Market Overview of Flexible OLED Encapsulation Techniques

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible OLED Encapsulation Evolution and Objectives

Flexible OLED (Organic Light-Emitting Diode) technology has undergone significant evolution since its inception in the late 1990s. The journey began with rigid OLED displays, which demonstrated the potential of organic materials for display applications but lacked flexibility. The transition to flexible OLEDs represented a paradigm shift in display technology, enabling curved, bendable, and eventually foldable display solutions that have revolutionized consumer electronics.

The critical challenge in flexible OLED development has consistently been encapsulation - the process of protecting the highly sensitive organic materials from environmental factors, particularly oxygen and moisture. Early encapsulation techniques relied on rigid glass barriers, which fundamentally limited flexibility. The technological evolution progressed through several distinct phases, from glass-based encapsulation to thin-film encapsulation (TFE) and hybrid approaches.

By the mid-2000s, researchers began exploring thin-film barrier technologies, utilizing alternating organic and inorganic layers to create effective moisture barriers while maintaining flexibility. This multilayer approach, often referred to as the "dyad" structure, became a cornerstone of flexible OLED encapsulation technology. The development of atomic layer deposition (ALD) techniques further enhanced the quality and performance of these thin barriers.

The 2010s witnessed significant advancements in encapsulation materials, including the introduction of hybrid organic-inorganic materials that combined the flexibility of organic components with the barrier properties of inorganic materials. Concurrently, manufacturing processes evolved from batch processing to roll-to-roll techniques, enabling more cost-effective production of flexible displays.

Recent years have seen the emergence of advanced approaches such as plasma-enhanced ALD, solution-processed barriers, and nanocomposite materials that offer superior barrier properties while maintaining the mechanical flexibility required for next-generation devices. The integration of self-healing materials represents the cutting edge of encapsulation technology, potentially addressing the long-standing challenge of maintaining barrier integrity during repeated flexing.

The primary objectives of flexible OLED encapsulation technology development include achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day, extending device lifetimes to exceed 10,000 hours under normal operating conditions, maintaining optical transparency above 90%, and ensuring mechanical durability through thousands of bending cycles. Additionally, the industry aims to develop encapsulation solutions that are compatible with high-throughput manufacturing processes while reducing material costs and environmental impact.

The trajectory of encapsulation technology development is increasingly focused on enabling more extreme form factors, including rollable and stretchable displays, which demand even more sophisticated barrier solutions. As the market for flexible displays continues to expand, encapsulation technology remains a critical enabler for innovation in this rapidly evolving field.

The critical challenge in flexible OLED development has consistently been encapsulation - the process of protecting the highly sensitive organic materials from environmental factors, particularly oxygen and moisture. Early encapsulation techniques relied on rigid glass barriers, which fundamentally limited flexibility. The technological evolution progressed through several distinct phases, from glass-based encapsulation to thin-film encapsulation (TFE) and hybrid approaches.

By the mid-2000s, researchers began exploring thin-film barrier technologies, utilizing alternating organic and inorganic layers to create effective moisture barriers while maintaining flexibility. This multilayer approach, often referred to as the "dyad" structure, became a cornerstone of flexible OLED encapsulation technology. The development of atomic layer deposition (ALD) techniques further enhanced the quality and performance of these thin barriers.

The 2010s witnessed significant advancements in encapsulation materials, including the introduction of hybrid organic-inorganic materials that combined the flexibility of organic components with the barrier properties of inorganic materials. Concurrently, manufacturing processes evolved from batch processing to roll-to-roll techniques, enabling more cost-effective production of flexible displays.

Recent years have seen the emergence of advanced approaches such as plasma-enhanced ALD, solution-processed barriers, and nanocomposite materials that offer superior barrier properties while maintaining the mechanical flexibility required for next-generation devices. The integration of self-healing materials represents the cutting edge of encapsulation technology, potentially addressing the long-standing challenge of maintaining barrier integrity during repeated flexing.

The primary objectives of flexible OLED encapsulation technology development include achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day, extending device lifetimes to exceed 10,000 hours under normal operating conditions, maintaining optical transparency above 90%, and ensuring mechanical durability through thousands of bending cycles. Additionally, the industry aims to develop encapsulation solutions that are compatible with high-throughput manufacturing processes while reducing material costs and environmental impact.

