Ammonia Fuel for Heat and Power: Balancing Performance and Cost

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Fuel Evolution and Objectives

Ammonia has emerged as a promising carbon-free energy carrier with potential to revolutionize the global energy landscape. The journey of ammonia as a fuel began in the early 20th century, with sporadic applications in internal combustion engines. However, it wasn't until the 1960s that serious research into ammonia's potential as an alternative fuel commenced, driven by concerns over energy security during periods of geopolitical tension.

The evolution of ammonia fuel technology accelerated significantly in the early 2000s, coinciding with growing awareness of climate change and the need for decarbonization strategies. This period marked a transition from viewing ammonia primarily as a fertilizer to recognizing its potential as an energy vector. Research institutions and industry pioneers began exploring ammonia's capabilities for both heat generation and power production, establishing the foundational knowledge that drives current innovation.

By 2010, the technical feasibility of ammonia as a fuel had been demonstrated across multiple applications, though economic viability remained a significant barrier. The subsequent decade witnessed remarkable progress in addressing technical challenges related to combustion efficiency, NOx emissions control, and catalyst development for cracking ammonia into hydrogen.

Today's ammonia fuel landscape is characterized by rapid technological advancement and increasing commercial interest. The dual application potential for heat and power generation positions ammonia uniquely among alternative fuels. In the power sector, ammonia can be utilized in modified gas turbines, fuel cells, and as a hydrogen carrier for conventional power plants. For heat applications, direct ammonia combustion offers a pathway to decarbonize industrial processes requiring high-temperature heat.

The primary objective in ammonia fuel development centers on achieving a delicate balance between performance and cost. Technical performance goals include improving combustion efficiency, reducing NOx emissions to meet stringent environmental standards, and enhancing energy density for storage and transportation. Simultaneously, cost objectives focus on reducing production expenses through green ammonia pathways, optimizing infrastructure requirements, and achieving price parity with conventional fuels.

Looking forward, the technology roadmap for ammonia fuel aims to establish it as a mainstream energy carrier by 2040. Near-term objectives include demonstrating commercial-scale power generation by 2025, followed by widespread industrial heat applications by 2030. The ultimate goal envisions ammonia as a cornerstone of a carbon-neutral energy system, providing flexible, storable energy that complements intermittent renewable sources while offering a practical solution for sectors difficult to electrify.

The evolution of ammonia fuel technology accelerated significantly in the early 2000s, coinciding with growing awareness of climate change and the need for decarbonization strategies. This period marked a transition from viewing ammonia primarily as a fertilizer to recognizing its potential as an energy vector. Research institutions and industry pioneers began exploring ammonia's capabilities for both heat generation and power production, establishing the foundational knowledge that drives current innovation.

By 2010, the technical feasibility of ammonia as a fuel had been demonstrated across multiple applications, though economic viability remained a significant barrier. The subsequent decade witnessed remarkable progress in addressing technical challenges related to combustion efficiency, NOx emissions control, and catalyst development for cracking ammonia into hydrogen.

Today's ammonia fuel landscape is characterized by rapid technological advancement and increasing commercial interest. The dual application potential for heat and power generation positions ammonia uniquely among alternative fuels. In the power sector, ammonia can be utilized in modified gas turbines, fuel cells, and as a hydrogen carrier for conventional power plants. For heat applications, direct ammonia combustion offers a pathway to decarbonize industrial processes requiring high-temperature heat.

The primary objective in ammonia fuel development centers on achieving a delicate balance between performance and cost. Technical performance goals include improving combustion efficiency, reducing NOx emissions to meet stringent environmental standards, and enhancing energy density for storage and transportation. Simultaneously, cost objectives focus on reducing production expenses through green ammonia pathways, optimizing infrastructure requirements, and achieving price parity with conventional fuels.

Looking forward, the technology roadmap for ammonia fuel aims to establish it as a mainstream energy carrier by 2040. Near-term objectives include demonstrating commercial-scale power generation by 2025, followed by widespread industrial heat applications by 2030. The ultimate goal envisions ammonia as a cornerstone of a carbon-neutral energy system, providing flexible, storable energy that complements intermittent renewable sources while offering a practical solution for sectors difficult to electrify.

