The Role of Polymer Materials in Flexible OLED Encapsulation

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Flexible OLED Encapsulation Background and Objectives

Flexible OLED (Organic Light-Emitting Diode) technology has emerged as a revolutionary advancement in display technology over the past two decades. The evolution of this technology has been marked by significant breakthroughs in materials science, particularly in the development of polymer materials that enable flexibility while maintaining display performance. The journey began with rigid OLED displays in the early 2000s, followed by the introduction of the first commercially viable flexible displays around 2013, showcasing the rapid technological progression in this field.

The encapsulation layer represents one of the most critical components in flexible OLED technology, serving as a protective barrier against environmental factors that can severely degrade organic materials. Traditional glass-based encapsulation, while effective for rigid displays, proved incompatible with the flexibility requirements of next-generation displays. This technological gap catalyzed intensive research into polymer-based alternatives that could provide adequate protection while maintaining the mechanical flexibility essential for bendable displays.

Current technological trends indicate a shift toward multi-layer encapsulation systems that combine inorganic barrier layers with polymer materials to achieve optimal performance. These hybrid approaches aim to balance the excellent barrier properties of inorganic materials with the flexibility and processability advantages of polymers. The industry is witnessing increasing interest in atomic layer deposition (ALD) techniques for creating ultra-thin barrier films and in the development of self-healing polymer materials that can repair microcracks formed during flexing.

The primary technical objectives for polymer materials in flexible OLED encapsulation include achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day and oxygen transmission rates (OTR) below 10^-5 cc/m²/day while maintaining mechanical flexibility through thousands of bending cycles. Additionally, these materials must demonstrate long-term stability under various environmental conditions, compatibility with existing manufacturing processes, and cost-effectiveness for mass production.

Beyond smartphones and wearable devices, which currently dominate the flexible display market, emerging applications in automotive displays, rollable televisions, and conformable medical devices are driving the need for more advanced encapsulation solutions. These applications present unique challenges related to durability, form factor, and operational environments that require tailored polymer encapsulation approaches.

The convergence of material science innovations, manufacturing process improvements, and increasing market demand is expected to accelerate developments in polymer-based encapsulation technologies. As the industry moves toward more ambitious form factors such as foldable and rollable displays, the role of advanced polymer materials becomes increasingly central to overcoming current technological limitations and enabling the next generation of flexible OLED devices.

The encapsulation layer represents one of the most critical components in flexible OLED technology, serving as a protective barrier against environmental factors that can severely degrade organic materials. Traditional glass-based encapsulation, while effective for rigid displays, proved incompatible with the flexibility requirements of next-generation displays. This technological gap catalyzed intensive research into polymer-based alternatives that could provide adequate protection while maintaining the mechanical flexibility essential for bendable displays.

Current technological trends indicate a shift toward multi-layer encapsulation systems that combine inorganic barrier layers with polymer materials to achieve optimal performance. These hybrid approaches aim to balance the excellent barrier properties of inorganic materials with the flexibility and processability advantages of polymers. The industry is witnessing increasing interest in atomic layer deposition (ALD) techniques for creating ultra-thin barrier films and in the development of self-healing polymer materials that can repair microcracks formed during flexing.

The primary technical objectives for polymer materials in flexible OLED encapsulation include achieving water vapor transmission rates (WVTR) below 10^-6 g/m²/day and oxygen transmission rates (OTR) below 10^-5 cc/m²/day while maintaining mechanical flexibility through thousands of bending cycles. Additionally, these materials must demonstrate long-term stability under various environmental conditions, compatibility with existing manufacturing processes, and cost-effectiveness for mass production.

Beyond smartphones and wearable devices, which currently dominate the flexible display market, emerging applications in automotive displays, rollable televisions, and conformable medical devices are driving the need for more advanced encapsulation solutions. These applications present unique challenges related to durability, form factor, and operational environments that require tailored polymer encapsulation approaches.

The convergence of material science innovations, manufacturing process improvements, and increasing market demand is expected to accelerate developments in polymer-based encapsulation technologies. As the industry moves toward more ambitious form factors such as foldable and rollable displays, the role of advanced polymer materials becomes increasingly central to overcoming current technological limitations and enabling the next generation of flexible OLED devices.