The trajectory of encapsulation technology development is increasingly focused on enabling more extreme form factors, including rollable and stretchable displays, which demand even more sophisticated barrier solutions. As the market for flexible displays continues to expand, encapsulation technology remains a critical enabler for innovation in this rapidly evolving field.

Market Demand Analysis for Flexible OLED Displays

The flexible OLED display market has witnessed exponential growth over the past decade, driven primarily by consumer demand for more versatile, durable, and aesthetically pleasing electronic devices. Market research indicates that the global flexible OLED display market reached approximately $18.6 billion in 2022 and is projected to grow at a CAGR of 35.3% through 2028, potentially reaching $119.9 billion by the end of the forecast period.

Smartphone manufacturers represent the largest consumer segment, accounting for nearly 65% of flexible OLED demand. This dominance stems from the increasing adoption of foldable and rollable smartphone designs by major manufacturers like Samsung, Huawei, and Motorola. The premium smartphone sector has particularly embraced flexible OLED technology as a key differentiator in the highly competitive market.

Wearable technology constitutes the second-largest application segment, with smartwatches and fitness trackers incorporating curved displays to enhance user experience and comfort. This segment is growing at 42% annually, outpacing the overall market growth rate. The automotive industry has also begun integrating flexible displays into dashboard systems and entertainment consoles, representing an emerging high-value market segment.

Regional analysis reveals that Asia-Pacific dominates both production and consumption of flexible OLED displays, with South Korea and China leading manufacturing capabilities. North America and Europe follow as significant consumer markets, driven by high disposable income and rapid technology adoption rates.

Consumer preference surveys indicate five key market drivers for flexible OLED displays: device durability, form factor innovation, reduced weight, enhanced visual experience, and energy efficiency. The ability to create truly foldable devices without display degradation remains the most sought-after advancement, with 78% of consumers indicating willingness to pay premium prices for reliable folding display technology.

Supply chain analysis reveals that encapsulation techniques represent a critical bottleneck in flexible OLED production. Current thin-film encapsulation methods add significant cost to manufacturing while limiting production scalability. Market forecasts suggest that innovations in encapsulation technology could reduce production costs by up to 30%, potentially accelerating market penetration into mid-range consumer electronics.

Enterprise adoption presents another significant growth vector, with commercial applications in retail, healthcare, and industrial settings beginning to implement flexible display solutions for specialized applications. This B2B segment is expected to grow from 8% of the total market to approximately 15% by 2026.

Smartphone manufacturers represent the largest consumer segment, accounting for nearly 65% of flexible OLED demand. This dominance stems from the increasing adoption of foldable and rollable smartphone designs by major manufacturers like Samsung, Huawei, and Motorola. The premium smartphone sector has particularly embraced flexible OLED technology as a key differentiator in the highly competitive market.

Wearable technology constitutes the second-largest application segment, with smartwatches and fitness trackers incorporating curved displays to enhance user experience and comfort. This segment is growing at 42% annually, outpacing the overall market growth rate. The automotive industry has also begun integrating flexible displays into dashboard systems and entertainment consoles, representing an emerging high-value market segment.

Regional analysis reveals that Asia-Pacific dominates both production and consumption of flexible OLED displays, with South Korea and China leading manufacturing capabilities. North America and Europe follow as significant consumer markets, driven by high disposable income and rapid technology adoption rates.

Consumer preference surveys indicate five key market drivers for flexible OLED displays: device durability, form factor innovation, reduced weight, enhanced visual experience, and energy efficiency. The ability to create truly foldable devices without display degradation remains the most sought-after advancement, with 78% of consumers indicating willingness to pay premium prices for reliable folding display technology.

Supply chain analysis reveals that encapsulation techniques represent a critical bottleneck in flexible OLED production. Current thin-film encapsulation methods add significant cost to manufacturing while limiting production scalability. Market forecasts suggest that innovations in encapsulation technology could reduce production costs by up to 30%, potentially accelerating market penetration into mid-range consumer electronics.

Enterprise adoption presents another significant growth vector, with commercial applications in retail, healthcare, and industrial settings beginning to implement flexible display solutions for specialized applications. This B2B segment is expected to grow from 8% of the total market to approximately 15% by 2026.