Market Analysis for Ammonia-Based Energy Solutions

The global market for ammonia-based energy solutions is experiencing significant growth, driven by the increasing demand for clean energy alternatives and the push towards decarbonization across various sectors. Currently valued at approximately $70 billion, the ammonia energy market is projected to grow at a CAGR of 7.5% through 2030, potentially reaching $120 billion by the end of the decade.

Geographically, Europe leads in ammonia energy adoption, particularly in countries like Germany, Denmark, and the Netherlands, where substantial investments in green ammonia infrastructure are underway. The Asia-Pacific region follows closely, with Japan, South Korea, and Australia emerging as key players. Japan's Strategic Energy Plan explicitly includes ammonia co-firing in thermal power plants, targeting 3 million tons of ammonia use annually by 2030.

Market segmentation reveals distinct application sectors for ammonia-based energy solutions. Power generation represents the largest segment (40% of market share), where ammonia is increasingly used for co-firing in existing coal plants and as a fuel for dedicated ammonia turbines. Industrial heat applications constitute approximately 30% of the market, with ammonia gaining traction in high-temperature industrial processes where electrification remains challenging.

The maritime sector represents a rapidly growing segment (15% market share), as international shipping seeks alternatives to comply with IMO emissions regulations. Several major shipping companies have announced pilot projects for ammonia-powered vessels, with commercial deployment expected by 2025.

Customer demand analysis indicates varying adoption drivers across sectors. Utilities prioritize cost-effectiveness and compatibility with existing infrastructure, while industrial users focus on process reliability and emissions reduction potential. The transportation sector emphasizes energy density and safety considerations.

Competitive pricing remains a significant market challenge. Currently, conventional ammonia costs $300-600 per ton, while green ammonia ranges from $700-1,200 per ton. This price differential represents a major barrier to widespread adoption, though analysts project green ammonia costs will decrease by 40-60% by 2030 as production scales and renewable electricity costs continue to fall.

Regulatory frameworks are increasingly favorable, with carbon pricing mechanisms, clean fuel standards, and targeted subsidies creating economic incentives for ammonia adoption. The EU's Carbon Border Adjustment Mechanism and various national hydrogen strategies explicitly include ammonia as a hydrogen carrier, further stimulating market growth.

Geographically, Europe leads in ammonia energy adoption, particularly in countries like Germany, Denmark, and the Netherlands, where substantial investments in green ammonia infrastructure are underway. The Asia-Pacific region follows closely, with Japan, South Korea, and Australia emerging as key players. Japan's Strategic Energy Plan explicitly includes ammonia co-firing in thermal power plants, targeting 3 million tons of ammonia use annually by 2030.

Market segmentation reveals distinct application sectors for ammonia-based energy solutions. Power generation represents the largest segment (40% of market share), where ammonia is increasingly used for co-firing in existing coal plants and as a fuel for dedicated ammonia turbines. Industrial heat applications constitute approximately 30% of the market, with ammonia gaining traction in high-temperature industrial processes where electrification remains challenging.

The maritime sector represents a rapidly growing segment (15% market share), as international shipping seeks alternatives to comply with IMO emissions regulations. Several major shipping companies have announced pilot projects for ammonia-powered vessels, with commercial deployment expected by 2025.

Customer demand analysis indicates varying adoption drivers across sectors. Utilities prioritize cost-effectiveness and compatibility with existing infrastructure, while industrial users focus on process reliability and emissions reduction potential. The transportation sector emphasizes energy density and safety considerations.

Competitive pricing remains a significant market challenge. Currently, conventional ammonia costs $300-600 per ton, while green ammonia ranges from $700-1,200 per ton. This price differential represents a major barrier to widespread adoption, though analysts project green ammonia costs will decrease by 40-60% by 2030 as production scales and renewable electricity costs continue to fall.

Regulatory frameworks are increasingly favorable, with carbon pricing mechanisms, clean fuel standards, and targeted subsidies creating economic incentives for ammonia adoption. The EU's Carbon Border Adjustment Mechanism and various national hydrogen strategies explicitly include ammonia as a hydrogen carrier, further stimulating market growth.

