How Market Demands Influence Flexible OLED Encapsulation Development

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible OLED Encapsulation Background and Objectives

Flexible OLED (Organic Light-Emitting Diode) technology has revolutionized display applications over the past decade, enabling the development of foldable smartphones, rollable televisions, and wearable devices. The evolution of this technology can be traced back to the early 2000s when researchers first demonstrated the potential of organic materials for creating flexible light-emitting displays. Since then, the trajectory has been marked by significant breakthroughs in materials science, manufacturing processes, and device architecture.

The critical challenge in flexible OLED technology lies in the encapsulation process. Unlike rigid OLEDs, flexible displays require barrier solutions that can maintain integrity while being bent, folded, or rolled repeatedly. Encapsulation serves as the protective shield against moisture and oxygen, which are particularly detrimental to the organic materials in OLEDs, causing rapid degradation and shortened device lifespans.

Market demands have been the primary driver behind the accelerated development of flexible OLED encapsulation technologies. Consumer electronics manufacturers have increasingly sought displays that offer not only visual excellence but also form factor innovation. This market pull has directed research efforts toward thin-film encapsulation (TFE) methods, hybrid organic-inorganic multilayers, and advanced barrier films that combine mechanical flexibility with superior barrier properties.

The technical objectives for flexible OLED encapsulation development are multifaceted. First, achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day is essential for ensuring adequate device lifetimes. Second, maintaining these barrier properties under mechanical stress remains a significant challenge, with targets for bend radii decreasing from 10mm to sub-3mm in recent years. Third, cost-effective manufacturing processes that can be scaled to mass production are crucial for commercial viability.

Current encapsulation technologies include atomic layer deposition (ALD), plasma-enhanced chemical vapor deposition (PECVD), and solution-processed barrier layers. Each approach offers distinct advantages and limitations in terms of barrier performance, flexibility, and manufacturing complexity. The industry trend is moving toward hybrid solutions that combine the benefits of multiple technologies to meet the increasingly demanding requirements of next-generation flexible displays.

Looking forward, the technical evolution of flexible OLED encapsulation is expected to focus on ultra-thin barrier films, self-healing materials, and environmentally sustainable solutions. These advancements will be critical in supporting emerging applications such as transparent displays, automotive integrations, and medical devices, where flexibility, durability, and reliability under various environmental conditions are paramount.

The convergence of material science innovations, manufacturing process improvements, and market-driven requirements will continue to shape the development trajectory of flexible OLED encapsulation technologies, making it one of the most dynamic areas in display technology research.

The critical challenge in flexible OLED technology lies in the encapsulation process. Unlike rigid OLEDs, flexible displays require barrier solutions that can maintain integrity while being bent, folded, or rolled repeatedly. Encapsulation serves as the protective shield against moisture and oxygen, which are particularly detrimental to the organic materials in OLEDs, causing rapid degradation and shortened device lifespans.

Market demands have been the primary driver behind the accelerated development of flexible OLED encapsulation technologies. Consumer electronics manufacturers have increasingly sought displays that offer not only visual excellence but also form factor innovation. This market pull has directed research efforts toward thin-film encapsulation (TFE) methods, hybrid organic-inorganic multilayers, and advanced barrier films that combine mechanical flexibility with superior barrier properties.

The technical objectives for flexible OLED encapsulation development are multifaceted. First, achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day is essential for ensuring adequate device lifetimes. Second, maintaining these barrier properties under mechanical stress remains a significant challenge, with targets for bend radii decreasing from 10mm to sub-3mm in recent years. Third, cost-effective manufacturing processes that can be scaled to mass production are crucial for commercial viability.

Current encapsulation technologies include atomic layer deposition (ALD), plasma-enhanced chemical vapor deposition (PECVD), and solution-processed barrier layers. Each approach offers distinct advantages and limitations in terms of barrier performance, flexibility, and manufacturing complexity. The industry trend is moving toward hybrid solutions that combine the benefits of multiple technologies to meet the increasingly demanding requirements of next-generation flexible displays.

Looking forward, the technical evolution of flexible OLED encapsulation is expected to focus on ultra-thin barrier films, self-healing materials, and environmentally sustainable solutions. These advancements will be critical in supporting emerging applications such as transparent displays, automotive integrations, and medical devices, where flexibility, durability, and reliability under various environmental conditions are paramount.

The convergence of material science innovations, manufacturing process improvements, and market-driven requirements will continue to shape the development trajectory of flexible OLED encapsulation technologies, making it one of the most dynamic areas in display technology research.

Market Demand Analysis for Flexible OLED Displays

The flexible OLED display market has experienced remarkable growth in recent years, driven by increasing consumer demand for innovative form factors in electronic devices. Market research indicates that the global flexible OLED market reached approximately $18.2 billion in 2022 and is projected to grow at a CAGR of 35.3% through 2028. This exponential growth is primarily fueled by the expanding adoption of flexible displays in smartphones, wearables, and emerging applications in automotive and IoT devices.

Consumer preferences have shifted dramatically toward devices with larger screen-to-body ratios, curved edges, and foldable capabilities. This shift has created substantial demand for flexible OLED technologies that can accommodate these design requirements while maintaining durability and performance. Market surveys reveal that consumers are willing to pay premium prices for devices featuring flexible displays, with over 70% of high-end smartphone users citing display quality and flexibility as key purchasing factors.

