufacturing equipment, and challenges with optical clarity maintenance after repeated bending cycles.

Key Patents and Breakthroughs in Barrier Materials

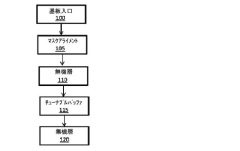

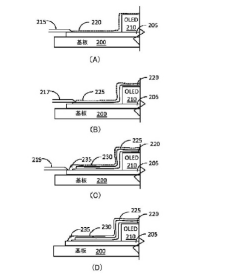

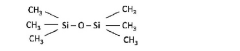

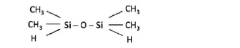

Encapsulation method for organic light emitting diode

PatentInactiveJP2022145802A

Innovation

- A method involving the formation of inorganic and organic layers in a controlled process chamber, utilizing tunable buffer layers formed from vaporized organosilicon compounds like hexamethyldisiloxane or tetramethyldisiloxane, with precise mask alignment outside the chamber to ensure encapsulation integrity.

Environmental Impact and Sustainability Considerations

The environmental impact of flexible OLED encapsulation materials represents a critical consideration in the sustainable development of next-generation display technologies. Traditional encapsulation approaches often rely on materials with significant ecological footprints, including rare earth elements, toxic compounds, and petroleum-based polymers that pose end-of-life disposal challenges. As flexible OLED technology moves toward mass commercialization, the environmental implications of these materials demand thorough assessment.

Life cycle analysis of current encapsulation solutions reveals concerning patterns in resource extraction and processing. Inorganic barrier layers typically require energy-intensive vacuum deposition processes, contributing to substantial carbon emissions during manufacturing. Meanwhile, organic materials often incorporate fluorinated compounds with high global warming potential and environmental persistence. The thin-film multilayer structures common in advanced barrier films present recycling challenges due to the difficulty in separating these tightly integrated materials.

Water consumption represents another significant environmental concern, particularly for solution-processed encapsulation layers that require extensive purification steps. Manufacturing facilities producing high-performance barrier films may consume thousands of gallons daily, placing pressure on local water resources. Additionally, chemical waste streams from these processes often contain specialized solvents and monomers that conventional treatment facilities struggle to process effectively.

Emerging sustainable alternatives show promising developments in this field. Bio-based barrier polymers derived from renewable feedstocks demonstrate comparable oxygen and moisture barrier properties while reducing dependence on petroleum resources. Several research groups have successfully developed cellulose-based nanocomposites that achieve impressive barrier performance through tortuous path effects rather than environmentally problematic chemical additives.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of electronic materials. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have already impacted encapsulation material selection, with similar legislation emerging in Asia and North America. Forward-thinking manufacturers are proactively reformulating encapsulation systems to eliminate substances of very high concern (SVHCs) before regulatory deadlines.

Energy efficiency during the application lifetime presents another sustainability dimension. Advanced encapsulation materials that extend OLED device lifespans effectively reduce electronic waste generation. Furthermore, encapsulation systems that maintain performance with reduced layer thickness can decrease material consumption while potentially improving device flexibility and reducing transportation-related emissions through lighter finished products.

Life cycle analysis of current encapsulation solutions reveals concerning patterns in resource extraction and processing. Inorganic barrier layers typically require energy-intensive vacuum deposition processes, contributing to substantial carbon emissions during manufacturing. Meanwhile, organic materials often incorporate fluorinated compounds with high global warming potential and environmental persistence. The thin-film multilayer structures common in advanced barrier films present recycling challenges due to the difficulty in separating these tightly integrated materials.

Water consumption represents another significant environmental concern, particularly for solution-processed encapsulation layers that require extensive purification steps. Manufacturing facilities producing high-performance barrier films may consume thousands of gallons daily, placing pressure on local water resources. Additionally, chemical waste streams from these processes often contain specialized solvents and monomers that conventional treatment facilities struggle to process effectively.

Emerging sustainable alternatives show promising developments in this field. Bio-based barrier polymers derived from renewable feedstocks demonstrate comparable oxygen and moisture barrier properties while reducing dependence on petroleum resources. Several research groups have successfully developed cellulose-based nanocomposites that achieve impressive barrier performance through tortuous path effects rather than environmentally problematic chemical additives.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of electronic materials. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have already impacted encapsulation material selection, with similar legislation emerging in Asia and North America. Forward-thinking manufacturers are proactively reformulating encapsulation systems to eliminate substances of very high concern (SVHCs) before regulatory deadlines.