Ammonia Fuel Technology Status and Barriers

Ammonia fuel technology has seen significant advancements in recent years, yet faces substantial technical and economic barriers to widespread adoption. Current ammonia combustion systems struggle with low flame speed and high ignition energy requirements, resulting in combustion instability and reduced efficiency compared to conventional fuels. These characteristics necessitate specialized burner designs and often require dual-fuel approaches with pilot fuels to maintain stable operation.

The NOx emissions challenge remains particularly problematic, as ammonia combustion inherently produces significant nitrogen oxide emissions due to fuel-bound nitrogen. While selective catalytic reduction (SCR) systems can mitigate these emissions, they add complexity and cost to the overall system, creating a technical barrier to market entry.

Material compatibility presents another significant hurdle, as ammonia's corrosive nature requires specialized materials for storage, transport, and combustion components. Standard carbon steel and certain copper alloys are particularly vulnerable to ammonia-induced stress corrosion cracking, necessitating the use of stainless steel or specialized coatings that increase system costs.

From an infrastructure perspective, the limited availability of ammonia distribution networks restricts deployment opportunities. While industrial ammonia production and handling infrastructure exists, it is primarily designed for fertilizer applications rather than energy purposes, creating logistical challenges for power generation applications.

Safety concerns constitute a major barrier, as ammonia is both toxic and hazardous, requiring robust safety systems and specialized training for handling. These requirements add significant operational complexity and cost compared to conventional fuels, particularly in densely populated areas where permitting becomes increasingly difficult.

Economic barriers are equally challenging, with current green ammonia production costs ranging from $600-1,200 per ton, significantly higher than fossil fuel alternatives. The capital expenditure for ammonia-compatible power generation equipment exceeds that of conventional systems by 20-40%, primarily due to specialized materials and additional safety systems.

Regulatory uncertainty further complicates adoption, as many jurisdictions lack clear frameworks for ammonia as an energy carrier. This regulatory gap creates investment risk and slows technology deployment, particularly for large-scale projects requiring significant capital investment.

Public perception and acceptance remain underexplored barriers, with limited awareness of ammonia's potential as a fuel and concerns about safety risks potentially creating community opposition to ammonia energy projects, particularly in residential areas.

The NOx emissions challenge remains particularly problematic, as ammonia combustion inherently produces significant nitrogen oxide emissions due to fuel-bound nitrogen. While selective catalytic reduction (SCR) systems can mitigate these emissions, they add complexity and cost to the overall system, creating a technical barrier to market entry.

Material compatibility presents another significant hurdle, as ammonia's corrosive nature requires specialized materials for storage, transport, and combustion components. Standard carbon steel and certain copper alloys are particularly vulnerable to ammonia-induced stress corrosion cracking, necessitating the use of stainless steel or specialized coatings that increase system costs.

From an infrastructure perspective, the limited availability of ammonia distribution networks restricts deployment opportunities. While industrial ammonia production and handling infrastructure exists, it is primarily designed for fertilizer applications rather than energy purposes, creating logistical challenges for power generation applications.

Safety concerns constitute a major barrier, as ammonia is both toxic and hazardous, requiring robust safety systems and specialized training for handling. These requirements add significant operational complexity and cost compared to conventional fuels, particularly in densely populated areas where permitting becomes increasingly difficult.

Economic barriers are equally challenging, with current green ammonia production costs ranging from $600-1,200 per ton, significantly higher than fossil fuel alternatives. The capital expenditure for ammonia-compatible power generation equipment exceeds that of conventional systems by 20-40%, primarily due to specialized materials and additional safety systems.

Regulatory uncertainty further complicates adoption, as many jurisdictions lack clear frameworks for ammonia as an energy carrier. This regulatory gap creates investment risk and slows technology deployment, particularly for large-scale projects requiring significant capital investment.

Public perception and acceptance remain underexplored barriers, with limited awareness of ammonia's potential as a fuel and concerns about safety risks potentially creating community opposition to ammonia energy projects, particularly in residential areas.