The automotive sector represents an emerging but rapidly growing market for flexible OLED displays. Premium vehicle manufacturers are increasingly incorporating curved OLED panels in dashboard systems and entertainment consoles. Industry forecasts suggest that the automotive flexible display market will grow at a CAGR of 24.3% through 2027, creating new opportunities for encapsulation technologies specifically designed for harsh automotive environments.

Wearable technology constitutes another significant market driver for flexible OLED encapsulation solutions. The global smartwatch market alone grew by 22% in 2022, with flexible displays becoming standard in premium models. These applications demand ultra-thin encapsulation layers that can withstand repeated bending while maintaining barrier properties against oxygen and moisture.

Regional market analysis reveals that Asia-Pacific dominates the flexible OLED supply chain, with South Korea and China leading manufacturing capacity. However, North America and Europe represent the largest end-user markets, particularly for premium devices incorporating advanced flexible display technologies.

Market requirements for encapsulation technologies have evolved significantly, with manufacturers prioritizing solutions that enable thinner device profiles, enhanced flexibility, and improved durability. Current market specifications demand encapsulation layers with water vapor transmission rates below 10^-6 g/m²/day, oxygen transmission rates below 10^-5 cc/m²/day, and the ability to withstand over 200,000 bending cycles without performance degradation.

Cost considerations remain a critical market factor, with manufacturers seeking encapsulation solutions that balance performance with economic viability. Current thin-film encapsulation processes contribute approximately 15-20% to overall flexible OLED production costs, creating market demand for more cost-effective alternatives that maintain barrier performance.

Consumer preferences have shifted dramatically toward devices with larger screen-to-body ratios, curved edges, and foldable capabilities. This shift has created substantial demand for flexible OLED technologies that can accommodate these design requirements while maintaining durability and performance. Market surveys reveal that consumers are willing to pay premium prices for devices featuring flexible displays, with over 70% of high-end smartphone users citing display quality and flexibility as key purchasing factors.

The automotive sector represents an emerging but rapidly growing market for flexible OLED displays. Premium vehicle manufacturers are increasingly incorporating curved OLED panels in dashboard systems and entertainment consoles. Industry forecasts suggest that the automotive flexible display market will grow at a CAGR of 24.3% through 2027, creating new opportunities for encapsulation technologies specifically designed for harsh automotive environments.

Wearable technology constitutes another significant market driver for flexible OLED encapsulation solutions. The global smartwatch market alone grew by 22% in 2022, with flexible displays becoming standard in premium models. These applications demand ultra-thin encapsulation layers that can withstand repeated bending while maintaining barrier properties against oxygen and moisture.

Regional market analysis reveals that Asia-Pacific dominates the flexible OLED supply chain, with South Korea and China leading manufacturing capacity. However, North America and Europe represent the largest end-user markets, particularly for premium devices incorporating advanced flexible display technologies.

Market requirements for encapsulation technologies have evolved significantly, with manufacturers prioritizing solutions that enable thinner device profiles, enhanced flexibility, and improved durability. Current market specifications demand encapsulation layers with water vapor transmission rates below 10^-6 g/m²/day, oxygen transmission rates below 10^-5 cc/m²/day, and the ability to withstand over 200,000 bending cycles without performance degradation.

Cost considerations remain a critical market factor, with manufacturers seeking encapsulation solutions that balance performance with economic viability. Current thin-film encapsulation processes contribute approximately 15-20% to overall flexible OLED production costs, creating market demand for more cost-effective alternatives that maintain barrier performance.

Current Encapsulation Technologies and Challenges

Flexible OLED encapsulation technology currently faces significant challenges despite substantial progress in recent years. The primary encapsulation methods in the industry include thin-film encapsulation (TFE), glass-to-glass sealing, and hybrid approaches combining inorganic and organic layers. TFE has emerged as the dominant solution for flexible displays due to its minimal thickness and flexibility characteristics, with major manufacturers adopting multi-layer structures alternating between inorganic barrier layers (typically AlOx or SiNx) and organic buffer layers.

The water vapor transmission rate (WVTR) requirements for OLED devices remain extremely demanding, with industry standards requiring levels below 10^-6 g/m²/day. This represents one of the most stringent barrier requirements in any industry application. Current technologies struggle to consistently achieve these levels while maintaining the flexibility and durability demanded by consumer electronics markets.

Manufacturing scalability presents another significant challenge. High-volume production of consistent barrier layers across large substrate areas requires precise deposition control that many existing systems cannot reliably deliver. The atomic layer deposition (ALD) process, while offering excellent barrier properties, faces throughput limitations that impact production economics at scale.

Mechanical durability under repeated flexing represents perhaps the most critical technical hurdle. Inorganic barrier layers, while providing superior moisture and oxygen protection, tend to develop microcracks when subjected to bending stress. These defects create permeation pathways that compromise the entire encapsulation system. Industry testing shows significant barrier degradation after as few as 1,000-10,000 bending cycles, far below the hundreds of thousands of cycles expected in commercial applications.