Market Analysis for Polymer-Based OLED Encapsulation

The global market for polymer-based OLED encapsulation materials is experiencing robust growth, driven by the expanding flexible display industry. Current market valuations indicate that the polymer encapsulation segment reached approximately $1.2 billion in 2022, with projections suggesting a compound annual growth rate of 15.7% through 2028. This growth trajectory is primarily fueled by increasing consumer demand for foldable smartphones, wearable devices, and other flexible display applications that require effective barrier solutions against oxygen and moisture.

Consumer electronics remains the dominant application sector, accounting for over 65% of the polymer encapsulation materials market. Within this segment, smartphones represent the largest end-use category, followed by smartwatches and other wearable technology. The automotive industry is emerging as a significant growth sector, with luxury vehicle manufacturers increasingly incorporating flexible OLED displays in dashboard and entertainment systems.

Regional analysis reveals that East Asia, particularly South Korea, Japan, and China, dominates the production landscape, collectively representing approximately 78% of global manufacturing capacity for polymer encapsulation materials. However, North America and Europe are witnessing accelerated research activities and production expansion, especially for specialized high-performance barrier films.

Market demand patterns indicate a clear shift toward multi-layer organic-inorganic hybrid encapsulation systems that combine the flexibility of polymers with the barrier properties of inorganic materials. Thin-film encapsulation (TFE) technologies utilizing alternating organic and inorganic layers have seen particularly strong demand growth, with market share increasing from 37% in 2020 to approximately 52% in 2023.

Price sensitivity analysis reveals that while cost remains a significant factor in mass-market applications, manufacturers of premium devices are increasingly willing to pay premium prices for encapsulation solutions that offer superior flexibility, transparency, and extended device lifetimes. The average selling price for high-performance polymer barrier films has increased by 8.3% annually, reflecting this value-oriented purchasing behavior.

Supply chain dynamics present both opportunities and challenges. Raw material availability, particularly for specialized monomers and additives, has experienced volatility, with several key components facing supply constraints. This has prompted leading manufacturers to pursue vertical integration strategies and develop alternative material formulations to mitigate supply risks.

Future market projections indicate that emerging applications in healthcare (flexible biosensors), energy (flexible solar cells), and advanced packaging will create new demand streams for polymer encapsulation materials, potentially expanding the addressable market by an additional 30% by 2030.

Consumer electronics remains the dominant application sector, accounting for over 65% of the polymer encapsulation materials market. Within this segment, smartphones represent the largest end-use category, followed by smartwatches and other wearable technology. The automotive industry is emerging as a significant growth sector, with luxury vehicle manufacturers increasingly incorporating flexible OLED displays in dashboard and entertainment systems.

Regional analysis reveals that East Asia, particularly South Korea, Japan, and China, dominates the production landscape, collectively representing approximately 78% of global manufacturing capacity for polymer encapsulation materials. However, North America and Europe are witnessing accelerated research activities and production expansion, especially for specialized high-performance barrier films.

Market demand patterns indicate a clear shift toward multi-layer organic-inorganic hybrid encapsulation systems that combine the flexibility of polymers with the barrier properties of inorganic materials. Thin-film encapsulation (TFE) technologies utilizing alternating organic and inorganic layers have seen particularly strong demand growth, with market share increasing from 37% in 2020 to approximately 52% in 2023.

Price sensitivity analysis reveals that while cost remains a significant factor in mass-market applications, manufacturers of premium devices are increasingly willing to pay premium prices for encapsulation solutions that offer superior flexibility, transparency, and extended device lifetimes. The average selling price for high-performance polymer barrier films has increased by 8.3% annually, reflecting this value-oriented purchasing behavior.

Supply chain dynamics present both opportunities and challenges. Raw material availability, particularly for specialized monomers and additives, has experienced volatility, with several key components facing supply constraints. This has prompted leading manufacturers to pursue vertical integration strategies and develop alternative material formulations to mitigate supply risks.

Future market projections indicate that emerging applications in healthcare (flexible biosensors), energy (flexible solar cells), and advanced packaging will create new demand streams for polymer encapsulation materials, potentially expanding the addressable market by an additional 30% by 2030.

Current Polymer Technologies and Barriers in OLED Protection

Polymer materials play a crucial role in flexible OLED encapsulation, with several technologies currently dominating the market. Thin-film encapsulation (TFE) represents the most widely adopted approach, utilizing alternating layers of inorganic and organic materials. Within this framework, parylene derivatives and epoxy-based polymers serve as the primary organic components, offering excellent barrier properties while maintaining flexibility. These polymers effectively fill microscopic defects in the inorganic layers, creating a tortuous path that significantly impedes moisture and oxygen penetration.