Current Ammonia Combustion and Conversion Systems

01 Ammonia fuel combustion systems and performance optimization

Various combustion systems have been developed to optimize ammonia fuel performance, including specialized engines and burners designed to handle ammonia's unique combustion properties. These systems incorporate technologies to address ammonia's lower flame speed and higher ignition energy requirements compared to conventional fuels. Performance optimization techniques include modified injection systems, catalytic combustion aids, and combustion chamber designs that enhance ammonia's energy efficiency while minimizing harmful emissions.- Ammonia fuel cell systems and performance optimization: Ammonia can be used in fuel cell systems to generate electricity efficiently. These systems convert ammonia directly into electrical energy through electrochemical reactions. Various designs and catalysts have been developed to improve the performance of ammonia fuel cells, including solid oxide fuel cells and proton exchange membrane fuel cells. Optimization techniques focus on increasing power density, improving conversion efficiency, and enhancing durability while reducing operational costs.

- Ammonia production, storage and transportation methods: Cost-effective methods for producing, storing, and transporting ammonia are critical for its viability as a fuel. Innovations include green ammonia production using renewable energy sources, advanced storage technologies that address ammonia's toxicity and corrosiveness, and specialized transportation systems. These developments aim to reduce the overall cost of ammonia fuel by optimizing the supply chain and infrastructure requirements while ensuring safety and efficiency.

- Ammonia combustion engines and performance enhancement: Ammonia can be used as a fuel in internal combustion engines with modifications to address its lower energy density and combustion characteristics. Research focuses on improving combustion efficiency through specialized injection systems, optimizing air-fuel ratios, and developing dual-fuel approaches that combine ammonia with other fuels. These enhancements aim to increase power output while reducing emissions and maintaining competitive operational costs compared to conventional fuels.

- Economic analysis and cost comparison of ammonia fuel: Economic analyses compare ammonia with conventional fuels and other alternative energy carriers. These studies evaluate production costs, infrastructure requirements, operational expenses, and lifecycle assessments. Factors considered include raw material costs, energy inputs for production, transportation expenses, and end-use efficiency. The economic viability of ammonia as a fuel depends on technological advancements, scale of adoption, and policy incentives that can help bridge the cost gap with established fuels.

- Environmental impact and emissions reduction potential: Ammonia offers significant environmental benefits as a carbon-free fuel when produced using renewable energy. Research examines its potential to reduce greenhouse gas emissions in various applications including shipping, power generation, and industrial processes. Studies also address concerns about nitrogen oxide emissions during combustion and develop mitigation strategies. The environmental performance of ammonia fuel is evaluated through lifecycle assessments that consider production methods, transportation, and end-use efficiency.

02 Ammonia production and storage technologies for fuel applications

Efficient production and storage technologies are critical for ammonia fuel applications. Production methods include both traditional Haber-Bosch processes and newer green ammonia production using renewable energy. Storage solutions address ammonia's toxicity and corrosiveness through specialized tank designs, safety systems, and materials selection. Advanced storage technologies include metal hydrides, solid-state storage media, and pressure management systems that improve safety while maintaining energy density advantages of ammonia as a hydrogen carrier.Expand Specific Solutions03 Economic analysis and cost reduction strategies for ammonia fuel

Economic analyses of ammonia as a fuel focus on production costs, infrastructure requirements, and market competitiveness compared to conventional fuels. Cost reduction strategies include scaling production, improving catalyst efficiency, integrating with renewable energy systems, and developing dual-fuel capabilities. The economic viability of ammonia fuel depends on factors such as carbon pricing, renewable energy costs, and policy incentives that can help bridge the cost gap with fossil fuels while accounting for environmental benefits.Expand Specific Solutions04 Ammonia fuel cells and power generation systems

Ammonia fuel cells represent an efficient way to extract energy from ammonia without combustion. These systems include direct ammonia fuel cells and systems that first crack ammonia into hydrogen for use in conventional fuel cells. Power generation systems utilizing ammonia as fuel offer advantages in energy density and existing infrastructure compatibility. Technical innovations focus on catalyst development, membrane technology, and system integration to improve electrical conversion efficiency while minimizing system complexity and cost.Expand Specific Solutions05 Environmental impact and emissions control for ammonia fuel

Ammonia fuel offers potential environmental benefits as a carbon-free energy carrier, but presents challenges in controlling nitrogen oxide (NOx) emissions and preventing ammonia slip. Emissions control technologies include selective catalytic reduction systems, advanced combustion control, and exhaust treatment processes. Environmental impact assessments consider the full lifecycle of ammonia fuel, from production through utilization, with particular focus on minimizing greenhouse gas emissions, reducing air pollutants, and ensuring safe handling throughout the supply chain.Expand Specific Solutions