Cost considerations further complicate technology development. Premium encapsulation solutions can represent 15-20% of total display manufacturing costs. Market pressure for lower-priced flexible devices creates tension between performance requirements and economic viability. The specialized equipment required for high-quality barrier deposition (particularly ALD systems) involves substantial capital investment that must be justified through production volume.

Geographically, encapsulation technology development remains concentrated in East Asia, particularly South Korea and Japan, with emerging capabilities in China. Western companies maintain strong positions in specialized materials and equipment but lag in integrated manufacturing solutions. This distribution reflects broader OLED industry dynamics but creates potential supply chain vulnerabilities.

Environmental concerns are increasingly influencing technology development, with regulatory pressure mounting against certain fluorinated compounds used in some encapsulation processes. Manufacturers must balance performance requirements with sustainability considerations, particularly as consumer electronics face growing scrutiny regarding end-of-life disposal and recycling challenges.

The water vapor transmission rate (WVTR) requirements for OLED devices remain extremely demanding, with industry standards requiring levels below 10^-6 g/m²/day. This represents one of the most stringent barrier requirements in any industry application. Current technologies struggle to consistently achieve these levels while maintaining the flexibility and durability demanded by consumer electronics markets.

Manufacturing scalability presents another significant challenge. High-volume production of consistent barrier layers across large substrate areas requires precise deposition control that many existing systems cannot reliably deliver. The atomic layer deposition (ALD) process, while offering excellent barrier properties, faces throughput limitations that impact production economics at scale.

Mechanical durability under repeated flexing represents perhaps the most critical technical hurdle. Inorganic barrier layers, while providing superior moisture and oxygen protection, tend to develop microcracks when subjected to bending stress. These defects create permeation pathways that compromise the entire encapsulation system. Industry testing shows significant barrier degradation after as few as 1,000-10,000 bending cycles, far below the hundreds of thousands of cycles expected in commercial applications.

Cost considerations further complicate technology development. Premium encapsulation solutions can represent 15-20% of total display manufacturing costs. Market pressure for lower-priced flexible devices creates tension between performance requirements and economic viability. The specialized equipment required for high-quality barrier deposition (particularly ALD systems) involves substantial capital investment that must be justified through production volume.

Geographically, encapsulation technology development remains concentrated in East Asia, particularly South Korea and Japan, with emerging capabilities in China. Western companies maintain strong positions in specialized materials and equipment but lag in integrated manufacturing solutions. This distribution reflects broader OLED industry dynamics but creates potential supply chain vulnerabilities.

Environmental concerns are increasingly influencing technology development, with regulatory pressure mounting against certain fluorinated compounds used in some encapsulation processes. Manufacturers must balance performance requirements with sustainability considerations, particularly as consumer electronics face growing scrutiny regarding end-of-life disposal and recycling challenges.