Pressure-sensitive adhesives (PSAs) based on silicone and acrylic polymers have emerged as another significant technology for OLED protection. These materials provide both encapsulation and bonding functions, simplifying manufacturing processes while maintaining adequate barrier properties. Recent advancements in PSA formulations have incorporated nanoparticles and cross-linking agents to enhance their moisture resistance without compromising optical clarity.

Fluoropolymer-based barriers represent a premium solution in the current market. Materials such as CYTOP and perfluorinated polymers deliver exceptional water vapor transmission rates (WVTR) below 10^-6 g/m²/day, approaching the theoretical requirements for long-term OLED protection. However, their widespread adoption remains limited by high material costs and complex processing requirements.

Despite these technological advances, significant barriers persist in polymer-based OLED protection. The fundamental challenge lies in the inherent permeability of polymeric materials to water vapor and oxygen. Even the most advanced polymer systems cannot match the barrier properties of glass encapsulation, necessitating complex multi-layer approaches that increase manufacturing complexity and cost.

Processing challenges also present substantial obstacles. Many high-performance polymers require specialized deposition techniques, including vapor deposition polymerization or solution processing under strictly controlled environments. These requirements limit scalability and increase production costs, particularly for large-area displays.

Long-term stability represents another critical barrier. Polymer materials are susceptible to degradation under UV exposure and high temperatures, conditions commonly encountered in display applications. This degradation can compromise barrier properties over time, reducing device lifespan. Additionally, the coefficient of thermal expansion mismatch between polymer barriers and other device components can induce mechanical stress during thermal cycling, potentially leading to delamination or crack formation.

The industry also faces challenges in measurement and quality control. Quantifying ultra-low permeation rates (below 10^-6 g/m²/day) requires specialized equipment and methodologies, making consistent quality assurance difficult across the supply chain. This measurement challenge complicates material development and validation processes for next-generation polymer barriers.

Pressure-sensitive adhesives (PSAs) based on silicone and acrylic polymers have emerged as another significant technology for OLED protection. These materials provide both encapsulation and bonding functions, simplifying manufacturing processes while maintaining adequate barrier properties. Recent advancements in PSA formulations have incorporated nanoparticles and cross-linking agents to enhance their moisture resistance without compromising optical clarity.

Fluoropolymer-based barriers represent a premium solution in the current market. Materials such as CYTOP and perfluorinated polymers deliver exceptional water vapor transmission rates (WVTR) below 10^-6 g/m²/day, approaching the theoretical requirements for long-term OLED protection. However, their widespread adoption remains limited by high material costs and complex processing requirements.

Despite these technological advances, significant barriers persist in polymer-based OLED protection. The fundamental challenge lies in the inherent permeability of polymeric materials to water vapor and oxygen. Even the most advanced polymer systems cannot match the barrier properties of glass encapsulation, necessitating complex multi-layer approaches that increase manufacturing complexity and cost.

Processing challenges also present substantial obstacles. Many high-performance polymers require specialized deposition techniques, including vapor deposition polymerization or solution processing under strictly controlled environments. These requirements limit scalability and increase production costs, particularly for large-area displays.

Long-term stability represents another critical barrier. Polymer materials are susceptible to degradation under UV exposure and high temperatures, conditions commonly encountered in display applications. This degradation can compromise barrier properties over time, reducing device lifespan. Additionally, the coefficient of thermal expansion mismatch between polymer barriers and other device components can induce mechanical stress during thermal cycling, potentially leading to delamination or crack formation.

The industry also faces challenges in measurement and quality control. Quantifying ultra-low permeation rates (below 10^-6 g/m²/day) requires specialized equipment and methodologies, making consistent quality assurance difficult across the supply chain. This measurement challenge complicates material development and validation processes for next-generation polymer barriers.

Mainstream Polymer Encapsulation Solutions

01 Biodegradable polymer materials

Biodegradable polymers are environmentally friendly materials that can decompose naturally over time. These materials are increasingly being used in various applications to reduce environmental impact. They can be derived from renewable resources or synthesized to have biodegradable properties. The formulation of these polymers often involves specific processing techniques to ensure proper degradation characteristics while maintaining necessary physical properties for their intended applications.- Biodegradable polymer materials: Biodegradable polymers are environmentally friendly materials designed to break down naturally after use. These materials combine sustainability with functionality, offering alternatives to conventional plastics. They can be derived from renewable resources and are engineered to decompose under specific environmental conditions while maintaining necessary performance characteristics during their intended use period.