Leading Companies in Ammonia Fuel Ecosystem

The ammonia fuel market for heat and power applications is currently in an early commercialization phase, with growing interest driven by decarbonization goals. The market size is expanding rapidly, projected to reach significant scale as ammonia's potential as a carbon-free energy carrier gains recognition. Technologically, the field shows varying maturity levels across applications. Academic institutions like Tianjin University, Harbin Engineering University, and Xi'an Jiaotong University are advancing fundamental research, while companies demonstrate different specialization areas: AMOGY focuses on transportation applications, TotalEnergies and Sinopec develop industrial-scale solutions, and equipment manufacturers like Mitsubishi Heavy Industries, Caterpillar, and Toyota are adapting engines and turbines for ammonia combustion. The ecosystem reflects a balance between established energy players and innovative startups working to overcome ammonia's performance challenges while improving cost-effectiveness.

AMOGY, Inc.

Technical Solution: AMOGY has developed a proprietary ammonia cracking technology that efficiently converts ammonia to hydrogen for fuel cell applications. Their system integrates a compact ammonia cracker with PEM fuel cells to generate clean electricity. The technology employs advanced catalysts that enable ammonia decomposition at lower temperatures (around 450°C compared to traditional 650-700°C), significantly reducing energy requirements. AMOGY's solution includes a comprehensive thermal management system that captures waste heat from the fuel cell to support the endothermic cracking process, improving overall system efficiency by approximately 15-20%. Their modular design allows for scalable implementation across various power requirements from 100kW to multi-MW applications, with demonstrated volumetric power density up to 3 times higher than conventional systems.

Strengths: Highly efficient ammonia cracking at lower temperatures; integrated thermal management system; modular and scalable design suitable for various applications from maritime to stationary power. Weaknesses: Still requires precious metal catalysts; system complexity may increase maintenance requirements; current cost structure remains higher than conventional power generation methods.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered direct ammonia fuel cell technology that eliminates the need for separate cracking processes. Their system utilizes a solid oxide fuel cell (SOFC) architecture capable of directly oxidizing ammonia at operating temperatures of 700-800°C. The technology incorporates proprietary ceramic electrolytes with enhanced ionic conductivity and specialized anode materials that resist sulfur poisoning. Toyota's approach achieves electrical efficiencies of 45-50% in direct ammonia operation, with combined heat and power efficiencies exceeding 85%. Their latest generation systems feature advanced thermal cycling resistance, allowing for more frequent start-stop operations than traditional SOFCs. Toyota has also developed a hybrid system that combines ammonia fuel cells with battery storage to manage transient loads and improve response times, particularly valuable for transportation applications where power demands fluctuate significantly.

Strengths: Direct ammonia utilization without separate cracking step; high electrical and combined heat-power efficiencies; advanced materials with improved durability and resistance to contaminants. Weaknesses: High operating temperatures limit rapid startup capabilities; current systems still face challenges with thermal cycling durability; higher capital costs compared to conventional power generation technologies.

Key Patents and Research in Ammonia Fuel Technology

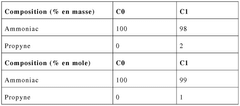

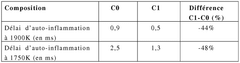

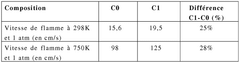

Fuel or combustible substance composition comprising ammonia and at least one alkyne

PatentWO2024218445A1

Innovation

- A fuel composition comprising ammonia and 0.01% to 20% by mass of C3 to C12 alkynes, which significantly reduces autoignition time, increases flame speed, and enhances combustion efficiency without the need for large hydrogen reserves or fossil fuels.

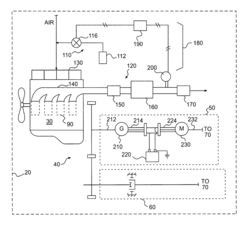

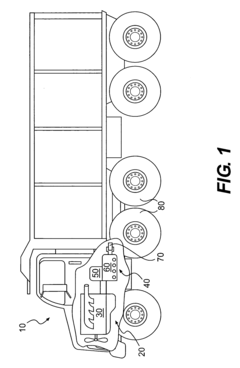

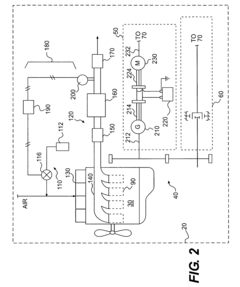

Power system having an ammonia fueled engine

PatentInactiveUS20100019506A1

Innovation

- A power system that uses ammonia as a primary fuel, supplemented by an electrical unit to generate mechanical power, allowing for controlled combustion engine operation within specific load ranges and extending the engine's operating range to low load and high speed conditions, while utilizing unburned ammonia as a NOx-reducing agent in the exhaust system.