Current Encapsulation Solutions and Implementation

01 Thin-film encapsulation technologies for flexible OLEDs

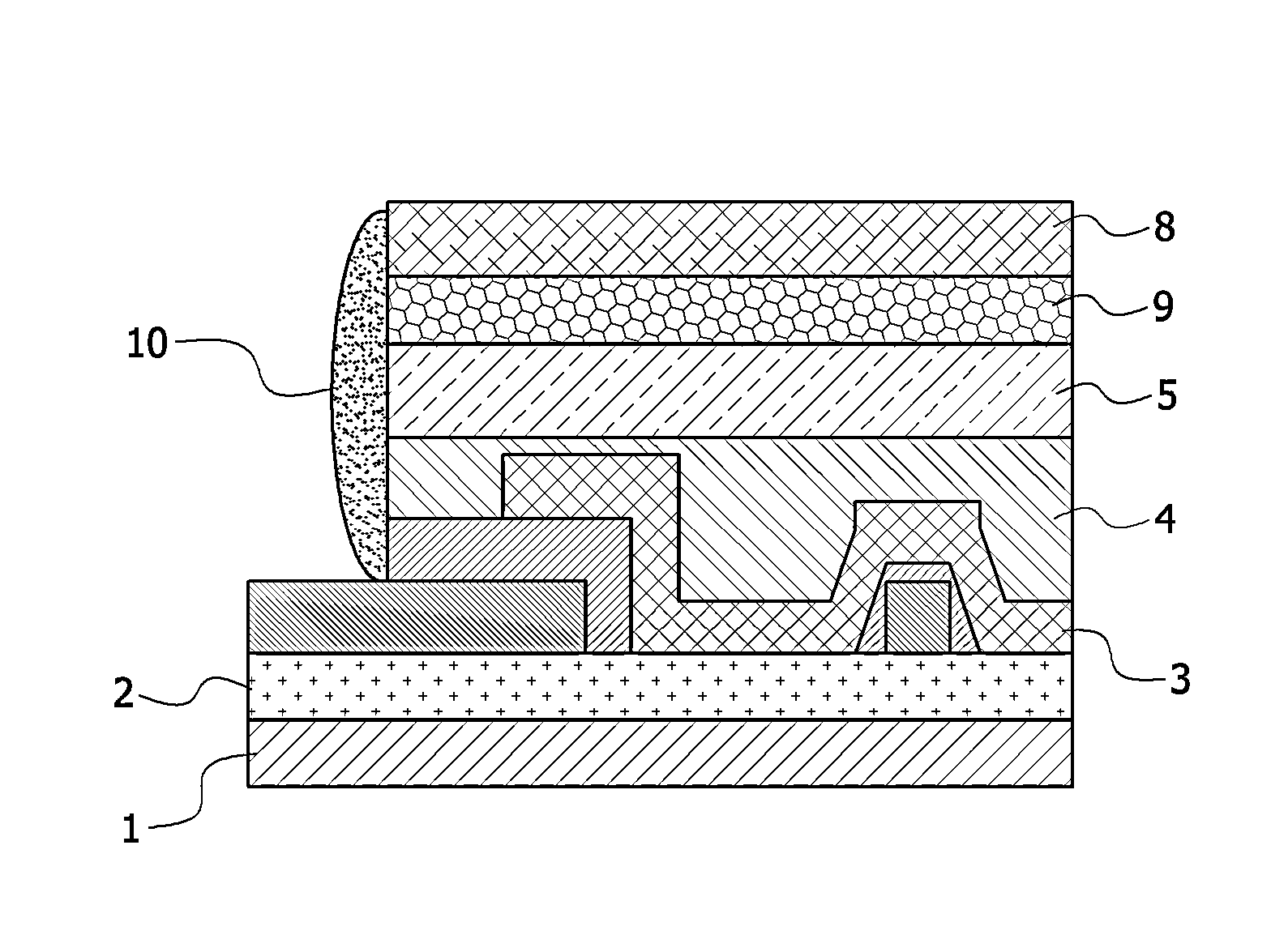

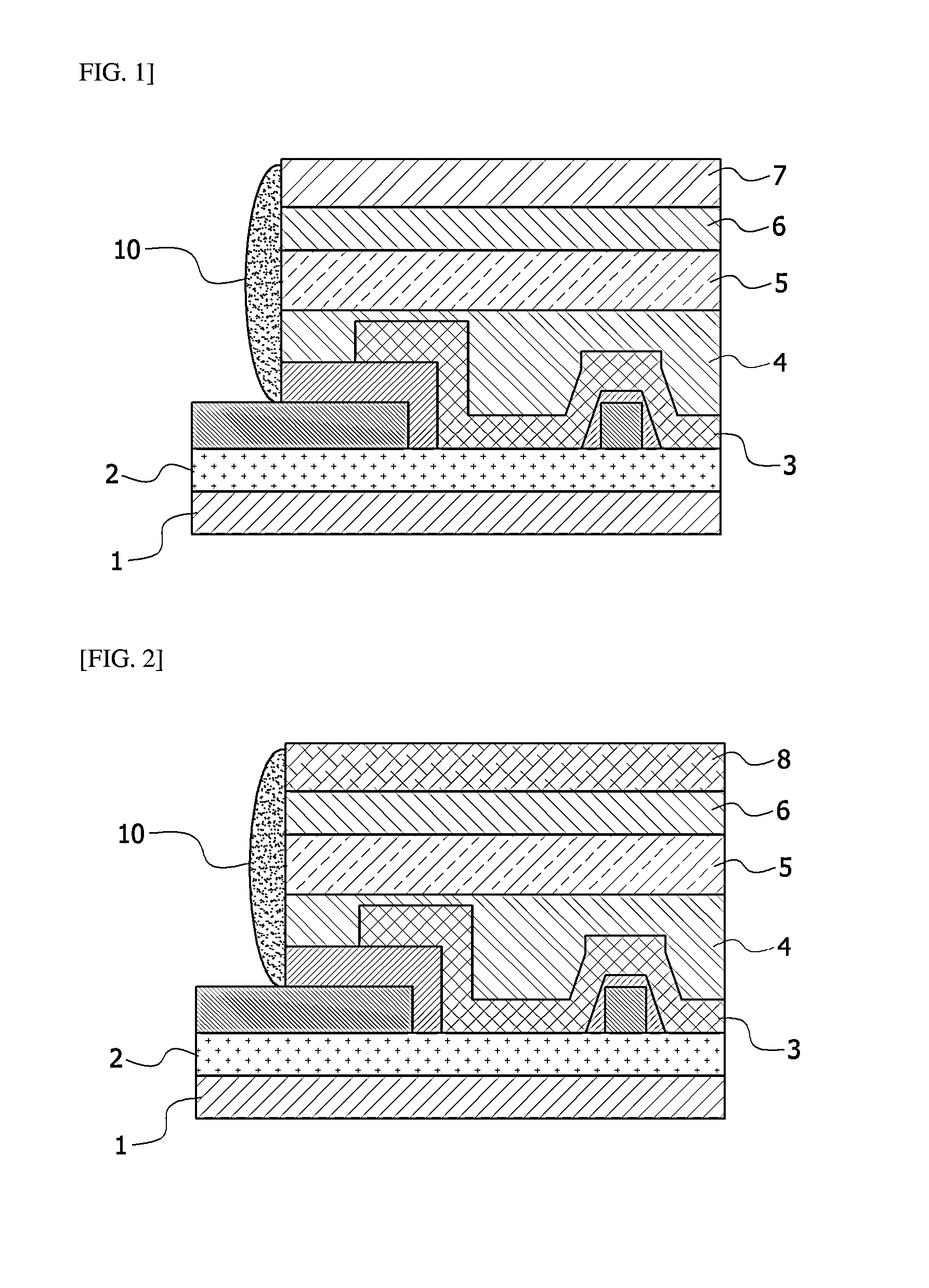

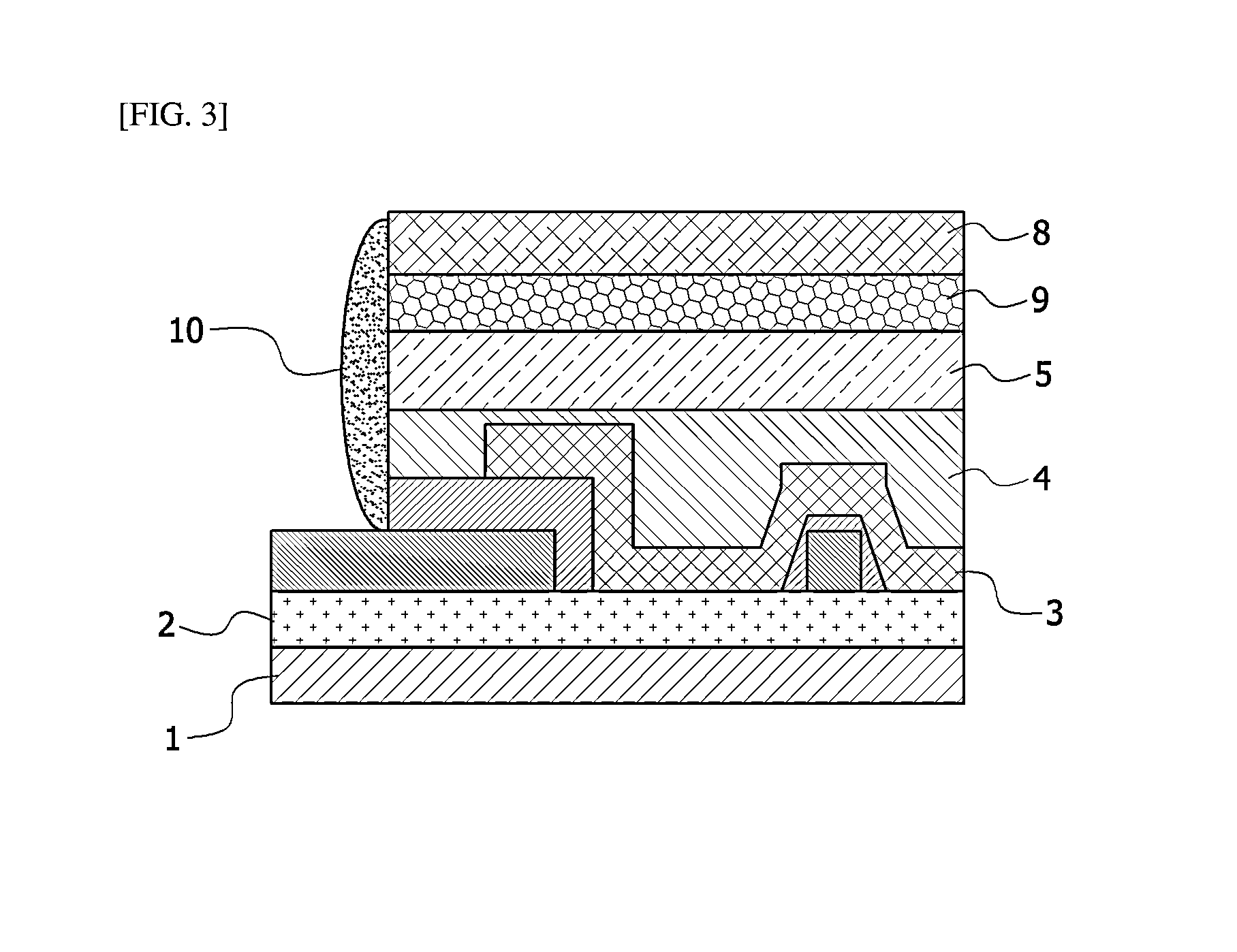

Thin-film encapsulation (TFE) is a critical technology for flexible OLED displays, providing protection against moisture and oxygen while maintaining flexibility. These technologies typically involve alternating organic and inorganic layers to create effective barrier properties. Advanced TFE solutions combine the advantages of inorganic layers (excellent barrier properties) with organic layers (flexibility and stress relief) to meet market demands for thinner, lighter, and more durable flexible displays.- Thin-film encapsulation technologies for flexible OLEDs: Thin-film encapsulation (TFE) technologies are crucial for flexible OLED displays as they provide effective barrier protection against moisture and oxygen while maintaining flexibility. These technologies typically involve alternating organic and inorganic layers to create a multi-layer barrier structure. The inorganic layers provide excellent barrier properties while the organic layers help to decouple defects and add flexibility. This approach enables the production of bendable and foldable OLED displays that meet market demands for durability and form factor innovation.

- Advanced barrier materials for OLED encapsulation: The market demands for flexible OLED encapsulation have driven the development of advanced barrier materials with superior moisture and oxygen blocking capabilities. These materials include high-performance inorganic films such as silicon nitride, aluminum oxide, and silicon oxide, as well as specialized organic materials that can withstand bending stress. The combination of these materials in multi-layer structures provides the ultra-low water vapor transmission rates required for OLED longevity while maintaining the mechanical flexibility needed for next-generation display applications.