- Polymer composites and blends: Polymer composites and blends combine different polymeric materials or incorporate fillers to achieve enhanced properties. These materials often exhibit improved mechanical strength, thermal stability, or specific functional characteristics that cannot be achieved with single polymers. The synergistic effects of combining multiple components result in materials with tailored properties for specialized applications.

- Smart and responsive polymer systems: Smart polymers respond to environmental stimuli such as temperature, pH, light, or electrical signals by changing their properties. These responsive materials can transform their structure, shape, or functionality when exposed to specific triggers. Applications include drug delivery systems, sensors, actuators, and adaptive materials that can self-regulate based on environmental conditions.

- Polymer processing technologies: Advanced processing technologies for polymers enable the creation of materials with specific structures and properties. These include extrusion, injection molding, 3D printing, electrospinning, and other fabrication methods that transform raw polymer materials into finished products. Innovations in processing techniques allow for greater precision, efficiency, and the ability to create complex geometries with tailored performance characteristics.

- Functional polymer materials: Functional polymers contain specific chemical groups or additives that provide unique properties beyond structural support. These materials can exhibit electrical conductivity, optical properties, catalytic activity, or selective permeability. By incorporating functional elements into the polymer structure or as additives, these materials can perform specialized tasks such as sensing, energy storage, selective filtration, or controlled release of substances.

02 Polymer composites and blends

Polymer composites and blends combine different polymeric materials or incorporate additives to enhance specific properties. These materials can exhibit improved mechanical strength, thermal stability, or electrical conductivity compared to single-component polymers. The process of creating these composites often involves careful selection of compatible materials and specialized mixing or processing techniques to ensure uniform distribution and optimal performance characteristics.Expand Specific Solutions03 Smart and responsive polymer materials

Smart polymers can change their properties in response to external stimuli such as temperature, pH, light, or electrical fields. These materials are being developed for applications in drug delivery, sensors, and actuators. The responsive nature of these polymers allows for controlled release mechanisms or adaptive behaviors that can be tailored for specific applications. Research in this area focuses on enhancing sensitivity, response time, and reversibility of the property changes.Expand Specific Solutions04 Polymer processing technologies

Advanced processing technologies for polymers include extrusion, injection molding, 3D printing, and various surface treatment methods. These techniques are crucial for transforming raw polymer materials into finished products with desired shapes and properties. Innovations in processing technologies focus on improving efficiency, reducing waste, and enabling the creation of complex structures with precise control over material properties and performance characteristics.Expand Specific Solutions05 Functional polymer materials

Functional polymers are designed with specific chemical groups or structures that provide unique properties such as conductivity, catalytic activity, or selective permeability. These materials are used in applications ranging from electronics to medical devices and environmental remediation. The functionality can be incorporated during polymer synthesis or through post-synthesis modifications. Research in this field aims to develop materials with increasingly specialized functions while maintaining processability and stability.Expand Specific Solutions

Leading Companies in Polymer OLED Encapsulation

The flexible OLED encapsulation market is currently in a growth phase, with polymer materials playing an increasingly critical role in addressing barrier requirements against oxygen and moisture. The market is projected to expand significantly as flexible displays gain traction in consumer electronics, with an estimated value exceeding $2 billion by 2025. Technologically, the field is advancing rapidly but remains challenging, with companies at varying maturity levels. Industry leaders like BOE Technology, Samsung SDI, and Applied Materials have established robust polymer encapsulation technologies, while TCL China Star Optoelectronics and Universal Display Corporation are making significant R&D investments. Chinese manufacturers including Everdisplay Optronics and Tianma Microelectronics are rapidly closing the technology gap with innovative polymer solutions that balance barrier performance with flexibility requirements.

BOE Technology Group Co., Ltd.