Current Encapsulation Technologies and Barriers

The flexible OLED encapsulation technology landscape is currently dominated by three primary approaches: thin-film encapsulation (TFE), glass encapsulation, and hybrid solutions. TFE has emerged as the leading technology for flexible displays, utilizing alternating layers of inorganic and organic materials to create effective moisture and oxygen barriers. The inorganic layers (typically silicon nitride or aluminum oxide) provide excellent barrier properties, while organic layers (often acrylic polymers) offer flexibility and stress relief.

Glass encapsulation, though traditionally used for rigid OLEDs, has evolved with ultra-thin glass (UTG) technology allowing for limited flexibility while maintaining superior barrier properties. UTG solutions typically range from 30-100 μm in thickness and offer excellent transparency and thermal stability compared to polymer alternatives.

Hybrid approaches combine elements of both technologies, often using thin glass with additional polymer layers or advanced edge sealing techniques to maximize performance while maintaining flexibility. These solutions represent the current cutting edge in balancing barrier requirements with mechanical flexibility.

Despite significant advancements, several critical barriers persist in flexible OLED encapsulation. The most fundamental challenge remains achieving sufficient barrier properties while maintaining flexibility. Current technologies struggle to simultaneously deliver water vapor transmission rates (WVTR) below 10^-6 g/m²/day and oxygen transmission rates (OTR) below 10^-5 cm³/m²/day while allowing for bending radii under 5mm.

Manufacturing scalability presents another significant hurdle, particularly for TFE processes which require precise deposition of nanometer-scale layers over large areas. Yield rates for high-quality encapsulation remain lower than desired, driving up production costs and limiting market expansion.

Durability under repeated flexing represents a persistent challenge, with encapsulation layers often developing microcracks after thousands of bending cycles. These defects compromise barrier integrity and ultimately lead to device failure through pixel degradation.

Cost factors continue to constrain market growth, with high-performance encapsulation solutions adding significantly to overall device manufacturing expenses. Current estimates suggest encapsulation accounts for 15-20% of flexible OLED production costs, creating pressure for more economical solutions.

Edge sealing technology remains particularly problematic, as the interface between different materials creates vulnerable points for moisture ingress. Current solutions often compromise either flexibility or barrier performance at these critical junctions.

Glass encapsulation, though traditionally used for rigid OLEDs, has evolved with ultra-thin glass (UTG) technology allowing for limited flexibility while maintaining superior barrier properties. UTG solutions typically range from 30-100 μm in thickness and offer excellent transparency and thermal stability compared to polymer alternatives.

Hybrid approaches combine elements of both technologies, often using thin glass with additional polymer layers or advanced edge sealing techniques to maximize performance while maintaining flexibility. These solutions represent the current cutting edge in balancing barrier requirements with mechanical flexibility.

Despite significant advancements, several critical barriers persist in flexible OLED encapsulation. The most fundamental challenge remains achieving sufficient barrier properties while maintaining flexibility. Current technologies struggle to simultaneously deliver water vapor transmission rates (WVTR) below 10^-6 g/m²/day and oxygen transmission rates (OTR) below 10^-5 cm³/m²/day while allowing for bending radii under 5mm.

Manufacturing scalability presents another significant hurdle, particularly for TFE processes which require precise deposition of nanometer-scale layers over large areas. Yield rates for high-quality encapsulation remain lower than desired, driving up production costs and limiting market expansion.

Durability under repeated flexing represents a persistent challenge, with encapsulation layers often developing microcracks after thousands of bending cycles. These defects compromise barrier integrity and ultimately lead to device failure through pixel degradation.

Cost factors continue to constrain market growth, with high-performance encapsulation solutions adding significantly to overall device manufacturing expenses. Current estimates suggest encapsulation accounts for 15-20% of flexible OLED production costs, creating pressure for more economical solutions.

Edge sealing technology remains particularly problematic, as the interface between different materials creates vulnerable points for moisture ingress. Current solutions often compromise either flexibility or barrier performance at these critical junctions.