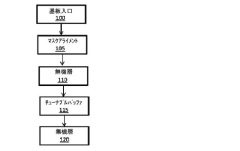

- Encapsulation process innovations for manufacturing scalability: Manufacturing scalability is a key market demand for flexible OLED encapsulation. Process innovations include advanced deposition techniques such as atomic layer deposition (ALD), plasma-enhanced chemical vapor deposition (PECVD), and solution-based processes that enable high-throughput production. These processes allow for uniform, defect-free barrier layers on flexible substrates at industrial scales. Additionally, innovations in curing methods and layer adhesion have improved production efficiency and yield rates, addressing the market need for cost-effective manufacturing of flexible OLED displays.

- Hybrid encapsulation solutions for enhanced flexibility and protection: Hybrid encapsulation approaches combine different technologies to meet the demanding requirements of flexible OLED applications. These solutions may integrate thin-film encapsulation with edge sealing techniques, or combine inorganic barrier layers with specialized adhesives and fillers. Some approaches incorporate nanocomposite materials or hybrid organic-inorganic structures to achieve an optimal balance between barrier performance and mechanical flexibility. These hybrid solutions address market demands for displays that can withstand repeated bending cycles while maintaining excellent protection against environmental factors.

- Edge sealing and mechanical protection technologies: The market for flexible OLEDs demands robust edge sealing and mechanical protection solutions to prevent moisture ingress at the vulnerable edges of displays and to protect against mechanical damage during bending. Technologies include specialized edge sealants, reinforced perimeter structures, and stress-distribution layers that prevent delamination and cracking. Some approaches incorporate flexible adhesives with self-healing properties or gradient structures that distribute mechanical stress. These technologies are essential for meeting consumer expectations for durable, long-lasting flexible OLED devices in applications ranging from smartphones to wearable electronics.

02 Barrier film structures and materials for OLED encapsulation

Market demands for flexible OLED encapsulation have driven innovation in barrier film structures and materials. Multi-layer barrier films incorporating various combinations of inorganic materials (like silicon nitride, aluminum oxide) and organic materials are being developed to achieve ultra-low water vapor transmission rates while maintaining flexibility. These barrier structures must balance excellent barrier properties with mechanical flexibility to prevent cracking during bending and folding operations, which is essential for next-generation flexible display applications.Expand Specific Solutions03 Manufacturing processes for flexible OLED encapsulation

Advanced manufacturing processes are being developed to meet market demands for cost-effective, high-throughput production of flexible OLED encapsulation. These include atomic layer deposition (ALD), plasma-enhanced chemical vapor deposition (PECVD), and solution-based processes for organic layers. Roll-to-roll manufacturing techniques are particularly important for scaling production and reducing costs. The market increasingly demands processes that can maintain high barrier performance while enabling higher production yields and lower manufacturing costs.Expand Specific Solutions04 Edge sealing and mechanical protection solutions

Edge sealing and mechanical protection are critical aspects of flexible OLED encapsulation market demands. As flexible displays become more prevalent in consumer electronics, solutions that protect the vulnerable edges of the display from moisture ingress while maintaining flexibility are increasingly important. Various approaches include specialized adhesives, foldable edge sealants, and integrated mechanical protection layers that can withstand repeated bending and folding without compromising the barrier properties of the encapsulation system.Expand Specific Solutions05 Transparent and high-performance barrier materials

The market increasingly demands transparent and high-performance barrier materials for flexible OLED encapsulation. These materials must maintain optical clarity while providing excellent barrier properties against moisture and oxygen. Innovations include transparent inorganic oxides, hybrid organic-inorganic materials, and nanocomposites that can achieve ultra-low permeation rates while maintaining high transparency. These materials are essential for ensuring display quality and longevity in flexible OLED applications, particularly for foldable smartphones and wearable devices.Expand Specific Solutions

Key Industry Players in Flexible OLED Encapsulation

The flexible OLED encapsulation market is currently in a growth phase, driven by increasing demand for foldable and bendable displays in consumer electronics. Market size is expanding rapidly, with projections exceeding $2 billion by 2025 as manufacturers seek thinner, more durable barrier solutions. Technologically, Chinese companies like BOE Technology Group and TCL China Star Optoelectronics are challenging traditional leaders LG Display and Samsung, while specialized materials firms such as Sumitomo Bakelite and Akron Polymer Systems are advancing barrier film innovations. The technology maturity varies across approaches, with thin-film encapsulation gaining momentum over traditional glass solutions. Research institutions including Shanghai University and HKUST are collaborating with industry players to overcome remaining challenges in moisture resistance and flexibility while reducing production costs.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive flexible OLED encapsulation solution driven by consumer electronics market demands for thinner, more durable devices. Their technology utilizes a hybrid encapsulation approach combining atomic layer deposition (ALD) for ultra-thin inorganic barrier layers with specially formulated organic polymer interlayers. This structure creates multiple dyads (alternating organic-inorganic layers) that effectively block moisture and oxygen penetration while maintaining flexibility. BOE's encapsulation technology achieves a water vapor transmission rate below 5×10^-6 g/m²/day while supporting over 200,000 bending cycles at a radius of 3mm. The company has integrated their encapsulation process directly into their flexible OLED production lines, using specialized equipment that allows for continuous deposition without breaking vacuum conditions between layers. BOE has also developed proprietary edge sealing materials that prevent lateral ingress of moisture and oxygen at display boundaries.