Technical Solution: BOE Technology has developed a sophisticated flexible OLED encapsulation system centered around their proprietary "BOE-Shield" polymer technology. This approach utilizes a multi-layer architecture where specially formulated polyacrylate-based polymers serve as both planarization and barrier enhancement layers. BOE's encapsulation process begins with a thin inorganic barrier layer (typically SiNx) deposited directly on the OLED device, followed by their proprietary polymer layer that smooths surface defects and provides stress relief during flexing. This alternating structure is repeated multiple times to create a comprehensive barrier. The polymer materials employed by BOE feature modified side chains with hydrophobic functional groups that significantly enhance moisture resistance. Their latest innovation incorporates fluoropolymer components that provide exceptional barrier properties while maintaining excellent optical transparency (>92% in the visible spectrum). BOE has also developed a specialized edge sealing technology using thermo-curable silicone-based polymers that create a robust perimeter seal resistant to environmental ingress. Their encapsulation technology has been implemented in mass production, achieving water vapor transmission rates below 5×10^-6 g/m²/day and oxygen transmission rates under 10^-3 cc/m²/day.

Strengths: Excellent barrier performance against both moisture and oxygen; superior optical properties with minimal light loss; good mechanical durability during repeated flexing cycles; established mass production capabilities. Weaknesses: Higher production costs compared to traditional encapsulation; requires precise control of polymer curing conditions; potential for yellowing after prolonged UV exposure; limited flexibility at extreme temperatures.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed an advanced multi-layer encapsulation technology for flexible OLEDs that combines specially engineered polymers with inorganic barrier layers. Their approach utilizes a proprietary hybrid encapsulation structure consisting of alternating organic/inorganic layers where the polymer components are primarily silicone-based elastomers modified with functional groups to enhance adhesion and barrier properties. Samsung's technology employs plasma-enhanced chemical vapor deposition (PECVD) to create ultra-thin (< 100nm) polymer layers that maintain flexibility while providing excellent barrier properties. Their latest generation encapsulation incorporates nanocomposite polymer materials containing dispersed ceramic nanoparticles that significantly enhance moisture resistance while maintaining optical clarity. Samsung has also pioneered the development of edge sealing polymers specifically designed to address the vulnerable perimeter of flexible displays, using UV-curable acrylate polymers with modified siloxane components that create a robust hermetic seal. This comprehensive encapsulation system has enabled Samsung's commercial production of flexible OLED displays with demonstrated lifetimes exceeding 40,000 hours under standard operating conditions.

Strengths: Comprehensive encapsulation solution addressing both surface and edge sealing requirements; excellent mechanical durability during repeated flexing; established mass production capabilities; integration with existing OLED manufacturing processes. Weaknesses: Complex multi-step deposition process increases manufacturing time; higher material costs compared to conventional encapsulation; potential for delamination at extreme bending angles.

Key Polymer Innovations for OLED Barrier Films

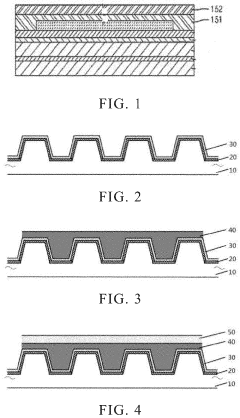

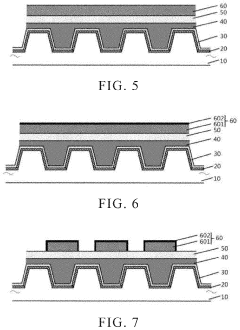

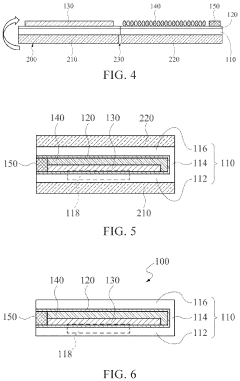

Encapsulation structure and encapsulation method for flexible organic light-emitting diode device

PatentActiveUS20230180509A1

Innovation

- An encapsulation structure comprising an organic matter protective layer, continuous or discontinuous organic flat layers, and inorganic barrier layers, with the outermost organic layers treated with plasma to form a surface hardened layer, creating an organic barrier layer that enhances moisture and oxygen blocking while allowing stress release.