Mainstream Encapsulation Solutions Comparison

01 Thin-film encapsulation (TFE) for flexible OLEDs

Thin-film encapsulation technology involves depositing alternating inorganic and organic layers to create a barrier against moisture and oxygen penetration. The inorganic layers (such as silicon nitride, aluminum oxide) provide excellent barrier properties while the organic layers (such as polymers) accommodate mechanical stress during bending. This multi-layer structure effectively prevents degradation of OLED materials while maintaining flexibility required for bendable displays.- Thin-film encapsulation for flexible OLEDs: Thin-film encapsulation (TFE) technology involves depositing alternating inorganic and organic layers to create a barrier against moisture and oxygen penetration. The inorganic layers (such as silicon nitride, aluminum oxide) provide excellent barrier properties while the organic layers help absorb mechanical stress during bending. This multi-layer structure enables flexibility while maintaining effective protection for the sensitive OLED materials, which is crucial for flexible display applications.

- Edge sealing techniques for flexible displays: Edge sealing is critical for flexible OLEDs as the edges are particularly vulnerable to moisture and oxygen ingress. Advanced edge sealing techniques include using specialized adhesives, frit glass sealing, and laser sealing methods that maintain flexibility while providing hermetic protection. These techniques focus on creating a complete barrier around the perimeter of the display to prevent lateral diffusion of harmful elements while allowing the display to bend without compromising the seal integrity.

- Hybrid encapsulation structures: Hybrid encapsulation combines multiple protection strategies to maximize barrier performance while maintaining flexibility. These structures typically incorporate thin-film barriers, edge seals, and sometimes additional protective layers or films. The hybrid approach allows for optimization of both mechanical flexibility and barrier properties by leveraging the strengths of different materials and deposition techniques. This method often includes combinations of atomic layer deposition (ALD) barriers with polymer interlayers or specialized composite materials.

- Atomic layer deposition for ultra-thin barriers: Atomic layer deposition (ALD) enables the creation of ultra-thin, highly conformal barrier layers that are ideal for flexible OLED encapsulation. This technique allows for precise control of film thickness at the atomic level, creating dense, pinhole-free barriers even at extremely thin dimensions. ALD-deposited materials like aluminum oxide and hafnium oxide provide excellent moisture barriers while being thin enough to flex without cracking, making them particularly valuable for bendable and foldable display applications.

- Self-healing encapsulation materials: Self-healing materials represent an innovative approach to flexible OLED encapsulation, designed to repair microcracks that form during bending. These materials typically incorporate polymers with dynamic bonds or microcapsules containing healing agents that are released when damage occurs. When the encapsulation layer experiences stress-induced damage during flexing, these materials can autonomously restore barrier integrity, significantly extending the lifetime of flexible displays by maintaining protection against moisture and oxygen even after repeated bending cycles.

02 Hybrid encapsulation with barrier films

Hybrid encapsulation combines different barrier technologies to achieve optimal protection for flexible OLEDs. This approach typically integrates thin-film barriers with additional protective elements such as edge sealants or adhesive barriers. The hybrid structure provides comprehensive protection against environmental factors while maintaining the mechanical flexibility needed for bendable displays. These systems often incorporate specialized adhesives that can withstand repeated bending cycles without compromising the barrier integrity.Expand Specific Solutions03 Atomic Layer Deposition (ALD) for barrier layers

Atomic Layer Deposition enables the creation of ultra-thin, highly conformal barrier layers with precise thickness control at the atomic scale. This technique is particularly valuable for flexible OLED encapsulation as it produces dense, pinhole-free films that provide excellent moisture and oxygen barriers even when subjected to bending stress. ALD-deposited materials like aluminum oxide and hafnium oxide offer superior barrier properties while maintaining the flexibility required for bendable display applications.Expand Specific Solutions04 Flexible glass and composite substrates

Ultra-thin flexible glass and composite substrate materials provide both barrier properties and mechanical flexibility for OLED encapsulation. These specialized substrates can be as thin as 100 micrometers or less while maintaining excellent barrier properties against moisture and oxygen. Some approaches combine flexible glass with polymer layers to create composite structures that offer improved impact resistance and handling characteristics while preserving the superior barrier properties of glass.Expand Specific Solutions05 Edge sealing techniques for flexible displays

Edge sealing is critical for preventing lateral ingress of moisture and oxygen in flexible OLEDs. Advanced edge sealing techniques include laser-assisted bonding, specialized adhesive systems, and multi-layer edge structures that maintain seal integrity during bending. These methods create robust perimeter barriers that work in conjunction with the primary encapsulation to provide comprehensive protection while accommodating the mechanical stress that occurs during flexing of the display.Expand Specific Solutions