Strengths: Highly scalable production process suitable for various display sizes; excellent mechanical durability under repeated bending; integrated manufacturing approach reducing production steps. Weaknesses: Higher material costs compared to traditional encapsulation; requires precise process control to maintain barrier uniformity; technology still evolving for ultra-small bend radius applications (<1mm).

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed a market-responsive flexible OLED encapsulation technology that addresses consumer demands for thinner, more durable displays. Their approach utilizes a hybrid thin-film encapsulation (TFE) system combining plasma-enhanced chemical vapor deposition (PECVD) for inorganic layers with specialized organic materials. The company's encapsulation structure typically consists of 3-5 alternating layers of silicon nitride and organic polymer, creating an effective barrier against moisture and oxygen while maintaining flexibility. TCL's technology achieves water vapor transmission rates below 10^-5 g/m²/day and supports bend radii down to 3mm for mobile device applications. Their manufacturing process incorporates in-line quality control systems that monitor layer thickness and defect density in real-time, allowing for immediate process adjustments to maintain barrier integrity. TCL has also developed specialized edge sealing techniques using UV-curable resins that prevent lateral moisture ingress at display boundaries.

Strengths: Cost-effective manufacturing process suitable for mass production; good balance between barrier performance and flexibility; established integration with existing display manufacturing lines. Weaknesses: Barrier performance not yet matching industry leaders; limited experience with ultra-small bend radius applications (<1mm); technology still evolving for automotive and wearable applications requiring extreme durability.

Critical Patents and Innovations in Barrier Technologies

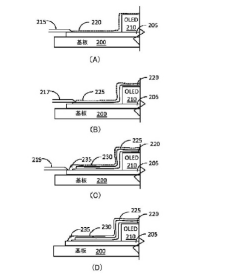

Organic light emitting device comprising encapsulating structure

PatentActiveUS20130207093A1

Innovation

- An encapsulating layer comprising a stack of at least two materials such as a water barrier film, glass cap, and metal foil is applied to the entire top surface of the OLED, providing excellent water and oxygen barrier effects while facilitating heat dissipation.

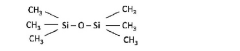

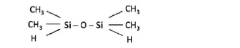

Encapsulation method for organic light emitting diode

PatentInactiveJP2022145802A

Innovation

- A method involving the formation of inorganic and organic layers in a controlled process chamber, utilizing tunable buffer layers formed from vaporized organosilicon compounds like hexamethyldisiloxane or tetramethyldisiloxane, with precise mask alignment outside the chamber to ensure encapsulation integrity.

Supply Chain Dynamics and Material Constraints

The flexible OLED encapsulation market operates within a complex supply chain ecosystem that significantly impacts technology development trajectories. Raw material availability represents a critical constraint, with key components such as barrier films, adhesives, and specialty chemicals often sourced from limited suppliers. This concentration creates vulnerability to disruptions, as evidenced during recent global supply chain crises when manufacturers faced extended lead times for essential encapsulation materials, directly impacting production schedules and technology implementation timelines.

Price volatility of rare materials used in high-performance encapsulation solutions presents another significant challenge. Thin-film encapsulation (TFE) processes require specialized inorganic materials and organic interlayers whose costs can fluctuate dramatically based on global market conditions. These fluctuations force manufacturers to continuously reassess material selection strategies, sometimes compromising between optimal technical performance and economic feasibility.

Geographic concentration of material production introduces additional complexity, with certain critical components predominantly manufactured in specific regions. For instance, high-quality barrier films and specialty adhesives are largely produced in East Asia, creating potential bottlenecks when regional disruptions occur. This concentration has prompted leading OLED manufacturers to pursue vertical integration strategies, with companies like Samsung and LG investing in their own encapsulation material production capabilities to ensure supply security.

Material qualification processes further constrain rapid innovation in encapsulation technologies. New materials must undergo extensive testing cycles—often 12-18 months—before implementation in commercial products. This extended qualification timeline creates significant lag between material innovation and market implementation, forcing manufacturers to plan encapsulation technology roadmaps with considerable lead time.

Sustainability considerations are increasingly influencing supply chain decisions for encapsulation materials. As environmental regulations tighten globally, manufacturers must balance performance requirements with environmental impact. This has accelerated research into bio-based alternatives for traditionally petroleum-derived components in encapsulation systems, though these alternatives often face challenges in matching the barrier properties of conventional materials.

The interplay between these supply chain dynamics and material constraints directly shapes the pace and direction of flexible OLED encapsulation technology development, creating a feedback loop where market demands must be balanced against material availability, cost considerations, and qualification timelines.

Price volatility of rare materials used in high-performance encapsulation solutions presents another significant challenge. Thin-film encapsulation (TFE) processes require specialized inorganic materials and organic interlayers whose costs can fluctuate dramatically based on global market conditions. These fluctuations force manufacturers to continuously reassess material selection strategies, sometimes compromising between optimal technical performance and economic feasibility.