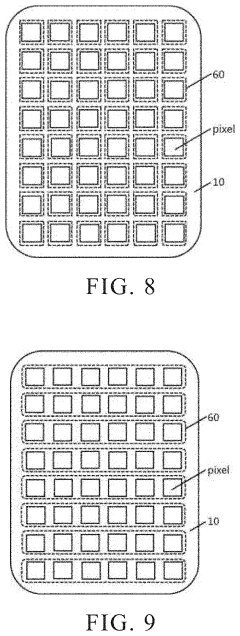

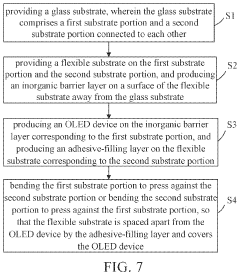

Flexible OLED substrate and encapsulation method thereof

PatentActiveUS20230200111A1

Innovation

- A flexible OLED substrate with an inorganic barrier layer and an adhesive-filling layer, along with a border adhesive, is used to enclose the OLED device, where the inorganic barrier layer is made of materials like aluminum oxide or silicon oxide, and the adhesive-filling and border adhesives provide additional water-resistant properties, simplifying the encapsulation process and enhancing protection.

Environmental Impact of Polymer Encapsulation Materials

The environmental impact of polymer encapsulation materials used in flexible OLED technology represents a growing concern as production volumes increase globally. Traditional encapsulation materials often contain halogenated compounds and heavy metals that pose significant environmental risks during both manufacturing and disposal phases. When these materials reach end-of-life, they can release harmful substances into soil and water systems if not properly managed, contributing to persistent environmental contamination.

Polymer-based encapsulation solutions present varying degrees of environmental impact depending on their chemical composition. Fluoropolymers, while offering excellent barrier properties, contain perfluorinated compounds that are highly persistent in the environment and potentially bioaccumulative. In contrast, newer biodegradable polymers and bio-based alternatives show promise for reducing environmental footprint, though they currently face challenges in meeting the stringent barrier requirements for OLED protection.

Manufacturing processes for polymer encapsulation materials typically involve energy-intensive procedures and solvent usage. The carbon footprint associated with these processes varies significantly based on production methods and energy sources. Recent life cycle assessments indicate that thin-film encapsulation technologies may reduce overall environmental impact by decreasing material usage and enabling more efficient recycling pathways compared to traditional laminated barrier films.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of electronic components. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have driven innovation toward less environmentally harmful encapsulation materials. Similarly, initiatives in Asia and North America are pushing manufacturers to develop greener alternatives that maintain performance standards while reducing ecological impact.

Recycling and end-of-life management present particular challenges for polymer-encapsulated OLEDs. The multi-layer structure of these devices makes material separation difficult, often resulting in downcycling rather than true recycling. Research into design-for-disassembly approaches and solvent-based recovery methods shows potential for improving recyclability, though commercial implementation remains limited. Some manufacturers have begun implementing take-back programs specifically addressing the complex nature of flexible display technologies.

Water consumption and wastewater generation during manufacturing represent additional environmental considerations. Polymer synthesis and application processes can require significant water resources and generate effluents containing residual monomers, catalysts, and processing aids. Advanced treatment technologies and closed-loop water systems are being adopted by leading manufacturers to mitigate these impacts, though implementation varies considerably across different production regions.

Polymer-based encapsulation solutions present varying degrees of environmental impact depending on their chemical composition. Fluoropolymers, while offering excellent barrier properties, contain perfluorinated compounds that are highly persistent in the environment and potentially bioaccumulative. In contrast, newer biodegradable polymers and bio-based alternatives show promise for reducing environmental footprint, though they currently face challenges in meeting the stringent barrier requirements for OLED protection.

Manufacturing processes for polymer encapsulation materials typically involve energy-intensive procedures and solvent usage. The carbon footprint associated with these processes varies significantly based on production methods and energy sources. Recent life cycle assessments indicate that thin-film encapsulation technologies may reduce overall environmental impact by decreasing material usage and enabling more efficient recycling pathways compared to traditional laminated barrier films.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of electronic components. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have driven innovation toward less environmentally harmful encapsulation materials. Similarly, initiatives in Asia and North America are pushing manufacturers to develop greener alternatives that maintain performance standards while reducing ecological impact.

Recycling and end-of-life management present particular challenges for polymer-encapsulated OLEDs. The multi-layer structure of these devices makes material separation difficult, often resulting in downcycling rather than true recycling. Research into design-for-disassembly approaches and solvent-based recovery methods shows potential for improving recyclability, though commercial implementation remains limited. Some manufacturers have begun implementing take-back programs specifically addressing the complex nature of flexible display technologies.

Water consumption and wastewater generation during manufacturing represent additional environmental considerations. Polymer synthesis and application processes can require significant water resources and generate effluents containing residual monomers, catalysts, and processing aids. Advanced treatment technologies and closed-loop water systems are being adopted by leading manufacturers to mitigate these impacts, though implementation varies considerably across different production regions.