Leading Companies in Flexible OLED Encapsulation

The flexible OLED encapsulation market is currently in a growth phase, with an expanding market size driven by increasing demand for foldable displays in smartphones and wearables. The technology is approaching maturity but still faces challenges in balancing barrier performance with flexibility. Chinese manufacturers dominate the competitive landscape, with BOE Technology Group, TCL China Star Optoelectronics, and Tianma Microelectronics leading development efforts. These companies are advancing thin-film encapsulation techniques and hybrid solutions, while Visionox and Everdisplay Optronics are making significant progress in AMOLED encapsulation technology. International players like 3M and Hamamatsu Photonics contribute specialized barrier materials and testing equipment, creating a globally competitive environment focused on improving encapsulation efficiency and durability.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced thin-film encapsulation (TFE) technology for flexible OLED displays, utilizing a multi-layer structure that alternates inorganic (SiNx, Al2O3) and organic layers. Their proprietary process employs atomic layer deposition (ALD) for inorganic layers and inkjet printing for organic materials, achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day[1]. BOE's encapsulation technology incorporates a unique stress-relief mechanism that maintains barrier integrity during bending, supporting a bend radius down to 1mm for their flexible displays[3]. The company has also pioneered hybrid encapsulation combining TFE with edge sealing techniques, enhancing both flexibility and durability. Recent advancements include plasma-enhanced chemical vapor deposition (PECVD) processes that improve throughput while maintaining barrier performance[5].

Strengths: Industry-leading WVTR performance; excellent mechanical flexibility; high production efficiency with reduced manufacturing steps. Weaknesses: Higher initial capital investment for ALD equipment; relatively complex process control requirements; challenges in scaling to ultra-large display production.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed an innovative "Multi-Barrier Lamination" (MBL) encapsulation technology for flexible OLED displays. Their approach utilizes alternating layers of inorganic barriers (primarily Al2O3 and SiNx) deposited via plasma-enhanced ALD at temperatures below 100°C, combined with specially formulated organic interlayers that absorb mechanical stress[1]. The company's proprietary process achieves WVTR below 10^-6 g/m²/day while supporting bend radii down to 1.5mm. TCL CSOT has implemented a unique "defect compensation mechanism" where the organic layers effectively seal any nano-defects in the inorganic barriers, creating a tortuous path for moisture penetration[3]. Their encapsulation technology also incorporates specialized edge sealing using laser-assisted bonding that maintains barrier integrity at the display perimeter. Recent advancements include the integration of nanocomposite materials in the organic layers that enhance both barrier properties and mechanical resilience during repeated bending cycles[6].

Strengths: Excellent moisture barrier performance; good mechanical durability during bending; effective defect compensation mechanism; comprehensive edge sealing solution. Weaknesses: Relatively complex manufacturing process requiring precise control; higher production costs compared to conventional encapsulation; challenges in scaling to very large display sizes.

Key Patents and Innovations in Barrier Technologies

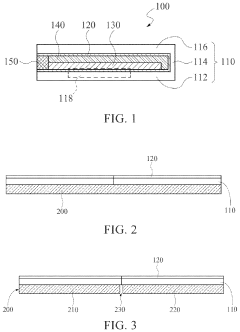

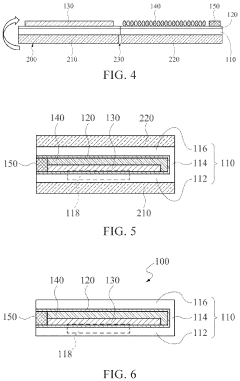

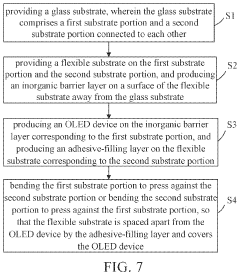

Flexible OLED substrate and encapsulation method thereof

PatentActiveUS20230200111A1

Innovation

- A flexible OLED substrate with an inorganic barrier layer and an adhesive-filling layer, along with a border adhesive, is used to enclose the OLED device, where the inorganic barrier layer is made of materials like aluminum oxide or silicon oxide, and the adhesive-filling and border adhesives provide additional water-resistant properties, simplifying the encapsulation process and enhancing protection.