Energy efficiency during the application lifetime presents another sustainability dimension. Advanced encapsulation materials that extend OLED device lifespans effectively reduce electronic waste generation. Furthermore, encapsulation systems that maintain performance with reduced layer thickness can decrease material consumption while potentially improving device flexibility and reducing transportation-related emissions through lighter finished products.

Manufacturing Scalability and Cost Analysis

The scalability of manufacturing processes for advanced flexible OLED encapsulation materials presents significant challenges that directly impact market adoption. Current thin-film encapsulation (TFE) technologies utilizing alternating layers of inorganic and organic materials require sophisticated deposition equipment and precise process control. Atomic Layer Deposition (ALD) methods, while offering excellent barrier properties, face throughput limitations with deposition rates typically below 2nm per minute, creating production bottlenecks for high-volume manufacturing.

Production yield remains a critical factor affecting cost structures. Industry data indicates that yield rates for flexible OLED encapsulation processes average between 70-85%, significantly lower than the 90%+ yields achieved in conventional rigid display manufacturing. Each percentage point improvement in yield can reduce production costs by approximately 1.5-2%, highlighting the economic importance of process optimization.

Capital expenditure requirements for establishing flexible OLED encapsulation production lines are substantial, with estimates ranging from $50-100 million for a medium-capacity production facility. This high initial investment creates significant barriers to entry for smaller manufacturers and necessitates large production volumes to achieve reasonable amortization periods, typically 3-5 years under optimal utilization scenarios.

Material costs constitute 30-45% of total encapsulation expenses, with high-purity precursors for barrier layers commanding premium prices. Recent innovations in material science have introduced lower-cost alternatives that maintain performance specifications, potentially reducing material costs by 15-20% over the next production cycle. However, these newer materials often require modified deposition parameters, necessitating equipment recalibration and process revalidation.

Energy consumption during encapsulation processes represents another significant cost factor, particularly for vacuum-based deposition methods. Solution-processed encapsulation techniques offer potential energy savings of 25-40% compared to vacuum deposition, though they currently face challenges in achieving equivalent barrier performance. The industry trend toward solution processing continues to gain momentum as performance gaps narrow.

Supply chain considerations further impact manufacturing economics, with specialized materials often sourced from limited suppliers. This supply concentration creates pricing pressures and potential availability risks. Diversification efforts are underway, with several major display manufacturers establishing strategic partnerships with multiple material suppliers to ensure continuity and improve negotiating positions.

Production yield remains a critical factor affecting cost structures. Industry data indicates that yield rates for flexible OLED encapsulation processes average between 70-85%, significantly lower than the 90%+ yields achieved in conventional rigid display manufacturing. Each percentage point improvement in yield can reduce production costs by approximately 1.5-2%, highlighting the economic importance of process optimization.

Capital expenditure requirements for establishing flexible OLED encapsulation production lines are substantial, with estimates ranging from $50-100 million for a medium-capacity production facility. This high initial investment creates significant barriers to entry for smaller manufacturers and necessitates large production volumes to achieve reasonable amortization periods, typically 3-5 years under optimal utilization scenarios.

Material costs constitute 30-45% of total encapsulation expenses, with high-purity precursors for barrier layers commanding premium prices. Recent innovations in material science have introduced lower-cost alternatives that maintain performance specifications, potentially reducing material costs by 15-20% over the next production cycle. However, these newer materials often require modified deposition parameters, necessitating equipment recalibration and process revalidation.

Energy consumption during encapsulation processes represents another significant cost factor, particularly for vacuum-based deposition methods. Solution-processed encapsulation techniques offer potential energy savings of 25-40% compared to vacuum deposition, though they currently face challenges in achieving equivalent barrier performance. The industry trend toward solution processing continues to gain momentum as performance gaps narrow.

Supply chain considerations further impact manufacturing economics, with specialized materials often sourced from limited suppliers. This supply concentration creates pricing pressures and potential availability risks. Diversification efforts are underway, with several major display manufacturers establishing strategic partnerships with multiple material suppliers to ensure continuity and improve negotiating positions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!