Environmental Impact Assessment

Ammonia as a fuel for heat and power generation presents a complex environmental profile that must be thoroughly assessed when considering its implementation at scale. The environmental impact of ammonia fuel spans multiple dimensions, beginning with its production pathways. Currently, over 90% of global ammonia is produced via the Haber-Bosch process, which is highly carbon-intensive when powered by fossil fuels, generating approximately 1.8 tons of CO2 per ton of ammonia produced. However, the emergence of green ammonia production using renewable electricity for hydrogen electrolysis offers a pathway to dramatically reduce these lifecycle emissions.

When combusted, ammonia produces zero carbon dioxide emissions at the point of use, representing a significant advantage over traditional fossil fuels. However, incomplete combustion can lead to the release of nitrogen oxides (NOx) and unreacted ammonia (NH3) slip, both of which contribute to air pollution and can form secondary particulate matter in the atmosphere. Advanced combustion technologies and selective catalytic reduction systems are being developed to mitigate these emissions, though they add complexity and cost to ammonia fuel systems.

Water usage represents another important environmental consideration. Green ammonia production via electrolysis requires substantial water inputs—approximately 9 tons of water per ton of ammonia. In regions facing water scarcity, this requirement could exacerbate existing resource pressures and create competition with agricultural and municipal water needs.

Land use impacts vary significantly depending on the ammonia production pathway. Green ammonia facilities powered by renewable energy may require substantial land area for solar or wind installations, potentially competing with agricultural land or natural habitats. Conversely, blue ammonia production (using natural gas with carbon capture) has a smaller physical footprint but greater subsurface impact through natural gas extraction.

The transportation and storage of ammonia also present environmental risks. While ammonia has been safely transported globally for decades as a fertilizer, its toxicity to aquatic life means that spills during transport could have severe localized environmental impacts. Proper safety protocols and infrastructure are essential to minimize these risks.

From a lifecycle perspective, ammonia's environmental credentials depend heavily on the production method. Green ammonia could achieve carbon intensity reductions of 80-90% compared to fossil fuels, while blue ammonia might achieve 60-80% reductions depending on carbon capture efficiency. These potential benefits must be weighed against the environmental impacts of infrastructure development and the energy efficiency losses in the ammonia production and utilization cycle.

When combusted, ammonia produces zero carbon dioxide emissions at the point of use, representing a significant advantage over traditional fossil fuels. However, incomplete combustion can lead to the release of nitrogen oxides (NOx) and unreacted ammonia (NH3) slip, both of which contribute to air pollution and can form secondary particulate matter in the atmosphere. Advanced combustion technologies and selective catalytic reduction systems are being developed to mitigate these emissions, though they add complexity and cost to ammonia fuel systems.

Water usage represents another important environmental consideration. Green ammonia production via electrolysis requires substantial water inputs—approximately 9 tons of water per ton of ammonia. In regions facing water scarcity, this requirement could exacerbate existing resource pressures and create competition with agricultural and municipal water needs.

Land use impacts vary significantly depending on the ammonia production pathway. Green ammonia facilities powered by renewable energy may require substantial land area for solar or wind installations, potentially competing with agricultural land or natural habitats. Conversely, blue ammonia production (using natural gas with carbon capture) has a smaller physical footprint but greater subsurface impact through natural gas extraction.

The transportation and storage of ammonia also present environmental risks. While ammonia has been safely transported globally for decades as a fertilizer, its toxicity to aquatic life means that spills during transport could have severe localized environmental impacts. Proper safety protocols and infrastructure are essential to minimize these risks.