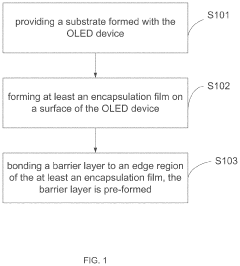

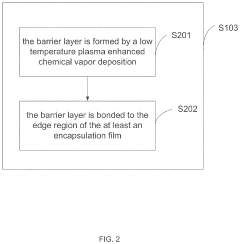

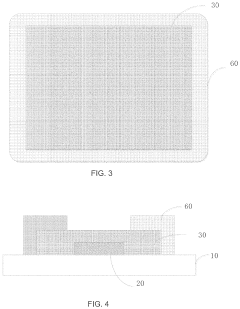

Encapsulation method of organic light emitting diode device and encapsulation structure encapsulated using same

PatentActiveUS20200083476A1

Innovation

- A method involving a pre-formed ring-shaped barrier layer made of inorganic materials like silicon nitride or aluminum oxide, bonded to the edge region of the encapsulation film using low temperature plasma enhanced chemical vapor deposition and rolling or vacuum bonding processes, which improves moisture and oxygen resistance.

Supply Chain Analysis for Encapsulation Materials

The flexible OLED encapsulation materials supply chain represents a complex ecosystem of raw material suppliers, chemical manufacturers, equipment providers, and end-product integrators. This chain begins with basic chemical suppliers providing precursors for thin-film barrier materials, including silicon, aluminum, and various organic compounds essential for hybrid encapsulation solutions.

Primary material manufacturers occupy the middle tier of this supply chain, converting raw materials into specialized encapsulation products. Companies like 3M, Vitriflex, and Samsung SDI have established significant market positions by developing proprietary thin-film encapsulation (TFE) materials. These manufacturers typically maintain close relationships with both upstream suppliers and downstream device manufacturers to ensure material compatibility and performance standards.

Equipment providers constitute another critical segment, supplying the specialized deposition and processing tools required for encapsulation layer application. Companies such as Applied Materials, Kateeva, and Aixtron have developed custom equipment specifically designed for OLED encapsulation processes, including atomic layer deposition (ALD) systems and organic vapor deposition tools.

Geographic distribution within the supply chain shows notable concentration in East Asia, particularly South Korea, Japan, and Taiwan, where major display manufacturers have established production facilities. This regional clustering has created efficiency advantages but also supply vulnerabilities, as evidenced during recent global supply chain disruptions.

Material qualification represents a significant bottleneck in the encapsulation supply chain. New materials typically require 12-18 months of testing and validation before integration into production lines, creating substantial barriers to entry for new suppliers and technologies.

Price volatility presents ongoing challenges, particularly for rare earth elements and specialized chemicals used in barrier films. This volatility has prompted increased vertical integration efforts among major manufacturers seeking to secure supply and stabilize costs. Samsung Display and LG Display have both expanded their in-house materials development capabilities to reduce dependency on external suppliers.

Sustainability concerns are increasingly influencing supply chain development, with growing pressure to reduce environmentally harmful chemicals and processes. Several leading suppliers have begun implementing green chemistry principles and developing water-based alternatives to traditional solvent-based materials, though these solutions currently command premium pricing in the market.

Primary material manufacturers occupy the middle tier of this supply chain, converting raw materials into specialized encapsulation products. Companies like 3M, Vitriflex, and Samsung SDI have established significant market positions by developing proprietary thin-film encapsulation (TFE) materials. These manufacturers typically maintain close relationships with both upstream suppliers and downstream device manufacturers to ensure material compatibility and performance standards.

Equipment providers constitute another critical segment, supplying the specialized deposition and processing tools required for encapsulation layer application. Companies such as Applied Materials, Kateeva, and Aixtron have developed custom equipment specifically designed for OLED encapsulation processes, including atomic layer deposition (ALD) systems and organic vapor deposition tools.

Geographic distribution within the supply chain shows notable concentration in East Asia, particularly South Korea, Japan, and Taiwan, where major display manufacturers have established production facilities. This regional clustering has created efficiency advantages but also supply vulnerabilities, as evidenced during recent global supply chain disruptions.

Material qualification represents a significant bottleneck in the encapsulation supply chain. New materials typically require 12-18 months of testing and validation before integration into production lines, creating substantial barriers to entry for new suppliers and technologies.