Scalability and Manufacturing Challenges

The scaling of polymer-based encapsulation technologies for flexible OLEDs represents one of the most significant challenges in transitioning from laboratory prototypes to mass production. Current manufacturing processes face substantial hurdles when attempting to maintain consistent barrier properties across large-area substrates. The primary difficulty lies in achieving uniform polymer layer deposition with nanometer-level precision over increasingly larger display dimensions, while simultaneously maintaining production throughput rates that satisfy commercial demands.

Defect control emerges as a critical factor in manufacturing scalability. Even microscopic pinholes or particulate contamination can compromise the entire barrier system, creating pathways for moisture and oxygen penetration. This challenge intensifies with larger substrate sizes, as the statistical probability of defects increases proportionally with area. Industry data suggests that defect densities must be maintained below 0.1 defects/cm² to achieve commercially viable yields, a threshold that becomes increasingly difficult to meet as display sizes grow.

Cost considerations further complicate the scaling equation. While multi-layer polymer-inorganic hybrid structures demonstrate superior barrier performance, they require multiple deposition steps and precise thickness control. Each additional layer increases production complexity and cost. Current estimates indicate that encapsulation can represent up to 15-20% of the total manufacturing cost for flexible OLED displays, creating significant pressure to develop more economical processes without compromising performance.

Equipment limitations present another significant barrier to scalability. Many advanced polymer deposition techniques that work effectively in laboratory settings—such as initiated chemical vapor deposition (iCVD) or molecular layer deposition (MLD)—require specialized equipment that has not been fully optimized for high-volume manufacturing. The capital investment required to develop and implement such equipment at production scale represents a substantial financial risk for manufacturers.

Roll-to-roll (R2R) processing offers promising solutions for continuous, high-throughput manufacturing of flexible OLEDs with polymer encapsulation. However, integrating vacuum deposition steps for inorganic barrier layers with solution-based polymer coating processes in a continuous R2R system presents significant engineering challenges. Current R2R systems struggle to maintain the ultra-high vacuum conditions required for high-quality barrier layer deposition while accommodating the physical handling requirements of flexible substrates.

Environmental considerations and regulatory compliance add another dimension to manufacturing challenges. Many traditional polymer processing techniques involve solvents or precursors with environmental or health concerns. As production scales increase, the environmental impact and regulatory burden associated with these materials grows proportionally, driving the need for greener alternatives that maintain performance standards while reducing environmental footprint.

Defect control emerges as a critical factor in manufacturing scalability. Even microscopic pinholes or particulate contamination can compromise the entire barrier system, creating pathways for moisture and oxygen penetration. This challenge intensifies with larger substrate sizes, as the statistical probability of defects increases proportionally with area. Industry data suggests that defect densities must be maintained below 0.1 defects/cm² to achieve commercially viable yields, a threshold that becomes increasingly difficult to meet as display sizes grow.

Cost considerations further complicate the scaling equation. While multi-layer polymer-inorganic hybrid structures demonstrate superior barrier performance, they require multiple deposition steps and precise thickness control. Each additional layer increases production complexity and cost. Current estimates indicate that encapsulation can represent up to 15-20% of the total manufacturing cost for flexible OLED displays, creating significant pressure to develop more economical processes without compromising performance.

Equipment limitations present another significant barrier to scalability. Many advanced polymer deposition techniques that work effectively in laboratory settings—such as initiated chemical vapor deposition (iCVD) or molecular layer deposition (MLD)—require specialized equipment that has not been fully optimized for high-volume manufacturing. The capital investment required to develop and implement such equipment at production scale represents a substantial financial risk for manufacturers.

Roll-to-roll (R2R) processing offers promising solutions for continuous, high-throughput manufacturing of flexible OLEDs with polymer encapsulation. However, integrating vacuum deposition steps for inorganic barrier layers with solution-based polymer coating processes in a continuous R2R system presents significant engineering challenges. Current R2R systems struggle to maintain the ultra-high vacuum conditions required for high-quality barrier layer deposition while accommodating the physical handling requirements of flexible substrates.

Environmental considerations and regulatory compliance add another dimension to manufacturing challenges. Many traditional polymer processing techniques involve solvents or precursors with environmental or health concerns. As production scales increase, the environmental impact and regulatory burden associated with these materials grows proportionally, driving the need for greener alternatives that maintain performance standards while reducing environmental footprint.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!