From a lifecycle perspective, ammonia's environmental credentials depend heavily on the production method. Green ammonia could achieve carbon intensity reductions of 80-90% compared to fossil fuels, while blue ammonia might achieve 60-80% reductions depending on carbon capture efficiency. These potential benefits must be weighed against the environmental impacts of infrastructure development and the energy efficiency losses in the ammonia production and utilization cycle.

Economic Viability Analysis

The economic viability of ammonia as a fuel for heat and power generation hinges on several interconnected factors that must be carefully evaluated against conventional alternatives. Current cost analyses indicate that ammonia fuel systems require significant capital investment, with specialized storage, handling, and combustion equipment adding 20-30% to initial system costs compared to natural gas installations. This premium reflects the technical requirements for safely managing ammonia's corrosive properties and toxicity concerns.

Production economics present a complex picture, with conventional Haber-Bosch ammonia production costs ranging from $400-600 per ton when using natural gas feedstock. Green ammonia, produced using renewable electricity, currently commands a substantial premium at $800-1200 per ton. However, projections suggest this gap may narrow to 15-20% by 2030 as renewable energy costs continue to decline and carbon pricing mechanisms mature in major markets.

Operational economics reveal that ammonia's lower energy density (18.6 MJ/kg compared to natural gas at approximately 50 MJ/kg) necessitates larger storage facilities and more frequent refueling, increasing logistical costs by an estimated 15-25%. Combustion efficiency penalties of 5-10% compared to natural gas further impact the economic equation, though these are partially offset by ammonia's superior storage and transportation characteristics.

Infrastructure adaptation represents another significant cost factor. Converting existing power generation facilities to ammonia compatibility requires investments of $200-500 per kilowatt of capacity, depending on facility age and configuration. New purpose-built ammonia power systems demonstrate better economics but still command a 15-25% premium over conventional alternatives.

Regulatory frameworks and carbon pricing mechanisms will substantially influence ammonia fuel economics. In jurisdictions with carbon prices exceeding $75-100 per ton, ammonia begins to approach cost parity with unabated fossil fuel systems. Several economic models project that with carbon prices reaching $150 per ton, which multiple countries anticipate by 2030, green ammonia would achieve direct cost competitiveness in many applications.

Levelized cost of energy (LCOE) analyses indicate that ammonia power generation currently ranges from $0.12-0.18 per kWh, compared to $0.06-0.10 for natural gas. However, this gap narrows significantly when accounting for carbon capture requirements for fossil systems, with ammonia-based systems potentially reaching cost parity by 2035 in regions with strong decarbonization policies and developed hydrogen infrastructure.

Production economics present a complex picture, with conventional Haber-Bosch ammonia production costs ranging from $400-600 per ton when using natural gas feedstock. Green ammonia, produced using renewable electricity, currently commands a substantial premium at $800-1200 per ton. However, projections suggest this gap may narrow to 15-20% by 2030 as renewable energy costs continue to decline and carbon pricing mechanisms mature in major markets.

Operational economics reveal that ammonia's lower energy density (18.6 MJ/kg compared to natural gas at approximately 50 MJ/kg) necessitates larger storage facilities and more frequent refueling, increasing logistical costs by an estimated 15-25%. Combustion efficiency penalties of 5-10% compared to natural gas further impact the economic equation, though these are partially offset by ammonia's superior storage and transportation characteristics.

Infrastructure adaptation represents another significant cost factor. Converting existing power generation facilities to ammonia compatibility requires investments of $200-500 per kilowatt of capacity, depending on facility age and configuration. New purpose-built ammonia power systems demonstrate better economics but still command a 15-25% premium over conventional alternatives.

Regulatory frameworks and carbon pricing mechanisms will substantially influence ammonia fuel economics. In jurisdictions with carbon prices exceeding $75-100 per ton, ammonia begins to approach cost parity with unabated fossil fuel systems. Several economic models project that with carbon prices reaching $150 per ton, which multiple countries anticipate by 2030, green ammonia would achieve direct cost competitiveness in many applications.

Levelized cost of energy (LCOE) analyses indicate that ammonia power generation currently ranges from $0.12-0.18 per kWh, compared to $0.06-0.10 for natural gas. However, this gap narrows significantly when accounting for carbon capture requirements for fossil systems, with ammonia-based systems potentially reaching cost parity by 2035 in regions with strong decarbonization policies and developed hydrogen infrastructure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!