Price volatility presents ongoing challenges, particularly for rare earth elements and specialized chemicals used in barrier films. This volatility has prompted increased vertical integration efforts among major manufacturers seeking to secure supply and stabilize costs. Samsung Display and LG Display have both expanded their in-house materials development capabilities to reduce dependency on external suppliers.

Sustainability concerns are increasingly influencing supply chain development, with growing pressure to reduce environmentally harmful chemicals and processes. Several leading suppliers have begun implementing green chemistry principles and developing water-based alternatives to traditional solvent-based materials, though these solutions currently command premium pricing in the market.

Environmental Impact of Encapsulation Processes

The environmental impact of flexible OLED encapsulation processes has become increasingly significant as production volumes scale up globally. Traditional encapsulation methods often rely on energy-intensive processes and environmentally problematic materials, raising sustainability concerns throughout the industry. Thin-film encapsulation (TFE), while offering superior performance for flexible displays, typically requires high-vacuum deposition processes that consume substantial energy and utilize specialized gases with high global warming potential.

Chemical vapor deposition (CVD) techniques employed in barrier layer formation generate hazardous byproducts requiring specialized treatment and disposal protocols. The industry faces particular challenges with perfluorinated compounds used in plasma processes, which possess extremely long atmospheric lifetimes and contribute disproportionately to climate change effects when released.

Material waste represents another critical environmental concern. The precision requirements of OLED encapsulation result in significant material rejection rates, with some manufacturers reporting up to 30% waste during production ramp-up phases. Additionally, the multi-layer structures in advanced barrier films often incorporate rare earth elements and precious metals that face supply constraints and involve environmentally damaging extraction processes.

Water consumption in encapsulation manufacturing presents a substantial environmental burden, particularly in regions already experiencing water stress. Cleaning and rinsing processes between deposition steps can consume thousands of liters per production hour, with ultrapure water requirements adding energy-intensive purification demands to the environmental footprint.

Recent industry initiatives have begun addressing these challenges through several approaches. Material innovation has yielded more environmentally benign alternatives, including water-based barrier materials and bio-derived polymers that maintain performance while reducing toxicity. Process optimization efforts have focused on reducing deposition temperatures and implementing more efficient equipment designs that minimize energy consumption and material waste.

Closed-loop manufacturing systems represent a promising development, with leading manufacturers implementing solvent recovery systems and material reclamation processes that significantly reduce waste volumes. These approaches have demonstrated potential to reduce environmental impact while simultaneously lowering production costs, creating economic incentives for wider adoption.

Regulatory pressures are increasingly shaping the environmental landscape for encapsulation technologies. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition away from certain problematic materials, while carbon pricing mechanisms in various markets are driving energy efficiency improvements throughout the production chain.

Chemical vapor deposition (CVD) techniques employed in barrier layer formation generate hazardous byproducts requiring specialized treatment and disposal protocols. The industry faces particular challenges with perfluorinated compounds used in plasma processes, which possess extremely long atmospheric lifetimes and contribute disproportionately to climate change effects when released.

Material waste represents another critical environmental concern. The precision requirements of OLED encapsulation result in significant material rejection rates, with some manufacturers reporting up to 30% waste during production ramp-up phases. Additionally, the multi-layer structures in advanced barrier films often incorporate rare earth elements and precious metals that face supply constraints and involve environmentally damaging extraction processes.

Water consumption in encapsulation manufacturing presents a substantial environmental burden, particularly in regions already experiencing water stress. Cleaning and rinsing processes between deposition steps can consume thousands of liters per production hour, with ultrapure water requirements adding energy-intensive purification demands to the environmental footprint.

Recent industry initiatives have begun addressing these challenges through several approaches. Material innovation has yielded more environmentally benign alternatives, including water-based barrier materials and bio-derived polymers that maintain performance while reducing toxicity. Process optimization efforts have focused on reducing deposition temperatures and implementing more efficient equipment designs that minimize energy consumption and material waste.

Closed-loop manufacturing systems represent a promising development, with leading manufacturers implementing solvent recovery systems and material reclamation processes that significantly reduce waste volumes. These approaches have demonstrated potential to reduce environmental impact while simultaneously lowering production costs, creating economic incentives for wider adoption.

Regulatory pressures are increasingly shaping the environmental landscape for encapsulation technologies. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition away from certain problematic materials, while carbon pricing mechanisms in various markets are driving energy efficiency improvements throughout the production chain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!