Geographic concentration of material production introduces additional complexity, with certain critical components predominantly manufactured in specific regions. For instance, high-quality barrier films and specialty adhesives are largely produced in East Asia, creating potential bottlenecks when regional disruptions occur. This concentration has prompted leading OLED manufacturers to pursue vertical integration strategies, with companies like Samsung and LG investing in their own encapsulation material production capabilities to ensure supply security.

Material qualification processes further constrain rapid innovation in encapsulation technologies. New materials must undergo extensive testing cycles—often 12-18 months—before implementation in commercial products. This extended qualification timeline creates significant lag between material innovation and market implementation, forcing manufacturers to plan encapsulation technology roadmaps with considerable lead time.

Sustainability considerations are increasingly influencing supply chain decisions for encapsulation materials. As environmental regulations tighten globally, manufacturers must balance performance requirements with environmental impact. This has accelerated research into bio-based alternatives for traditionally petroleum-derived components in encapsulation systems, though these alternatives often face challenges in matching the barrier properties of conventional materials.

The interplay between these supply chain dynamics and material constraints directly shapes the pace and direction of flexible OLED encapsulation technology development, creating a feedback loop where market demands must be balanced against material availability, cost considerations, and qualification timelines.

Sustainability Considerations in Encapsulation Development

The sustainability aspect of flexible OLED encapsulation has become increasingly critical as environmental concerns gain prominence across global markets. Encapsulation materials and processes traditionally involve energy-intensive manufacturing and potentially hazardous chemicals, creating a growing tension between technological advancement and environmental responsibility. Market research indicates that consumers and regulatory bodies are increasingly demanding products with reduced environmental footprints, directly influencing R&D priorities in the OLED industry.

Current encapsulation technologies often rely on rare earth elements and compounds with significant extraction impacts. The thin-film barrier layers frequently utilize materials like aluminum oxide and silicon nitride, which require substantial energy during deposition processes. Additionally, traditional encapsulation often incorporates adhesives containing volatile organic compounds (VOCs) that pose environmental and health risks during manufacturing and disposal phases.

Leading manufacturers are responding to these sustainability challenges by developing bio-based alternatives for adhesive components and implementing closed-loop manufacturing systems. Companies like Samsung Display and LG Display have announced commitments to reduce carbon emissions in their production processes by 30% by 2030, with encapsulation technologies being a key focus area. This shift represents both a response to market pressure and strategic positioning for future regulatory compliance.

Energy efficiency improvements in encapsulation processes are emerging as another significant trend. Atomic Layer Deposition (ALD) techniques are being refined to operate at lower temperatures, reducing energy consumption while maintaining barrier performance. These advancements align with broader industry goals to minimize the carbon footprint associated with display manufacturing, addressing a growing concern among environmentally conscious consumers.

End-of-life considerations are also reshaping encapsulation development strategies. The complex multi-layer structure of traditional encapsulation makes recycling challenging, contributing to electronic waste issues. Research into delamination techniques and material selection that facilitates component separation is gaining traction, with several academic-industrial partnerships focused on developing encapsulation systems designed for eventual disassembly and material recovery.

Water-based encapsulation systems represent one of the most promising sustainable innovations, potentially eliminating the need for organic solvents in certain applications. These systems have demonstrated encouraging water vapor transmission rates in laboratory settings, though challenges remain in scaling production while maintaining performance consistency. Market analysis suggests that brands emphasizing such eco-friendly innovations can command premium pricing in certain consumer segments, creating economic incentives that further drive sustainability-focused R&D.

Current encapsulation technologies often rely on rare earth elements and compounds with significant extraction impacts. The thin-film barrier layers frequently utilize materials like aluminum oxide and silicon nitride, which require substantial energy during deposition processes. Additionally, traditional encapsulation often incorporates adhesives containing volatile organic compounds (VOCs) that pose environmental and health risks during manufacturing and disposal phases.

Leading manufacturers are responding to these sustainability challenges by developing bio-based alternatives for adhesive components and implementing closed-loop manufacturing systems. Companies like Samsung Display and LG Display have announced commitments to reduce carbon emissions in their production processes by 30% by 2030, with encapsulation technologies being a key focus area. This shift represents both a response to market pressure and strategic positioning for future regulatory compliance.

Energy efficiency improvements in encapsulation processes are emerging as another significant trend. Atomic Layer Deposition (ALD) techniques are being refined to operate at lower temperatures, reducing energy consumption while maintaining barrier performance. These advancements align with broader industry goals to minimize the carbon footprint associated with display manufacturing, addressing a growing concern among environmentally conscious consumers.

End-of-life considerations are also reshaping encapsulation development strategies. The complex multi-layer structure of traditional encapsulation makes recycling challenging, contributing to electronic waste issues. Research into delamination techniques and material selection that facilitates component separation is gaining traction, with several academic-industrial partnerships focused on developing encapsulation systems designed for eventual disassembly and material recovery.

Water-based encapsulation systems represent one of the most promising sustainable innovations, potentially eliminating the need for organic solvents in certain applications. These systems have demonstrated encouraging water vapor transmission rates in laboratory settings, though challenges remain in scaling production while maintaining performance consistency. Market analysis suggests that brands emphasizing such eco-friendly innovations can command premium pricing in certain consumer segments, creating economic incentives that further drive sustainability-focused R&D.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!